- What is an Insurance Broker, and what do they do?

- Who should go with an Insurance Broker?

- What does an Insurance Broker do?

- Can we trust an Insurance Broker?

- Do Insurance Brokers Understand the Products They Sell?

- The Benefits of Working with an Insurance Broker in Toronto

- Some Tips On Choosing The Right Insurance Broker

- Process of Application

- What is the cost of buying Insurance from the Best Insurance Broker in Canada?

- Other Insurance Buying Options

- Final Thoughts

Insurance brokers are licensed professionals who help individuals with their insurance needs, including identifying the right policy based on their specific needs and budget.

What is an Insurance Broker, and what do they do?

A professional who is an expert in the field of insurance and provides professional advice and continuous service as per the needs of its customers whenever required is an insurance broker. If you are new to the world of insurance and don’t know what to do, then an insurance broker can make everything quite simple and smooth.

They research and provide the best possible insurance solutions as per individual needs. You get access to insurance which offers the best value and peace of mind with the knowledge of an insurance broker. An insurance broker looks after all your insurance needs, thus saving you your time, money and all the worry. They will suggest you a variety of products within your budget after assessing your exposure to risk.

You can gather more information on insurance brokers through the government website as well.

Who should go with an Insurance Broker?

The below-mentioned types of buyers get the most benefits from using an insurance broker to buy insurance:

- Applicants who are purchasing insurance for the first time in their life.

- Applicants who are purchasing insurance to review their Insurance policy.

- Applicants who are purchasing insurance to increase their Insurance coverage.

- Applicants who have certain special insurance needs.

- Applicants who are looking for insurance that provides them with the best value for their money

- Applicants who want to make the insurance buying process simple and time-saving.

Top 11 Benefits of Insurance Brokers in Canada

Below mentioned are the reasons you should use an insurance broker in Brampton:

- Independent professionals: When you choose to get insurance through an insurance broker, you are dealing with an independent advisor and not the company. You will ultimately make the final decision, and your insurance advisor from Canadian LIC is there to guide you along the process. If you are looking for an affordable insurance plan and need the help of experts to get you the best coverage, look no further than the reliable insurance brokers in Brampton – Canadian LIC, for top-quality service. Additionally, in the event you need to make a claim, you can be rest assured; that our brokers will take your side and help you resolve it effectively.

- Takes care of all the claims: After purchasing insurance, if something awful happens, or in the event of a terrible loss, you need to ensure that you are covered entirely and your claim is taken care of swiftly and professionally. Insurance brokers offer expert advice during the claims process and also work with your insurance company on behalf of you to assist you. With the help of an insurance advisor, you can rest assured the claim process will be quick, fair, and transparent.

- Variety of Options: Working with an insurance broker from Canadian LIC gives you access to a wide range of insurance plans to choose from, as they have a large network of insurance companies they consult with. Most insurance advisors will at least provide the client with 3 to 5 plans to ensure they make a well-informed decision. There are several benefits for the client as they can save money and get you the best coverage possible. The experienced insurance advisors in Brampton – Canadian LIC will identify the best deals to ensure you the best quotes and insurance options.

- Highly professional and certified: Every insurance broker in Brampton from Canadian LIC is required to be licensed and regulated. The licensing process is strict, and a lot of applications don’t make the cut. Additionally, insurance advisors are required to take education courses every year to make sure they are up-to-date with the latest details. Whether you are working with a broker in person, over the phone, via text, or online, you can have peace of mind knowing you are dealing with a highly trained professional who will take accountability for your actions.

- Human touch vs. digital: If you are a person who likes to handle things for yourself, there are a plethora of insurance advisors that provide this kind of service. But if you choose to have a hands-on service, you are more than welcome to get in touch with our insurance advisors in Brampton today. Whatever your specific requirements, our brokers are up-to-date with all the latest information offering the best service that is guaranteed to meet the needs of our clients.

- Free and reliable advice: An insurance broker earns from the service that is built into the cost of the insurance policy. There is no additional fee asked or taken to your insurance premium. For many, an insurance plan is a major expense. Having an insurance broker in Brampton. Canadian LIC, which provides a personal service and guides you to make a well-informed decision is worth taking advantage of.

- Specialized service: Most insurance brokers help with a range of insurance plans like Life Insurance, Critical Illness Insurance, and investment plans to name a few. There are a few insurance advisors in Brampton that specialize in one insurance category. When it comes to understanding the nuances of the various coverage options, Licensed insurance advisors are experts. They also have a wealth of experience in identifying the best policy that provides stable rates.

- Saving you a lot of time and hassle: If you do not wish to work with an insurance broker, the other alternative is to do it yourself, which can be time-consuming and stressful. The significant advantage of working with an insurance broker is that you will be dealing with an individual who has expert knowledge and can help solve any queries that you may have.

- Free and reliable advice: An insurance broker earns from the service that is built into the cost of the insurance policy. There is no additional fee asked or taken to your insurance premium. For many, an insurance plan is a major expense. Having an insurance broker in Brampton. Canadian LIC, which provides a personal service and guides you to make a well-informed decision is worth taking advantage of.

- Free and reliable advice: An insurance broker earns from the service that is built into the cost of the insurance policy. There is no additional fee asked or taken to your insurance premium. For many, an insurance plan is a major expense. Having an insurance broker in Brampton. Canadian LIC, which provides a personal service and guides you to make a well-informed decision is worth taking advantage of.

- Free and reliable advice: An insurance broker earns from the service that is built into the cost of the insurance policy. There is no additional fee asked or taken to your insurance premium. For many, an insurance plan is a major expense. Having an insurance broker in Brampton. Canadian LIC, which provides a personal service and guides you to make a well-informed decision is worth taking advantage of.

- Free and reliable advice: An insurance broker earns from the service that is built into the cost of the insurance policy. There is no additional fee asked or taken to your insurance premium. For many, an insurance plan is a major expense. Having an insurance broker in Brampton. Canadian LIC, which provides a personal service and guides you to make a well-informed decision is worth taking advantage of.

Can we trust an Insurance Broker?

Insurance brokers usually get commissions from the insurance companies for the many types of insurance they sell if they are able to sell it successfully. These insurance agents work with a number of insurance providers, so there are very few chances of them having a monetary bias for any one particular product. Hence they are unbiased and impartial parties and provide you with a policy that would be in your budget as per your requirements from so many different insurance companies in their knowledge.

Do Insurance Brokers Understand the Products They Sell?

You will definitely be able to make a much better decision if you buy insurance through an insurance broker rather than directly from any insurance company. An insurance broker’s job is to have all the best knowledge about the best insurances available in the market from the best insurance companies and hence will advise you for one which is perfect for your budget. These insurance brokers in Canada are very well aware of the application requirements, coverage terms, and pricing.

Whatever insurance you are looking for, be it critical illness insurance, disability insurance, life insurance, etc., you can easily buy through an insurance broker in Ontario after comparing them with each other. Mostly all the insurance brokers cover all types of insurance, but you might find a few who specialize in specific ones. So if you want an expert opinion on a particular insurance, you can go to these types of insurance brokers in Canada.

The Benefits of Working with an Insurance Broker in Toronto

Alongside helping you choose the ideal insurance policy for you and your family, working with expert insurance brokers has its advantages. Here’s how you will benefit from hiring an insurance broker in Toronto before choosing a policy:

- Experienced and best insurance brokers in Canada always keep themselves up to date with the latest trends in the insurance market; they can help you choose the ideal insurance plan based on your needs and industry standards.

- Your insurance broker in Toronto will be connected with many companies, and that gives them access to several insurance products. Once they know all your needs, they can compare multiple plans and policies and present the ones suited to your requirements and within your budget.

- Once you have selected a policy, they can help negotiate premiums and see that you get an affordable monthly rate for the plan you choose.

- If you are not sure which insurance policy is ideal for you, an insurance broker can share their unbiased advice so you can make an informed decision.

- They can also help in settling claims. Once you have submitted your claim, your insurance broker will follow up to ensure the claim is processed correctly.

- An insurance broker can help you settle legal disputes with the insurance company as well.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

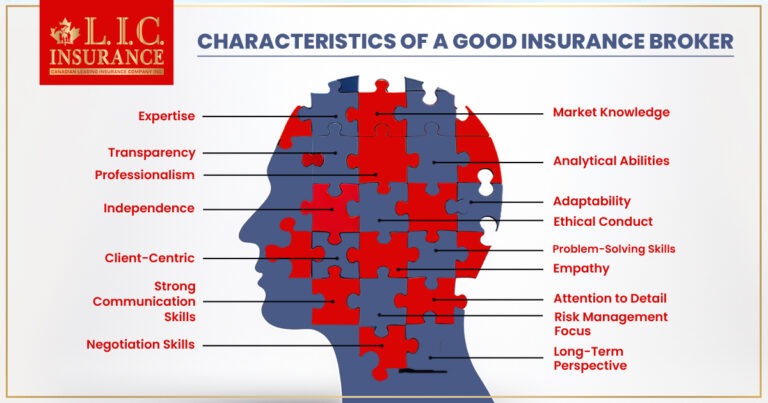

Some Tips On Choosing The Right Insurance Broker

Although there is no established formula for finding the right broker for your insurance needs, what you should look for is someone who has a minimum set of attributes to shift through several policies and identify the right option for you. Here are some tips that can help you hire an insurance broker:

- Visit their website and have a look at their customer reviews. This will give you a better insight into how they have worked with their previous customers.

- Check if the insurance broker works with several companies; if they do, that would mean that they are well-established in the industry.

- You can ask them for proof of their experience, as all registered insurance brokers must possess a minimum set of qualifications.

- Ask for a consultation, and during the first meeting, you can resolve all the queries you may have.

- Also, when you are searching for an insurance broker, you should pay close attention to their availability, as well as how long they take to return phone calls or respond to emails. Choose an insurance broker who is always prompt with their replies.

Process of Application

During the Application process, certain documents will be needed from you, such as:

- Personal health records

- Lifestyle habits

- Income

- Assets and Liabilities list

There are certain insurance policies that might even require you to go for a Health Exam before the issue of the policy, but it has become really rare now.

Whatever situations you might be facing for the type of insurance you are dealing with, you will have complete guidance and support from the insurance broker in Toronto you are working with. A few things to consider before making your decision to buy your policy are as follows:

- Is the policy fulfilling your needs?

- Clarity of the coverage terms and the fine print

- Are you getting the best value for the plan you are going for?

If in case you have missed anything or want to add to your plan, your broker should be able to do that for you effortlessly. Once you have made up your mind, the insurance broker will complete the application process and will proceed with the payment process for you. If you are required to make a claim, the broker might also support you after the coverage gets life.

To learn more about the application process, you can read – Getting an Insurance Policy.

What is the cost of buying Insurance from the Best Insurance Broker in Canada?

An insurance broker is paid by insurance companies and not by clients. They cannot charge a fee; if they do, then it might be a scam.

You only have to pay the fee for the insurance policy you buy but not any fee to the broker. The prices of different insurance policies vary to a great extent as per their type and coverage.

In fact, if you buy insurance from an insurance broker in Canada, it might be cheaper than buying directly from the insurance company. This happens because the insurance broker provides you with various discounts and also negotiates the price of the plan. You can even take the benefits of rebates by bundling different policies together.

Thus to put it in simple terms, you might experience a vast difference in the cost of insurance when you buy it through a broker but not in any case, you will have to pay fees to the broker. You will only have to pay the price of the insurance policy you are buying after you have made the decision to buy it.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Other Insurance Buying Options

You can even buy your insurance directly through the insurance company or work with an agent if you are not interested in buying through a broker. But if you do so, then you will lose the biggest benefit of comparing different insurances available in the market. If you decide to work with an agent, it is best advised to do your proper research so that you are able to grab the best deal for your plan.

Final Thoughts

Hiring an insurance broker can be difficult, but if you choose our team at Canadian LIC in Toronto, you will be hiring a team of professionals who can help you get a tailored insurance policy at affordable premium rates. Please schedule a consultation today; we look forward to meeting you. We are based in Toronto.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]