- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

Why Are Term Life Insurance Claims Rejected?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 27th, 2024

SUMMARY

This blog delves into why Term Life Insurance claims are declined in Canada, discussing common causes like misrepresentation on applications, missed payments, lapses of policies, nondisclosure of high-risk activities, and documentation issues. It provides real client struggles shared by Canadian LIC and offers practical tips to avoid claim denials. The blog puts much emphasis on correct applications and proper guidance from trusted brokers.

Introduction

You bought a term life policy, paid your premiums dutifully, and assumed that after your passing, your loved ones were well taken care of financially. But what if they aren’t? Sometimes, claim denials can leave people feeling devastated, putting family members in a precarious situation financially. Many of your clients at Canadian LIC, Ontario’s leading insurance brokerage, approach our team asking why claims are sometimes denied despite people’s best efforts. These are more common concerns than you would think, and knowing why claims get rejected can help you avoid making common mistakes.

In this blog, we’ll explore the reasons Term Life Insurance claims are denied, share relatable situations our clients face, and provide tips to ensure your claims are processed smoothly. By the end, you’ll understand how to secure your policy’s success with Canadian LIC’s expert guidance.

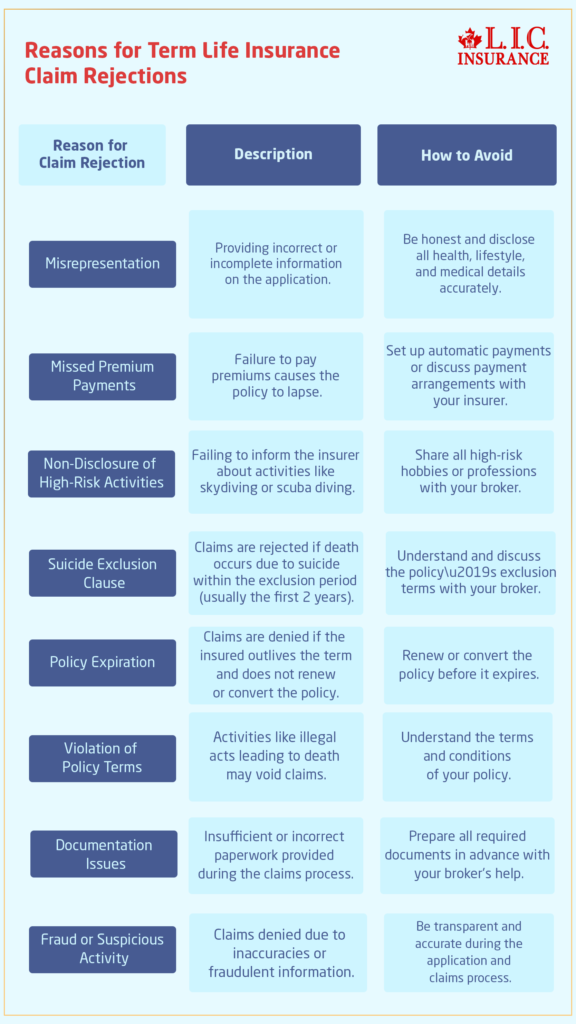

Misrepresentation on the Application

Misrepresentation or error within the Life Insurance application is one of the most common reasons an insurance claim is denied. Insurers depend a lot on information used when giving a Term Life Insurance Plan, such as your health history, smoking status, and lifestyle.

A Client’s Perspective

An Ontario client shared with me a case in which a minor omission caused her father’s claim to be denied. When completing the application, her father had omitted mentioning a minor surgery he had several years ago, thinking it wasn’t a big deal. Unfortunately, the insurer later picked this up when reviewing his medical records after his death and marked the policy for review.

How to Avoid This

Always ensure the information given when applying for a Term Life Insurance policy is complete and accurate. Canadian LIC’s Term Life Insurance Brokers will get to know you very well to ensure no surprises arise afterward.

Policy Lapses Due to Missed Payments

The other most common issue is allowing the policy to lapse because one missed the premium payments. Life can get very busy, and missing a premium payment is easier than you would have imagined. However, if the policy was not active at the time of death, the insurer might decline claims.

A Real Situation We Encountered

A client had Term Life Insurance for over 15 years, but she did not make two payments during one tough financial period. A month later, she died when the policy lapsed. The Life Insurance Company denied her claim, and the family scrambled for financial support.

How to Avoid This

At Canadian LIC, we advise that direct debit or automatic payments be set up to avoid lapses. Secondly, most Life Insurance Policies have grace periods—usually 30 days—to lapse before you are declared lapsed. If a payment is missed, discuss alternative arrangements with your insurer.

Non-Disclosure of High-Risk Activities

Engaging in high-risk activities, such as skydiving or scuba diving, can increase the chances of a claim being rejected if these activities weren’t disclosed during the application process.

How This Impacts Claims

The husband of one client is a crazy enthusiast of the odd extremes. He cannot recall this when applying for insurance because he goes skydiving once every year. That is when this information has come to the surface. The accident during the dive uncovered this omission. The insurer denied the claim on grounds of non-disclosure.

How to Avoid This

Always inform your insurance broker of any high-risk activities you engage in, even if they’re infrequent. Canadian LIC’s team ensures your policy aligns with your lifestyle, avoiding such complications.

Suicide Exclusion Clause

Most term life policies contain an exclusion clause for suicide, normally effective for a period of two years during the initial period of coverage. An insurer will almost certainly refuse to pay any claim resulting from suicide within such a two-year period.

A Sensitive Case

The family came to us after they were rejected in their claim when their loved one died within the exclusion period. Although the insurance company refunded the Life Insurance premiums, the family was not in a position to meet the financial difference.

What You Should Know

Understanding your policy’s terms, including any exclusion clauses, is crucial. Canadian LIC brokers explain these details clearly, ensuring you and your family are well-informed.

Outliving the Policy Term

A Term Life Insurance policy covers only the term of the policy. The term could be 10, 20, or 30 years. After that, if the insured survives, there will be no payout unless the policy is renewed or converted to Permanent Life Insurance Policies.

Client Experience

A client in Ontario was shocked when her father’s claim was declined after his passing at 75. What actually happened was that the five-year renewal of his 20-year Term Life Insurance Ontario Canada was passed up, and by that time, the policy was not in force.

How to Avoid This

Stay proactive about renewing or converting your policy as it nears expiration. Canadian LIC’s brokers help you evaluate your options well in advance to ensure continuous coverage.

Violation of Policy Terms

Term Life Insurance Coverage comes with certain terms and conditions. Breach of such terms and conditions results in the rejection of the claim. For instance, if illegal activities are associated with the cause of death of the policyholder, the insurer may reject the claim.

What Happened to a Client

An uncle of one client had been involved in an unintentional car accident while being intoxicated. Though tragic, the company denied the claim on account of its policy not providing for that particular condition.

How to Avoid This

Understanding the fine print is essential. Canadian LIC’s brokers simplify complex terms, ensuring you’re fully aware of your policy’s limitations.

Documentation Issues

Even if all else goes right, not having adequate or proper documents will prolong or deny a claim. Insurers need these: the death certificate, proof of relation, and medical reports.

A Client’s Experience

One family’s claim was delayed for months because they provided incomplete medical records. The stress of collecting additional documents during a difficult time took an emotional toll.

How to Avoid This

Canadian LIC brokers assist clients in understanding the claims process and preparing the required documentation in advance, minimizing delays.

Involvement of Fraud

Insurance fraud is a serious issue, and even unintentional discrepancies can raise red flags. If an insurer suspects fraud, they may investigate extensively, delaying or denying the claim.

What Fraud Looks Like

Fraud may be any information provided in the application process or how someone tries to get benefits under suspicious circumstances. Insurers take such serious cases to protect the system.

How to Avoid This

Be honest and transparent throughout the application and claims processes. Canadian LIC’s brokers guide you in presenting your case accurately and avoiding any missteps.

Reasons for Term Life Insurance Claim Rejections

How Canadian LIC Can Help

We at Canadian LIC know the Term Life Insurance claim problem families face. Our professional Term Life Insurance Brokers work really hard to ensure clients are matched up with the best policy and make sure claims are filed correctly. By having easy access to many different online Term Life Insurance Quotes Online, we make it easier for you to compare your options and make a decision that will fit your needs. We can help you whether you are in Ontario or any other province in Canada.

With Canadian LIC, you don’t just buy a policy; you get a trusted advisor who will stand by your side and ensure you and your loved ones are protected when it matters most.

More on Term Life Insurance

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions: Why Are Term Life Insurance Claims Rejected?

Claims may be declined due to, for instance, incorrect information on the application, failure to pay premiums, or exclusions of policies. In Canadian LIC, we have witnessed our clients being rejected because of minor mistakes they didn’t know they had committed. Always have your application reviewed with your broker to ensure that you have no mistakes.

Disclose everything about your health, habits, and lifestyle. This includes medical history, smoking, or risky hobbies like skydiving. One client in Ontario didn’t mention their occasional scuba diving trips, and this led to issues with their claim. Being upfront helps avoid surprises later.

If you miss a payment, your policy might lapse, and a claim could be rejected. Most policies have a grace period of 30 days. One of our clients avoided losing their coverage by contacting us early for solutions. Setting up automatic payments is a simple way to prevent lapses.

Yes, insurers review your medical records during the claims process. If something was omitted, it might lead to rejection. A Canadian LIC broker can guide you through the application to ensure all details are included.

Most causes are covered, but exclusions apply. For example, suicide within the first two years is often excluded. We always explain these clauses to our clients during the policy selection process to avoid confusion later.

It depends on the policy and whether the activity was disclosed during the application. A client once had their claim denied because they didn’t mention their annual participation in extreme sports. Always discuss your hobbies with your broker when buying a policy.

Yes, many policies allow renewals, but premiums may increase. One of our Ontario clients renewed their plan and avoided a gap in coverage. We help clients review their options before policies expire.

The key is transparency and staying updated. Provide accurate information when applying and keep your premiums current. At Canadian LIC, we guide families through the claims process, ensuring all required documents are in place.

Yes, brokers can help you understand the reasons for denial and guide you on what steps to take next. Our team at Canadian LIC has helped clients appeal claims by providing additional documentation or clarifications.

You can find quotes from leading insurers in Ontario and across Canada using the Canadian LIC platform. We make the whole process easy and transparent and help you choose the right policy for your needs.

Claims can be denied due to errors such as misinformation on the application, failure to pay premiums, or policy exclusions. We have seen clients rejected due to small errors that they never knew they committed at Canadian LIC. Always go through your application with your broker to ensure it is correct.

Disclose everything about your health, habits, and lifestyle. This includes medical history, smoking, or risky hobbies like skydiving. One client in Ontario didn’t mention their occasional scuba diving trips, and this led to issues with their claim. Being upfront helps avoid surprises later.

If you miss a payment, your policy might lapse, and a claim could be rejected. Most policies have a grace period of 30 days. One of our clients avoided losing their coverage by contacting us early for solutions. Setting up automatic payments is a simple way to prevent lapses.

Yes, insurers review your medical records during the claims process. If something was omitted, it might lead to rejection. A Canadian LIC broker can guide you through the application to ensure all details are included.

Most causes are covered, but exclusions apply. For example, suicide within the first two years is often excluded. We always explain these clauses to our clients during the policy selection process to avoid confusion later.

Yes, many policies allow renewals, but premiums may increase. One of our Ontario clients renewed their plan and avoided a gap in coverage. We help clients review their options before policies expire.

The key is transparency and staying updated. Provide accurate information when applying and keep your premiums current. At Canadian LIC, we guide families through the claims process, ensuring all required documents are in place.

Yes, brokers can help you understand the reasons for denial and guide you on what steps to take next. Our team at Canadian LIC has helped clients appeal claims by providing additional documentation or clarifications.

You can compare quotes from some leading Ontario and Canadian insurance players with the help of this Canadian LIC platform offered through its website. We find it to be very easy and transparent in such decision-making processes.

A Term Life Insurance Plan provides coverage for a set period, such as 10, 20, or 30 years. If the insured passes away within this time, the policy pays out a benefit to their beneficiaries. Our brokers at Canadian LIC help Ontario clients select the most suitable term length and coverage.

The cost of Term Life Insurance depends upon your age, health condition, and the amount covered. It is easier to find a plan that will fit your budget when comparing Term Life Insurance Quotes Online with Canadian LIC.

Yes, many policies are convertible term life to permanent policies. That is handy if the needs change over time. This is a benefit many of our clients here in Ontario like very much.

You’ll need a death certificate, proof of relationship, and any other documents specified by your insurer. At Canadian LIC, we guide families step-by-step to ensure they submit everything correctly.

Claims might be delayed if documentation is incomplete or if the insurer needs to investigate further. Our brokers at Canadian LIC work with insurers to minimize delays and keep you informed.

Sources and Further Reading

Government of Canada – Life Insurance Information

https://www.canada.ca

Comprehensive details on life insurance regulations and consumer rights in Canada.

Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

Official guidelines and resources about life insurance policies in Canada.

Insurance Bureau of Canada (IBC)

https://www.ibc.ca

Insights into the insurance industry and consumer-focused resources.

Financial Consumer Agency of Canada (FCAC)

https://www.canada.ca/en/financial-consumer-agency.html

Tools and advice for making informed decisions about life insurance.

Key Takeaways

- Accurate Information is Crucial: Misrepresentation or omissions on a Term Life Insurance Plan application can lead to claim rejection. Be honest and thorough.

- Keep Policies Active: Missing premium payments can cause policy lapses. Set up automatic payments to maintain coverage.

- Disclose High-Risk Activities: Inform your broker about hobbies or jobs involving risk to ensure your policy covers them.

- Understand Exclusion Clauses: Suicide clauses and illegal activity exclusions may lead to denied claims if not understood properly.

- Document Thoroughly: Provide all necessary paperwork, including medical records and proof of relationship, to avoid delays or denials.

- Policy Expiration Matters: If the term ends, the policy provides no payout unless renewed or converted. Plan ahead.

- Trust Experienced Brokers: Work with trusted Term Life Insurance Brokers, like Canadian LIC, to ensure your policy aligns with your needs and the claims process is smooth.

- Fraud Can Jeopardize Claims: Avoid inaccuracies or suspicious activities to prevent investigations or rejections.

- Review and Update Your Policy: Life changes may require updates to your policy. Regular reviews help maintain alignment with your needs.

- Stay Informed: Understanding your Term Life Insurance Quotes Online and policy details empower you to secure your family\u2019s financial future.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your experience. Your feedback will help us understand the challenges people face when learning why Term Life Insurance claims are rejected. Please fill out the form below.

Thank you for your valuable input! We\u2019ll use your feedback to improve our services and provide better support for understanding Term Life Insurance policies and claims.