- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is the Shortest-Term Life Insurance Policy?

- Why Short Term Life Insurance is Important for Some Canadians

- What is the Shortest Term Life Insurance Policy?

- How Affordable Are Short Term Life Insurance Plans?

- The Pros and Cons of Short Term Life Insurance

- Who Benefits the Most from a Short Term Life Insurance Policy?

- Stories from Canadian LIC: How Short Term Life Insurance Made a Difference

- How to Get the Best Short Term Life Insurance Policy

- Final Thoughts: Choosing the Right Coverage

- More on Term Life Insurance

- FAQs: What is the Shortest Term Life Insurance Policy?

- Sources and Further Reading

- Key Takeaways

- Your Feedback Is Very Important To Us

What Is the Shortest-Term Life Insurance Policy?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 21th, 2024

SUMMARY

Many will ask themselves if, on a particular life insurance plan, they really need Long Term coverage. The thought of locking in for 20 or 50 years can be daunting and certainly is if you’re just looking for protection over some specific short period of time. At Canadian LIC, we have seen clients walk into our office and raise concerns about covering Short Term obligations, say a mortgage or debt, but still in the dark as to which of the life insurances fits the bill. One common question from our clients is, “What is the Shortest Term Life Insurance Policy and is it worth it? “In this blog, we’ll explore how Short Term Life Insurance can be a practical and cost-effective solution for many and why the best Short Term Life Insurance Policy might be exactly what you’re looking for

Why Short Term Life Insurance is Important for Some Canadians

Life insurance is by no means a product that fits every need of every person. Some people simply require coverage for just a couple of years because they have financial obligations- such as a loan or mortgage-that have an early termination date. We meet clients here at Canadian LIC who want to have coverage in place to protect their family for just five years, usually if they are nearing retirement or will pay off a debt. In such cases, Short Term Term Life Insurance Plans will most likely become the most effective solution.

Let’s take one of our recent clients as an example. The couple had approached us for this insurance since five years had elapsed into the redemption of their mortgage. They wanted Short Term insurance for immediate needs; they did not necessarily need lifelong insurance but worried about what would happen if one died before the outstanding mortgage was settled. After we discussed the option, we were able to get them an express Short Term Life Insurance Policy covering the remainder of their years to complete the mortgage period, which gave them peace of mind without a commitment to a Long Term plan. Certainly, theirs is not the only story; there are many Canadians like them who can benefit from such a solution.

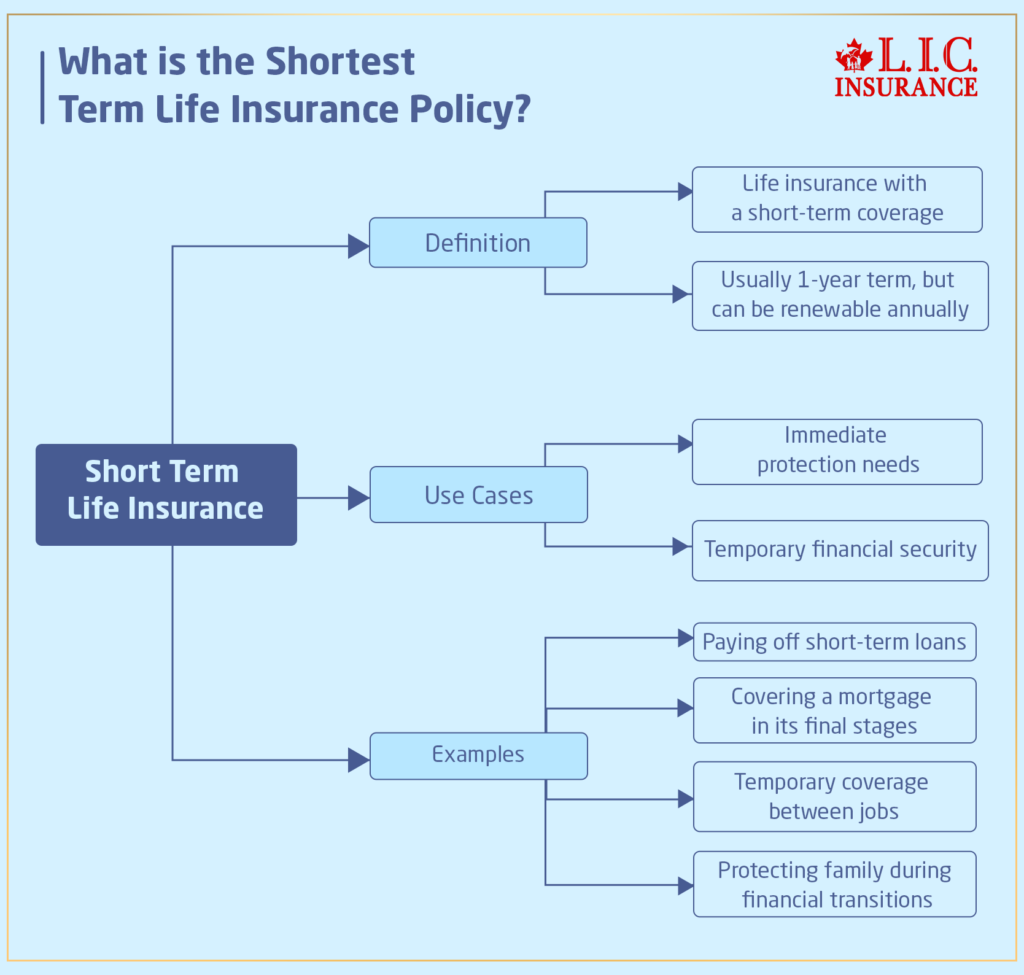

What is the Shortest Term Life Insurance Policy?

In Term Life Insurance, the “term” is how long the policy will be in effect. Terms are usually anywhere between 10 to 50 years. However, if you want to have the best Short Term Life Insurance coverage, you can have a term that lasts as short as just one year. These are usually designed for people who need to acquire immediate Short Term protection.

For instance, at Canadian LIC, we have dealt with clients who are in the last rung of life or are getting into a financially secure situation, and they require only very Short Term coverage. Sometimes, the client opts for a renewable yearly policy the point here is that a one-year term policy can be renewed annually to still allow the client flexibility yet have the protection he or she requires.

Short Term Life Insurance covers specific needs that range from a short term in time to a one-year term. Examples include:

- Paying off Short Term loans

- Covering a mortgage in its final stages

- Temporary coverage between jobs or while employer-provided life insurance isn’t active

- Protecting a family during a short financial transition period

How Affordable Are Short Term Life Insurance Plans?

Of course, the cost is always a primary concern in life insurance. Most of our customers are pleasantly surprised to discover how affordable Short Term policies can be. The premium tends to be much more manageable since the coverage period is so short, which is attractive to customers on a budget or those who do not need Long Term protection.

A customer who approached us through the Canadian LIC for life insurance coverage had been with us for years and had various grievances about the exorbitant premium prices. After taking all his requirements into consideration, we presented him with one year of Term Life Insurance. This made sure that his family was financially protected without stretching his pockets too far. He could perfectly see how economic Short Term coverage would be with the Term Life Insurance Quotes that we provided to him.

The Pros and Cons of Short Term Life Insurance

Like any kind of insurance, Short Term Life Insurance has its advantages and disadvantages. As a principle, at Canadian LIC, we advise our clients to consider it carefully before making any decision. Here are some key points that are often discussed:

Benefits:

- Affordability: Since the policy lasts for a shorter time, the premiums are typically lower.

- Flexibility: You can choose a term that matches your specific needs, such as one, five, or ten years.

- Renewable Option: Some Short Term policies offer the ability to renew year after year if your situation changes.

- Simple: Short Term policies often come with fewer medical underwriting requirements, making the process faster and easier.

Drawbacks:

- Limited Coverage: Short Term policies may not offer the same level of coverage that Long Term plans provide.

- Renewal Costs: While the initial premiums may be low, renewable Term Life Insurance premiums can increase significantly with each renewal.

- Lack of Long Term Security: If you are looking for lifelong coverage or to leave a legacy, Short Term Life Insurance might not be the best fit.

At Canadian LIC, we have also seen the worst of these issues. For instance, a client came to us seeking the cheapest possible policy for just three years, but they didn’t consider how renewing the policy after that period would become increasingly expensive. In cases like this, we always encourage clients to think ahead and evaluate both the Short Term and Long Term benefits of their coverage.

Who Benefits the Most from a Short Term Life Insurance Policy?

As you decide which kind of life insurance might be best for you, remember that financial goals and coverage length are huge factors. Short Term Life Insurance is a good fit for those who:

- Have a temporary financial obligation, such as a loan or debt

- Need life insurance but plan on retiring soon

- Are you looking for coverage while transitioning between jobs or major life events

- Want affordable, temporary protection for their family

We have a good number of customers in these groups at Canadian LIC, and we have been able to give them the appropriate Short Term Life Insurance Policy that is most beneficial to them.

Stories from Canadian LIC: How Short Term Life Insurance Made a Difference

At Canadian LIC, we know firsthand how Short Term Life Insurance Plans can be a game-changer for clients. Case in point: one couple we’ve worked with needed life insurance to protect young children for only a few years while working on accumulating savings. A Short Term policy helped provide affordable protection on a budget where they did not require a Long Term policy and, correspondingly, could not afford that anyway. All the protection they were looking for came through this flexible option, and the affordability of premiums was all that made them happy.

Another client near retirement only cared about the last few payments left on his mortgage. The problem was that if anything were to happen to him in the next three years, the trouble of having the mortgage fall would be left for his wife to deal with alone. Using our assisting agents with great experience, we brought him a Short Term policy that gave him enough coverage for those very critical three years without costing him an arm and a leg.

These are some of the many stories we hear daily at Canadian LIC, where Short Term Life Insurance has proven to be a practically affordable solution for clients taking on temporary financial responsibilities.

How to Get the Best Short Term Life Insurance Policy

We at Canadian LIC strive to ensure that every client gets the best insurance plan for their money. In light of the fact that life insurance shopping entails a big task and can be very overwhelming, even when you find the best Short Term Term Life Insurance, we have made sure that help is ready for all clients who search for such kinds of services.

Getting quotes for Term Life Insurance online is easier than ever. And it’s the best way to compare prices and options. Still, many people will feel quite uncertain about what kind of policy they should take. That’s what we are here for. We’ll provide you with personalized service by ensuring that your Short Term policy perfectly fits your needs and budget.

Final Thoughts: Choosing the Right Coverage

If you are not aware of whether it should be a Short Term or a Long Term policy, do not hesitate to approach an expert who can guide you to a better decision. We at Canadian LIC have been guiding many Canadians to find the right Term Life Insurance Plansfor specific purposes, whether it is just one year or several decades.

There is no need to make the process of choosing the right Term Life Insurance difficult. With our experts, you can enjoy full assurance that you will get the coverage you need at a price you can afford. Whether you seek Short Term coverage to pay off a mortgage or just need peace of mind during the financial transition, the Canadian LIC stands ready to help you find the right solution.

If you’re ready to explore your options and get Term Life Insurance Quotes, contact us today. We’ll work with you to find the right coverage that fits your needs and budget.

More on Term Life Insurance

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

Get The Best Insurance Quote From Canadian L.I.C

Call +1 844-542-4678 to speak to our advisors.

Get Quote Now

FAQs: What is the Shortest Term Life Insurance Policy?

The Shortest Term Life Insurance Policy you can get is typically a one-year term. This policy is renewable yearly, which allows flexibility for people who need coverage for a short time. At Canadian LIC, we’ve helped clients choose these types of policies when they only need protection for a limited period, such as during the final years of a mortgage.

A Short Term Life Insurance Policy is best for people who only need coverage for a specific period. For example, if you have a Short Term loan or are nearing retirement, you might not need Long Term coverage. We’ve worked with clients who wanted protection just until their financial obligations, like a loan or mortgage, were completed. Short Term policies provided a cost-effective solution.

Yes, Short Term Life Insurance Plans are generally more affordable than Long Term policies. Because the coverage period is shorter, the premiums tend to be lower. Many of our clients at Canadian LIC have found that Short Term Life Insurance allows them to get the protection they need without overextending their budget.

Yes, Short Term Life Insurance Policies, especially one-year terms, are often renewable. You can renew the policy annually, but it’s important to remember that the premiums may increase as you age. We often see clients at Canadian LIC who start with a Short Term policy and renew it a few times, especially if their circumstances change and they need coverage for a bit longer.

In order to get the best Short Term Life Insurance Policy, it’s essential to compare Term Life Insurance Quotes from different insurance providers. At Canadian LIC, we help clients find the most suitable options by assessing their specific needs and budget. Many of our clients benefit from our personalized guidance, ensuring they choose the right coverage without paying more than they need.

Short Term policies provide temporary life insurance coverage, usually for one to five years, while Long Term Policies last for decades. We often explain to our clients that Short Term policies are perfect for covering immediate financial needs, like a mortgage or Short Term debt, while Long Term Policies are better for lifelong protection.

Yes, you can easily get Term Life Insurance Quotes online for Short Term policies. At Canadian LIC, we offer an easy way to compare quotes and find the best Short Term Life Insurance Policy that fits your needs. Our clients often appreciate how straightforward it is to get accurate quotes without the hassle.

Yes, Short Term Life Insurance can be a great option for people approaching retirement. Many of our clients who are just a few years from retirement use Short Term Policies to cover any remaining financial responsibilities, like a mortgage or debt. This helps them protect their loved ones without the need for a Long Term commitment.

If you outlive your Short Term life policy, the coverage simply ends. However, many Short Term policies are renewable, so you can continue your coverage if needed. At Canadian LIC, we always recommend discussing your future needs with our experts so that you can decide whether to renew your policy or explore other options.

Yes, it’s possible to switch from a Short Term policy to a longer-term one. At Canadian LIC, we’ve helped clients transition from Short Term to Long Term policies as their needs changed over time. It’s always a good idea to review your insurance options regularly to make sure you’re getting the right coverage.

If you need temporary coverage to protect specific financial obligations, a Short Term Life Insurance Policy could be the best option. At Canadian LIC, we often see clients who only need coverage for a few years, such as when they’re finishing off a mortgage or loan. Short Term plans provide flexibility without committing to Long Term premiums.

The key difference is the duration of the coverage. Short Term Life Insurance Policies cover a specific period, usually between one to five years, while Long Term Policies last 10, 20, or more years. Many clients come to us at Canadian LIC needing Short Term protection for temporary financial needs, like covering Short Term debt, whereas Long Term Policies are suited for lifelong protection.

Yes, many Short Term Life Insurance Policies allow you to add riders for additional coverage, such as critical illness or accidental death benefits. We’ve helped clients at Canadian LIC customize their Short Term plans with these riders to ensure they get the exact protection they need.

It depends on the insurer and the amount of coverage you need. Some Short Term Life Insurance Plans require a medical exam, while others may offer no medical options. At Canadian LIC, we help clients compare Term Life Insurance Quotes that meet their preferences—whether or not they want to go through a medical exam.

Short Term Life Insurance Policies often have a faster approval process, especially if no medical exam is required. We’ve had clients at Canadian LIC who were able to get coverage in just a few days, which is ideal if you need insurance quickly for an immediate financial concern.

Some Short Term Life Insurance Policies offer a conversion option that allows you to switch to a longer-term plan without having to go through the underwriting process again. We often recommend this to clients at Canadian LIC if they expect their needs to change in the future and want the flexibility to extend their coverage.

The best way to compare Short Term Life Insurance Policies is to get multiple-Term Life Insurance Quotes. At Canadian LIC, we work closely with clients to find and compare different options, ensuring they get the best value. We look at factors like premiums, renewal terms, and additional benefits to find the best match.

Yes, the premiums may increase when you renew a Short Term Life Insurance Policy, especially as you get older. We often help clients at Canadian LIC weigh the costs of renewal versus locking into a longer-term plan to make sure they are making the best financial decision for their situation.

The coverage amount varies depending on the policy and insurance company, but most Short Term Life Insurance Plans offer coverage that can range from a few thousand dollars to over a million. At Canadian LIC, we’ve helped clients secure Short Term policies with substantial coverage to meet their specific needs.

Yes, Short Term Life Insurance can be a great choice for young professionals who are starting their careers and only need temporary coverage. For example, we’ve worked with young clients at Canadian LIC who wanted coverage while they paid off student loans or secured their first mortgage. Short Term plans allowed them to get affordable protection without a Long Term commitment.

Some of the most frequently asked questions we get from our clients at Canadian LIC as they pursue their Term Life Insurance, most of which are about how long coverage lasts- from one year to another. Let’s understand the benefits of Short Term Life Insurance and how it can give you the right protection for your situation.

Some of the most frequently asked questions we get from our clients at Canadian LIC as they pursue their Term Life Insurance, most of which are about how long coverage lasts- from one year to another. Let’s understand the benefits of Short Term Life Insurance and how it can give you the right protection for your situation.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – Offers comprehensive information about life insurance products and the industry in Canada. www.clhia.ca

- Financial Consumer Agency of Canada (FCAC) – Provides guidance on choosing the right life insurance policy and understanding Term Life Insurance options. www.canada.ca/fcac

- Insurance Bureau of Canada (IBC) – Explains different types of life insurance, including Short Term and Term Life Insurance Plans. www.ibc.ca

- MoneySense – A trusted source for financial advice, including detailed comparisons of life insurance plans in Canada. www.moneysense.ca

These resources can help you dive deeper into understanding the best Short Term Life Insurance Policy options available in Canada.

Key Takeaways

- Shortest Term Life Insurance – The Shortest Term Life Insurance Policy is typically one year, offering flexible, renewable coverage for Short Term financial needs.

- Best for Temporary Needs – Short Term Life Insurance is ideal for covering Short Term obligations like a loan, mortgage, or temporary coverage during job transitions.

- Affordable Premiums – Short Term policies often have lower premiums compared to Long Term options, making them a cost-effective solution for many clients.

- Renewable Policies – Many Short Term policies are renewable yearly, but premiums may increase with age, so it’s important to evaluate future needs.

- Personalized Coverage – Short Term Life Insurance Plans can be tailored with riders and coverage amounts, ensuring your specific needs are met without overcommitting to Long Term protection.

- Quick Approval – Short Term Life Insurance Policies often have a faster approval process, making them convenient for those needing immediate coverage.

Your Feedback Is Very Important To Us

We would love to hear your thoughts on the challenges Canadians face when it comes to choosing a Short Term Life Insurance Policy. Your feedback helps us understand your needs better and improve our services at Canadian LIC. Please take a few moments to answer the following questions:

Thank you for sharing your thoughts! Your feedback helps us improve our services and provide better insurance solutions for Canadians.

IN THIS ARTICLE

- What Is the Shortest-Term Life Insurance Policy?

- Why Short Term Life Insurance is Important for Some Canadians

- What is the Shortest Term Life Insurance Policy?

- How Affordable Are Short Term Life Insurance Plans?

- The Pros and Cons of Short Term Life Insurance

- Who Benefits the Most from a Short Term Life Insurance Policy?

- Stories from Canadian LIC: How Short Term Life Insurance Made a Difference

- How to Get the Best Short Term Life Insurance Policy

- Final Thoughts: Choosing the Right Coverage

- More on Term Life Insurance

- FAQs: What is the Shortest Term Life Insurance Policy?

- Sources and Further Reading

- Key Takeaways

- Your Feedback Is Very Important To Us