- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

- What is a Deductible in Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Get Super Visa Insurance If I Am Over 85 Years Old?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- What Are the Consequences of Not Having Valid Super Visa Insurance?

- Is There A Waiting Period For Super Visa Insurance?

- What Is the Processing Time for a Super Visa in Canada?

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is The Success Rate Of A Super Visa In Canada?

- Understanding the Super Visa Process

- Key factors affecting the success rate of a Super Visa in Canada

- Essential Factors That Influence Super Visa Approval

- Experiences and Stories from the Field

- Strategies to Enhance Your Application's Success Rate

- Understanding Insurance Options and Requirements

- Advice From the Experts

- Steps to Take When Facing Difficulties

- Personal Reflections and Client Feedback

- Taking Action With Confidence

What Is The Success Rate Of A Super Visa In Canada?

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 10th, 2025

SUMMARY

This blog details factors influencing Super Visa success in Canada. It explains essential documents, insurance coverage, and financial proof for extended family visits. The post also offers tips on comparing Super Visa Insurance Plans and policy quotes, buying Super Visa Insurance online, and working with Super Visa Insurance Brokers. Client stories add practical advice and solutions for overcoming common challenges in the Super Visa application process.

Introduction

Many families in Canada wonder if their application for a Super Visa will go through. If you have ever searched for Super Visa Insurance Plans, compared Super Visa Insurance Policy Quotes, or planned to buy parent and grandparent Super Visa Insurance online, you are not alone. Many others consult Super Visa Insurance Brokers for such services. We recognize that this Super Visa journey can be overwhelming and that sometimes you may stumble upon obstacles like confusion between paperwork, misunderstandings concerning policies, or getting asked unexpected questions about your application. Every day, we hear stories from clients who have had experiences with the intricacies of the process. Today, we are going to talk about the Super Visa success rate, share experiences from our work at the best insurance brokerage in Canada, and give you clear advice to help you feel more confident in your journey.

Understanding the Super Visa Process

The Super Visa grants parents and grandparents of Canadian citizens or permanent residents the ability to spend years in Canada. Families often dream of being able to reunite in one place rather than constantly requiring renewals. However, the process is multi-layered with requirements that can be hectic even for the most organized applicant. We frequently talk with clients who are anxious about making sure to cover all the details of the application. They mention their fears of medical check-ups, proof of financial assistance, and, most importantly, the reliable insurance provider.

We, therefore, suggest that you start with a comparative analysis of the Super Visa Insurance policies. Some of the customers have been complaining of frustration because of getting unclear Super Visa Insurance Policy Quotes that don’t seem to meet their expectations. Others have made the easy mistake of buying Super Visa Insurance online, not knowing at times that they could benefit much from some advice given by experienced Super Visa Insurance Brokers. All of these examples prove that a good application depends on the right planning and proper choice. You would then ask, “How can I ensure my application meets all requirements?” Let’s break it down into processes and key factors influencing the success rate.

Key factors affecting the success rate of a Super Visa in Canada

Essential Factors That Influence Super Visa Approval

Several factors determine a successful application rate for the Super Visa. At the best insurance brokerage in Canada, our team of professionals listens to client concerns and makes things easier to understand. Here are some of the key factors:

- Accurate and Complete Documentation: Your application requires all documents possible, from a financial statement to medical records. Many clients explain to us how missing or obsolete documents can mean delays or, worse, denials. The only way to secure your chances at success is to ensure that every single document is the most current and complete.

- Valid Insurance Coverage: The need for medical insurance is one of the most significant components of the application process. Clients must ensure they have adequate insurance that covers all the aspects set by the standards of Canada. We counsel our clients to analyze various Super Visa Insurance policies. Some of the clients complained at first because the insurance policy quotes they got were less than the minimum coverage, thus a reevaluation of their insurance covers.

- Proof of Financial Support: The host in Canada should have enough proof of income to sustain the visitor. Several clients are concerned about whether their sponsor’s income is sufficient. By presenting bank statements, employment records, and tax documents in preparation, you make a stronger claim

- Health and Background Checks: They carry out a proper medical checkup and background review. We’ve seen applicants whose excellent financial records and documentation run into delays on account of a minor health problem. Getting minor health issues treated early by a healthcare provider helps smoothen your application.

- Clear Communication and Consistency: The details of the application and proper communication with immigration officers are very important. Most of our clients have said that even minor discrepancies on the application form raise suspicion. It pays to double-check your application.

Each of the factors above impacts the overall success rate. It is, however, when they are understood and acted upon in advance that things improve considerably.

Experiences and Stories from the Field

We meet families every day who want to apply for a Super Visa. They narrated to us first-hand how tough the whole process has been. One client approached us after spending months gathering his documents. He had just been disappointed when his insurance coverage did not meet the requirements listed. They realized that, among other different plans for Super Visa Insurance, one minor detail solved the problem. Following guidelines from our well-experienced team and guidance through Super Visa Insurance Brokers, they managed to come up with an appropriate policy which satisfied all conditions. The applicant was approved; thus, she can now be with her dear ones in Canada for longer times.

Another family had encountered problems with presenting proof of sufficient financial support. The host did have a secure income, yet the paperwork in question did not clearly show meeting the income-based threshold. This required us to spend additional hours clarifying and advising on just what financial proof was needed for their case, and the result was that all their hard work paid off – the immigration services responded positively.

These are, therefore, stories that resonate with many people facing similar issues. It is easy to be perplexed by the long lists of details, but learning from the shared experiences will better equip you. Some key takeaways include ensuring one starts on time, gathering documents on which one can be reasonably sure, and finding expert advice whenever there is a need. The family, therefore, can still be equipped to overcome similar pitfalls on Super Visa applications through guidance offered by our team.

Strategies to Enhance Your Application's Success Rate

Super Visa application success can be boosted through proper planning. The following are some practical steps that have worked for our clients:

- Early Preparation and Organization: First, prepare a checklist of all documents that you require. Keep your paperwork organized in a way that nothing gets missed. The well-organized application usually shows care and commitment to the process. Prepared clients do not feel so stressed during the process and suffer fewer setbacks.

- Review Insurance Options Thoroughly: Compare various Super Visa Insurance Plans when searching for the right one. Study Super Visa Insurance Policy Quotes closely, as is the case with some policies that seem very attractive at first but fail to provide the desired requirements. Many families have benefited from advice supplied by Super Visa Insurance Brokers who are well-equipped and familiar with the ins and outs of policies. These brokers help you identify a policy that meets the immigration requirements but also gives you complete coverage.

- Maintain Transparency in Financial Documentation: Clearly present financial records to prove that your host in Canada is able to take care of your stay. Be ready with the most detailed financial statements and their supporting documents. Clear articulation of a sponsor’s financial stability is a much easier process. If in doubt, always consult professionals when preparing financial documents for visa application.

- Seek Professional Advice: Engaging experts who regularly handle Super Visa applications can work in your favour. Our professionals at the best insurance brokerage in Canada work with clients to explain every requirement in detail and develop specific solutions accordingly. Professional guidance can help prevent mistakes and present an application aligning with prevailing rules.

- Double-Check Medical Insurance Details: The primary determiner of whether your application will be approved or not shall be medical insurance. Be sure the insurance policy you choose covers at least the minimum coverage level. Some of the clients said they faced difficulties while purchasing Super Visa Insurance online, failing to confirm the details. Review the terms of the policy and seek direct consultation with Super Visa Insurance Brokers to ensure you get the proper coverage.

With these strategies, you are sure to meet the requirements and walk through the process with confidence. Families who do this have fewer complications and an easy journey through it.

Understanding Insurance Options and Requirements

Medical insurance on a Super Visa is not simply a formality; it’s a basic condition that safeguards the visitor and host country. There must be adequate coverage for any health care bills incurred during a visitor’s sojourn in Canada. Frequently, we advise our clients to critically evaluate different types of Super Visa Insurance Plans to find out which one best matches their needs and budget.

Several points help clarify what to look for:

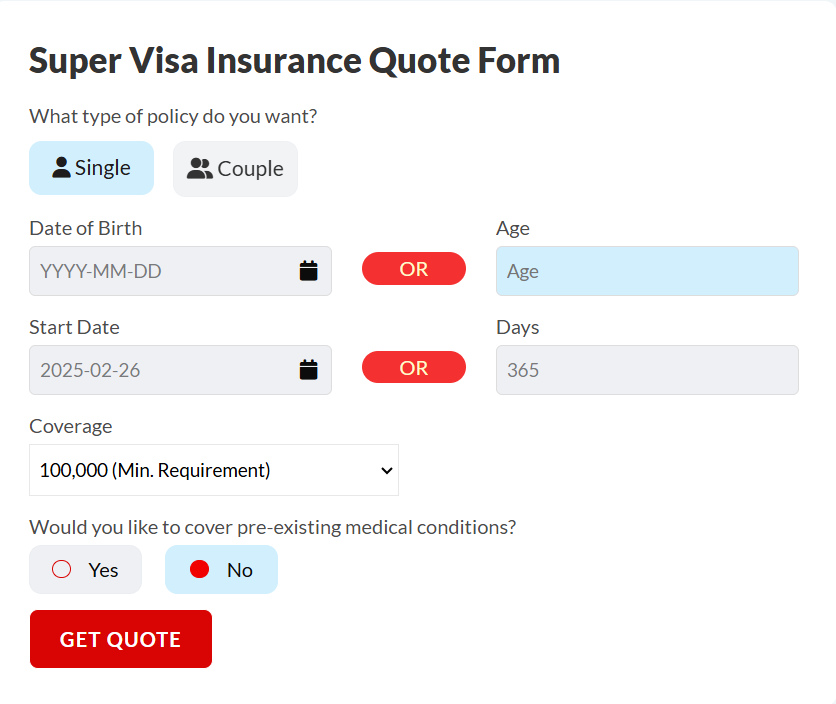

- Minimum Coverage Amount: The quote acquired for the Super Visa Insurance Policy has to be at least the minimum health care expenditure as set by the immigration rules. In most cases, clients are misled about their quotes for the Super Visa policy because it does not meet all the standards set. The quotes of the Super Visa Insurance Policy have to be compared so that the plan selected is adequate.

- Duration of Coverage: The insurance should be in effect for a minimum of one year from the date of arrival in Canada. This requirement simply means that you should choose a policy that offers long-term coverage. Families sometimes experienced delays since their policy had lapsed before the one-year mark. Proper planning and confirmation of the period help avoid such problems.

- Comprehensive Benefits:Try to find policies that give hospital care, emergency services, and repatriation. A few clients express interest in getting the cheapest quote with no regard for the comprehensiveness of the policy. When you carefully look at quotes for Super Visa Insurance, you can identify a suitable policy that will offer strong benefits. Our interactions with many clients show that those who select more comprehensive coverage face very few complications later.

- Reliable Providers: The most important is the selection of a highly reputable provider. There are many families that seek Super Visa Insurance Brokers who will offer personalized advice based on the individual needs of each client. Generally, advice leads to extremely successful applications. They know diverse insurance options to help you avoid any pitfalls and select a plan that actually complies with the requirements.

With more time invested in understanding the available insurance options, your chances of getting a Super Visa are even stronger. The inspiring stories about the success of some clients over the struggles initially posed with their insurance prove the efficacy of good decisions and consulting professionals for sound advice. It usually goes in conjunction with prudent planning and a forward-looking approach for probable setbacks.

Advice From the Experts

Our team at the best insurance brokerage in Canada works with families who are involved in the process of getting a Super Visa every day. We have seen first-hand how little mistakes or simple oversights create barriers. Here are some expert tips based on our experiences:

- Verify Everything Twice: Verify each document and detail before submitting an application. Have someone else review your work as well. This one step might catch other errors that could delay getting approved.

- Utilize Technology: Many clients rely on online options that enable them to compare Super Visa Insurance Policy Quotes side-to-side. When you wish to buy a Super Visa online, you will also get a full range of opportunities and information. Tools help you opt for smart moves that are based on the current rules.

- Questions to Ask: Do not wait to ask any questions that need clarification. Speaking with a Super Visa Insurance broker or a smart friend can quickly clarify things so you can go forward with more confidence. Open communication is very important in our office, and many clients like to ask questions early to prevent later problems.

- Stay Updated on Policy Changes: Immigration requirements and insurance policies may change. It is, therefore, essential to keep abreast of the latest information so that your application is always in line. We inform our clients regularly about the latest updates, which has helped many families avoid setbacks.

- Build a Support Network: Sometimes, the process can be somewhat isolated. Connecting with community groups or forums where other people share their experiences often provides emotional support as well as practical advice. Knowing that others have walked this road and survived is often very motivating.

These expert tips have helped many families successfully go through the process of a Super Visa. A careful and well-informed approach will enable you to cross those hurdles and be closer to bringing your loved ones to Canada.

Steps to Take When Facing Difficulties

Even with the best planning, you may encounter some obstacles along the way. You should be resilient and proactive. Here are some steps that are recommended when things get tough:

- Reassess Your Documentation:

If you get feedback saying that something is not there or that there is some other error, then you must take a step back and look at your application. Ensure that every document is accurate and all the requirements are met. Many families had to wait for extra time only because one document was missed. Re-checking these issues precisely will solve the problem quickly.

- Consult with Experienced Brokers:

If there is confusion, consulting experienced Super Visa Insurance Brokers may clear the situation. Their expertise in the application process and requirements of insurance may correct errors that may turn out to be a serious problem before they become so. Our team has often helped clients identify and rectify mistakes, which in turn have smoothed the application processes.

- Adjust Your Insurance Coverage:

If your existing policy is not up to the mark as per the criteria, then don’t wait; shop around. Compare Super Visa Insurance Policy Quotes and choose to buy Super Visa Insurance online from companies that suit the criteria the best. Many clients have claimed that once their insurance details are adjusted with the help of professionals, their applications proceed without a further hitch.

- Keep Communication Open:

If you have concerns or questions regarding your case, stay in touch with the officers handling it. Clear communication may often clarify misunderstandings that can otherwise become the cause of many delays. Clients appreciate our direction in the making of clear, direct correspondence to handle any questions likely to come about before they cause significant hindrances.

These alone show you are a person who will dutifully take every step to finish the process. Whether disappointments are discouraging or not, every step you take towards rectifying them strengthens your application and strengthens your confidence in the overall process.

Personal Reflections and Client Feedback

Our daily work subjects us to so many experiences. Many families approach us with mixed feelings of hope and frustration after experiencing minor setbacks and major setbacks in their Super Visa applications. One family commented that, after months of uncertainty, guidance on how to purchase Super Visa Insurance online and proper Super Visa Insurance Policy Quotes was the difference maker. The relief was palpable and welcomely evident when the application finally received approval, and they celebrated it with gratitude and renewed confidence in future applications.

Another client, who initially found difficulty in organizing financial documents, has reported that it is easier to review if there is a better structure. It has been such a learning curve for them to prepare well for such reviews, and they share their experience with friends and family when they face the same problems. These personal experiences encourage others to be positive and persistent, even when the process feels long and complicated.

Customers appreciate the clear, actionable advice given when we address concerns. Questions such as, “What other steps can I take to meet the insurance requirements?” or “How do I make sure my financial documents are correct?” are always reflective of an opportunity to explain and demystify the process. Building a community of well-informed Super Visa applicants helps build rapport among applicants and yields valuable insights on the way to final approval.

Taking Action With Confidence

Reviewing these insights will prepare you better for the Super Visa application process. Many people have faced such obstacles, and it is essential to handle each requirement with care and clarity. Proper review of necessary documents, proper selection of Super Visa Insurance Plans, and constant consultation with Super Visa Insurance Brokers increase the success rate.

Your journey is divided into several steps, which range from organizing documentation and making sure you have valid insurance coverage to presenting your financial support in the clearest way possible. At each stage, you need to be meticulous and learn to ask for help when needed. We see with our families that, with diligence and support in working through the process, your application can meet all the necessary standards.

Well, in most discussions, it states that the procedure may look challenging when first viewed. However, by taking full control of all the steps taken, you translate potential obstacles into opportunities for self-improvement. Every hurdle you overcome puts you in greater experience and makes you well prepared for later endeavours, including Super Visa applications or any kind of immigration application.

Final Thoughts and a Call to Action

Everyone has a different story, and this is reflected in the success rate of Super Visa applications. These personal stories, along with the expert advice offered here, represent success when people prepare well and make use of available resources. Comparing Super Visa Insurance Policy Quotes carefully and selecting different plans of Super Visa Insurance will put you on the right track. That is if you decide to buy the online version of Super Visa Insurance when the need arises and with the help of Super Visa Insurance Brokers.

The process is sometimes like trying to navigate through a maze; however, with every clear step you take, you build up your confidence, and your prospects improve. Experiences at the best insurance brokerage in Canada show that clients who invest some time in knowing the requirements and are engaged with experts to understand them in detail really enhance their likelihood of approval significantly.

It’s not the application but the caring and dedication of all little points while submitting displays it for the family. A better application by considering every documentation and every trace of evidence that comes within every policy’s details; such a procedure actually strengthens one to make better presentations.

If you have been feeling uncertain or overwhelmed by the process, take a moment to review your strategy. Check your documents, confirm that your insurance meets all guidelines, and seek advice from trusted professionals. You have a community of experts ready to assist, and many families have walked this path successfully before you.

It’s time to be bold and take the right step forward. Now is the time to apply for the proper insurance coverage. Be sure every single part of your application will sparkle with clarity and accuracy. It is tough but not impossible, and this path to a successful Super Visa application is yours. Every step taken today is closer to being able to spend precious moments with the ones you love and all years to come, filled with warm visits to Canada.

Act today to get the best insurance for your needs. An aggressive, planning-oriented, and expert approach to applying for immigration will convert an application process into a successful success story for others to tell about. You have a bright future in Canada. Taking such measures will guide you towards the smooth completion of your application.

Remember that persistence and methodology are key. When you spend the time comparing options, preparing your documents, and getting good advice from reliable Super Visa Insurance Brokers, you’re building a solid foundation to get approved. Every small step builds into a larger picture: that of a united family, with all the obstacles well-managed and overcome.

With all this work and dedication, the end product would come just the way you envisioned. Experience and advice like those given above would surely be motivation to propel you ahead, sure of where you are heading and confident. Finalize plans and get everything documented while applying for insurance as required. With that done, you have enriched your application even more while connecting to thousands of other families that have gone through and fulfilled Super Visa requirements.

Taking action today will bring you one step closer to a future where extended family gatherings in Canada are a regular joy rather than a distant hope. Take the process, learn from those who have come before you, and take every opportunity to improve your application. Your success is within reach—prepare, act, and celebrate the journey toward reuniting with your loved ones in Canada.

By addressing every requirement with care and seeking the best advice, you transform challenges into achievements. The Super Visa application process is a series of steps that, when managed well, lead to a successful outcome. We hope the insights shared resonate with your experience and empower you to move forward with renewed assurance. The way to join your family in Canada is open, and every effort you invest in today brings that reality closer. Enjoy the journey, stay committed, and watch your plans come to fruition through careful planning and expert support.

Embark on your journey with clarity and determination. Every detailed check through your documents, every question you ask about Super Visa Insurance Plans, and all your comparisons of Super Visa Insurance Policy Quotes make for a strong application. Work with experienced Super Visa Insurance Brokers who understand your needs and can guide you toward the best possible solutions. Your proactive actions today will become the building blocks of a successful application tomorrow, and your dream of visiting extended family in Canada will become a reality.

More on Super Visa Insurance And Super Visa

- How Can You Use Deductibles to Reduce the Premium of Super Visa Insurance?

- What is a Deductible in Super Visa Insurance?

- Can I Choose My Own Doctor or Hospital with Super Visa Insurance?

- Are Psychological or Psychiatric Services Covered Under Super Visa Insurance?

- How Can One Appeal a Denied Claim Under Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Change the Effective Dates of My Super Visa Insurance After Purchase?

- Can I Include My Spouse in the Same Super Visa Insurance Policy?

- Can I Get Super Visa Insurance If I Am Over 85 Years Old?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- What Are the Consequences of Not Having Valid Super Visa Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- Is There A Waiting Period For Super Visa Insurance?

- Is Super Visa Insurance Refundable?

- How to Find the Most Affordable Super Visa Insurance Plan?

- Where Can You Buy Super Visa Insurance in Canada?

- Is a Medical Test Required for Super Visa Canada?

- What Is the Processing Time for a Super Visa in Canada?

- Can Parents Work on Super Visa in Canada?

- Can We Cancel Super Visa Insurance?

- Can I Pay Monthly for Super Visa Insurance?

- When Should Super Visa Insurance Start in Canada

- 2023 Super Visa Program and Insurance Requirements Guide: Essential Updates and Insights

- Visitor Visa vs. Super Visa: Understanding the Differences

FAQs on Super Visa Application Success and Insurance

You can enhance your possibilities by making all the papers perfect. Most families are successful when they review every requirement. One client could not manage incomplete paperwork. They reviewed Super Visa Insurance Plans and all the papers. With the support of expert advisors, their application got approval.

You need a policy that is in accordance with the rules in Canada. The team often recommends clients see various Super Visa Insurance Plans. One family got confused about the plan to opt for. They compared several and consulted with some Super Visa Insurance Brokers. After that, they selected a policy that met the rules and then calmed them down.

You can compare Super Visa Insurance Policy Quotes online. Most clients examine the best quotation for the premium and coverage available. One candidate could not decipher the differences at first. After comparing quotes from several providers and consulting with some Super Visa Insurance Brokers, things became clearer, and they made an informed choice.

Yes, Super Visa Insurance is available to purchase online. The majority of the families utilize web-based alternatives when checking and getting insurance. There was a customer who purchased a Super Visa online, then afterward went for a consultation and asked for all the details; he then seemed confident in their plan.

Super Visa Insurance Brokers provide professional suggestions regarding all details. They help you select plans and compare Super Visa Insurance Policy quote options. One family felt hassled due to too many options. A broker guided the family step by step and suggested the best plan. They gave their family due support, which made them feel safe and informed.

You require financial documents, medical history, and other insurance documents. Some of our clients lose some papers, leading to delayed cases. Our team advised one of the clients on how to manage all their papers. They considered all requirements, including Super Visa Insurance plan information, which aided in completing a great application.

Your financial documents are of primary importance. The sponsor in Canada needs to prove they are capable of financially supporting the visitor. Most families fear these regulations. A particular client needed to renew their financial documents twice. After consultation, they structured easy-to-understand records and upgraded their application.

Compare the quotes and review your existing policy if needed. Some people apply and discover their current insurance is not good enough. A client had to switch plans, for example. He reviewed them all carefully with his Super Visa Insurance Brokers, who could recommend alternatives and better plans. The new one met the requirements and enabled further progress in the application process.

The time can depend on many reasons. Some applicants complete their forms in a matter of months. Others may require more time in case they require updating documents or insurance. The applicant, who used to keep track of the professionals and was keeping himself organized, did steady work, which helped him complete the procedure in a good amount of time.

You can seek the help of experts. The Super Visa Insurance Brokers and advisors work with several families at the top insurance brokerages. A client asked many questions about documents and insurance. They reached out to a trustworthy broker who explained every step. Support like that clears all doubts and improves their chances of approval.

Feel free to ask more questions as you work on your application. Many have gone through very similar situations; planning and using the right assistance have helped ease such situations many times. Every question counts; experts are poised to help compare quotes and recommend the best of the Super Visa Insurance Plans. Enjoy the ride, ask any questions, and take each step forward with care.

Sources and Further Reading

- Government of Canada – Super Visa Information

https://www.canada.ca/ - How to Apply for a Super Visa

https://www.canada.ca/ - Insurance Bureau of Canada

https://www.ibc.ca/ - Canadian Life and Health Insurance Association

https://www.clhia.ca/ - CIC News – Updates on Canadian Immigration

https://www.cicnews.com/

Key Takeaways

- Thorough Preparation:

Complete documentation is essential. Ensure you have all the necessary papers, from financial proof to medical records, to boost your application success. - Reliable Insurance Coverage:

Securing valid insurance is a must. Compare Super Visa Insurance Plans and review Super Visa Insurance Policy Quotes carefully to meet Canadian requirements. - Online Options with Expert Support:

Buying Super Visa Insurance online is convenient. However, many clients find that consulting with Super Visa Insurance Brokers clarifies details and ensures the best coverage. - Clear Financial Evidence:

Demonstrate your host’s financial stability with well-organized documents. Clear financial support records strengthen your application. - Practical Tips and Real Experiences:

The blog shares advice and stories from families who faced challenges. Their experiences highlight the benefits of careful planning and professional guidance throughout the Super Visa process.

Your Feedback Is Very Important To Us

We value your input. Please share your experiences and challenges regarding the Super Visa success rate in Canada. Your responses will help us improve the support we provide. All fields are required.

Thank you for taking the time to complete this questionnaire. Your feedback is important to us and will help improve the experience for future applicants.

IN THIS ARTICLE

- What Is The Success Rate Of A Super Visa In Canada?

- Understanding the Super Visa Process

- Key factors affecting the success rate of a Super Visa in Canada

- Essential Factors That Influence Super Visa Approval

- Experiences and Stories from the Field

- Strategies to Enhance Your Application's Success Rate

- Understanding Insurance Options and Requirements

- Advice From the Experts

- Steps to Take When Facing Difficulties

- Personal Reflections and Client Feedback

- Taking Action With Confidence