- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Which Is Better, Term Insurance or SIP?

- Understanding Term Insurance

- Key Features of Term Life Insurance

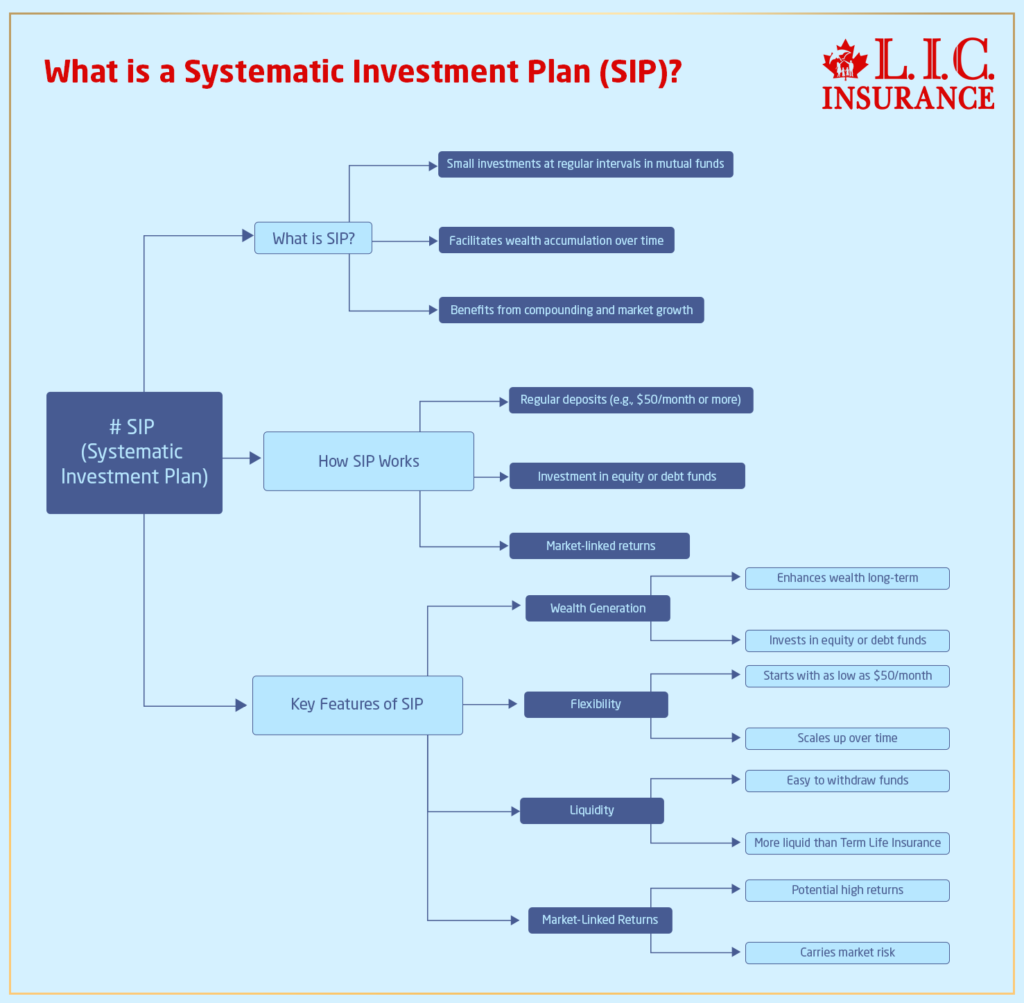

- What is a Systematic Investment Plan (SIP)?

- How Does SIP Work?

- Key Features of SIPs

- Comparing Term Life Insurance and SIP

- Term Life Insurance V/S SIP

- Why Term Life Insurance is Crucial

- How to Decide?

- Why Choose Canadian LIC for Term Life Insurance?

Which Is Better, Term Insurance or SIP?

By Harpreet Puri

CEO & Founder

- 11 min read

- November 27th, 2024

SUMMARY

Most Canadians wish to strike a balance between protecting loved ones and acquiring wealth while handling their finances. Considering the number of investment and insurance options today, one feels overwhelmed about choosing between the Term Life Insurance Plan and the Systematic Investment Plan, or SIP. The two instruments are fundamentally far apart, yet they address critical aspects of financial planning, and they form a highly considered pairing.

Let’s explore how each option works, and by the end, you’ll have a clearer understanding of which one aligns better with your financial goals.

Understanding Term Insurance

A Term Life Insurance Plan is a straightforward insurance policy that provides financial protection to your beneficiaries in the event of your death during the policy term. It’s one of the simplest and most affordable ways to ensure that your loved ones are financially secure, especially if you’re the primary breadwinner.

Canadian LIC often comes across clients who feel they cannot opt for Term Insurance since they will not even reap its rewards. However, one of our agents once dealt with a very young couple from Ontario who had recently purchased their first house. They opted for a Term Life Insurance Plan in case their mortgage takes them back in the old days or if they need to ensure financial security for their child. That peace of mind is worth much more than gold and silver.

Key Features of Term Life Insurance

- Affordability: Term Life Insurance premiums are relatively inexpensive and more affordable compared to Whole Life Insurance. Thus, most Canadians can afford it.

- Flexibility: The flexibility to choose a policy term that best compliments your financial responsibilities, for instance, a 20-year term in place of paying off a mortgage.

- Customizable Coverage: Whether you need coverage on $100,000 or $1 million, the company can design coverage tailored to fit your needs.

- Tax-Free Payout: The death benefit paid out to your beneficiaries is usually tax-free.

You can approach Term Life Insurance websites to buy Term Life Insurance Online or seek the aid of Term Life Insurance Agents who will guide you throughout the process.

What is a Systematic Investment Plan (SIP)?

How Does SIP Work?

Under an SIP scheme, you can invest small sums of money in mutual funds at regular intervals. SIPs are often sold as a route that enables you to amass wealth over time, thereby taking advantage of compounding and market growth.

One of our clients, a young professional from Vancouver, was in two minds about whether to invest in SIPs or plan for Term Life Insurance. He called one of our agents; upon detailed discussion with the agent, he realized that SIPs could grow his wealth but without any protection from leaving for the family in case of an unfortunate tragedy. The client finally opted to take up SIP along with a Term Life Insurance product to ensure both growth and security.

Key Features of SIPs

- Wealth generation: SIPs are on the lines of enhancing your wealth in the long term through equity or debt funds.

- Flexibility: It can start with a petty amount of $50 a month, which will be added gradually.

- Liquidity: SIPs are more liquid than Term Life Insurance; you can withdraw your money whenever required.

- Market-Linked Returns: A return linked to the market performance has the side effect of both being an advantage and a risk.

Comparing Term Life Insurance and SIP

Even though the objectives of Term Insurance and SIP differ, they can complement each other in a portfolio. Let’s break it down to know the differences between the two and which one is suitable.

- Term Life Insurance: Its primary function is for protection. It provides for your family with money in the event of your death. For example, a Term Insurance Investment ensures that your family continues to pursue your lifestyle after your passing, paying off debts or utilizing it for significant expenses such as education.

- SIP: SIPs are investment instruments that create wealth. Though SIPs do not offer the security of an insurance policy, your money will grow over time for your future requirements, such as retirement and buying a house.

- Term Life Insurance: There’s no risk involved in Term Insurance. The premiums remain fixed, and the payout is guaranteed if the policyholder passes away during the term.

- SIP: SIP carries market risk because the returns are directly correlated to mutual fund performance. On one hand, they provide higher potential returns than traditional savings accounts, but the investment can also erode in value.

- Term Life Insurance: The cost of Term Insurance is relatively low, especially if you start young. Getting Term Life Insurance Quotes Online will show you how affordable coverage can be.

- SIP: Contributions to SIPs can vary according to the number of units an investor can invest each month, but there are no insurance benefits in SIPs; thus, you may have to pay extra for stand-alone insurance.

- Term Life Insurance: In Canada, the death benefit is tax-free for beneficiaries, providing additional value. While premiums are not tax-deductible, the coverage ensures financial security for your family.

- SIP: SIPs may offer tax benefits under certain conditions, but these benefits depend on the type of mutual fund and your overall investment portfolio.

- Term Life Insurance: Term policies provide significant value in terms of peace of mind and financial protection for your family. However, there is no maturity benefit if you outlive the policy term.

- SIP: SIPs can provide substantial long-term returns if invested consistently and wisely. However, they do not provide immediate financial security in the event of an untimely death.

Term Life Insurance V/S SIP

Why Term Life Insurance is Crucial

While SIPs are a great investment choice for wealth creation, they cannot substitute the cover for Term Life Insurance. For instance, If you were to die suddenly, the SIP investments might not be sufficient to pay for your family’s liabilities, especially if you’re in the early stages of investment.

One agent of Canadian LIC recalls that to prepare her teenage children for a financially secure future, she decided to purchase a Term Life Insurance policy after realizing her Term Life Insurance Investments alone wouldn’t be enough to provide the safety net her family required. So, she was guided through the process of comparing Term Life Insurance Quotes Online to ensure getting the best coverage available at an affordable rate.

How to Decide?

Your decision would depend upon your short-term financial needs and objectives. If you have security for your family, securing your family’s future in case of an emergency is a better choice where Term Life Insurance is concerned. SIPs are preferable for the growth of your wealth for long-term goals.

Many clients at Canadian LIC opt for a combination of both. Term life investment paired with SIP helps save and protect your family while at the same time building savings for the future. You can build a comprehensive planning solution to meet your specific needs through Term Life Insurance Agents.

Why Choose Canadian LIC for Term Life Insurance?

The family-friendliness of Canadian LIC will ensure and keep helping Canadians find the best financial solutions for their families. Our team, with its years of experience and being client-first, has guided numerous individuals and families along their financial journeys.

Working with a Canadian LIC gives you the following:

- Expert Guidance: Our experienced agents provide personalized recommendations tailored to your financial situation.

- Budget-Friendly Plans: We help you compare Term Life Insurance Quotes Online to find the best cheap coverage.

- Convenient options: Be you want to meet an agent or buy online Term Life Insurance, we make the process easy and hassle-free.

Choosing between Term Life Insurance and SIP doesn’t have to be complicated. By understanding their differences and evaluating your financial goals, you can make an informed decision that benefits your family now and in the future. If you desire security for your family, look no further than to explore the Term Life Insurance Plan options here today with Canadian LIC, the best insurance brokerage in Canada.

More on Term Life Insurance

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Term Insurance vs. SIP in Canada

Here, Term Life Insurance focuses on protecting your loved ones by availing them of any monetary help in the case of your death. SIPs are investment tools that help grow wealth over time. And most of our clients, after understanding this, start choosing the best of both worlds for a balanced financial plan.

Term Life Insurance is not an investment, but it’s a protection plan that provides financial security for your family. If growth is what you want, then a Term Life Insurance Plan with an SIP can really work for you. One of the agents from Canadian LIC recently helped a young family balance its budget by effectively using these two options.

A Term Life Insurance Plan is usually more affordable than a SIP because it focuses solely on protection. SIPs require regular contributions and are linked to market performance, which can be unpredictable. Comparing Term Life Insurance Quotes Online can help you find a plan that fits your budget.

There is no financial risk involved in Term Life Insurance. The premiums are fixed, and there is an absolute payout if the policyholder dies within the term. This is one of the reasons why most families prefer buying Term Life Insurance online after consulting Term Life Insurance Agents.

No, SIP returns aren’t guaranteed. They are based on the market performance. One of our clients learnt that they lost in SIP investments when the markets went south. They decided to cover their family with a Term Life Insurance Plan and keep making small SIP contributions for long-term growth.

Where to find the best plan: Compare Term Life Insurance Quotes Online or work with experienced Term Life Insurance Agents. Canadian LIC has helped thousands of clients in choosing policies that fit their needs and budget. Full transparency and guidance throughout the process are assured.

In fact, the Term Life Insurance in tandem with SIP is the best idea. Many clients at Canadian LIC use Term Life Insurance for financial protection and SIPs for the formation of wealth. Both security and growth can be balanced together using this combination.

There will be no payout if you outlive the term of your life insurance. However, it had done its job by protecting your family in that crucial year. Many clients use it in combination with SIPs to save for their old age after the term is over.

You can begin by comparing Term Life Insurance Quotes Online or even speaking with Term Life Insurance Agents. Canadian LIC simplifies the process by providing expert advice and guiding you through the application process, thus ensuring that you acquire the best coverage for your needs.

You can contact the best insurance brokerage in Canada, Canadian LIC, who can help you connect with experienced Term Life Insurance Agents who can guide you through all possible options to buy Term Life Insurance online quickly and without hassle.

Canadian LIC’s expert agents are always here to guide you if you have more questions. Start exploring your options today to secure your family’s future.

Sources and Further Reading

- TD Insurance: Offers insights into various life insurance options available in Canada, including Term Life Insurance.

TD Insurance - RBC Insurance: Provides detailed explanations of term, permanent, whole, and universal life insurance, highlighting their differences and benefits.

RBC Insurance - Blue Cross of Canada: Explains how Term Life Insurance works, its benefits, and considerations for choosing the right policy.

Blue Cross - Canada Life: Compares term and permanent life insurance, outlining key features to help you make an informed decision.

Canada Life - Sun Life: Discusses the differences between term and permanent life insurance, assisting in selecting the appropriate coverage for your needs.

Sun Life

Key Takeaways

Purpose Differentiation

- Term Life Insurance is for financial protection, ensuring your family’s security if something happens to you.

- SIPs are for wealth creation, helping you grow your investments over time.

Affordability and Accessibility

- Term Life Insurance is highly affordable, especially for young Canadians starting their financial planning journey.

- SIPs allow you to invest small amounts regularly, making them accessible for all income levels.

Risk and Returns

- Term Life Insurance has no financial risk and offers guaranteed payouts during the policy term.

- SIP returns are market-linked, offering higher potential growth but also carrying investment risks.

Tax Benefits

- Term Life Insurance provides tax-free death benefits for beneficiaries.

- SIPs may offer tax benefits depending on the type of mutual funds chosen.

Combining Both for a Balanced Portfolio

- Pairing a Term Life Insurance Plan with SIP investments can provide financial protection and wealth growth simultaneously.

Choosing Term Life Insurance

- Comparing Term Life Insurance Quotes Online and working with Term Life Insurance Agents helps you find the best plan for your family’s needs.

Flexibility in Financial Planning

- SIPs offer liquidity and flexible contributions, while Term Insurance offers customizable coverage and fixed premiums.

Long-Term Security

- Term Life Insurance ensures your family’s financial stability during critical years. SIPs support future financial goals, such as retirement or education.

Your Feedback Is Very Important To Us

We value your insights! Please take a few minutes to answer this questionnaire to help us understand your struggles related to finding out if Term Life Insurance can be a business expense.

Thank you for your valuable feedback! Your responses will help us improve and create tailored solutions to address your concerns. If you selected “Yes” for personalized advice, one of our agents will contact you shortly.

IN THIS ARTICLE

- Which Is Better, Term Insurance or SIP?

- Understanding Term Insurance

- Key Features of Term Life Insurance

- What is a Systematic Investment Plan (SIP)?

- How Does SIP Work?

- Key Features of SIPs

- Comparing Term Life Insurance and SIP

- Term Life Insurance V/S SIP

- Why Term Life Insurance is Crucial

- How to Decide?

- Why Choose Canadian LIC for Term Life Insurance?