- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Type Of Risk Is Covered By Short Term Insurance?

- Short-Term Insurance vs. Long Term Life Insurance Policies

- Types of Risks Covered by Short Term Life Insurance

- Why Short Term Life Insurance Is Cost-Effective

- How to Choose the Right Short-Term Policy

- Success Stories from Canadian LIC

- Why Canadian LIC Is Your Best Partner

- Take the Next Step with Confidence

- More on Term Life Insurance

What Type Of Risk Is Covered By Short Term Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 24th, 2024

SUMMARY

Short Term Life Insurance Policies can be temporary coverages over specified periods for particular needs, like loan repayments, job change, or parenting. Here, you will learn about the risks covered by these Short Term Policies, compare them with Long Term life insurance, and learn how this is cheap and flexible. It also teaches how to choose the best policy and get Term Life Insurance Quotes online.

Introduction

Often, people view life insurance as something Long Term. Life has twists and turns sometimes; that’s when the requirement to be covered for some periods of time is made necessary. This is when Short Term Life Insurance is considered indispensable. It ensures you’re covered during those life cycles and protects you from risk during unpredictable periods of time. Whether you have changed jobs, started up a business, or need coverage for a loan, the assurance to loved ones is provided so they do not face hardships.

We have had thousands of clients come to us in Canadian LIC, wrestling with whether they should buy short-term insurance. It’s very challenging to determine when it’s necessary to have comprehensive coverage without going over budget and what types of risks are covered. Let’s find out what types of risks are covered in short-term insurance and why it may be just the perfect solution for your current life situation.

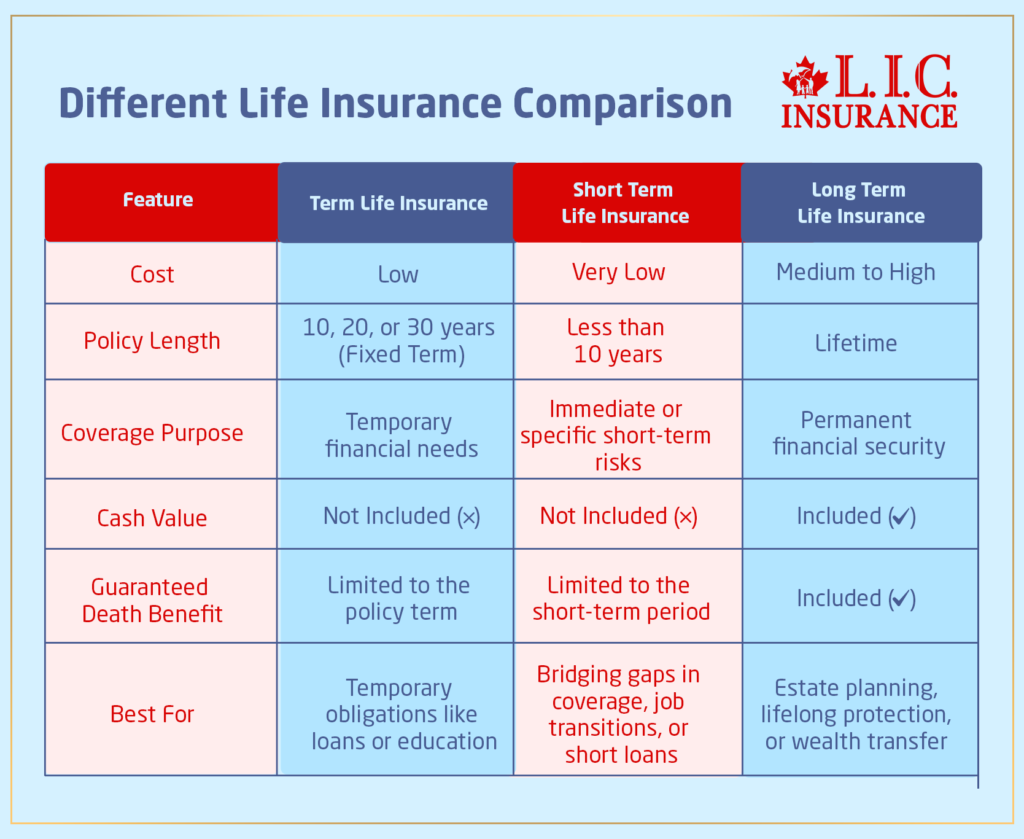

Short-Term Insurance vs. Long Term Life Insurance Policies

Therefore, the choice between short-term and Long Term life insurance Policies should be according to your coverage requirements. Long Term insurance provides Long Term protection for a lifetime, whereas short-term insurance is supposed to cover current risks.

This kind of term life insurance became especially ideal for a young entrepreneur; his interest in a term life plan was sparked when the need started arising. He wanted assurance of his family’s safety in case something untoward happened in the first five years of his business; in his case, this Short Term Life Insurance Policy gave peace without any Long Term financial obligations or involvement.

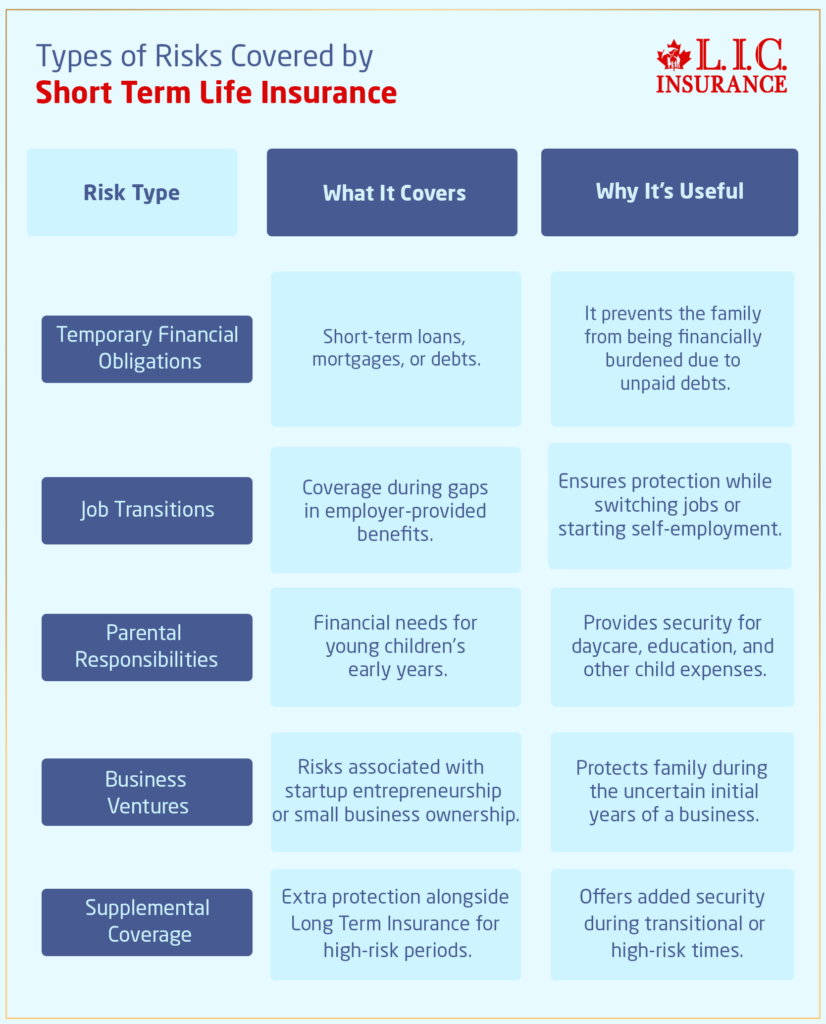

Types of Risks Covered by Short Term Life Insurance

Temporary Financial Obligations

It is thus recommended for short-term cover with regard to temporary loan/mortgage commitments. Thus, if you have a car/personal loan, for instance, for five years, this policy ensures the debt doesn’t burden your family if something happens to you.

One of our customers was using this approach to protect her family from the possibility that her student loan would end up becoming their debt. She selected a short-term policy that equalled the time span of her loan and, for that reason, felt safe enough to continue with her career ambitions.

Job Transitions

A change in job can create a gap in employer-based insurance. Short-term coverage bridges the gap, allowing the policyholder to stay covered until new benefits take effect. It is also very important for people transitioning between jobs or those beginning a freelance career.

We often recommend this option to clients who lose their employer benefits. For example, a client who took off for six months to try his hand at self-employment opted for a Short Term Life Insurance Policy to safeguard his family during that uncertain time.

Parental Responsibilities

The new experience of parenthood often comes with joy and financial responsibility. Many short-term insurance policies are preferred for their child’s future when their child is very young.

One couple came to us just after the birth of their baby. They opted for a ten-year Term Life Insurance Plan, which they knew would be able to cover the child’s expenses for daycare and early education if anything were to happen to them.

Business Ventures

The initial years of startup entrepreneurship and small business ownership are usually risky. Any short-term policy could, therefore, afford them protection for the next of kin as they build and develop their business.

A business owner revealed how he felt secure that if his venture failed, then the financial burden wouldn’t be on his family. It was like having a safety net where the owner could confidently venture into the business.

Supplemental Coverage

Existing Long Term Policies may sometimes be short in periods for a given cover. A Short Term Policy could supplement an existing one to help cover higher-risk times.

For instance, one of our clients had taken up a short-term policy in order to provide added cover during the time when his family was moving to Canada. This additional cover gave them financial security during this transitional period.

Why Short Term Life Insurance Is Cost-Effective

One of the biggest benefits of short-term insurance is affordability. It is the realistic choice for those in dire need of coverage, as it is budget-friendly. Most Short Term Policies charge less premium than Long Term Plans. Because of this, it is easier to take care of your family’s future without putting a strain on the finances.

When comparing premium prices, many clients will be shocked by how short-term plans can be more affordable. Clients can see the coverage they can afford by acquiring Term Life Insurance Quotes Online.

How to Choose the Right Short-Term Policy

Assess Your Needs

Determine your exact needs for coverage. Is it to protect your family while you are transitioning a job, securing a loan, or covering your child’s early years?

Compare Policies

Look for policies that match your needs. Online tools make it easy to compare Short Term Life Insurance Policies and find the best fit.

Work with trusted advisors

We help clients decide on the right policy among various options available while consulting experts like Canadian LIC ensures you get personalized advice.

Success Stories from Canadian LIC

We at Canadian LIC have assisted numerous clients in finding the best short-term insurance to meet their specific needs. For instance, a young professional who was not ready to commit to a Long Term Policy opted for a five-year Term Life Insurance Plan, thus ensuring her financial security while building up her career and saving for a Long Term Policy.

Another client was a family man with a mortgage who selected a short-term policy matching the term of his loan. He felt very comforted knowing that his family would not be burdened if anything were to happen to him.

Why Canadian LIC Is Your Best Partner

Short-term insurance decisions appear to be overwhelming, but this is not the case if appropriately guided. Canadian LIC will help clients navigate their options by ensuring they get the right amount of coverage at the best available price. Buying Term Life Insurance online through us enables you to have access to trusted advice and a very smooth process.

Take the Next Step with Confidence

Short-term insurance protects against risk but also affords peace of mind regarding life’s transition, whether it’s to pay a loan, start a new business or guarantee the family’s future. A Short Term Life Insurance Policy will give you room for flexibility and affordability.

Now is the time to act. Do not allow short-term risks to compromise your financial security. Let Canadian LIC guide you in making the right choice for a Term Life Insurance Policy. Learn Term Life Insurance Quotes today and start acquiring them tomorrow.

More on Term Life Insurance

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Understanding Risks Covered by Short-Term Insurance in Canada

This policy is for a short time and can be from one to ten years. This insurance is meant for short-term needs, such as loan coverage or financial protection in life transitions. It’s often the preferred option of many of our clients here at Canadian LIC when they want to have affordable and flexible coverage for a limited period of time.

A short-term policy is for a short period, while Whole Life or Universal Life insurance is for a long period. A short-term policy is less expensive and is usually employed in case of short requirements. For instance, when someone was paying off his five-year car loan, he chose short-term insurance. Then, another person chose to use Long Term insurance to leave behind a good legacy for his family.

Short-term coverage is only for people with temporary financial obligations. He or She may be a person owing loan repayments, a parent with young kids, an entrepreneur just establishing a new business, or someone transitioning between jobs. Actually, one of the customers used short-term cover whilst changing careers to ensure his family was covered during the time gap of employer-provided benefits.

Short-term insurance covers risks, including loan repayment, income replacement, and financial security during transitions. For instance, a family buys a short-term policy so that if something happens, their mortgage will be covered. Another client used it to secure his family while building his business.

Term Life Insurance can be easily and conveniently purchased online. For clients, Canadian LIC will facilitate the comparison of policies and quotes to find the most appropriate one. Many appreciate that the entire process, from researching a Term Life Insurance Plan to purchasing a suitable policy, can be conducted online.

Indeed, short-term insurance policies are more affordable compared with Long Term Plans. One reason for this is they only give coverage for some time; therefore, a premium becomes cheaper. Recent news came about when a young professional showed us how they obtained the five-year policy covering family members at a suitable price when a career in the profession only started.

Many Short Term Policies offer you an option to convert to Long Term Life Insurance. Such policies help you change coverage in line with changing requirements. One client bought the short-term plan but later, when they were financially established, changed it to the Long Term Plan.

For example, when choosing a Term Life Insurance Policy, one has to consider the length of the financial obligations, the budget, and the coverage amount. For instance, a client who needed protection for a seven-year business loan chose a matching policy term so that financial constraints would not burden his family.

You can easily get quotes for Term Life Insurance from a reliable insurance platform, such as Canadian LIC. Most clients find this very helpful when comparing policies and deciding which is the best for their needs.

Canadian LIC has personal counsel for clients to help them choose the proper short-term policy suited for the client’s unique circumstances. We work closely with each of our clients so that you can understand your options and confidently decide on what will work for you. We can secure a temporary loan or just provide for your family in cases of transition.

Yes, you can have short-term and Long Term Life Insurance. Many clients opt for these in combination to be well-covered. For instance, an individual with a mortgage and a young family bought short-term coverage for the duration of the loan and a Long Term Policy to cover them throughout life.

Short Term Policies usually get approved faster compared to Long Term Plans. Most clients appreciate the convenience of buying Term Life Insurance online and getting coverage within days, thereby providing immediate protection for the most important life events.

Short Term Policies focus primarily on life coverage. Others have add-ons with options that include Critical Illness and Disability Protection. A client we assisted sought alternatives for a policy term, including some extra benefits to counterbalance short-term health risks.

Indeed, many Short Term Policies are renewable. You can renew your policy after the initial term. However, premiums might go up in the process. A client of ours renewed his policy after five years to continue covering his family during a career transition.

The term must coincide with your specific financial obligation or need. For example, if you have a seven-year car loan, opt for a policy that also has the same term. One of our clients acquired an eight-year policy that matched their child’s education timeline.

Yes, the short-term policy can be cancelled. Refunds are issued based on the terms. At one point, a client cancelled because they paid a loan early and did not need coverage.

If the policy term expires and you are still alive, the coverage lapses. There is no payback, but you can renew or buy another plan. For example, a client whose ten-year policy term expired chose Long Term Life Insurance to remain covered all their lives.

The amount of coverage should align with your financial obligations, such as loan repayments or income replacement. One client selected an amount equivalent to the value of their mortgage so that their family would not be left burdened.

Some Short Term Policies require a medical exam, but others offer no medical options. These are popular among clients looking for quick and hassle-free coverage, especially for shorter terms.

Getting term insurance quotes can help you compare a cost to coverage. We find this step helpful; many of our clients tend to prefer the most cheap and effective policy for their case.

Yes, Short Term Policies are available for seniors. We recently assisted a senior client in securing a policy to cover final expenses, providing peace of mind for their family.

Entrepreneurs seek Short Term Policies to stabilize their family’s finances when starting up a business. One of the small business owners that we worked with chose to take a five-year policy in order to protect the family while building up his business.

Yes, you can often add riders for additional benefits, like accidental death coverage. A client included an accidental death rider to enhance their coverage during their short-term policy term.

Short Term Policies then provide coverage during the months when employer benefits are temporarily unavailable. We just received a six-month policy coverage for a client who was recently transitioning between jobs, thus leaving his family protected.

Short Term Policies are flexible, and one can pay either monthly or annually. Most clients prefer to pay monthly because it is aligned with their budget and ensures continuous coverage.

These FAQs provide answers to many questions about short-term insurance and help you decide. For specific assistance, you can always look forward to Canadian LIC support. Choose your options today and be assured of the future.

Sources and Further Reading

- Government of Canada – Life Insurance Overview

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life.html

This page provides a comprehensive overview of life insurance types, including Term Life Insurance and its benefits. - Insurance Bureau of Canada (IBC)

https://www.ibc.ca

A trusted resource for understanding insurance products, including Term Life Insurance, and tips for choosing the right policy. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

CLHIA offers detailed information on life insurance policies, consumer rights, and industry insights. - Investopedia – Term Life Insurance

https://www.investopedia.com

A trusted source for financial education, including guides on Term Life Insurance Policies, costs, and benefits. - Financial Consumer Agency of Canada – Managing Money and Insurance

https://www.canada.ca/en/financial-consumer-agency.html

Offers tools, resources, and articles on life insurance and financial planning. - Insure.com – Life Insurance Basics

https://www.insure.com

Detailed explanations about different life insurance products, their pros and cons, and who they benefit. - Sun Life Canada – Term Life Insurance

https://www.sunlife.ca

A provider perspective on Term Life Insurance benefits and considerations for Canadians.

Key Takeaways

- Affordable Coverage: Term Life Insurance offers high coverage at a lower cost, making it ideal for young families or those on a budget.

- Temporary Financial Protection: Perfect for individuals with short-term financial obligations like mortgages, education loans, or child-rearing expenses.

- Dependents Benefit Most: Provides financial security to spouses, children, or dependents in the event of the policyholder’s untimely death.

- Flexible Terms: Options for 10, 20, or 30 years allow customization based on life stages and specific needs.

- Business Protection: A safeguard for business partners or owners, ensuring continuity in case of unexpected events.

- Key for Parents: Parents with young children can secure funds for future education or living expenses.

- No Cash Value Accumulation: Unlike permanent insurance, Term Life Insurance focuses solely on providing death benefits during the coverage term.

- Ease of Access: Term Life Insurance Policies are straightforward to understand and quick to purchase, with online quotes and broker assistance available.

- Renewal Options: Many term policies offer renewable and convertible options, ensuring continued coverage without a medical exam.

- Best Fit for Financial Planning: A smart choice for individuals needing affordable, temporary coverage to align with specific financial goals.

Your Feedback Is Very Important To Us

We value your insights! Please take a few minutes to complete this questionnaire to help us better understand your struggles related to the risks covered by Short-Term Insurance.

Thank you for sharing your valuable feedback! Your responses will help us address common struggles and improve our offerings.

Note: By providing your email address, you consent to receive follow-up communication regarding your feedback.

IN THIS ARTICLE

- What Type Of Risk Is Covered By Short Term Insurance?

- Short-Term Insurance vs. Long Term Life Insurance Policies

- Types of Risks Covered by Short Term Life Insurance

- Why Short Term Life Insurance Is Cost-Effective

- How to Choose the Right Short-Term Policy

- Success Stories from Canadian LIC

- Why Canadian LIC Is Your Best Partner

- Take the Next Step with Confidence

- More on Term Life Insurance