- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

What Is the Difference Between Term Insurance and Group Term Insurance?

What is Term Life Insurance?

What is Group Term Insurance?

How Term Life Insurance and Group Term Insurance Differ

Benefits of Term Life Insurance

Benefits of Group Term Insurance

Should You Opt for Term Life Insurance or Group Term Insurance?

When Term Life Insurance Makes Sense

When Group Term Insurance Fits

Finding the Right Balance

What Is The Difference Between Term Insurance And Group Term Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 12th, 2024

SUMMARY

Exploring life insurance options often leaves individuals confused between Term Life Insurance and Group Term Insurance. This is because the two share similar benefits but are used differently. It can be quite confusing when trying to determine which one to get, especially considering affordability, coverage, and long-term value. Through Canadian LIC’s experience as one of the best Term Life Insurance Brokers, we have seen people and families struggle with what best aligns with their individual needs. Let’s dissect this topic and help you make an informed decision.

What is Term Life Insurance?

This kind of insurance covers one individual for a term, and the length of the period often varies between 10 and 50 years. The death benefit is usually payable upon death during the policy period. This type of insurance is widely known for its affordability and flexibility.

- Adjustable Term: You can choose the duration that suits your economic needs, extended enough to pay off your mortgage or your children’s college fees.

- Affordability: Their premiums are relatively cheaper than Permanent Insurance forms.

- Individual Ownership: The policyholder retains all individual ownership rights of the policy and its terms.

A client, a young father, approached us when he realized he needed financial security for his family if something untoward happened. He desired robust protection, but the worry of cost was a constraint. A specially tailored Term Life Insurance Policy brought him comfort without stretching his budget.

What is Group Term Insurance?

On the other hand, Group Term Insurance is commonly offered by employers as a fringe benefit. The policy gives life insurance protection to a group of individuals under a single contract. It’s convenient and cheap for the employees but needs to be more flexible.

- Limited Customization: Coverage amounts and terms are predetermined by the employer or group administrator.

- Lower Costs or Free Coverage: Employees often pay little or nothing for basic coverage.

- Tied to Employment: The coverage ends or becomes more expensive if you leave the organization.

A Canadian LIC client once recalls being frustrated when leaving one job that had Group Term Insurance. He realized after leaving the job that there was no life insurance coverage any longer, and he had to start from scratch with his personal policy. This is one major drawback of relying solely on Group Term Insurance.

How Term Life Insurance and Group Term Insurance Differ

- Term Life Insurance: You own the policy, and it stays with you regardless of changes in employment or life circumstances.

- Group Term Insurance: Coverage is tied to your employment. Leaving your job typically results in the loss of coverage.

Many clients have approached Canadian LIC seeking guidance after losing their Group Coverage. We can’t emphasize enough the importance of having their own personal Term Life Insurance Policy to ensure continuous protection.

- Term Life Insurance: Allows for higher coverage amounts based on your financial needs. You can purchase a Term Life Insurance Policy that covers everything from mortgage payments to your children’s future education expenses.

- Group Term Insurance: Coverage is usually limited and may not be enough for significant financial obligations.

- Term Life Insurance: Premiums are based on factors such as age, health, and term length. While it may cost more than group insurance initially, it offers comprehensive coverage tailored to your needs.

- Group Term Insurance: Typically cheaper or even free, but the coverage is often minimal.

A middle-aged woman from Canada learned it the hard way when her group insurance could not cover her family’s expenses after her sudden sickness. Later, she enriched it by purchasing an individual life insurance policy.

- Term Life Insurance: You can select your term, coverage amount, and even riders like Critical Illness Coverage to go along with it.

- Group Term Insurance: Very little flexibility because the employer determines the terms.

Benefits of Term Life Insurance

Term Life Insurance is a good option for those seeking full and customizable coverage. Here’s why:

- Long-Term Value: Locking in low premiums early in the game provides you with consistent coverage in the long term.

- Flexible Coverage Ideal for life stages: Paying off a mortgage, raising children, or saving for a spouse’s retirement.

- Supplemental Options: Riders can include benefits such as disability or accidental death coverage.

Canadian LIC has helped many clients get Term Life Insurance Quotes Online that meet their budgets and goals. The process is, therefore, easy and stress-free.

Benefits of Group Term Insurance

Group Life Insurance Coverage is an attractive option for short-term needs or as supplemental coverage:

- Cost-Effective: It is free or at least heavily subsidized by employers.

- Convenient Enrollment: Typically, no medical underwriting is required, making the policy accessible to people with pre-existing conditions.

- Short-Term Security: Suitable for young professionals who start working immediately.

But, obviously, relying solely on group coverage becomes quite difficult, which many clients know the hard way when they change jobs or retire.

Should You Opt for Term Life Insurance or Group Term Insurance?

This is another very important decision: Term Insurance versus Group Term Insurance. It’s really all dependent on your current situation, financial goals, and plans for the future. Both of these products serve a purpose, but knowing when one makes sense over the other is vital. So let’s get down to details so you can decide.

When Term Life Insurance Makes Sense

You can have a Term Life Insurance Policy for 10, 20, or even 30 years. This would be great for people who take responsibility for long-term financial obligations, such as mortgages or dependent care. With Group Term Insurance, once you leave your job, your group insurance usually ends; personal Term Life Insurance stays with you, providing uninterrupted coverage no matter where life takes you.

For example, a young couple with toddlers sought the help of a Canadian LIC when they decided they needed an uncompromising safety net to stay strong with their careers and lifestyles. They turned to Term Life Insurance Brokers and established a tailored plan in conjunction with their goals.

Life is uncertain, and big-ticket purchases such as home mortgages, education, and retirement are huge liabilities that require massive coverage. Group Term Life Insurance typically does not adequately address these needs since it is limited to a fraction of the actual need, which may be a gaping hole for families.

It is this gap that Term Life Insurance bridges. Through Canadian LIC, you can obtain Term Life Insurance Quotes Online that will give you adequate coverage to protect your family’s financial security. It is a proactive approach toward ensuring that your loved ones do not have to face any unnecessary financial burdens in your absence.

An individual investment in Term Life Insurance empowers you to customize your plan to fit your unique circumstances. From the coverage to its add-ons, such as the riders for Critical Illness or accidental death benefits to enhance benefits in case of untimely death, are left entirely to your choices. Group Term Insurance cannot enjoy much flexibility since the conditions of the policy are standardized by an employer.

Canadian LIC has helped clients modify policies to reflect their changing circumstances, from adding coverage upon starting a family to altering terms to meet retirement goals. With control over your policy, it works for you, not the other way around.

When Group Term Insurance Fits

This form of term insurance works quite well as additional coverage. Most clients use it as supplemental to their existing Term Life Insurance Policy, therefore making overall coverage with minimal or no additional costs. It’s an effective way to improve financial security, especially when your employer pays for part or the entire premium.

For example, a young professional working in a tech company approached Canadian LIC to explore Term Life Insurance Brokers for a primary policy. With expert guidance, they combined a robust personal policy with their employer’s group term coverage, creating a comprehensive safety net that covered immediate and long-term needs.

Group Term Insurance is suitable for people in the early stages of their careers or lives. If you are young, single, and have no dependents, then the basic coverage that your employer provides may be all you need at this time. It is usually a low-cost or free benefit that gives you peace of mind while you get your financial footing.

However, as lives change—due to marriage, children, or a home purchase, limitations of group coverage become apparent. Many Canadian LIC clients found themselves moving into individualized coverage after realizing what was missing from their employer’s plan.

Finding the Right Balance

For the average person, the best choice is neither Term Life Insurance nor Group Term Insurance, but rather learning how these two may work in tandem with each other. A Term Life Insurance investment provides the foundation for long-term financial security, while Group Term Insurance acts as a useful supplement.

This simplifies the process since Canadian LIC offers tailored advice and online Term Life Insurance quotes. Whether you’re looking for basic coverage or just need more protection, our experienced Term Life Insurance Brokers are here to help with your customized plan.

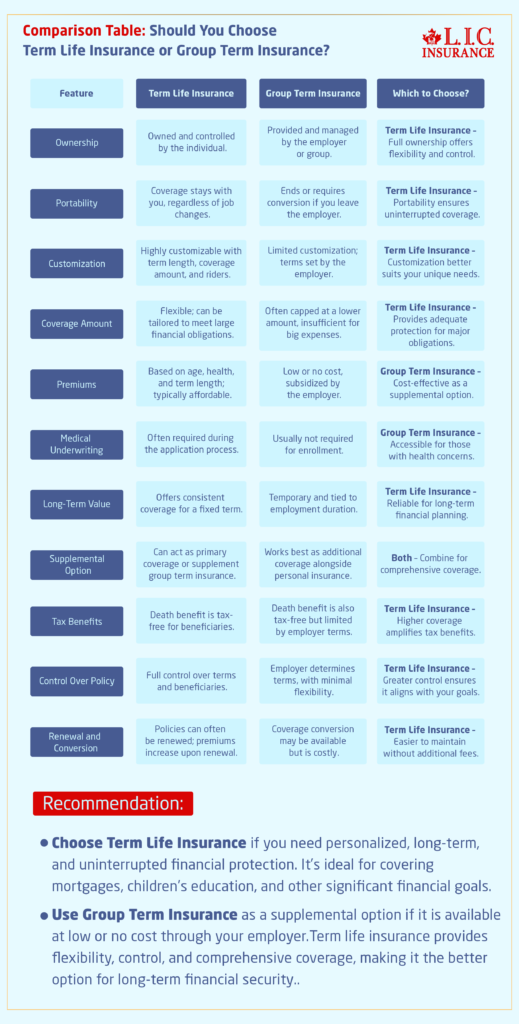

Comparison Table: Should You Choose Term Life Insurance or Group Term Insurance?

Recommendation:

- Choose Term Life Insurance if you need personalized, long-term, and uninterrupted financial protection. It’s ideal for covering mortgages, children’s education, and other significant financial goals.

- Use Group Term Insurance as a supplemental option if it is available at low or no cost through your employer.

Term life insurance provides flexibility, control, and comprehensive coverage, making it the better option for long-term financial security.

Why Canadian LIC Recommends Term Life Insurance

Canadian LIC has catered to thousands of clients by providing them with customized life insurance solutions. Group Term Insurance can be a useful starting point, but it is rarely adequate for long-term family and individual needs. A Term Life Insurance investment offers flexibility, control, and peace of mind.

In accessing Term Life Insurance Brokers from Canadian LIC it ensures the following benefits to clients:

- Expert advice on policy customization.

- Best online Term Life Insurance quotes.

- Ongoing support to adapt policies as needs change.

How to Get Started

Choosing the right insurance doesn’t have to be overwhelming. Canadian LIC has a simplified process that helps you compare options and then select a policy accordingly.

- Assess Your Needs: Your financial goals, dependents, and long-term obligations.

- Compare Quotes: Utilize the Canadian LIC’s system to find the best online Term Life Insurance quotes.

- Speak to a Specialist: Canadian LIC brokers can be reached to assist you at all stages.

Realizing the True Value of Term Life Insurance

Ultimately, it will depend upon your individual needs. Group Term Insurance may be a convenient place to keep money in case there is an emergency, though often, this is not substantial enough to be considered broad protection. A Term Life Insurance Policy tailored to individual needs will ensure that money will be available to any family in the event of unexpected loss.

With Canadian LIC being the best insurance brokerage in partnership with you, it provides the expertise and tools for making a confident decision. Be it a novice or looking to enhance your coverage, Canadian LIC has your back.

More on Term Life Insurance

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About Term Life Insurance and Group Term Insurance

Term Life Insurance is a personally owned and individually controlled product that allows customized coverage in terms of your individual goals. Group Term Insurance is usually available from an employer and provides coverage under a group policy. Under a group term policy, you do not own the policy, and the insurance will stop at the point you leave your job. Indeed, most Canadian LIC customers prefer to invest their savings in individually owned Term Life Insurance as a more effective source of long-term financial protection.

A good place to start may be with Group Term Insurance, which typically provides minimal coverage. Employers usually limit the coverage, so a larger policy is needed for substantial financial commitments, such as paying for a house or educating children. In fact, clients at Canadian LIC usually use a personal Term Life Insurance Policy to top off the group coverage and thereby secure their overall finances.

Term Life Insurance is normally more expensive than group insurance because it offers personalized coverage. However, it remains a cheap form of long-term protection compared to other insurance products. Using Term Life Insurance Brokers, you can get competitive quotes for Term Life Insurance online that suit your budget and needs.

Group Term Insurance typically laps when you change jobs. There is sometimes an option for an employer to convert coverage into individual Term Life Insurance. But the premiums are often higher. Many Canadians in this situation learned too late about the value of holding their own Term Life Insurance.

You sure can. Many of our clients utilize group term coverage as an adjunct benefit with a personal term life as the core coverage; doing both offer comprehensive coverage for sure. Canadian LIC was an invaluable source of assistance for a client who wanted to combine both choices, effectively making the term life coverage more formidable as a diversified term life investment.

This is an amount based on the individual’s debt obligations, future expenses, and income replacement. Here at Canadian LIC, our Term Life Insurance Brokers can assist in making the calculations for this factor while searching online for the best Term Life Insurance quotes that match one’s needs.

Even if your Group Term Insurance is free, it may not be sufficient to cover all your financial obligations. Personal Term Life Insurance coverage ensures uninterrupted protection as needed by your family. Many clients of Canadian LIC take extra cover under group insurance but, for comprehensive protection, rely on personal policies.

It’s extremely flexible. You can specify how long you need to buy a policy and how much coverage you want, and you can add riders for additional features, such as Critical Illness or accidental death benefits. Canadian LIC helps its clients construct unique, time-adjusting term life investments.

Yes, you can. However, the premiums will be higher based on the health condition. However, Canadian LIC has worked with clients in different health conditions to find the right policies.

Getting started is easy as you determine your need for life insurance, research quotes online for Term Life Insurance, and speak to an experienced broker. Our brokers walk each step of the way for you as you pick the right policy for your situation at Canadian LIC.

Getting started is easy as you determine your need for life insurance, research quotes online for Term Life Insurance, and speak to an experienced broker. Our brokers walk each step of the way for you as you pick the right policy for your situation at Canadian LIC.

Term Life Insurance covers the individual for a specified number of years. It may be for 10, 20, 30 or even 50 years. This is better placed to provide for short-term needs such as clearing mortgages or children’s education. Permanent Life Insurance will cover the life of an individual and provide cash value. In Canadian LIC, however, most clients opt for Term Life Insurance due to its low price and clear-cut structuring.

Yes, most Term Life Insurance Policies provide renewability. Premiums are, however, subject to increase by your age at renewal. Most Canadian LIC clients in Canada assess their financial position and check quotes online for cheaper term life cover towards the end of the policy term.

Most term insurance is offered by an employer, association, or union through a benefits package. It isn’t an option if you are self-employed or work for a small business and do not have group benefits. Canadian LIC assists such clients without group benefits in finding a personal policy through trusted Term Life Insurance Brokers.

You should select a term length consistent with your payment obligations. For example, if you have 20 years on your mortgage, a term of that length is great. A common recommendation from Canadian LIC brokers is to match Term Life Insurance Investments to significant, long-term financial goals.

Group Term Insurance has few customization options. It is usually determined by the employer in terms of coverage amount and terms. There is not much scope for changes. For greater flexibility, a personal Term Life Insurance Policy is more suitable. Many Canadian LIC clients opt for both types for maximum coverage.

Yes, Term Life Insurance Policies often allow you to add riders for additional benefits. Popular options include Critical Illness, waiver of premium, and accidental death benefits. At Canadian LIC, our brokers help clients enhance their policies to cover unexpected scenarios.

It is important to maintain an updated policy that keeps the details of accurate beneficiaries up-to-date and, most importantly, shows your family all the necessary papers. Canadian LIC brokers assist clients in maintaining their Term Life Insurance Policy so they can receive benefits smoothly.

It’s tax-free in Canada when the beneficiaries receive Term Life Insurance. This makes it an even more effective instrument in securing your family’s financial future. This is considered very important by most Canadian LIC clients who have Term Life Insurance in Canada.

Indeed, you may change at any time. A number of Canadian LIC customers opt for Personal Term Life Cover once they have an idea that the Group Cover has some limits. Our brokers guide the client in comparing quotes online for the best Term Life Cover.

Look for their experience, transparency, and broad-based access to various insurance providers. Canadian LIC brokers have a long history of working with clients to find personalized Term Life Insurance Investments to meet specific needs. Clarity and client satisfaction characterize every transaction.

Of course, Term Life Insurance is highly relevant in estate planning. The death benefit will provide for the payment of taxes, other debts, and other final expenses to make sure the family assets stay intact. Canadian LIC is often helpful in integrating term policies into the client’s overall financial plan.

When comparing prices, look for premium rates, coverage limits, term length, and flexibility in terms of policy types. Canadian LIC offers easy access to finding and comparing reliable Term Life Insurance quotes, making it straightforward to choose what is best for any situation.

Sources and Further Reading

- Group Term Life Insurance Policies – Employer-Paid Premiums

The Canada Revenue Agency outlines the tax implications and operational details of employer-paid Group Term Life Insurance Policies in Canada.

Canada.ca - Group Life Insurance in Canada: How It Works, Benefits & More

This resource explains the mechanics of group life insurance in Canada, including its benefits and limitations.

Savvy New Canadians - Understanding Employer’s Group Term Life Insurance and Individual Term Insurance

TD Insurance offers insights into the differences between employer-provided Group Term Life Insurance and individual Term Life Insurance, helping you make an informed choice.

TD Insurance - Group Term Life Insurance: What You Should Know

Dundas Life discusses the essentials of Group Term Life Insurance, including how it works and its role within employee benefit packages.

Dundas Life

Key Takeaways

- Term Life Insurance Offers Individual Control: A Term Life Insurance Policy is owned and controlled by you, providing customizable coverage tailored to your financial needs.

- Group Term Insurance Is Employer-Provided: Group Term Insurance is tied to your job and often ends when you leave your employer, making it less reliable for long-term protection.

- Coverage Amounts Differ: Term Life Insurance can provide higher coverage amounts, while Group Term Insurance often has limited benefits that may not cover major financial obligations.

- Cost and Premiums: Term Life Insurance premiums are based on your age, health, and coverage, while Group Term Insurance is often subsidized by employers or free.

- Supplemental Coverage Is Beneficial: Many people use Group Term Insurance as supplemental coverage and rely on Term Life Insurance Investments for primary, long-term security.

- Portability Matters: Term Life Insurance stays with you regardless of job changes, whereas Group Term Insurance coverage is non-transferable.

- Customizable Options in Term Insurance: Term Life Insurance Policies offer flexibility with riders, such as critical illness coverage, which is not available with Group Term Insurance.

- Combining Both Can Maximize Benefits: Using Group Term Insurance alongside a personal Term Life Insurance Policy can create a comprehensive financial safety net.

- Canadian LIC Simplifies the Process: Experienced brokers at Canadian LIC help clients find personalized Term Life Insurance Quotes Online, tailored to their unique needs and goals.

- Long-Term Reliability: Term Life Insurance is a dependable investment for protecting your family’s financial future, even as life circumstances change.

Your Feedback Is Very Important To Us

We value your feedback! Please take a few moments to share your experience and struggles related to understanding the differences between Term Life Insurance and Group Term Insurance. Your insights will help us provide better solutions for your insurance needs.

Thank you for your valuable input! If you have any additional comments or suggestions, please share them below:

We will use your responses to improve our services and provide better support in addressing your insurance needs.

IN THIS ARTICLE

- What Is the Difference Between Term Insurance and Group Term Insurance?

- What is Term Life Insurance?

- What is Group Term Insurance?

- How Term Life Insurance and Group Term Insurance Differ

- Benefits of Term Life Insurance

- Benefits of Group Term Insurance

- Should You Opt for Term Life Insurance or Group Term Insurance?

- When Term Life Insurance Makes Sense

- When Group Term Insurance Fits

- Finding the Right Balance