- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Why This Topic is Important for Canadian Seniors

- Why Term Life Insurance is Important for Seniors Over 70

- Factors That Affect Term Life Insurance Rates for Seniors

- How to Find the Cheapest Term Life Insurance for Seniors Over 70

- The Application Process for Seniors

- Why Work With Canadian LIC?

- Conclusion: Why Canadian Seniors Should Act Now

- More on Term Life Insurance

- FAQs About the Cheapest Term Life Insurance for Seniors Over 70 in Canada

- Sources and Further Reading

- Key Takeaways

- Your Feedback Is Very Important To Us

What Is the Cheapest Term Life Insurance for Seniors Over 70?

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 18th, 2024

SUMMARY

In securing relatively cheap Term Life Insurance, seniors in Canada who are 70 years old and older seem to be fighting a losing battle. The older one gets, the higher the premiums and the more restrictive the policy, not to mention the lingering presence of various medical conditions often haunting seniors as part of the natural aging process. Very often for Canadian seniors, the question arises of whether the elderly person can still find relatively affordable Term Life Insurance. The short answer is yes, and we’re going to help you find the most affordable Life Insurance option for your specific needs.

Why This Topic is Important for Canadian Seniors

Basic need for Life Insurance: An individual’s basic need for Life Insurance increases as he ages. While ensuring that loved ones do not bear the burden of final expenses or pay off remaining debts, leaving a financial cushion for family members to fall back on is equally imperative. Life Insurance can indeed be quite integral to your financial plan. However, most believe that cheap Term Life Insurance Plans are off-limits to seniors over 70 due to either their age or health-related issues. Not necessarily so.

Canadian seniors, especially those above the age of 70, often fear their premium cost or the complexity of the process involved in being insured at this stage of life. However, this blog will dispel such fears as a clear guide on how seniors above 70 years can find the cheapest Term Life Insurance without any compromise on coverage. We take this opportunity to learn through these ways how factors influence the rate of insurance, how to obtain reasonably priced policies, and why choosing the right brokerage, such as Canadian LIC, can make all the difference.

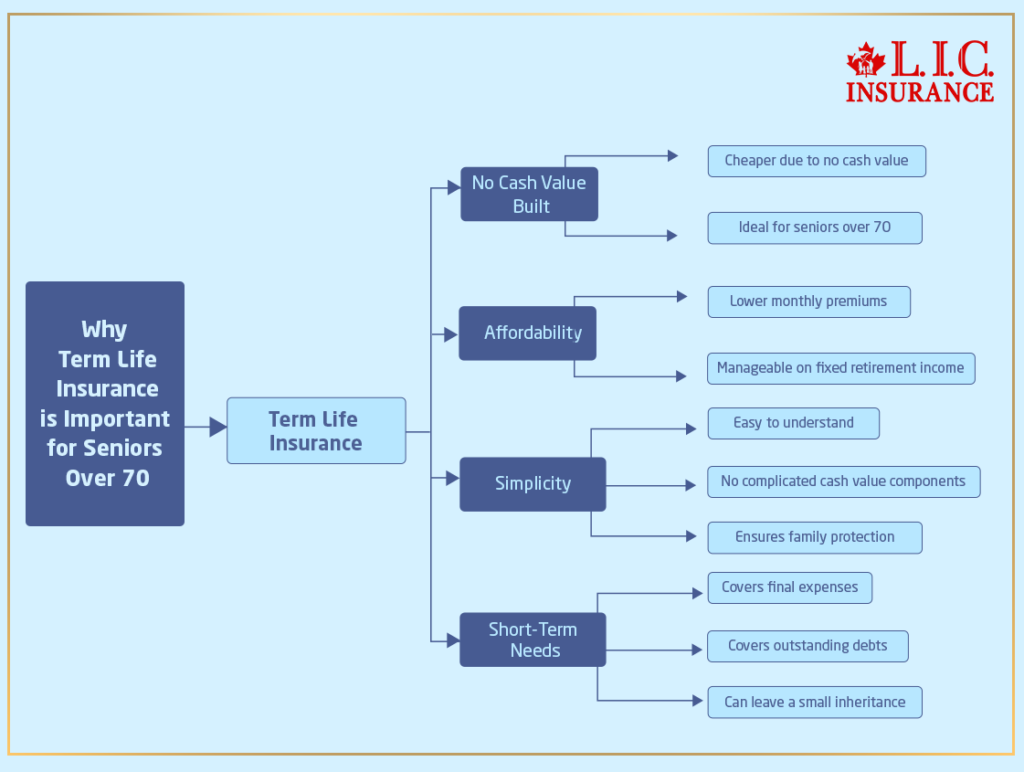

Why Term Life Insurance is Important for Seniors Over 70

The word Term Life Insurance provides an obvious method of ensuring that the elderly will have their loved ones taken care of after they are gone, which is not to be found in Whole Life Insurance Policy as it builds up cash value. Term Life Insurance is cheaper because it only covers a certain period, such as 10 to 50 years. For those older than 70, Term Life Insurance might be excellent because it has no cash value built and, therefore, may be less expensive.

- Affordability: Term Life Insurance tends to have lower monthly premiums compared to whole Life Insurance, making it more manageable on a fixed retirement income.

- Simplicity: Term Life Insurance is easy to understand. There are no complicated cash value components, making it a straightforward solution for seniors who just want to ensure their family is protected.

- Short-Term Needs: Many seniors don’t need a lifetime of coverage, but they may want coverage for the next decade or two to cover final expenses, outstanding debts or to leave a small inheritance.

While Term Life Insurance can provide valuable protection, finding affordable Term Life Insurance options becomes a bit more challenging as you grow older, especially after 70.

Factors That Affect Term Life Insurance Rates for Seniors

Multiple factors will determine the costs of Term Life Insurance for Seniors, mostly older clients. A senior can ponder applying for Life Insurance; however, it is not a simple task, and some preparation and research into these factors can help them get ready for this process and perhaps find cheaper options.

Age

Another important cost component of the policy is your age. Needless to say, the more mature you become, the higher you will pay because most Life Insurance companies perceive older people as having greater risks. Rates for those over 70 years old are sometimes higher, but there are affordable options, especially through a brokerage specializing in senior Life Insurance policies, like Canadian LIC.

Health Condition

Of course, the first and perhaps most critical determinant of Term Life Insurance premiums for seniors is general health. Insurers will look at your medical history, existing conditions, and whether you smoke or have previously smoked. All of these factors are known to produce higher premiums, but your health does not necessarily have to be a reason to keep you from applying. Despite health conditions, many seniors have been able to find cheap rates because many insurers specialize in coverage for people with health issues, and their various policies can be compared.

Coverage Amount

Again, the amount of coverage you require will also determine your premium prices. The more massive the death benefit you require, the more premiums you’ll pay. You’ve got to balance between how much coverage you want and what you can afford. Most people over 70 seek term policies that can be used to pay for a funeral or other final bills or opt for much smaller policies that may serve to pay off specific debts.

Policy Term Length

Policy term in years impacts the Life Insurance cost. Term Life Insurance is comparatively cheaper than Life Insurance permanently, and there is always a choice to get a policy for short terms, like 10 or 15 years, which is extremely cheap. Seniors don’t need policies for 30 years, so this brings down the cost. Canadian LIC can help seniors decide what term will be suitable for them in accordance with their coverage requirements and budget.

Insurance Broker vs. Direct Provider

Most seniors do not realize the enormous distinction working with an insurance broker, like Canadian LIC, can be. A brokerage, such as Canadian LIC, has access to multiple insurance providers and can shop these for you in order to determine the cheapest rates appropriate for your situation. Instead of going directly to a Life Insurance company, where the pricing of one provider limits you, brokers are allowed to shop the market on your behalf.

How to Find the Cheapest Term Life Insurance for Seniors Over 70

Finding low-cost Term Life Insurance as a senior is like looking for a needle in a haystack, but the right approach can help you find coverage without busting the bank. Here is how:

Work With a Specialized Insurance Brokerage

Extremely conversant with the exact challenges that seniors face while shopping for Term Life Insurance, Canadian LIC comes with vast experience in those challenges. You can take a specialized brokerage, which enables you to access several providers offering senior-friendly policies, thus upping your chances of getting affordable rates on policies that cut into your specific needs and health condition.

Compare Quotes Online

The most direct way to get cheap Term Life Insurance quotes is by comparing them online. Canadian LIC has an easy way to get quotes for Term Life Insurance where the customer can see possible different policy options, rates, and amounts of coverage without all the pressure. In return, this allows you to be fully informed so that you can make an accurate decision as regards which of them suits your needs.

Look for Policies With No Medical Exam

For seniors over the age of 70 who have been diagnosed with medical conditions, a policy that does not require a medical examination can be an excellent way to circumvent increases in premium charges. These kinds of policies, known as Simplified Issue Life Insurance, typically come with a slight premium increase from a fully underwritten policy, but they are a good option for those with diagnosed health conditions.

Consider Lower Coverage Amounts

This means that the death benefit opted for would be smaller. Many elderly seniors above 70 do not need huge policies but enough to clear final expenses or small debts. Choosing a lower coverage amount will keep your premiums affordable and help take care of the final interests of your loved ones.

The Application Process for Seniors

Applying for Term Life Insurance as a senior can feel overwhelming, but with the right support, it’s a straightforward process. Here’s a step-by-step guide to what you can expect:

- Initial Consultation: When you reach out to Canadian LIC, you’ll start with an initial consultation where an experienced agent will assess your needs, health condition, and budget.

- Comparing Quotes: Once your agent has a clear understanding of your needs, they will shop the market for the best Term Life Insurance policies available to seniors over 70. You’ll receive multiple quotes to compare.

- Choosing a Policy: After reviewing your options, you can choose the policy that offers the best balance between affordability and coverage. Canadian LIC’s agents will guide you through this decision.

- Application Process: For most seniors, the application process is simple. If you are applying for a policy with a medical exam, you may need to provide medical records or complete an exam. For no-medical-exam policies, the process is quicker, with approval often within a few days.

Why Work With Canadian LIC?

Canadian LIC is an insurance brokerage that partners with seniors to help them secure their financial future. Specialists with years of experience under their belt know the requirements of seniors very well and thus understand the often confusing world of Life Insurance. Seniors benefit when working with a brokerage such as Canadian LIC:

- Expert Guidance: Canadian LIC has agents who are experienced in helping seniors over 70 find the best Term Life Insurance policies for their needs.

- Access to Multiple Providers: Instead of being limited to one provider’s rates, Canadian LIC can access a network of insurance companies, helping you find the most affordable options.

- Tailored Solutions: Canadian LIC offers personalized advice to help you find a policy that fits your budget and coverage needs.

Conclusion: Why Canadian Seniors Should Act Now

Affordable Term Life Insurance for Seniors over 70 is not just a dream—it’s a reality. The key is understanding your options, comparing quotes, and working with a trusted brokerage like Canadian LIC. Acting now, the seniors can rest assured that their loved ones will be well taken care of financially once they are gone.

Don’t wait till it becomes too late. Be in contact with Canadian LIC, whereby you will find the cheapest Term Life Insurance for Seniors over 70 and finally take that first step toward securing your financial future.

More on Term Life Insurance

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

FAQs About the Cheapest Term Life Insurance for Seniors Over 70 in Canada

Yes, seniors over 70 can still get Term Life Insurance. Many Life Insurance companiesoffer plans specifically designed for older adults. Canadian LIC helps seniors over 70 find the best Term Life Insurance Plans by comparing multiple options from different providers. Seniors often think it’s too late, but our agents at Canadian LIC have helped many seniors secure affordable coverage even at this stage in life.

While premiums can be higher for seniors over 70, it’s still possible to find affordable Term Life Insurance. Factors like health, coverage amount, and term length all affect the price. At Canadian LIC, we often help seniors lower their costs by tailoring policies that meet their needs and budget. Comparing Term Life Insurance Quotes Online is a good first step to finding an affordable plan.

Most Term Life Insurance Plans for seniors over 70 offer terms ranging from 10 to 20 years. Shorter terms, like ten years, tend to be more affordable and practical for seniors who only need coverage for a specific period, such as paying off final expenses. Canadian LIC frequently assists seniors in choosing the right term length based on their financial goals.

It depends on the policy. Some Term Life Insurance Plans for seniors require a medical exam, while others offer simplified issue policies that do not. Simplified policies usually have higher premiums but are a great option for seniors with health concerns. Canadian LIC works closely with seniors to find Term Life Insurance Plans that fit their health status, whether or not a medical exam is needed.

Seniors over 70 can lower premiums by opting for a shorter term, reducing the coverage amount, or choosing a plan that doesn’t require a medical exam. Canadian LIC often advises seniors to compare multiple-Term Life Insurance Quotes Online to find the best rates. We help seniors balance their budget and coverage needs, ensuring they don’t overpay for unnecessary coverage.

A Term Life Insurance Plan is typically more affordable than Whole Life Insurance because it only covers a specific period. Seniors often don’t need lifetime coverage but prefer Term Life Insurance to cover things like funeral costs or remaining debts. At Canadian LIC, we help seniors understand the benefits of Term Life Insurance and ensure it meets their financial goals without paying for unnecessary lifetime coverage.

Yes, even seniors with health conditions can get Term Life Insurance. Some policies may require a higher premium, but there are options like no-medical-exam policies that simplify the process. Canadian LIC frequently helps seniors with various health conditions secure affordable coverage by finding plans that are tailored to their unique situation.

Getting Term Life Insurance Quotes Online is easy. You can visit Canadian LIC’s website, enter a few details about your age, health, and coverage needs, and you’ll receive multiple quotes from different providers. Our agents are always available to guide seniors through the process, making sure they understand each option and helping them pick the best plan for their needs.

The coverage amount depends on what you need the policy for. Many seniors over 70 choose Term Life Insurance to cover final expenses, such as funeral costs, which typically range between $10,000 and $20,000. Canadian LIC helps seniors determine the right coverage based on their financial situation and goals. We always recommend choosing a coverage amount that balances affordability with the necessary protection for your loved ones.

The application process for Term Life Insurance is simple. You can apply online or through an insurance broker like Canadian LIC. We guide seniors every step of the way, from comparing quotes to filling out forms and submitting any required health information. Our agents make sure the process is easy and stress-free, ensuring that seniors get the protection they need without hassle.

Yes, many insurers offer Term Life Insurance for Seniors over 75, although the options might be more limited. The premiums may be higher, but it is still possible to find coverage. Canadian LIC works closely with seniors over 75, helping them explore the best Term Life Insurance Plans available. We’ve helped many clients in this age group find policies that fit their needs and budget.

The approval time can vary depending on the insurance provider and whether a medical exam is required. Policies that require a medical exam may take a few weeks, while simplified issue policies can be approved within a few days. Canadian LIC helps seniors through the entire process, keeping them updated and informed so they know what to expect during each step of their application.

It depends on the type of policy you choose. Some Term Life Insurance Plans allow you to convert your policy to a permanent one or adjust the coverage amount, but this depends on the insurer’s terms. At Canadian LIC, we always recommend discussing your future needs with one of our agents so that we can guide you to a policy that offers flexibility if needed.

If you outlive your Term Life Insurance Coverage, the coverage simply ends, and there is no payout. Some seniors prefer this type of plan because it is more affordable, and they only need coverage for a set number of years. Canadian LIC often works with seniors who want coverage just for a specific period, such as covering final expenses or debts. We ensure they understand how the policy works and what happens at the end of the term.

When comparing Term Life Insurance Quotes Online, it’s important to look at more than just the price. You should consider the coverage amount, term length, and any special features like conversion options or no-medical-exam requirements. Canadian LIC helps seniors review all these aspects, ensuring they choose a policy that provides the best value for their needs.

In most cases, if you cancel your Term Life Insurance policy early, you won’t get a refund. However, some policies may include provisions for returning unused premiums. Canadian LIC advises seniors to carefully review their policy terms before making any changes. Our agents can help you understand the terms and assist you in making decisions that protect your financial interests.

Simplified issue Term Life Insurance doesn’t require a medical exam and is faster to apply for, but the premiums may be higher. Fully underwritten policies require a medical exam, but they often come with lower premiums. Canadian LIC helps seniors compare both options, offering guidance based on their health and budget so they can choose the best Term Life Insurance Plan for their situation.

Working with an insurance brokerage like Canadian LIC gives seniors access to multiple Term Life Insurance providers. This means you can compare quotes and policies easily, finding the best rates and coverage. We work directly with our senior clients to understand their needs, offering personalized support that helps them secure affordable Term Life Insurance Quotes Online without any hassle.

In Canada, the death benefit from a Term Life Insurance Plan is typically not taxable. This means your beneficiaries will receive the full amount of the coverage without worrying about taxes. At Canadian LIC, we explain all aspects of Term Life Insurance to our senior clients, ensuring they understand how the policy works, including any tax implications.

One of the biggest challenges seniors face is higher premiums due to age and potential health conditions. However, with the right support and comparison of options, many seniors over 70 can still find affordable Term Life Insurance. Canadian LIC sees this struggle with many clients, but we have a strong track record of helping seniors overcome these hurdles by finding policies that meet their specific needs at an affordable price.

These FAQs should guide you better in understanding how Term Life Insurance for Seniors over 70 works and how to get the right policy. If there are more questions that you need answers to, contact Canadian LIC’s agents and get their professional assistance in finding the best coverage options for your needs.

These FAQs cover the common concerns we hear from clients at Canadian LIC. Whether you’re starting a family, purchasing a home, or planning for the future, a Term Life Insurance Policy could be the right solution to protect your loved ones. Feel free to reach out to us for more personalized Term Life Insurance Quotes and advice.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

This resource offers valuable information on Life Insurance in Canada, including Term Life Insurance options for seniors.

https://www.clhia.ca - Insurance Bureau of Canada (IBC)

The IBC provides insights into different types of insurance policies and what seniors need to know when applying for Term Life Insurance.

https://www.ibc.ca - Government of Canada – Financial Consumer Agency of Canada

The official government website offers information on choosing Life Insurance, understanding premiums, and comparing quotes for seniors.

https://www.canada.ca/en/financial-consumer-agency.html - Term Life Insurance for Seniors – PolicyAdvisor

This article provides helpful comparisons and explanations about Term Life Insurance for Seniors, including tips for finding affordable coverage.

https://www.policyadvisor.com

Key Takeaways

- Term Life Insurance for Seniors over 70 is available – Seniors can still find affordable coverage despite higher premiums due to age and health.

- Factors affecting premiums include age, health condition, coverage amount, and policy term length, all of which impact the cost of the policy.

- Simplified issue policies are an option for seniors who want to avoid medical exams, though they may come with higher premiums.

- Comparing Term Life Insurance Quotes Online is a simple and effective way for seniors to find the most affordable coverage.

- Canadian LIC, an insurance brokerage, offers personalized guidance to help seniors find the right Term Life Insurance Plan by comparing multiple providers.

Your Feedback Is Very Important To Us

We would love to hear about your experience and challenges in finding affordable Term Life Insurance. Your feedback will help us improve our services to better assist seniors over 70. Please take a moment to answer the following questions:

Thank you for sharing your thoughts! Your feedback will help us provide better support and information about who benefits from Term Life Insurance and how to make the right decision.

IN THIS ARTICLE

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Why This Topic is Important for Canadian Seniors

- Why Term Life Insurance is Important for Seniors Over 70

- Factors That Affect Term Life Insurance Rates for Seniors

- How to Find the Cheapest Term Life Insurance for Seniors Over 70

- The Application Process for Seniors

- Why Work With Canadian LIC?

- Conclusion: Why Canadian Seniors Should Act Now

- More on Term Life Insurance

- FAQs About the Cheapest Term Life Insurance for Seniors Over 70 in Canada

- Sources and Further Reading

- Key Takeaways

- Your Feedback Is Very Important To Us