September 26, 2023, ,

Reaching your retirement age and worrying about how to make the best life after your retirement? A lot might be going on in your mind. But what if we tell you that there is a perfect solution that will instantly make everything easy for you, and that is a Registered Retirement Savings Plan with the help of which you can keep your pre-taxed income aside and invest in a lot of ways? Whatever growth you will achieve in your investments will not get taxed until you take it out when you retire or transfer it to RRIF (Registered Retirement Income Fund).

So an RRSP is an easy and quick saving solution that is great for building long-term wealth. A Canadian RRSP is a very smart option for smooth retirement planning. In this article, we will learn about the Canadian Registered Retirement Savings Plan, its working process, why one should have it who is eligible for it, etc.

A Registered Retirement Savings Plan is mainly a plan for your retirement. This savings and investment plan will be an income source when you retire and will no longer work. This plan drops your taxable income by allowing you to keep your pre-tax income aside. You can invest the money in your RRSP in mutual funds, stocks, bonds, and GICs.

Till the time you are not withdrawing your money, the growth of your RRSP is protected from taxation. The best thing about RRSPs is they help you conveniently create long-term wealth compared to traditional savings accounts.

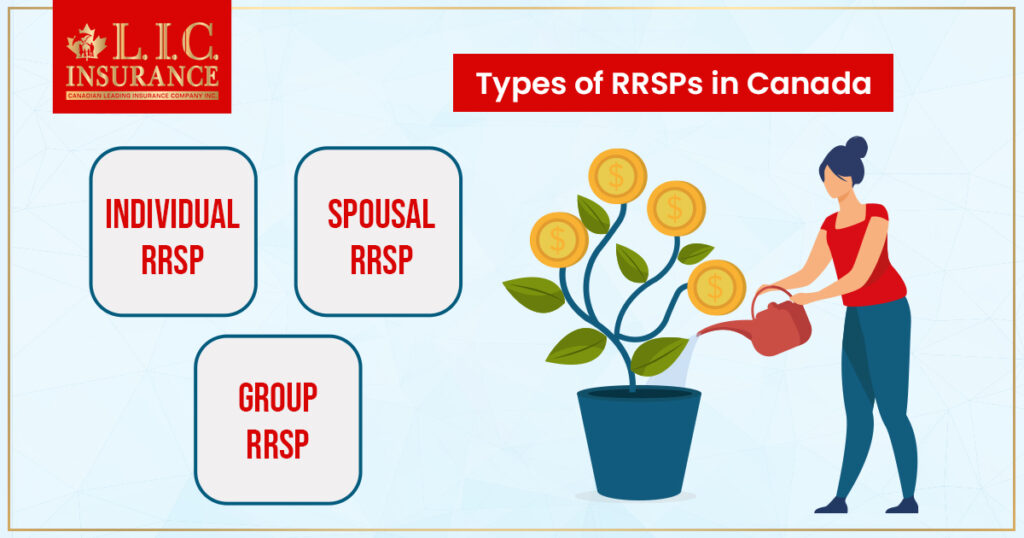

You will find quite a number of Canadian Retirement Savings Plans in the market as per your decision of investment and risk tolerance levels; they can provide huge returns for your retirement savings. Mainly there are three types of RRSP’s. The most commonly known is an individual RRSP, but you might find spousal or group RRSPs interesting too. Let’s find out more about them.

Individual RRSP: An individual RRSP account is registered in your name, providing you with all the tax benefits. This is the most flexible and common type of plan, and its tax benefits are totally yours. It is up to you whether you want to build your RRSP by yourself or want to take the help of an advisor.

Spousal RRSP: This type of RRSP is registered in your spouse’s name. Even though they own the investment, the contribution has to be yours. In the case of any contributions you make, you get tax deductions on it. Your own RRSP limit of deduction also gets reduced for about a year for any contributions you make. But the amount your spouse can contribute doesn’t get affected.

You and your spouse can evenly divide your income at the time of retirement with the help of a spousal RRSP. With a combined RRSP, you will have to pay less income tax which would have been higher in the case if you had a separate RRSP for yourself. Going for a combined Registered Retirement Income Fund is beneficial in the case of having a higher income than your spouse, as the amount of income tax to be paid by you individually will be reduced greatly.

The eligibility criteria for a spousal RRSP are as follows:

In case your partner takes out the money you have contributed:

You will have to pay the tax on the amount withdrawn within three years of the contribution date. Your spouse will have to pay tax when the amount is withdrawn three years after the contribution date.

In the case, your relationship gets over:

Spousal RRSPs are best to equalize income at the time of retirement and reduce the amount of tax to be paid. If you think your spouse’s income will be almost equal at retirement, then there is no point in going for a spousal RRSP.

Group RRSP: Group RRSPS are offered by some employers to make it easy for employees to save for their retirement. In the case of a group Canadian Retirement Savings Plan, you will have to open an individual RRSP, which you have to contribute to through your employer. In group RRSP all the employees’ RRSPs are in the same financial institution.

Let’s find out how a Group RRSP works:

It is very important to understand RRSP well. To learn more about it, you can read – What Should You Know About RRSP?

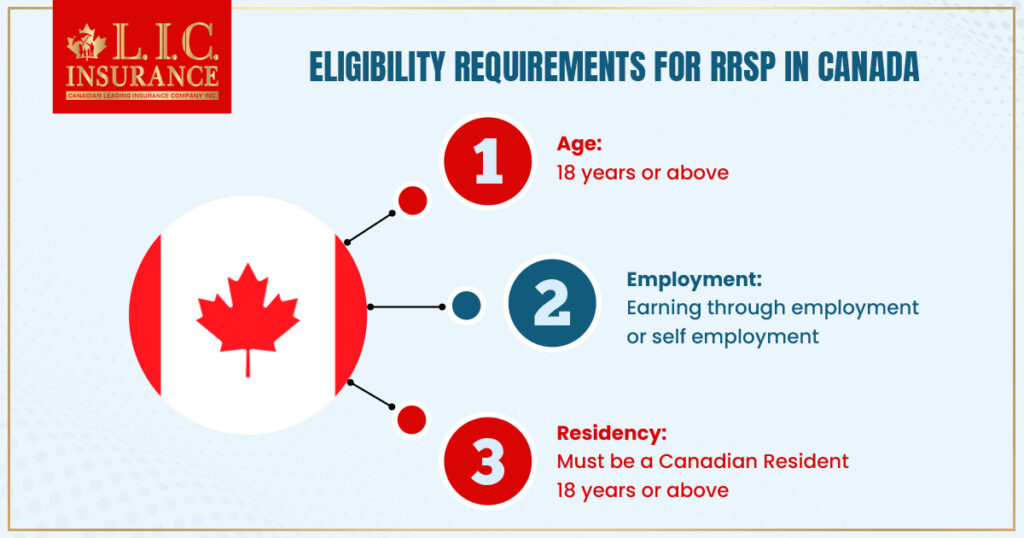

A Canadian Registered Retirement Savings Plan is a perfect savings plan to help you save for your retirement. Not only it helps to save for retirement, but it also offers various tax benefits before your retirement. If you earn and file your income tax return, you can for an RRSP account.

Places where you can open an RRSP include:

As long as you are earning and filing your tax return, you can have your RRSP at any age. Around the age of 71 is the best time to close an RRSP. It grows fully tax-free until you are ready to withdraw your money from your RRSP.

To understand more about what an RRSP is and why you should invest in it more clearly, read- What is RRSP and Reasons to make RRSP Investments

If you want to open your RRSP in Canada, then:

The CRA (Canada Revenue Agency) sets the amount of contribution you can make to an RRSP each year as per your previous year’s income. You can learn more about the amount you can contribute and the deduction limits on the CRA website.

One thing to keep in mind is that there is an age limit to contribute to an RRSP. The year when you will turn 71 years of age, you can contribute only till December 31st of that year. The rules will be different if you plan to leave Canada permanently.

A Registered Retirement Income Fund is not only a great way to save for retirement, but it offers many other benefits. Let’s get to know them one by one:

Hence having an RRSP is not only beneficial for tax savings but reduces your taxable income and also helps in estate planning by transferring money directly to your heirs.

Contact any of the below-mentioned institutions to set up your Registered Retirement Savings Plan:

Each institution has its own portfolio to offer, with an investment gain of a different interest rate.

One of the best ways to have access to money when you retire is withdrawing from an RRSP only thing is you have to take care of certain restrictions like:

So after reading all this, you might now have a better idea about how to go about it, and you will definitely be able to make a wiser decision on whether to start your RRSP contributions or not.

It would be an even smarter decision if you also take the advice of an investment professional as they will guide you in detail as per your requirements and financial conditions, and thus you will end up having the maximum tax benefits.

You can contact us today, and our experts will do their best to guide you through everything you need to know.

The rates of return offered by different financial institutions differ from each other. Some financial institutions offer up to 5% of interest rate, but on average, the return on a Canadian Registered Retirement Savings Plan is between 3-4%. So the important thing is to find an interest rate that suits you as per your requirements, fulfilling your objectives.

A lot of factors need to be considered before you make a decision to invest in an RRSP(Registered Retirement Savings Plan).

These factors are your:

Generally, it is best advised to contribute between 10-20% of your income. But it is important not to forget your current financial situation and the amount of previous investments made, if any. The right way to go about making the best decision for yourself is to seek the help of an experienced financial advisor to secure your future with the best you can.

The best time to start your contributions is as early as you can for the best results. The sooner you start, the more your tax-free investments will have time to grow. It is best to start in your early twenties as you will have sufficient time to save until you retire. But don’t get disheartened if you haven’t started yet, as it is never too late to begin anything. Whatever age you start, even if you are in your fifties, you will still enjoy great benefits from an RRSP. The main thing to focus on is making regular contributions and increasing your savings by utilizing the full benefits of tax breaks and compound interest.

The above information is only meant to be informative. It comes from Canadian LIC's own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]