- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- What is Term Life Insurance with Return of Premium (ROP)?

- The Cost Factor of Term Life Insurance Return of Premium

- Limited Flexibility: A Key Concern

- Comparing Investment Returns: Why ROP May Fall Short

- Real-Life Experiences: Financial Pressure and the ROP Option

- Is the Return of Premium Life Insurance Worth the Wait?

- Alternative Approaches: Making the Most of Your Premiums

- What Happens if You Don’t Outlive the Policy?

- Is ROP Right for You? Key Considerations

Why Is Term Life Insurance With A Return Of Premium Option Not The Best Risk Coverage For You?

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 11th, 2024

SUMMARY

Term Life Insurance with a return on premium is one of the most promising policies for many investors searching for an insurance policy with the hope of returning their investment if they outlive the policy. While the concept seems appealing, particularly for those who want some form of refund on their investment, Canadian LIC clients often come to realize that the reality may not match the initial appeal. The important coverage of Term Life Insurance and the subtle nuances of ROP in Canada will help you in choosing an appropriate option between protection and finances. Through the day-to-day experiences we see at Canadian LIC, it’s clear that while ROP may sound like an ideal choice, it may not be the best fit for everyone when looking at overall risk coverage.

What is Term Life Insurance with Return of Premium (ROP)?

Term life policies provide cover for a specific period. It can be as low as 10 years or as high as 50 years. When the person dies during this term, there would be a direct payment of a death benefit to the beneficiaries. In Canada, term life quotes vary from very high to very low. On average, Term Life Insurance is the cheapest kind because it only provides you with coverage for a specified period. The return of premium option helps the policyholder recover the total premiums paid if he or she survives the policy term.

Such an option seems promising since it returns the premium after the policy term. But then, one needs to understand the actual value when opting for this and understand that the premiums paid under ROP can be quite heavy and, many a time, end up being much more than in a Traditional Term Life \Insurance policy.

The Cost Factor of Term Life Insurance Return of Premium

At Canadian LIC, we’ve seen many clients initially interested in Return of Premium Term Life Insurance options due to the possibility of getting their money back. However, they are often surprised by the significant cost difference. Term life with an ROP is way more premium than plain coverage compared to traditional term life policies, which are more affordable. For example, a 30-year-old who buys a 20-year level term policy without ROP will pay dramatically less per month than an ROP option.

This is why the ROP option forces insurance providers to cover the added risk of paying back premiums. In this respect, the firm charges higher rates than the prevalent regime. The extra costs often become a financial burden in the long run, especially when alternative investments or savings options could offer better returns.

Limited Flexibility: A Key Concern

Term Life Insurance that returns premiums also has very minimal flexibility, and most clients come to be surprised by the restrictions. Canada’s standard Term Life Insurance features the simplest but cheapest form of protection, and coverage is easily adjusted on demand. However, when options under ROP are included with the policy, the contract is rigid due to its design. In that case, if a holder needs to cancel or vary their coverage before the termination of the term, it may mean missing the refundable premiums.

In our business experience, most customers inquiring about Term Life Insurance Canada require flexible policies that can adapt to changes in lifestyle, whether new family responsibilities, career changes, or health changes. Again, the ROP option tends to lock customers into a fixed policy, which is frustrating when life circumstances change.

Comparing Investment Returns: Why ROP May Fall Short

One of the most important considerations associated with Term Life Insurance ROP policies involves the opportunity cost. As such, the Canadian LIC generally advises its clients to compare the ROI of paying for the premiums on ROP with that of alternative investment strategies. Many clients initially look upon ROP only as a way of “saving,” whereby they feel paying for premiums can’t be any worse than losing them at the bank.

But when you compute returns, you can see that there are other choices that you could have made which might produce a better return over a period of years. For example, suppose the difference between regular Term Life Insurance premiums and ROP premiums is placed in a retirement saving account, such as an RRSP or another type of investment account. In that case, there are good returns, financially speaking, over 20 or 30 years.

Real-Life Experiences: Financial Pressure and the ROP Option

At Canadian LIC, we receive clients who experience surprising financial setbacks necessitating reconsideration of their respective insurance options. When a client is locked into a Term Life Insurance ROP policy, their premium payments become non-negotiable due to the potential loss of the refund if they cancel early. These rigidities often add stress to the situation, especially with the person experiencing job changes or other expenses.

Clients who first enter for ROP often need help in keeping to the long-term commitment. They fear to change or scale down their coverage as they may lose their refund, which sometimes forces them to keep up with an unsustainable financial commitment. This can make the ROP option a financial burden instead of a benefit.

Is the Return of Premium Life Insurance Worth the Wait?

For most clients, the issue basically becomes whether the refund is worth the wait. At 20 or 30 years, a Term Life Insurance Return of Premium feels like a huge payment. However, when spreading that over inflation, the value of the refund may not be as outstanding as one feels it is today. Moreover, policyholders do not earn any interest on premiums returned. Their money just sits in an account with the Life Insurance Company pending a refund.

We notice that most clients at Canadian LIC have usually been interested in seeing some form of growth with the money over time instead of waiting for some form of payout with no interest or added value attached to it. Not many find financial growth in many cases, and ROP options do not accommodate this need.

Alternative Approaches: Making the Most of Your Premiums

Instead, options for making Term Life Insurance Policies work better include the possibility of combining a standard term life policy with a dedicated investment account. The savings that result from choosing the regular term instead of the ROP option can be allocated into an investment account that can produce possibly better returns and grow over time.

The most important example is as the Canadian LIC states with reference to alternative savings for retirement alternatives like TFSAs, or RRSP, they are able to advise them on the tax, and compounds and growth potential, enabling more maximizing of savings than offered from the return of the premium insurance policy.

What Happens if You Don’t Outlive the Policy?

There is a very important but sometimes forgotten factor related to ROP: what actually happens if the policyholder does not outlive the policy term? If he dies in the term, the refund option does not count anymore since he is paid the death benefit to his beneficiaries. For clients who are going to pay a higher premium for ROP, this means that they spent a lot of money on an option they did not ultimately have the chance to use.

The advantage of standard term life is the cheaper premium, which allows clients to put the difference elsewhere, be it in personal investments, estate planning, or even extended insurance coverage.

Is ROP Right for You? Key Considerations

An ROP investment might be suitable for someone, but it tends to work best for people with specific financial goals or long-term stability. At Canadian LIC, we encourage our clients to consider the following factors:

- Budget: Can you comfortably afford the higher premium without risking financial strain?

- Financial Goals: Are you seeking an insurance solution that also functions as a forced savings plan, or do you prefer an investment with a potential for growth?

- Flexibility Needs: Do you anticipate needing flexibility in your coverage or the option to change policies as your financial or personal situation evolves?

- Inflation Impact: Are you considering how inflation may affect the value of the refunded premiums in 20 or 30 years?

For many individuals, the answers to these questions reveal that ROP may not align with their long-term objectives, especially when alternative strategies can provide more flexibility and growth potential.

Considering Term Life Insurance Policies that Suit Your Needs

The wide array of Term Life Insurance available in Canada necessitates the consideration of all of them. Canadian LIC offers clients the scope to meet different budgets, needs for coverage, and investment goals. By carrying out exhaustive research on personal financial goals and even life circumstances, clients can find term life quotes that match their needs, enabling them to purchase what they need without breaking the bank.

Why Canadian LIC Recommends Standard Term Life Insurance Over ROP

Throughout our years of experience, Canadian LIC has witnessed the benefits of providing traditional term life over ROP. For those clients who are seeking easy, affordable coverage that buys them peace without having to pay more, standard-term life policies remain a better selection. Furthermore, the added flexibility and affordability with chances to put savings elsewhere align with what most clients are interested in.

Along with the low Return of Premium Life Insurance Cost and flexibility, standard term life provides the added benefit of tailoring coverage for each stage in life. Some clients need higher coverage during their prime working years when children are in school, or the client has a mortgage to pay off. Later in life, when financial responsibilities lessen, they can reduce coverage without being locked into a pricey premium.

Potential Drawbacks of ROP: Missed Investment Opportunities

The one major drawback of the ROP option that we frequently present to clients is the potential for lost investment opportunities. The extra money paid for ROP may otherwise be put into diversified assets that will earn returns over time. Thus, for instance, if one is to invest the additional premium into a low-risk investment or savings account, this would, of course, end up as an amount collected by the end of the policy term, possibly much bigger than what they would otherwise get through the ROP refund.

Tax Implications and Lack of Growth on ROP Refunds

In most instances, one is not thinking of how the return of premium tax would apply to the refund of premiums. This return of premium is tax-free, though it had no interest, nor was it growing in value under the terms of the policy itself. For all practical intents and purposes, that was a sum that had not only lost its chance at having grown in value but would be lost from an account that was otherwise tax-deferred.

We notice at Canadian LIC, most clients would like to see their premiums go toward financial gains in growth vehicles that also bring tax advantages; outcomes will be better over time than a static refund of out-of-term insurance policies. By pointing out the cost of insurance in Term Life Insurance Policies, especially those within Canada, one sees how an effective component can be ascertained in a more holistic financial plan.

Why Standard Term Life Insurance Fits Better in a Long-Term Financial Strategy

A prudent and far cheaper option would mean standard Term Life Insurance is but part of a broader investment plan. Instead of simply ensuring the financial security of loved ones, this approach would seek to generate financial gains through prudently invested resources. By opting for a cheap Term Life Insurance without ROP, the clients will be able to invest elsewhere and grow their wealth independently of their coverage.

The only experience we find with many clients is that of young families who call ROP for something that might “save” them money in insurance. They usually end up looking at other options with Canadian LIC and realize that using the difference they would save as a contribution to their child’s education fund or to a retirement savings plan is more materially meaningful than getting their premiums back.

When Return of Premium Might Be a Suitable Option

While Canadian LIC generally often recommends standard-Term Life Insurance, we recognize that ROP could indeed be an ideal arrangement for some individuals with specific needs or their very own unique goals. For instance, savers who probably would struggle to save otherwise may find an excellent utility in ROP as an appeal of a structured savings plan despite no resultant growth or interest. For instance, some of the clients are still interested in having peace of mind knowing that they “will get something back,” even if it doesn’t quite amount to efficient use of funds.

We advise any person to consult a trusted insurance broker before opting for ROP since ROP should be opted in the knowledge of what it is about and what its true costs are, whether in terms of opportunity costs or any other way. It should be ascertained whether ROP meets personal finance goals and risk-taking capabilities rather than just for a refund at the end.

Comparing Term Life Insurance Quotes: The Value of Canadian LIC’s Expertise

Comparing quotes and understanding all the options that are available for Term Life Insurance is one of the most sensible decisions that you can ever make. Canadian LIC provides a wide range of Term Life Insurance Quotes across Canada, extending from traditional term life to ROP, thus providing clients with an open view of what’s in store for them. The goal should, therefore, be to ease this process for clients, guiding them in weighing the costs, benefits, and drawbacks of each kind of policy so as to apply them to their circumstances directly.

Clients working with Canadian LIC will expect advice beyond premium rates; they have insight into the way each policy impacts their overall financial strategy. We focus on making the insurance selection process as personal and effective as possible so that each client can feel confident in their decision.

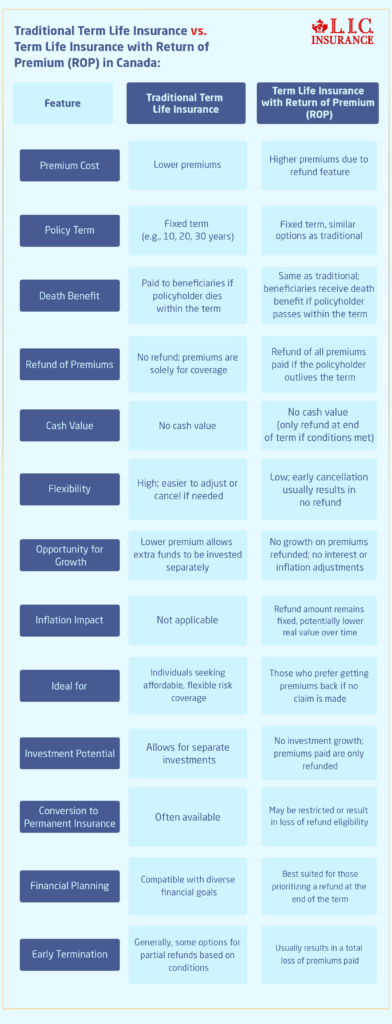

Traditional Term Life Insurance vs. Term Life Insurance with Return of Premium (ROP) in Canada:

The Bottom Line: Why Term Life Insurance with Return of Premium May Not Be the Best Option for Risk Coverage

Basically, term life with an ROP can be insufficient for cost-sensitive, coverage-seeking clients. ROP policies drain quite a lot of unnecessary wealth from policyholders because they are highly priced and not flexible. In addition, the refunded premiums do not grow, so the client might end up with less over time than they could have earned using alternative investment strategies.

Standard-Term Life Insurance provides the desired cover with the least overshooting in finance, thus making it suitable for clients who intend to maximize coverage and overall financial growth. At Canadian LIC, we see firsthand how this choice enables individuals to focus on additional financial goals, such as retirement planning or savings growth, without locking themselves into restrictive, high-cost insurance plans.

Moving Forward with Confidence: Why Canadian LIC is Here to Help

Choosing the Term Life Insurance policy to fit your life will be an important decision, and at Canadian LIC, we believe in arming our clients with the proper information to make informed decisions. Our team of expert brokers is prepared to offer detailed comparisons, recommend options personally tailored to you and provide you with the support required to navigate the Canadian insurance landscape with confidence.

Whether it is standard Term Life Insurance you are assessing, whether you have an ROP available to add to your policy, or whether you are simply looking to clarify which type of insurance is right for you, then Canadian LIC is here for you. We want our clients to feel sure and clear of their insurance path so they don’t go down any old road choosing any old policy that gives them false peace of mind. The right guidance makes securing dependable, affordable insurance an empowering step toward the goal of long-term financial stability.

More on Term Life Insurance

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Term Life Insurance with Return of Premium – Common Questions Answered

Term Life Insurance with a return of premium (ROP) option is a type of policy that refunds all the premiums you’ve paid if you outlive the policy term. This option appeals to people who like the idea of getting their money back after the policy ends. At Canadian LIC, we often explain to clients that, while it seems like a good deal, it usually comes with much higher premiums than regular Term Life Insurance Policies.

Term Life Insurance Policies with an ROP option generally cost more than standard policies. This extra cost covers the insurer’s risk of returning your premiums at the end of the term. Clients at Canadian LIC often see the price difference and realize they could invest that additional money in other ways to see better growth over time. Comparing Term Life Insurance Quotes from standard and ROP options is a good way to see how much more you might pay for the ROP feature.

Whether the ROP option is worth the extra cost depends on your financial goals. For some, it offers peace of mind knowing they will get back what they paid if they outlive the policy. However, we often advise clients that the ROP option may not be the best way to achieve growth. Investing the difference in a tax-free savings account (TFSA) or retirement account (like an RRSP) could bring higher returns over the same period.

If you don’t outlive the policy term, the ROP feature becomes irrelevant because your beneficiaries receive the policy’s death benefit instead. At Canadian LIC, we’ve seen that some clients are surprised by this aspect, thinking they might still benefit from the ROP. In reality, the ROP option only applies if you outlive the policy term. This can make standard-Term Life Insurance Policies more appealing for those focused solely on risk coverage.

No, if you cancel your ROP policy before the term ends, you typically forfeit the return of premium benefit. This policy type generally requires you to keep it for the entire term to receive the premium refund. We advise our clients to consider how long they can commit to a policy before choosing an ROP option since early cancellation may result in a total loss of premiums paid.

Yes, many people find that they can achieve better financial growth by investing the extra cost of an ROP option into other savings or investment accounts. We often suggest comparing the returns you might get by putting that extra money in a TFSA, RRSP, or low-risk investment. In many cases, clients at Canadian LIC see more significant returns through these methods than waiting for a premium refund years down the road.

Choosing ROP depends on your financial priorities. At Canadian LIC, we ask clients to think about their budgets, savings goals, and the value they place on flexibility. If a guaranteed refund sounds appealing and fits comfortably into your budget, ROP might be an option. However, if flexibility and growth potential are important, regular-Term Life Insurance might be a better choice.

No, not all Term Life Insurance Policies in Canada include an ROP option. It’s a specific feature that some insurers offer, and it usually comes with added premiums. Canadian LIC helps clients compare different Term Life Insurance Quotes and policies to find options that fit their needs, with or without the ROP option.

Yes, the refunded premiums in an ROP policy are typically tax-free. However, remember that the refund doesn’t include any interest or growth—it’s just the amount you originally paid in premiums. This means your money didn’t earn anything while it was with the insurance company. Clients sometimes prefer to invest elsewhere, where they can gain tax advantages and growth over time.

An ROP option can make switching policies more challenging because of the high premium cost and the risk of losing the return benefit if you cancel early. At Canadian LIC, we often remind clients to consider how long they’re willing to keep a policy. For those seeking flexibility, a standard Term Life Insurance policy might be easier to adapt to changing needs.

Canadian LIC often recommends standard Term Life Insurance Policies because they are more affordable and flexible. With lower premiums, clients can invest the difference for potentially better returns. Standard-Term Life Insurance also lets clients adjust or switch policies more freely without the worry of losing a refund, making it more suited to long-term financial strategies.

The return of premium (ROP) feature does not change the death benefit amount. If you pass away during the term, your beneficiaries still receive the death benefit as outlined in your policy. The ROP benefit only applies if you outlive the policy term. We find that clients sometimes misunderstand this detail, thinking ROP affects the death benefit. Canadian LIC is here to clarify that ROP only impacts your premium return if you outlive the policy.

No, Term Life Insurance with an ROP option isn’t an investment in the traditional sense. While you receive a refund of premiums if you outlive the policy, those premiums do not grow or earn interest. Clients sometimes view ROP as a “savings” feature, but Canadian LIC explains that it doesn’t provide the same growth as a dedicated investment account or savings plan.

In most cases, you cannot add ROP to an existing Term Life Insurance policy. Typically, you must choose the ROP feature when you initially purchase the policy. For clients who are already locked into a standard policy, Canadian LIC often suggests reviewing their financial goals and considering other ways to invest rather than trying to convert their policy.

The ROP feature can be available for different term lengths, such as 10-year or 20-year terms. However, the premium amount usually varies with the length of the term. A longer-term with ROP tends to have a higher premium due to the extended coverage period. Canadian LIC helps clients understand that, while a 10-year term may have lower costs, the refund of premiums will also be lower than in a 20-year term since you’re paying in for a shorter time.

Generally, the refunded premiums are returned in a lump sum at the end of the policy term. This refund does not come in installments or partial payments. Canadian LIC finds that clients sometimes expect flexible payout options, but the ROP refund is typically structured as a single payment once the term is complete.

No, having an ROP Term Life Insurance policy does not impact your eligibility for other Term Life Insurance Policies. However, your financial commitments to the ROP premiums could limit your budget for additional coverage. Canadian LIC helps clients assess how much coverage they need and what they can afford, whether they choose an ROP or standard policy.

Yes, stopping premium payments on an ROP policy before the term ends usually means losing the return of premium benefit. If payments stop, the policy typically lapses, and you won’t be eligible for a refund. Canadian LIC advises clients to consider their ability to maintain payments throughout the term before choosing ROP, as missing payments can result in losing both coverage and the refund.

Some Term Life Insurance Policies in Canada allow for conversion to permanent insurance, but the ROP option often limits this flexibility. Many ROP policies don’t offer conversion, or they may require you to give up the return of premium benefit if you do convert. At Canadian LIC, we encourage clients to review policy terms carefully if they’re considering conversion options.

To find the best Term Life Insurance Quotes in Canada, comparing policies from multiple providers is essential. Canadian LIC assists clients in finding competitive quotes, factoring in both standard term policies and ROP options. This comparison helps clients understand the cost differences and make informed choices based on their financial goals.

No, ROP policies usually don’t offer partial refunds if you shorten the policy term. Most insurers require you to complete the full term to receive the premium refund. Canadian LIC advises clients who might need flexibility to consider standard Term Life Insurance Policies instead, as they allow more options for adjusting coverage.

If you need more coverage during your ROP policy term, you may have to purchase a separate policy, as most ROP policies don’t allow for easy adjustments. Canadian LIC helps clients determine if buying additional Term Life Insurance Policies is feasible or if a standard term policy with built-in flexibility might better meet their evolving needs.

The refund from an ROP policy is based on the total premiums you paid and doesn’t include interest or adjustments for inflation. Over time, inflation can erode the purchasing power of the refunded amount. Canadian LIC often explains to clients that the real value of an ROP refund may be lower than anticipated due to inflation, which is why some clients prefer investing the premium difference elsewhere for potential growth.

No, ROP Term Life Insurance doesn’t offer cash value during the term. Unlike whole life insurance, which can build cash value over time, an ROP policy only refunds your premiums if you outlive the term. We frequently clarify this difference to clients at Canadian LIC, as some may expect cash value similar to permanent life insurance policies.

This is a set of FAQs targeting the primary concerns our clients most frequently raise in our discussions about Term Life Insurance returns of premium policies. As such, by giving insight into each question, Canadian LIC aims to make clients better equipped in understanding the choices they are making in their insurance choices.

Sources and Further Reading

To deepen your understanding of Term Life Insurance and the return of premium (ROP) option in Canada, consider exploring the following resources:

Term Life Insurance Canada – Get a Quote and Apply | TD Insurance

This page provides detailed information on Term Life Insurance options available through TD Insurance, including policy features and application processes.

TD Insurance

Return of Premium (ROP) – Garrett

An insightful article that explains the essential aspects of Return of Premium in Canada’s life insurance sector, helping you make informed decisions about your insurance needs.

Garrett

Term Life Insurance Canada – Manulife

Manulife’s overview of Term Life Insurance products, highlighting coverage options and benefits tailored to various needs.

Manulife

What is Return of Premium Life Insurance? | MyChoice

This article discusses the concept of return of premium life insurance in Canada, outlining its features, costs, and considerations for potential policyholders.

MyChoice

Term Life Insurance Canada – RBC Insurance

RBC Insurance offers insights into their Term Life Insurance Policies, including coverage details and how they can help protect your family’s financial future.

RBC Insurance

Term Life Insurance | Sun Life Canada

Sun Life Canada’s page on Term Life Insurance provides information on policy terms, benefits, and how to choose the right coverage for your situation.

Sun Life

3 Best Return-of-Premium Life Insurance Policies in October 2024

An analysis of top return-of-premium life insurance policies, offering comparisons and insights to help you evaluate if this option suits your needs.

NerdWallet

Affordable Term Life Insurance with Blue Cross Life – Blue Cross of Canada

Blue Cross Life outlines their Term Life Insurance offerings, emphasizing affordability and coverage options available to Canadians.

Blue Cross

Term Life Insurance: What You Need to Know | Finder Canada

A comprehensive guide on Term Life Insurance in Canada, covering the basics, benefits, and considerations for choosing the right policy.

Finder

Best life insurance in Canada for 2024 – MoneySense

An article that reviews and compares the best life insurance options in Canada for 2024, helping you make informed decisions about your coverage.

MoneySense

What Is the Return of Premium Life Insurance & Is It Worth It

This resource explores the return of premium life insurance option, discussing its benefits and potential drawbacks to help you assess its value.

Canadian Life Insurance Company

What is Term Life Insurance with Return of Premium? | Assurity

Assurity’s article explains the concept of Term Life Insurance with a return of premium option, detailing how it works and considerations for potential policyholders.

Assurity

Get a Term Life Insurance quote online – Canada Life

Canada Life offers an online tool to obtain Term Life Insurance Quotes, providing information on policy options and coverage details.

Canada Life

Affordable Term Life Insurance Rates from $15/month

This resource discusses affordable Term Life Insurance options in Canada, highlighting rates and coverage details to help you find cost-effective solutions.

MyChoice

These resources offer valuable insights into Term Life Insurance Policies and the return of premium options in Canada, aiding you in making informed decisions about your insurance needs.

Key Takeaways

- Higher Premiums for ROP

Term Life Insurance with a return of premium (ROP) typically has higher premiums than standard Term Life Insurance Policies, impacting affordability. - Limited Flexibility

ROP policies often lack flexibility. Cancelling early usually forfeits the premium refund, locking policyholders into long-term commitments. - Missed Investment Potential

The extra cost of ROP could be invested elsewhere, potentially offering greater financial growth than waiting for a premium refund. - No Interest or Inflation Adjustment

ROP only returns the premiums you paid, without interest or adjustments for inflation, reducing its value over time. - Suitable for Specific Needs

ROP may be a fit for those prioritizing a refund at the term’s end, but standard Term Life Insurance Policies often better support flexible, growth-oriented strategies. - Comparison is Essential

Getting Term Life Insurance Quotes for both standard and ROP options helps in evaluating which aligns best with your financial goals.

Professional Guidance Matters

Consulting with an insurance expert, like Canadian LIC, can clarify whether ROP or standard Term Life Insurance is a better fit for your situation.

Your Feedback Is Very Important To Us

We appreciate your time in providing insights into your experiences with Term Life Insurance with a return of premium option. Your responses will help us understand the challenges Canadians face when evaluating this type of insurance.

Thank you for sharing your experiences and thoughts. Your feedback will help us support Canadians better in understanding and selecting the right Term Life Insurance options for their needs.

IN THIS ARTICLE

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- What is Term Life Insurance with Return of Premium (ROP)?

- The Cost Factor of Term Life Insurance Return of Premium

- Limited Flexibility: A Key Concern

- Comparing Investment Returns: Why ROP May Fall Short

- Real-Life Experiences: Financial Pressure and the ROP Option

- Is the Return of Premium Life Insurance Worth the Wait?

- Alternative Approaches: Making the Most of Your Premiums

- What Happens if You Don’t Outlive the Policy?

- Is ROP Right for You? Key Considerations