The financial planning of your kid’s education in Canada can sometimes be intimidating. Most of the time, Registered Education Savings Plans (RESPs) make parents and guardians confused by the infinite options and limits involved. John and Mary, a couple from Toronto, were literally on the cusp of taking the next exciting leap into sitting down and planning how to start saving for their child’s college. They’ve heard a bit about the RESP program but were left with a certain vacuum in mind as to how much contribution they can make towards it or what the impact would be once those limits are reached. But they aren’t all that different; many Canadian families are doing everything they can to make the most of what they have in their education savings plans. You would want to know what those limits are, especially when it comes to the amount of RESP contribution limits. Then, in that case, you would also want to avoid finding yourself caught in the same confusion and missteps as John and Mary’s family, right? We hope that the real-life struggles and solutions shared in this blog will clear you up about the limits of RESPs in Canada and that you will know how to protect your child’s educational future confidently.

What is the RESP Limit in Canada?

So, What Is the RESP Limit in Canada? Ultimately, The Registered Education Savings Plan (RESP) is a government-supported scheme in Canada. It allows parents, guardians, and friends to save toward their child’s post-secondary education. The most interesting thing about an RESP is its ability to let the investment grow tax-free until the beneficiary decides to withdraw for educational purposes. Furthermore, the government adds to the plan by giving grants that boost savings quite significantly. Nonetheless, the most important factor is that understanding the contributions’ limits will make it easier for you to figure out the maximum you can receive in terms of a grant and how it is going to affect your financial planning.

Find Out: Important things about RESP in Canada

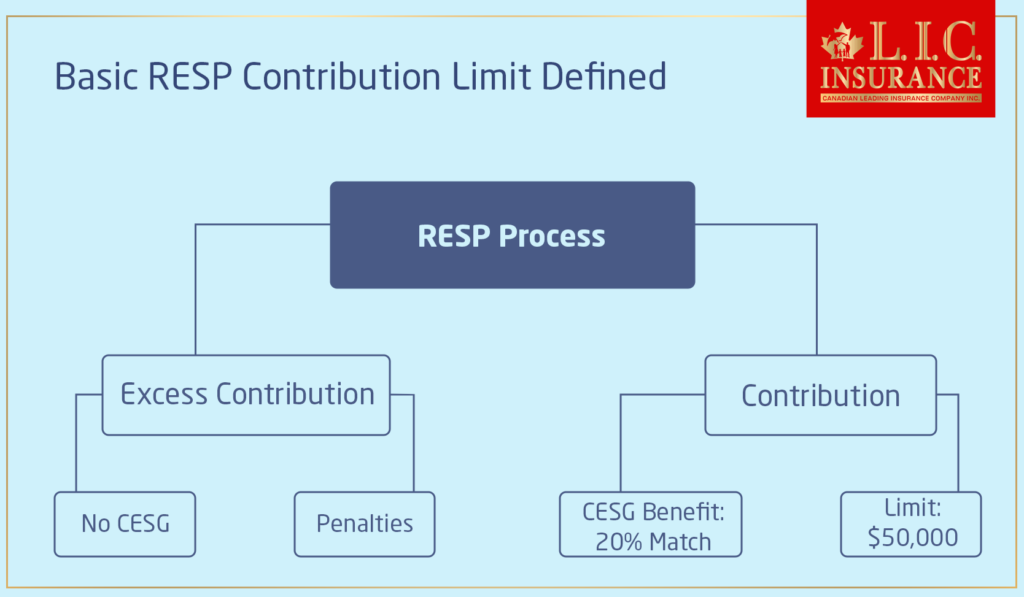

Basic RESP Contribution Limit Defined

The lifetime contribution limit for an RESP in Canada is $50,000 per beneficiary. But that’s not to say you should just stop there. But, when you’ve reached contributions of $50,000, any contributions over that, though, won’t qualify for government grants and could even attract penalties, for example, in the case of Emily, a single mother in Vancouver, who initiated an RESP upon the birth of her daughter Sophie, where she was to contribute $2,500 each year to maximize full use of the Canada Education Savings Grant (CESG), which matches 20% of annual contributions to a limit of $500 per year. What Emily did not know at the time was that she had gone above the cap of $50,000 due to a one-time lump-sum contribution from her parents, who meant well. Now, she has to try to withdraw the excess to save the penalties—a pitfall that so many first-time contributors to RESPs fall into.

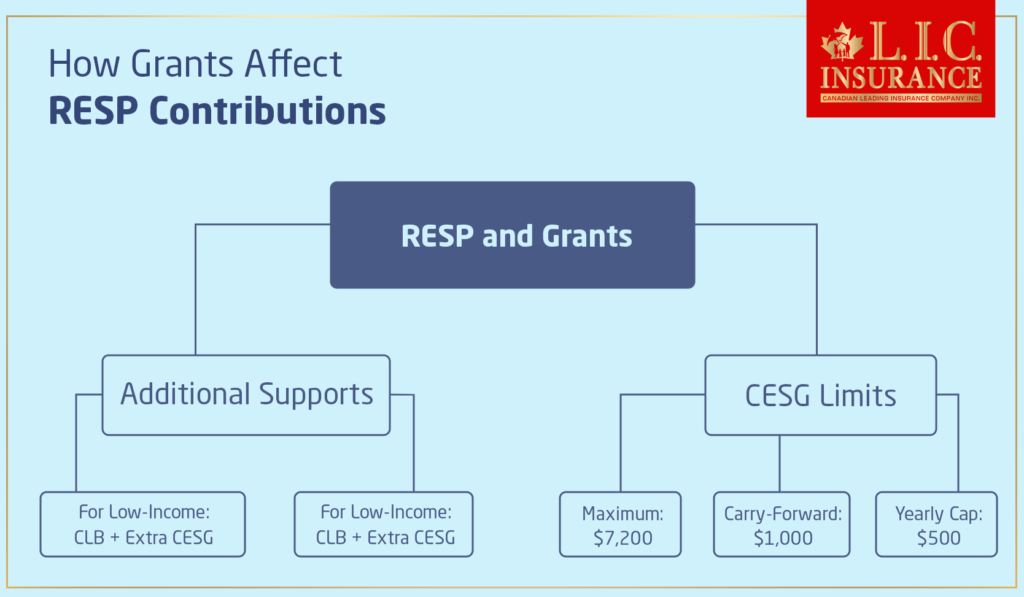

How Grants Affect RESP Contributions

An individual beneficiary under an RESP can also be entitled to receive a maximum of $7,200 in CESGs over the life of the plan, capped at $500 a year, with $1,000 of carry-forward capacity. Planning contributions to maximize these grants requires a strategic approach. Imagine if Sarah and Mark from Calgary front-loaded their contributions in the early years of their son’s life. While this seemed a very proactive strategy, it did limit their receipts for CESG because they quickly hit the grant cap, leaving potential free money on the table. For low-income families, more help is given through the Canada Learning Bond (CLB) and additional grants for the CESG, but prudent planning has to be done not to hit the limit too early.

Strategies to Maximize Your RESP Contributions

Contributing to a Registered Education Savings Plan (RESP) is a pivotal decision for securing your child’s educational future in Canada. However, knowing how much and when to contribute can maximize the financial benefits your child receives. Here the following points will help you to optimize your RESP contributions effectively:

Start Early and Contribute Regularly

Why It Works: The power of compound interest is significant in long-term savings. Starting early gives your investment more time to grow.

Real-life Example: Meet Lisa, a mother from Montreal, who opened an RESP for her daughter as soon as she received her Social Insurance Number. By contributing small, manageable amounts monthly, Lisa not only spread the financial load but also maximized the interest accumulated over the years. She kept at it and eventually saved up a good amount of money for her daughter’s higher education.

Aim for the Annual CESG Cap

Why It Works: Each year, you can receive a 20% match on your contributions up to $2,500 per beneficiary, which translates to $500 from the Canada Education Savings Grant (CESG).

Real-life Example: Consider the case of Aaron from Halifax. By targeting the $2,500 annual contribution mark, Aaron ensured he maximized the $500 CESG each year without fail. This not only optimized the government contributions but also kept his savings on a consistent growth track.

Utilize Catch-up Contributions

Why It Works: If you miss contributing in a year, you can make up for it the following year. You can contribute up to $5,000 per year if you have unused grant room from previous years.

Real-life Example: Samiara from Toronto realized she had not maximized her RESP contributions for the past two years. By contributing $5,000 in the current year, she was able to claim the missed CESG, catching up on her potential government grants.

Spread Contributions to Avoid Hitting the Lifetime Limit Too Early

Why It Works: Spreading out your contributions helps you manage yearly CESG receipts and ensures that you don’t hit the $50,000 limit prematurely, which could lead to missing out on potential grants.

Real-life Example: James from Edmonton, as mentioned earlier, spaced his contributions to align with the CESG limits, ensuring that each dollar contributed was working as hard as possible before reaching the RESP’s contribution ceiling.

Consider Lower Income Benefits

Why It Works: If your family’s income qualifies, you could access additional government incentives like the Canada Learning Bond (CLB) and additional CESG amounts.

Real-life Example: Rita from Winnipeg, a single mother earning a modest income, applied for the CLB and received an initial $500 deposit into her son’s RESP without any contribution required, followed by additional amounts that helped grow the savings significantly.

Review and Adjust Contributions as Your Financial Situation Changes

Why It Works: Life’s unpredictable nature means your financial circumstances might change. Regularly reviewing and adjusting your contributions can keep your RESP aligned with your current financial capabilities.

Real-life Example: Tom and Karen from Calgary faced financial difficulties when Tom lost his job. They reduced their RESP contributions during this period to keep their family budget in check. Once Tom secured a new job, they increased their contributions to catch up on their savings plan insurance for education.

Summing It Up

As a common thread in the real-life examples we’ve looked at, this entails a mix of knowledge and strategic planning and sometimes lessons from common mistakes when going through the limits of RESPs. As a leading insurance brokerage, Canadian LIC provides professional advice and planning services that can assist you in setting up an RESP according to your financial situation and educational goals. That’s where all of the benefits of setting up an RESP with the help of an advisor who knows come in: they can make all of that look like a piece of cake.

“One thing is understanding the RESP limits, and another thing is taking action to ensure a secured educational future for your child.”. With Canadian LIC, you get a partner who will not only walk you through the nitty-gritty of the savings plan insurance for education but also partner to ensure that you are making the best from your investments. No day should pass in doubt. Reach out to Canadian LIC today and set off on the right path toward giving your children a bright educational future. After all, one smart step at a time can really turn the dream into reality.

This blog is meant to be your ultimate resource for understanding and maximizing your contributions within RESPs in Canada. You could be either starting a plan or seeking to optimize an existing one; always keep this in mind—whatever the timeline may be, the earlier and smarter you contribute, the better educational foundations you’re laying for your beneficiary.

Find Out: Can you use RESP outside Canada?

Find Out: How to check your RESP in Canada?

Find Out: Find out everything about RESP in Canada

Find Out: Why go for an RESP

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Maximizing Contributions in a Registered Education Savings Plan (RESP)

If you are interested in getting a quote for a Registered Education Savings Plan, you may talk to an advisor or simply drop by any of your local banks that offer these types of accounts. Describe your financial standings and what kind of education you would like for your child. They will quote you according to the amount you wish to contribute and the matching grants from the government, too. For instance, David from Saskatoon contacted his bank to get a Registered Education Savings Plan Quote and found out he could maximize his contributions to benefit from annual government grants, effectively planning his savings for his daughter’s college education.

The RESP maximum lifetime contribution limit per beneficiary is $50,000. Always remember, even if there is no annual contribution limit, a government contribution should be limited to a 20% match of $2,500 in a year under the Canada Education Savings Grant (CESG). For example, Maria from Montreal set a goal to contribute $2,500 each year to ensure she fully capitalized on the CESG for her son’s RESP, thereby optimizing her total investment.

Play CESG catch-up. Contribute up to $5,000 per year per beneficiary to make up for unclaimed government grants. That means you can receive up to $1,000 in CESG per year until you catch up. Look at Paul in Toronto. He began contributing to his RESP late. By contributing $5,000 for a few years, he successfully claimed the CESG he missed in earlier years, enhancing his overall savings.

If you exceed the RESP contribution limit of $50,000, you will have to withdraw the extra amount contributed, keeping in mind that the excess will be penalized. Take, for instance, the case of Anita from Vancouver, who has realized she over-contributed $2,000. She withdrew the excess quickly to minimize penalties. It is one of the important things in being effective in this procedure of managing an RESP.

In this case, for a low-income family, the difference in the income level could mean a lot as it relates to the grants that would find their way into the RESP. Such families may, however, be entitled to other government grants like the Canada Learning Bond (CLB) and additional CESG. For example, Jeremy from Halifax took advantage of these extra grants that greatly increased the available funds in his children’s RESP despite a modest income, truly a show that researching all available options for savings plan assurance for education is important.

Many options are available when a beneficiary does not pursue post-secondary education. You may transfer the RESP to another eligible family member without penalty or withdraw your contributions without tax penalties if the beneficiary is not pursuing post-secondary education. However, grants and their growth will need to be returned to the government unless transferred to an RRSP. For example, Lucy from Edmonton faced this situation when her son decided against university. She wisely transferred the funds to her younger daughter’s RESP, keeping the family’s educational finances intact.

To reduce the financial burden, consider making smaller, more frequent contributions throughout the year rather than one large sum. This approach eases your budget and allows flexibility based on current financial conditions. Tom from Calgary adopted this method, making monthly contributions aligned with his cash flow and maximizing the annual CESG for his two children.

It’s best to consult a qualified financial advisor or an RESP provider for a personalized quote. Provide details such as your financial goals, your child’s age, and your yearly contribution capacity. Nina from Prince Edward Island did this and discovered RESP options that perfectly suited her financial situation, enabling her to maximize her savings.

Contributions to an RESP are not tax-deductible; you cannot use them to reduce your taxable income. However, the investment grows tax-free until funds are withdrawn for educational purposes. At that point, the funds are taxed in the hands of the student, who typically has a lower income, resulting in a lower tax rate. Harpreet from Surrey found this beneficial as his daughter’s tax bill was minimal when she began using the funds for the university.

Yes, suppose your child receives a scholarship, and you have excess funds in the RESP. In that case, depending on the available contribution room, you can transfer the surplus to another registered savings plan, like an RRSP for yourself or your spouse. This flexibility allowed Liam from Toronto to transfer excess funds into his RRSP after his son received a full scholarship, continuing to secure his financial future without penalties.

The $50,000 limit is the lifetime contribution limit per beneficiary, not per subscriber. If you have multiple children, you can contribute up to $50,000 to each of their RESP accounts. Sandra from Ottawa employed this strategy by contributing equally to the plans for all three of her children, ensuring each has equal educational opportunities.

Family members can contribute to an RESP, but it’s important to track these contributions carefully to ensure they do not exceed the lifetime limit for the beneficiary. Alex from Calgary coordinated contributions from grandparents to avoid accidental over-contributions, thus avoiding penalties and maximizing the CESG received.

To promote the continuous growth of your child’s RESP, diversify investments based on the child’s age and the time horizon needed for the funds. Early in the child’s life, you might opt for more aggressive investments, switching to more conservative options as college or university nears. This approach helped Emma from Halifax adjust her investment strategy over time, protecting her son’s education funds from significant market downturns.

Withdrawing money from an RESP for non-educational purposes can lead to penalties. Contributions can be withdrawn without penalties, but the grants and the growth of those grants must be returned to the government, and there might be tax implications for the growth. Derek from Edmonton learned this the hard way when he had to withdraw funds early and faced significant penalties, underscoring the importance of using RESP funds solely for educational purposes.

These FAQs provide you with the insights needed to manage your RESP effectively. Whether you’re starting an RESP or aiming to optimize existing contributions, these principles will guide you in building a solid educational fund. Remember, every contribution is more than just a saving; it’s an investment in your child’s future. Start by getting a Registered Education Savings Plan quote today, and ensure your education savings plan is well-optimized for the years ahead.

Usually, seeking a quote for Visitor Insurance comes with certain questions about some of the basic pieces of information regarding one’s parents—ages, the period they intend to stay in Canada, and any specific health conditions. This is much the same way you book a flight, requiring you to proceed with the passengers’ details. For example, when James was inquiring about insurance for his mom, the site only wanted the age of his mom and the travel dates; he didn’t need to give full details about his mom and even got a quote for the trip.

Sources and Further Reading

To deepen your understanding of the RESP limits and effective strategies for managing education savings in Canada, consider exploring the following resources:

Canada Revenue Agency (CRA) – The CRA website provides official information on RESP contribution limits, the Canada Education Savings Grant (CESG), and other pertinent details about educational savings plans. Visit CRA – RESP for comprehensive guidelines and updates.

Employment and Social Development Canada (ESDC) – For details on the Canada Learning Bond (CLB) and additional CESG, ESDC offers extensive resources that can help lower-income families maximize their educational savings. Access their resources at ESDC – Education Funding.

Financial Consumer Agency of Canada (FCAC) – The FCAC provides educational materials on choosing the right type of RESP and understanding the associated financial implications. Their guides are particularly helpful for new subscribers. Explore at FCAC – RESPs.

Investopedia – For a broader understanding of how RESPs compare to other savings options and to gain insight into investment strategies for RESPs, Investopedia offers articles written by financial experts. Check out their coverage on RESPs at Investopedia -How it works?.

Canadian Scholarship Trust Foundation – This foundation provides not only RESP plans but also educational resources to help families plan and save for post-secondary education. Their insights into RESP contributions and educational planning can be invaluable. Visit CST – RESP Resources.

Books:

“Family Finance: The Essential Guide for Parents” by Ann Douglas. This book covers various aspects of family financial planning, including saving for education through RESPs.

“The RESP Book: The Simple Guide to Registered Education Savings Plans for Canadians” by Mike Holman. This is a comprehensive guide to understanding and managing RESPs effectively.

By utilizing these resources, you can ensure that you are well-informed and able to make the best financial decisions regarding your child’s educational future. Each of these sources provides a wealth of information that can help clarify the complexities associated with RESP limits and contributions.

Key Takeaways

- The lifetime contribution limit for an RESP in Canada is $50,000 per beneficiary.

- Aim to contribute at least $2,500 per year per child to maximize the annual Canada Education Savings Grant (CESG) of up to $500.

- You can make catch-up contributions of up to $5,000 per year to receive missed CESG.

- Lower-income families may qualify for additional benefits like the Canada Learning Bond (CLB) and extra CESG amounts.

- Spread out contributions to avoid hitting the lifetime limit too early and to keep receiving annual government matches.

- Regularly adjust your contributions based on financial changes to maintain sustainable funding for the RESP.

- If the original beneficiary does not need the funds, the RESP can be transferred to another family member or the subscriber's RRSP under certain conditions.

- Obtain a Registered Education Savings Plan quote and consult with a financial advisor to tailor the RESP to your financial needs and goals.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]