- What’s the Maximum Payout for Critical Illness Insurance in Canada?

- Struggles with Critical Illness Insurance Payouts

- Understanding the Maximum Payout of Critical Illness Insurance in Canada

- Key Factors Influencing Maximum Payout

- Pros and Cons of High Maximum Payout Policies

- How Critical Illness Insurance Payouts Can Help with Recovery

- Critical Illness Insurance Quotes Online: How to Get the Right Policy

- The Critical Illness Insurance Landscape in Canada: What You Need to Know

- How to Choose the Right Maximum Payout for Critical Illness Insurance

- Critical Illness Insurance in Canada: A Vital Safety Net

- What Happens if You Don’t Have Critical Illness Insurance?

- Final Thoughts: Protecting Yourself with Critical Illness Insurance

Critical Illness Insurance plays a big factor when it comes to financial security during unfortunate times of one’s life. Whether you are aware of it or not, Critical Illness Insurance payouts in Canada are bound to be lifesavers. However, here’s the thing: the understanding of what maximum payout is and how these could differ does overwhelm people in search of safeguarding against illnesses.

Struggles with Critical Illness Insurance Payouts

Let’s face it: most of us never stop to consider the financial implications of a sudden serious illness until it happens to someone we know, even to ourselves. Perhaps it is a friend who gets cancer or a family member who has a heart attack. Then, out of nowhere, you start talking about medical bills, time off work without pay, and how it is such a massive burden trying to keep everything together while recovery is underway.

A number of people came through our doors confused as to how Critical Illness Insurance works in relation to the maximum payout they get. Some of these people thought that once they had Critical Illness Insurance, their payout was guaranteed to cover all expenses. It’s actually a little more complex than that. Most clients would ask while going along, “How much can I really get from Critical Illness Insurance in Canada?” or “What determines the maximum payout?” This is where we guide them through for the most suitable coverage.

So, what is the maximum payout for Critical Illness Insurance in Canada, and why is it an important number? Let’s break it down step by step.

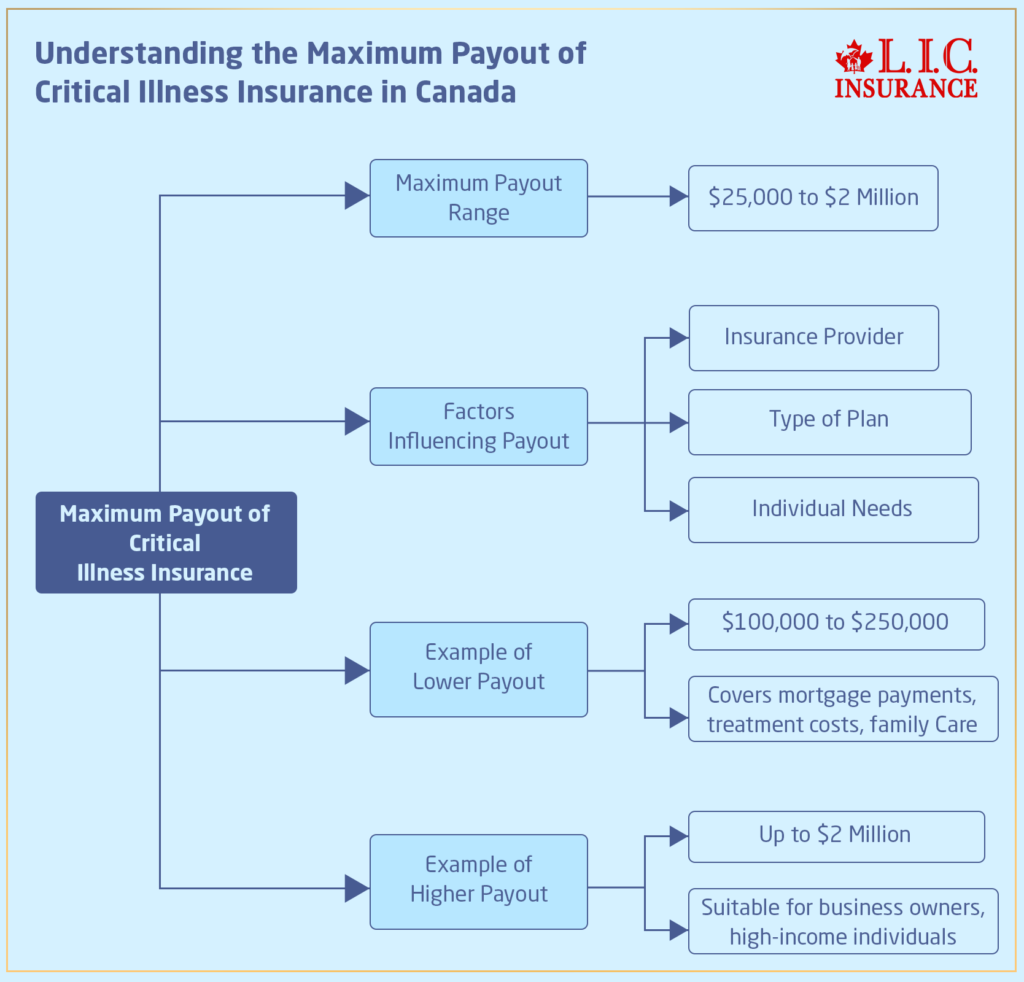

Understanding the Maximum Payout of Critical Illness Insurance in Canada

The amount that one can claim as a payout through a Critical Illness Plan differs by many factors, including but not limited to the provider of the insurance, the plan in question, and one’s needs. In Canada, this can fall anywhere within the range of $25,000 to $2 million. Yes, you read that right. For as much as many policies will keep their payouts considerably low, some policies will go to as high as $2 million. Not every policy is exactly alike.

For instance, some people think that a higher payout automatically means better protection, but that’s not always the case. Here in Canadian LIC, we have customers who do not need policies worth millions; what they are worried about is, in fact, mortgage payments, continual treatment costs and family care costs that can be comfortably managed with $100,000 or $250,000.

On the other hand, others require higher coverage, especially if the level of income and financial responsibilities is greater. Business owners, for instance, can choose a much higher payout since they would want their business to be well taken care of, even as they undergo treatment for a critical illness. For such clients, policies offering up to $2 million make sense.

Key Factors Influencing Maximum Payout

Several factors determine how much an individual can receive as a payout from Critical Illness Insurance. Let’s look at some of them:

- Age: Typically, the younger you are when you purchase a policy, the more likely you are to get a higher payout at a lower cost. Younger individuals are perceived as having a lower risk for critical illnesses, which is reflected in the premium and potential payout amount.

- Health Status: Your current health plays a significant role. If you have pre-existing medical conditions or a family history of critical illnesses, your maximum payout could be lower, and premiums could be higher. Some clients we’ve worked with at Canadian LIC have had to navigate this tricky situation, and while it might feel discouraging, there are always options available.

- Policy Type: The type of policy you choose also matters. Comprehensive policies might offer higher payouts but come with higher Critical Illness Insurance premiums. For instance, some clients opt for policies that cover a broad range of illnesses (heart attack, stroke, cancer, etc.), while others might go for more specific coverage.

- Occupation: High-risk occupations, such as those in construction or other physically demanding jobs, could lead to higher premiums or even a lower maximum payout. Insurance providers assess your risk levels before finalizing the payout structure.

Pros and Cons of High Maximum Payout Policies

When deciding on a Critical Illness Insurance Policy, it’s important to weigh the pros and cons. Here’s what we’ve observed in our daily interactions at Canadian LIC:

Pros:

- Financial Protection: With a high payout, you can be sure that your medical bills, mortgage, and daily expenses will be covered, allowing you to focus solely on your recovery.

- Comprehensive Coverage: Higher payouts generally come with comprehensive coverage, meaning a wide range of illnesses are covered.

Peace of Mind: Clients with high payout policies often tell us that they feel secure, knowing their families won’t have to bear the financial burden if something unexpected happens.

Cons:

- Higher Premiums: Of course, the higher the payout, the more you will have to pay in premiums. Some of our clients initially opted for high payout policies but later downgraded to more affordable options.

- Possibility of Overinsurance: There’s such a thing as having too much coverage. If your primary need is to cover basic expenses, a million-dollar payout might be unnecessary, and you’d be paying for more coverage than you need.

How Critical Illness Insurance Payouts Can Help with Recovery

One of the biggest advantages of Critical Illness Insurance Plans is that the payout is in a lump sum, meaning you get the entire amount at one time. This allows you to spend it as you see fit to help your recovery. Whether it be to pay for alternative treatments, to travel to receive specialized care, or even just to take time off work, the payout offers a buffer during challenging times.

That is what happened with one of our clients, Mr. George. He was holding a policy of $200,000 to manage medical bills and mortgage payments, leaving him a fiscal cushion while focusing on recovery. The best flexibility that Critical Illness Insurance can have in Canada is in regard to using the funds.

Critical Illness Insurance Quotes Online: How to Get the Right Policy

We often encourage our clients at Canadian LIC to check out Critical Illness Insurance Quotes Online. This is the quickest way of knowing what’s available in the market and which policies will likely fit their needs.

When you view quotes online, there are going to be various structures for payouts. You may find that some provide a higher payout with increased premiums; others may be cheaper in premiums but lower in payouts. It is all about finding the right balance between your financial needs and what you can afford to pay over a period.

We always advise our clients to remember the following whenever they take quotations over the Internet:

- What’s the illness coverage like? Ensure that the critical illnesses that concern you most are covered under the policy.

- Is there a waiting period? Some policies might require you to wait 30, 60, or even 90 days before you can receive your payout.

- Are the premiums sustainable? Don’t just focus on the payout—make sure you can afford the premiums long-term.

The Critical Illness Insurance Landscape in Canada: What You Need to Know

Critical Illness Insurance has gained popularity due to the fact that people realize the financial impact a serious illness may bring to their lives. There is no universally applied choice when purchasing such policies. Everything has to be considered in detail: pros and cons, maximum payout, and so on.

Some want a policy that can comprehensively cover them for more illnesses, while others will look out for policies that pay the largest amount possible. It is our responsibility to ensure at Canadian LIC that whatever decision is made is very informed and based on the person’s situation.

Critical Illness Insurance has become an integral part of the safety net needed in Canada to avoid financial ruin in the case of serious illness. Protection for mortgage payments and medical bills, or simply peace of mind, will be based on different policy needs for each individual. Remember, the maximum payout can differ, so finding a policy that strikes a balance between coverage and affordability is key.

As we have learned from our clients at Canadian LIC, Critical Illness Insurance is much more than the number; it is about protection- the protection of your life and the ones you love.

How to Choose the Right Maximum Payout for Critical Illness Insurance

Although the temptation for high payouts may intrigue your mind, the selection of the right maximum payout depends upon your personal scenario. Many of our clients who visit Canadian LIC are clueless about what amount would be suitable for them. Following is a simple approach to how you can determine the right maximum payout for your Critical Illness Insurance Policy:

- Assess Your Financial Responsibilities: Consider your mortgage, loans, daily living expenses, and medical costs. The payout should be sufficient to cover these if you’re unable to work during your recovery.

- Think About Future Needs: Will your family need additional support if you’re incapacitated? Will you need long-term care or specialized treatments? Having these factors in mind can help guide you toward the appropriate payout level.

- Balance Premiums with Payouts: A higher payout sounds great, but the premiums that come with it may strain your budget. Choose a payout that strikes a balance between affordability and coverage.

- Consult with an Expert: Speaking to experts, a licensed insurance advisor at Canadian LIC can help clarify any doubts. They have helped countless clients match their financial needs with the right payout amount, ensuring they are covered for all possibilities.

Critical Illness Insurance in Canada: A Vital Safety Net

With Canada’s healthcare system paying a lot, there are still considerable out-of-pocket expenses for a person in long-term recovery from a critical illness. From treatments not covered by government health plans to travel for specialized care, these expenses add up quickly.

The sad truth is that so many Canadians grossly underestimate the value of Critical Illness Insurance until it’s too late. Many of our clients here at Canadian LIC never thought they needed extra coverage, but when an illness took such a toll on a family member or close friend, they made sure to protect themselves and their loved ones as well.

Whether you are a single professional or have children, Critical Illness Insurance in Canada provides peace of mind in these times of uncertainty. There are a great number of different policies available, and finding the right one really depends on your specific needs and circumstances.

What Happens if You Don't Have Critical Illness Insurance?

Without Critical Illness Insurance, the financial implications of a serious illness are daunting. Many clients have related stories of friends or family members who struggle to keep up with mortgage payments or medical expenses while trying to recover. In those cases, the lack of financial security added unnecessary stress during an already difficult period.

You can be properly covered with Critical Illness Insurance so that you can take care of yourself, recover, and know you’re covered financially. The last thing you want when you’re sick is to be worried about how to pay your bills or keep a roof over your head.

Final Thoughts: Protecting Yourself with Critical Illness Insurance

Buying the right payout for Critical Illness Insurance in Canada is a crucial step toward securing your financial future. At Canadian LIC, we have helped numerous clients find the right balance between coverage and affordability so that they are prepared to take on whatever life throws their way.

Nobody can tell exactly when a serious illness could happen, and proper insurance helps. Whether you need a payout to cover medical costs, mortgage payments, or daily expenses, the key is to choose a policy that meets your needs without breaking the bank.

By working with Canadian LIC, you will be assured that you have made an informed decision backed by years of expertise and experience. Please don’t wait until it’s too late; think about your options in terms of Critical Illness Insurance today and take the first step toward securing your future.

More on Critical Illness Insurance

- Can I purchase Critical Illness Insurance if I am already retired?

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- How Does Inflation Affect My Critical Illness Insurance Coverage?

- Can You Claim Twice for Critical Illness Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Can I Purchase Critical Illness Insurance for My Children?

- Does Critical Illness Insurance Cover Broken Bones?

- Can I Cancel My Critical Illness Insurance?

- Can You Add Critical Illness Cover to an Existing Policy?

- What is a Critical Illness Insurance Claim?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- Can I Have Two Critical Illness Policies?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- What Age Should You Get Critical Illness Cover?

- Critical Illness vs. Disability Insurance in Canada: Understanding the Differences and Making Informed Choices

- What is the Difference between Life Insurance and Critical Illness Insurance?

- All About The Critical Illness Insurance Policy & The Benefits of Critical Illness Insurance

- Why is Critical Illness Insurance Coverage Important? And Do We Need It?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

The average maximum payout can range from $25,000 to $2 million, depending on the policy and insurance provider.

Yes, but it may affect your premiums or the coverage options available to you. Always discuss pre-existing conditions with your insurer.

Many insurance providers in Canada offer tools to get Critical Illness Insurance Quotes Online. You can also consult with Canadian LIC for help guiding you through the process.

Coverage varies by policy. Commonly covered illnesses include cancer, heart attack, stroke, and organ failure, but some policies may include additional conditions.

In most cases, the payout is tax-free in Canada, but it’s always good to confirm this with your insurance provider.

Yes, the payout is typically provided as a lump sum, and you can use it for anything you need, such as medical bills, mortgage payments, travel for treatment, or even household expenses.

The waiting period can vary depending on your policy and provider. Some policies may have a 30-day waiting period, while others could be longer. It’s important to check your policy terms to know the specifics.

Most Critical Illness Insurance Policies in Canada cover major illnesses like cancer, heart attack, stroke, kidney failure, and major organ transplants. Some policies may also include conditions like Alzheimer’s, multiple sclerosis, or Parkinson’s disease.

Yes, many life insurance policies offer Critical Illness Coverage as an optional rider. This can provide a more comprehensive protection package, allowing you to get Critical Illness Coverage without purchasing a separate policy.

In most cases, if you don’t make a claim, there is no payout. However, some policies may offer a return of premium option, where you receive a refund of the premiums paid if no claim is made after a certain period.

Critical Illness Insurance Coverage generally focuses on physical health conditions like cancer or heart disease. However, some policies may cover conditions like Alzheimer’s or other mental impairments related to aging. Coverage for mental health-related issues is typically not included.

Yes, in many cases, you can increase your coverage after the initial purchase, though it may require additional underwriting. Your insurer will assess your current health status before approving the increase.

The cost of Critical Illness Insurance depends on factors such as your age, health condition, occupation, lifestyle habits, and the amount of coverage you choose. The younger and healthier you are, the lower your premiums are likely to be.

Most Critical Illness Insurance Policies are designed for Canadian residents and may not be transferable if you move abroad. However, some insurers may offer international coverage. It’s important to check with your provider about their specific terms.

If your claim is denied, review the reasons provided by your insurer and ensure that all medical documentation and claim forms are accurate and complete. You can also work with Canadian LIC to help navigate the process and potentially appeal the denial.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

This is a valuable resource for understanding insurance products, including Critical Illness Insurance, in Canada. They provide information about various insurance types, consumer rights, and industry standards.

Website: www.clhia.ca - Government of Canada – Financial Consumer Agency of Canada (FCAC)

The FCAC offers consumer education on insurance products, including Critical Illness Insurance. They provide tools and guides for choosing the right insurance plan.

Website: www.canada.ca - Insurance Bureau of Canada (IBC)

The IBC is a national industry association that provides insights and data on various types of insurance products in Canada.

Website: www.ibc.ca - Sun Life Financial – Critical Illness Insurance

Sun Life Financial is one of Canada’s largest insurance providers. They offer detailed information on Critical Illness Insurance, including payout structures and benefits.

Website: www.sunlife.ca - Manulife – Critical Illness Insurance

Manulife is another major insurance provider in Canada, offering various Critical Illness Insurance options. Their website includes an overview of illnesses covered and how policies work.

Website: www.manulife.ca

These resources can provide a deeper understanding of Critical Illness Insurance and help in making informed decisions.

Key Takeaways

- Maximum Payout Range: The maximum payout for Critical Illness Insurance in Canada can range from $25,000 to $2 million, depending on the insurance provider, policy type, and personal factors like age, health, and occupation.

- Factors Influencing Payout: The payout amount is determined by several factors, including age, health status, lifestyle, and the level of coverage you choose. Younger and healthier individuals generally receive higher payouts at lower premiums.

- Pros and Cons of High Payout Policies: High payout policies offer more financial protection but come with higher premiums. It's important to balance your coverage needs with what you can afford.

- Lump-Sum Payout: Critical Illness Insurance typically provides a lump-sum payout upon diagnosis of a covered illness, allowing policyholders to use the money for anything from medical bills to personal expenses, giving them financial flexibility.

- Quotes Available Online: Critical Illness Insurance quotes can be obtained online, making it easier to compare coverage options and premiums from different providers.

- Critical Illness Insurance Is Essential: Even with government healthcare in Canada, Critical Illness Insurance provides vital financial support during recovery, helping with costs that public health plans may not cover.

- Payouts are Generally Tax-Free: In most cases, the lump-sum payout from Critical Illness Insurance is tax-free in Canada, making it a more effective financial buffer.

- Consult with Experts: Speaking with professionals, like those at Canadian LIC, ensures you choose the right policy tailored to your specific needs and financial situation.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. We’re looking to understand the challenges Canadians face when it comes to selecting the right maximum payout for Critical Illness Insurance. Your responses will help us improve our services and provide better guidance to clients like you.

Thank You for Your Feedback!

Your input will help Canadian LIC provide more tailored and supportive services to meet the Critical Illness Insurance needs of Canadians.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]