September 1, 2023, ,

Are you planning to stay with your children or grandchildren for more than a year? Then you should probably apply for a Super Visa. This Super Visa Insurance allows the parents and grandparents of Canadian citizens or permanent residents to visit them for up to two years at a time. The advantage of the Super Visa is that it allows them to enter the country multiple times for ten years, and each visit can last for five years without the need to reapply. There is another alternative if you are looking to visit the country for less than six months. That does not require a parent or a grandparent to apply for a Super Visa or an Electronic Travel Authorization (eTA) if they arrive from a visa-exempt nation.

The Super Visa Insurance Canada- Key Benefits

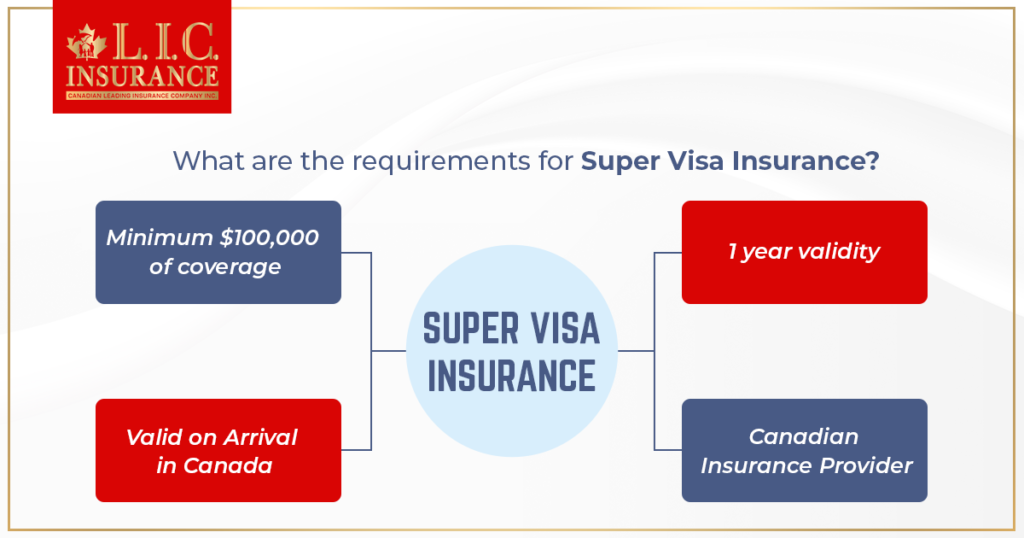

What are the requirements for Super Visa Insurance in Canada?

The cost of Super Visa insurance in Canada

What are the minimum necessary levels of coverage for Super Visa insurance in Canada?

When does the super visa coverage start?

Does Super Visa Insurance in Canada cover pre-existing conditions??

How much Super Visa Insurance coverage should one get?

Can I purchase Super Visa Insurance in Canada on my visiting family’s behalf?

Are there any other alternatives to Super Visa Insurance in Canada?

Is purchasing Super Visa Insurance in Canada from a Canadian insurance company necessary?

Can I get a refund on my Super Visa Insurance in Canada?

Does Super Visa Insurance in Canada cover dental work or dental emergencies?

Do you also get coverage for travelling to countries other than Canada through a Super Visa?

One of the many Super Visa approval requirements is that the individual will need to apply for medical insurance from a Canadian insurance company with a minimum coverage of at least $100,000. The plan should cover the applicant for at least one year from the date of arrival to Canada. This is what Super Visa insurance is all about. This is because the country wants to ensure that you will not be a liability to the public-funded health system when you visit the country. So, you will need to submit your Canadian insurance to the immigration authorities as proof that you are covered in the event you need your medical needs tended to.

To know more about Super Visa Insurance benefits in detail you can read- Benefits of Super Visa Insurance

These are merely just a few requirements of the Super Visa insurance and not the Super Visa itself. To learn more about Super Visa Insurance and the application process go to the Canadian government’s website.

Like most medical insurance plans, the cost of Super Visa insurance varies depending on several factors, such as the applicant’s age, if the applicant has a pre-existing medical condition etc. The estimate for a Super Visa insurance policy that has a coverage of $100,000 for one year is between $1,000. An individual in their forties can expect to pay around $800 and $1,800. A couple in their forties with no pre-existing medical conditions can spend somewhere between $1,600 and $3,600. A seventy-year-old individual with no pre-existing medical conditions is expected to pay between $1,700 and $4,600 for their Super Visa insurance. If the seventy-year-old has a pre-existing medical condition, it can start from $2,200. These figures mentioned above are not exact but merely estimates to give you an idea of how much a Super Visa insurance plan costs.

To find out more information on super visa insurance or to apply for one, get in touch with the team at Canadian L.I.C. today.

The minimum super visa levels of insurance coverage are:

When the visa holder visits Canada, the super visa coverage starts. In case of any changes in the travelling plan, most insurance providers change the start date if you have informed them of the right time.

If certain conditions are fulfilled, then some super visa insurance providers will cover travellers with pre-existing conditions. For instance, if your plan was stable and controlled 180 days before the effective date of your policy.

As per the law, you must buy at least $100,000 CAD in coverage — but is it actually sufficient? Well, that depends on certain conditions, like, the length of stay, your medical history and the level of financial security you want to have in the case of an illness or an accident.

In case you are old, need certain medications or have a pre-existing health condition, then, in that case, purchasing more than the minimum will be worth it. You can go for super visa insurance in Toronto for up to $1 million.

If you are a permanent resident of Canada, then yes, you can buy Super Visa Insurance on behalf of your family members, but you cannot buy it on behalf of your spouse’s family. In case you are sponsoring a person’s stay in Canada, then, in that case, you must bear the medical expenses if they cannot pay for themselves. Most Canadians purchase insurance coverage on behalf of their family members for this very reason. When entering Canada, they want to ensure their family members and loved ones have access to adequate medical insurance.

You cannot avoid super visa insurance if you want a super visa. You must have at least $100,000 in super visa insurance coverage to apply for the visa.

Before 2022 one could buy coverage only from a Canadian company. But since July 4, 2022, it has been allowed to purchase insurance from an insurer outside of Canada, as long as the Government of Canada has approved it.

In a lot of situations, you can easily get a refund like:

Yes, super visa medical insurance covers dental emergencies. However, the coverage limits vary from one plan to another for dental work and emergencies.

If certain specific conditions are being met, then super visa insurance also provides coverage for travelling to countries other than Canada; There are certain policies that cover travelling to another country till the time:

Make sure to read the policy terms carefully to determine what is covered before signing up since each insurance policy is different.

The super visa coverage lasts for a period of one year and can be purchased in one-year increments. If you get back to your home country and then come back to Canada again, you will need new coverage in that case.

Coming to the end of this article by now you would have been all clear on Super Visa, its benefits, cost and all the other related knowledge which will help you to decide as to what you should look for in your super visa insurance.

If you still want more knowledge on the subject you can visit- visit here to find out How to Apply for one?

The above information is only meant to be informative. It comes from Canadian LIC's own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]