- What Pre-Existing Conditions Are Not Covered in Visitor Insurance?

- The Reality of Pre-existing Conditions in Visitor Insurance

- What Pre-existing Conditions Are Not Covered?

- Why Are These Conditions Not Covered?

- What Can You Do If You Have a Pre-existing Condition?

- The Importance of Knowing Before You Go

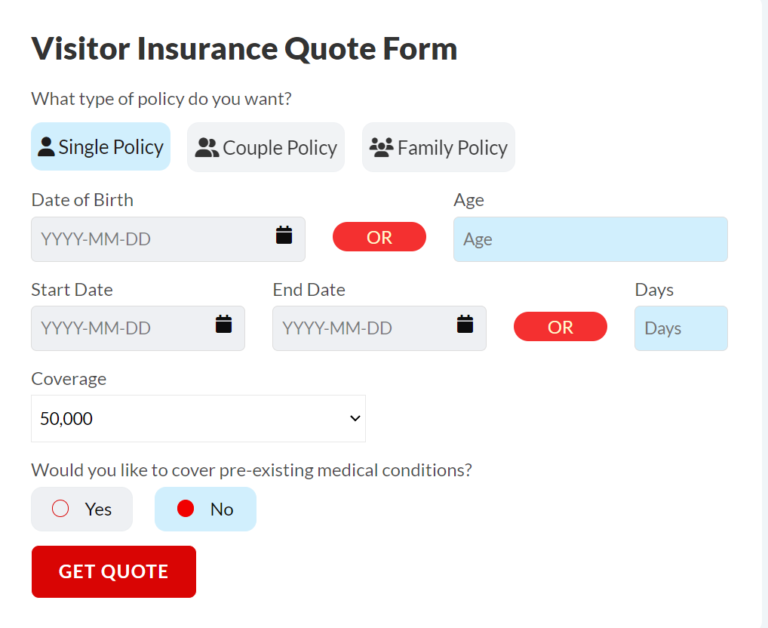

When people come to visit Canada, one of the biggest questions most face is how to secure Visitor Insurance that will correctly cover them regarding their medical needs, especially for pre-existing conditions. After all, it is no secret that Canadian health care is extremely expensive for non-residents, and Visitor Insurance will surely cover these costs. But what if one has a pre-existing condition? More importantly, which pre-existing conditions are not covered under Visitor Insurance in Canada?

This is one of the most frequent questions that we at Canadian LIC get day in and day out. Clients walk into our office or give us a call, feeling overwhelmed by the complexities of insurance policies, particularly when it concerns pre-existing medical conditions. We have seen many visitors get frustrated when they realize their history might be their limitation to coverage. Those are some very valid and realistic struggles, and this blog will guide you on which pre-existing conditions may not be covered under the Visitor Insurance plan and why that is so.

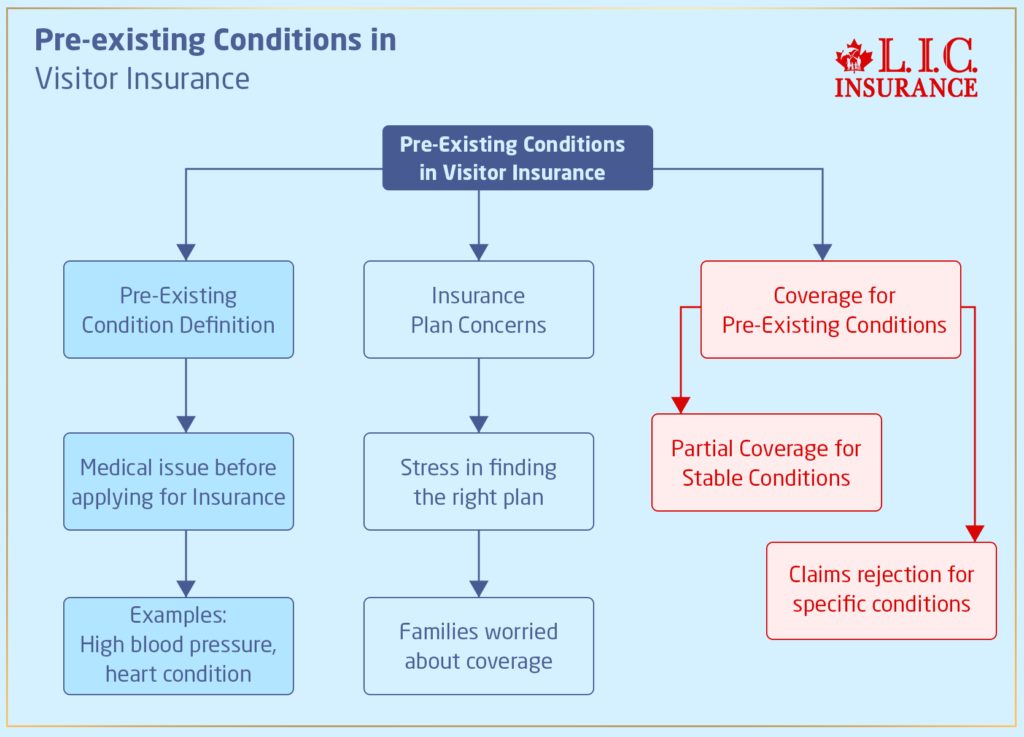

The Reality of Pre-existing Conditions in Visitor Insurance

If you or your loved one has a pre-existing medical condition, then you have likely already felt the stress of finding the right insurance plan. At Canadian LIC, we have seen many families, parents, and grandparents concerned about the coverage of their health conditions. This is quite understandable, especially when you come to Canada on an extended stay and need to make sure that you will not get stuck with huge bills if a pre-existing condition flares up.

What, then, are pre-existing conditions? A pre-existing condition is any form of medical sickness or health problem you have had before the date of applying for the insurance policy. It can be as basic as high blood pressure or as serious as a heart condition. While some insurance companies cover only a portion of stable pre-existing conditions, others reject any claims related to certain specific conditions. Let’s look deeper into the conditions which may not be covered by Visitor Insurance.

What Pre-existing Conditions Are Not Covered?

Many visitors are often shocked to learn that all pre-existing conditions are not covered under Visitor Insurance. In fact, some policies explicitly exclude coverage of certain conditions. Following is a list of certain conditions that may not be covered under Visitor Insurance in Canada:

Unstable Pre-existing Conditions

The most significant pre-existing condition exclusion, perhaps, is the one concerning unstable pre-existing conditions. If, for instance, over a given period before travel, normally 90 to 180 days, your condition has worsened or altered, most insurers will view this pre-existing condition as unstable. Those pre-existing conditions requiring hospitalization or needing new medications, surgical interventions, or any other changes in treatment within such a period are usually excluded from insurance coverage.

At Canadian LIC, we very often come across cases where the client has diabetes, heart disease, or other conditions; however, in the last months or years, the medication or treatment has changed. It is likely that their insurance will not cover these conditions while in Canada.

Severe Heart Conditions

Other rather general medical emergencies include conditions that usually have to do with the heart. Generally, conditions related to a heart attack, heart surgery, or other serious cardiovascular problems you may have had in the last few years are excluded, as these are usually high-risk and not covered. Especially excluded are those when the condition is unstable or treatment, medication, or symptoms have changed.

A client once came to us to buy online Visitor Insurance for her aged father, who had had a heart attack six months back. His heart condition was unstable, and we had to tell him that his pre-existing Visitor Insurance would not cover any future heart-related issues.

Chronic Lung Diseases

Other common pre-existing condition exclusions include chronic conditions such as COPD – Chronic Obstructive Pulmonary Disease – and severe asthma. A few insurance plans may cover the condition if it is considered stable. However, if the lung condition has experienced recent flare-ups or required recent hospitalization, it is most likely excluded from the Visitor Insurance Policy.

We once dealt with a client who had severe asthma and had been hospitalized twice in the six months prior to visiting Canada. Her condition was considered unstable, and the insurance provider excluded it. That put the family in a very difficult situation, searching for a solution that could have been avoided if this exclusion had been known in advance.

Recent Stroke or Transient Ischemic Attack (TIA)

Given that you have recently had a stroke or TIA, the commonly used term is mini-stroke- your Visitor Insurance would most definitely exclude that from the policy. These are considered severe medical events, and insurers are often hesitant to cover the risk of a recurrence, particularly within the first year of the stroke.

A family once contacted us about their mother, who had a stroke three months prior to visiting them in Canada. They were in for a surprise to find that her insurance would not cover any related medical emergency while she was there.

Cancer

Recent cancer diagnoses or active treatments for cancer are also excluded by the Visitor Insurance Policy quite commonly. Some of the insurance companies may not be able to cover conditions associated with cancer even if you happen to be in remission if, over the recent past, it has been an active condition. It is most unlikely that you would find coverage for your condition under normal Visitor Insurance if you are currently receiving chemotherapy or radiation and other such aggressive treatments.

A couple in Canada, on account of a family reunion, contacted us as they had been having a lot of problems in finding a policy that would cover the ongoing cancer treatment of the husband. Unfortunately, a lot of Visitor Insurance Policies exclude such conditions due to high risk.

Kidney Disease and Dialysis

Most of the Visitor Insurance does not cover severe kidney diseases that require dialysis. The reason for this is that dialysis, coupled with other forms of kidney-related treatment, is usually long-term, high-cost care, which most insurers are unwilling to include in a regular Visitor Insurance Policy.

We had one client searching for coverage for her mother, who was on dialysis. We had to explain that most Visitor Insurance Plans exclude coverage for dialysis due to the high medical costs associated with the treatment.

Organ Transplants

Anything related to it will be excluded from most Visitor Insurances if you already have an organ transplant or are on the waiting list to get one. The reason is very simple: post-transplant care and complications involve high risk and cost, and the insurance company will definitely not be exempt from non-coverage.

Recently, we addressed a client who had just undergone a kidney transplant and was travelling to Canada. We were able to provide a policy covering her for general medical emergencies; however, treatments and complications related to her transplant were excluded.

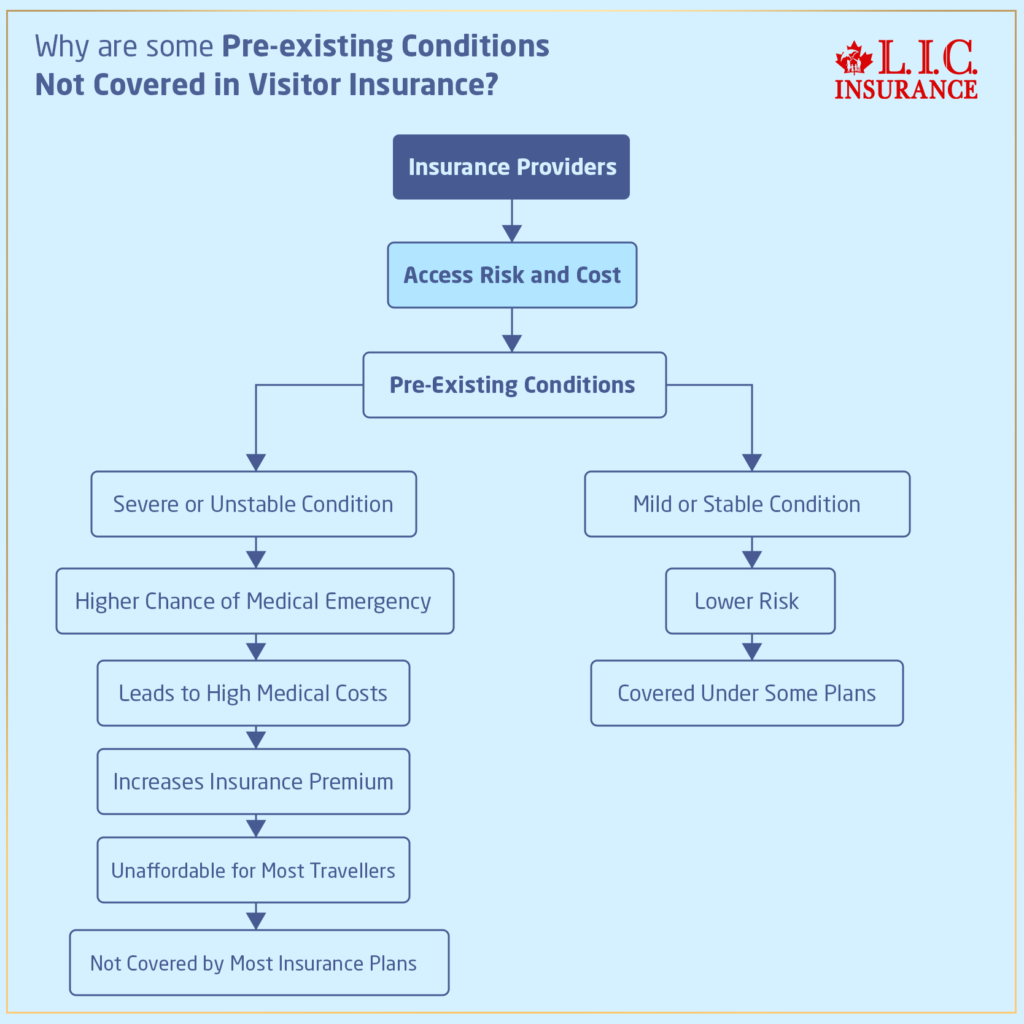

Why Are These Conditions Not Covered?

The insurance providers decide on the basis of risk and cost. Pre-existing conditions, especially unstable or severe, have more possibilities of getting into a medical emergency. Covering pre-existing conditions would raise the insurance plan’s cost by many folds, hence making it unaffordable for most travellers. Moreover, medical costs while treating severe conditions like heart attacks, strokes, and cancer are extremely high, and this very reason makes them excluded from most of the regular Visitor Insurance Plans.

At Canadian LIC, we advise our clients that even though it buys peace of mind, there are limits to what any insurance can cover. Those with severe or unstable pre-existing conditions have to weigh the financial risk against their reasons for travelling without full coverage.

What Can You Do If You Have a Pre-existing Condition?

So, if you have a pre-existing condition that may not be covered, what should you do? At Canadian LIC, we often recommend that clients explore a few options:

- Look for Specialized Insurance Providers: Some companies offer plans specifically designed for visitors with pre-existing conditions. These plans may come at a higher premium but could provide the coverage you need.

- Review the Stability Clause: If your condition is stable and hasn’t required any changes in treatment or medication for a specific period (usually 90 to 365 days), you might still be eligible for coverage. Always ask your insurance provider to explain the stability clause in detail.

- Consider Your Length of Stay: If your stay in Canada is short, you might decide to take the risk and rely on your home country’s insurance for coverage. However, for longer stays, it’s crucial to understand the financial risks of travelling without adequate insurance.

- Consult with an Insurance Broker: Navigating insurance policies can be confusing, especially when dealing with pre-existing conditions. Speaking with an experienced insurance broker like Canadian LIC can help you understand your options and find the best coverage for your specific needs.

The Importance of Knowing Before You Go

Through the years working at Canadian LIC, we have come across far too many situations wherein the client was discovering certain exclusions in his or her Visitor Insurance Policy for the first time. Perhaps one of the important steps one can take before travelling is to read the fine print and understand what is covered and what is not covered under your Visitor Insurance plan. Whether it’s heart disease, cancer, or any other condition, this advanced notice can save one from financial pressures during their visit to Canada.

With us, you can compare Visitor Insurance Quotes, find plans that fit your specific needs, and even buy Visitor Insurance online in one place. We are here to ensure that you and your loved ones are taken care of during your stay in Canada, regardless of your medical history.

More on Visitor Visa and Visitor Insurance

- Can I Use Visitor Insurance for Routine Check-Ups and Preventive Care?

- Can Visitor Insurance Cover Emergency Dental Care During My Stay in Canada?

- What Is the Difference Between Visitor Insurance and Regular Health Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- How Can I Verify If a Hospital or Clinic Accepts My Visitor Visa Insurance?

- Does Visitor Insurance Cover Mental Health Services?

- Can Family Members Visiting Together Get a Group Discount on Visitor Insurance?

- Are There Any Age Restrictions for Purchasing Visitor Insurance?

- What Documents Do I Need to Buy Visitor Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- How Do You File a Claim for Visitor Insurance?

- Can I Extend My Visitor Insurance If I Decide to Stay Longer?

- Which Visitor Insurance is Best?

- Is Visitor Insurance Mandatory?

- Is Visitor Insurance the Same as Travel Insurance?

- Can I Get Visitor Insurance with Pre-Existing Conditions?

- What Can You Not Do with a Visitor Visa?

- Can I Buy Visitor Insurance After Arrival in Canada?

- Can I Get Insurance as a Visitor in Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions: Pre-existing Conditions and Visitor Insurance in Canada

It all depends on the type of Visitor Insurance plan. Some of them cover a visitor for a stable pre-existing condition, and some others may not. At Canadian LIC, we get clients every day anxiously wondering if their condition will be covered or not. It is very important to get a plan tailored to suit your needs. You can fill out a request for a Visitor Insurance Quote to explore your options.

A Pre-Existing Condition is stable if, in a certain period of time immediately prior to buying the policy, you have not had any changes in your treatment, medication, or symptoms. This period varies among different insurance companies but is usually taken as 90 to 365 days. We have many clients who question if their condition is stable; hence, we always recommend verifying with the insurance company prior to purchasing Visitor Insurance online.

These generally include, but are not limited to, heart attacks, strokes, cancer treatments, or any chronic conditions that have required recent hospitalizations. What we commonly tell our clients at Canadian LIC is that unstable or high-risk conditions are generally excluded. It is important to always read the policy details before finalizing your insurance.

Yes, but your pre-existing condition may not be covered. We have a lot of clients who were surprised to find that such serious conditions as cancer or heart disease may not be covered under their policy. You can still buy Visitor Insurance online to cover other medical emergencies during your stay.

Most insurance providers will have a “stability clause” in the policy, which defines the period during which your condition must be stable. We suggest you read this clause carefully. You can also contact us at Canadian LIC for a comprehensive Visitor Insurance Quote in order to determine which policies may cover your condition.

Yes, some policies do cover pre-existing conditions that are stable. Of course, it is very important to read the terms to find out if your condition will qualify. We often help clients understand their options and enable them to purchase Visitor Insurance online that actually works for their unique situation.

That all depends on the insurance provider. With most insurance policies, once your policy has kicked in, you are unable to add any pre-existing conditions to it. We have seen that at Canadian LIC, and we always advise our clients to plan ahead of time and discuss all your needs prior to your arrival.

Because of the higher risk, Visitor Insurance for pre-existing conditions is generally more expensive. Quite often, we give quotes for Visitor Insurance to our clients for price comparison in order to find the one that fits their budget and medical needs.

Insurers exclude some of the pre-existing conditions due to the high risk of medical complications. We have helped numerous clients realize that treatments for a number of these conditions, such as heart disease, cancer, and kidney failures, are very expensive; thus, they are often not preferable to insurance companies.

Yes, but switching mid-policy may come with restrictions. At all times, we suggest our clients go through the terms and conditions of the policy thoroughly before deciding. You can even get advice from Canadian LIC to help you compare the quotes for Visitor Insurance and find an appropriate provider.

You will have to pay most expenses out-of-pocket for treatments associated with an excluded pre-existing condition. We have seen so many clients getting unforeseen circumstances and medical bills because they did not understand their condition wasn’t covered. That is why it’s so crucial to ask all questions and know your policy before you buy Visitor Insurance online.

Yes, you can apply for Visitor Insurance if you have more than one pre-existing condition; however, that does not mean that all conditions are necessarily covered-particularly if they are severe or unstable. At Canadian LIC, we’ve helped many clients compare policies, and sometimes, multiple conditions can affect the coverage. It’s best to obtain a tailored Visitor Insurance Quote for your particular health needs.

Most Visitor Insurance for pre-existing conditions focus on emergency medical care. This means that if your condition worsens unexpectedly, you may be covered. Regular check-ups and medical treatment related to pre-existing conditions are normally excluded. We have people asking us all the time who think they’re covered for anything medical, which is just not the case; we always recommend checking with your provider before you buy Visitor Insurance online.

The period of time before purchasing insurance, wherein a pre-existing condition has not become worse and has not required new treatments or medications, means that it is stable. If an immediate change is happening in the treatments or visits to hospitals, it is unstable, which makes it a riskier condition, too. Most clients ask us if their conditions are stable. We always advise going with a detailed Visitor Insurance Quote so you understand what is covered.

If the condition itself is excluded, complications arising from it may not be covered. We explain this many times to our clients, who seem to assume that at least small complications are covered. It is very important that you verify this before you buy Visitor Insurance online.

Yes, most of the time, you can renew your Visitor Insurance Policy. However, this will be impacted if there have been changes in your medical condition. At Canadian LIC, we have had clients who have renewed their policies and found out later that the renewed plan no longer covered them for pre-existing conditions. Always check the terms before renewing.

It may also not cover any medical emergencies related to the condition if your condition becomes unstable during your stay. We found that clients have issues with this because they may have assumed that the change in their condition would not affect their coverage. This is something important to note when considering your Visitor Insurance for pre-existing conditions.

The waiting period for coverage varies from policy to provider. Some may have no waiting period if the condition is stable, while others may require a waiting period of 90 or more days. Most of our clients ask us how quickly they can get coverage, and we always suggest they go through the policy in detail or request a Visitor Insurance Quote to get accurate information.

Yes, you can switch insurance plans, but make sure the new plan offers better coverage for your pre-existing condition. We have helped clients switch to policies that better suit their needs, and a good first step is always comparing Visitor Insurance Quotes.

If your prescription medication is related to your pre-existing condition, it may not be covered, and that is sometimes a surprise for many of our clients. Hence, we encourage you to make this one of the points to ascertain prior to purchasing Visitor Insurance online.

If you’re unsure about any of this coverage, consulting with the insurance provider or dealing through an experienced broker like us at Canadian LIC is always better. We regularly take our numerous clients through the fine print in their policies. You may also request a quote for Visitor Insurance to see exactly what is covered in detail.

These frequently asked questions bring forth some of the day-to-day challenges visitors face when handling their pre-existing conditions with the help of Visitor Insurance. You can work directly with Canadian LIC for personalized assistance in finding the perfect insurance plan to fit your needs in Canada, whether it be general coverage or one that includes your pre-existing conditions.

Sources and Further Reading

- Government of Canada: Visitor Insurance and Healthcare in Canada

Official information about healthcare options and requirements for visitors to Canada, including the importance of insurance coverage.

https://www.canada.ca - Canadian Life and Health Insurance Association (CLHIA)

Detailed guidelines on Visitor Insurance Policies, including pre-existing conditions and coverage options.

https://www.clhia.ca - Insurance Brokers Association of Canada (IBAC)

Resources for comparing Visitor Insurance Plans and understanding the exclusions related to pre-existing conditions.

https://www.ibac.ca - Ontario Ministry of Health – Visitor Healthcare Coverage

Information on healthcare services available to visitors in Ontario and the need for private insurance.

These sources provide valuable information and context for anyone interested in understanding Visitor Insurance Coverage, especially when dealing with pre-existing conditions.

Key Takeaways

- Not all pre-existing conditions are covered in Visitor Insurance for Canada, especially if they are unstable or high-risk.

- Common exclusions include severe heart conditions, recent strokes, cancer treatments, chronic lung diseases, and organ transplants.

- Stable pre-existing conditions may be covered under specific policies if they haven't required changes in treatment within a set period.

- Visitor Insurance for pre-existing conditions may come at a higher cost, so it's important to compare plans using a Visitor Insurance Quote.

- Always review the terms and conditions of the policy carefully before you buy Visitor Insurance online to ensure your medical needs are met.

- Consult with insurance brokers like Canadian LIC to find the best policy tailored to your health condition and travel plans.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide feedback. Your responses will help us better understand the challenges Canadians face when dealing with pre-existing conditions that may not be covered by Visitor Insurance in Canada. Please answer the following questions as honestly as possible.

Thank you for your feedback! Your insights are valuable in helping us understand the real-life struggles Canadians face with Visitor Insurance and pre-existing conditions.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]