- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- When Does Term Life Insurance Payout?

- Let's first look at What a Term Life Insurance Plan is?

- When Does Term Life Insurance Pay Out?

- Factors Affecting Term Life Insurance Payout

- Common Misconceptions About Term Life Insurance Payouts

- How to Ensure a Timely Payout

- Benefits of a Term Life Insurance Plan

- Why Choose Canadian LIC for Your Term Life Insurance?

- More on Term Life Insurance

When Does Term Life Insurance Payout?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 5th, 2024

SUMMARY

You have probably heard about Term Life Insurance and how it protects the financial future of your loved ones. But do you know when Term Life Insurance pays out? This is very important information because you must be well aware of when you can expect a payout so that you fully understand what your policy involves and how it works in the best interest of your family.

We often hear stories from clients about how they really had to struggle to understand how and when their Term Life Insurance Plan would help them financially in important times. Some people get frustrated when they discover that they have not chosen an appropriate length for their Term Life Insurance. Others are not sure of how to ensure their loved ones can get the benefit. Some of these fears are justified, but proper advice brings you peace of mind, knowing you’re making a secure arrangement for your family’s future financial well-being. Now, let’s explore the essential components that are part of term life payouts and how these match your requirements.

Let's first look at What a Term Life Insurance Plan is?

Before we discuss payment terms, we need to know what a Term Life Insurance Plan is. In simple words, this type of insurance covers you for a specific period, known as the “term.” Terms last between 10 and 50 years, depending on what you need and want. In case you die within the term period, the payout or “death benefit” will be received by your beneficiaries.

Many Canadian LIC clients often need clarification on this length. For instance, one client would require a short term in order to pay for his mortgage, while another client would require a longer term in order to pay for his children’s education. You can choose a coverage that suits your life goals by choosing the length of your Term Life Insurance.

When Does Term Life Insurance Pay Out?

Now, Term Life Policy payout depends on specific grounds, mainly in case the insured passes during the term of the Term Life Insurance. Generally, the major incidences of Term Life Insurance Cover include:

- Death During the Policy Term: This is the first requirement for a Life Insurance claim. If the insured dies during the active term of the policy, the agreed death benefit is paid to the listed beneficiaries. For example, one of our clients purchased a 20-year Term Life Insurance Policy for his family while paying off his mortgage. Unfortunately, they died within the 15th year, but the money saved was adequate to liquidate the outstanding debts besides creating an appropriate cushioning for the financial situation in that family.

- Policy Active and Premiums Paid: The premium is paid without interruption in term insurance. Providing the premium is paid periodically and without lapse, then the policy will continue uninterrupted, thus making the policy’s death benefit deliverable at the right moment. One couple we counselled skipped a premium when they could not afford it during a budget squeeze. Thankfully, Canadian LIC allowed them to reinstate the policy, so their family is still covered.

- Exclusions: Other policy exclusions include suicides within the first two years of coverage. One should read through the policy agreement in full to know what to anticipate and what not to anticipate. That is something our clients are grateful for, and we take our time to show them all these nuances of their policy agreements.

Factors Affecting Term Life Insurance Payout

Several factors can impact how and when a Term Life Insurance payout occurs. Understanding these ensures you choose the right policy and avoid potential complications:

- Accurate Beneficiary Information: Always have the right information about your beneficiaries. A misspelled name or outdated information may delay the payout process. Canadian LIC once helped one of its clients resolve a case of an outdated beneficiary’s contact details, which could have caused severe delays.

- Policy Length Selection: Term length is an important decision. Policies lapse at the end of a term and do not pay out unless there is a claim at that time. Many clients mistakenly believe their coverage never ends. This would be quickly clarified during a consultation.

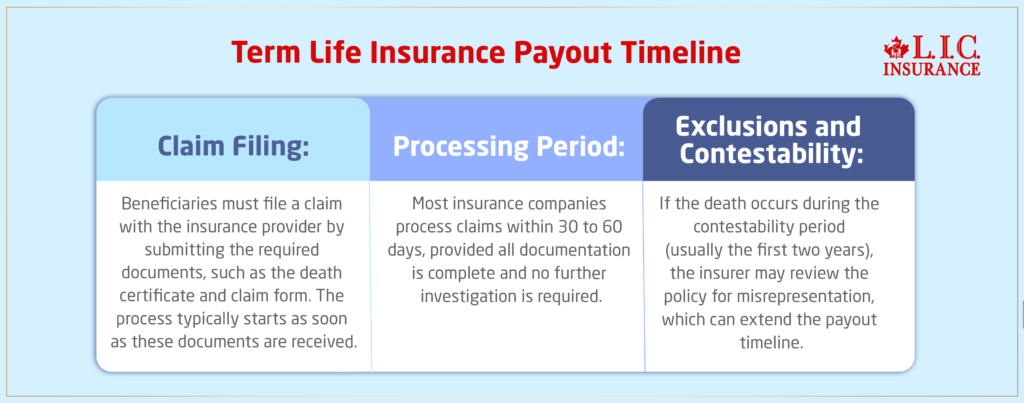

- Claim Filing Process: It defines how to file a claim where the completion of a form by a beneficiary, a death certificate, and other policy documents may be present. Our team assists our clients in going through this smoothly and stress-free.

- Contestability Period: Most policies contain a contestability period, usually for two years from the date of inception. In such a case, the insurance provider is permitted to review the policy details and decline a claim based on material misrepresentation.

Common Misconceptions About Term Life Insurance Payouts

We frequently encounter myths surrounding Term Life Insurance payouts. Let’s clear up a few misconceptions:

- “Payouts Are Guaranteed Regardless of Individual Circumstances”

While payouts are highly reliable, certain conditions, like failure to pay Term Life Insurance premiums or exclusions, can void the policy.

- “I Don’t Need Term Life Insurance If I’m Healthy”

Life is unpredictable. Many clients we’ve worked with initially hesitated to purchase Life Insurance, only to later recognize its value in ensuring their family’s financial security.

- “Term Life Insurance Is Too Expensive”

Term Life Insurance is one of the most inexpensive coverages. Compare Term Life Insurance Quotes with Canadian LIC and find a plan that fits your budget without sacrificing protection.

How to Ensure a Timely Payout

Make sure that your policy pays in when needed by considering the following:

- Keep Your Policy Up to Date: Review and update your beneficiary information regularly. This can include a marriage, divorce, or birth.

- Define Policy Terms: One must read the policy thoroughly and note down the exclusions, terms and conditions. Canadian LIC ensures that it guides every client on the details so that no confusion remains.

- Pay Premiums on Time: Premiums need to be reminded or put on automatic deduction so there will be no lapse in coverage.

- Work with Good Professionals: Canadian LIC ensures proper guidance and support for proper services. From comparing quotes for the Term Life Insurance Plan to even buy Term Life Insurance online, we make everything easier for you.

Benefits of a Term Life Insurance Plan

A Term Life Insurance Plan offers some policy benefits that place it as a favourite of many Canadians:

- Affordability: Term Life Insurance is cheaper compared to Permanent Life Insurance. Customers can enjoy excellent coverage without stretching their finances beyond limits.

- Flexibility in term length: You can choose the Term Life Insurance Length to be anywhere from 10 to 50 years. You may choose one that fits your financial goals, such as paying off your mortgage or funding your child’s education.

- Liberty from Anxiety: This provides one’s family with much value for peace of mind regarding finances if you were to lose your life. Canadian LIC clients often remark on this: this assurance frees you to live fully.

- Easy Application Procedure: You can obtain term insurance with much less paperwork, along with saving time and hard work, through the internet.

Why Choose Canadian LIC for Your Term Life Insurance?

We simplify the insurance process here at Canadian LIC. Our experienced brokers are going to listen to your needs, help you compare Term Life Insurance Quotes and help guide you in choosing the Term Life Insurance Plan that would fit your lifestyle and budget. Our commitment to transparency and personalized service has made us earn the trust of our clients across Canada.

Canadian LIC wants to help you understand your choices so that you can be relieved or you need to ensure your family’s future is saved. Reach out today and take that step toward a worry-free tomorrow.

More on Term Life Insurance

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions About Term Life Insurance Payouts

Term life pays out when the policyholder passes in the active term of the policy; the death benefit is paid directly to the named beneficiaries to pay their financial obligations.

Of course, you have the right to select the term length that fits your preference. Typical alternatives are 10, 20, 30 and 50 years. Canadian LIC usually allows the customer to coincide a term period with one’s objective – for example, repaying the mortgage or financing the education costs of one or more children.

The death benefit is paid to the beneficiaries in a lump sum. A claim form, death certificate, and other documents are required. Canadian LIC helps families navigate this process smoothly.

Most Term Life Insurance Policies cover a very broad range of causes of death. But suicide in the first two years is usually excluded. Read your policy to find out the specifics.

No, Term Life Insurance pays nothing if the insured person lives beyond the stipulated term. That is why choosing the correctly viewed term length for your Term Life Insurance is important.

You can get competitive Term Life Insurance Quotes by comparing policies from different providers. Canadian LIC simplifies this process by presenting options tailored to your needs.

Online Term Life Insurance purchase is pretty easy and hassle-free. You could choose the right plan for your needs with expert advice without much hassle involved.

Failure to make a premium payment can cause your policy to lapse. Canadian LIC encourages clients to request reminders or even an electronic payment system to avoid this.

Some Term Life Insurance Plans are convertible to Permanent Life Policy or renewable at the end of their term. This is precisely where Canadian LIC can guide us in not breaking the flow.

Depending on one’s financial goals, the length of a Term Life Insurance can be fitted. Some may prefer a 20-year term for covering a mortgage, while others like to create a 30-year term to secure funds for the children’s education; Canadian LIC helps clients match term lengths to life stages.

Many Term Life Insurance Plans require a medical exam, but there are options for no-medical-exam policies. Canadian LIC helps you explore all available options based on your preferences.

Once a claim is filed with the required documents, payouts are typically processed within a few weeks. Canadian LIC supports families in expediting the claims process.

Yes, you can name multiple beneficiaries and specify the percentage each receives. Keeping this information updated is vital, and Canadian LIC often assists clients in making these adjustments.

The cost of Term Life Insurance Quotes depends on factors like age, health, term length, and coverage amount. Canadian LIC helps clients find affordable options that match their budgets.

Most plans offer a renewal option, but premiums may increase. Canadian LIC advises exploring this option or converting to a Permanent Plan for extended coverage.

No, the death benefit from a Term Life Insurance Coverage is generally not taxable in Canada. Beneficiaries receive the full amount as outlined in the policy.

Before you purchase a Term Life Insurance Policy online, consider your financial goals, the desired term length, and your budget. Consulting Canadian LIC ensures you make an informed decision.

Yes, you can cancel your Term Life Insurance Plan anytime, but there will be no refund for premiums already paid. Canadian LIC helps clients understand the implications of cancellation.

Term Life Insurance is popular for its affordability, flexibility, and straightforward structure. Canadian LIC clients often choose as it is focused on financial support during key life stages.

Sources and Further Reading

- Canada Life: Offers insights into selecting the appropriate term length for your life insurance policy.

- Blue Cross of Canada: Provides a comprehensive guide on Term Life Insurance, including coverage details and payout processes.

- Sun Life Canada: Details various Term Life Insurance options and their respective benefits.

Key Takeaways

- Payout Conditions: Term Life Insurance pays out if the policyholder passes away during the active term, ensuring financial support for beneficiaries.

- Term Length Matters: Choosing the right Term Life Insurance Length is critical to aligning with your financial goals, such as paying off debts or funding education.

- No Payout After Term Ends: If the policy term expires without a claim, there is no payout. Renewal or conversion options can ensure continued coverage.

- Affordable Coverage: A Term Life Insurance Plan offers cost-effective financial security compared to other types of life insurance.

- Ease of Purchase: You can conveniently buy Term Life Insurance online, simplifying the process of securing your family’s financial future.

- Critical Policy Details: Understanding exclusions, premiums, and claims processes ensures beneficiaries receive timely payouts.

- Trusted Guidance: Working with Canadian LIC helps you compare Term Life Insurance Quotes and select the best plan tailored to your needs.

- Beneficiary Updates: Keep beneficiary information current to avoid delays in claim processing.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts. Your feedback will help us address the most common struggles Canadians face when it comes to Term Life Insurance payouts.

Thank you for your responses. Your input will help us create better solutions to address these concerns. We may reach out to you for further clarification if needed.

IN THIS ARTICLE

- When Does Term Life Insurance Payout?

- Let's first look at What a Term Life Insurance Plan is?

- When Does Term Life Insurance Pay Out?

- Factors Affecting Term Life Insurance Payout

- Common Misconceptions About Term Life Insurance Payouts

- How to Ensure a Timely Payout

- Benefits of a Term Life Insurance Plan

- Why Choose Canadian LIC for Your Term Life Insurance?

- More on Term Life Insurance