- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- When To Cancel Term Life Insurance?

- Why Do People Consider Canceling Term Life Insurance?

- Key Questions to Ask Before Canceling

- When Canceling Makes Sense

- How to Cancel a Term Life Insurance Policy

- Stories From Canadian LIC

- Is Canceling Term Life Insurance Worth the Risk?

- The Financial and Emotional Impact of Canceling Term Life Insurance

- Common Misconceptions About Canceling Term Life Insurance

- How Canadian LIC Helps Clients Make Informed Decisions

- Common Questions Asked About Canceling Term Life Insurance

- Steps to Avoid Canceling Your Term Life Insurance

When To Cancel Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 6th, 2025

SUMMARY

This blog addresses the issue of when to cancel a Term Life Insurance Plan and the reasons involved, such as financial constraints or reduced need for coverage. The blog explores alternative options such as reducing coverage, adjusting terms, or converting to permanent insurance. The blog then goes on to highlight the risks involved in cancelling prematurely, consulting Term Life Insurance Brokers, and how Canadian LIC helps clients by providing tailored advice, comparing Term Life Insurance Rates and quotes, and finding the right options for them.

Introduction

Just when life turns you on its head, so do your financial priorities. We often come across questions from Canadian LIC clients, the most trusted Term Life Insurance brokerage in Canada: “Should I cancel my Term Life Insurance?” Sometimes, perhaps, it is from a financial consideration or a change in financial circumstances within the family or simply a lack of understanding of the coverage’s purposes. Cancelling a Term Life Insurance Plan, though, becomes very daunting sometimes.

We have come across clients who have wrestled with the choice of cancelling or not. Others are afraid that their money is not well spent, and others fear that leaving their families unguarded will put them in danger. This blog is here to help you conclude whether cancelling your policy is the best move for you when you have once been in such a situation.

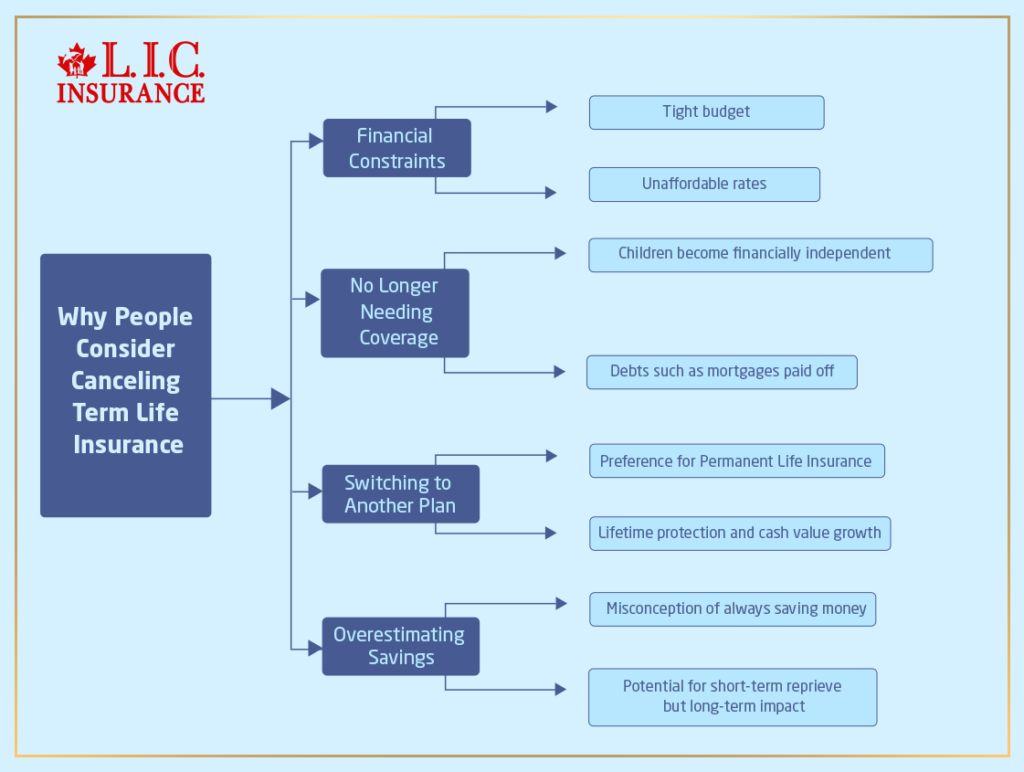

Why Do People Consider Canceling Term Life Insurance?

Term Life Insurance Plans are taken out to provide coverage for a fixed period. Life, however, is not static over the term of the policy. Here are a few common reasons why people consider cancellation of their policy:

Financial Constraints

Our client, Mark, had several ongoing expenses: his mortgage and his child’s tuition fees, to name a few. His question came in the form of whether he could save some money by cancelling his Term Life Insurance Plan. This is indeed a very common dilemma, given a tight budget and unaffordable rates on Term Life Insurance.

No Longer Needing Coverage

Term Life Insurance is viewed as having lost its usefulness by certain policyholders, who believe their safety net no longer applies to their children when they become financially independent or when debts like mortgages have been paid.

Switching to Another Plan

We have clients such as Priya who needed to switch from Term Life Insurance coverage to a Permanent Life Insurance Policy. She felt that the latter would grow in cash value and could offer her lifetime protection.

Overestimating Savings

A common misconception is that cancellation of any policy will always save money. Such cancellation might offer a quick, short-term reprieve, but the long-term risks are most often not even comparable to what can be attained in the short term.

Key Questions to Ask Before Canceling

Before making the decision, consider these crucial questions:

Have Your Financial Needs Changed?

Evaluate your present and future responsibilities towards money. Do you still support a family with your earnings? Are you paying off any loans that your heirs might find unbearable in the event of your passing?

Are You Aware of the Financial Risks?

Cancelling a policy means that one loses the cover for which he or she has been paying. If unforeseen circumstances arise, a family might suffer significantly without a safety net.

Can You Afford a Replacement?

It seems attractive to change to another term of life insurance, but are you ready for the possibility of higher Term Life Insurance Rates based on changes in age or health?

When Canceling Makes Sense

While keeping coverage is often the best option, there are scenarios where cancelling your policy might be justified.

Your Dependents Are Financially Independent

If your children have grown up and can support themselves, and you no longer have dependents relying on your income, it may make sense to reconsider your policy.

You’ve Paid Off Major Debts

If your mortgage, car loans, or other significant debts are cleared, the initial purpose of the Term Life Insurance Plan might no longer apply.

You Have Sufficient Savings

For example, Raj gained the confidence to cancel his Term Life Insurance by establishing a sizeable emergency fund and acquiring other sources of assets. The necessity to have the cover will be greatly reduced if one has savings that are enough for any form of an emergency.

How to Cancel a Term Life Insurance Policy

If you’ve evaluated your situation and believe cancelling is the right decision, follow these steps to ensure a smooth process:

Review Your Policy

Before contacting your insurance provider, thoroughly review the terms of your policy. Check for cancellation clauses and any penalties that may apply.

Discuss With Your Insurance Broker

We always encourage clients to seek recommendations from their Term Life Insurance broker before cancellation. A professional can provide insights into alternatives, such as changing your coverage or switching to another kind of plan.

Submit a Cancellation Request

Most insurance companies request a formal cancellation. Prepare to provide identification and policy information during this process.

Keep Records

Always save your cancellation confirmation document for future use. Also, keep an eye on your account to ensure no more payments are debited from the same.

Alternatives to Canceling

Cancelling isn’t the only solution. Consider these alternatives:

Reduce Coverage

If high Term Life Insurance Rates are a concern, ask your insurer if you can reduce the policy amount. Lower coverage often results in reduced Term Life Insurance Premiums.

Switch to a Different Term

Instead of cancelling, some clients benefit from modifying their Term Life Insurance Plan to a shorter or longer duration.

Convert to Permanent Insurance

Many term policies come with a conversion option. This way, you can convert it to Permanent Coverage without needing to undergo a new medical exam. That’s an excellent choice if you want lifetime coverage.

Stories From Canadian LIC

At Canadian LIC, we have assisted thousands of clients in navigating so many term life decisions. Take the case of Lily, who wanted to cancel her coverage because the kids were independent. We discussed the goals and instead recommended reducing the coverage rather than cancelling it outright. This helped save premiums but also protected her to a certain extent.

Then, there is Ahmad, who wanted to abandon his plan as the costs continued to increase. We helped him compare the quotes for Term Life Insurance, and he switched to a more competitive policy. These are stories of how one needs help from experts prior to change.

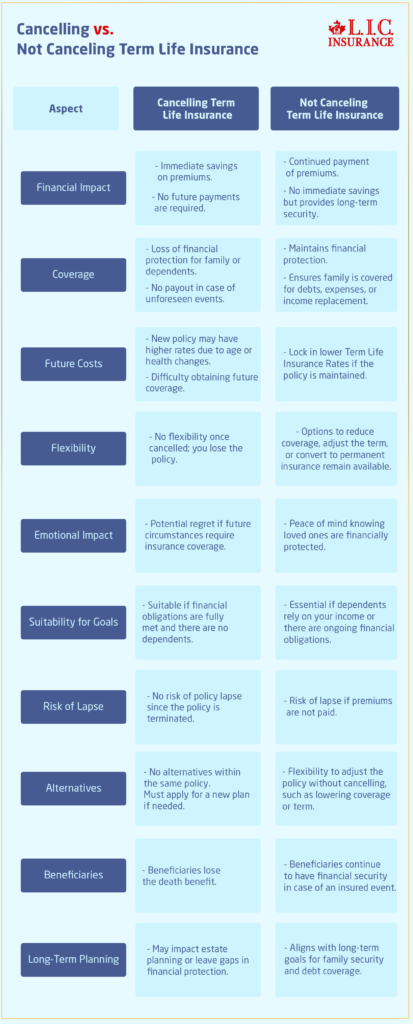

Is Canceling Term Life Insurance Worth the Risk?

Weigh the pros and cons of cancelling your Term Life Insurance. Sure, cancelling can give you short-term relief, but you could be throwing away critical protection for your family.

The Financial and Emotional Impact of Canceling Term Life Insurance

Anytime one has thoughts of revoking their Term Life Insurance, financial benefits related to saving their premiums are often factored into consideration, while emotional impacts relating to not creating a safety net for the family are overlooked.

Protecting Your Loved Ones

A Term Life Insurance Policy is not just a policy but is an assurance to ensure the future of all your family members. In the absence of insurance, your family might face difficulties in clearing mortgages, sending children to school, or even buying groceries. Think through how they will be affected by your budget.

Mental Peace for You and Your Family

It brings great comfort to know your family is provided for financially in your absence. Many clients come to regret having cancelled their policy once they miss the safety net.

Common Misconceptions About Canceling Term Life Insurance

Many people decide to cancel their Term Life Insurance Plans based on misinformation. Let’s address some of these misconceptions:

“I Don’t Need Life Insurance Because I’m Healthy.”

Health is unpredictable. Most healthy individuals may not know when an unexpected event will strike them. So, locking in Term Life Insurance Rates before attaining maturity and experiencing costly health problems has proven to be a shrewd investment.

“I’ll Just Get Another Policy Later.”

It’s possible to purchase Term Life Insurance online at a later time, but premiums increase with age. Any shift in your health can also make it more challenging or expensive to get coverage.

“I Can Rely on My Savings Instead.”

Building sufficient savings to replace the coverage provided by a Term Life Insurance Plan can take years. In the meantime, your family could be vulnerable to financial hardships.

How Canadian LIC Helps Clients Make Informed Decisions

At Canadian LIC, we understand the importance of guiding our clients in understanding their options. We understand that cancelling or maintaining a Term Life Insurance Policy is not one-size-fits-all. Through discussing your financial goals, family needs, and long-term plans, we help you choose the best option.

Personalized Policy Reviews

One of our experienced brokers will analyze your current policy to determine whether adjustments, rather than cancellations, might be more beneficial.

Exploring Competitive Rates

Sometimes, the client is not aware of the available competitive Term Life Insurance Rates. We assist you in comparing quotes for Term Life Insurance to identify the best for you.

Flexible Coverage Options

We have helped customers explore flexible coverage options, such as reducing the term or converting to a different type of policy, to ensure continuity of protection that meets their financial requirements.

Common Questions Asked About Canceling Term Life Insurance

Can I Get a Refund If I Cancel My Term Life Insurance?

Most term life policies are non-cancellable. In the event of cancelling their coverage, then their insurance stops as of that exact date, though the premiums paid on such a plan cannot be reclaimed; however, it may come in return if they can take advance premium payments.

What Happens If I Stop Paying My Premiums?

If you stop paying your premiums without officially cancelling, your policy will lapse. This means you lose coverage and may face challenges reinstating the policy later.

Is It Better to Reduce Coverage Than to Cancel?

Reducing coverage can be a more balanced approach. By lowering the policy amount, you save on premiums while still maintaining some level of protection for your family.

Steps to Avoid Canceling Your Term Life Insurance

Cancelling isn’t always the best option, even if you’re facing financial difficulties. Here are steps to help you maintain your coverage:

Work With Your Broker

Your broker can help you find ways to adjust your policy or explore other Term Life Insurance Plans that better suit your current financial situation.

Review Your Budget

Look for ways to reallocate funds to prioritize your premiums. Small adjustments in daily expenses can often cover the cost of your policy.

Consider a Shorter Term

If you’re at the end of your policy’s term, consider renewing for a shorter duration to reduce costs.

The Cost of Canceling Too Soon

One of our clients, David, cancelled his policy after his children moved out and thought he didn’t need the coverage anymore. A year later, however, he suffered a health condition and found himself in a tight financial situation and couldn’t get another policy at a reasonable rate. He then regretted having cancelled his policy and wished he had consulted his broker before doing so.

The Role of Term Life Insurance Brokers

Term Life Insurance Brokers such as Canadian LIC are very essential when making decisions about your policy. Brokers offer:

- Expert Advice: To help you decide whether to cancel or not.

- Market Insights: Get competitive term life quotes that are custom-designed to suit you.

- Long-Term Support: Get long-term support to enable policy modifications, renewals, and transfers.

Why Choose Canadian LIC for Your Term Life Insurance Needs

We have long been the dependable name among Term Life Insurance Brokers in Canada, combining years of experience with personal service to build confidence in a decision. Maybe you want to buy TermLiife Insurance Online; perhaps you simply need some information about your current plan.

Final Thoughts

Depending on individual finances, needs, and futures, the best time to cancel Term Life Insurance may vary very widely. This then requires seeking independent advice from a professional broker who offers the right guidelines with regard to personal issues of such a nature.

You are never alone with regard to these choices with Canadian LIC. Contact our experienced team today to discuss Term Life Insurance Rates, compare Term Life Insurance Quotes, and determine the best Term Life Insurance Plan for your future.

More on Term Life Insurance

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About When to Cancel Term Life Insurance

People usually consider cancelling a Term Life Insurance Plan when they feel their financial obligations have been reduced. This includes paying off major debts, such as mortgages, or when their dependents have become financially independent. At Canadian LIC, we’ve seen clients also cancel their policies when they want to switch to Permanent Insurance or feel they can no longer afford the premiums.

If you are on a tight budget, you can also consider reducing your coverage amount. Most insurers allow this, and the Term Life Insurance Rates are consequently lower. Canadian LIC brokers help clients modify their policies to fit changing budgets while maintaining the necessary coverage.

With any plan, if you find better terms, they can be upgraded. Many opt for this, especially when they notice competitive Term Life Insurance Quotes for a policy along with other facilities. Canadian LIC brokers can work with you to make a comparison and provide guidance on the desired policy.

You will be losing the coverage that you pay for if your policy is cancelled before term. Most Term Life Insurance contracts do not provide a refund for the unused premiums. At Canadian LIC, we always advise our clients to weigh out the risks and consider alternatives before making such a decision.

Cancelling is usually worse than reducing. Some level of protection is preserved while premiums decrease. Many of our clients, when working with Canadian LIC, preferred this kind of approach since it was a better way of dealing with finance.

Yes, most Term Life Insurance Policies have a conversion option. This means that you can switch to a Permanent Policy without needing a new medical exam. Many Canadian LIC brokers actually recommend that clients opt for this option in order to receive lifetime coverage or to avoid the future possibility of becoming uninsurable.

If you don’t pay your premiums, your policy will lapse, and your coverage will end. This leaves your family vulnerable to any eventuality. As a Canadian LIC broker would explain, all avenues should be considered before allowing the policy to lapse.

You are to notify your insurer, usually in writing, that you want to cancel. Their requirements can be found in your policy. A Canadian LIC broker can help you review your policy and walk you through the cancellation process with no dissatisfaction at all.

Most Term Life Policies do not actually refund the money you have paid on unused premiums, although if a premium has been prepaid, the corporation may refund just a portion. Our insurance specialists at Canadian LIC can explain each of the applications of these differing refund policies by the plans in more detail.

Before cancelling, consider your family’s financial needs and current debts and consider whether reducing coverage may be a better alternative. Consult a Canadian LIC broker who will evaluate your circumstances and offer individualized advice for your decision-making process.

Yes, Term Life Insurance Quotes do go up with age, and health changes will further drive up the price. We help clients find cheap Term Life Insurance Quotes at Canadian LIC so they don’t miss out on coverage they need because of the cost.

Yes, Term Life Insurance can be purchased online, but then one needs to compare quotes and understand the new terms. Canadian LIC brokers help clients find policies that best match their needs and budget to ensure they make the best choice.

Instead of cancelling, options may include reducing coverage, extending the term, or converting to a Permanent Plan. Many clients have found creative solutions through Canadian LIC brokers that keep their families protected without overextending their budgets.

Cancelling your policy will not impact your ability to get insurance later, but age and health can make new coverage more expensive or even impossible to obtain. Our brokers at Canadian LIC recommend considering long-term risks before cancelling.

With expert advice from Canadian LIC, brokers can help you understand the Term Life Insurance benefits and risks associated with cancellation. They can explore options for you, compare quotes for Term Life Insurance, and find alternatives that suit your needs.

Most Term Insurance Plans do not allow pauses in coverage. Canadian LIC brokers could help you consider choices such as lowered coverage or more affordable policies and lower-Term Life Insurance Rates when affordability is your concern.

They offer personalized advice according to the client’s current financial situation and goals. Therefore, at Canadian LIC, we analyze your policy, compare quotes for Term Life Insurance, and help you choose whether to cancel, modify or switch.

Yes, but it’s usually either a misunderstanding or a financial challenge; most of the clients we encounter at Canadian LIC have initially considered a cancellation of policy but opted to alter it after considering other options.

No, cancellation of the Term Life Insurance does not reflect on your credit score, but the loss of coverage leaves the family without monetary protection. Canadian LIC in most Canadian locations advises weighing the risks long before cancelling the coverage.

Discuss changing your coverage or switching to a lower-Term Life Insurance rate with your broker. Many clients of Canadian LIC have successfully done so without sacrificing their most important coverage.

Some insurers allow online cancellations, but it’s essential to review the terms and conditions. Canadian LIC brokers can guide you through the process to ensure there are no misunderstandings.

If you have no dependents, you would need to weigh whether your insurance coverage still holds the same significance. Still, it could still serve to clear off debt or to provide an inheritance. Consult a Canadian LIC broker to see how well your current policy aligns with your changing needs.

It is definitely possible to switch, and Canadian LIC brokers can assist you in comparing Term Life Insurance Quotes to get a better rate. Just make sure you do not cancel your existing one before your new cover is activated.

If you cancel and then later want to purchase Term Life Insurance online, you may end up paying a much higher premium rate because of your age or change in health. Canadian LIC brokers can be used to source competitive quotes; however, there are risks to consider before cancellation.

Well, cancellation will mean that your beneficiaries will not have the opportunity for any payout if death should happen to you. At Canadian LIC, we always advise our clients to discuss such a decision with family members before proceeding with cancellation.

Yes, many insurance companies accept tweaks such as coverage minimization or term shortening. Canadian LIC brokers often advise most of their Canadian clients to adjust in that respect as a means to minimize costs but retain a certain level of protection.

Cancelling too soon can leave your family without financial protection and make it harder to get affordable coverage later. At Canadian LIC, we’ve seen clients regret cancelling prematurely and always advise careful consideration.

In most instances, it’s cheaper to cut coverage rather than cancel. You get to keep some protection with lower-Term Life Insurance Rates. Our brokers at Canadian LIC have helped clients explore this often.

Yes, but your new policy may charge more, and you may also be required to take a medical exam. A Canadian LIC broker can help you locate and compare Term Life Insurance Quotes for your new policy.

If your financial situation improves, consider reapplying for coverage. At Canadian LIC, we help clients who cancel their policies explore new options that match their updated circumstances.

Sources and Further Reading

Government of Canada – Life Insurance Overview

Learn more about the basics of life insurance, including Term Life Insurance Policies, on the official Government of Canada website.

https://www.canada.ca

Canadian Life and Health Insurance Association (CLHIA)

Access resources and guidelines about life insurance options and consumer protection in Canada.

https://www.clhia.ca

Financial Consumer Agency of Canada (FCAC)

Understand how life insurance works and get tips on managing your insurance needs.

https://www.canada.ca/en/financial-consumer-agency.html

Insurance Brokers Association of Canada (IBAC)

Find insights into the role of insurance brokers in selecting the right Term Life Insurance Plan for your needs.

https://www.ibac.ca

Key Takeaways

- Reasons to Cancel

Common reasons for cancelling a Term Life Insurance Plan include reduced financial obligations, dependents becoming independent, or affordability concerns. - Alternatives to Canceling

Before cancelling, consider options like reducing coverage, adjusting the term, or converting to permanent life insurance to maintain protection. - Consult a Broker

Term Life Insurance Brokers, like Canadian LIC, provide expert guidance, helping you explore competitive Term Life Insurance Rates and quotes. - Risks of Canceling

Cancelling prematurely can leave your family without financial protection and make obtaining future coverage more expensive due to age or health changes. - Decision Support

Always review your policy, evaluate your current financial situation, and consult professionals before cancelling to make the best choice for your needs.

Your Feedback Is Very Important To Us

Thank you for sharing your feedback! This questionnaire is designed to understand the challenges people face when deciding whether to cancel a Term Life Insurance Plan. Your responses will help us provide better resources and support.

Thank you for taking the time to provide your feedback. We value your input and will use it to improve our services.

Please submit the completed questionnaire, and one of our team members will be in touch if you’d like further assistance.

IN THIS ARTICLE

- When To Cancel Term Life Insurance?

- Why Do People Consider Canceling Term Life Insurance?

- Key Questions to Ask Before Canceling

- When Canceling Makes Sense

- How to Cancel a Term Life Insurance Policy

- Stories From Canadian LIC

- Is Canceling Term Life Insurance Worth the Risk?

- The Financial and Emotional Impact of Canceling Term Life Insurance

- Common Misconceptions About Canceling Term Life Insurance

- How Canadian LIC Helps Clients Make Informed Decisions

- Common Questions Asked About Canceling Term Life Insurance

- Steps to Avoid Canceling Your Term Life Insurance