October 25, 2023, Pushpinder Puri, 7 Mins

Retirement is a significant milestone in one’s life, representing the culmination of years of hard work and financial planning. For those planning to retire in Canada, determining how much money is needed for a comfortable retirement is a crucial question. The answer varies depending on various factors, including your lifestyle, location, retirement age, and financial goals. In this comprehensive guide, we will delve into the key considerations and calculations to help you estimate how much you need to retire in Canada.

The Basics of Retirement Planning in Canada

Determining Your Retirement Age

Estimating Your Retirement Expenses

Calculating Your Retirement Savings Goal

Investment Strategies for Retirement

Tax Considerations in Retirement

Retirement planning in Canada is a multifaceted endeavour that involves setting financial goals, assessing your current financial situation, and creating a roadmap to achieve those goals. Here are some fundamental steps to get started:

One critical decision in retirement planning is determining your retirement age. The age at which you choose to retire has a significant impact on how much you need to save. In Canada, the standard retirement age for receiving full Old Age Security (OAS) and Canada Pension Plan (CPP) benefits is currently 65. However, you can choose to retire earlier or later based on your preferences and financial circumstances.

To determine how much you need to retire comfortably, you must estimate your retirement expenses. These expenses can be categorized into essential and discretionary:

To estimate your expenses accurately, consider factors like inflation, potential healthcare costs, and any existing debts that need to be paid off before retirement.

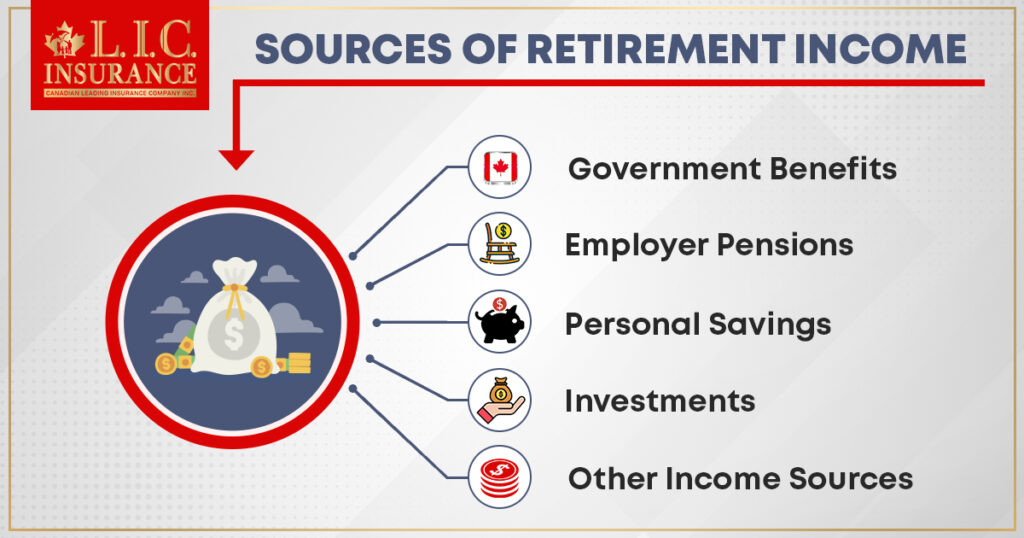

In Canada, retirees typically rely on a combination of income sources to fund their retirement lifestyle. Understanding these sources is crucial when calculating how much you need to retire comfortably:

The Canadian government provides several retirement benefits, including the Old Age Security (OAS) and the Canada Pension Plan (CPP). The amount you receive depends on factors like your years of contribution and retirement age.

If you have a workplace pension plan, it will provide a reliable source of retirement income. The amount you receive depends on your salary, years of service, and the plan’s terms.

Personal savings, including Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), play a significant role in retirement planning. These accounts allow you to save and invest money tax-efficiently.

Investments such as stocks, bonds, and mutual funds can generate income through dividends, interest, and capital gains. Proper investment planning is essential to ensure a steady income stream.

Consider any other sources of income you may have in retirement, such as rental income, part-time work, or business income.

Life insurance is another source of retirement income to take into account. Although a lot of individuals primarily consider pensions as a way to support their families when they pass away, they can also be used to supplement retirement income.

If you want to use life insurance for retirement, your options include whole life or universal life. Both are types of permanent life insurance, which means the protection is lifelong in nature. They also develop cash value, which can be accessed whenever you like and increases tax-deferred.

Cash value only becomes taxable upon withdrawal because it grows tax-deferred. If you use it after retirement, your tax burden will likely be lower because your taxable income will be smaller than it is now.

By surrendering your policy, you might get cash value all at once or in monthly installments. Only people under the age of 45 should consider using life insurance as a vehicle for retirement planning because cash value growth doesn’t accelerate until after 10 to 15 years.

Cash value from whole life insurance accrues interest at a certain rate set by the insurer. In contrast, with universal life insurance, the pace of cash value growth is not fixed. The performance of the metrics of the sub-accounts that are linked to it can also affect the cash value growth rate.

To estimate how much you need to retire in Canada, you can follow these steps:

For example, if your income gap is $20,000 per year and your chosen withdrawal rate is 4%, your savings goal would be $500,000.

As you approach retirement, your investment strategy may shift from wealth accumulation to income generation and capital preservation. Here are some investment strategies to consider:

Understanding the tax implications of your retirement income is essential for effective retirement planning. Key tax considerations include:

Your retirement plan is not static; it should evolve as your circumstances change. Here are some considerations for adjusting your retirement plan:

Let’s explore how these retirement saving rules can be applied in the context of Canada:

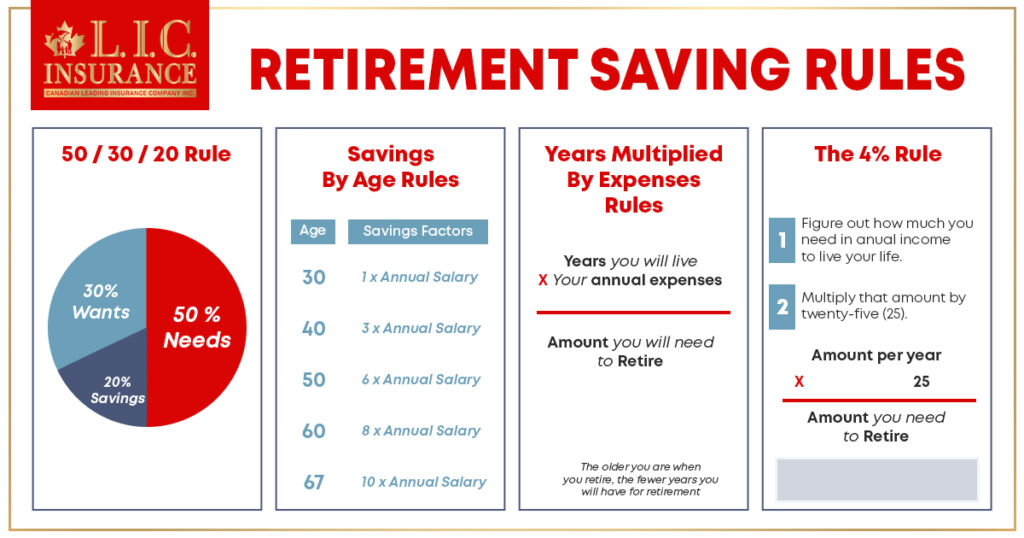

The 50/30/20 Rule:

The 50/30/20 rule is a budgeting guideline that can be adapted for retirement savings in Canada. Here’s how you can apply it:

Adhering to this rule can help you balance your current lifestyle with your retirement savings goals.

Savings by Age (As a Multiplier of Income) Rule:

The “Savings by Age” rule provides a rough guideline for how much you should aim to have saved for retirement at various stages of your life. In Canada, the rule can be adapted as follows:

These multipliers can serve as benchmarks, but remember that individual circumstances, such as lifestyle, retirement goals, and investment returns, can significantly impact your actual savings needs.

Years Multiplied by Annual Expenses Rule:

The “Years Multiplied by Annual Expenses” rule is a useful way to estimate your retirement savings requirements in Canada:

Keep in mind that these rules offer simplified guidance and should be adapted to your specific circumstances. Consulting with a financial advisor and using retirement planning tools can provide a more personalized and accurate retirement savings strategy tailored to the Canadian context. Additionally, consider the impact of government programs like the Canada Pension Plan (CPP) and Old Age Security (OAS) in your retirement planning.

Planning for retirement in Canada requires careful consideration of your lifestyle, financial goals, and income sources. You can work towards a comfortable and financially secure retirement by estimating your retirement expenses, calculating your savings goal, and crafting an investment strategy. Keep in mind that retirement planning is an ongoing process that should adapt to your changing circumstances and financial landscape. With prudent financial management and a clear retirement plan, you can look forward to enjoying your retirement years with peace of mind.

Ideally, you should start planning for retirement as early as possible. Many financial experts recommend beginning in your 20s or 30s. The earlier you start saving and investing, the more time your money has to grow, potentially resulting in a more substantial retirement fund.

Life expectancy can vary among individuals. You can use general statistics for Canadians, but it’s often more accurate to consider your family’s health history and your own lifestyle choices. A financial advisor can help you make a reasonable estimate.

While government pension benefits can be a significant part of your retirement income, they are typically not sufficient to maintain your desired lifestyle in retirement. It’s advisable to supplement these benefits with personal savings, investments, and possibly employer pensions.

The amount you should contribute to your RRSP depends on your income, tax situation, and retirement goals. The Canada Revenue Agency (CRA) sets annual RRSP contribution limits based on your income. A financial advisor can help you determine an appropriate contribution strategy.

RRSPs allow you to contribute pre-tax income and defer taxes until withdrawal, making them tax-advantageous if you expect to be in a lower tax bracket in retirement. TFSAs, on the other hand, use after-tax contributions but offer tax-free growth and withdrawals, making them flexible for various financial goals, including retirement.

Yes, it’s possible to retire early in Canada (as early as age 55), but it may result in reduced government pension benefits, such as OAS and CPP. Consider how early retirement may affect your overall retirement income and plan accordingly.

To account for inflation, you can use a rule of thumb that assumes an average annual inflation rate of around 2-3%. Adjust your projected expenses for each year of your retirement accordingly to maintain your purchasing power.

Investment strategies for retirement should balance growth and preservation of capital. This often involves a diversified portfolio that includes stocks, bonds, and other asset classes. Your asset allocation should reflect your risk tolerance and time horizon.

Yes, Canada offers programs like the Canada Pension Plan (CPP), Old Age Security (OAS), and the Guaranteed Income Supplement (GIS) to provide financial support in retirement. Additionally, there are incentives like RRSPs and TFSAs that offer tax benefits for retirement savings.

Creating a retirement budget involves estimating your expenses and matching them to your retirement income. Tracking your spending, having a buffer for unexpected expenses, and periodically reviewing and adjusting your budget can help you stay on track in retirement.

These FAQs provide valuable insights into retirement planning in Canada and the factors to consider when determining how much you need to retire comfortably. Keep in mind that retirement planning is a personalized process, and consulting with a financial advisor can help you create a tailored retirement plan that aligns with your goals and financial situation.

The above information is only meant to be informative. It comes from Canadian LIC's own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]