- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

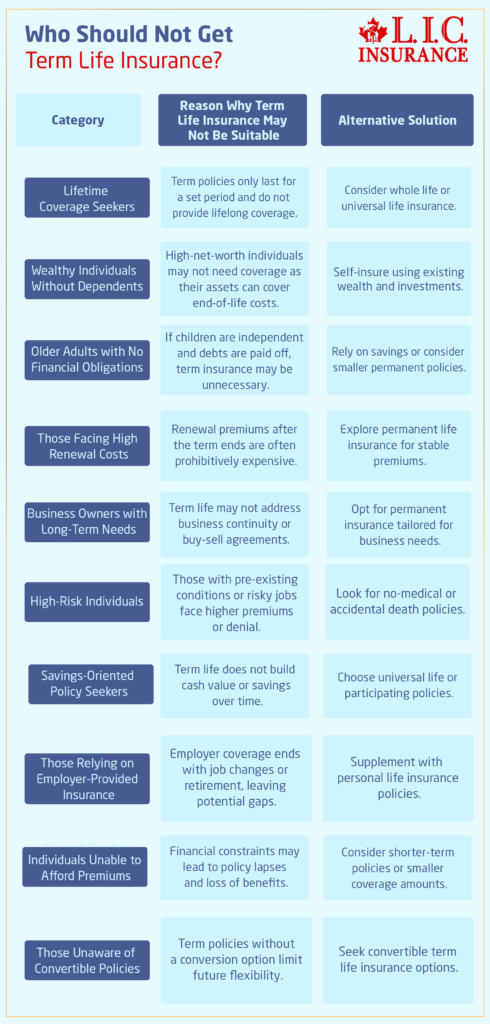

- Who Should Not Get Term Life Insurance?

- When the Coverage Doesn't Align with Your Needs

- Individuals Seeking Lifetime Coverage

- Wealthy Individuals with No Dependents

- Older Adults with Expired Financial Responsibilities

- People Who Cannot Afford Renewing or Extending Coverage

- Business Owners with Complex Insurance Needs

- High-Risk Individuals Facing Policy Denials or High Premiums

- Those Who Prefer Savings-Oriented Policies

- Individuals Relying on Employer-Provided Life Insurance

- Those Unwilling to Commit to Regular Premiums

Who Should Not Get Term Life Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 4th, 2024

SUMMARY

When the Coverage Doesn't Align with Your Needs

Imagine a scenario whereby one has just bought Term Life Insurance but realizes at some point that it may not help in their long-run goals. For instance, two parents planning for a special child for their lifetime might be forced to realize that the duration the Term Life Insurance covers is less for their lifetime needs. For others, especially when individuals retire, and children have raised families, paying premiums may end up being a meaningless task. These are the all-too-common stories that we hear at Canadian LIC while counselling our clients:

Here, we will discuss the groups of people who might not benefit from Term Life Insurance. Whether it is due to financial stability, changing needs, or better alternatives, understanding these reasons will help you make a decision that aligns with your unique circumstances.

Individuals Seeking Lifetime Coverage

One of the features is that Term Life Insurance does not last for the entire period. The duration for which such policies are generally available covers a fixed period, for example, 10, 20, or 30 years. It suits individuals who require protection during their working years. However, it does not support people needing protection throughout their lives.

For instance, if it is a person who is in his or her 30s and has a family history of medical complications, then such a person would be looking for a policy that not only covers immediate financial risks but also pays back later in life. Whole or universal life insurance would serve the purpose because it offers lifetime protection and accumulates cash value over time.

Key takeaway: If your priority is lifetime security, Term Life Insurance Agents may recommend exploring Permanent Life Insurance Options instead.

Wealthy Individuals with No Dependents

We often meet clients who initially feel obligated to purchase Life Insurance because it’s widely regarded as a financial necessity. However, if you’re financially independent, have no dependents, and your assets are enough to cover end-of-life expenses, Term Life Insurance might be redundant.

For example, a retired professional with a substantial investment portfolio and no dependents may not require Term Life Insurance. He can serve as his own insurance mechanism to pay all his bills in case he dies and then requires no additional insurance.

Key takeaway: Term Life Insurance Quotes are designed to be affordable, but even affordable premiums can feel unnecessary if you already have ample financial resources.

Older Adults with Expired Financial Responsibilities

Term Life Insurance is particularly well suited for those who are paying for young families or have large debts, such as a mortgage. As the individual gets older, these obligations generally decrease. Once children become independent and major debts are over, the need for insurance also generally decreases.

We helped several clients in their late 60s determine what they needed. Most discovered that they were no longer in need of Term Life Insurance since their families could take care of themselves, and they had minimal risks when it came to their finances.

Key takeaway: If you’re no longer financially supporting anyone or managing significant debt, it might be time to reconsider renewing your Term Life Insurance policy.

People Who Cannot Afford Renewing or Extending Coverage

Most people misunderstand Term Life Insurance, assuming the premiums are always going to be affordable. Term policies are cheap in their initial stage, but renewals, after the term is over, are much more expensive.

For example, a couple can buy a 20-year term policy when they establish their family. However, upon approaching the 50th year, they might think it’s too pricey to renew, if at all, due to a bad health status at the time. It becomes vital, therefore, that they know the actual renewal cost.

Key takeaway: If you anticipate needing coverage beyond the initial term, consider alternatives that offer better long-term affordability.

Business Owners with Complex Insurance Needs

Businesses may require life insurance for either protecting the business or for the continuity of the business. Term Life Insurance may suffice to provide that protection temporarily, but in most cases, it doesn’t serve to fund buy-sell agreements or pay for liabilities extending far into the future.

One business owner we worked with at Canadian LIC shared how their term policy fell short when it came to securing their company’s future. Instead, a permanent policy provided both the necessary longevity and the ability to accumulate cash value.

Key takeaway: If you own a business with long-term obligations, consult with Term Life Insurance Agents to explore specialized solutions beyond Term Life Insurance.

High-Risk Individuals Facing Policy Denials or High Premiums

Usually, for people with previously existing health conditions or dangerous occupations, obtaining term life coverage is almost impossible. Even if that does not happen, the cost of premiums makes the coverage impractical.

An example would include a client who operated in extreme sports. Even with a very strong desire to be covered, quoted premiums for coverage were substantially beyond what would be considered affordable by such clients. Such people might be much better served with no-medical life insurance or accidental death policies balancing coverage against cost.

Key takeaway: High premiums or frequent denials make it essential to weigh alternative coverage options that align with your circumstances.

Those Who Prefer Savings-Oriented Policies

Term Life Insurance offers coverage without an investment component that builds cash value over time. It makes the premiums more affordable, but there will be no financial return unless the policyholder passes away during the term.

Some clients we’ve met prioritize policies that allow them to save and grow their wealth. For example, Universal Life Insurance Policies combine coverage with investment opportunities, making them attractive for people who want a dual benefit.

Key takeaway: If your goal is to combine insurance with savings, Term Life Insurance Policies might not meet your expectations.

Individuals Relying on Employer-Provided Life Insurance

Convenient and inexpensive as employer-provided life insurance usually seems, relying exclusively on this kind of plan is dicey; it typically ends at the time you quit work or retire.

We have worked with clients who thought their employer’s policy was sufficient, and then they ended up uninsured when they changed careers. Personal policies offer better security and flexibility, but some people do not want to duplicate coverage.

Key takeaway: If you’re satisfied with employer-provided coverage, ensure it’s enough to meet your family’s long-term needs.

Those Unwilling to Commit to Regular Premiums

Even the cheapest Term Life Insurance Quotes require you to pay premiums on a regular basis to keep your coverage. If you cannot afford to pay regularly, you will lose your policy.

One client shared that at one time, due to a sudden strain on finances, he had to let the policy lapse. He later regretted this, especially after paying higher premiums upon reapplication.

Key takeaway: Before signing up for Term Life Insurance, assess your ability to pay premiums throughout the policy’s duration consistently.

People Unaware of Customizable Alternatives

Many people end up automatically being enrolled in term life coverage without exploring options customized according to their specific requirements. For instance, convertible policies allow you to switch from Term to Permanent Coverage later, providing the flexibility that pure term policies lack.

We have been able to walk many clients through the process, finding policies that would grow with their changing needs. Being aware of what’s available can make a huge difference in making sure your insurance plan stays pertinent over time.

Key takeaway: Consult knowledgeable Term Life Insurance Agents to understand the full range of options available before making a decision.

Who Should Not Get Term Life Insurance?

Final Thoughts: Making the Right Choice with Canadian LIC

Choosing the right life insurance policy is a very personal decision. Term Life Insurance has many benefits, but it’s not the best option for everyone. Knowing who may not benefit from Term Life Insurance Policies will help you make a better decision on whether it fits into your financial goals.

We pride ourselves at Canadian LIC on being able to find that perfect insurance solution for clients. If term life isn’t the right option for you, we have plenty of other options available to help you find what will provide you with the protection and peace of mind you need. Let’s work together and build a plan that actually addresses your needs today and into the future.

More on Term Life Insurance

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs Around "Who Should Not Get Term Life Insurance?

Term Life Insurance is best for individuals who need temporary coverage. For example, young parents securing their children’s education or someone with a mortgage. The duration of fixed-Term Life Insurance makes it ideal for covering short-term financial responsibilities.

Term Life Insurance only provides protection for a specific period. If you need lifelong coverage, like securing financial support for a special needs child or covering estate taxes, Term Life Insurance Policies might fall short. Permanent insurance, like whole or universal life, is a better choice for such needs.

If someone has substantial assets and no dependents, they may not need Term Life Insurance. Wealthy individuals can use their resources to cover expenses, making Term Life Insurance Quotes irrelevant to them.

If your Term Life Insurance Duration ends and you need continued coverage, you can either renew the policy or convert it to a permanent one. However, renewal premiums can be much higher. At Canadian LIC, we often guide clients in finding the most cost-effective options during this stage.

Term Life Insurance can help business owners temporarily, such as by securing loans. However, for long-term needs like succession planning or buy-sell agreements, Permanent Coverage works better. Our Term Life Insurance Agents frequently help business owners explore options tailored to their specific requirements.

Renewing a term policy can be expensive, especially if health conditions change. We’ve seen clients struggle with this, and they often switch to alternatives like shorter terms or no medical insurance. It’s crucial to evaluate your long-term budget before committing.

Employer-provided policies are a good starting point but are not always enough. They usually end when you leave your job or retire. Many clients rely solely on these plans, only to find themselves uninsured at critical times. Having personal coverage ensures more control and consistency.

High-risk individuals often face higher premiums or outright denials for Term Life Insurance. At Canadian LIC, we’ve helped such clients explore specialized products like accidental death policies or no-medical coverage, which provide a balance between affordability and protection.

Some people want their premiums to contribute to savings or investment growth. Term Life Insurance doesn’t offer this, as it only provides death benefits. Products like universal life insurance allow coverage while also building cash value over time.

Yes, combining term and permanent policies can be an effective way to balance affordability and long-term security. Many of our clients use this strategy to protect short-term needs while ensuring lifetime coverage for key responsibilities.

If Term Life Insurance doesn’t align with your goals, explore other options like whole life, universal life, or no-medical policies. Working with experienced Term Life Insurance Agents can help you understand what works best for your financial situation.

A Term Life Insurance policy usually lasts for a set period, such as 10, 20, or 30 years. The duration of the Term Life Insurance depends on your chosen plan. Many clients opt for a term that matches their financial obligations, like a mortgage or children’s education expenses.

You can often renew or convert Term Life Insurance, but renewal premiums can be much higher. Many of our clients decide to convert their term policy into permanent coverage when they foresee extended financial needs.

No, Term Life Insurance does not build cash value. It focuses on providing a death benefit during the term. Clients who seek savings or investment opportunities often prefer permanent insurance options instead.

Term Life Insurance is cheaper because it only covers a specific period and doesn’t include a cash value component. For example, we’ve worked with clients who needed affordable coverage for short-term goals, and Term Life Insurance fit their budget perfectly.

If you outlive the policy’s term, the coverage ends, and there’s no payout. Some clients choose to renew their policy, while others explore permanent insurance to maintain protection. It’s essential to evaluate your needs before your policy expires.

Yes, you can buy multiple-term policies to cover different financial obligations. Many clients at Canadian LIC use this strategy, such as pairing one policy for a mortgage with another for children’s education.

To compare Term Life Insurance Quotes, look at the coverage amount, policy duration, and premium costs. Our Term Life Insurance Agents often help clients analyze these factors to ensure the policy aligns with their needs and budget.

The main risk is losing coverage after the Term Life Insurance Duration ends. Clients who only rely on term policies may face high renewal premiums or gaps in protection. Planning for long-term needs with a combination of policies can mitigate this risk.

Term Life Insurance can cover high-risk professions, but premiums are often higher. We’ve helped clients in high-risk jobs find policies that balance cost and coverage, ensuring they feel secure without overpaying.

Factors include your age, health, policy duration, and coverage amount. For example, a healthy individual in their 30s will typically get lower premiums than someone in their 50s. Our Term Life Insurance Agents work closely with clients to secure the most competitive rates.

Both options have benefits. Buying online is convenient, but working with Term Life Insurance Agents ensures personalized guidance. We’ve found that many clients prefer having an expert explain the details and answer questions before making a decision.

If leaving an inheritance is your goal, permanent life insurance is a better choice. Term policies only provide coverage for a limited period, which might not align with long-term estate planning goals.

Term Life Insurance suits you if you have temporary financial responsibilities, like repaying a loan or supporting young children. During consultations, we help clients assess their unique situations to determine if Term Life Insurance Policies meet their needs.

Yes, you can cancel your term policy anytime, but there’s no refund for past premiums. We’ve seen clients switch policies when their financial goals changed, and our agents guided them through the transition seamlessly.

Yes, smokers generally pay higher premiums. However, quitting smoking can lower your costs over time. We’ve worked with clients to revisit their Term Life Insurance Quotes after they quit smoking, resulting in significant savings.

Sources and Further Reading

- “7 Questions to Ask When Buying Term Life Insurance in Canada” by Blue Cross Life: This guide offers critical questions to consider, ensuring that potential policyholders make informed decisions about Term Life Insurance.

Blue Cross - “Your Complete Guide to Life Insurance in Canada” by MoneySense: This resource delves into various life insurance options available in Canada, including Term Life Insurance, and discusses scenarios where it may or may not be suitable.

MoneySense - “Term Life Insurance in Canada: All You Need to Know” by Money.ca: This article explains the workings of Term Life Insurance, its benefits, and limitations, aiding readers in assessing its relevance to their needs.

Money.ca

Key Takeaways

- Term Life Insurance Has a Specific Duration: Policies cover a fixed period, such as 10, 20, or 30 years, making them ideal for temporary financial needs.

- Not Suitable for Lifetime Coverage: If you need protection for your entire life or want to leave a legacy, Term Life Insurance may not be the right choice.

- Wealthy Individuals Often Don’t Require It: Those with significant assets and no dependents may find Term Life Insurance unnecessary.

- High Renewal Costs Can Be a Barrier: Renewing a policy after the initial term can lead to steep premium increases, making it less practical for extended needs.

- No Cash Value Component: Unlike permanent life insurance, term policies do not build savings or investments over time.

- Business Owners May Need Specialized Solutions: For long-term obligations, like succession planning, Term Life Insurance alone might not suffice.

- Employer-Provided Coverage Isn’t Always Enough: Relying solely on employer-provided insurance can leave gaps, especially after retirement or a job change.

- High-Risk Individuals Face Unique Challenges: Those with pre-existing conditions or risky professions often face higher premiums or limited coverage options.

- Budget Constraints Matter: Term Life Insurance requires consistent premium payments, and lapsing coverage can lead to a loss of benefits.

- Consider Combining Policies: A mix of term and permanent life insurance can offer a balance of affordability and long-term security.

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand the challenges Canadians face when determining if Term Life Insurance is the right choice. Your insights will help us provide better guidance. Please fill out the form below.

Thank you for your valuable feedback!

By submitting this form, you agree to be contacted for follow-up discussions or offers related to life insurance.

IN THIS ARTICLE

- Who Should Not Get Term Life Insurance?

- When the Coverage Doesn't Align with Your Needs

- Individuals Seeking Lifetime Coverage

- Wealthy Individuals with No Dependents

- Older Adults with Expired Financial Responsibilities

- People Who Cannot Afford Renewing or Extending Coverage

- Business Owners with Complex Insurance Needs

- High-Risk Individuals Facing Policy Denials or High Premiums

- Those Who Prefer Savings-Oriented Policies

- Individuals Relying on Employer-Provided Life Insurance

- Those Unwilling to Commit to Regular Premiums