October 31, 2023, Canadian LIC, 6 Mins

Planning a trip can be an exciting yet overwhelming experience, and one crucial aspect often overlooked is Travel Medical Insurance. Canadian LIC, a leading insurance brokerage in Canada, understands the importance of ensuring your health and financial well-being while abroad. This blog explains how Canadian LIC compares Travel Medical Insurance plans, empowering you to make an informed choice and enjoy your journey with a relaxed mind.

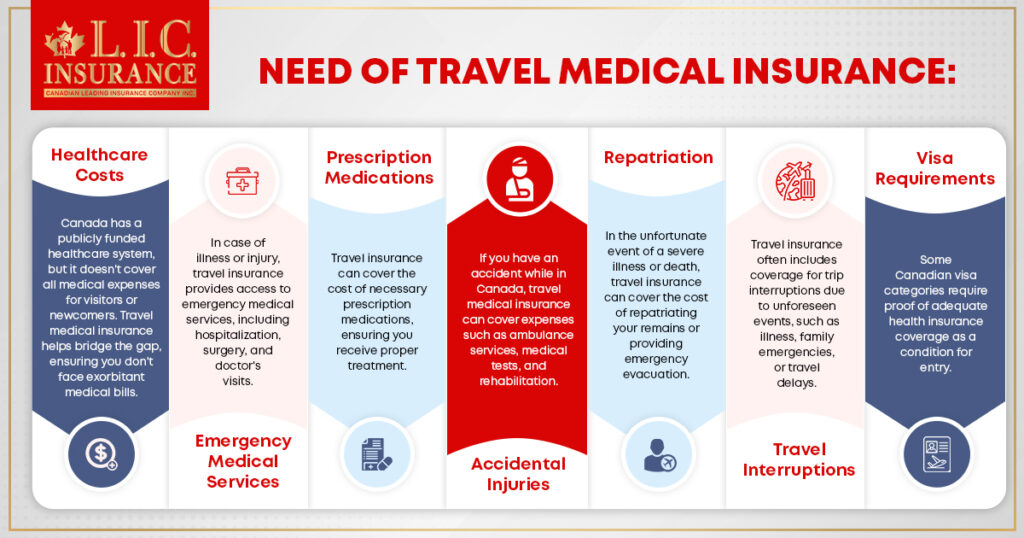

Before delving into the process of securing Travel Medical Insurance with Canadian LIC, it’s essential to understand why such coverage is critical. For Canadian travelers, having provincial healthcare coverage can be a reassuring protection. However, it comes with limitations when you venture beyond the country’s borders.

When travelling abroad, your provincial healthcare plan may offer limited coverage, leaving you vulnerable to high medical costs in case of illness or injury. Additionally, expenses related to emergency medical evacuation, repatriation, or unexpected trip interruptions are typically not covered by provincial healthcare.

Travel Medical Insurance steps in to fill these gaps. It provides coverage for medical emergencies, hospitalization, medical transportation, and other unexpected incidents that can occur while you’re away from home. By securing Travel Medical Insurance, you ensure that you and your loved ones have access to quality healthcare and financial protection during your travels.

Canadian LIC has earned a reputation as a trusted insurance advisor, offering expert guidance and a wide range of insurance solutions. With a commitment to customer satisfaction, Canadian LIC stands out in helping you navigate the complex world of insurance, including Travel Medical Insurance.

Choosing a suitable Travel Medical Insurance plan can be challenging due to the multitude of options available. Policies vary in terms of coverage, limits, exclusions, and premiums. Understanding the fine print is crucial to ensure you receive adequate protection during your travels.

Canadian LIC simplifies the process of selecting the right Travel Medical Insurance plan by offering a comparative approach. Their experts thoroughly review multiple insurance plans from reputable providers, considering factors such as:

Canadian LIC goes the extra mile by providing personalized recommendations. They consider your travel destination, duration, activities, and any pre-existing medical conditions to tailor their suggestions to your unique requirements. Whether you’re embarking on a relaxing beach vacation, a daring adventure, or visiting family abroad, Canadian LIC ensures you have the right level of coverage.

Canadian LIC’s user-friendly online platform allows you to compare Travel Medical Insurance plans at your convenience. You can access quotes, policy details, and expert recommendations from the comfort of your home, saving you time and effort.

Real-life testimonials from satisfied travellers highlight Canadian LIC’s commitment to excellence. These stories demonstrate how Canadian LIC helped travellers during challenging situations abroad, showcasing their dedication to providing reliable insurance solutions.

Canadian LIC’s thorough comparative approach ensures you choose the most suitable Travel Medical Insurance plan for your trip. By addressing potential concerns and risks in advance, you can embark on your journey with peace of mind, knowing that you are adequately protected.

Every traveller is unique, with specific needs, preferences, and circumstances. Canadian LIC recognizes this individuality and ensures that the insurance plans they recommend can be customized to align with your unique requirements.

Here’s how Canadian LIC facilitates customization:

Customization ensures that your Travel Medical Insurance plan is tailored to your specific needs and preferences. This level of personalization allows you to travel with confidence, knowing that your coverage aligns perfectly with your unique circumstances.

One of the significant advantages of working with Canadian LIC is the freedom of choice when it comes to insurance providers. Canadian LIC maintains an extensive network of insurance providers, allowing you to access a diverse range of plans from various companies.

Here’s why having multiple insurance providers at your disposal is advantageous:

Having the freedom to choose from multiple insurance providers means that you are not limited to a single provider’s offerings. This flexibility ensures that you have access to a comprehensive selection of plans, increasing the likelihood of finding one that perfectly suits your travel needs.

Securing Travel Medical Insurance through Canadian LIC offers several key benefits that make the process straightforward and advantageous:

Read More – Travel Insurance

Choosing the right Travel Medical Insurance plan is a critical step in ensuring a worry-free and enjoyable journey. Canadian LIC, with its commitment to customer satisfaction and expertise in the insurance industry, stands as a reliable partner for Canadian travellers. Their approach to comparing Travel Medical Insurance plans simplifies the decision-making process, allowing you to make informed choices that cater to your unique needs, preferences, and budget.

With Canadian LIC by your side, you can embark on your travels with the confidence that you are well-protected. The freedom to choose from multiple insurance providers, the transparency in pricing, and the focus on customization ensure that your Travel Medical Insurance plan is as unique as your travel experiences. So, before you embark on your next adventure, remember the importance of Travel Medical Insurance, and consider contacting Canadian LIC as your trusted partner in securing the right coverage for your journey.

The above information is only meant to be informative. It comes from Canadian LIC's own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]