- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- Can I Name Multiple Beneficiaries for My Whole Life Insurance Policy?

- What Is Underwriting in Term Life Insurance?

- Can I Adjust My Whole Life Insurance Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Are the 2 Disadvantages of Whole Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Best Age to Buy Universal Life Insurance?

- Are There Any Tax Benefits for Life Insurance?

- Understanding How Does a Whole Life Insurance Policy Work: A Comprehensive Guide

- What Is True About Permanent Life Insurance?

- What Are the Benefits of Universal Life Insurance in Canada?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- What Happens If I Take a Loan from My Whole Life Insurance Policy?

- How Do I Become a Life Insurance Agent in Canada?

- What Are Paid-Up Additions in Whole Life Insurance?

- Are There Any Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Which Life Insurance Is Most Popular?

- What’s the Longest Term Life Insurance You Can Get?

- What Are the Two Main Charges Deducted Monthly from a Universal Life Insurance Policy?

BASICS

- Can I Name Multiple Beneficiaries for My Whole Life Insurance Policy?

- What Is Underwriting in Term Life Insurance?

- Can I Adjust My Whole Life Insurance Policy?

What Does Term Life Insurance Cover and Not Cover?- What Are the 2 Disadvantages of Whole Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Best Age to Buy Universal Life Insurance?

- Are There Any Tax Benefits for Life Insurance?

- Understanding How Does a Whole Life Insurance Policy Work: A Comprehensive Guide

- What Is True About Permanent Life Insurance?

- What Are the Benefits of Universal Life Insurance in Canada?

- Can You Cash Out a Term Life Insurance Policy?

REVIEWS

COMMON INQUIRIES

- What Happens If I Take a Loan from My Whole Life Insurance Policy?

- How Do I Become a Life Insurance Agent in Canada?

- What Are Paid-Up Additions in Whole Life Insurance?

- Are There Any Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Which Life Insurance Is Most Popular?

- What’s the Longest Term Life Insurance You Can Get?

- What Are the Two Main Charges Deducted Monthly from a Universal Life Insurance Policy?

IN THIS ARTICLE

- What Happens to My Life Insurance Policy If I Move Abroad?

- Will My Life Insurance Policy Still Be Valid If I Move Abroad?

- Will My Premiums Change If I Move Abroad?

- Do I need to update my beneficiaries when I move abroad?

- Currency Concerns: What Happens to Payouts?

- Should I Consider Getting a New Life Insurance Policy in My New Country?

- Will My Policy Still Cover Me During International Travel?

- Are There Any Tax Implications for My Life Insurance Policy If I Move Abroad?

- Wrapping It All Up

What Happens to My Life Insurance Policy If I Move Abroad?

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 7th, 2024

SUMMARY

This blog explains how moving abroad impacts your Canadian life insurance policy. It covers whether your coverage remains valid, potential premium changes, updating beneficiaries, and currency issues. It also discusses the option of purchasing additional coverage abroad, tax implications, and the need to notify your insurance agent. Real-life examples illustrate how ex-pats manage these changes to ensure their financial security remains intact despite international moves.

Moving abroad is such an exciting experience in itself, full of new opportunities, challenges, and experiences. Among all the planning and organizational tasks done, not everyone actually reminds himself of what will happen with the Life Insurance policy left behind in Canada. Does the coverage stay intact? Will premiums change, and so on, if a new country has different regulations about Life Insurance? This is the kind of concern so many face.

We have seen hundreds of those questions across clients at Canadian LIC. They call us in a stressed condition, usually confused, to find out what they should do in this regard so that it can be ensured that whatever may happen with them, the future of their near ones is secured in terms of finances. This discussion is deserved because leaving the country does not merely mean taking out boxes from one home and shifting to another home; it means taking along your financial security, like Life Insurance.

Will My Life Insurance Policy Still Be Valid If I Move Abroad?

But the good news is that in most instances, the Life Insurance you have purchased in Canada will remain effective regardless of you moving abroad. Life Insurance Plans taken from a Canadian insurer are typically drafted to cover you anywhere you would be living if you continue to pay your premiums on time.

However, you must notify your Life Insurance provider or your agents of any change in your address. We always advise our clients at Canadian LIC to make such a notification. In case of lack of this notification, you will face the consequences at some future time, especially while processing claims or even changing policy details, for instance, contact information or currency preference.

For instance, let’s take the case of Karen, one of our long-standing clients who decided to relocate to the UK. Karen didn’t know what would happen to her Life Insurance policy. In seeking our help, we ensured Karen continued her policy without a break-only by continuing to pay her premiums on time. There were some minor changes in what she preferred to communicate through, which we accommodated fairly smoothly for her. After all, Karen’s story is not unique-she is just one of many individuals we help every year who relocate for work, for retirement, or for other family reasons.

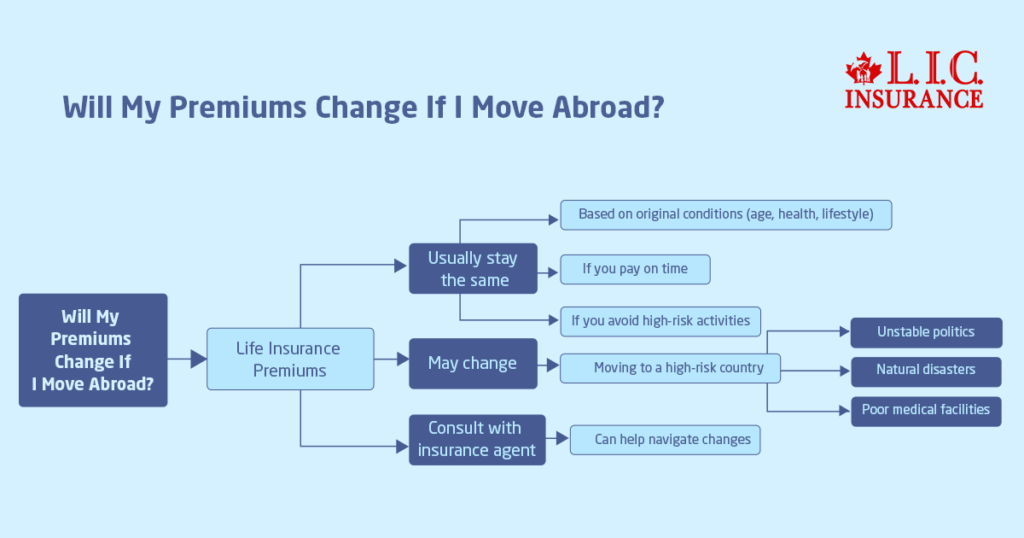

Will My Premiums Change If I Move Abroad?

One of the most common questions we get at Canadian LIC from clients moving overseas is whether their Life Insurance premiums will change. Well, the answer depends on a great number of factors. For most people, your premium amount will be the same. This is because Life Insurance Plans are usually based on the conditions set when you initially purchased the policy—your age, health status, and lifestyle at that time.

However, sometimes, your insurer would be required to review your risk factors depending on your new location. For instance, if you are moving to a country that is considered to be at a higher risk — maybe because of unstable politics, natural disasters, or lack of medical facilities, etc. — then your premiums might change. This is why staying in contact with your Life Insurance Agents is the need of the hour during such a period. They may help walk you through such transitions and let you know if you need to change your premiums.

For example, there was Mark, a client of ours in Canadian LIC. He had gone to a country which was in the clutches of mass political upheaval. He was quite disturbed whether his policy would be affected or not. After discussions with his Life Insurance agent, he came to know that the premiums would remain the same as long as he paid them in due time and did not indulge in some high-risk activities.

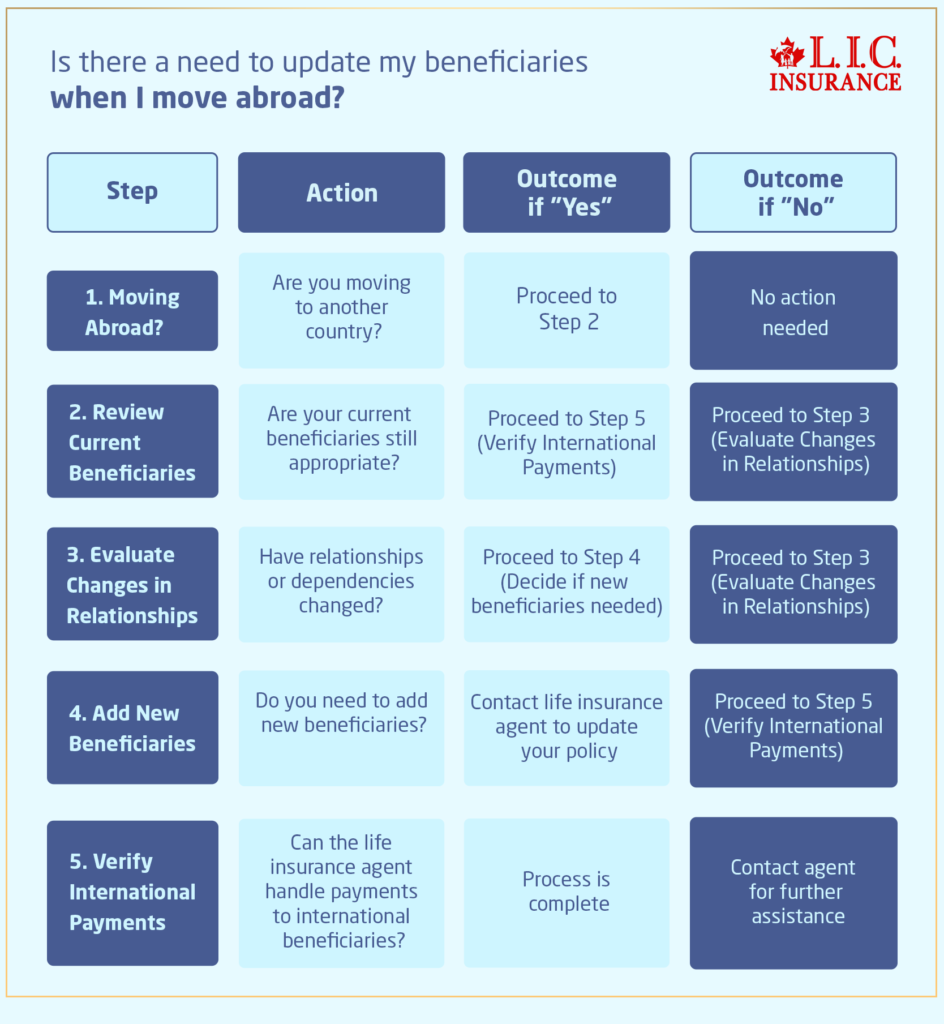

Do I need to update my beneficiaries when I move abroad?

The next thing you have to check on is the beneficiaries of your life Coverage. When you are leaving, there might be a change in situations, and so would the relationship and dependency level. You would want to check whether your present set of beneficiaries makes sense in your new location. Besides, if your beneficiaries are elsewhere, you have to verify with your life agents how the money would be returned to international beneficiaries.

Let us give you an example. David and his wife had bought Life Insurance years ago. That was back in the day when they were living in Canada. They later moved to Australia for work. They had their first child, and at this point, their Life Insurance beneficiaries suddenly needed a re-evaluation. He approached us at Canadian LIC, where we had his policy updated to reflect his child as a beneficiary. Today, he can take care of his growing family even if they are miles apart all over the globe.

Currency Concerns: What Happens to Payouts?

Another factor that will creep in when you decide to live abroad is currency. Your Life Insurance policy in Canada usually pays in Canadian dollars, but you may end up changing currency if you move to another country. This may deter the full payout that your beneficiaries will get upon maturity of your policy and the eventual payout. As such, it would be wise to talk to your agents about whether your policy is flexible about the currency for payout or if your beneficiary will have to exchange this accordingly.

We have one client, Lisa, who moved to Japan; she was concerned about this issue. With the support of Canadian LIC, we were able to explain to her how currency changes might affect the beneficiaries and introduced her to ways of planning financial protections. Not all insurers provide multi-currency payouts, so it’s essential to discuss information with your provider.

Should I Consider Getting a New Life Insurance Policy in My New Country?

One question we are always asked by expats moving overseas is, should they purchase a new Life Insurance policy in their new country of residence? It really depends on a whole array of factors. While you may be able to continue carrying your Canadian Life Insurance policy, some clients would like to have additional coverage in their new country of residence, depending upon the uncertainty of their long-term plans.

A new policy might also prove more advantageous if you’ll be abroad for a long time or forever. It can be of use when managing local taxes, regulations, or even changes in lifestyle not initially anticipated under the old policy.

Let’s take the example of Priya, one of our clients who moved to Germany for employment. Priya already had an existing Life Insurance policy with Canadian LIC but felt apprehensive about some gaps which were being formed due to variations in local laws and taxes. Eventually, after consulting with us, she went ahead and kept her existing policy but took a smaller supplementary life policy in Germany, as well. With that, she was assured that no matter what, both fronts of her family’s financial situations were protected.

Will My Policy Still Cover Me During International Travel?

If you are moving abroad and will frequently be travelling internationally, then you’re probably wondering what impact that has on your Life Insurance. The good news is that most Life Insurance issued in Canada is global in scope, meaning you’re covered regardless of the territory. There are, however, specific high-risk countries whose frequent travel visits or stays may invalidate coverage in your Life Insurance policy.

For example, we have a client, Robert, at Canadian LIC, who operates in the oil business and travels frequently to areas of high political tension. His Life Insurance Agent closely collaborated with him so that his travel schedule did not compromise coverage. His policy was scrutinized, and exclusions were placed on certain areas of high risk. It always helps double-check travel plans with Life Insurance Agents and ensure your coverage is not voided.

Are There Any Tax Implications for My Life Insurance Policy If I Move Abroad?

Taxes are another area that can easily become complicated with Life Insurance policies when you move abroad. Generally speaking, Life Insurance proceeds are not taxable in Canada, but the tax treatment of those proceeds may change if either you or your beneficiaries cease being Canadian residents. So, make sure to discuss the tax implications of your Life Insurance Plans with both a Life Insurance agent and a tax professional familiar with cross-border taxation.

As a matter of fact, Canadian LIC will regularly coach the client on how to understand taxes in their new country and how that affects Life Insurance. In particular, Greg, who is one of our expats working in Singapore, asked us whether the payout from his Life Insurance would be taxed. We presented him to a tax consultant, and after careful analysis, we could tell him that his Life Insurance policy in Canada would remain fully on to provide the policy benefits he was saving for his family without undue taxes.

Wrapping It All Up

Moving abroad can be very exciting and has its changes and challenges, but your Life Insurance policy should not be the thing keeping you awake at night. At Canadian LIC, we help clients every day to ensure their Life Insurance Plans remain effective and serve their loved ones, no matter where they choose to live. You could work closely with Life Insurance Agents to review your coverage and make any necessary adjustments.

If you’re moving or have already moved, remember also to contact the premier insurance brokerage, Canadian LIC. We are with you each and every step of the way to make sure your Life Insurance stays robust and strong.

More on Life Insurance Coverage

- Top Life Insurance Options for October 2024

- What is Guaranteed Life Insurance for Seniors?

- What Happens If My Life Insurance Provider Goes Bankrupt?

- How Do I Become a Life Insurance Agent in Canada?

- Steps to Ensure Your Life Insurance Application is Approved

- Is Mortgage Protection Insurance Better Than Life Insurance?

- Which Life Insurance Is Most Popular?

- Are There Any Tax Benefits for Life Insurance?

- Why Buy Life Insurance for Kids?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- Is Life Insurance Worth It After 70?

- What Is the Best Age to Buy Life Insurance?

- Is Life Insurance a Good Investment in Canada?

- 10 Best Life Insurance Plans for 2024

FAQs: What Happens to My Life Insurance Policy If I Move Abroad?

Yes, in most cases, your Life Insurance Plans will continue to cover you even if you move abroad. However, it’s important to notify your Life Insurance Agents about your move so they can ensure all your information is updated. At Canadian LIC, we have helped many clients maintain their coverage after moving to other countries, making sure there are no interruptions.

Your premiums will generally remain the same. Life Insurance Quotes are usually based on factors like your health, age, and lifestyle when you first bought the policy. However, if you move to a high-risk country, your Life Insurance Agents may suggest changes. For example, we’ve had clients who moved to politically unstable countries, and while their premiums remained unchanged, we made sure their policies reflected their new situation.

Yes, always inform your Life Insurance Agents if you’re planning to move abroad. This helps avoid any issues when it comes to updating your policy or making claims. At Canadian LIC, we make it a point to stay updated with our clients’ relocations and guide them through any necessary adjustments.

Most Life Insurance Plans pay out in Canadian dollars. If your beneficiaries live in a country with a different currency, they may need to convert the payout. It’s something we regularly discuss with our clients at Canadian LIC, especially when moving to countries where currency fluctuations might impact the payout amount.

It depends on your specific situation. Some of our clients at Canadian LIC have decided to keep their Canadian Life Insurance Plans and add a new policy in their new country. If you’re unsure, it’s best to talk to Life Insurance Agents who can help you assess whether additional coverage is necessary.

Your beneficiaries will still receive the death benefit, but if they live in a different country, there might be delays or extra steps in processing the payout. We’ve seen this with clients at Canadian LIC, and we always work with them to update their beneficiary details and make sure everything is in order before the move.

Yes, most Canadian Life Insurance Plans cover you while travelling internationally. However, frequent or long-term stays in high-risk countries may affect your coverage. We’ve helped many clients at Canadian LIC review their travel plans and ensure their policies cover them wherever they go.

No, your policy won’t be cancelled simply because you move abroad. As long as you continue to pay your premiums on time and notify your Life Insurance Agents about your relocation, your policy will remain valid. We always advise our clients at Canadian LIC to keep their insurers informed to avoid any confusion.

The tax treatment of your Life Insurance payout may change depending on your new country’s regulations. In Canada, Life Insurance payouts are generally tax-free, but this could differ in your new location. We often guide clients at Canadian LIC to consult tax professionals for more accurate advice on this matter.

To keep your Life Insurance active while living abroad, make sure to continue paying your premiums and stay in contact with your Life Insurance Agents. At Canadian LIC, we’ve worked with clients worldwide, helping them maintain their Life Insurance policies effortlessly.

Yes, you can still receive Life Insurance Quotes while living abroad, especially if you are looking to purchase new coverage in your new country of residence. Many of our clients at Canadian LIC have inquired about comparing Life Insurance Plans from both Canada and their new location. Life Insurance Agents can help you explore quotes and compare Life Insurance Options.

In most cases, you cannot transfer your Canadian Life Insurance Plan to a new country. However, your existing Canadian policy will usually remain valid as long as you continue to pay your premiums. If you want local coverage, Life Insurance Agents can assist you in securing new Life Insurance Plans in your new country, as we have done for many clients.

If you miss a premium payment, your Life Insurance policy may lapse. However, many Life Insurance Plans offer a grace period, usually 30 days, to make up for missed payments. At Canadian LIC, we remind clients to set up automatic payments, especially after moving abroad, to avoid missing any premiums. Life Insurance Agents can also help you reinstate your policy if it lapses.

Yes, you can continue working with your Canadian Life Insurance Agents even after moving abroad. At Canadian LIC, we have many clients who live overseas, and we keep in regular contact with them to help manage their Life Insurance Plans. Whether you need advice or updates, your agents are always available to assist you.

Your Life Insurance policy will remain intact as long as you continue paying your premiums. However, some countries may have different regulations or tax rules regarding Life Insurance payouts. We’ve seen clients at Canadian LIC face these questions, and we always recommend they consult both local advisors and their Life Insurance Agents to ensure compliance.

Yes, in many cases, you can still add riders or benefits to your existing Life Insurance Plans, such as critical illness or Disability Coverage. However, this may depend on the terms of your original policy. We’ve helped several clients at Canadian LIC update their policies even after they moved abroad by adding additional coverage through their Life Insurance Agents.

Yes, Life Insurance Quotes may change if you apply for a new policy after moving abroad. Factors like your age, health, and location influence the cost of Life Insurance. At Canadian LIC, we help clients compare Life Insurance Quotes from their new country and discuss how local factors may impact premiums.

Yes, you can keep your Canadian Life Insurance even if you become a citizen of another country. Your Life Insurance Plans will stay in effect as long as you meet your policy obligations. We’ve worked with many clients at Canadian LIC who became citizens of other countries but continued their Canadian policies with ease.

Yes, your Life Insurance Agents can still assist you with claims while living abroad. At Canadian LIC, we frequently help clients and their families process claims internationally. We work closely with both the clients and the Life Insurance Providers to ensure everything runs smoothly, regardless of location.

Yes, your beneficiaries can receive the Life Insurance payout even if they live in another country. However, the payout may be subject to currency exchange and local taxes, depending on their country of residence. At Canadian LIC, we have helped many clients understand how international payouts work and ensure their loved ones receive what they are entitled to.

These FAQs cover key points that many clients face when moving abroad with their Life Insurance Plans. Whether you’re relocating for work or settling in a new country, keeping an open dialogue with Life Insurance Agents can make the process much smoother.

Sources and Further Reading

- Government of Canada – Life Insurance and Related Products

- Visit the official Government of Canada website to learn about different types of Life Insurance Plans and their benefits.

- Visit the official Government of Canada website to learn about different types of Life Insurance Plans and their benefits.

- Canadian Life and Health Insurance Association (CLHIA)

- Get insights into Life Insurance in Canada, including how it works and frequently asked questions about Life Insurance Plans. https://www.clhia.ca

- Canada Revenue Agency (CRA) – Tax Treatment of Life Insurance

- Understand the tax implications of Life Insurance Plans and payouts when moving abroad. https://www.canada.ca/en/revenue-agency.html

- Canadian LIC – Life Insurance Agents Insights

- Read more about Life Insurance Agents’ role in assisting with Life Insurance Plans, quotes, and relocation-related concerns.

https://www.canadianlic.com

- Read more about Life Insurance Agents’ role in assisting with Life Insurance Plans, quotes, and relocation-related concerns.

These sources provide reliable information and further details on Life Insurance in Canada, especially for individuals moving abroad.

Key Takeaways

- Life Insurance Plans remain valid if you move abroad, but you must inform your Life Insurance Agents about your relocation to avoid complications.

- Premiums usually stay the same, though moving to a high-risk country might lead to adjustments. Consult your Life Insurance Agents for guidance.

- Beneficiaries in other countries can still receive payouts, but factors like currency conversion and taxes may apply.

- Keep paying your premiums on time and maintain communication with Life Insurance Agents to ensure your policy stays active.

- Consider additional coverage in your new country if local regulations or your circumstances have changed.

Your Feedback Is Very Important To Us

We appreciate your feedback! Please help us understand the challenges you faced or concerns you had regarding your Life Insurance policy when moving abroad. Your responses will help us improve our services and better address your needs.

Thank you for sharing your feedback!

IN THIS ARTICLE

- What Happens to My Life Insurance Policy If I Move Abroad?

- Will My Life Insurance Policy Still Be Valid If I Move Abroad?

- Will My Premiums Change If I Move Abroad?

- Do I need to update my beneficiaries when I move abroad?

- Currency Concerns: What Happens to Payouts?

- Should I Consider Getting a New Life Insurance Policy in My New Country?

- Will My Policy Still Cover Me During International Travel?

- Are There Any Tax Implications for My Life Insurance Policy If I Move Abroad?

- Wrapping It All Up