- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is the Maximum Limit in Term Insurance?

- Understanding the Concept of Maximum Limit in Term Insurance

- Factors That Determine the Maximum Limit

- Typical Maximum Limits for Term Life Insurance Plans in Canada

- How to Choose the Right Coverage Amount?

- Overcoming Struggles with Maximum Limits

- The Role of Term Life Insurance Brokers in Securing Maximum Coverage

- Steps to Apply for Higher Coverage

- Why Choose Canadian LIC for Your Term Life Insurance Needs?

What Is The Maximum Limit In Term Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 3nd, 2024

SUMMARY

When discussing Term Life Insurance, one question that is common among the clients is whether they are able to have maximum coverage. People wish to know that their families will not lack money if they were to die; however, it becomes quite confusing trying to determine what amount is sufficient and what amount is considered the maximum. Through the years, we have worked with clients in Canadian LIC—the best insurance brokerage—and people face this struggle over and over. Let’s explore this topic and dig up everything you need to know about the maximum limit in Term Insurance.

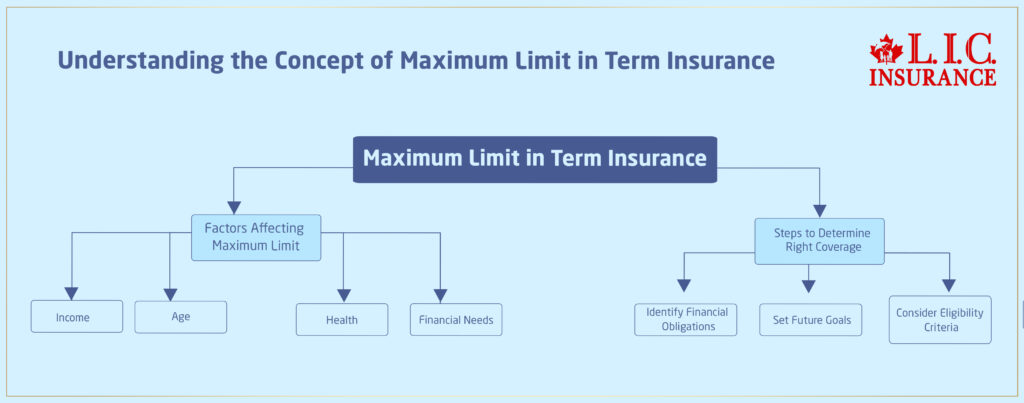

Understanding the Concept of Maximum Limit in Term Insurance

The maximum limit in Term Life Insurance refers to the highest amount of coverage you can obtain under a Term Life Insurance Policy. This amount varies with income, age, health, and financial needs.

For example, one of our clients, a young professional in their 30s, was not quite sure how much coverage they needed. They knew they wanted to protect their family but were overwhelmed by terms like “coverage caps” and “eligibility criteria.” This is quite common, but it is very important to determine your financial obligations and future goals to make the right choice.

Factors That Determine the Maximum Limit

Typically, the annual income used is the base for calculations to determine the coverage provided. In Canada, Term Life Insurance Brokers often recommend an amount of coverage between 10 to 20 times the annual income, depending upon one’s needs.

For instance, if you earn $75,000 a year, then you may qualify for coverage from $750,000 to $1.5 million. This range ensures that your family has enough financial security to cover expenses like mortgage payments, education costs, and daily living expenses.

The two most important factors for a maximum coverage limit are age and health. Normally, younger and healthier applicants qualify for higher limits and lower premiums. When people are older or suffer from pre-existing medical conditions, their coverage options tend to get capped.

Our oldest client, who has health issues, was thankful for the Canadian LIC’s advice. Helping them to obtain maximum cover is rewarding enough, especially knowing that their spouse would not face financial ruin in the future.

Different life stages require different levels of coverage; for example:

- A single individual might need coverage to pay off debts or leave a legacy.

- Parents may target a higher coverage so that their children’s education and upbringing are safe and sound.

- Entrepreneurs may need coverage to protect their business interests.

- The purpose of your coverage is to help Term Life Insurance Brokers determine what works best for you.

Typical Maximum Limits for Term Life Insurance Plans in Canada

In Canada, many have up to $1, $10 million, and over. But this amount’s not arbitrary; it very closely relates to your own financial profile because the best-case scenario for insurers should ensure adequate coverage without over-insuring clients.

Policies for high-net-worth individuals or business owners can be far beyond $10 million. Many plans are customized to account for larger financial risks such as estate taxes or business continuity planning.

You can easily acquire Term Life Insurance online or connect with experienced Term Life Insurance Brokers to lead you through the process if you wish to pursue these options.

How to Choose the Right Coverage Amount?

Balancing your family’s future needs with your current financial situation is what selecting the right coverage entails. Here are a few tips to help you decide:

List out your debts (like mortgages or loans), future expenses (like college tuition), and ongoing costs (like household expenses). This step will give you a clear picture of how much coverage is necessary.

What seems like enough today might not cover future costs due to inflation. Selecting a slightly higher coverage ensures your family’s financial security remains intact.

An experienced broker can analyze your financial situation and recommend a Term Life Insurance plan that fits your needs. At Canadian LIC, we’ve helped countless clients navigate this process, ensuring they feel confident about their choices.

Overcoming Struggles with Maximum Limits

Recently, one couple came to us, concerned about whether they could afford enough coverage. The husband was the primary breadwinner, earning $100,000 annually, and they had two young children. They initially wanted a $500,000 policy, but after discussing their long-term goals and financial obligations, we recommended that they increase it to $2 million. They were surprised at how affordable the premiums were after comparing Term Life Insurance Quotes.

Another client, a small business owner, needed coverage to ensure their company’s continuity. They required a $5 million policy to cover debts and secure their family’s financial future. With our guidance, they found a plan that met their needs without overburdening their budget.

The Role of Term Life Insurance Brokers in Securing Maximum Coverage

Brokers offer several advantages when determining your maximum coverage limit:

- Tailored Recommendations: Brokers assess your particular circumstances to make recommendations.

- Access to Multiple Plans: Brokers work with various providers, helping you compare Term Life Insurance Plans Canada-wide.

Expert Advice: They can guide you through the application process, especially if you are targeting higher cover.

When you purchase Term Life Insurance online through Canadian LIC, the support comes along with the specialized knowledge to answer every doubt.

Steps to Apply for Higher Coverage

If you’re aiming for a higher limit, here’s what to expect during the application process:

Insurers often require proof of income and assets to justify higher coverage. This step ensures the policy aligns with your financial profile.

Most insurers will assess your health through a medical exam. Healthy applicants are more likely to qualify for higher limits at competitive Term Life Insurance Rates.

The length of the term determines the overall cost of the coverage. Long-term plans normally charge higher premiums but also provide security.

Compare quotes from several agents. It will allow you to identify the best insurance plan for you at a price you can afford.

Common Myths About Maximum Limits in Term Insurance

While this is partially true, the increase in premiums isn’t always proportional to the coverage. Comparing plans ensures you get the most value for your money.

With the right preparation and guidance from Term Life Insurance Brokers, qualifying for higher coverage is often simpler than expected.

Why Choose Canadian LIC for Your Term Life Insurance Needs?

We take pride in Canadian LIC in making insurance accessible and easy to understand. Suppose you are buying Term Life Insurance online or seeking expert advice on Term Life Insurance plans in Canada. In that case, We have witnessed how the right policy changes lives, offering families the security they deserve.

That ensures your loved ones remain safe if something unforeseen befalls you, and at Canadian LIC, you will always be in touch with such customized solutions and experienced people for easy availability of perfect Term Life Insurance coverage.

More on Term Life Insurance

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About the Maximum Limit in Term Insurance

Term Life Insurance depends on factors like your income, age, and health, so it has a maximum limit. Many providers in Canada offer coverage ranging from $1 million to $10 million and, in some cases, even higher. Your Term Life Insurance broker will be able to help determine the exact amount you qualify for based on your financial situation.

To determine coverage, make a list of your financial responsibilities, such as a mortgage, children’s education, and other debts. Consider your family’s future living expenses. Most people want coverage 10 to 20 times their annual income. Comparing Term Life Insurance Quotes is a good place to begin the process.

Yes, you can actually buy Term Life Insurance online with high coverage amounts. Though some providers have an easy online application process, you might have to provide additional documentation, such as proof of income or a medical report for higher limits. This is where Canadian LIC comes into play and makes the entire process smooth by guiding the client through every step.

Absolutely, the amount of income affects the maximum coverage. That being said, insurance companies also make sure that the amounts under this coverage are up to 10-20 times your annual earnings, thereby matching the amount to your financial profile, not to be underinsured or over insured at any time.

Older individuals can still qualify for high coverage amounts, but it depends on their health and financial standing. We’ve worked with many seniors at Canadian LIC who secured significant coverage after consulting with experienced Term Life Insurance Brokers.

Yes, it’s possible to get high coverage even if your health isn’t perfect. Insurers may ask for additional health-related details or adjust the premium rates. At Canadian LIC, we’ve helped clients with health conditions find plans that meet their needs.

Absolutely. Many Term Life Insurance Policies offered in Canada provide business owners with larger limits, covering debts on their businesses or guaranteeing their continuance. Several entrepreneurs who want their family and business covered have succeeded, thanks to Canadian LIC.

For high coverage, you may be required to provide proof of income, financial statements, and a medical report. These enable the insurer to evaluate whether you qualify. If unsure, Term Life Insurance Brokers will help you walk through this process.

Yes, quotes vary with the amount of coverage, term length, and your personal details. However, more coverage doesn’t necessarily mean exponentially higher premiums. Term Life Insurance Quotes can help you compare and find the most affordable options.

Some policies have provisions that enable you to increase or decrease the coverage limit. However, it’s best to opt for the correct amount in the first place. If you’re still unsure, Term Life Insurance Brokers at Canadian LIC can help you evaluate your long-term needs.

At Canadian LIC, we work directly with clients to understand their current financial situation and help them find suitable Term Life Insurance plans in Canada. You may want to buy Term Life Insurance online or look for personalized advice; the team ensures you get the best coverage for your needs.

Higher coverage usually translates to a little higher premium, but these are workable if you plan well. Canadian LIC brokers help clients find cost-effective Term Life Insurance plans suitable for their budgets.

Most insurance companies require a medical exam for higher coverage amounts. However, some policies may waive this requirement under certain conditions. It is best to discuss your options with a Term Life Insurance broker to understand what applies in your case.

Many Term Life Insurance Plans Canada-wide offer riders that enhance your policy. These can include Critical Illness Coverage or Disability Insurance. Riders can be added even to high-coverage policies to ensure comprehensive protection.

The approval time may vary depending on the insurer and the documentation submitted. Higher coverage may take a little longer because of additional checks. Canadian LIC ensures that all the paperwork is in order, so the approval process for our clients is faster.

Yes, you can buy Term Life Insurance online, even for higher coverage amounts. Many insurers offer an online process that includes an initial quote and application. For higher limits, you may need additional documentation or a medical check, but Term Life Insurance Brokers can guide you through the steps.

Term Life Insurance Quotes give a good idea of the cost, but final rates depend on various factors such as health, income, and coverage selected. Comparing quotes from different providers will help you get the best value. Canadian LIC ensures that you receive accurate quotes and guidance tailored to your needs.

Most Term Life Insurance plans in Canada are pretty flexible. You can cover the amount and the time period as per your monetary goals. If you cannot decide, Term Life Insurance Brokers will be able to suggest options suitable to your family’s needs.

Calculate your right coverage: Financial obligations, such as debts from loans, mortgages, or education, as well as future living expenses for your family. A broker can help you evaluate these factors and recommend a suitable plan.

Premiums usually rise with higher coverage, but the increase is often manageable. Insurers balance costs to ensure affordability. Getting Term Life Insurance Quotes for different coverage amounts can help you decide.

No, brokers like Canadian LIC don’t charge extra for their services. The insurance providers compensate them, so you can benefit from expert advice at no additional cost.

If you don’t qualify for the maximum limit you’re seeking, brokers can help you explore alternative solutions. This could include adjusting the coverage amount or term length or considering a joint policy with a spouse.

Yes, you can switch plans or apply for additional coverage if your financial needs change. Many clients we’ve worked with at Canadian LIC adjusted their policies as their families grew or their incomes increased.

In Canada, Term Life Insurance payouts are usually tax-free for beneficiaries. This makes it an excellent choice for ensuring financial security without additional tax burdens.

Yes, you can combine Term Life Insurance with other policies, like Critical Illness or Disability Insurance. Adding these to your term life plan can provide comprehensive protection. Speak to a broker to explore these options.

Most Term Life Insurance plans available in Canada come with terms of 10, 20, or 30 years. Long-term options provide more stability but tend to be more expensive. Brokers can guide you in selecting the right term based on your needs.

Renewal depends on the policy. Some Term Life Insurance plans automatically renew after the term ends, while others require you to reapply. Brokers can clarify this during the selection process.

Canadian LIC simplifies the process by offering personalized advice, comparing quotes, and helping with paperwork. Our team ensures you understand every detail so you feel confident about your decision.

Indeed, many Term Life Insurance Policies in Canada are personalized. For instance, you may include riders for additional benefits or coverage adjustments to fit certain unique financial situations. There are also brokers who could assist you with these choices.

Health is the greatest determinant of coverage limits. Individuals who are in good health are likely to qualify for higher coverage at lower coverage limits. Even in cases of health concerns, brokers can still look out for suitable options for you.

Absolutely. Comparing Term Life Insurance Quotes lets you see how one provider offers better value than another, and brokers at Canadian LIC can help by comparing options for you.

For insurance above $10 million, they specialize in high-net-worth individuals or businesses. If you need coverage above that amount, Canadian LIC knows how to obtain it, and they can help with that.

This can mean that a young professional often has high coverage at cheaper premium rates. Many of our younger clients at Canadian LIC have successfully secured large policies for the protection of their families and futures.

Approval times vary, but it usually takes a couple of weeks to a couple of months for high-limit policies. Providing accurate documents and working with a broker can help speed up the approval process.

Canadian LIC provides expert guidance, compares plans across multiple providers, and helps clients secure the best Term Life Insurance plans in Canada. Our team prioritizes your needs, ensuring you get the right coverage without stress.

Sources and Further Reading

- Canada Life: Canada Life offers Term Life Insurance with flexible term lengths and coverage options. Their product comparison chart provides detailed information on issue ages, coverage types, and conversion options.

Canada Life - Sun Life Canada: Sun Life provides Term Life Insurance plans with term lengths of 10, 15, 20, or 30 years. They offer tools to calculate costs and obtain quotes online, helping you understand available coverage options.

Sun Life - Blue Cross Canada: Blue Cross Life offers Term Life Insurance with coverage options up to $5 million and term lengths between 10 to 30 years. Their online application process is straightforward, and they provide additional benefits such as discounts for couples and free life insurance for dependent children.

Blue Cross - PolicyMe: PolicyMe discusses Term Life Insurance coverage by age, explaining how needs evolve over different life stages. They provide insights into selecting appropriate coverage amounts and term lengths based on individual circumstances.

PolicyMe

Key Takeaways

- Maximum Coverage Varies: The maximum coverage for Term Life Insurance in Canada typically ranges from $1 million to $10 million, based on your income, health, and financial needs.

- Income-Based Calculation: Most insurers recommend coverage of 10 to 20 times your annual income to ensure sufficient financial protection for your loved ones.

- Health and Age Matter: Younger and healthier individuals often qualify for higher coverage at lower premiums, while older applicants may face limitations.

- Flexibility in Plans: Term Life Insurance plans in Canada offer flexible coverage options and customizable add-ons like riders for enhanced protection.

- Affordable Premiums for High Coverage: While higher coverage increases premiums, the cost is often manageable, especially when comparing Term Life Insurance Quotes.

- Brokers Simplify the Process: Term Life Insurance Brokers provide personalized advice, compare options, and guide clients through application processes to secure the best plan.

- Tailored for Life Stages: Coverage needs vary by life stage—whether single, married, or a business owner. Assessing financial obligations helps determine the right amount.

- Online Options Available: You can buy Term Life Insurance online for high coverage, making the process convenient and accessible.

- Tax-Free Benefits: Term Life Insurance payouts in Canada are usually tax-free, offering peace of mind for beneficiaries.

- Canadian LIC Expertise: Canadian LIC specializes in helping clients secure high coverage Term Life Insurance plans tailored to their unique financial goals.

Your Feedback Is Very Important To Us

We aim to understand the challenges Canadians face regarding the maximum coverage in Term Life Insurance. Your feedback will help us provide better solutions tailored to your needs. Please fill out the following questionnaire:

Thank you for your valuable feedback!

Your responses will help us better understand and address the challenges Canadians face with Term Life Insurance.

IN THIS ARTICLE

- What Is the Maximum Limit in Term Insurance?

- Understanding the Concept of Maximum Limit in Term Insurance

- Factors That Determine the Maximum Limit

- Typical Maximum Limits for Term Life Insurance Plans in Canada

- How to Choose the Right Coverage Amount?

- Overcoming Struggles with Maximum Limits

- The Role of Term Life Insurance Brokers in Securing Maximum Coverage

- Steps to Apply for Higher Coverage

- Why Choose Canadian LIC for Your Term Life Insurance Needs?