- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Fundamentals

Reviews

Common Questions

What is Guaranteed Life Insurance for Seniors?

SUMMARY

Life Insurance for many people is something they continue to put off until they feel it is necessary, but by the time it comes, the thought of actually getting coverage as a senior feels overwhelming. For most seniors in Canada, many Life Insurance Policies come with requirements, including medical exams and tedious application processes. That is where Guaranteed Life Insurance enters as a much simpler, more accessible alternative.

- 11 min read

- September 11th, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- September 11th, 2024

This is the case with many of our clients who have approached us at Canadian LIC -some fearing they do not stand a good chance because of age or health concerns, other insurance companies have denied some, while others fear the high Life Insurance rates that come with senior Life Insurance Policies. These particular situations create a feeling of uncertainty about what avenues are available to a senior citizen. Our clients frequently ask about Life Insurance for Seniors and express grave concern about their possible qualification for affordable protection.

If you find yourself in a similar situation, know you are not alone. Let’s dive into what Guaranteed Life Insurance for Seniors is, how it works, and why it may be a great option for you or someone close.

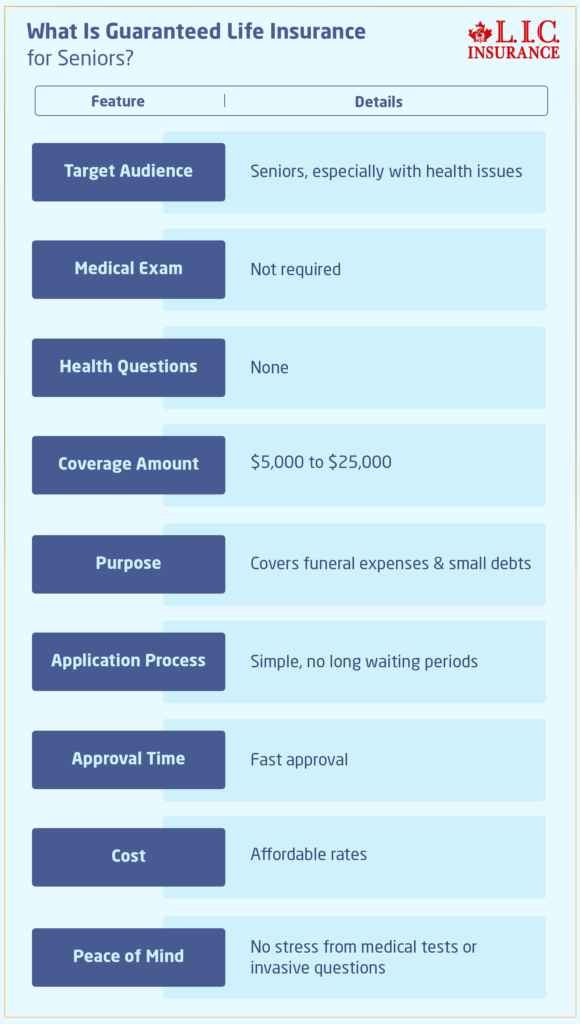

What Is Guaranteed Life Insurance for Seniors?

Guaranteed Life Insurance is designed specifically for those individuals who, for one reason or another relating to age or health conditions, may not be able to qualify for a regular Life Insurance Policy. As the name suggests, Guaranteed Life Insurance is fully guaranteed, with no need to disclose your health status. The majority of these policies are aimed at seniors looking for affordable rates and lenient underwriting with no medical examination or intrusive questions about one’s health status. It offers an entry to the healthcare system for people who otherwise might have been denied coverage.

Most of the time, unlike the traditional policy, Guaranteed Life Insurance comes in less coverage amount, ideally between $5,000 and $25,000, for things like funeral expenses or other small debts.

When seniors come to us at Canadian LIC, we often hear a sigh of relief from finally knowing that no stressful medical tests are in store, nor is a wait of weeks for approval expected. They tell us how the simplicity and ease of Guaranteed Life Insurance make it a perfect fit for their insurance needs.

| Criteria | Guaranteed Life Insurance for Seniors | Traditional Life Insurance |

|---|---|---|

| Medical Exam Requirement | No medical exam or health questions | Medical exam usually required |

| Eligibility | Guaranteed acceptance regardless of health | Based on age, health status, and lifestyle |

| Coverage Amount | Typically between $5,000 and $25,000 | Can range from $100,000 to millions |

| Waiting Period | 2-3 years for natural causes (premiums refunded if death occurs) | No waiting period once coverage is active |

| Premiums | Higher premiums per dollar of coverage | Generally lower premiums for higher coverage |

| Application Process | Simple, quick approval | More complex, may take longer for approval |

| Target Audience | Seniors with health issues or difficulty qualifying for traditional policies | Individuals in good health seeking higher coverage |

| Death Benefit | Provides smaller payout primarily for final expenses | Offers higher payouts for larger financial needs |

| Policy Duration | Usually whole life (coverage lasts for lifetime) | Can be either term (specific period) or whole life |

| Cost to Beneficiaries | Generally lower due to smaller coverage amounts | Can provide substantial financial support |

| Purpose | Cover final expenses, such as funeral costs | Cover family’s financial security, debts, and future needs |

| Age Restrictions | Typically available up to age 85 | May have lower age limits, depending on the policy |

| Premium Payments | Fixed premiums throughout life | Premiums may increase with age (for term policies) |

Why Do Seniors Need Life Insurance?

Most people think of Life Insurance as something for younger people with families and dependents. However, seniors have a number of reasons for needing Life Insurance. First, end-of-life expenses can grow very quickly. The cost of a funeral in Canada could go as low as $5,000 or as high as $15,000 or even more, considering what services one may want. Without Life Insurance, these costs may fall upon your family members, adding extra stress during a difficult time.

Such a customer was Mike, a senior who had just retired and found that his retirement savings would not provide enough money for his funeral. He felt it would be unfair to leave all of that expense to his family. Guaranteed Life Insurance for Seniors gave Mike peace of mind, knowing his family would be very well-protected against any sudden financial surprises.

Furthermore, some seniors might want to leave a small inheritance behind for their loved ones or want any unsettled debts left behind, such as medical bills or credit card debt, taken care of. Guaranteed Life Insurance provides financial protection for your family, no matter the amount.

How Does Guaranteed Life Insurance Work?

When you apply for Guaranteed Life Insurance, the process is painless. There’s no medical involved in it, and applications generally take a few minutes to complete. You simply fill out a form and provide basic information such as your age and the coverage amount you are seeking, and that is all. In many cases, it is normally automatic acceptance, and the cover starts shortly after your first premium payment.

One thing to know about guaranteed issue Life Insurance Policies is that most have a “waiting period.” This is usually some time frame, starting from the issue date, of 2-3 years. If the insured dies from natural causes during the waiting period, then the beneficiaries get back only the premiums paid plus interest, not the full death benefit amount. The full benefit is payable immediately on the death of the insured if it results from an accident.

Some of our clients were very apprehensive about this at the outset of our work with them. One of the couples we met, Mary and Robert, questioned whether this kind of policy would be worth the effort if one of them passed away shortly after taking out the coverage. However, once we explained to them exactly how the waiting period works and that it was designed to keep monthly premiums as low as possible, they seemed more confident in their decisions.

The Benefits of Guaranteed Life Insurance for Seniors

Guaranteed Acceptance

The most significant benefit is that acceptance is guaranteed. Seniors who other Life Insurance Companies may have turned down due to pre-existing conditions or age are eligible. This can be life-changing for individuals who have spent months searching for coverage without success.

No Medical Exams

Another key benefit is that there are no medical exams. You won’t need to undergo health checks, provide medical records, or answer medical questions. This is perfect for seniors who have health issues that might disqualify them from traditional Life Insurance Policies.

Simple Application Process

The simplicity of applying for Guaranteed Life Insurance makes it one of the most attractive options for seniors. As mentioned earlier, the application can usually be completed in minutes, and approval is quick. This makes the process hassle-free, especially compared to traditional policies.

Affordable Premiums

Guaranteed Life Insurance Policies often come with lower premiums than you might expect. Because these policies offer smaller coverage amounts, the Life Insurance cost is usually much more affordable compared to larger Life Insurance Policies. It’s an excellent option for seniors who are on a fixed income or budget-conscious.

At Canadian LIC, we’ve seen many clients surprised at how affordable Life Insurance for Seniors can be, even without a medical exam. When they compare Life Insurance Quotes Online, they often realize how competitive the pricing is, especially when weighed against the peace of mind it offers.

Coverage for Final Expenses

For many seniors, the main concern is covering end-of-life expenses like funerals, burial, or cremation costs. A Guaranteed Life Insurance Policy ensures that your family doesn’t have to worry about how to cover these expenses during an emotionally challenging time. The payout from these policies is often just enough to cover those final costs, making it a practical option.

Drawbacks of Guaranteed Life Insurance for Seniors

While guaranteed medical Life Insurance offers numerous advantages, it’s essential to understand the potential downsides to make an informed decision.

Limited Coverage

One of the main drawbacks is that Guaranteed Life Insurance Policies typically offer lower coverage amounts compared to traditional policies. As mentioned earlier, most policies range between $5,000 and $25,000. If you’re looking for larger coverage amounts to leave a more substantial inheritance or pay off significant debts, this type of policy may not meet your needs.

Higher Premiums for the Coverage Amount

Guaranteed Canadian Life Insurance Policies may have higher monthly payments or premiums per dollar of coverage compared to traditional Life Insurance Policies. This is because the insurer is taking on more risk by not requiring medical exams or health questions.

Waiting Period

As discussed earlier, there is usually a waiting period of 2 to 3 years before the full death benefit is available for natural causes. While this may not be an issue for some, it’s essential to understand this limitation before choosing a Guaranteed Life Insurance Policy.

How to Get the Best Life Insurance for Seniors

Comparing online Life Insurance quotes is an important first step when considering Life Insurance as a senior. Most Life Insurance Companies will allow guaranteed policies, but the rates and terms vary significantly. Using an experienced insurance broker, such as Canadian LIC, can help you navigate the options to find the best policy available to your needs and budget.

At Canadian LIC, we help many seniors every day who are searching for Life Insurance solutions that suit their unique situations. That may be Guaranteed Life Insurance or another option we recommend to you based on your needs. We’ll make sure to match our clients with appropriate coverage. When you compare Life Insurance Quotes Online and discuss your options with a knowledgeable insurance agent, you can have complete confidence in your choice.

Is Guaranteed Life Insurance Right for You?

The answer to this question can be of any kind, depending on your condition or financial situation. For any senior who has previously declined a Life Insurance Plan due to health concerns or for anyone who seeks an easy option to apply for with no medical exams, Guaranteed Life Insurance is a perfect fit. This is one surefire way to cover your final expenses without burdening your loved ones financially.

Conversely, other Life Insurance might offer more competitive rates or higher death benefits if you are in relatively good health condition and looking for larger coverage amounts.

Many of our clients come into Canadian LIC and vent their frustrations from dealing with trying to find Life Insurance previously. Countless seniors have told us about the headaches and confusion they had trying to deal with traditional insurance processes. But once we introduce them to guaranteed issue Life Insurance, showing them how it fits into their needs, they are able to feel relief from having made the right decision.

Summing It Up

The simplicity and ease of Guaranteed Life Insurance for Seniors cannot go unnoticed. Eliminating the headache of medical examinations, added with guaranteed acceptance, simply makes this type of insurance more accessible for seniors to cover end-of-life expenses. Any person who has found it difficult to secure insurance would be wise to investigate this option. You will never go alone on this journey if you have Canadian LIC by your side, which is considered by industry standards to be among the best insurance brokerages in the business. With many years of experience in serving seniors from coast to coast across Canada, we at Canadian LIC have realized now that Guaranteed Life Insurance offers both financial security and peace of mind for you and your loved ones.

More on Life Insurance

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- What Happens If My Life Insurance Provider Goes Bankrupt?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- How Can You Use Whole Life Insurance to Create Wealth?

- How Can You Use Whole Life Insurance to Create Wealth?

- What Happens If I Take a Loan from My Whole Life Insurance Policy?

- How Do I Become a Life Insurance Agent in Canada?

- What Are Paid-Up Additions in Whole Life Insurance?

- 5 Steps to Ensure Your Life Insurance Application is Approved

- What Is Underwriting in Term Life Insurance?

- Are There Any Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- Can I Adjust My Whole Life Insurance Policy?

- Is Mortgage Protection Insurance Better Than Life Insurance?

- What Does Term Life Insurance Cover and Not Cover?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- At What Age Should You Stop Buying Term Life Insurance?

- What Age Does Whole Life Insurance End?

- What are the advantages of Short-Term Life Insurance?

- What Are the 2 Disadvantages of Whole Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- At What Age Is Whole Life Insurance Good?

- What Is the Main Disadvantage of Term Life Insurance?

- Can I Buy Whole Life Insurance for My Child?

- Who Should Opt for Whole Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Which Life Insurance Is Most Popular?

- How to Buy a Million Dollar Life Insurance Policy?

- What Is the Best Age to Buy Universal Life Insurance?

- Is Whole Life Insurance Expensive?

- Can I Leave My Life Insurance to My Child?

- Can I Get a Million Dollar Life Insurance Policy Without a Medical Exam?

- Are There Any Tax Benefits for Life Insurance?

- Understanding How Does a Whole Life Insurance Policy Work: A Comprehensive Guide

- Why Buy Life Insurance for Kids?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- How Long Do You Pay Premiums for Universal Life Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Is Life Insurance Worth It After 70?

- What Is the Best Age to Buy Life Insurance?

- What Is the Biggest Risk for Whole Life Insurance?

- What Is True About Permanent Life Insurance?

- What Are the Two Main Charges Deducted Monthly from a Universal Life Insurance Policy?

- Do I Get Money Back from Term Life Insurance?

- What Are the Benefits of Universal Life Insurance in Canada?

- How is a Million Dollar Life Insurance Policy Paid Out?

- Can You Cash Out a Term Life Insurance Policy?

- Is Life Insurance a Good Investment in Canada?

- 10 Best Life Insurance Plans for 2024

- Is it Possible to have a Million Dollar Life Insurance Policy?

- What are the Biggest Life Insurance Companies in Canada?

- What is the Difference between Life Insurance and Critical Illness Insurance?

Frequently Asked Questions: What is Deductible in Super Visa Insurance?

Following are some of the most frequently asked questions about Guaranteed Life Insurance for Seniors in Canada. Let’s answer each question based on what we have encountered while helping our clients at Canadian LIC, which will make you easily understand each of your queries.

Guaranteed Life Insurance is a type of Life Insurance designed for seniors who may have difficulty qualifying for traditional policies. It doesn’t require medical exams, and acceptance is guaranteed, regardless of health. Many seniors we help are relieved when they learn they can get coverage without any health check.

Guaranteed Life Insurance is ideal for seniors who want to cover final expenses like funeral costs or small debts but have been turned down by other Life Insurance Companies due to health issues. At Canadian LIC, we often see clients in this situation, and they find comfort in knowing they can still secure affordable Life Insurance.

Most Guaranteed Life Insurance Policies offer coverage amounts between $5,000 and $25,000. We’ve found that many seniors choose this coverage to ensure their family won’t struggle with funeral costs. It’s not a huge payout, but it’s enough to cover final expenses, which many of our clients find helpful.

Yes, Guaranteed Life Insurance usually has a waiting period of 2 to 3 years. During this time, if death occurs from natural causes, only the premiums paid plus interest are returned. However, accidental death is covered right away. Many of our clients initially worry about the waiting period, but after explaining how it keeps premiums affordable, they feel more comfortable.

No, there are no medical exams or health questions required for Guaranteed Life Insurance. This makes the process quick and easy, which is why many seniors we work with prefer this option. They don’t want to deal with long applications or health exams, especially if they have existing health issues.

You can easily compare Life Insurance Quotes Online by visiting websites that specialize in senior Life Insurance. We always recommend our clients compare quotes from multiple Life Insurance Companies to find the best deal. Many seniors we assist at Canadian LIC are surprised at how much they can save just by comparing Life Insurance Quotes Online.

Guaranteed Life Insurance can have higher premiums for the amount of coverage offered, but the cost is often more affordable than traditional policies that require health exams. Our clients often find the cost worth it because they don’t have to worry about being denied coverage due to their health.

Yes, you can use Guaranteed Life Insurance to leave a small financial gift to your family. Most seniors we meet at Canadian LIC use this type of policy to cover final expenses and leave a little extra for their loved ones, ensuring that no one is left with the financial burden of their passing.

If you pass away from natural causes during the waiting period, your beneficiaries will receive the premiums you’ve paid plus some interest. However, if death occurs due to an accident, the full death benefit(or accidental death benefit) is paid out. We’ve helped many clients understand this detail, and they appreciate the protection Guaranteed Life Insurance offers even during the waiting period.

Yes, many Life Insurance Companies in Canada offer Guaranteed Life Insurance to seniors, even over 80 years old. We’ve worked with several clients in their 80s who were relieved to know they could still qualify for affordable coverage without medical exams.

Yes, Guaranteed Life Insurance Plans are available to seniors all across Canada. We help clients from coast to coast find the right policies that fit their needs and budget. Whether you live in Ontario, British Columbia, or any other province, you can get Life Insurance for Seniors.

Yes, many insurance companies offer the option to purchase Guaranteed Life Insurance online. It’s a quick and easy process. At Canadian LIC, we often guide seniors through this process, making sure they get the best rates and coverage.

These FAQs reflect the questions and concerns we witness our clients struggle with on a day-to-day basis at Canadian LIC. If you are one of those seniors who can’t decide whether or not Guaranteed Life Insurance is suited for you, the answers above shall provide some ideas for making your decision. Knowing what to expect, rather than going in blind, is a huge help for most of our clients and also makes them feel more confident about securing coverage.

Sources and Further Reading

- Government of Canada – Life Insurance Basics

A comprehensive guide to Life Insurance options, including coverage for seniors, provided by the Government of Canada.

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life.html

- Canadian Life and Health Insurance Association (CLHIA)

Information on Life Insurance Policies available in Canada, including Guaranteed Life Insurance for Seniors.

https://www.clhia.ca/ - Insurance Bureau of Canada (IBC) – Understanding Life Insurance

A detailed overview of Life Insurance types and considerations for Canadian consumers.

https://www.ibc.ca - InsuranceQuotes.ca – Life Insurance for Seniors

Comparison of Life Insurance Quotes Online for seniors, including guaranteed issue policies.

https://www.insurancequotes.ca

These resources provide additional information to help seniors make informed decisions about their Life Insurance options in Canada.

Key Takeaways

- Guaranteed Life Insurance for Seniors in Canada offers coverage without medical exams or health questions, making it accessible to all.

- This type of policy is ideal for covering final expenses like funerals and small debts, with coverage amounts typically ranging from $5,000 to $25,000.

- Guaranteed Life Insurance Policies often come with a waiting period of 2 to 3 years, but accidental death is covered immediately.

- Seniors can easily compare Life Insurance Quotes Online to find affordable policies from various Life Insurance Companies in Canada.

- While premiums can be higher than traditional Life Insurance, Guaranteed Life Insurance offers peace of mind for seniors who have been denied coverage elsewhere.

- 11 min read

- September 11th, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- September 11th, 2024

Your Feedback Is Very Important To Us

Thank you for your valuable feedback!

IN THIS ARTICLE

- What is Guaranteed Life Insurance for Seniors?

- What Is Guaranteed Life Insurance for Seniors?

- Why Do Seniors Need Life Insurance?

- How Does Guaranteed Life Insurance Work?

- The Benefits of Guaranteed Life Insurance for Seniors

- Drawbacks of Guaranteed Life Insurance for Seniors

- How to Get the Best Life Insurance for Seniors

- Is Guaranteed Life Insurance Right for You?

- Summing It Up