Insurance in a new country can be overwhelming. Many newcomers visiting Canada face this challenge as they try to understand the difference between Visitor Insurance and Health Insurance. At Canadian LIC, we see clients every day who need clarification and support about making the right choices to protect themselves and their families. Their stories are not just about insurance; they’re about finding peace of mind in a new home. This blog will demystify these two types of insurance so you can understand and confidently choose the right one.

Understanding the Basics: What is Visitor Insurance?

Visitors’ Insurance Plans are, as the name says, for visitors to Canada for business trips, travel, or family visits. This insurance is a short-term Health Insurance plan that will cover, if needed, a medical emergency caused by sudden illness or bodily injury while in Canada. One of our clients, Maya, recalled the story of relief when her father needed urgent medical attention in Canada due to a broken leg; he was visiting from Italy. Thanks to the Visitor Insurance Plan they had chosen through one of our skilled Visitor Insurance agents, she did not bear any financial burden for the emergency medical care received by her father, as the medical bills were covered.

Key features of Visitor Insurance Plans:

- Short-term coverage

- Covers emergency medical expenses

- No coverage for routine medical visits or pre-existing medical conditions unless specified

Regular Health Insurance: The Long-Term Safety Net

Regular Health Insurance, on the other hand, targets residents and citizens of Canada. It has a better scope of coverage and is usually designed to give long-term coverage. This insurance will, therefore, cover a wide spectrum of health services, including routine doctor visits, preventive health care, or even ongoing treatment for chronic conditions. Regular Health Insurance greatly benefited one of our clients, Joy, who was a permanent resident when he was diagnosed with diabetes. All his ongoing treatments and regular check-ups were covered, which otherwise, without his insurance, would have been a big drain on the finances.

Key features of Regular Health Insurance:

- Long-term coverage

- Includes routine and preventive care

- Covers pre-existing medical conditions.

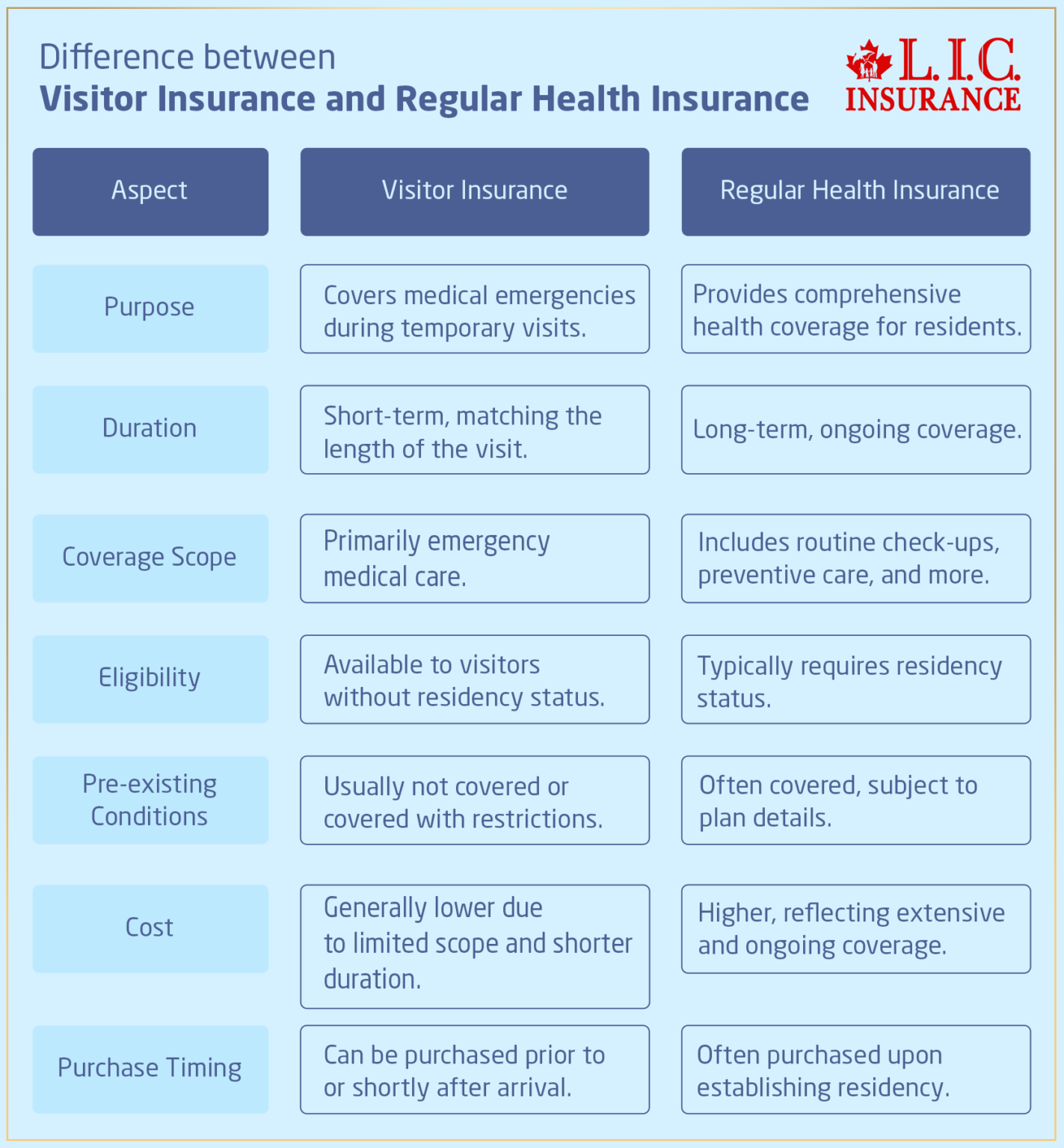

Decoding the Differences between Visitor Insurance and Regular Health Insurance

Any person who wants to visit this beautiful land of Canada needs to learn the differences between Visitor Insurance and Regular Health Insurance. Both forms of insurance have their purposes, which are quite significant in their own ways but different with respect to different needs and circumstances. We’ll break down the primary differences that will help you choose the right kind of coverage for your stay.

Purpose of Insurance

- Visitor Insurance: Designed specifically for travellers and short-term visitors to Canada, this insurance covers medical emergencies that occur during your stay. It’s ideal for tourists, temporary workers, or those visiting family.

- Regular Health Insurance: Intended for residents or citizens of Canada, this insurance provides comprehensive coverage that includes routine doctor visits, preventive care, and ongoing treatments for existing health conditions.

Coverage Duration

- Visitor Insurance: This is a short-term solution tailored to the duration of your visit, which can be anywhere from a few days up to a year, depending on the policy.

- Regular Health Insurance: Offers long-term, ongoing coverage that continues as long as you are enrolled in the plan and are paying the premiums.

Scope of Coverage

- Visitor Insurance: Focuses primarily on emergency medical services such as accidents, sudden illnesses, and urgent care. It generally does not cover routine medical appointments or preventive health services unless specified.

- Regular Health Insurance: Covers a broader range of health services, including regular check-ups, prescription medications, mental health services, and more comprehensive management of chronic diseases.

Eligibility Criteria

- Visitor Insurance: This insurance is available to any non-resident or visitor without the need for a medical examination, though pre-existing conditions are typically not covered or are covered with restrictions.

- Regular Health Insurance: Usually requires you to be a resident or citizen. You might also need to undergo a waiting period if you are a new resident in Canada.

Cost of Premiums

- Visitor Insurance: The cost is generally lower than Regular Health Insurance due to the shorter coverage period and limited scope. Premiums are influenced by the length of stay and the amount of coverage.

- Regular Health Insurance: Premiums can be higher but are offset by the extensive coverage provided. Costs can vary based on factors like age, health status, and the chosen level of coverage.

Claims Process

- Visitor Insurance: Claims must be made for each incident, and the process is typically straightforward, focusing on reimbursement for acute medical treatments.

- Regular Health Insurance: Often involves co-pays and deductibles as part of the ongoing health management process, with the possibility of direct billing between the insurance company and insurers.

It is only by realizing these prime differences that you will be able to decide on what type of insurance best suits your needs while coming to Canada. Be it for a short visit or the desire to settle down here forever, knowing exactly what benefits are offered ensures an adequate insurance policy.

Decoding the Differences with Real-Life Stories

The main difference between Visitor Insurance and Regular Health Insurance lies in the scope and duration of coverage. Visitor Insurance is temporary, focusing on emergencies, whereas Regular Health Insurance is comprehensive and ongoing. We often encounter clients like Ahmed, who initially purchased Visitor Insurance, thinking it would cover his regular health check-ups. Stories like his emphasize the need for clear communication and understanding when choosing a plan.

Choosing the Right Plan: Tips from Experts

While seeking to navigate the world of insurance in Canada, one easily becomes overwhelmed with regard to what to go for: Visitor Insurance or just Regular Health Insurance. Following are some expert tips from our daily interactions at Canadian LIC that will help you make a better decision:

Assess Your Status and Needs

- Visitor or Resident? Identify if you’re a visitor or a resident. Visitor Insurance is ideal if you’re in Canada temporarily. For residents or those planning to immigrate, Regular Health Insurance is more suitable.

- Example: A client, Tigmanshu, initially needed clarification about which insurance to choose and realized through consultation with our Visitor Insurance agents that since he was only in Canada on a six-month work project, Visitor Insurance was the appropriate choice.

Understand the Coverage Duration

- Short-term vs. Long-term: Visitor Insurance typically covers you for the duration of your visit, while Regular Health Insurance provides long-term coverage.

Example: Emeena, on a tourist visit to Canada, opted for Visitor Insurance that covered her for three weeks. This decision was crucial when she unexpectedly needed medical care for a minor accident, highlighting the importance of choosing the right duration of coverage.

Identify the Scope of Coverage

- Emergency vs. Comprehensive: Determine if you need coverage just for emergencies or more comprehensive health care. Visitor Insurance Plans usually focus on emergencies, whereas Regular Health Insurance covers a broader range of health services.

- Example: When our client Rajeshwar needed an emergency appendectomy, his Visitor Insurance covered the costs, saving him from a hefty medical bill. This situation underlines the importance of having the right emergency coverage when away from home.

Get a Customized Visitor Insurance Quote

- Tailored to Your Needs: Utilize platforms like Canadian LIC to get a personalized Visitor Insurance Quote. Our Visitor Insurance agents specialize in customizing plans to fit individual circumstances without adding unnecessary extras.

- Example: Lara, who planned a skiing trip to Canada, worked with one of our agents to include coverage for sports-related injuries, which proved beneficial when she had a minor fall on the slopes.

Consult with Expert Visitor Insurance Agents

- Professional Advice: Speak with a professional Visitor Insurance broker who can guide you through the process and explain the nuances of different policies.

- Example: Mario, overwhelmed by the various options, found clarity after a consultation with our agents, who helped him understand the specific benefits of each Visitor Insurance Plan, leading to a well-informed decision.

Review and Compare Plans Thoroughly

- Compare Options: Don’t settle on the first plan you come across. Compare different Visitor Insurance Plans to find one that offers the best value and coverage for your specific needs.

- Example: Saba compared several plans with the assistance of Canadian LIC and chose one that offered the best coverage for her chronic condition at an affordable rate.

Read Reviews and Testimonials

- Learn from Others: Check reviews and testimonials about different Visitor Insurance Companies Canada and plans. Learning from other people’s experiences can provide insights into how claims are handled and customer service responsiveness.

- Example: After reading positive reviews about our swift claim handling, Jenny felt confident in choosing a Visitor Insurance Plan from Canadian LIC for her parents, who were visiting from abroad.

Choosing the right insurance plan for Canada does not need to be a single-handed job. Our group at Canadian LIC will help you understand every step so that you are sure about your options and choose one that will put your mind at rest for the duration of your stay in Canada. From emergency coverage to comprehensive plans, expert-led Visitor Insurance agents dedicated to serving you will help you get the kind of coverage you want. Reach out for a personalized Visitor Insurance Quote today and start your journey across Canada with confidence!

Summing It All Up

More on Visitor Insurance

- Does Visitor Insurance include coverage for mental health services?

- Can family members visiting together receive a group discount on Visitor Insurance?

- Are there age limits for buying Visitor Insurance?

- What documents are required to purchase Visitor Insurance?

- How is a claim filed under Visitor Insurance?

- Is it possible to extend Visitor Insurance if I choose to prolong my stay?

- Which Visitor Insurance Plan is recommended?

- Is acquiring Visitor Insurance a mandatory requirement?

- Are Visitor Insurance and travel insurance the same thing?

- Is it possible to obtain Visitor Insurance if I have pre-existing medical conditions?

- Can I purchase Visitor Insurance after I’ve already arrived in Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs)

Getting Visitor Insurance Quotes Online from Canadian LIC is easy and hassle-free. All one needs to do is log on to our website and fill in the basic form with one’s travel details. An agent from Visitor Insurance will give a personalized quote. The quote, of course, would mean coverage options that would be attuned to your particular needs for your stay in Canada. For instance, we could help George from Brazil a lot when he was looking for an economic plan to support a 2-month culinary tour and needed full coverage against all possible medical issues without overpaying.

While considering Visitor Insurance Plans, make sure to examine the kind of medical emergencies that are covered. Check the coverage limits, exclusions, and whether the plan pays for any pre-existing condition. We would recommend discussing this with our Visitor Insurance agents, who will walk you through the details and ensure that your exact needs are included in the plan. For instance, our consultation was of great value to Sarla as she sought a plan that would certainly cover her emergency surgeries, which she would require during her attempt to do adventure sports during her stay.

The choice between visitor and Regular Health Insurance is linked to your status in Canada, whether you are a visitor or a resident, among other matters relating to your health coverage. This clearly tells you that Visitor Insurance is ideal for short visits and only caters to emergencies, while Regular Health Insurance is comprehensive in nature and suitable for long-time residents who have uninterrupted health care needs. For instance, our client Tanmay, being a temporary worker, had Visitor Insurance but switched to Regular Health Insurance when he became a permanent resident.

Absolutely! Our Visitor Insurance agents specialize in tailoring insurance plans to your particular health requirements. You should, therefore, inform our agents if you have any special health needs. They are experienced in tailoring plans covering a wide array of health conditions and treatments, just like they did with Mei, who wanted to get coverage for her asthma medication during her three-month stay in Canada.

The coverage can start as early as the next day, although common times of activation vary depending on different Visitor Insurance Policies. For maximum protection, though, the best option is to buy Visitor Insurance before coming to Canada. Our client Alex did just that and activated his plan immediately upon his arrival, which luckily proved to be a good thing since he had a medical emergency on his very first day.

If you need to extend Visitor Insurance, kindly extend it before your current Visitor Insurance Policy expires. While extensions are almost always possible, extension requests should be handled promptly in order to avoid lapses in coverage. Last year, when Emma needed to extend her stay due to unforeseen circumstances, we quickly adjusted her coverage to ensure she remained protected.

Yes, we have family and group discounts if people buy Visitor Insurance Plans together. This brings down the cost for everybody in the group. When the Nayyer family decided to have a reunion in Canada, they saved substantially by buying a group insurance plan through Canadian LIC.

Submitting a claim with Visitor Insurance is easy. Always retain the receipts and other relevant documents for your emergency medical treatment. Then, get in touch with one of our Visitor Insurance agents, who will walk you through the process of submitting the claim. For example, recently, our client, Linda, was admitted to the hospital for an unexpected surgical procedure and had to file a claim; one of our agents walked her through the proper documentation so that her claim was processed efficiently, and she got her money back on time.

Coverage for pre-existing conditions varies by plan. Some will partially or conditionally cover pre-existing conditions; others exclude them altogether. On this note, it is very important to discuss any medical history with one of our Visitor Insurance agents, who will help you pick out the plan that best fits your needs. Well, as in the case of Robert—a man who had some record of hypertension—our agents found a plan partially covering his condition to put him at ease during such trips.

In case of an early return home, Visitor Medical Coverage can be cancelled. Most of the plans will refund the money proportionately to the remaining duration minus any claims made. Cancel by contacting us with your policy details and proof of early departure, and activation will be done. Our client Sofia returned two weeks early last year, and with our assistance, she was able to cancel the coverage and get an appropriate refund.

This will necessitate you taking time to analyze the level of your medical requirements as well as the probable risks during your stay in Canada. In order for you to get the right level of coverage, our Visitor Insurance agents will assist you in analyzing your situation so they can suggest the appropriate coverage limits that will ensure you have protection in full. For instance, when the Chen family visited Canada for a skiing holiday, we recommended a higher coverage limit due to the increased risk of sports-related injuries, which they found invaluable after a minor skiing accident.

Visitor Insurance costs are generally the same whether you buy it from an agent or online, but purchasing through an agent like those at Canadian LIC can provide added value through personalized service and tailored advice. Our client, Jonas, appreciated the personalized attention he received, which helped him understand the nuances of his coverage options better than when he tried to compare plans online.

Review your visitor’s insurance plan annually or with any change in your travel plans. The review ensures that your current coverage is suitable for your needs and any new regulations. There was an annual review that aided our client Miguel in realizing additional coverage was necessary since he was going to stay longer in Canada. Secondly, he had increased his travel to many places across Canada.

We hope that you now feel a little more enlightened and confident in choosing the right insurance coverage for your visit to Canada, as we have now answered these typical questions with some vivid examples from our everyday lives at Canadian LIC. Our team is here to help you with everything possible so that your stay in Canada is safe and without any worries.

About the Author: Harpreet Puri

Harpreet Puri stands as a distinguished Insurance Adviser and MDRT qualifier, bringing nearly a decade of steadfast expertise to the field. Recognized as one of the top Insurance Brokers in the Greater Toronto Area, Ontario, Harpreet’s deep understanding of insurance formalities and legalities ensures that clients receive the most accurate and effective insurance advice. With a proven track record in navigating the complexities of various insurance products, Harpreet excels in providing tailored insurance solutions that cater to individual needs. Specializing in Super Visa Insurance and Life Insurance, Harpreet’s guidance is invaluable for anyone seeking knowledgeable and efficient insurance planning. Choosing Harpreet as your Insurance Adviser guarantees not only expert advice but also the highest standard of service to meet your insurance needs.

Sources and Further Reading

To deepen your understanding of visitor and Regular Health Insurance in Canada, consider exploring the following resources:

- Government of Canada – Health Insurance: Learn about health coverage options and eligibility requirements in Canada from the official government portal. Health Canada

- Canadian Life and Health Insurance Association (CLHIA): Access detailed guides and reports on various types of insurance available in Canada, including visitor and Regular Health Insurance. CLHIA

- Insurance Bureau of Canada: Offers comprehensive information on insurance products, including tips on choosing the right insurance plan and understanding your policy. Insurance Bureau of Canada

- Immigration, Refugees and Citizenship Canada (IRCC): Provides insights into Health Insurance requirements for newcomers and visitors to Canada. IRCC

- Canadian Healthcare Association: Find publications and resources that explain the healthcare system in Canada, helping you understand how Health Insurance integrates with national and provincial health services. Canadian Healthcare Association

These resources offer reliable and comprehensive information that can help you make informed decisions about Health Insurance in Canada, whether you’re a visitor or planning to settle in the country.

Key Takeaways

- Visitor Insurance is for short-term, emergency coverage; Regular Health Insurance offers comprehensive, long-term care

- Consider your status (visitor or resident), length of stay, and health service needs before choosing a plan.

- Visitor Insurance typically excludes routine and pre-existing conditions, focusing on emergencies.

- Visitor Insurance is generally cheaper than Regular Health Insurance due to its limited scope.

- Consulting with knowledgeable insurance agents ensures your plan meets your specific needs.

- Visitor Insurance Plans can be adjusted or extended to accommodate changes in travel plans.

- Know Canadian immigration laws regarding insurance, especially for visitors needing proof upon entry.

Your Feedback Is Very Important To Us

We appreciate your participation in understanding the challenges and struggles different communities in Canada face regarding the uptake of Registered Education Savings Plans (RESPs). Your feedback will help improve our services and outreach efforts. Please select the appropriate options for the following questions:

Thank you for your time and valuable insights! Your responses will help us better tailor our services to meet the needs of those navigating the complexities of insurance in Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]