- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is The Best Length For Term Life Insurance?

- What are Term Life Insurance Policies?

- Factors to Consider When Choosing the Length

- Why Do Delays Happen in Term Life Insurance Payouts?

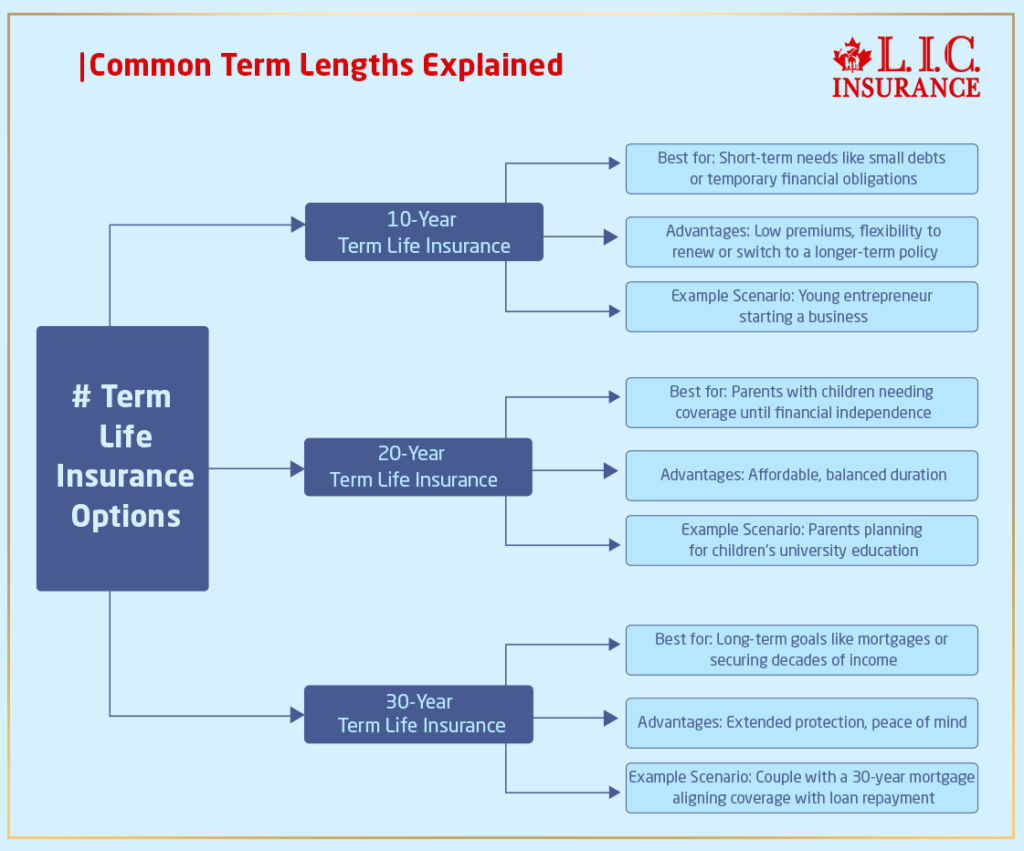

- Common Term Lengths Explained

- Why Use Term Life Insurance Quotes?

- Tailoring the Length to Your Needs

- Advantages of Choosing the Right Term Length

- Common Mistakes to Avoid When Choosing a Term Length

- How to Decide Between Long and Short Terms

What Is The Best Length For Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 18th, 2024

SUMMARY

Learn how one can determine the best term length for a Term Life Insurance Policy, considering the financial obligations, age, budget, and long-term goals. Common term lengths of 10, 20, and 30 years are discussed along with their suitability to different stages of life, like covering a mortgage, paying for the education of children, or any short-term loans. The blog emphasizes the importance of comparing Term Life Insurance Quotes, options for features like renewal and conversion, and the length of Term Life Insurance plans to ensure extended coverage and affordability benefits by buying them at an early age. It also stresses the importance of personalized advice for choosing the right policy and real-life insights from Canadian LIC’s client experiences. To evaluate their financial needs, readers learn the cost implications and the convenience of purchasing Term Life Insurance online.

Introduction

Choosing the correct length of Term Life Insurance in Canada can prove quite tricky for most individuals. From a young professional laying a financial foundation, through parents planning for their children’s future, up to the entrepreneur wanting protection of the business, these choices must be considered deeply. We’ve been assisting various clients with their diverse needs in trying to find out how long a Term Life Insurance should be. In this blog, we’ll outline factors that may help guide your decision.

What are Term Life Insurance Policies?

Term Life Insurance Policies covers us for a stipulated time. If, during that term, the insured person dies, his or her beneficiaries receive a death benefit payout. It can be taken for a minimum period of 10 years and a maximum period of 30 years, according to one’s demand.

For example, consider the scenario where a client had just become a parent and was seeking advice from Canadian LIC for a first child. He had to choose between two different term options: a 20-year term in order to raise the child or a 30-year term for securing the wife’s financial security. Any other individual would have wished for affordability along with long-term security.

Factors to Consider When Choosing the Length

The Term Life Insurance Claim Period refers to the amount of time the insurance provider will take to process and pay out the death benefit following a claim submission. Most insurance companies in Canada would expect to settle claims as promptly as possible; however, the timespan for doing so can range quite a bit due to many factors:

- Submission of necessary documents: Proper documentation is essential. Lacking or incomplete paperwork delays the processing.

- Verification of the Claim: Insurers must verify the validity of the claim to ensure it aligns with the policy’s terms.

- Contestability Period of the Policy: The insurer will verify whether the claim is valid under the terms of the policy.

According to Canadian LICs, Term Life Insurance Brokers state that transparency and accuracy during the application process can dramatically reduce potential delays at the claims stage.

Why Do Delays Happen in Term Life Insurance Payouts?

Your Age and Life Stage

Your age will also determine your term length. A Term Life Insurance plan is the most appropriate for younger clients who would like to insure themselves for a longer duration at a lower premium compared to the old clients on the brink of retirement who can afford a shorter one.

One of our clients was a 40-year-old single professional. She chose a 15-year term to pay off the remaining amount on her mortgage, which she was expecting to retire by the age of 55. She felt that this term suited her financial goals.

Financial Obligations

Assess your present and future obligation to pay. If you are raising young children, a long-Term Life Insurance plan like a 25- or 30-year term can provide education for their children and financial support after your death. For those of you with shorter obligations to repay, such as a car loan, a ten or 15-year policy would meet your needs.

Budget Considerations

Most people consider cost. Even though a longer term provides coverage for a longer period, the premiums are usually more expensive. Many clients who visit Canadian LIC use Term Life Insurance Quotes to compare the costs for various terms. This enables them to make an informed choice that is within their budget.

Common Term Lengths Explained

- Best for: Short-term needs like small debts or temporary financial obligations.

- Advantages: Low premiums and flexibility to renew or switch to a longer-term policy later.

- Example Scenario: A young entrepreneur who needed coverage while starting their business chose this option to protect their family from immediate financial risks.

- Best for: Parents with children who need coverage until the kids become financially independent.

- Advantages: A balance between affordability and duration.

- Example Scenario: A couple planning for their children’s university education found this option ideal, ensuring they had financial protection during critical years.

- Best for: Long-term goals such as a mortgage or securing income for decades.

- Advantages: Peace of mind knowing your family is protected for an extended period.

- Example Scenario: A young couple with a 30-year mortgage opted for this plan to align with their home loan repayment schedule.

Why Use Term Life Insurance Quotes?

Term Life Insurance Quotes are valuable for comparing cost and feature offerings between policies. Here at Canadian LIC, we walk our clients through this process, analyzing premium costs to find the plans that best align with their financial goals. Through quotes, you can determine whether a Long Term Life Insurance Plan is affordable or if you need a shorter term.

Tailoring the Length to Your Needs

Families with Young Children

Parents usually select a term that coincides with their children’s age. For example, if your youngest child is 5 years old, then a 20-year term can cover up until they graduate from university.

Individuals with Debt

Many term length requirements are tied to debt repayment schedules. If you have 15 years remaining on your mortgage, a 15-year policy ensures that the people who care about you won’t be burdened by debt if something happens to you.

Business Owners

Most business owners need customized coverage. One client at Canadian LIC opted for a 10-year policy to secure a loan for business expansion. The term of the policy was aligned with the loan repayment period so that the required protection was given without overextending coverage.

Advantages of Choosing the Right Term Length

Selecting the appropriate term length for your life insurance policy can have lasting benefits. Here’s how making the right decision can positively impact you and your loved ones:

This ensures that neither your family nor your dependents suffer from debt or financial hassle. A long-Term Life Insurance Policy can be sustained for a period as long as mortgage payments or a child’s educational expenses are there.

The idea is that you wouldn’t pay more for terms than you absolutely need for coverage. You might look at a term that justifies 20 years for lots of families, thus saving in cost over having a term for 30 years.

Knowing that your family will be taken care of in case something happens to you is a great comfort. Whether you have a 10-year or 30-year term, knowing that your loved ones will be financially set in case something happens to you is invaluable.

Most policies provide the option to convert to Permanent Life Insurance should your needs change. Therefore, you do not commit to a lifetime of protection upfront, but you can still make provisions to extend it later on.

Common Mistakes to Avoid When Choosing a Term Length

While choosing a term length may seem like a simple task, there are common pitfalls you should avoid:

One of the reasons many people opt for shorter terms is in a bid to save on premiums without considering whether their financial obligations will extend beyond the policy expiration. For example, if you choose a 10-year term but still have 15 years left on your mortgage, you might end up with a coverage gap.

On the other hand, taking a policy term that is much longer than your needs may mean paying for premiums that are higher than they should be. A 30-year term may not be necessary if your financial obligations will be settled in 20 years.

Some people do not know that they can actually renew their term policy or convert it into Permanent Insurance. Such an oversight results in gaps in coverage or, even worse, requirements for a new medical exam; this may cost more.

This would be the worst mistake, at least not trying out several options. Get to know the most cost-effective Term Life Insurance Quotes by comparing them with your desired term length.

How to Decide Between Long and Short Terms

When choosing between a Short or Long Term Policy, ask yourself the following questions:

What Are My Immediate and Long-Term Financial Goals?

Maybe for you, if you are paying a mortgage that is 15 years, then 15 years would be appropriate. If you intend to save for your child’s education, then you’ll probably need a longer term.

How Much Can I Afford?

Calculate how much you will pay monthly to determine what you can comfortably spend on premiums. A Long Term Life Insurance Plan is usually more expensive, so it is essential that it fits your financial plan.

What Is My Current Health Status?

Your health can impact your qualification for a policy in the future. Therefore, if you are relatively healthy now, it may make sense to lock in for a longer term today.

How Term Life Insurance Fits Into a Broader Financial Plan

Term Life Insurance is the backbone of an overall financial plan. This is how it fits in with other pieces:

Mortgage Protection

A level mortgage term policy ensures that your family remains in their house when something happens to you. Many clients opt for a Long Term Life Insurance Plan to cover the full period of their mortgage.

Income Replacement

For those with dependents, Term Life Insurance provides a financial safety net, replacing lost income for the policy’s duration.

Business Security

Entrepreneurs often use Term Life Insurance to secure business loans or protect their partners. A 10- or 15-year term can be tailored to match loan repayment schedules.

Estate Planning

Even though Term Life Insurance is not typically used for estate planning, converting a policy to Permanent Coverage can provide long-term benefits, including tax-advantaged wealth transfer.

Canadian LIC's Commitment to Personalized Solutions

At Canadian LIC, we emphasize understanding what our clients really need. We take into account one-on-one consultations regarding options available that align with your financial goals, such as getting a Long Term Life Insurance plan or even a Short Term Policy. Our expertise enables us to streamline the process of comparing Term Life Insurance Quotes and selecting the most appropriate coverage.

One of the latest stories of success was for a customer who initially needed a policy for 10 years on account of a budget reason. After they discussed how they wanted protection for a young family, they determined that a 20-year term would serve their interests without over-stretching their budget.

How to Get Started

If you’re ready to secure a policy, follow these steps:

- Assess Your Insurance Needs: Identify your financial obligations, such as debt, dependents, and long-term goals.

- Use Term Life Insurance Quotes: Compare options to understand pricing and features for different term lengths.

- Consult an Expert: Speak with professionals at Canadian LIC who can guide you through the decision-making process.

- Apply Online: Many clients choose to buy Term Life Insurance online for convenience and efficiency.

How Canadian LIC Helps Clients Decide

We have assisted numerous families, professionals, and even business owners in finding that perfect term length for individual needs at Canadian LIC. One of our clients, a mother of two, initially leaned toward a 10-year term. After discussing her long-term goals and using our Term Life Insurance Quotes, she opted for a 20-year term, ensuring her children’s financial security until they were independent.

Building Financial Confidence

Term Life Insurance is more of a long-term choice – not just about the term years but really creating an emergency safety blanket that grows along with you. Whether for family protection, mortgage security, or retirement savings, the right choice means your loved ones will be provided for at the very worst time.

Why Choose Canadian LIC?

Canadian LIC is known for its professional ability to help clients select the Term Life Insurance Policy that will suit their individual circumstances. We can assist you in comparing Term Life Insurance Quotes, knowing about renewability options, and knowing what type of policy will fit your life stage. Our goal is to give you the knowledge and tools that you need to make confident financial decisions about your future.

More on Term Life Insurance

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About Choosing the Best Length for Term Life Insurance

It really depends on your goals and financial obligations. For those with long-term commitments, for instance, a 25-year mortgage or providing for the income of one’s family, a long-Term Life Insurance plan is highly recommended. For short-term requirements like paying off a small loan, a 10- or 15-year term would do.

At Canadian LIC, we often encounter clients who are confused about their choices. We consider every individual’s financial situation and direct them toward making the best choice that serves their purposes.

Start by determining what financial responsibilities you have. If you have little kids, a term that ends when they are independent is excellent. For instance, if your youngest is 5, a 20-year policy can pay off educational and other costs incurred until they are financially independent. If your concern lies with a mortgage with another 15 years, you could then match your policy with the same period.

We always meet clients who, in a bid to reduce costs, initially choose shorter terms than what they may need later, so we always plan with a long-term need.

If you live past your policy, coverage automatically ends, and no benefits are paid. You can continue to renew your policy, but premiums will have increased. You can even convert your Term Policy to a Permanent One, maintaining coverage without a new medical exam.

We have dealt with clients in Canadian LIC who initially select Short Term plans and later convert or renew them. It allows for flexibility in your cover.

The reason longer terms have a bigger premium is that they typically cover more years, whereas locking in your rate throughout the term can actually pay off in the Long Term. A lot of customers find value in their policy because it covers the entire critical life stage period.

Using Term Life Insurance Quotes to compare costs can determine whether the extra years of coverage are worth the higher premiums.

Yes. You can easily obtain Term Life Insurance online. Most companies, like Canadian LIC, offer to compare Term Life Insurance Quotes and their application online. Buying Life Insurance online saves time and often provides access to the resources that you may need.

We have had clients who first thought applying online would be complicated. But with our help, they found it simple and convenient.

The most practical is to match the term length with your mortgage. For instance, if your mortgage remains for 20 years, you can have a 20-year Term Policy so that your family will not experience the burden of financial stress when something bad happens to you.

For example, one client approached Canadian LIC with this precise concern. By ensuring the policy matched their timeline concerning mortgage, they were guaranteed the ultimate financial security for their family without overpaying for unnecessary coverage.

You cannot change the term length of an existing policy, but you can look into renewability or buying a new policy. Some Term Life Insurance Policies also offer conversion options, where you can convert to Permanent Coverage.

At Canadian LIC, we constantly advise our clients to evolve their insurance as and when their needs change. From renewals to conversions, we ensure that they’re always covered throughout their lives.

This would be ideal for Short Term policy coverage if you have Short Term financial obligations, like a car loan or temporary debt. It is also less expensive, which makes it more favourable for young professionals beginning their careers.

We commonly encounter clients who choose Short Term policies because they are tight on budget. As they improve their financial conditions, they revisit their options for longer coverage.

You may consider adding riders or converting the Term Policy into Permanent Coverage in case of a change in financial condition. These options are generally included with term life policies to provide for greater flexibility.

It occurred once with a family growing unexpectedly to a client who experienced this when their family had an unexpected expansion. Their new responsibilities were thus addressed through conversion features available under their policy.

You can compare quotes through online resources or by consulting experts, such as Canadian LIC, and look at factors that include premiums, term lengths, and additional benefits to find out which policy best suits you.

We assisted numerous clients in comparing Term Life Insurance Quotes and determining how various options would impact their coverage and budget. With our consulting, they will feel sure about their ultimate choices.

Canadian LIC stands out for its personalized approach. It understands your requirements, identifies your needs, and gives you the most suitable duration of term insurance. Online purchase of term life or expert advice at length–it all matters for us.

Most of our customers come back to us because they trust our experience and commitment to finding the right solutions.

Yes, you can use the ladder strategy by buying policies of various term lengths. We remember a client who bought a 10-year policy for the loan of his car and a 20-year policy to pay for his children’s education. He did this and saved money all at once.

The younger you are, the better the chances of lower rates are. A long-term policy purchased at age 30 will cost much less compared with one purchased at 45. Many clients opt for longer terms as offered by Canadian LIC early on to maintain current affordable rates for longer life.

Most Term Life Insurance Policies are renewable after the term expires, yes. However, renewal premiums usually increase because of your advanced age. We always tell our clients to review their needs before renewing because it may not be the best option for them.

These are just a few ways in which you can lower your costs, including healthy living, comparison of term life quotes, and selecting the deductible or rider that would best suit your needs. Just recently, we worked with a client who saved money by adjusting policy features while retaining essential coverage.

But more than that, you can purchase Term Life Insurance while seeking advice from professionals online. At Canadian LIC, we walk clients through the online application process, helping them understand options and answering their questions.

Most Term Policies allow you to cancel them without penalty, but no refunds of previous premiums. One of our clients cancelled the policy early because they didn’t need it anymore since they paid off their debts. We assisted them in seeking alternative insurance coverage for their future needs.

Term Life Insurance gives you coverage for a specified period, and Whole Life Insurance is paid for a lifetime, and it accumulate cash value over time. Many clients purchase coverage because it is cheaper and allows them to concentrate on particular goals, such as paying off a mortgage. Learn more about Term Life Insurance V/s Whole Life Insurance here.

Yes, you can add riders for extra benefits. You can have additional Critical Illness Insurance Coverage or even a waiver of premium in case you become disabled. In the case of Canadian LIC, one client added a rider to his policy that guaranteed him protection in the case of a major health event. He ensured he received the coverage according to his needs.

A Long Term Life Insurance Policy is best suited for people with Long Term financial liabilities, such as a 25-year mortgage or a growing family. We often see clients in consultations at Canadian LIC take longer terms to provide stability over decades.

In fact, term life policies can be built around specific situations or goals like protection for the business loan or education for the children. One of our business-owner clients utilized a 15-year term policy to secure a loan so that if anything were to happen, there would be no financial risk to the family.

Approvals can take as little as a few days for clients who purchase Term Life Insurance online, assuming no medical exams are required. We help our clients to prevent delays and ensure that all necessary paperwork is submitted promptly.

Employee-provided Life Insurance is very attractive but typically offers insufficient benefits on its own. We have worked with many clients who also add Personal Term Insurance to increase their workplace coverage for comprehensive protection of their family’s future.

Yes, you can. You would pay a higher premium, though. We help clients at Canadian LIC with conditions that require them to get Term Life Insurance and find relatively inexpensive coverage options.

If you are unsure about anything in your Term Life Insurance, contact a professional. Canadian LIC offers the services of choosing the correct policy for you, from Long Term Life Insurance coverage to buying Term Life Insurance online.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

Learn about life insurance types, term lengths, and industry standards in Canada.

Website: https://www.clhia.ca - Insurance Bureau of Canada (IBC)

Offers insights into Term Life Insurance Policies and tips on finding the right coverage.

Website: https://www.ibc.ca - Financial Consumer Agency of Canada (FCAC)

Provides guidance on assessing financial needs and comparing insurance options.

Website: https://www.canada.ca/en/financial-consumer-agency.html - Life Happens

A nonprofit resource offering tools and educational material on life insurance planning.

Website: https://www.lifehappens.org - Canada Life

Detailed information on Term Life Insurance plans and their benefits.

Website: https://www.canadalife.com - Sun Life Canada

Learn about customizable Term Life Insurance solutions tailored to individual needs.

Website: https://www.sunlife.ca - Manulife Canada

Explore comprehensive Term Life Insurance offerings and policy options.

Website: https://www.manulife.ca

Key Takeaways

- Term Length Depends on Your Needs:

Choose a term that aligns with your financial goals, such as covering a mortgage, children’s education, or other obligations. - Common Term Lengths:

A 10-year term suits short-term needs, while 20- or 30-year terms are ideal for long-term commitments like family income or mortgage protection. - Age and Affordability Matter:

Purchasing a long-Term Life Insurance plan at a younger age locks in lower premiums and provides extended coverage. - Use Term Life Insurance Quotes:

Comparing quotes helps identify cost-effective policies tailored to your needs and budget. - Consider Flexibility:

Features like renewability and conversion allow adjustments to your policy as your needs evolve. - Expert Guidance Helps:

Working with trusted advisors, such as Canadian LIC, simplifies the process and ensures your policy suits your unique situation. - Buy Term Life Insurance Online:

Online platforms make it easy to apply, compare policies, and secure coverage efficiently.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts. This feedback will help us understand your challenges and provide better solutions tailored to your needs.

Thank you for your input! Your responses will help us improve our services and provide better support to individuals like you.

IN THIS ARTICLE

- What Is The Best Length For Term Life Insurance?

- What are Term Life Insurance Policies?

- Factors to Consider When Choosing the Length

- Why Do Delays Happen in Term Life Insurance Payouts?

- Common Term Lengths Explained

- Why Use Term Life Insurance Quotes?

- Tailoring the Length to Your Needs

- Advantages of Choosing the Right Term Length

- Common Mistakes to Avoid When Choosing a Term Length

- How to Decide Between Long and Short Terms