At Canadian LIC, we deal with vibrant individuals from all walks of life, each aiming to secure their family’s financial future daily. Among those are smokers, many of whom are surprised when they see their Whole Life Insurance Quotes. It is not a lack of options or clarity but the heavy impact of smoking on their potential whole-life premiums. Imagine this: John, a heavy smoker all his life, comes into our office thinking he is going to get a standard premium like his buddy who does not smoke, only to find out that he will be paying nearly double. This blog will tell you why smokers pay more and how grasping that understanding will help you navigate the best route toward a Whole Life Insurance Policy in Canada. Stay with us as we narrate real stories from our interactions every day, giving insights and advice that best fit your life scenarios.

Understanding Whole Life Insurance

A Whole Life Insurance Policy is a commitment. While Term Insurance will cover you for a specified period, Whole Life Insurance gives you peace of mind for your whole life. Whole life coverage combines the death benefit with a savings portion that increases in cash value over time. It is an extremely attractive feature because financial stability is what we all want to attain. However, the journey to obtaining a Whole Life Insurance Policy really begins with an entirely honest self-assessment of the factors that affect whole life premiums.

The Smoking Factor

But why does it really matter that much when it comes to your Whole Life Insurance Premiums? The answer to this is just a little more involved than you might think. Here’s a further explanation of how smoking affects the risk assessment that makes up your Whole Life Insurance Quotes and premiums.

Increased Health Risks

Smoking is widely recognized by health professionals and a life insurance company alike as a major risk factor for serious diseases. Let’s explore how these health risks translate into higher Whole Life Insurance Premiums:

Lung Cancer: Smokers have a significantly higher risk of developing lung cancer. This disease is not only deadly but also expensive in terms of medical treatment, which increases the risk to insurers.

Heart Disease: Smoking contributes to coronary artery disease and other heart conditions, leading to a higher chance of heart attacks. These health events often result in early death, prompting insurers to increase premiums to cover this risk.

Stroke: The chemicals in tobacco can cause blockages in the veins and arteries, leading to strokes. Again, this increases the likelihood of early claims on a Whole Life Insurance Policy.

Tom’s Realization

Tom, a client at Canadian LIC, was a smoker for over 30 years. When he applied for a Whole Life Insurance Policy, he was startled by the high premiums quoted to him. During our sessions, we explained how his smoking directly impacted these costs. Understanding the connection between his habit and the increased health risks, Tom began to consider quitting to reduce his premiums and improve his health.

Shorter Life Expectancy

Smoking statistically reduces life expectancy, a key factor in how insurers calculate Whole Life Insurance Premiums. A shorter expected lifespan means that the insurer anticipates the likelihood of an earlier payout on the policy.

Janet’s Challenge

Janet came to Canadian LIC worried about her future financial security. As a smoker, the Whole Life Insurance Quotes she received were quite high, reflecting her shorter life expectancy. Our discussions helped Janet see the long-term cost of her smoking, not just in terms of health but also in her financial planning. This was a wake-up call that led her to consider smoking cessation programs.

Higher Cost of Insurance

The risk of insuring a smoker is higher, and this is reflected in the premiums. Insurance companies must balance the risk they take on with the premiums they charge, and smokers invariably fall into a higher risk category.

Eric’s Decision

Eric, another smoker who sought out Canadian LIC for insurance advice, was initially frustrated by the high costs of the Whole Life Insurance Quotes he received. Through our guidance, Eric understood that his smoking habit directly affected these costs. Motivated by both the potential health benefits and financial savings, Eric decided it was time to quit smoking.

Preventive Measures and Policy Adjustments

Insurance companies often incentivize healthier lifestyle choices by adjusting policies for those who quit smoking.

Melissa’s Improvement

After learning about the impact of smoking on her Whole Life Insurance Premiums, Melissa, a client at Canadian LIC, decided to quit smoking and work on her overall health. A year later, she returned to us, and we helped her secure a new Whole Life Insurance Policy with much lower premiums. Melissa’s story is a testament to how making significant lifestyle changes can positively affect insurance costs.

Continuous Support and Guidance

At Canadian LIC, we don’t just provide quotes; we build relationships. We understand that quitting smoking is a significant challenge, and we support our clients through this process, helping them to secure the best possible outcomes for their Whole Life Insurance policies.

If you’re a smoker and concerned about how your habit affects your Whole Life Insurance Premiums, remember, it’s never too late to make changes. Contact Canadian LIC today. Let us guide you through the process of understanding and potentially reducing your premiums through healthier choices. Together, we can find a solution that fits your lifestyle and budget, ensuring you and your loved ones are well-protected for the future.

Maria’s Eye-Opening Experience

Maria, a 40-year-old smoker, came to Canadian LIC to get her Whole Life Insurance quote. She was taken aback by the premium rates. Like many smokers, she hadn’t considered the financial implications of her smoking on insurance costs. We walked Maria through how insurers view smoking and discussed steps she could take to reduce her life insurance rates in the future. Her story is a common one we see every day, and it highlights the need for clear information and supportive guidance.

Quantifying the Impact on Premiums

You may wonder just how much more you would need to pay for Whole Life Insurance if you smoke. This differs from person to person and could be huge—it can be as huge as a 100% price difference between smokers and nonsmokers—depending on other health factors and the duration of smoking.

The Underwriting Process Explained

The moment one applies for a Whole Life Insurance Policy, underwriting takes place. It is, in essence, an assessment of health conditions, lifestyle, and entire medical history. The most important factor here is honesty, most notably in relation to smoking. Never hide the fact that you smoke because it may just cause your claims to be denied or your policy invalidated; that would be totally opposite to why a person got injured in the first place.

Kevin’s Turnaround

Kevin, a smoker since his teens, decided to quit when he turned 30. Two years later, he approached us for a Whole Life Insurance Policy. Thanks to his smoke-free lifestyle, his premiums were substantially lower than what he would have paid as a smoker. Kevin’s story is a testament to the positive changes you can make to reduce your premiums and improve your health. His success in quitting smoking and securing affordable insurance is an inspiration to many of our clients.

Tips for Smokers Seeking Insurance

If you’re a smoker and looking for purchasing life insurance policy, here are a few tips to help you navigate the process:

Shop Around: Different insurers have different policies regarding smokers. It pays to compare Whole Life Insurance Quotes.

Consider Quitting: The best way to reduce your premiums is to quit smoking. Even a few years of smoke-free can significantly lower your rates.

Be Honest: Always disclose your smoking habits during the life insurance application process. Being upfront will help you find a policy that truly covers your needs.

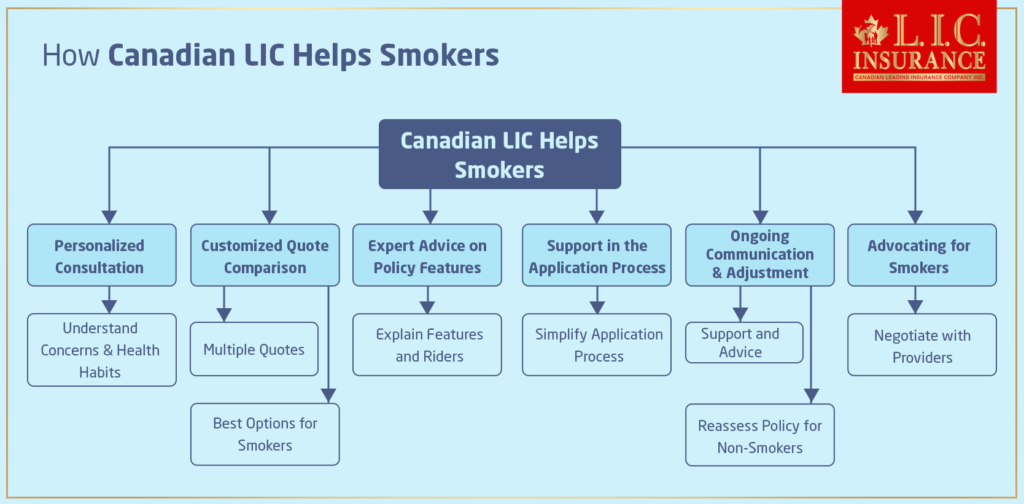

How Canadian LIC Helps Smokers

At Canadian LIC, we are proud of our ability to help smokers get through the red tape and obtain a Whole Life Insurance Policy that best fits each lifestyle and budget. We understand how smoking does enormous damage to your Whole Life Insurance Premiums, and our team is here to make the journey easier and more transparent for you. That’s just one way we can help:

Personalized Consultation

When you step into our office or call us, we start with a personal consultation. We listen to your concerns, understand your financial situation, and consider your health habits, including smoking.

Customized Quote Comparison

We don’t just provide one quote; we shop around. Using our extensive network of life insurance providers, we gather multiple Whole Life Insurance Quotes tailored to smokers. This comparison allows you to see various options and choose the best one for your needs.

Expert Advice on Policy Features

Whole Life Insurance policies come with various features and riders that can be beneficial, especially for smokers. Our brokers explain these features in simple terms—like accelerated death benefits, critical illness riders, and waiver of premium options—and how they can affect your Whole Life Insurance Policy.

Support in the Application Process

Applying for a Whole Life Insurance Policy can be daunting. We simplify the application process by assisting you every step of the way, from filling out forms to understanding medical requirements and what to expect during health assessments.

Ongoing Communication and Adjustment

Your needs and circumstances and your policy requirements may change. We keep in touch with our clients, offering ongoing support and advice. If you decide to quit smoking, we can help reassess your policy and potentially lower your premiums.

Advocating for Smokers

At Canadian LIC, we advocate for our clients. We negotiate with insurance providers on your behalf to ensure you receive fair treatment and the best possible rates despite your smoking status.

To Sum It All Up

Mastering Whole Life Insurance coverage as a smoker might be a bit tricky, but that is okay because it’s doable with proper advice. We at Canadian LIC witness the struggles and successes of people just like you every day. So, we are committed to getting you a Whole Life Insurance Policy that will secure your future and give you peace of mind, regardless of whether you are a smoker or not. Remember, a Whole Life Insurance Policy is an investment not in insuring risks but in ensuring a steady financial future for your family. That is not going to let smoking interfere with this critical step. Reach out to the best insurance brokerage, Canadian LIC, today, and let us bring you closer to a secure future. Your family depends on it, and so do you.

Know More On Whole Life Insurance

Can You Adjust Your Whole Life Insurance Policy?

How Can You Find The Best Whole Life Insurance Without A Medical Exam?

What Age Does Whole Life Insurance End?

What Are The 2 Drawbacks Of Whole Life Insurance?

At What Age Is Whole Life Insurance Best?

Can I Buy Whole Life Insurance For My Kid?

Who Should Go For Whole Life Insurance?

Is Whole Life Insurance Costly?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Whole Life Insurance for Smokers

Since smoking has a huge effect on increasing the chances of contracting health issues, Whole Life Insurance Premiums are going to be highly inflated. For instance, James, one of Canadian LIC’s clients, determined that his premiums were more or less 80 percent higher than those of nonsmokers. That is because an extra risk of health issues, including heart disease and cancer—a usual case among smokers—is taken into consideration by the insurer.

Yes, competitive Whole Life Insurance Quotes are still within reach for a smoker. Canadian LIC shops a number of leading insurers to ensure you get the best rate available. We recently helped a client named Marina, who took matters into her own hands, canvassing directly for the best quote. Seeing high quotes being quoted for her by every insurer, much to her frustration, we were able to provide more reasonable pricing for her without giving up coverage for what she wanted.

By quitting, you are putting yourself at risk of qualifying for lower Whole Life Insurance Premiums. Normally, an insurer would ask that you have abstained from smoking for at least 12 months before you are put in the nonsmoker category for premium purposes. Kevin is very happy to know that he can now reduce his premiums by 50% since he stopped smoking three years ago and is able to prove that he has really quit smoking.

Most Whole Life Insurance policies do view smoking as one of the risk factors and charge accordingly. Some policies, explicitly drafted with regard to smokers, may have better terms. At Canadian LIC, we will help you go through these options and find a policy that will appreciate your efforts by reducing the frequency of smoking or attending cessation programs.

Since Canadian LIC comes with the expertise in securing the best Whole Life Insurance policies for smokers at competitive rates, we would take our expert network and its knowledge to compare quotes, explain the policy, and ensure fair treatment from insurers. As such, when Tom came to see us, he was overwhelmed by the complexity of the terms and the high premium rates. We took him through the steps to make sure that he understood every piece of his policy and received a rate that reflected his lifestyle.

Full disclosure is imperative when applying for Whole Life Insurance. You will have to be honest about the frequency of your smoking and the quantity you go through. This can help Canadian LIC to provide you with the best possible Whole Life Insurance Quotes with no problems down the line. Remember, nondisclosure may result in problems with claim or policy validity. There is the example of a client, Rick, whose claim had been denied because of undisclosed smoking.

We would suggest a review of a Whole Life Insurance Policy a minimum of every two to three years or after any significant change in your smoking habits or health. This will keep the policy competitive and up-to-date with your present needs; whatever changes were made to smoking and health status can result in things that lower premiums. We did a policy review with one of our clients, Lina, after she successfully quit smoking and moved her to a lower premium rate class.

Yes, improved health can get you better Whole Life Insurance Premiums. Maintaining a healthy weight—quitting smoking, exercising, and keeping other health conditions controlled—all have positive implications for your rates. We helped many clients, like David, make changes that netted them the best-reduced insurance costs tied to an improved health profile.

Most insurers have a threshold of 12 months for an individual to achieve nonsmoker status. That may vary from one insurer to the other, though. At Canadian LIC, we recently helped Paul, who was quitting smoking and looking to lower his Whole Life Insurance Premiums. We took him through documenting his smoke-free status and worked with the insurance provider to have his premiums lowered after the required period.

They will want to know how frequently you smoke, or how often you smoke, what you smoke with—cigarettes, e-cigarettes, cigars, etc.—and how long ago you started smoking. Your answer should be accurate and detailed so that insurers can provide Whole Life Insurance Quotes that reflect your real risk profile. For instance, Jane at Canadian LIC used to smoke cigars occasionally rather than cigarettes daily, which impacted her insurance quotes differently.

Exposure to second-hand smoke, on its own, will not affect insurance premiums unless it has caused any medical conditions. However, any health problems caused by second-hand smoke must be disclosed when completing an application. We once had a client, Eric, whose spouse smoked heavily. He had some chronic lung issues from years of second-hand smoke that we were able to help him describe on his application, so the underwriters understood the origin of his health concerns.

Proof may be required through a nicotine test or physician’s records that you are a nonsmoker. At Canadian LIC, we help clients like Alice with this part of their insurance application. Alice had quit smoking and wanted her Whole Life Insurance Premiums adjusted accordingly. We coordinated with her healthcare provider to obtain documentation that confirmed she was a nonsmoker.

This could mean that premiums for smokers are radically different—up to two to three times higher, depending on the age and general health of the individual—from those for nonsmokers. For instance, when Canadian LIC client Brian compared his premiums as a smoker with those after he quit, he found a substantial difference that helped motivate him to stay smoke-free.

Indeed, some of them do have specific policies targeted at smokers, and such policies are usually more expensive than others. In such special policies, enhanced risks are accounted for, but the benefits may also be oriented to address needs relevant to smokers. We can often advise on smoker-specific policies, as Mike is looking for, in order to find the best cost versus coverage trade-offs.

Yes, you would want to update your policy if you start smoking, for instance, after the policy has been issued, to keep your coverage valid. Failure to do so can result in a denial of a claim. We help our clients go through the steps of updating their policies to correlate with their current smoking status so that coverage remains in force and on terms reproductive for the client’s actual lifestyle.

In contrast, health checks for smokers compared to nonsmokers may be relatively rigid. They typically include tests for lung function and screening for smoking-related conditions. At Canadian LIC, we advise our clients on how to prepare for such tests and the best way to present their health condition.

Whole-life insurance for smokers can be very complicated to navigate on your own. Canadian LIC is committed to transparency and assistance tailored to the unique situation at hand. If you are considering quitting or would like to ensure you get the best whole-life insurance policy available to smokers, then we’re here to guide you step by step through any case you may need our help on. Get in touch today, and let us see how we can help you secure your financial future.

Sources and Further Reading

Insurance Information Institute: An invaluable resource for understanding how lifestyle choices, including smoking, affect insurance premiums and coverage options. Visit Website

Canadian Life and Health Insurance Association (CLHIA): Provides detailed insights into Whole Life Insurance policies in Canada, with specific sections on how smoking impacts insurance costs. Visit Website

Health Canada: Offers comprehensive data on the health impacts of smoking, useful for understanding why smokers face higher insurance premiums. Visit Website

Smoke-Free Canada: Provides resources and tools for quitting smoking, which can be beneficial for those looking to lower their insurance premiums. Visit Website

Canadian Medical Association Journal: Contains research articles on the long-term health effects of smoking and the benefits of quitting, which can affect life insurance rates and health assessments. Visit Website

These resources will provide you with a deeper understanding of the factors influencing Whole Life Insurance Premiums for smokers and offer strategies for securing more favorable terms.

Key Takeaways

- Smokers typically face higher Whole Life Insurance Premiums due to increased health risks.

- Smoking significantly impacts the cost of Whole Life Insurance Quotes, often doubling premiums compared to non-smokers.

- Quitting smoking can potentially reduce Whole Life Insurance Premiums after a smoke-free period of at least 12 months.

- Accurate disclosure of smoking habits is crucial to avoid complications like policy voidance or claim denial.

- There are specialized Whole Life Insurance policies for smokers, though these are generally more expensive.

- Canadian LIC specializes in helping smokers navigate applying for Whole Life Insurance, offering personalized advice and support.

- Smokers are advised to regularly review their Whole Life Insurance policies, especially after significant life changes like quitting smoking.

- Improving overall health through better lifestyle choices can also help reduce Whole Life Insurance Premiums.

Your Feedback Is Very Important To Us

We are gathering insights to better understand the struggles that Canadians face regarding the impact of smoking on Whole Life Insurance Premiums. Your feedback is invaluable and will help us tailor our services to better meet your needs.

Your input is crucial to helping us understand and address the unique challenges faced by smokers in Canada. Thank you for your time and valuable insights!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]