- What is a Deductible in Super Visa Insurance?

- The Basics of Deductibles in Super Visa Insurance

- Why Do Deductibles Exist?

- Choosing the Right Deductible

- How Deductibles Impact Your Super Visa Insurance Quote

- Common Struggles with Understanding Deductibles

- Impact of Deductibles on Super Visa Insurance

- Final Thoughts on Choosing the Right Deductible

Mostly, a deductible is one of the most confusing aspects of Parent Super Visa Insurance. If you have been reading about Super Visa Insurance Policies, you must have wondered how deductibles work and how they would affect your overall Super Visa Insurance cost. This is a common problem for any family: they want to have the best protection for their visiting parents without burdening themselves with extra financial stress. We have seen many clients here at Canadian LIC, wherein initially, they were always in doubt about choosing an appropriate deductible amount for their needs, but by the end of their journey with us, they were at peace.

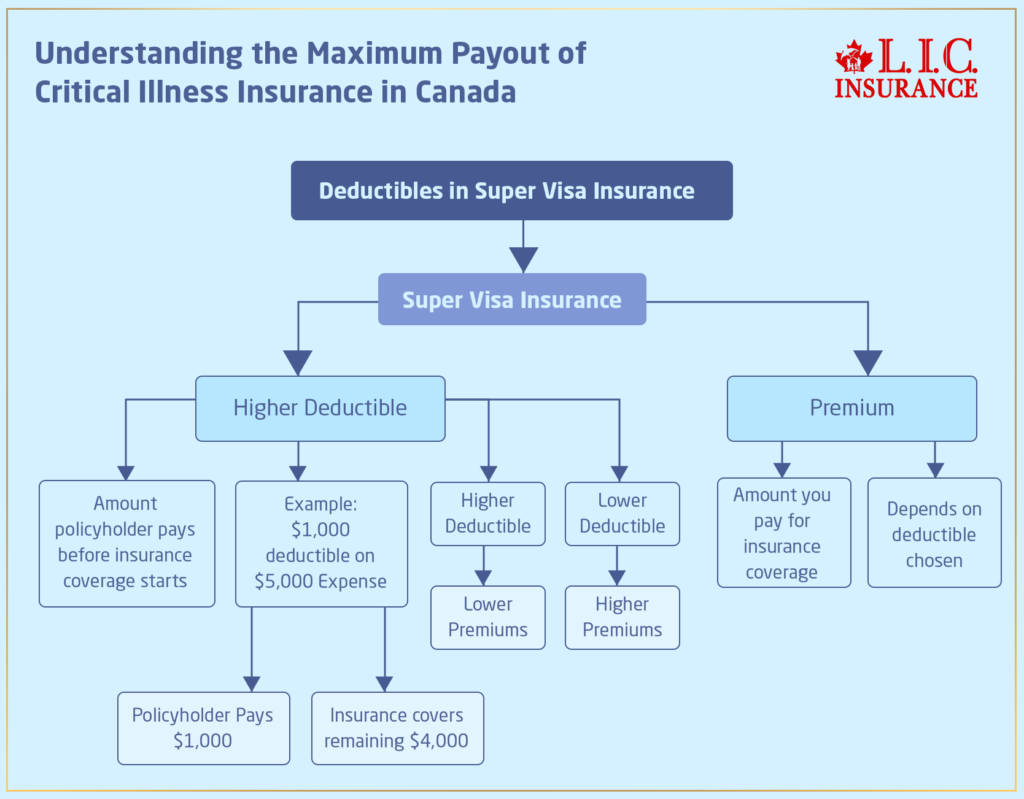

A deductible is what you agree to pay when an insurance claim is being made, and the amount needs to be paid out of pocket before the insurance provider covers the rest. While that may sound simple, how it will ultimately impact the quote for Super Visa Insurance and your coverage might just make all the difference in the world in your final decision.

The Basics of Deductibles in Super Visa Insurance

A Super Visa Medical Insurance Policy deductible is an amount of money that has been agreed upon and is paid by the policyholder(you)-before the insurance company starts paying out the remaining cost of a claim. This is a way of cost sharing, assisting different insurance companies in managing their risk while, at the same time, giving you more control over your premium.

Think of it this way: it’s the starting point at which your financial responsibility comes in. For instance, your parent’s Super Visa Insurance Policy has a deductible of $1,000. Your parent’s medical expenses amount to $5,000. You pay the first $1,000, and the remaining amount of $4,000 comes from the insurance.

But here is the catch- the higher the deductibles are, the lower the premiums will become, and vice versa. When our clients come to us at Canadian LIC, we always recommend finding that point where the deductible is within reach without the premium becoming unaffordable.

Why Do Deductibles Exist?

Deductibles in a Super Visa Canadian Medical Insurance exist for a few reasons:

- Cost-sharing: By agreeing to pay a portion of the claim, you take on some of the financial responsibility, which reduces the risk for insurance companies.

- Lowering Premiums: When clients ask us how they can get a lower Super Visa Insurance Quote, one of the simplest ways is to opt for a higher deductible. This reduces the cost of premiums since the insurance company will be responsible for less in case of a claim.

- Avoiding Small Claims: Deductibles discourage filing minor claims. For example, if you know you have a $500 deductible, you’re less likely to file a claim for something that costs $200.

From our experience, most clients find deductibles to be a useful tool for balancing the cost of their premiums while still ensuring their parents are protected.

Choosing the Right Deductible

It depends on several factors, such as the financial status and risk tolerance of the insured. Some clients who are looking to reduce their monthly payment feel comfortable with a high deductible, while others prefer the security of a low deductible because they will pay less upon submitting their claim.

- Financial Comfort: One of our clients wanted to buy Parent Super Visa Insurance for his parents, who are visiting from India. He wanted to opt for the highest deductible since it was a lot cheaper in terms of the premium price. But when we explained that if an emergency happened, he would need to come up with that higher deductible amount before the insurance kicked in, he reconsidered. After reviewing his financial situation, he opted for a middle-tier deductible, which gave him more peace of mind, knowing he could handle the cost if something happened.

- Frequency of Visits: It may make a lot of sense to choose a lower deductible, especially if your parents are coming very frequently or staying for longer lengths of time. Quite often, we see clients whose parents visit Canada for extended periods of time opt for lower deductibles, as there’s naturally going to be more of a chance they’ll require medical attention over a longer stay.

One client would have his mother visit him every year for six months. At her age and frequency of visits, he had wisely chosen a lower deductible to guard against surprise medical bills.

- Your Budget for Premiums: Other families want full coverage but do not want to pay high, unreachable monthly premiums. As they increase their deductibles, the premiums become cheaper. In the recent past, we worked with a family that was in dire need of keeping their upfront costs as low as possible since other commitments had strained finances to the limit. They opted for a higher deductible, knowing that they could afford the emergency case result, but preferred to cut costs on their monthly premium.

How Deductibles Impact Your Super Visa Insurance Quote

The Super Visa Insurance Coverage deductible you select will, in itself, affect your Super Visa Insurance Quote. A higher deductible means lower premiums, while a lower deductible brings about higher premiums. This is because, with a lower deductible, the risk to the insurance company is higher.

At Canadian LIC, whenever we provide a quote for Super Visa Insurance to a client, we always show them how it would change the premium cost with a deductible. This way, families can make an informed decision. As a matter of fact, we would suggest they ask themselves, “Would I be comfortable paying this deductible in case of an emergency?” If the answer is yes, usually that’s a pretty good sign that the deductible is appropriate.

For example, it is a given that a Super Visa Medical Emergency Coverage with no deductible will cost more than the one with a $1,000 deductible. We had a client interested in obtaining a policy with no deductible, but the premium soon became out of her reach. By adjusting the deductible a little, we were able to give her a much more affordable plan without sacrificing protection for her visiting parents.

Common Struggles with Understanding Deductibles

At Canadian LIC, we often are confronted with clients who don’t understand how deductibles work. Perhaps the most common frustration we get is trying to understand the trade-off between a lower premium and a higher deductible. Many families think that choosing the lowest premium is always the best, but after discussing the potential out-of-pocket costs with them, they often change their thinking.

One customer shared with us that they chose a very high deductible to save on premiums but regretted it when their parents suddenly needed some unexpected emergency medical care. Out-of-pocket expenses were much higher than they expected, and the strain caused them financial stress. They wish now they’d chosen a lower deductible to make the situation less stressful.

That is why we take the time to explain all the details with respect to the Parent Super Visa Insurance and how different deductibles affect both the premium and potential out-of-pocket costs. It’s not just about saving on premiums; it’s finding that sweet spot that will work for your family’s financial situation.

Impact of Deductibles on Super Visa Insurance

Over the years, we have catered to numerous families who shared their stories of deductibles in their Super Visa Insurance Policies. There was this one family that really stood out. They chose to go with a low premium and a higher deductible, thinking they were saving money. An accident occurred while their parents were visiting, and the family had to incur thousands of dollars in medical bills, finding themselves looking for a way to cover the deductible amount.

It is not an uncommon story. Many families, when faced with the reality of medical emergencies, realize that their deductible plays a much larger role than they initially thought. In the course of our work at Canadian LIC, we have come to realize that the best approach is to fully understand the financial commitment involved when choosing a deductible. Comparison often allows families to find Super Visa Insurance Policies with which they can be confident, whether that confidence comes from affordability or complete coverage.

Final Thoughts on Choosing the Right Deductible

In the end, picking the right deductible for your parent’s Super Visa Insurance all comes back to the right balance. You want to make sure that the premium is as affordable as it can get, yet the deductible must be realistically recoverable in case a claim is filed.

We’ve seen it over and over at Canadian LIC: families taking due care to consider their financial situation, the likelihood of needing medical care, and their comfort level regarding risk often make the best decisions regarding their Super Visa Insurance Policy. It is not about finding the cheap one but rather about finding the one that provides you with just the protection needed while fitting into your budget.

If you are not sure as to what deductible might be best for you, that is what we are here for. Our experience in working with so many different clients on a day-in and day-out basis provides unique insights related to your situation that make for a confident decision on your part.

By choosing the right deductible, you will save not only on a Super Visa Insurance Quote but also keep your parents well-insured during their stay in Canada. Let us walk you through this so that you can get back to what is important: spending time with your family.

More on Super Visa and Super Visa Insurance

- Can I Choose My Own Doctor or Hospital with Super Visa Insurance?

- Are Psychological or Psychiatric Services Covered Under Super Visa Insurance?

- How Can One Appeal a Denied Claim Under Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Change the Effective Dates of My Super Visa Insurance After Purchase?

- Can I Include My Spouse in the Same Super Visa Insurance Policy?

- Can I Get Super Visa Insurance If I Am Over 85 Years Old?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- What Are the Consequences of Not Having Valid Super Visa Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- Is There A Waiting Period For Super Visa Insurance?

- Is Super Visa Insurance Refundable?

- How to Find the Most Affordable Super Visa Insurance Plan?

- Where Can You Buy Super Visa Insurance in Canada?

- Is a Medical Test Required for Super Visa Canada?

- What Is the Processing Time for a Super Visa in Canada?

- Can Parents Work on Super Visa in Canada?

- Can We Cancel Super Visa Insurance?

- Can I Pay Monthly for Super Visa Insurance?

- When Should Super Visa Insurance Start in Canada

- 2023 Super Visa Program and Insurance Requirements Guide: Essential Updates and Insights

- Visitor Visa vs. Super Visa: Understanding the Differences

- What is a Super Visa Income Requirement?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions: What is Deductible in Super Visa Insurance?

A deductible is the amount you agree to pay before your insurance starts covering medical expenses. If your deductible is $1,000 and the total medical bill is $5,000, you will pay the first $1,000, and the insurance company will cover the rest. We often explain this to our clients at Canadian LIC, and many find it helpful in lowering their premiums.

The higher your deductible, the lower your premium. Many families we’ve helped at Canadian LIC choose a higher deductible to save on monthly premiums, but they ensure they can afford the deductible in case of a medical emergency. It’s about finding the right balance for your budget.

Insurance companies usually offer a range of deductible amounts to choose from, like $0, $500, $1,000, or even higher. When clients ask us which amount to choose, we always recommend that they consider their financial situation and comfort level when paying out-of-pocket costs.

A higher deductible lowers your premium, so it can be a smart choice if you want to reduce your monthly costs. We often see families with healthy parents or those visiting for shorter periods opt for higher deductibles to keep their premiums affordable.

If a medical emergency occurs, and you can’t pay the deductible, you might struggle to get the coverage you need. We’ve seen clients learn this the hard way. That’s why we encourage people at Canadian LIC to choose a deductible they can comfortably pay.

Usually, you cannot change your deductible on Supervisa Insurance once the policy is active, but you can always adjust it when renewing your policy. We remind our clients to review their Super Visa Insurance Policy every year to ensure it still meets their needs.

No, the deductible only affects how much you pay before your insurance starts covering costs. The rest of the coverage remains the same. We often explain to our clients that whether they choose a high or low deductible, their parents will still receive the same quality medical coverage once the deductible is met.

At Canadian LIC, we’ve seen that many families choose a deductible of $1,000. It provides a good balance between a manageable premium and a deductible that isn’t too high in case of an emergency

Yes, the deductible applies to each new claim. For example, if you have multiple medical claims, the deductible will apply to each one. We always remind our clients about this so they aren’t surprised by extra costs down the line.

Choosing the best deductible comes down to your financial situation and how much risk you’re comfortable taking. We work with families every day at Canadian LIC to help them pick a deductible that fits their budget while providing the right coverage for their parents’ needs.

These questions are what we commonly hear from families seeking Super Visa Insurance Quotes. By understanding how deductibles work, you’ll be better equipped to choose a policy that protects your loved ones and fits within your budget.

Sources and Further Reading

- Government of Canada – Super Visa Program Requirements:

- Canadian Life and Health Insurance Association (CLHIA) – Visitor Insurance Guide:

https://www.clhia.ca - Insurance Bureau of Canada (IBC) – Health Insurance for Visitors to Canada:

https://www.ibc.ca

These resources offer more detailed insights on Parent Super Visa Insurance, Super Visa Insurance Policies, and Super Visa Insurance Quotes.

Key Takeaways

- Deductibles are the amount you pay out-of-pocket before your Super Visa Insurance Policy starts covering costs.

- Choosing a higher deductible can lower your Super Visa Insurance Quote, but you'll need to cover more if a claim is made.

- The right deductible depends on your financial situation and comfort with paying upfront costs.

- You cannot change the deductible mid-policy, but you can adjust it at renewal.

- A higher deductible does not reduce the quality of your coverage. The policy remains the same once the deductible is met.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. We’re looking to understand the challenges Canadians face when it comes to selecting the right maximum payout for Critical Illness Insurance. Your responses will help us improve our services and provide better guidance to clients like you.

Thank you for your feedback! It will help us understand your struggles and improve our service.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]