November 23, 2023, Pushpinder Puri, 8 Mins

When it comes to safeguarding your future and that of your loved ones, choosing the right type of Life Insurance is crucial. In this article, we’ll explore the nuances of Term Life Insurance and Short-Term Life Insurance, helping you understand which option may be better suited for your unique circumstances.

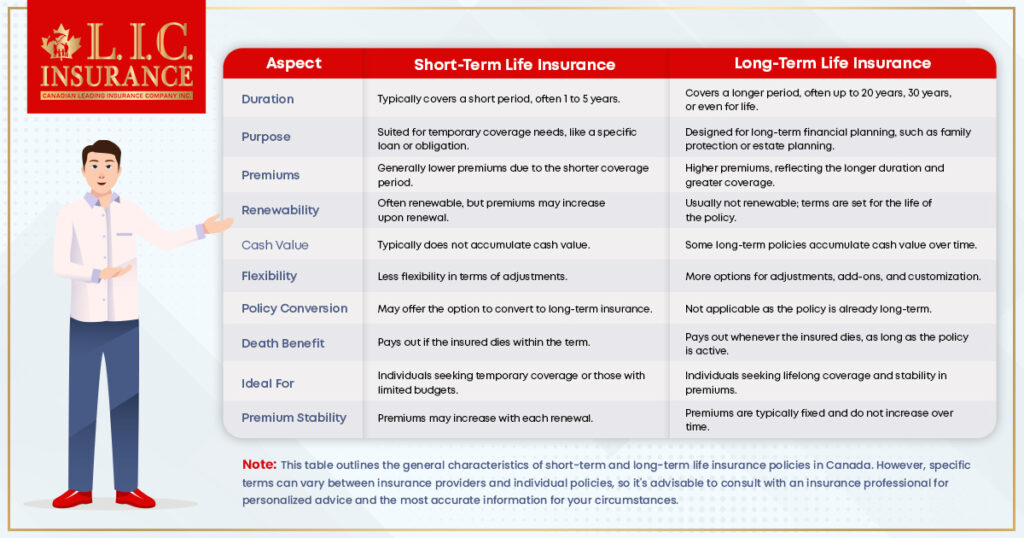

Term Life Insurance is a straightforward concept: it offers coverage for a specified “term” or period. If the policyholder passes away within this period, the beneficiaries receive the death benefit. It’s a cost-effective way to provide financial security.

Short-Term Life Insurance, typically lasting for a few years, is designed for temporary coverage needs. It’s ideal for those who need immediate coverage but want to avoid committing to a long-term policy.

Long-Term Life Insurance offers extended coverage, often up to 20-30 years. This type of insurance is suitable for individuals looking to secure their financial future over a more extended period.

Read More – Term Life Insurance here

When choosing between short-term and long-term insurance, cost is a crucial consideration. Short-term policies are typically more affordable, offering coverage for a limited period, usually up to 10 years. These policies are cost-effective for addressing immediate, specific financial obligations, like covering a short-term debt. However, they provide less comprehensive coverage and do not offer a return on premiums if the policyholder outlives the term.

In contrast, long-term insurance, such as whole life or universal life policies, covers the policyholder’s entire life and incorporates a savings component that accumulates cash value. This extended coverage and added financial benefit come at higher premiums. These policies are suitable for individuals looking for consistent, lifelong coverage and an investment component for long-term financial planning.

The choice between short-term and long-term insurance should align with your financial goals and needs. Short-term insurance is ideal for temporary coverage with lower premiums, while long-term insurance offers a more comprehensive, albeit costlier, solution for sustained financial security. It’s beneficial to consult with a financial advisor to know which option best suits your financial situation and future plans.

Navigating the world of Life Insurance can be complex, but understanding its basics is essential for making informed decisions. Here, we break down what Life Insurance is, why it’s important, and the various types available to Canadians.

Deciding between short-term and long-term insurance largely depends on your coverage needs and life circumstances. Short-term insurance, often lasting a few years, is ideal for temporary or specific financial responsibilities like covering a loan or providing a safety net during life transitions. It’s a flexible choice for those in changing life stages or with evolving financial obligations.

Long-term insurance, on the other hand, offers lifelong coverage and is better suited for sustained family protection and long-term financial commitments, such as a mortgage or estate planning. This type of insurance provides a stable and continuous safety net for your loved ones, ensuring financial security regardless of when it’s needed.

Your choice should reflect your current life stage and financial goals. Short-term insurance is practical for immediate, temporary needs, while long-term insurance is more appropriate for consistent, long-term protection. Evaluating your financial situation and future plans can help determine which option aligns best with your needs. Consulting a financial advisor can also be beneficial in making this decision.

When choosing Life Insurance, it’s vital to consider how your needs might change over time. Opting for a policy that offers flexibility to adapt to evolving circumstances is essential.

Adapting to Life’s Changes

Life events like marriage, parenthood, or career shifts can impact your insurance needs. An adaptable policy allows for adjustments in coverage to align with these milestones. Short-Term Policies offer immediate, flexible coverage for specific periods or obligations, while Long-Term Policies, like whole or universal life, provide options to modify premium payments or access the policy’s cash value.

Customization with Riders

Both Short and Long-Term Policies can be customized with riders, such as disability or critical illness riders, adding layers of protection tailored to your changing needs.

Regular Policy Review

Regularly reviewing your Life Insurance ensures it stays in line with your current life situation and future goals. Adjustments can be made to maintain the right level of protection as your circumstances evolve.

In summary, selecting a Life Insurance policy with the capacity for adaptation and flexibility is crucial, ensuring you remain adequately covered through various life stages.

Your risk profile, encompassing factors like age, health, lifestyle, and financial responsibilities, is crucial in choosing the right Life Insurance. High-risk individuals, such as those with potential health concerns or long-term financial commitments, often benefit more from Long-Term Policies like whole or universal Life Insurance. These provide lifelong coverage, ensuring protection regardless of future health changes or life circumstances.

For those with a lower risk profile or specific short-term coverage needs, Short-Term Life Insurance can be more appropriate. It offers flexibility and is cost-effective for temporary financial obligations or life stages with anticipated changes.

Balancing the level of coverage with the cost of premiums is important. Higher risk usually means higher premiums, but the comprehensive coverage and security offered by Long-Term Policies might justify the expense.

Given the complexities of assessing risk and its impact on insurance choices, seeking advice from insurance professionals can be helpful. They can assist in aligning your insurance choice with your risk profile and financial goals, ensuring you get the most suitable coverage.

Policy riders are additional features that allow for customization of your Life Insurance policy, applicable to both short-term and long-term coverage. These riders enable you to tailor your insurance to your unique needs and circumstances.

Consider your risk factors and financial situation when selecting riders. It’s important to balance the additional protection they offer with their extra costs. Consulting with an expert insurance professional can aid in understanding which riders are most beneficial for your situation.

In essence, policy riders offer a way to customize your Life Insurance, enhancing its relevance and value to your specific life scenarios, whether you opt for short-term or long-term coverage.

Getting to know the tax implications of Life Insurance policies is essential for effective financial planning. Different policies have varying tax benefits and liabilities.

Typically, Life Insurance premiums are not tax-deductible, regardless of whether the policy is short-term or long-term. Business owners may be able to deduct premiums paid for employee Life Insurance as a business expense.

A major advantage of Life Insurance is that the death benefit is usually exempt from federal income tax. This is applicable to both short-term and Long-Term Policies, ensuring beneficiaries receive the full policy amount without income tax deductions.

In Long-Term Policies like whole life or universal life, the cash value component grows tax-deferred. Taxes aren’t paid on interest, dividends, or capital gains until the policy is surrendered, and withdrawals exceeding premiums paid may be taxable.

Loans taken against the cash value of a long-term policy are generally tax-free. However, if the policy lapses or is surrendered with an outstanding loan, that amount may become taxable.

Surrendering a policy early might lead to charges and potential income tax on the cash value received, especially if it exceeds the premiums paid.

Life Insurance proceeds might be included in your taxable estate, but proper planning can mitigate potential estate taxes.

Given the complexity of tax laws, consulting with a tax professional is advisable to navigate these nuances and maximize your policy’s financial benefits.

In summary, while Life Insurance offers significant tax benefits, especially on death benefits and cash value growth, understanding the specifics of these advantages and potential liabilities is crucial in making the most of your Life Insurance policy.

Short-Term Life Insurance is a suitable option in various scenarios where temporary coverage is needed, offering flexibility and specificity in its application.

Ideal for ensuring that short-term financial commitments like personal loans or car loans are covered, Short-Term Life Insurance can protect your family or estate from the burden of these debts in case of untimely death.

During major life transitions such as a career change, starting a new business, or undergoing personal changes like divorce, short-term insurance provides a financial safety net to cover obligations in these critical periods.

It’s beneficial for temporary coverage during certain life stages, such as ensuring financial security for young children, or during short-term high-risk activities or projects, without committing to a long-term policy.

For those developing a long-term financial plan, Short-Term Life Insurance can act as an interim solution, offering immediate coverage while more permanent insurance arrangements are being considered.

With lower premiums compared to Long-Term Policies, Short-Term Life Insurance is a budget-friendly option for immediate, specific insurance needs.

In essence, Short-Term Life Insurance is an effective tool for addressing immediate, specific insurance requirements, providing a focused and temporary coverage solution that can adapt to your life’s transitions and specific financial phases.

Long-Term Life Insurance benefits individuals with extended financial obligations and those seeking a stable, long-term financial safety net.

Ideal for covering long-term financial responsibilities such as mortgages or multi-year loans, Long-Term Life Insurance ensures these debts don’t burden your family in the event of your passing.

If you have dependents reliant on your income for many years, this type of insurance can provide for their needs, like living expenses and education, securing their financial future.

It’s a strategic tool in estate planning, facilitating tax-efficient wealth transfer to heirs and fulfilling your legacy wishes.

For couples, Long-Term Life Insurance can ensure financial stability for the surviving spouse, which is especially important in retirement planning.

Many Long-Term Policies include a cash value component, offering a savings opportunity and financial flexibility through loans or withdrawals.

Securing a long-term policy at a younger age can lead to lower, stable premiums and ensures coverage despite future health changes.

In essence, Long-Term Life Insurance is a comprehensive choice for those with long-term financial plans, providing enduring coverage and additional financial benefits like cash value, making it an integral part of a well-rounded financial strategy.

Regularly reassessing your Life Insurance is crucial as your circumstances change. Knowing when and how to switch between different policies ensures your coverage remains aligned with your current needs.

Life events such as marriage, childbirth, career changes, or retirement are critical times to reevaluate your insurance. These changes can significantly alter your financial responsibilities.

Initially, short-term insurance may suffice for specific financial needs. However, as you encounter new life stages like family expansion or homeownership, transitioning to a long-term policy can offer broader, more consistent coverage suitable for long-term financial planning and family support.

For those with long-term insurance, adjustments might be needed to match growing financial obligations, like increasing the death benefit. Changes in health or personal circumstances can also necessitate policy adjustments to reflect new premiums or coverage needs.

Changes in health or age can influence the decision to switch policies. For example, deteriorating health might make converting a term policy to a permanent one more advantageous, especially if it doesn’t require a new health exam.

Changing policies involves financial considerations, including differences in premiums, possible surrender charges, and tax implications. It’s important to evaluate these factors, perhaps with professional advice, to understand the financial impact of any changes.

In summary, Life Insurance needs to evolve, and it’s important to review and potentially adjust your policy periodically. Whether switching from short-term to long-term insurance or modifying your current policy, these changes help ensure that your Life Insurance remains a suitable safeguard for you and your family’s evolving needs.

Your health status significantly influences the type of Life Insurance you choose and the premiums you pay.

Healthier individuals often get lower premiums on Term Life Insurance, as their good health presents a lower risk for insurers. This makes term insurance an attractive, cost-effective option for those in good health seeking coverage for a specific time frame.

For Long-Term Policies like whole or universal life, healthier individuals can also benefit from more favourable rates. These policies are particularly beneficial for those expecting a longer lifespan due to the added advantage of a cash value component.

Premium rates are heavily influenced by health factors, including age, medical history, and lifestyle habits. Healthier individuals tend to enjoy lower premiums, while those with pre-existing conditions or high-risk health profiles might face higher rates or limited coverage options.

Maintaining good health and regular check-ups can lead to better insurance premiums. Improved health or a commitment to a healthier lifestyle can sometimes result in reduced premiums.

In summary, your health is a key determinant in both the selection of a Life Insurance policy and the cost of premiums. Whether choosing short-term or long-term insurance, understanding how your health impacts these choices is crucial for securing appropriate coverage at a reasonable cost.

The payout structures of Short-term and Long-Term Life Insurance policies vary significantly, influencing the choice based on your financial needs and goals.

So, choosing Short-Term and Long-Term Insurance should align with your financial situation and coverage needs. Short-Term Policies are suitable for defined temporary coverage, while Long-Term Policies offer the added benefit of a cash value component and lifetime coverage.

Understanding the options for renewing or converting your Life Insurance policy is crucial for adapting to life’s changes and maintaining financial security.

Consulting with insurance professionals is advisable to navigate these options effectively and ensure your policy continues to meet your evolving needs.

In summary, renewal and conversion options in Life Insurance policies provide the flexibility to adapt your coverage as your life and financial circumstances evolve, helping to ensure ongoing financial protection.

Tailoring your Life Insurance to suit various life stages ensures you have the right coverage when you need it most.

Young Adulthood

Family Formation

Mid-Life

Approaching Retirement

Retirement and Beyond

Regular Reviews

Hence, choosing and adjusting your Life Insurance as you move through life’s stages—from young adulthood to retirement—provides necessary financial protection and peace of mind for you and your loved ones.

When choosing between Short-Term and Long-Term Life Insurance, consider these key factors:

Balancing these considerations will guide you in selecting a policy that aligns with both your immediate and long-term financial needs and goals.

Choosing the right Life Insurance, whether short-term or long-term, hinges on your individual needs, financial goals, and life circumstances. It’s a decision that demands careful consideration of your current and future responsibilities, health status, and family dynamics.

Regular consultation with experts and periodic policy reviews are crucial to ensure your Life Insurance aligns with your evolving needs. Ultimately, the choice should support your long-term financial security, adapting to your life’s changes and safeguarding your loved ones’ future.

This section aims to address some of the most common questions about Short-Term and Long-Term Life Insurance, providing clarity and further insight to help you make an informed decision.

Short-Term Life Insurance, typically known as Term Life Insurance, provides coverage for a specific period. If the policyholder passes away during this term, beneficiaries receive a death benefit. Long-term insurance, including whole life or universal life, offers lifelong coverage with additional benefits like a cash value component.

Individuals with temporary financial obligations, such as mortgages or young children, might find Short-Term Life Insurance appropriate. It’s also a good choice for those on a limited budget needing substantial coverage.

Long-Term Life Insurance is ideal for those seeking lifelong coverage, wanting to accumulate cash value for future financial needs, or involved in long-term estate planning.

Many Short-Term Policies offer a conversion option, allowing you to switch to a long-term policy without a new medical examination, usually within a specific timeframe.

Generally, the younger you are when you purchase Life Insurance, the lower your premiums. As you age, the risk to the insurer increases, leading to higher premium rates.

The death benefit from a Life Insurance policy is usually not taxable. However, if you have a policy with a cash value component and it’s withdrawn or borrowed against, there may be tax implications.

Insurers consider your health and lifestyle when determining premiums. Poor health or high-risk lifestyles can lead to higher premiums, whereas healthier individuals typically pay less.

Should you surpass the duration of your Term Life Insurance Policy, the coverage ceases without any payout. You may have the option to renew, convert, or purchase a new policy.

Long-Term Life Insurance policies with a cash value component can be used as part of retirement planning, providing a source of funds later in life.

Regularly reassessing your Life Insurance policy is recommended, particularly following significant life events such as getting married, having a child, or experiencing notable financial changes.

These FAQs provide a wider overview of the key aspects of Short-Term and Long-Term Life Insurance, helping you navigate the complexities and nuances of Life Insurance planning.

The above information is only meant to be informative. It comes from Canadian LIC's own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]