- What is the impact of divorce or separation on an RESP?

- Understanding the Basics: What Is an RESP?

- Real Struggles of People: Divorce, Separation, and the RESP

- Who Controls the RESP After a Divorce or Separation?

- Impact on Contributions and Government Grants

- Handling Withdrawals: Who Decides?

- The Role of Canadian LIC: Helping You Go through the Process

- The Emotional Impact on Children

- Long-Term Planning: Ensuring the RESP’s Success

- Conclusion: Securing Your Child’s Educational Future with Canadian LIC

Divorce or separation is probably one of the toughest experiences of a family, not only emotionally but also financially. For many parents in Canada, ensuring their children’s education is secured despite the breakdown of a marriage is a top priority. However, when it comes to a Registered Education Savings Plan (RESP), the path forward can often seem unclear. We’ve been privy at Canadian LIC to watch these complex situations play out over and over again. There are many questions and concerns when clients come in: Who will control the RESP now? How will future contributions work? Will my child still be able to access these funds for their education? These are not purely financial questions but are personal and anchored in the wish to protect one’s children from the fallout of a difficult situation.

In this blog, we will look at the effects of a divorce or separation on an RESP in Canada, using real stories and experiences we have come across at Canadian LIC. By the end, you’ll not only clearly understand how to manage an RESP in this situation, but you will actually be empowered to make decisions that will secure your child’s educational future.

Understanding the Basics: What Is an RESP?

But before we delve into how exactly divorce or separation shall work with it, maybe we can remind ourselves what an RESP is and how it generally operates. An RESP is a registered education savings plan in Canada. It is a plan meant to enable parents or guardians to gradually save for a child’s post-secondary education without paying taxes on the investment’s income. The federal government of Canada does tie this with extra support through the Canada Education Savings Grant (CESG), where the government matches a particular percentage of the input.

When two parents set up an RESP together, they typically become joint subscribers. This means both are responsible for making annual RESP contributions and managing the account. However, divorce or separation can complicate this arrangement, particularly when both parties are not on the same page about how to continue managing the RESP.

Real Struggles of People: Divorce, Separation, and the RESP

At Canadian LIC, we have managed many families going through the difficult process of divorce or separation. Out of all those, the case of Shaina and Jacob came to light: they had opened an RESP for their daughter, Emma, shortly after her birth. They contributed to it every year, so they knew that the savings were safe and that the amount of Emma’s education savings was growing. However, as their marriage began to falter, so did their separation agreement on how to manage the RESP.

However, the two of them fundamentally did not agree because Shaina was anxious that Jacob, who had made the most contribution to the RESPs, would simply stop all payments since he had broken up with her. Jacob, on the other hand, was anxious about the sum of money Shaina would spend on some other purpose and not leave enough for Emma’s education. Their worry might have arisen from the very fact that Emma should be educated, but the way both perceived the management of RESP added stress to the already tense situation.

Stories like Shaina and Jacob are far too common. Parents often are unable to agree on the terms of an RESP, and divorce or separation only adds fuel to the fire. Our function at Canadian LIC is to help parents like Shaina and Jacob sort through these complexities, ensuring that the RESP remains focused on its original purpose: funding their child’s education.

Who Controls the RESP After a Divorce or Separation?

One of the most immediate questions running through parents’ minds is: What happens to the RESP in the case of a divorce or separation? Generally, an RESP would remain in force with the subscribers continuing joint contributions as joint subscribers unless the arrangement had provided for anything to the contrary. This, however, would optimally require an extra degree of open and honest discussions and communication or collaboration between the two parents, which, as you might imagine, can be difficult during and after a divorce.

If the parents are unable to come to a consensus on how to manage the RESP collectively, the parents may decide that one of them would act on it individually. That implies that the other parent would remove themselves from the subscriber role. Objectively, this may seem simple, but in actuality, this can give rise to problems, especially when both of the parents are making annual RESP contributions to the RESP. There are times when one parent has stopped contributing to the plan, thus leaving the other parent to solely finance it, which already strains the relationship, furthered by the fact that this could potentially reduce the amount of grant money an RESP is earning from the government.

At Canadian LIC, we recommend to our customers that such issues be brought up as early as the initial divorce process. In some divorce cases, it might be prudent to contract a document that lays out the obligations of each parent concerning the RESP in use to avoid conflicts and ensure that the child’s education remains the top priority.

Impact on Contributions and Government Grants

Divorce or separation can significantly impact the contributions made to an RESP. If one parent is contributing the most, then he or she might negatively suffer financial distress during the event of separation, hence failure to make regular contributions. Alternatively, in a scenario whereby both parents contribute equal shares, failure to communicate during divorce might lead to missing contributions and negatively affect the growth of the RESP.

Shaina and Jacob both contributed to Emma’s RESP in equal proportions, but upon separation, Jacob’s financial situation changed, and he was not able to afford an equal contribution in total dollar amount as before. This basically hampered the growth of the RESP and many government grants, like the CESG, that will be benefiting Emma. Generally, the CESG matches 20% on the first $2,500 contributed per year and per beneficiary, up to a maximum contribution of $7,200 for the lifetime. If contributions fall, so does the amount of grant money, and this reduced amount can have a massive difference when it’s time for Emma to attend the university.

This scenario is a common concern among our clients. We, at Canadian LIC, work with the parents to find other solutions on, for instance, establishing a new contribution plan more in line with their current financial situation while trying to make the most out of government grants. We would also stress the importance of ongoing contributions in order to make sure that the RESP stays on track for the child’s needs.

Handling Withdrawals: Who Decides?

When the time comes– that is when your child attends post-secondary education – the child’s education fund in the RESP has to be accessed. This process is known as making an Educational Assistance Payment (EAP). Deciding how and when to withdraw from the RESP can become another point of argument during times of divorce or separation.

In Shaina and Jabob’s situation, their daughter, Emily, was just a few years away from needing her RESP funds for the university. The couple had varied opinions on how the money was to be used. Shaina wanted to ensure the funds covered all tuition and living expenses for her daughter, while John believed that some of the money should be set aside for future needs related to education, such as earning a master’s degree.

Establish clear guidelines on how and when RESP withdrawals are made in order to prevent conflicts. Often, during a divorce settlement, we at Canadian LIC recommend that parents set up a joint withdrawal agreement detailing who can make the withdrawal, how much is to be withdrawn, and for what use it is to be withdrawn. By putting these decisions in writing, you can help avoid miscommunication and ensure the RESP performs the way you want.

The Role of Canadian LIC: Helping You Go through the Process

At Canadian LIC, we understand that divorce or separation is not exclusively legal and financial complexities; it’s personal. That means impacting every area of your life, including the education of your child. It is, therefore, an additional management, adding to an already heavy emotional load, to deal with a Registered Education Savings Plan in divorce or separation. That is why Canadian LIC will walk you through each step of the process to ensure your child’s education remains secure.

Here’s how we can help you wade through some of the confusing aspects of managing an RESP during divorce or separation:

Personalized Guidance and Support

Every family’s case differs, and so do the challenges. At Canadian LIC, we first listen. We take time to understand your circumstances—peculiar to you: your financial circumstances, your goals regarding your child’s education, and the dynamics of your separation. This will help us tailor advice and support to best suit your needs. Be it a contentious divorce or an amicable separation, we shall help you adopt strategies that work best for you.

We had a client, Jessica, going through a very nasty divorce. She was worried about the impact of the split on her son’s RESP—into which she and her ex-husband had been making regular contributions for years. She wasn’t quite sure how to bring it up with him or how the RESP should be handled in the future. We worked closely with her and tailored solutions so that she would know what best to decide for herself while feeling confident—and peace of mind knowing that the education of her son was safe.

Expertise in RESP Management During Divorce

Divorce adds a layer of complexity to RESP management. Questions about control, contributions, and withdrawals can become contentious. Our Canadian LIC advisors have dealt with many situations of divorcing parties when managing an RESP. We are up to date with the legal and fiscal consequences of dealing with a plan during separation and use that knowledge to help you make smooth transitions.

Take Mark and Lisa, for example. Both parents wanted to keep contributing to their daughter’s RESP but couldn’t agree on how the account should be handled following the divorce. We stepped in and gave them a plan that clearly spelled out the roles and responsibilities of each parent. The plan helped not only to avoid conflict but also ensured she was fully funded for her education.

Assistance with Revisiting Your Savings Plan Insurance for Education

Not only does your financial position change drastically after a divorce or separation, but your entire savings plan—including your RESP—has to be looked at afresh to ensure that it’s still in tandem with your goals and financial capacity. Canadian LIC helps you revise your education insurance savings plan with valuable insights and readjustments that are crucial in keeping your child’s education on course.

After the divorce, Sandra realized she would no longer be able to contribute to her daughter’s RESP at the same level as before. This really worried Sandra—as her daughter’s future was at stake. We helped Sandra analyze alternative savings and amend her registered education savings plan insurance. This review helped Sandra to contribute to the RESP regularly, such that she eventually did not miss funding her daughter’s education.

Exploring Registered Education Savings Plan Quotes Online

Divorce may also be a time for reconsidering your provider for the RESP. You may want to switch to a plan that is more flexible or better adapted to your new financial situation. Canadian LIC can be really instrumental in providing you with Registered Education Savings Plan Quotes Online, with which you will surely find the one that caters to your needs best.

After separating, David and Michelle decided that they would like to move their RESP to a different provider that offered more facilities in terms of online management. They were more than overwhelmed by the myriad options at hand. We helped them go through a comparison of the available online Registered Education Savings Plan quotes in search of a new provider that matched their new requirements.

Facilitating Open Communication Between Parents

Communication between the two parents is one of the greatest hurdles to effectively manage an RESP in divorce or separation. That is very critical to ensure the continuity of the growth of your RESP and remaining focused on your child’s education. Canadian LIC keeps emphasizing cooperation and provides valuable tools and strategies for how to communicate about the RESP effectively with both parents.

We worked with a couple, Emma and Tom, who were struggling to communicate about their son’s RESP after their divorce. Every conversation seemed to lead to an argument. We introduced them to a structured communication plan by which they can discuss matters of the RESP in a very composed and constructive way. This not only improved their co-parenting relationship but ensured that the education of their son remained on track.

Developing a Long-Term RESP Strategy

You don’t need to lose your peace of mind when divorce or separation throws a wrench into the long-term plans for your life, including your child’s education. We help you develop a long-term strategy regarding contributions and investment options so that it remains aligned with your child’s educational needs despite personal changes in your life.

When Anne and her ex-husband had to decide on separating, one of the major concerns was how all these changes in their financial situation were going to affect their daughter’s RESP. We worked with them to create a long-term action plan, adjusting their contributions and investment choices for optimum effect. This ensured that, despite the separation, their daughter would have the funds she needed for her education.

Ongoing Support and Monitoring

It doesn’t mean that once you have adjusted your RESP, it’s the end of the journey. Life goes on with its changes, and so does your financial situation. At Canadian LIC, we give ongoing support and monitor your RESP continuously. We keep in touch to make sure that your plan continues to meet your goals and your child’s needs for education.

After Julie’s divorce, she didn’t know where to begin with her son’s RESP. We not only helped her get a new plan but also continued to support her. We called her every once in a while to ensure everything was going the way it should be and that whatever needed to be done got done. That ongoing relationship gave Julie peace of mind, knowing her son’s education was in good hands.

Empowering You to Make Informed Decisions

While divorce or separation may cause you to feel like your life is out of your hands, you can still regain at least some control through your child’s education. We at Canadian LIC arm you with the right knowledge and resources to take charge of your RESP management confidently. Whether it is understanding the legal implications, exploring new Savings Plan Insurance for Education options, or finding Registered Education Savings Plan Quotes Online, we equip you to make the best choices for your child’s future.

We had a client, James, who, during his divorce, was overwhelmed by the decisions he needed to make regarding his daughter’s RESP. Not knowing where to start, he felt lost. We helped James understand things better through clear, easy-to-understand information and walked him through the process page by page. By the end, James felt quite confident that he was going to be able to handle the RESP and was empowered to make great decisions for his daughter’s education.

At Canadian LIC, we understand that divorce or separation is the most difficult time in everyone’s lives, and dealing with an RESP can be overwhelming. You do not have to face this alone. Our team of experienced advisors is here to guide and support you through the process of protecting your child’s education. With our services, you now get an opportunity to get online registered education savings plan quotes, review your insurance savings plan for education, and develop a long-term strategy that is more in sync with your new circumstances.

We believe in open communication and working together with you to help maintain a focus on your child’s future, notwithstanding all the changes life brings forward. Contact Canadian LIC today and let us help you secure your child’s education journey with confidence and peace of mind.

The Emotional Impact on Children

The financial and logistical decisions involved in managing an RESP through divorce or separation can sometimes overshadow the emotional impacts on the child. Children often have a keen sense of what is happening around them and are concerned about how those changes will affect their future, including their education.

In the case of Shaina and Jacob, their daughter was first and foremost concerned about how her parents’ separation would affect her going away to university. She had overheard RESP disputes between her parents and became worried that when it came time to need the funds, they wouldn’t be available. It is additional stress on an already quite stressful life period.

We at Canadian LIC firmly believe in the idea that keeping things transparent and giving peace of mind to your child regarding his education is crucial. If they are old enough, involve them with the decision and explain how you intend to handle this RESP going ahead and reassure them that their education remains on track. This can help alleviate some of their anxiety and provide them with a sense of security during a time of change.

Long-Term Planning: Ensuring the RESP's Success

Divorce or separation can disrupt long-term financial plans, including the RESP. With careful planning and the right advice, however, you can ensure that an RESP remains on track for when it’s needed the most. Canadian LIC works with parents to review the RESP strategy against your changed situation. That can include revising contribution amounts, exploring other investment options, or even adding other types of savings plans to offset the RESP.

Another long-term planning component is ensuring the RESP stays aligned with your child’s educational plans. As he or she gets older, his or her plans for college may change. It’s important to review regularly to ensure the RESP still meets these goals. For example, if your child is going to have a more expensive program, he or she is going abroad, or you want to adjust the savings strategy, you should be able to do this when needed.

Canadian LIC will provide you with a comprehensive review of your RESP for keeping you on track as your circumstances change. We offer tools that allow you to shop online for Registered Education Savings Plan quotes more easily, enabling you to find better plans for your needs.

Conclusion: Securing Your Child's Educational Future with Canadian LIC

Though divorce or separation may be an emotionally challenging time, it doesn’t have to mean a child’s education goes off the rails. Keeping in mind the effect of these changes on your RESP and the steps taken to handle it effectively can ensure that your child is educationally covered.

Canadian LIC will help you sail through all the complexities of managing your RESP during divorce or separation. Our advisory team is experienced and feels for your condition; hence, we will offer you the right guidance and advice to make correct decisions—be it revisiting insurance on your savings plan for education or exploring Registered Education Savings Plan Canada options; we are here to guide you through all steps.

We encourage you to reach out to us to discuss your RESP needs. Together, we can develop a plan that will keep your child’s education on track as life changes. Canadian LIC is not just an insurance brokerage but your dedicated partner in ensuring that your child’s future is secure. Don’t wait—contact us today for more information on how we can help you manage your RESP through this tough time.

More on RESPs

- The Differences Between a Family Plan and an Individual Plan RESP

- The Uptake of RESPs Among Different Communities in Canada

- RESP Rules and Contribution Limits in 2024

- The Time an RESP Remains Open

- The Results of Missing Contributing to an RESP for a Year

- Opening an RESP for a Child Who Is Not My Own

- Using an RESP for Rent

- The Disadvantages of RESP

- Expenses Eligible for RESP in Canada

- The RESP Limit In Canada

- Withdrawing Money from RESP in Canada

- Is it important for a RESP Beneficiary to Live in Canada?

- Is It Possible to Use My RESP Outside Of Canada?

- Checking My RESP in Canada

- Impact on RESP If You Decide To Leave Canada

- Transferring an RESP to an RRSP

- Important Things About RESP

- Everything To Know About RESP

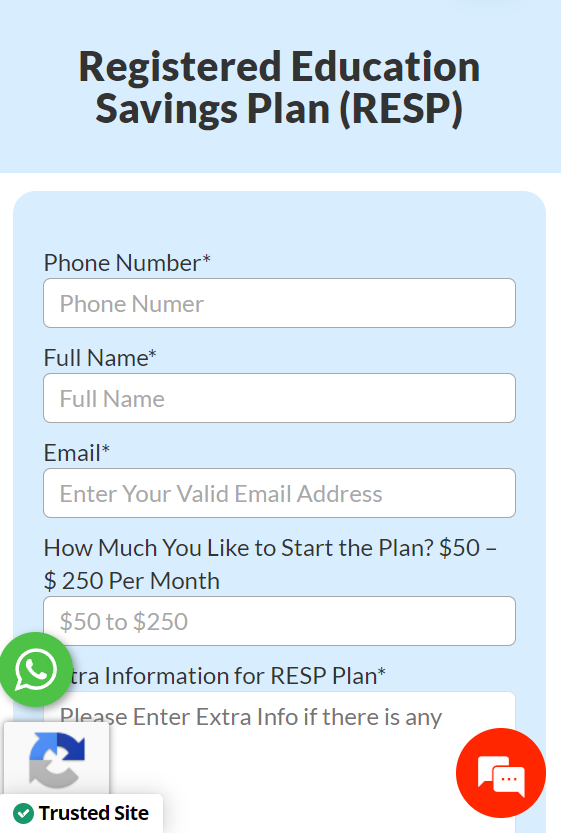

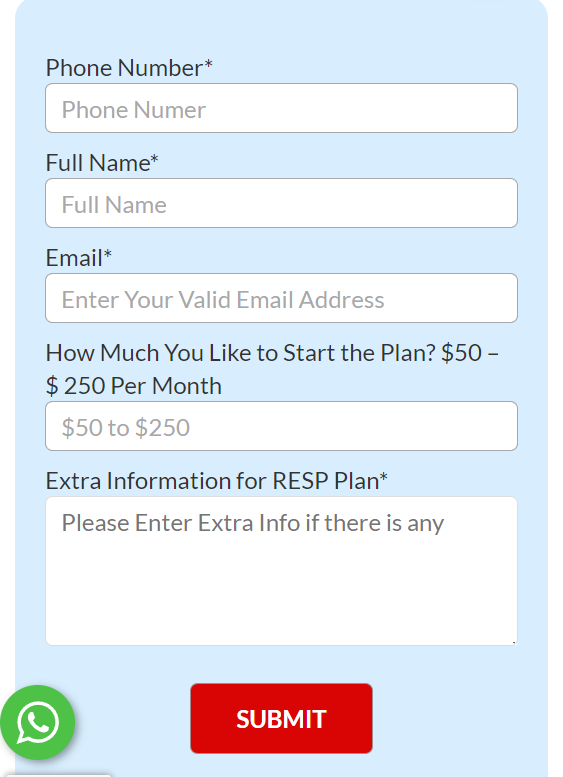

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Managing an RESP During Divorce or Separation in Canada

Quite often, in fact, parents ask the question at Canadian LIC: “How does divorce or separation affect my child’s RESP?” Although the RESP per se is unaffected, its management is. You and your ex-spouse will have to decide whether you will continue to be joint subscribers or if just one of you is to take over the account. This decision will vastly impact your child’s education savings, so it is very important that parents are on the same page when making the right decision for their child.

Yes, after separation, both parents can continue making contributions to the RESP. It is, however, very important that you agree with your ex-partner exactly how the contributions are going to be made in order not to create misunderstanding and potential future conflict. At Canadian LIC, we assisted many clients in structuring the contribution plans for their children, taking into account the new financial reality. This ensures continuation of growth for the RESP and secures your child’s education.

Government grants, like the Canada Education Savings Grant, are matched according to the contributions that are made to an RESP. If the contributions are lower due to divorce or separation, your child could receive a lesser amount of CESG. At Canadian LIC, we have walked through this many times by readjusting the insurance savings plan for education with many customers to ensure they get the maximum possible benefits for a child.

With divorce, it is not easy to know when to make withdrawals and how from the RESP. Parents have to agree on how and when money should be withdrawn to ensure that funds are used for appropriate education of the child. Canadian LIC recommends that during divorce settlement, parents should outline a withdrawal agreement. This avoids frustration later on down the road and confirms your child’s education is paramount.

Yes, you can change the RESP provider after divorce in case you get a better plan that works for you in light of your new circumstance. At Canadian LIC, we help clients explore Registered Education Savings Plan Quotes Online to get the best options out there. Whether you need more flexibility or improved online management tools, we will walk you through selecting a provider who will meet your needs.

This will become very important in case your financial situation changes after the divorce. Canadian LIC will work with you in reassessing your financial plans and, where necessary, adjusting contributions toward the RESP. This will ensure that, even though your financial situation has changed, the future education of your child will still be secure.

Communication is the key to an effective management plan for the RESP after a divorce. Canadian LIC actively supports and promotes communication between both parents. We see all too often how the integration of structured communication plans can forestall conflict and keep the RESP growing. It is for this reason that our advisors are here to help you set these plans in place and then have the ongoing services available to keep everything on track.

Let divorce not destroy the future prospects of the education of your children. Canadian LIC will assist in designing a long-term RESP strategy, considering your new financial situation and your child’s educational goals. We have assisted many clients in planning to ensure the child’s RESP is on the right path for growth and will provide the funds necessary when seeking higher education.

It’s easier than you think to get started in reviving your RESP following a divorce. Canadian LIC will initially counsel you into reviewing your current plan. Hereafter, online registered education savings plan quotes and reassessment in insurance for a savings plan in education can be pursued, and a strategy for moving forward can be tailored according to your new situation. Our advisors are always ready to help walk you through this.

Choosing Canadian LIC means partnering with a team that understands the complexities of managing an RESP during a divorce. We’ve helped many clients facing the very same challenges and given personalized responses to difficulties, surfing Registered Education Savings Plan Quotes Online, and keeping your insurance savings plan on education targeted at your child’s future. We want to make this process as easy and stress-free as possible for you so you can focus on what really matters: your child’s education.

If both parties agree, the RESP can be transferred to the ex-spouse. This may ultimately be the best option, provided that one parent will take full control and management of the RESP. At Canadian LIC, we have helped a lot of such clients perform this type of transfer in a seamless manner. The most crucial thing is to understand what such a transfer implies in terms of the government allowances and the insurance on the education savings plan. Our advisors are here to help guide you through the process so everything is properly handled.

We had such a client, Karen, who needed to put through a transfer of the RESP to her ex-husband because he had more financial stability. We just explained how it works and the benefits and made the transfer to ensure the savings for their children for future education remain intact and safe.

The most shared disputes, however, come when it’s time to manage the RESP after divorce, and these disputes can be settled with the right approach. If you and your former spouse cannot come to an amicable agreement on this issue, the intervention of a third-party mediator or legal counsel may be required. Canadian LIC has had a lot of effective communication and involvement to prevent these types of disputes. We encourage parents to discuss and, where possible, agree on their arrangements in writing to identify their mutual understanding clearly.

Ensuring consistent contributions to the RESP is crucial for your child’s educational future. In case of divorce, it is important to come up with a clear contribution plan right away, especially if both parents are involved. At Canadian LIC, we help our clients set up an automatic contribution or come up with a schedule that best fits their new financial situation. In this way, you will be rest assured that your insurance savings plan for education is well on its way.

We had one client, David, who was concerned his ex-wife wouldn’t continue contributing to his daughter’s RESP following the divorce. We set up automatic contributions on his end and advised him to have a clear agreement with his ex-wife. This ensured that their daughter’s education savings would continue to grow without interruption.

The tax treatment of an RESP generally doesn’t change after the divorce, but there are considerations to be understood. If the holder or the ex-spouse withdraws funds, the income becomes taxable in the hands of the beneficiary once it is used for education. At Canadian LIC, we have walked clients through these tax implications to help them make educated decisions when choosing to withdraw. Of course, you should always consult a tax professional if you need more clarification.

Lisa was worried about the taxation that would arise from the liquidity of the funds in her son’s RESP after the divorce. We explained to her how the income in this account is subjected to tax and suggested the best strategy to minimize this tax liability to a manageable level. This gave Lisa peace of mind, knowing she could effectively manage the RESP.

Yes, you can. In such a scenario, you may want to have a family RESP in case you have more than one child. That way, you can allocate how much in savings each has towards their own educational needs. At Canadian LIC, our team of professionals has experience handling the complexities involved with splitting an RESP. We work closely to ensure that the education of each child remains fully funded, even when the RESP has to be divided.

After their divorce, Sarah and Mark needed to divide their RESP between their two children. We showed them how to do this effectively to secure both children’s education savings, giving them confidence that their children’s futures were protected.

If your PAN goes into default or your ex-spouse stops contributing to the RESP, it’s important to deal with this situation right away so that your child’s education savings are not affected. We at Canadian LIC have seen this before and found solutions for our clients. We will support you in taking over the contributions, adjusting the contribution amounts, or even discussing the best way forward in this situation and solving the problem amicably.

Rebecca was concerned when her ex-husband stopped contributing to their son’s RESP. We worked with Rebecca to adjust her contributions and explored other savings options to make up the difference. This ensured that the change would not impact her son’s education.

Making sure that your RESP funds are utilized for the education of your child is the first and foremost priority. It is very critical to specify how and when money is withdrawn from the plan. At Canadian LIC, we help parents draft withdrawal agreements stating specific conditions of usage for the RESPs. This helps assure you that the funds will be utilized only for educational purposes.

Tom and Lisa needed to ensure their daughter’s RESP would be used only to fund her education, even after their divorce. We helped them draft a withdrawal agreement that identified how much could be accessed and under what conditions. This provided clarity and protected their daughter’s education.

We have assisted hundreds of clients going through the process of handling an RESP during and after a divorce. Whether by ongoing support, expert advice, or finding you the best registered education savings plan in Canada options, we are here to make this process as smooth as possible for you and your family.

Of course, managing an RESP whilst undertaking a divorce or separation can be an overwhelming experience. When you seek professional advice from Canadian LIC at this point in time, providing for your child’s educational security will become a sure bet. We’re here to provide the support and guidance you need to deal with this process confidently. More questions? Need help getting started? Please do not hesitate to contact us. We are here to help you every step of the way.

Sources and Further Reading

- Government of Canada – Registered Education Savings Plan (RESP)

- Detailed information on how RESPs work, including contributions, withdrawals, and government grants.

- Visit the official website

- Canadian Revenue Agency (CRA) – RESP Information

- Comprehensive guidelines on the tax implications of RESPs, including during life changes like divorce or separation.

- Visit the CRA RESP page

- Canadian Bar Association – Family Law and RESPs

- Legal insights into how family law intersects with RESP management during divorce or separation.

- Read more on the Canadian Bar Association website

- Financial Consumer Agency of Canada – Saving for your child’s education

- Practical advice on managing education savings plans, including RESPs, especially after major life events.

- Visit the Financial Consumer Agency of Canada

- Investopedia – What You Should Know About RESPs

- An in-depth look at the benefits and challenges of RESPs, including during a divorce.

- Visit the Investopedia page

These sources provide additional information and insights that can help you better understand how to manage an RESP during a divorce or separation in Canada.

Key Takeaways

- RESPs remain intact after a divorce or separation but require clear communication and cooperation between parents to ensure the child’s education is fully funded.

- Contribution plans may need adjustment post-divorce to reflect new financial realities while maximizing government grants like the Canada Education Savings Grant (CESG).

- Deciding on control and withdrawals from the RESP is crucial; formal agreements can help prevent conflicts and ensure funds are used appropriately for education.

- Canadian LIC provides personalized support to navigate RESP management during divorce, including revisiting Savings Plan Insurance for Education and exploring new RESP options.

- Open communication between parents is essential to maintaining the RESP’s growth and ensuring the child’s education remains the top priority.

Your Feedback Is Very Important To Us

Feedback Questionnaire: Understanding the Impact of Divorce or Separation on Your RESP

We appreciate your time in sharing your experience. Your feedback will help us better understand the challenges couples face regarding their RESP during a divorce or separation. Please take a few minutes to answer the following questions.

Thank you for your valuable feedback. Your insights will help us provide better support and resources to individuals managing their RESP during such challenging times.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]