- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I purchase Critical Illness Insurance if I am already retired?

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- Can You Claim Twice for Critical Illness Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Does Critical Illness Insurance Cover Broken Bones?

- Can You Add Critical Illness Cover to an Existing Policy?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- Can I Have Two Critical Illness Policies?

- Can You Take Out Critical Illness Cover Without Life Insurance?

What Is the Average Percentage of Critical Illness Claims Paid Out?

SUMMARY

The blog discusses the high claim payout rates of Critical Illness Insurance in Canada, averaging 90-95%. It highlights reasons for denied claims, such as non-disclosure of medical history, exclusions, and unmet waiting periods. Misconceptions about claim payouts are addressed, emphasizing transparency and understanding policies. The blog shares insights from Canadian LIC on choosing the right policy and ensuring successful claims through accurate disclosure, policy knowledge, and expert guidance.

- 11 min read

- September 30th, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- September 30th, 2024

Introduction

Critical Illness Insurance gives an assurance that you can cope with all the unforeseen expenses triggered by a major illness that life throws your way. Most people ask, “What is the average percentage of critical illness claims paid out? “It is a genuine question at a time when cost is also associated with such policy commitments.

You want to know whether insurers will be there when you need them the most. Many Canadians, like you, will be required to make a very difficult decision concerning choosing a Critical Illness Insurance Policy. At Canadian LIC, we have observed that some clients care so much about whether their claims will be paid out when a diagnosis comes in. Many people fear insurance companies, especially with stories of claims that get invalidated. To wipe away skepticism, let’s break down some facts about how average percentages of paid claims in Critical Illness Insurance in Canada relate to your thought process.

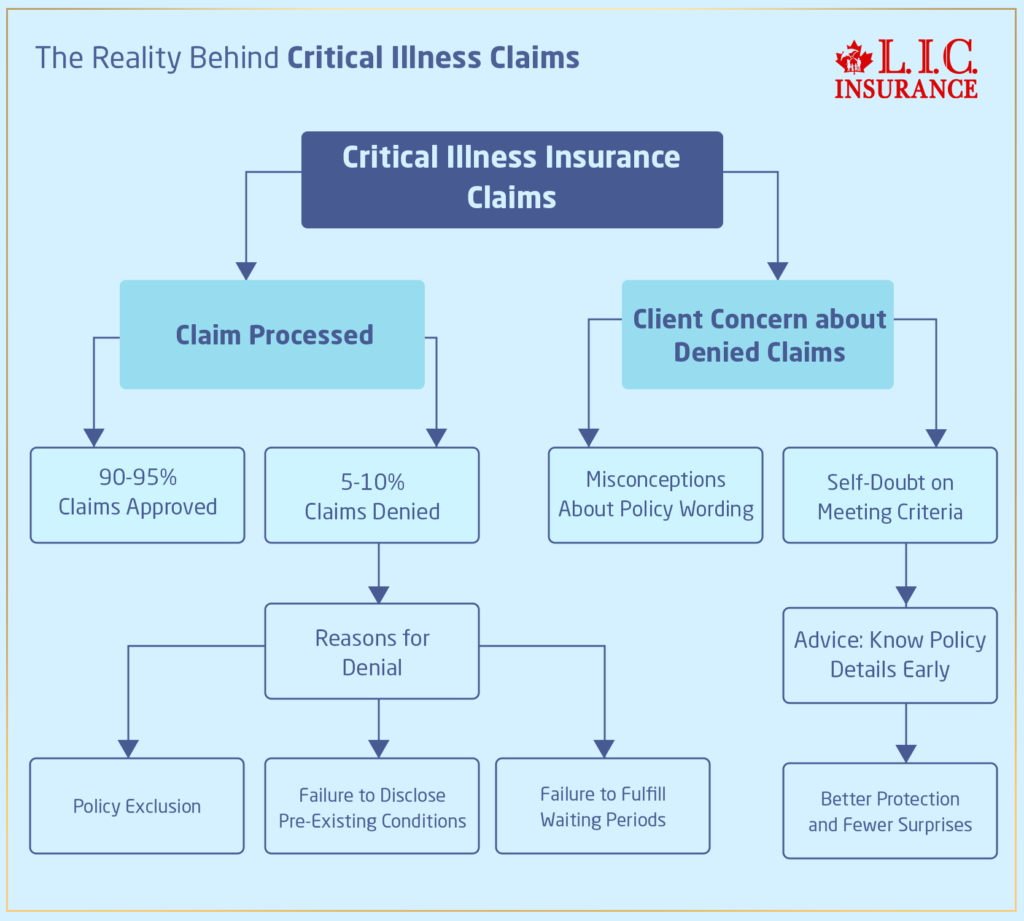

The Reality Behind Critical Illness Claims

According to industry statistics, payouts on most Critical Illness Insurance Policies do occur in Canada. Insurance providers process about 90-95 percent of all critical illness claims. While that much payment rate does seem reassuring, still many people would want to know what happens to the remaining 5-10 percent of claims. Claims that are not claimed generally tend to be attributed to certain reasons; for example, it could be due to an exclusion in the policy, failure to disclose pre-existing conditions or failure to fulfill the waiting periods for the policy.

At Canadian LIC, where we frequently interact with clients on a daily basis, we often hear clients speaking about their fears of denied claims. Fears mostly arise from misconceptions regarding policy wording or are due to self-doubts about whether they will meet the criteria that would lead to a successful claim. We assure the clients that knowing the minute details of their Critical Illness Insurance Policy right from the beginning will avoid surprises later. A sure way to guarantee protection against the unforeseen moments of life is by being well-informed.

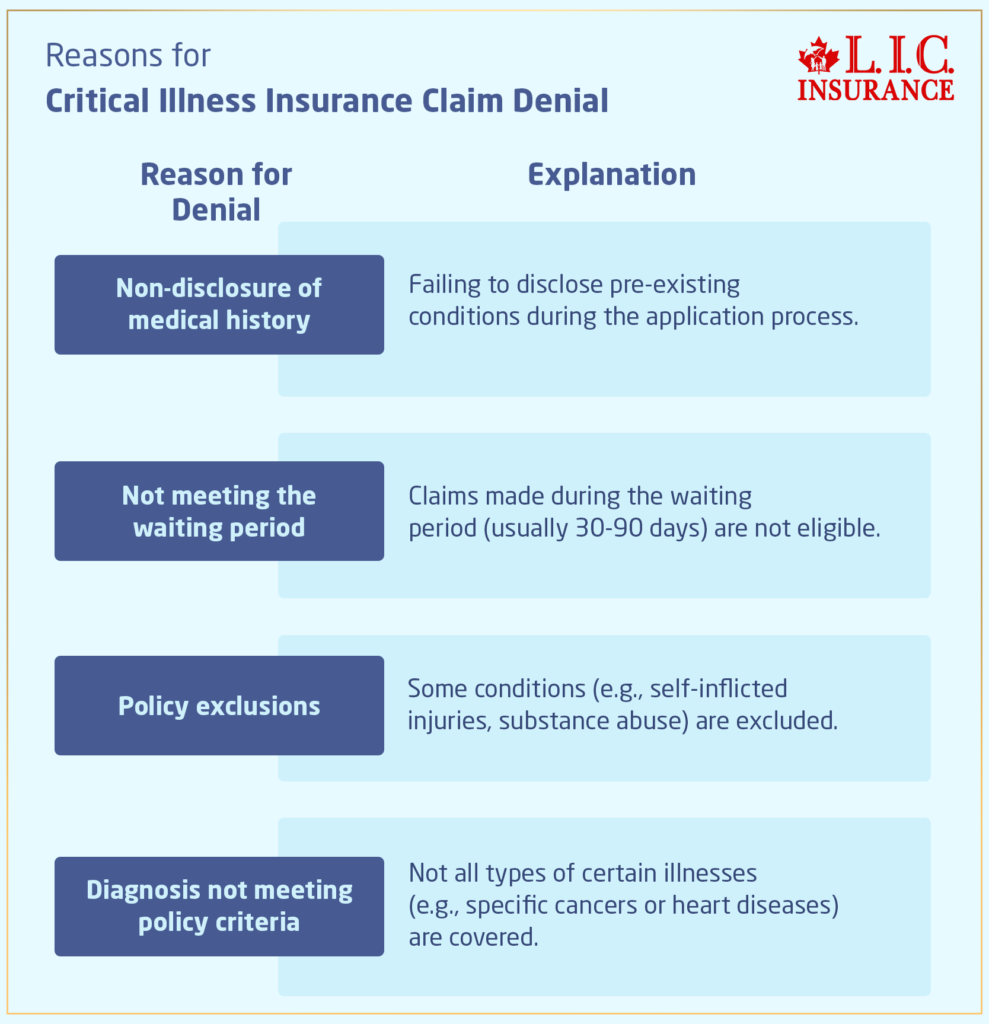

Why Are Some Critical Illness Claims Denied?

It might thus prove useful to look closer at why a tiny percentage of critical illness claims are denied. We hear this question repeatedly from our clients, and it is easy to see why they would be concerned with whether they could rely on their coverage in the worst-case scenario.

- Non-disclosure of medical history: One of the leading reasons Critical Illness Insurance claims are denied is the non-disclosure of pre-existing conditions covered during the application process. When you apply for a Critical Illness Insurance Policy, it’s essential to provide accurate information about your health history. Failing to mention previous serious illnesses or ongoing conditions can lead to complications later, potentially resulting in a denied claim.

- Not meeting the waiting period: Many policies come with a waiting period, typically ranging from 30 to 90 days. This means that if you’re diagnosed with a critical illness during this waiting period, you won’t be eligible to claim. We’ve seen clients who are unaware of this waiting period and, as a result, face difficulties when trying to claim. That’s why it’s vital to understand the terms of your policy fully.

- Policy exclusions: Every Critical Illness Insurance Policy has exclusions, which are specific conditions or situations that the policy doesn’t cover. These can include self-inflicted injuries or critical illnesses related to substance abuse. Understanding these exclusions ensures that you won’t be caught off guard when it’s time to file a claim.

- Diagnosis not meeting policy criteria: Insurance companies define specific medical conditions under very particular guidelines. For example, not all forms of cancer or heart disease may be covered, depending on the policy. Clients at Canadian LIC often ask us for clarification on what conditions are covered, which helps them avoid misunderstandings if they ever need to make a claim.

Building Trust with Critical Illness Insurance

Here at Canadian LIC, we always emphasize choosing a Critical Illness Insurance Plan to suit your needs and understanding all the terms before you agree to commit. In truth, insurers actually pay out a pretty good number of claims, and in Canada, it is fairly obvious, given the high payout percentage. However, such a claim will be achieved if your declaration is clear, and this will only come to pass if there is perfect disclosure in the application and one gets to understand what is covered under their policy.

For example, we had a client who was unsure if a family history of sickness would affect the outcome of their application process. They completely opened up their medical background to us and emerged with a policy that would specifically indicate what is covered. Years later, when diagnosed with cancer, they filed a successful claim, which they used for treatments both at the hospital and at home.

This story reflects how working with the right brokerage—one that puts client education first—makes a significant difference when it comes to critical illness claims. Therefore, as experience with clients has shown, it boils down to transparency and understanding, which are major factors in ensuring claims get paid without any issues.

Common Misconceptions About Critical Illness Claims

Many people avoid getting a Critical Illness Insurance Policy due to misconceptions about claim payouts. Let’s address some of these common concerns:

My policy won’t cover me because of my family’s medical history.

This is a common fear, but most critical illness policies are based on your individual health and lifestyle. While family history can influence your eligibility, insurers are primarily focused on your personal health status at the time of application. It’s important to discuss these factors with your insurance provider to find the right policy for you.

If I don’t meet all the conditions exactly, my claim will be denied.

While it’s true that policies come with specific criteria, insurers are not looking for reasons to deny claims. In fact, the majority of claims are paid out as long as the policyholder meets the outlined conditions. This is why working with a knowledgeable brokerage like Canadian LIC is key. We help you navigate through the requirements so there are no surprises when it comes to filing a claim.

My insurer might deny my claim based on technicalities.

In most cases, claims are denied because the applicant didn’t provide full information upfront, not because of technicalities. At Canadian LIC, we emphasize the importance of complete transparency when applying for a Critical Illness Insurance Policy. By being open about your health status and any potential concerns, you increase the likelihood of a smooth claims process if you ever need to make one.

How to Ensure Your Critical Illness Claim Is Paid

While the critical illness payout percentage for critical illness claims in Canada is quite high, there are steps you can take to protect yourself further:

- Be transparent about your health: Always disclose your full medical history when applying for a Critical Illness Insurance Policy. This helps avoid complications and ensures that you’re covered for the conditions you’re most likely to face.

- Understand your policy: Take the time to fully understand what your policy covers, including any waiting periods and exclusions. If you’re unclear, ask questions. At Canadian LIC, we encourage our clients to ask as many questions as needed to feel confident about their Critical Illness Cover.

- Work with an experienced brokerage: Having the support of a trusted brokerage like Canadian LIC can make all the difference when choosing and understanding your policy. We work closely with our clients, providing guidance on the best policy for their needs and helping them avoid common pitfalls that could lead to a denied claim.

- Keep your policy up to date: Life changes such as marriage, the birth of a child, or changes in your health can impact your insurance needs. Regularly review your policy to ensure it still meets your requirements. We often remind our clients to schedule periodic reviews of their policies to ensure they’re still adequately covered.

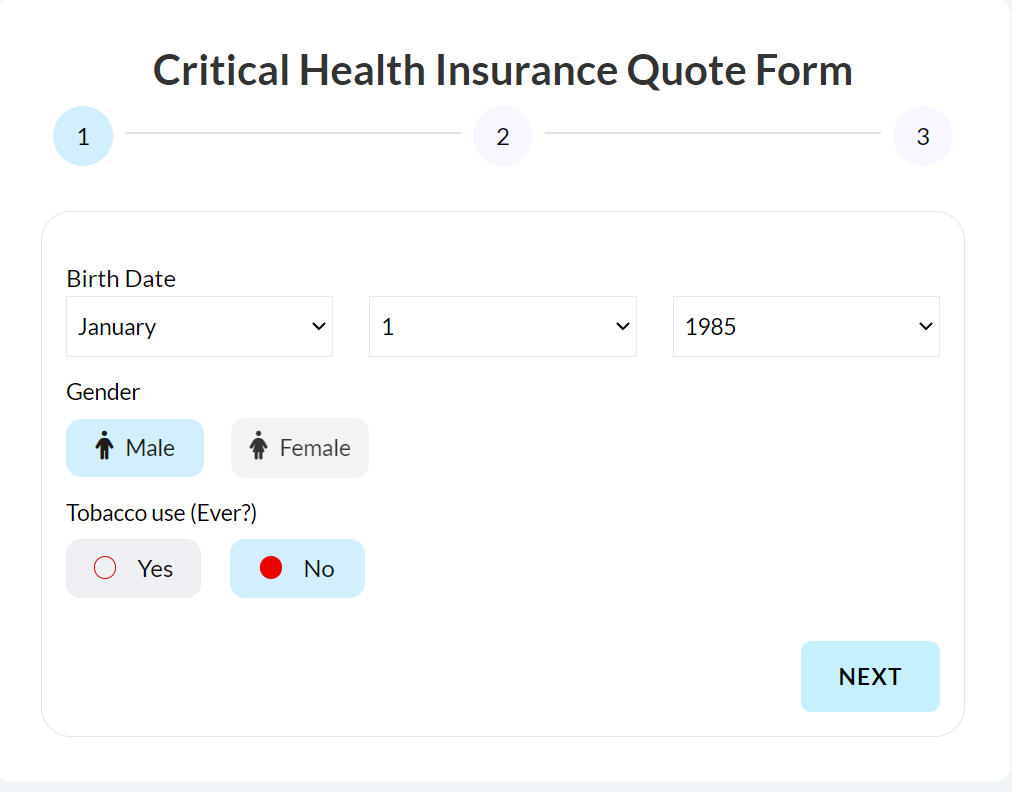

Understanding Critical Illness Insurance Quotes

As you go through this form of insurance, one often asks how to get accurate, Critical Illness Insurance Quotes Online. Most people want a quick estimate of the costs before committing to a policy, although they should remember that actual quotes from online sources are just estimates. You will realize that so many factors, such as your health, age, coverage amount, and even kind of policy, will ultimately determine your premium.

We have met clients who were quoted rather low online quotations for critical illness coverage but had those premiums shoot up for a final premium based on details such as a family history of illness or lifestyle choices. By working with Canadian LIC, you can get more accurate information tailored to your specific situation.

More on Critical Illness Insurance

- Can I Use Critical Illness Insurance to Cover Mortgage Payments?

- What’s the Maximum Payout for Critical Illness Insurance in Canada?

- Can I purchase Critical Illness Insurance if I am already retired?

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- How Does Inflation Affect My Critical Illness Insurance Coverage?

- Can You Claim Twice for Critical Illness Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Can I Purchase Critical Illness Insurance for My Children?

- Does Critical Illness Insurance Cover Broken Bones?

- Can I Cancel My Critical Illness Insurance?

- Can You Add Critical Illness Cover to an Existing Policy?

- What is a Critical Illness Insurance Claim?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- Can I Have Two Critical Illness Policies?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- What Age Should You Get Critical Illness Cover?

- Critical Illness vs. Disability Insurance in Canada: Understanding the Differences and Making Informed Choices

FAQs: Average Percentage of Critical Illness Claims Paid Out in Canada

Here are the most popular questions regarding the average percentage of critical illness claims paid out in Canada. Built on our experience at Canadian LIC, we ensure that the clients understand their Critical Illness Insurance Policy and how to get free online quotes for Critical Illness Insurance to meet their needs.

Most critical illness claims in Canada, around 90-95%, are paid out. This high percentage shows that insurance providers generally honour their commitments, but it’s important to ensure your Critical Illness Insurance Policy is accurate and up-to-date and that you meet all the requirements.

Claims can be denied for a few reasons, including non-disclosure of pre-existing conditions, not meeting the waiting period, or if the illness is excluded from the policy. We often explain to our clients that honesty and understanding your Critical Illness Insurance Policy are key to avoiding denied claims.

Be open about your medical history when applying. Understand what your policy covers and any exclusions. We always tell our clients to review their Critical Illness Insurance Policy thoroughly and ask us questions to avoid confusion later.

Your personal health is the main factor, though family history may be considered. At Canadian LIC, we’ve seen clients with a strong family history of illness still receive coverage by ensuring their policy fits their unique situation.

Yes, most policies have a waiting period, usually between 30 to 90 days. We remind clients about this period when they apply so they’re not caught off guard if a diagnosis happens soon after they’ve purchased a policy.

Getting Critical Illness Insurance Quotes Online can give you an idea of the cost, but they are just estimates. Your health, lifestyle, and the amount of coverage you want will impact the final premium. We often help clients compare quotes and tailor their coverage based on their needs.

Yes, the older you are when you apply for Disability Insurance, the higher your premium will likely be. Many of our clients at Canadian LIC have found that locking in a plan at a younger age helps them avoid higher costs later on. We often advise our clients to consider purchasing a plan earlier in life for this reason.

Most Critical Illness Insurance Policies cover major illnesses like cancer, heart attacks, strokes, and organ transplants. However, each policy is different. At Canadian LIC, we’ve seen clients opt for comprehensive policies that match their personal health concerns to ensure the right illnesses are covered.

The lump sum payment from a Critical Illness Insurance Policy can be used for anything, from medical expenses to mortgage payments. We’ve helped clients navigate tough financial situations by guiding them through the claim process and making sure they know how to use their payout.

Pre-existing conditions may not be covered unless they are disclosed during the application. If you’re upfront about your health, you can avoid surprises. Many of our clients at Canadian LIC have successfully secured coverage despite having pre-existing conditions because they were transparent from the start.

Yes, you can still get Disability Insurance in Canada even if you have pre-existing health issues. However, this may lead to higher premiums. At Canadian LIC, we’ve helped clients with various health conditions find suitable coverage that fits their needs, though we always make sure to explain that their premiums may be higher or have certain exclusions.

Yes, you can have multiple policies. Some clients choose this route for extra financial protection. We often work with clients who want to combine work benefits with individual policies to ensure they have comprehensive coverage.

Most critical illness policies in Canada do not cover mental health issues. Coverage typically focuses on physical illnesses like cancer and heart disease. We help clients understand what’s included in their Critical Illness Insurance Policy to avoid any misunderstandings when they need to claim.

Yes, you can usually increase or decrease your coverage. Many of our clients at Canadian LIC revisit their policies over time as their needs change, such as after having children or buying a house.

It typically takes 30-60 days to receive a payout after making a claim once all necessary documents are submitted. We work with our clients to ensure they file everything correctly to avoid delays in getting their funds.

Some policies offer a return of premium option, where you can get some of your premiums paid back if you don’t make a claim. However, these policies often come with a higher premium. Many of our clients choose this option for extra financial security.

To know if you’re covered, it’s important to carefully read through your Critical Illness Insurance Policy and check the list of covered illnesses. If you’re unsure, you can always ask your insurance broker for clarification. At Canadian LIC, we take the time to explain the details to our clients, ensuring they understand what’s included in their policy.

Yes, you can still get a Critical Illness Insurance Policy if you’re a smoker, but the premium will likely be higher than for non-smokers. We’ve worked with many clients who smoke, and we help them find the best coverage options available to fit their needs while keeping the cost manageable

The amount of coverage depends on your personal financial needs, such as covering medical bills, paying off a mortgage, or supporting your family. Many of our clients at Canadian LIC opt for coverage that would replace a year or two of their income, just in case they need extra time to recover.

Yes, you can switch providers, but it’s important to make sure you have new coverage in place before cancelling your current policy. We’ve had clients at Canadian LIC who needed better coverage or lower premium payments, and we guided them through switching policies without a gap in coverage.

Yes, if your health or life circumstances change, it’s a good idea to review and possibly update your policy. We’ve seen clients who’ve had significant life events, like having children or buying a home, and needed more coverage to protect their loved ones.

Yes, once you receive the lump-sum payout, you can use it for anything you need, not just medical bills. Some of our clients at Canadian LIC have used their payouts to pay off loans, take time off work, or cover travel costs for specialized treatment.

To get the best Critical Illness Insurance Quotes Online, make sure to provide accurate information about your health and lifestyle. At Canadian LIC, we help our clients by comparing quotes from different providers to ensure they get the best value for their needs.

If your policy expires and you haven’t made a claim, some policies offer a return of premium option, while others simply end. We help clients choose policies with return-of-premium options when they fit their long-term financial goals.

Yes, many people use Critical Illness Insurance as part of their broader financial plan, especially to protect their income and savings during retirement. At Canadian LIC, we often see clients adding Critical Illness Insurance to their retirement planning to ensure they have coverage for unexpected health issues.

Most insurance companies have age limits for applying, often between 60 and 65 years old. At Canadian LIC, we always encourage our clients to apply for coverage earlier to lock in lower premiums and ensure they have protection when they need it most.

Choosing the right Critical Illness Insurance Policy depends on your health, financial needs, and personal situation. We work with our clients at Canadian LIC to find policies that align with their goals, whether it’s covering potential medical costs or ensuring their families are protected.

Some insurance providers allow you to add your spouse or children to your critical illness policy, but it depends on the specific policy. We often guide clients in finding family plans that offer comprehensive coverage for everyone in the household.

The claim process can take anywhere from a few weeks to a couple of months, depending on how quickly the necessary documents are submitted. At Canadian LIC, we’ve helped clients submit their claims efficiently to reduce the waiting time and ensure they get their payout as quickly as possible.

If the illness you’re diagnosed with isn’t covered under your policy, you won’t be eligible for a payout. We make sure our clients at Canadian LIC understand exactly what their policy covers so they know they are protected from the illnesses most relevant to their situation.

Yes, but pre-existing conditions may affect your coverage or premium rates. We work with clients at Canadian LIC who have pre-existing conditions and help them find the best possible coverage. Some policies may exclude certain conditions, but there are options available.

If you purchase a level-premium policy, your premiums will stay the same throughout the policy’s term. However, if you opt for a renewable term policy, your premiums may increase as you age. At Canadian LIC, we help our clients decide which option works best for their financial situation.

We have these FAQs – types of questions we quite often receive from clients at Canadian LIC. We endeavour to ensure every client leaves with a full understanding of the Critical Illness Insurance Policy that they have purchased and knows what to expect when Critical Illness Insurance quotes are online Let’s help you make the best decision for your health and future.

Sources and Further Reading

Here are some recommended sources and further reading to explore the topic of Critical Illness Insurance claims and policies in Canada:

Sources:

- Canadian Life and Health Insurance Association (CLHIA)

This organization provides insights into the life and health insurance industry in Canada, including Critical Illness Insurance statistics and best practices.

Website: www.clhia.ca - Manulife Financial – Critical Illness Insurance Overview

Manulife offers detailed information on their Critical Illness Insurance products and claims process.

Website: www.manulife.ca - Sun Life Financial – Critical Illness Insurance Policies

Sun Life provides resources about the coverage options and claims for Critical Illness Insurance in Canada.

Website: www.sunlife.ca - Canada Life – Understanding Critical Illness Insurance

Canada Life offers a comprehensive guide to Critical Illness Insurance, including statistics on payout rates and coverage details.

Website: www.canadalife.com

Further Reading:

- Insurance Bureau of Canada – Health Insurance Basics

The Insurance Bureau of Canada offers general information on health and Critical Illness Insurance in the country.

Website: www.ibc.ca - Financial Consumer Agency of Canada – Guide to Insurance

A federal guide providing a breakdown of the different types of insurance, including Critical Illness Insurance, in Canada.

Website: www.canada.ca

These sources and readings can provide additional information and help you better understand Critical Illness Insurance Policies, claims, and payouts in Canada.

Key Takeaways

- High Payout Rate: Around 90-95% of Critical Illness Insurance claims in Canada are paid out, indicating a strong likelihood that insurers will honor valid claims.

- Reasons for Denied Claims: The small percentage of denied claims is often due to non-disclosure of pre-existing conditions, not meeting waiting periods, or policy exclusions.

- Transparency is Key: To ensure your claim is paid, be open about your medical history and fully understand the terms of your Critical Illness Insurance Policy.

- Customizable Coverage: You can tailor your coverage based on your health needs, financial situation, and lifestyle, and adjust it as your life changes.

- Accurate Quotes: Getting Critical Illness Insurance Quotes Online provides a good estimate, but final premiums depend on individual factors like health and coverage amount.

- Claim Usage Flexibility: The payout from a Critical Illness Insurance Policy can be used for any purpose, from medical expenses to everyday living costs.

- Regular Review: It’s essential to regularly review and update your policy to ensure it continues to meet your needs as life circumstances change.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We would love to hear about your experiences and struggles related to Critical Illness Insurance claims in Canada. Your feedback will help us better understand and address the concerns Canadians face when dealing with Critical Illness Insurance.

Thank you for taking the time to share your thoughts! Your feedback will help us better understand the struggles Canadians face when dealing with Critical Illness Insurance Policies and claims.

IN THIS ARTICLE

- What Is the Average Percentage of Critical Illness Claims Paid Out?

- The Reality Behind Critical Illness Claims

- Why Are Some Critical Illness Claims Denied?

- Building Trust with Critical Illness Insurance

- Common Misconceptions About Critical Illness Claims

- How to Ensure Your Critical Illness Claim Is Paid

- Understanding Critical Illness Insurance Quotes