You’re a hard-working tech professional in Toronto. You love your job, but a severe back injury has left you unable to sit at your desk, let alone manage the long hours your role requires. You always knew you needed a safety net, so you wisely invested in Disability Insurance. But now, when you need to claim your benefits, you run into the “elimination period” – a term that sounds like something from a sci-fi movie, not insurance jargon. This waiting period before your benefits kick in feels like an eternity when bills are piling up and your ability to earn an income is compromised.

This is a common problem for our clients at Canadian LIC, where every day, individuals find themselves grappling with the realities of their Disability Insurance policies during their most vulnerable times. In this blog, we’ll break down what the elimination period in Disability Insurance means, why it exists and how to go through it. We’ll share real-life stories and insights from our daily interactions with clients so you have the tools and knowledge to tackle this often-overlooked part of Disability Insurance in Canada.

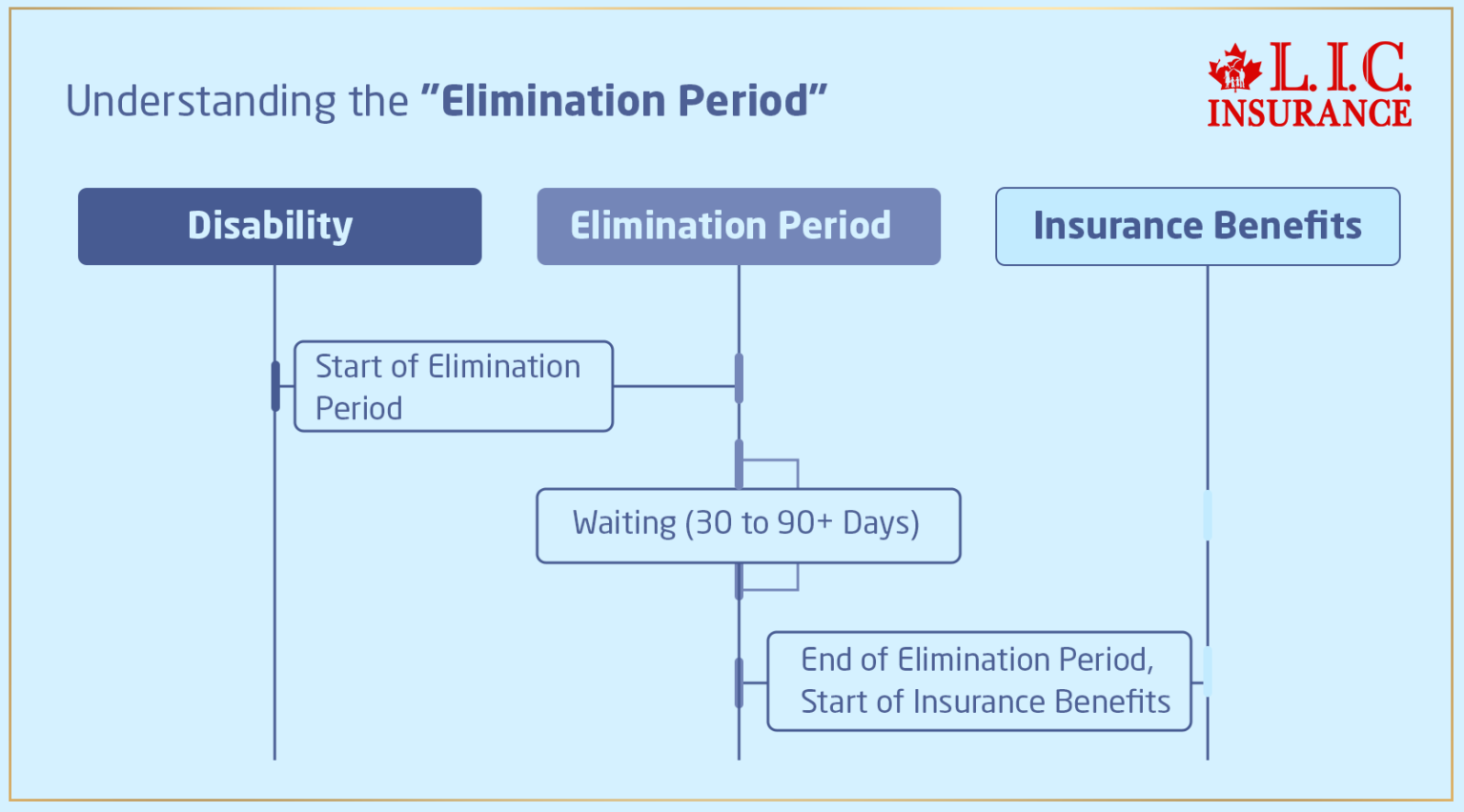

Understanding the "Elimination Period"

What Is the Elimination Period?

In the Canadian Disability Insurance sector, the elimination period refers to the time between the date of your disability and the date when your insurance benefits can start being paid out. You can consider it a type of deductible time, not in dollars but in days. Depending on the policy, this may take anywhere between 30 days and 90 days or more.

The Purpose Behind the Waiting

Why impose a waiting period in such critical times? The elimination period serves multiple purposes. Most importantly, it makes premiums more affordable for all policyholders. As the insurance company won’t have to pay immediately, it thus reduces the risk and administrative costs of short-term disabilities that resolve in no time. It distinguishes this insurance from Health Insurance, which usually bears immediate medical costs.

How It Affects You

For many, the elimination period is a stressful time. Clients at Canadian LIC often share stories of uncertainty and financial strain during this period. Shikha, a graphic designer from Vancouver, shared her anxiety during the 60-day wait: “Every day without a paycheck was a dip into my savings. I was counting the days until my benefits would start.”

Planning for the Elimination Period

Evaluate Your Needs

Everyone has different requirements and financial conditions. Knowing your regular expenses and having a buffer in the expenses might help ease the impacts of the elimination period a bit. When buying a Disability Insurance policy, consider how long you think you might be able to get by without an income.

Consider Shorter Periods

If the periods of elimination sound too long, then some Disability Insurance Providers offer options for shorter periods. Remember that all such options increase your premium. It’s all about a delicate balance between the needs of the present and long-term financial planning.

Real-Life Strategies

At Canadian LIC, we help clients like Mark, a small business owner from Calgary, strategize for such eventualities. Given his unstable business income during his recovery, Mark opted for a shorter elimination period to ensure quicker access to funds. “It was a safety cushion that allowed me to focus on healing without the added stress of immediate financial woes,” Mark explained.

Getting Through With Canadian LIC: Your Trusted Partner in Disability Insurance

There is no doubt that Canadian LIC stands out in terms of the complexities that come with Disability Insurance in Canada. The experience is that every client differs and needs attention; that is why we are dedicated to customized solutions that best equip you for that most crucial period: the elimination period. Here’s how we make this journey smoother and more accessible for you:

Personalized Insurance Assessments

Real-Life Story: Take the case of Anna, a freelance photographer from Montreal, who came to us after being diagnosed with chronic fatigue syndrome. Given her fluctuating work schedule and income, standard plans didn’t fit her needs. We worked closely with Anna to tailor a Disability Insurance plan that not only accommodated her unpredictable income but also provided a shorter elimination period to quicken her access to benefits.

How We Help: At Canadian LIC, every client undergoes a thorough assessment of their financial needs and health status. We explore various Disability Insurance Quotes and plans to find the perfect match that aligns with your specific lifestyle and risk factors.

Expert Guidance on Managing the Elimination Period

Real-Life Story: John, a software developer from Edmonton, faced a difficult situation when he unexpectedly needed to undergo major surgery. The prospect of a lengthy elimination period was daunting as his savings were limited. Our team stepped in to guide John through budgeting his existing resources and selecting a temporary coverage option that bridged the gap until his disability benefits commenced.

How We Help: We don’t just sell you a policy; we equip you with strategies to manage the elimination period effectively. Whether it’s setting aside an emergency fund or choosing plans with shorter waiting periods, Canadian LIC ensures you’re not left struggling when you most need financial support.

Seamless Claim Support

Real-Life Story: Sania, an elementary school teacher from Halifax, found the claims process overwhelming after a severe arthritis diagnosis. Our dedicated agents helped Sania gather the necessary documentation and expedited her claim process, reducing her stress and helping her focus on her health.

How We Help: Filing a disability claim can be intricate and stressful. Our team at Canadian LIC assists you every step of the way, from initial documentation to final approval. We simplify the process, making it transparent and straightforward, ensuring you receive your benefits as swiftly as possible.

Continuous Policy Review and Adjustments

Real-Life Story: Michael, a small business owner from Vancouver, initially had a Disability Insurance plan that suited him well. However, as his business and personal life evolved, so did his insurance needs. Recognizing this, we regularly reviewed his policy and made necessary adjustments, which proved beneficial when he faced a health issue later in life.

How We Help: Disability Insurance needs can change as your life does. At Canadian LIC, we conduct periodic reviews of your circumstances and policy to ensure it always meets your current needs. This proactive approach helps avoid any gaps in coverage and provides peace of mind that your policy remains effective and comprehensive.

Education and Resources

Real-Life Story: Linda, a recent graduate starting her career in Ottawa, was new to the concept of Disability Insurance. Our educational workshops and personalized consultations helped Linda understand the importance of Disability Insurance, guiding her to make an informed decision about her coverage options.

How We Help: Understanding the ins and outs of Disability Insurance Plans can be daunting. Canadian LIC provides educational resources, workshops, and one-on-one consultations to demystify insurance terms and processes, empowering you with the knowledge to make informed decisions.

Be assured that your financial security in times of turmoil comes first at Canadian LIC. We won’t be just one of the Disability Insurance Providers; we’re your partner in planning for the unexpected. Get a no-obligation quote tailored to your personally designed Disability Insurance coverage today, and let us explain everything we will do in our power to help you navigate the elimination period and beyond as smoothly as possible. Let us handle the details so that you can take care of yourself and your health.

Conclusion: Act Now with Canadian LIC

Your journey through understanding and managing the elimination period of Disability Insurance does not have to be a lonely one filled with hazards and distress. With Canadian LIC, you get a partner by your side who is armed with expertise and empathy. Don’t wait for a crisis to realize the value of comprehensive Disability Insurance. Contact us today to learn more and secure a plan that will not only suit your needs but also provide peace of mind during those critical waiting periods. Let us help you protect your income and protect your future, so if something bad happens in life, you’re prepared to catch it.

Remember, though, that proper planning and knowledge can help break down the elimination period of a Disability Insurance policy, which seems tough at first, into a rather manageable interval. With Canadian LIC, you are never on this journey alone. Join the myriad of Canadians who trust us to protect their most precious asset: their ability to earn an income. Get in touch now for a Disability Insurance Quote, giving you and your family great financial security.

More on Disability Insurance

- Does Disability Insurance Cover Mental Health Issues?

- Is Disability Insurance Taxable?

- How to Calculate Disability Insurance?

- Why Can’t I Buy Disability Insurance?

- Critical Illness vs. Disability Insurance in Canada: Understanding the Differences and Making Informed Choices

- Must Know Pros and Cons of Disability Insurance in Canada: A Comprehensive Guide

- Why Do Professionals Need Disability Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions(FAQs) About Disability Insurance in Canada

Disability Insurance can sometimes be convoluted, but you can make empowered decisions if you are armed with the proper knowledge. Following are the most frequently asked questions that we get at Canadian LIC so that you can relate to and understand each aspect better:

Maria is a freelance graphic designer in Toronto. She wasn’t sure where to start with respect to Disability Insurance. She called Canadian LIC and received a free, no-obligation quote, tailored to her budget and coverage requirements. We went through all of the options and explained what is driving your premiums so everything was very clear and easy to understand.

Get a quote for Disability Insurance simply by contacting a reputable Disability Insurance carrier like Canadian LIC. We require only some basic information on your occupation, your earnings, and your health before coming up with a tailored quote for you.

Kevin, a construction worker from Calgary, needed coverage for his specific on-the-job risks. Having discussed the everyday duties and possible associated risks, we picked one that provided comprehensive coverage on injuries common in his particular field of endeavor.

Factors that one should pay attention to in the process of selecting a Disability Insurance plan include the amount covered, disability elimination period, premium rates, and the real words significant in triggering any benefit payment. It is, therefore, very crucial to be able to pick a plan aligning with one’s career risk and financial condition.

Sophie is a yoga instructor living in Vancouver and seeking flexibility regarding her Disability Insurance—her income changes tremendously throughout the year. We introduced her to a variety of plan options that offer adjustability in both premiums and benefits.

There are a variety of Disability Insurance Plans; you can have short-term and long-term Disability Insurance. Some other plans allow your premium and benefit levels to change as your income or job status changes.

Among them is Amit, a technology startup owner in Montreal, who wanted to make sure he got the best one for his needs. We assisted Amit in comparing several providers. We beamed through each of them on their reputation, terms of policies, customer service, and processes on claim support.

Comparing Disability Insurance Providers on the basis of their financial stability, customer service rating, speed, ease of claim processing, and feedback from current customers are major considerations. Consulting an experienced broker, like Canadian LIC, may also offer great insights and recommendations relevant to your particular case.

Rachel, a dentist from Halifax, initially purchased a plan that suited her when she was just starting her career. A few years later, her income and lifestyle had changed significantly. We reviewed her policy and made necessary adjustments to ensure her coverage still provided adequate protection.

Your Disability Insurance plan should, therefore, be reviewed from time to time if there are any changes in either need or around other parameters. Through such reviews, your coverage level can be either increased or decreased to more appropriately fit your current income, lifestyle, and exposure to risk. Providers such as Canadian LIC can help you assess your current set of conditions and, where necessary, adjust your policy.

Alex, a software engineer from Ottawa, fell ill very suddenly and was hindered from working. He feared not being able to work for quite a while and being supported financially for recovery. We eased his concern by letting him know that a 90-day elimination period was standard on his policy, and we assisted him in navigating the time frame of managing his finances so that he could move to the paid benefits.

Often, it is 30 to 120 days, depending on the policy, before the beginning of your Disability Insurance benefit. It’s a very critical period, and you’ll want to know it while selecting your plan so that you’re sensitive to it.

Jenna is an Edmonton bakery owner diagnosed with rheumatoid arthritis and feared she couldn’t obtain Disability Insurance. After she consulted with us here at Canadian LIC, we found providers willing to cover her, albeit with slightly higher premiums or specific exclusions related to her condition.

You can still buy Disability Insurance if you have a pre-existing condition; however, it may have terms such as exclusions or higher premiums. When seeking a Disability Insurance Quote, full disclosure of any health-related issues at the very start is most important.

Liam, an architect in Toronto, was concerned about tax implications concerning his disability benefits. We went through the details and explained to Liam that if he, personally, had paid for his premiums with after-tax dollars, his benefits would be tax-free.

Disability Insurance benefits are taxable, depending on who is paying the premium. If you pay your premiums in after-tax dollars, the benefits will normally be tax-free. But if your employer pays for the insurance, then the benefits you get may be taxable.

A teacher in Saskatoon, Sandra had a group disability plan through her employer, but wasn’t sure if she had enough coverage. We reviewed her insurance coverage, realizing that this particular insurance did not address many of the specifics she needed. Sandra decided to supplement this group plan with an individually underwritten policy designed specifically for her unique needs.

Yes, there is. There is a major difference. Group Disability Insurance Plans normally come from employers that normally only give basic coverage; options are very few. Individual Disability Insurance Plans are customized to your needs and lifestyle and are usually more comprehensive.

Derek, a landscaper in Halifax, was getting frustrated with the slow process of filing a claim with a previous insurance provider. We helped him understand what documentation was required and really streamlined things for him here at Canadian LIC, so it was smooth.

Such details may include:

- Detailed records of your medical treatment.

- Regular correspondence with your insurance provider regarding the status of your claim.

- Prompt forwarding of all required documents.

Working with a knowledgeable provider like Canadian LIC can help make this process much easier because we will help guide you through each step and help you be better positioned to plan ahead for any issues that may arise.

Whether you are just starting to consider some kind of Disability Insurance or are considering making changes to an existing policy, it is truly vital that you are informed and enabled to make choices that best suit your lifestyle and needs. Canadian LIC will help you all along the way, so you are bound to feel empowered to make sure your Disability Insurance decisions are followed. There’s no better time to reach out and discuss your options so that together, you can find peace of mind and a solid plan for financial support when the need arises.

Sources and Further Reading

To deepen your understanding of the elimination period in Disability Insurance and explore more about disability coverage options in Canada, consider the following sources:

- Insurance Bureau of Canada – Offers comprehensive resources on various types of insurance available in Canada, including detailed guides on Disability Insurance. Visit IBC

- Canadian Life and Health Insurance Association – Provides information on life and health insurance products, including Disability Insurance, and offers consumer tips on choosing the right insurance plan. Visit CLHIA

- Financial Consumer Agency of Canada – Features useful information on managing and understanding insurance, including the rights and responsibilities of insurance policyholders. Visit FCAC

- Advocis, The Financial Advisors Association of Canada – Contains articles and advice from financial advisors on planning and insurance strategies, which can be useful when considering Disability Insurance. Visit Advocis

These resources provide reliable information and can help you make informed decisions regarding Disability Insurance in Canada. They also offer tools and advice to help you understand your insurance policy and its benefits thoroughly.

Key Takeaways

- The elimination period is the critical waiting time between the onset of a disability and the start of benefit payments, varying by policy.

- This period helps keep insurance premiums affordable by reducing the insurer's risk of covering short-term disabilities.

- It can be financially stressful; preparation involves understanding your policy and possibly setting aside emergency funds.

- Canadian LIC offers personalized assessments and guidance to help navigate the elimination period effectively.

- Choosing the right Disability Insurance plan should consider the elimination period length, coverage amount, and premium costs.

- Working with experienced providers like Canadian LIC simplifies the management of Disability Insurance and enhances policy tailoring to individual needs.

Your Feedback Is Very Important To Us

We value your insights and experiences with the elimination period in Disability Insurance. Your responses will help us better understand the challenges you face and improve our services.

Please submit your responses through the provided link or return this form to our office. Your feedback is invaluable, and we thank you for taking the time to help us serve you better.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]