- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is The Waiting Period For Term Insurance?

- Understanding the Waiting Period for Term Insurance

- Everyday Challenges with Waiting Periods

- How Waiting Periods Affect Term Life Insurance Costs

- Comparing Waiting Periods Across Provinces

- Practical Tips to Handle the Waiting Period

- Expert Advice from Insurance Professionals

- Learning from Day-to-Day Experiences

- Evaluating Your Options and Taking Action

- Reflecting on the Importance of Clarity

- The waiting period for Term Insurance

- Final Thoughts on Taking the Next Step

What Is The Waiting Period For Term Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 4th, 2025

SUMMARY

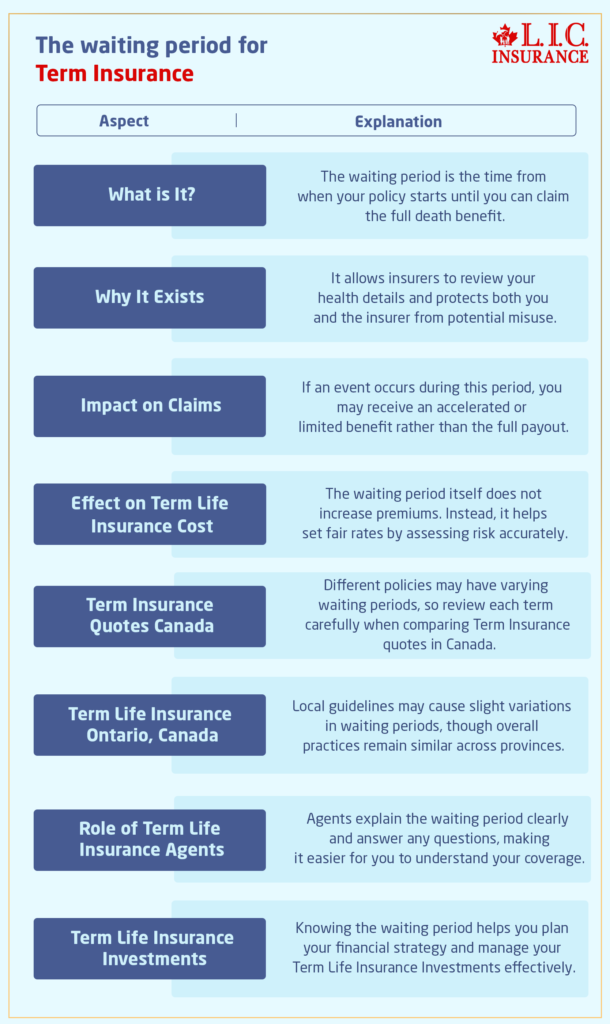

The blog explains the waiting period for Term Insurance in Canada. It covers why this period exists, how it affects Term Life Insurance Costs, and the options in Term Life Insurance in Ontario, Canada. It offers practical tips, client stories, and insights from Term Life Insurance Agents. It also discusses comparing Term Insurance quotes in Canada and managing Term Life Insurance Investments.

Introduction

The waiting period is the other term that one hears about the right Term Insurance plan cost when searching or requesting Term Insurance quotes in Canada. The majority of Canadians experience various challenges and lack clarity regarding coverage during this waiting period. In fact, most have asked Term Life Insurance Agents with regard to Term Life Insurance Investments on the option of Term Life Insurance in Ontario, Canada. At Canadian LIC, we share with you the daily battles of clients and practical solutions to making each step of your journey to securing your family’s future easier to understand.

Life indeed keeps everyone pretty busy, so insurance details sometimes seem to overpower. Most of our clients mention that the key issue is whether they need to wait for long before the total coverage kicks in, especially because they want immediate financial protection in case of untimely loss. Here, we discuss what the waiting period means, why it exists, and how it affects the overall Term Life Insurance Cost. This blog shares experiences from our day-to-day interactions with clients who request Term Insurance quotes in Canada and from those looking for Term Life Insurance in Ontario, Canada. You will find that the waiting period, though an apparent obstacle in the process of getting insured, is important for both the insured and the insurance provider.

Understanding the Waiting Period for Term Insurance

The waiting period is the period between applying for Term Life Insurance, activating your policy, and claiming the death benefit under specific conditions. Normally, the waiting period is used to safeguard you and the insurance company by avoiding covering pre-existing conditions or even undiagnosed health problems. This will translate for many clients as a short lapse before full coverage comes into force and also leaves insurers time enough to verify if the applicant’s health has stabilized.

You could wonder how such a waiting period influences Term Life Insurance Investments and why it is needed. Let’s think of this: most insurers want to avoid the situation when an individual might apply for coverage when his health condition is worsening, and he can file a claim immediately. Setting a waiting period helps protect insurers from fraudulent situations and, at the same time, forces the clients to preserve their healthy habits. When you compare Term Insurance quotes in Canada, you may find that policies with short waiting periods sometimes come with higher Term Life Insurance Costs, whereas longer waiting periods might offer lower premiums.

Clients often ask us: “What happens during the waiting period in case of some unexpected occurrence?” Our response is simple. During the waiting period, in case of an occurrence, the policy may pay only a reduced amount of the benefit, often termed an accelerated benefit and not the death benefit. This is a common arrangement in many policies and ensures that there is always some level of support for your family, even if the full benefit does not apply immediately.

Everyday Challenges with Waiting Periods

Many of our clients share similar experiences when they explore Term Life Insurance options in Ontario, Canada. Recently, one of our clients expressed to us how anxious they were when they heard about the waiting period. They had just begun a new job and wanted to have immediate reassurance that their loved ones were covered. The waiting period, although it was necessary, made them feel slightly vulnerable during that entry period. We heard them out and explained how the waiting period serves as a precautionary measure. Our client eventually understood that this short-term helps keep overall Term Life Insurance Costs lower and prevents possible abuse of the coverage.

Another case involved a family looking for a Term Insurance quotation in Canada, considering they needed big coverage during finance planning. That is why there was anxiety: the activation was going to become full after considerable time and be included in finance planning. We explain that, while waiting periods might seem like an obstacle, in fact, they give clarity about what is covered and what is not, which helps both the insurer and the policyholder to know the timeline. By working through these common challenges, we empower our clients to feel more confident in their decisions and realize that the waiting period is there for a very good reason.

We invite you to think about your own experience. Do you remember having any confusion regarding how long you would have to wait for full protection once your policy is effective? Asking your questions or voicing your concerns can be an important step in gaining a clearer understanding of what you are buying. Many people find that having a frank conversation with experienced Term Life Insurance Agents will modify their views about these waiting periods.

How Waiting Periods Affect Term Life Insurance Costs

One of the prime reasons clients often ask about Term Life Insurance Costs is that they fear waiting periods may increase their premiums. Upon discussing Term Life Insurance Investments with clients, we find that the waiting period itself does not directly impact a client’s premium amount. Instead, it becomes a factor in the entire underwriting process. Insurance companies weigh out the risks of your health profile, lifestyle, and even family history for some based on the waiting period.

It will be interesting when you compare quotes for Term Insurance in Canada: you may realize that there is a variety of waiting periods. For instance, policies with certain conditions have longer waiting periods while others do not. The overall premium cost, therefore, would be slightly higher for the latter than for the former. This is because insurance companies assume low risk when they have more time to assess an applicant’s health status. By taking this extra time, they can offer a fairer premium to clients who maintain their health and disclose all relevant information.

In most discussions with clients, our group in Canadian LIC usually shares all these details. One client was initially concerned that the waiting period would mean a loss of protection in case he or she had to claim early on. When we explained that the accelerated benefits are available and also that this waiting period is already included in the computation of the Term Life Insurance Cost, the client calmed down. The transparent approach makes you see that waiting periods are not a penalty but a part of the system that helps keep insurance affordable for everyone.

Comparing Waiting Periods Across Provinces

Canada is a vast country, and rules or traditions can be different from one province to another. Suppose you have been searching for Term Life Insurance options in Ontario, Canada. In that case, you might be asking if the waiting period is any different in Ontario than it is in other provinces. In general, the waiting period for Term Insurance is similar throughout the country, but there may be some slight variations on how quickly some benefits start. Some provinces may even have guidelines about waiting periods of a number of months on specific policy parts.

Many clients speak about the diversity of the areas. One British Columbia client reported she felt more comfortable in her coverage after realizing she could qualify under a shorter wait for accelerated benefits due to some local regulations applied in her community. Clients living in other provinces were comforted by the lengthy wait, which they thought made it longer to verify crucial information on their health. Such variations in practices are indicative of the fact that while the waiting period may be the common feature, its impact could vary based on regional standards and the specifics of your chosen policy.

As you compare Term Insurance quotes in Canada, you may note that your local Term Life Insurance choices in Ontario, Canada, are closely in line with national best practices. Our work with clients involves explaining that you will want to know these regional variations so you can select the right policy that meets your lifestyle and needs. It all comes down to knowing your policy and asking detailed questions if anything does not make sense.

Practical Tips to Handle the Waiting Period

You may have wondered how to deal with this waiting period yet still feel confident about your cover. We guide our clients on how to deal with this period.

Plan Your Finances Wisely:

As you wait for the full cover, take this moment to assess and set aside extra money in the budget for unplanned events. You should know if there will be a deficiency in the funds during this plan and prepare them for the next step.

Understand Your Policy Terms:

Take time to read the fine print of your policy. Know which conditions or claims might receive only partial benefits during the waiting period. Asking your Term Life Insurance Agents for clear explanations can make a huge difference.

Maintain a Healthy Lifestyle:

Many respondents said that the waiting period becomes painless to spend focusing on health and wellness, thus lessening anxiety levels. Check-ups, exercises, and a well-balanced diet not only improve one’s general health but also create the conditions upon which your policy was issued.

Maintain Open Communication

Keep in touch with your insurance company. If your circumstances change or you have an issue during the waiting period, speak with your agent. They usually have tactics or extra coverages that will help to relieve you temporarily.

Discuss other coverage options:

You could consider other supplemental policies that pay benefits during the waiting period. This may cost a bit more for Term Life Insurance, but it may bring you some much-needed peace of mind when you feel a little naked during the waiting period.

Utilize the Waiting Period to Know More:

This time would be utilized to research further into investments in Term Life Insurance and then get advice from experts who better understand the market. Many customers find that a waiting period often gives them opportunities to ask other questions and, hence, gain a deep understanding of coverage options.

These recommendations have benefited many clients who are preparing to activate their cover completely. This depends on information, being proactive, and asking all the questions you have in mind. Clear communication with seasoned professionals will convert an uncertain time into a growth and learning moment.

Expert Advice from Insurance Professionals

Seasoned-Term Life Insurance Agents repeatedly tell their customers that a waiting period is something to be found in most insurance policies. The waiting period offers time for reviewing your application in detail and acts as a preamble to a safe, long-term contract. Instructing their clients to think of the waiting period not as a delay but as an integral part of a larger safety strategy that also safeguards the insurance professional.

One memorable conversation was with a client who had reservations that waiting would result in an untoward health event. Our knowledgeable agent described might actually find it easy if serious illness or injury were sustained, and accelerated benefits will often take care of many cases. In these instances, reassurance about such matters gave them a wake-up call in respect of realizing flexibility within the waiting period.

We also counsel our clients regarding Term Life Insurance Investments, including the fact that these policies will form an essential part of a diversified financial strategy. Though there will be a waiting period, the overall value of the policy remains intact, and benefits can be accessed in ways that align with personal and financial goals. Our experts entice you to ask detailed questions on what scenarios will trigger the waiting period and some exceptions that may exist. This way, you are assured that everything about your policy is very transparent and clearly tailored according to your best interests.

Learning from Day-to-Day Experiences

Each day, we witness clients dealing with issues that revolve around waiting periods. A client recounted the way in which they juggled the perceived limitation of short-term coverage versus the broader strategy for their lives. They had begun a new business and sought reassurance that their family would still be protected even during the waiting period. The waiting period was what the team needed to clarify: the insurer requires the waiting period to collect adequate health data; during this waiting period, they are entitled to some claim benefits. The same client was later relieved to know how the system worked and would advise friends with similar cases to get full information from their Term Life Insurance agent.

Another case study involved a couple planning for a life-changing milestone: the acquisition of a home. They needed assurance that there would be no gaps in their cover during the waiting period. From an in-depth conversation with our consultants, it was established that most insurance companies offer at least partial coverage during times of immense need. The couple was grateful for the candid conversation and more empowered to control risk as a way of embracing a home. These engagements remind us to be empowered by open dialogue clarity that creates uncertainty.

Our team always encourages your thoughts and experiences. If you find yourself curious about the Term Life Insurance in Ontario, Canada, or indeed learn how Term Life Insurance Cost factor into your decision, a simple conversation with knowledgeable agents will clear up most misunderstandings. We will always stand by you to ensure every question you have gets clear and thoughtful responses.

Evaluating Your Options and Taking Action

When you search for Term Insurance quotes in Canada, you quickly learn that every policy is different. The waiting period is only one of the components that play a part in conjunction with other elements, such as premium rates, coverage limits, and benefits during special circumstances. Many clients decided to compare different policies before making their final choice. You are likely to find that policies carrying shorter waiting periods have a different Term Life Insurance Cost than those carrying longer waiting periods. Our advice is to look at the overall picture rather than keep tabs on one feature.

You may have seen ads or online articles that talk about the speed of coverage activation. But what matters most is that you know how each is structured and what kind of trade-offs exist in each type of insurance. For example, a longer waiting period might result in a more competitive premium rate, but if you have concerns about activating it immediately, then a shorter waiting period might be a better choice. Discuss your needs with trusted Term Life Insurance Agents to make an informed decision, balancing your present situation with long-term financial plans.

We would like to urge you to deliberate on your choices carefully. Discuss your policy with experts who are abreast of all the minute details and ask about each nuance that affects your policy. Very often, such proactive behaviour brings to light the fact that the waiting period is not a constraint but a smart step taken for the overall stability of your Term Life Insurance Investments.

Reflecting on the Importance of Clarity

The waiting period usually seems confusing at first. However, it has clarity on both sides-by your side and the side of the insurer. Insurers ensure the coverage is both adequate and sustainable by taking the time to verify the details of your application. I have witnessed from the conversations with clients that an understanding of this process can change how the waiting period comes into perception. This usually comes across to many clients as a delay, but eventually, many come to regard it as a protective measure to ensure the long-term viability of their policy.

When you request Term Insurance quotes in Canada or are considering Term Life Insurance in Ontario, Canada, recall that the waiting period helps to ensure the stability of the entire insurance structure. Our experts have always said that although the waiting period does not come easily, it goes a long way in ensuring smoother claims processes when needed. This approach will help you to see the waiting period in a balanced way, designed to have a long run that helps to protect both you and your family.

The waiting period for Term Insurance

Final Thoughts on Taking the Next Step

We know how overwhelming discussions of insurance details can be, particularly when you are juggling your everyday responsibilities. Many clients question whether the waiting period means they are left without protection. We have found consistently that, if planned and communicated properly, the waiting period can be a manageable and even positive part of your overall coverage plan.

You ought to feel empowered when you search for Term Insurance quotes in Canada or when speaking with Term Life Insurance Agents regarding Term Life Insurance Investments, knowing that every element of your policy was set up to protect you over time. The waiting period doesn’t weaken your policy; it actually does the opposite and strengthens it so that the insurer is better able to provide secure and reliable service in years to come.

It is very natural to be reluctant when waiting for something as precious as life insurance. But think about the bigger picture. Your way of securing your family’s future goes beyond activation, which will activate immediately. Instead, it goes about the making of thought-provoking decisions that eventually result in long-term benefits. With the support of knowledgeable professionals and clear knowledge of how each element of your policy works, you will be fully ready to adopt waiting periods as a minor but inevitable step in a grand plan of comprehensive financial endeavours.

Protection for your loved ones is a key decision. All conversations with experienced Term Life Insurance Agents and going through Term Insurance quotes in Canada really emphasize that a waiting period forms an integral element of keeping the policy balanced and fair. In addition to that, you will now be even better prepared for making the choices after knowing how daily experiences, along with practical tips shared by our team, can serve as guidelines to help you go ahead with much clarity and confidence.

As you reflect on all these points, consider how much value you gain when you take the time to understand every detail of your policy. Whether you focus on the Term Life Insurance Cost or the specifics of Term Life Insurance options in Ontario, Canada, every detail contributes to a secure future. Remember, every question you ask is a step toward greater security for your family.

Your journey to the proper Term Insurance policy is a process, and the waiting period is just part of that process. It’s approached with clear knowledge, practical advice, and willingness to communicate with those you trust. We would love for you to ask more questions, share your experiences, and discuss how these insights may apply to your personal situation.

If you are willing to safeguard the future of your family with a policy that never takes a thing lightly, this is the perfect time to start. Understanding your waiting period, coupled with some handy advice and guidance from an expert, will boost confidence in your ultimate decision. Time spent in preparing today becomes solid, dependable protection tomorrow.

We hope you are better able to see that the waiting period serves as a reasonable part of a comprehensive system meant to safeguard you. It also serves as proof that each and every detail in your life insurance policy, from Term Life Insurance Cost to the accurate terms being provided by Term Life Insurance Agents, is made to provide a secure, lifelong safety net for you and those you care about.

Take this moment to ask more questions, review the options at hand, and spend time talking with professionals prepared to guide you to a safer tomorrow. Your road to a safe tomorrow starts today by understanding what is included in your policy and everything explained, including waiting periods. Thank you for spending this time with us, and we encourage you to keep learning about your choices. Your decision today builds the road to a safer tomorrow.

More on Term Life Insurance

- Should I get a 20 or 30-year Term?

- How Do I Claim Term Insurance?

- Can I Use My Term Life Insurance To Pay Off Debt?

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs on Waiting Period of Term Life Insurance

The waiting period is the gap between when your policy begins and when you are allowed to file a claim on the full death benefit. A few clients may be concerned with any gap in protection. Our team explains to them that the waiting period actually helps insurers cross-check your health details. It keeps the cost of Term Life Insurance fair and helps protect both the client and the insurer.

The waiting period adds no extra fees to your premium. Instead, it enables the underwriters to set a fair rate based on your health. In most cases, Term Insurance quotes in Canada clients ask if a waiting period implies higher costs. We always share that the waiting period is but one of the usual procedures. It assists in sustaining Term Life Insurance Investments that are stable and affordable over time.

Yes, you may claim some benefits during the waiting period. Some clients often ask Term Life Insurance Agents whether or not they become unprotected in such a situation. Our experts then explain that, in the case of an early claim, there may be an accelerated benefit received. Such a benefit is not a full death benefit but would provide for your family. We like to share these with you to make you more comfortable about the coverage you may have for them.

Similar wait times apply all over Canada; however, small variations exist between provinces. Some clients in Ontario often question if their wait is different from that of others in other provinces. We usually inform them that the guidelines are virtually the same, but local rules might allow for a slightly shorter or longer waiting period. This variation does not tend to make a big difference when it comes to the Term Life Insurance Cost. Clients learn that they can compare Term Insurance quotes in Canada and choose what fits best for them.

Term Life Insurance Agents explain it in detail. Clients often mention that, at first, they get confused regarding the waiting period. Our agents answer any questions in plain language, using examples from everyday situations to show that the waiting period is not a form of penalty. This clear conversation works out well with most clients in settling into their policy more easily.

Review your plans for finances and health goals. We advise our clients to maintain a healthy lifestyle and receive all the medical check-ups. This leaves you prepared when full benefits start. You can also seek extra information from your Term Life Insurance Agents. This will help you stay updated on your Term Life Insurance Investments and prepare for the future.

No, it does not affect your future applications. After your policy has started, this waiting period is normal. Some clients worry that this period will harm their ability to get better coverage later on. Our experts explain that the waiting period only helps set a secure rate now. It doesn’t harm your ability to get new quotes when needed.

When you compare Term Insurance quotes in Canada, find out the waiting period for each policy. While some policies provide shorter waiting periods, others will have longer ones. Our team educates our clients that a waiting period is just one factor among many, including the Term Life Insurance Cost and overall benefits. You can discuss these details with knowledgeable Term Life Insurance Agents. This will help you select a policy which suits your personal needs and financial plans.

We hope these questions and answers enable you to realize how the waiting period functions on your term life policy. Many clients come to us with concerns similar to yours, and we work together to clear up any confusion. We encourage you to keep asking questions. Your active involvement will help you make a confident choice about your insurance investments.

Sources and Further Reading

- Insurance Bureau of Canada

Offers comprehensive information on different insurance types and policies in Canada.

https://www.ibc.ca - Financial Consumer Agency of Canada

Provides consumer guides and resources on financial products, including Term Insurance.

https://www.canada.ca/en/financial-consumer-agency.html - Canadian Life and Health Insurance Association

Contains detailed insights and consumer information about life and health insurance.

https://www.clhia.ca - Investopedia

Features articles that explain insurance concepts like waiting periods and Term Life Insurance Costs in simple terms.

https://www.investopedia.com

Key Takeaways

- The waiting period in Term Insurance gives time for insurers to review your health and protect both you and your family.

- The waiting period does not raise the overall Term Life Insurance Cost; it ensures fair and stable premiums.

- Policies may offer limited benefits during the waiting period, easing early concerns for clients.

- Guidelines on waiting periods are similar across Canada, with minor differences in Term Life Insurance Ontario Canada options.

- Expert Term Life Insurance Agents help explain details and support your decisions about Term Life Insurance Investments and Term Insurance quotes in Canada.

Your Feedback Is Very Important To Us

IN THIS ARTICLE

- What Is The Waiting Period For Term Insurance?

- Understanding the Waiting Period for Term Insurance

- Everyday Challenges with Waiting Periods

- How Waiting Periods Affect Term Life Insurance Costs

- Comparing Waiting Periods Across Provinces

- Practical Tips to Handle the Waiting Period

- Expert Advice from Insurance Professionals

- Learning from Day-to-Day Experiences

- Evaluating Your Options and Taking Action

- Reflecting on the Importance of Clarity

- The waiting period for Term Insurance

- Final Thoughts on Taking the Next Step