Think about arriving in Toronto, Canada, all set to enjoy the beautiful sights and experience the diverse culture. Then, suddenly, you have a health issue. Now, you are out there in a foreign healthcare system, worrying about the health care costs and what your regular health insurance will or will not cover regarding medical problems. This is more common than you think, and it underlines the importance of securing the right Canadian Visitor Health Insurance.

With so much to choose from out there, it can get a little scary exploring the myriad of Visitor Insurance Policies. This blog tries to make the process easier and gives you a straight guide on how to choose the best Visitor Insurance in Canada so that worry is reduced to the least during your stay. We will share the real-life struggles and successes of real people like you who’ve already dealt with the complexities of securing comprehensive coverage. Let’s go deeper to understand how to get the best Visitor Insurance in Canada.

Choosing the Right Visitor Insurance Policy

Understanding the Basics

First things first: before understanding the intricacies of Canadian Visitor Health Insurance, it is important that one understands just what the insurance really is. In layman’s words, this insurance is more like a safety net that covers medical expenses that can arise while in Canada. These expenses can range from a visit to the doctor to hospital emergency stays, and in some cases, they also include prescribed drugs. However, not all policies are the same.

Take, for instance, the case of John, a visitor from the Philippines, who overlooked the importance of reviewing the terms of his insurance for visitors. A minor skiing accident in British Columbia resulted in a hefty medical bill that his basic policy did not fully cover, turning his dream vacation into a stressful financial burden. This example highlights the necessity of understanding the specifics of your policy.

Find Out: Is Visitor Insurance mandatory?

Comparing Visitor Insurance Policies

When comparing Visitor Insurance Policies, consider what coverage is most important to you. Are you planning adventurous activities, or do you have existing medical conditions? Answers to these questions will guide your choice.

Tip: List down your top three activities planned in Canada. Next to each, fill in possible risks and how you would feel if you had to pay out of pocket for associated emergency medical costs. This will help you decide which features in an insurance plan are most important to you.

Key Features to Look For

Below are features that you should prioritize when shopping for insurance.

Emergency medical coverage: This is a big one. Ensure that it covers a lot to handle severe emergencies, as the treatment cost in Canada might be huge if it’s not enough.

Coverage for pre-existing conditions: Only some offer this, so make sure, in case this applies to you, the policy chosen includes it.

Repatriation: This is an example of a contribution in case of a serious medical problem that would include transport back to your home country. Find out if your policy covers it.

Duration of coverage: Be sure that the insurance purchased covers the entire period of a stay.

Sapna from the UK had a policy that expired three days before her departure from Canada, thinking it wouldn’t be a problem. Unfortunately, she slipped and broke her wrist just two days before leaving. This oversight cost her over $2,000, which a more appropriately timed policy could have covered.

Making an Informed Decision

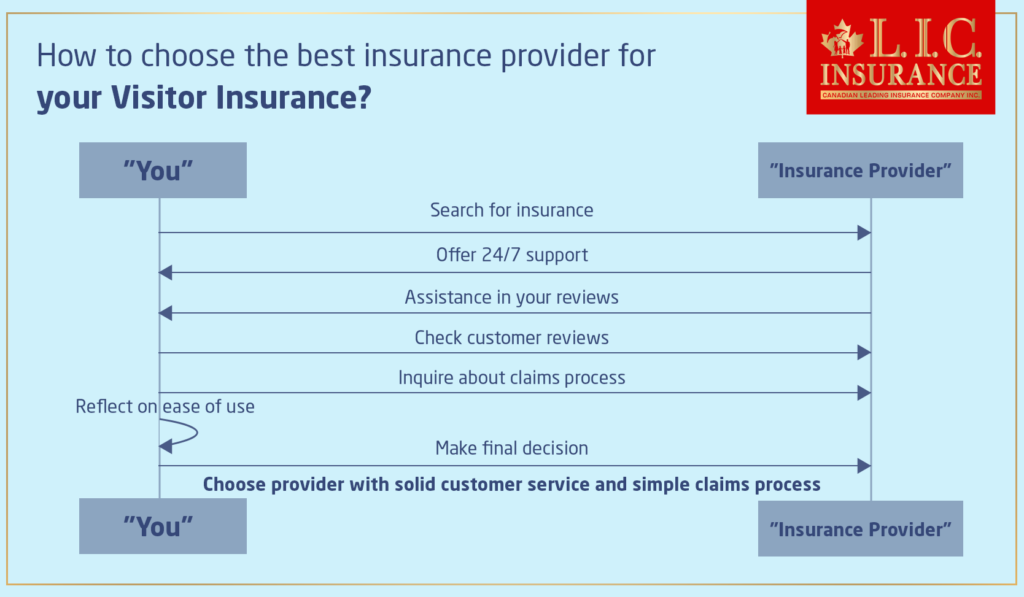

When searching for the best Canadian Visitor Health Insurance, choosing a provider that matches your specific needs with excellent service and support is vital. This part of the blog will help you effectively evaluate different insurance companies.

Solid Customer Service

Key Consideration: Does the insurance provider offer 24/7 support? Can you access assistance in your language? These are critical questions, as solid customer service ensures help is at hand whenever you need it, no matter where you are in Canada.

Ana, from Brazil, experienced a medical emergency during a late-night excursion in Niagara Falls. Her insurance provider offered round-the-clock support, and she received guidance in Portuguese, making a potentially overwhelming situation manageable. Ana’s story underscores the importance of choosing a provider like Canadian LIC, which offers comprehensive support at any time of the day.

Positive Reviews and Testimonials

Key Consideration: What are other customers saying? Look for reviews and testimonials to gauge the satisfaction of previous clients. Positive feedback is a strong indicator of reliability and customer satisfaction.

Interactive Tip: Go online and search for customer reviews on forums and websites dedicated to Canadian Visitor Health Insurance. Pay attention to what people are saying about their experiences—both good and bad.

Real-Life Scenario: Michael from the UK chose his insurance provider based solely on pricing without checking reviews. Unfortunately, when he needed to claim expenses for minor surgery, he encountered a slow response and poor service. This situation could have been mitigated by selecting a provider with better-reviewed customer service.

Hassle-Free Claims Process

Key Consideration: Is the claims process straightforward? Can claims be filed online or via a mobile app? A simplified claims process means less stress in times of need.

Interactive Question: Imagine you’ve had a minor accident while ice skating in Ottawa. How would you prefer to handle the insurance claim? You’d want it to be quick and easy, allowing you to continue enjoying your trip with minimal interruptions.

Real-Life Scenario: Emily from Australia had an unfortunate slip on a snowy day in Montreal. Her Visitor Insurance policy allowed her to file a claim through an app, and she received confirmation of the claim processing within hours. This ease of handling reassured her and allowed her to focus on recovery, showcasing the benefits of choosing a policy with a user-friendly claims process.

Choosing the right insurance provider for your Canadian Visitor Health Insurance is more than just reading policies and comparing prices. It involves understanding what real service looks like—responsive, transparent, and user-friendly. Every visitor to Canada deserves a policy that not only protects them financially but also provides peace of mind.

Call to Action:

Think about what you would need most in an emergency medical treatment far from home.

Reflect on these stories and use them to guide your decision.

Opt for a provider that makes you feel secure.

Make the informed choice; your safety and financial security in Canada depend on it.

To Wrap Up

Trying to walk through visitor’s insurance in Canada can be a challenging task for visitors to Canada. With the right kind of help and insight, you should easily be able to get a policy that will take you through your visit with security. Canadian LIC is here to assure you that your Canadian adventure is covered with the best coverage for you. Don’t wait for so long. Get your health and peace of mind insured by the best brokerage in Canada for visitors. Buy the policy today and make your stay in Canada the most enjoyable experience without any worries.

Find Out: Can I buy Visitor Insurance after arrival in Canada?

Find Out: What can you not do with a Visitor Visa?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions: Canadian Visitor Health Insurance

Usually, the Canadian Visitor Health Insurance coverage includes the expenses of medical treatment, visiting a doctor, staying in a hospital, and sometimes even prescribed medication and emergency dental care. However, the level of such coverage from one policy to another generally varies greatly.

Tom had travelled from India to Toronto. He had a very sharp, unbearable toothache in the middle of the night. He was relieved to find that his Visitor Insurance included emergency dental coverage, which paid for his treatment without any hassle.

The coverage of pre-existing medical conditions depends on the policy one is going for. Some provide coverage where the condition has been stable for a certain period before the policy starts, while others do not cover pre-existing conditions at all.

Review the terms regarding pre-existing conditions whenever you are comparing Canada insurance plans. Consider your own health needs to ensure you choose a plan that provides the appropriate coverage.

It is just the extent of their coverage that greatly varies. Regular Travel Insurance covers, at best, trip cancellations, lost luggage, and sometimes limited medical emergencies. On the other hand, Canadian Visitor Health Insurance is primarily based on medical expenses in Canada and provides more comprehensive health coverage.

Carlos purchased Canada Travel Insurance Coverage for his stay in Montreal, assuming that he stood a chance to be insured, at least in terms of medical expenses. Media coverage after a ski accident that he was involved in left him amazed. He later switched to a specific Canadian health insurance plan for visitors that had the amount of money needed to cater to his treatment and rehabilitation.

Most Visitors to Canada Insurance plans generally allow access to any licensed doctor or hospital within Canada. Some may have preferred networks that make the billing process smoother. Always check your policy details to find out where you can receive care. Knowing beforehand can save time and possible confusion in an emergency.

Jane, a UK national, was not aware that her insurance policy provided for a preferred provider network, and therefore, the claim process went to a standstill once she settled in a hospital that was off-network. This proves how important it is to know and understand your policy’s network restrictions.

A deductible is an out-of-pocket amount before your insurance begins to cover costs. Depending on the plan, it can be charged per policy, per year, or per incident.

Aya from Japan has chosen a policy with a $100 deductible per incident. Because she has been to the emergency room twice during her stay, she realizes that paying a deductible each time really takes more from her budget than she expected. Knowing how your deductible works can help you manage your finances better.

Yes, some Visitors’ Insurance Cover has limits beyond their validity. They usually offer different terms for seniors and aged persons or an increase in premiums for older travellers.

Consider whether your age might affect the kind of coverage you can obtain. How might this influence your choice of policy?

Mohan from India found that most of the policies either cost him more money or offered reduced coverage. Hence, detailed research was undertaken. As such, one specifically meant for senior visitors was chosen, and therefore, it could provide the required full coverage.

The time limit for claiming varies from one visitor’s insurance policy to another, but it usually advises the client to claim as soon as possible, generally within 90 days of treatment.

An Australian guy named Sam, who had just broken his ankle, waited nearly three months just to file his insurance claim and nearly missed submitting it way past the deadline. This served as a close call, reminding me of the importance of timely claim submission.

For example, routine checkups, elective surgeries, cosmetic procedures, or treatment of chronic conditions, if not declared prior, usually form part of the exclusions in the Visitor Insurance policy. Go through the section of Exclusions carefully for your policy.

Maria was really surprised when she noticed that not all dental emergencies are covered under Canadian Visitor Health Insurance. She thought that all cases would be considered dental emergencies. However, this does point out the importance of knowing what is actually not covered under a policy.

Most Visitor Insurance plans in Canada provide coverage for prescription drugs. Generally, this would be related to a covered medical emergency or treatment. However, the level of coverage can change, so definitely be sure to check this point.

Take a look at your current prescriptions and think about it. Would you have to refill the prescriptions that are going to be necessary for the trip? That’s something to think about since most of the time, such prescription drugs are covered under the prospective policy.

Haruto from Japan needed a specialized prescription after a small accident in Vancouver. Fortunately for him, his insurance would cover the cost, and he was relieved to note this because, indeed, the medicine was very expensive.

There is a wide variation in how much each policy covers these services. Most policies include coverage for psychiatric emergencies but provide only limited or no benefits for the care of mental illness.

Reflect on the importance of mental health coverage for you, especially if you are prone to stress or if travelling triggers anxiety. How might this influence your choice of an insurance policy?

Emily came from the UK and was looking for help because of her acute anxiety, as she was staying for over a week. This is where her visitor’s insurance coverage for psychological services really helped Emily to carry through with her condition on the trip.

Please confirm the start and end dates on your policy to ensure it covers your entire planned stay. If you plan to extend your visit, consider purchasing a policy with extension options.

Thomas from South Africa found himself in a tricky spot as he faced an unexpected extension in the stay duration because of travel regulations. He went in for a policy with easy extension processing, which set him up and took away the tension by rectifying his coverage dates without any break.

Just make sure that whatever policy you purchase it has an amount that meets the minimum requirement of the Canadian government. This is usually at $100,000 CAD. It is also supposed to cover repatriation in case of death and is valid for every day that you spend in Canada.

Lina is a visa applicant from Lebanon. She was to avail of a Visitor Insurance policy for her cultural exchange program. It served as an instrument that smoothed her requirements for the Canadian visa she applied for and supported the smoother process of her application.

Most companies accept renewals online these days. Contact your provider to renew before your current policy expires.

David had to extend his stay in Canada only to experience a Canadian winter. He went online, contacted the Canadian insurance company, and easily renewed the policy two weeks before its expiry. He remained duly covered without any break.

Engage in high-risk activities, such as skiing or hiking, and your insurance premiums are sure to go through the roof. Most standard policies will not cover accidents associated with them, and you will need to purchase extra coverage.

Before you engage in any high-risk activities, review your policy to confirm whether such events are covered. If not, consider upgrading your policy or getting additional coverage. Real-life scenario:

An Australian skier, Mia, had properly arranged her Visitor Insurance with the coverage for winter sports included. She was wise enough, as following the incident of her skiing accident in Quebec, she was able to seek medical attention without any delays.

Yes, children can be included under family Visitor Insurance Policies. These policies typically provide the same level of medical coverage for children as they do for adults.

If you’re travelling with children, what are your main concerns regarding their health coverage? Reflecting on this can help you choose a policy that best fits your family’s needs.

The Chen family from China included their two children on their Visitor Insurance policy during their three-month stay in Canada. When their daughter fell ill with pneumonia, the policy covered her hospital stay and treatments, relieving the family from significant financial stress.

Always keep your policy number, insurance contact numbers, and a copy of the insurance policy handy. Keep all the medical receipts and documentation because filing claims is done based on the same receipts and documents.

Jamal from Morocco kept a digital copy of his insurance information on his phone, which was invaluable when he needed to visit an emergency room after a biking accident. Having all necessary information immediately accessible helped expedite the medical and insurance processes.

The other routine exclusions are cases of pre-existing medical conditions not previously stabilized before the insurance date, routine checkups, and elective procedures. Cases of alcoholism and drug abuse are also common exclusions.

Natasha was from Russia, and she realized that her insurance really didn’t cover incidents that involved alcohol. After an accident after a night out and drinking, she has incurred quite a sum of medical bills not covered by insurance.

If you’ve picked reputable Canadian insurance companies that are reputed for following Canadian health insurance regulations, then you’re good. It’s also wise to consult with a broker who specializes in Canadian Visitor Health Insurance to ensure compliance.

Kevin from Ireland used a broker service to locate a policy that was fully compliant with Canadian health standards and would allow him to go about his six-month academic stay with a settled mind.

We do hope these frequently asked questions will help bring clarity to you so that you arrive at the right Canadian Visitor Health Insurance.

Sources and Further Reading

Exploring Canadian Visitor Health Insurance can be complex, but having reliable resources at your disposal can make the process much clearer and more straightforward. Below, we provide a list of sources and further reading materials that can help you deepen your understanding of Visitor Insurance Policies in Canada. These resources offer detailed insights and guidance to assist you in making informed decisions about your insurance needs while visiting Canada.

Official Government and Regulatory Resources

Immigration, Refugees and Citizenship Canada (IRCC): The official IRCC website provides essential information on the health insurance requirements for visitors to Canada, including details relevant to visa applications.

Canadian Life and Health Insurance Association (CLHIA): A comprehensive resource for understanding the types of health insurances available in Canada, including guides on choosing the right Visitor Health Insurance.

Insurance Comparison Websites

Kanetix.ca: This platform allows you to compare different Canadian Visitor Health Insurance policies, helping you find one that best fits your needs.

InsuranceHotline.com: Another valuable tool for comparing insurance rates and coverage options across various Canadian providers.

Blogs and Personal Stories

Immigroup Forum: A community forum where real users share their experiences with Canadian Visitor Health Insurance, offering personal insights and advice.

These resources will provide you with a robust foundation for understanding Canadian Visitor Health Insurance, helping you compare and choose the right policy that meets your needs. Whether you’re looking for basic coverage or comprehensive protection, these links can guide you toward making a well-informed decision.

Key Takeaways

- Assess your health and activity plans to determine your coverage needs before purchasing insurance.

- Use comparison tools to analyze different policies, focusing on coverage limits and exclusions.

- Choose policies that cover pre-existing conditions if this applies to you, to avoid claim denials.

- Select providers known for an easy and supportive claims process.

- Research provider reputations through customer reviews to gauge reliability and service quality.

- Opt for policies that allow for extensions if there's a possibility your stay might extend.

- Verify that the insurance meets Canadian health standards and visa requirements.

- Consider using a specialized insurance broker to navigate complex insurance options.

- Be aware of your policy's provisions for emergency medical repatriation and high-risk activities.

- Keep insurance documents handy and know how to contact your provider in emergencies.

Your Feedback Is Very Important To Us

Your feedback is invaluable and will help us improve our services and resources. Please take a few moments to answer the following questions about your experiences with finding and using Visitor Insurance in Canada.

Thank you for taking the time to provide your feedback. Your insights are crucial in helping us enhance the experience for Canadians and their visitors when selecting Visitor Insurance.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]