- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Happens If You Can't Pay Your Term Life Insurance?

- Why Missing Term Life Insurance Payments Happens

- What Happens If You Miss a Payment on Your Term Life Insurance?

- How to Avoid Missing Payments on Your Term Life Insurance

- Alternatives If You Can't Afford Your Term Life Insurance

- Why It's Important to Keep Your Term Life Insurance Plan

- How Canadian LIC Can Help

- The End

- More on Term Life Insurance

What Happens If You Can’t Pay Your Term Life Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 23th, 2024

SUMMARY

The blog discusses what happens if you can’t pay your Term Life Insurance, including the grace period, policy lapse, and reinstatement options. It shares practical tips to avoid missed payments, such as budgeting, automatic payments, and working with Term Life Insurance Brokers. It highlights alternatives like lowering coverage or switching providers and emphasizes the importance of maintaining coverage for your family’s financial security, with insights from Canadian LIC’s experience.

Introduction

Life is full of surprises, and sometimes, paying for a Term Life Insurance Plan becomes hard. This is a situation many people in Ontario, Canada, and all over the country have encountered. It could be financial setbacks, medical bills, or loss of a job. The thought of losing Term Life Insurance coverage is nerve-racking. From our experience at Canadian LIC, one of the best term life insurance brokers, we can see that clients often raise concerns about what happens if they miss payments on their policies. If this sounds like you, read on to understand your options and how to avoid losing your valuable coverage.

Why Missing Term Life Insurance Payments Happens

Life is unpredictable, and a financial situation can easily turn around overnight. Often, we hear from clients who purchased a Term Life Insurance Plan when they were at their best financially, only to find it a difficult proposition to keep premiums flowing afterwards.

Common causes of late payments are:

- Job Loss: A loss of a source of income can make it challenging to prioritize insurance premiums.

- Unexpected Expenses: Medical bills, car repairs, or other emergencies can strain a budget.

- Underestimation of Premiums: Sometimes, the client underestimates the premium amount of their Term Life Insurance policy when they don’t get precise quotes about Term Life Insurance online.

If any of these challenges sound familiar, rest assured they are not isolated concerns. Canadian LIC collaborates closely with clients in Ontario and Canada as a whole to come up with solutions best suited for the respective clients.

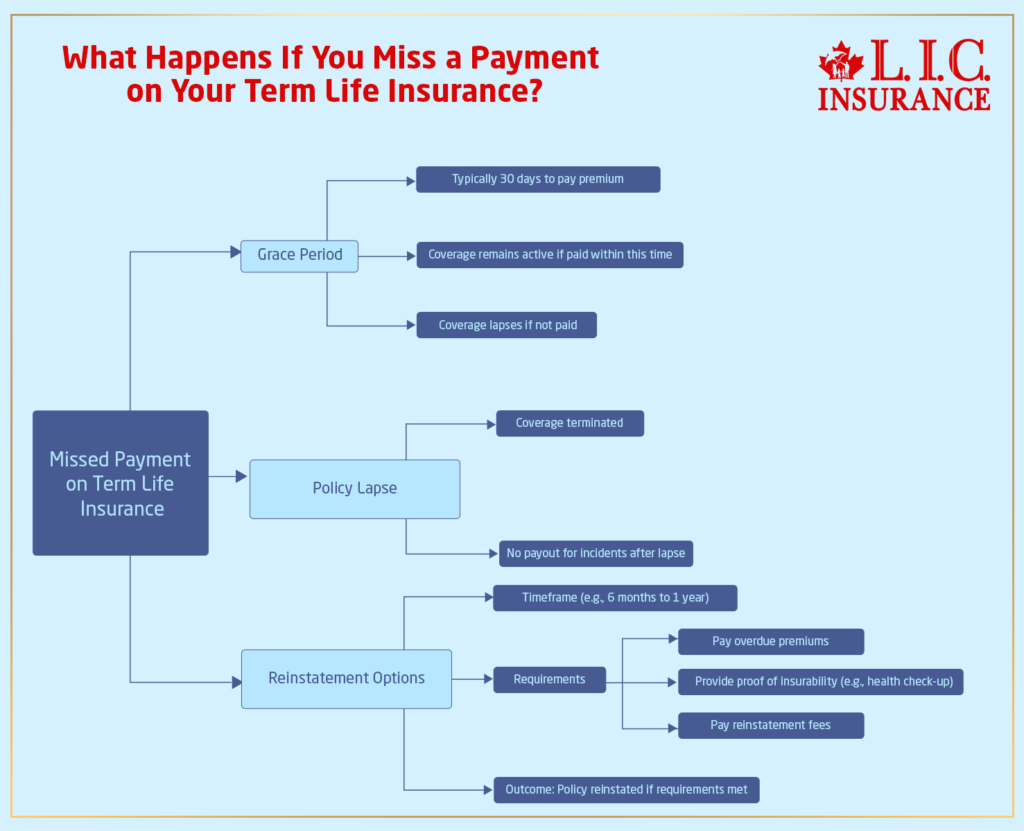

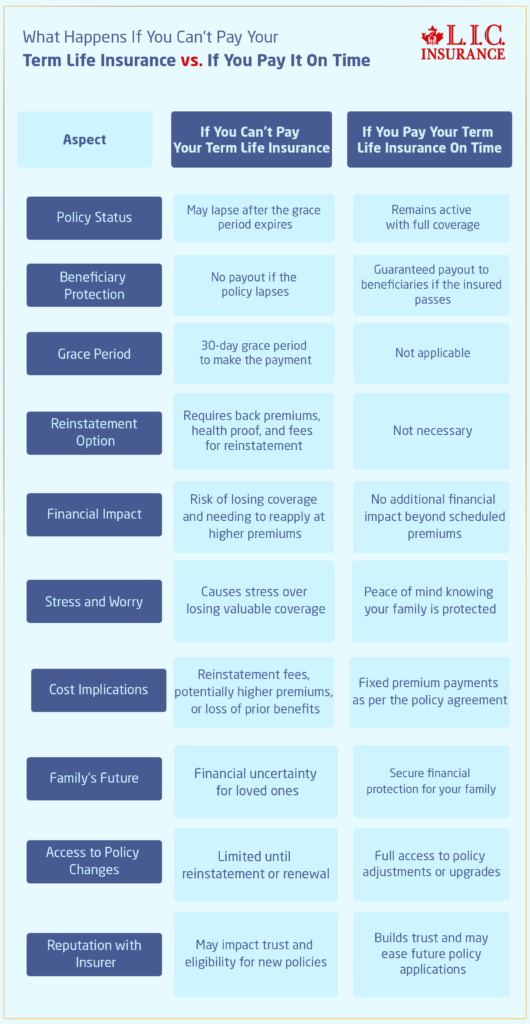

What Happens If You Miss a Payment on Your Term Life Insurance?

This, in turn, doesn’t necessarily cancel the policy due to missing a payment but, indeed, starts a process you must understand.

Grace Period

Term Life Insurance Ontario Canada has a grace period. This refers to a specific number of days, usually 30 days, during which the premium can be paid so that the coverage is reinstated.

If you pay before this grace period, then your cover is active and free of penalties. On the other hand, the cover may lapse if one fails to pay within this grace period.

Policy Lapse

When grace periods end without paying premiums, your Term Life Insurance lapses. That simply means the coverage is terminated, and in the case of any mishap that may occur, nothing will be paid to the beneficiary.

Policy lapses are one of the common concerns, but as experienced Term Life Insurance Brokers, we always guide our clients on how to prevent this.

Reinstatement Options

If your policy lapses, don’t lose hope. Many Term Life Insurance providers offer reinstatement options. This allows you to reactivate your policy within a specific time frame (often up to six months or a year).

To reinstate your policy, you’ll typically need to:

- Pay overdue premiums.

- Provide proof of insurability (such as a health check-up).

- Pay any additional fees associated with reinstatement.

How to Avoid Missing Payments on Your Term Life Insurance

Preventing missed payments helps ensure that your Term Life Insurance Plan is maintained. We have extensive experience helping people in Ontario, Canada, to share some practical steps, and these are:

- Pick the Right Term Life Insurance Plan: The first crucial step is to choose a policy within your budget. Canadian LIC always emphasizes the need to obtain accurate Term Life Insurance Quotes Online before committing to a given plan.

- Choose Automatic Payments: Automatic payments ensure that you don’t miss a payment date, and most Term Life Insurance providers offer such services for added convenience.

- Rebalance Your Budget Periodically: Life happens, and so do your Term Life Insurance premiums. Work with an insurance broker to discuss how you may need to alter your budget.

- Work with Term Life Insurance Brokers: Trusted brokers, such as those at Canadian LIC, can help you find flexible policies and guide you if financial difficulties arise.

Alternatives If You Can't Afford Your Term Life Insurance

If your financial situation becomes unmanageable, there are alternatives to completely losing your coverage.

Reduce Your Coverage

Talk to your life insurance company about reducing the amount of coverage you have. This will lower your premiums paid while still giving out some level of protection.

Convert to a Permanent Life Insurance Policy

A lot of Term Life Insurance policies are convertible to a Permanent Insurance Policy. Although the Permanent Life Insurance premiums may be higher, they provide cash value accumulation that can be accessed during difficult times.

Seek Aid Programs

Some Term Life Insurance firms in Ontario, Canada, are offering premium relief programs for policyholders who are experiencing temporary hardship. This may be discussed with your broker.

Change Companies

Switch providers if your existing provider cannot satisfy your needs; Term Life Insurance Brokers will help find cheaper alternatives.

Why It's Important to Keep Your Term Life Insurance Plan

Maintaining your Term Life Insurance coverage would prove to outweigh the pains of missing out on those payments. In the end, Term Life Insurance provides for your loved ones, meaning that they have a bright future, regardless of how short your lifetime may have been.

Regrets of Canadian LIC clients with lapse policies often come forth because they underestimated the role a Term Life Insurance plays, and this is something they can avoid with proper assistance.

How Canadian LIC Can Help

We’re aware of how hard it is to keep insurance coverage when it’s most important, and we’re actually amongst the top Term Life Insurance Brokers in Ontario, Canada. Our team collaborates with the clients to:

- Find Term Life Insurance Quotes Online that suit their budgets.

- Provide flexible solutions to avoid policy lapses.

- Give advice according to individual circumstances.

We are here for you to protect what’s important to you without causing stress.

The End

A missed payment on your Term Life Insurance policy is definitely one of the challenges most Canadians face, and it’s not the road’s end. Understanding these options will help you get on track.

You can find solutions specific to your needs by dealing with trusted Term Life Insurance Brokers like Canadian LIC. When looking for term life quotes online or need assistance that may help you avoid lapse, you can seek guidance.

Act today and ensure your family’s future. Contact Canadian LIC for expert advice and personalized assistance.

More on Term Life Insurance

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: What Happens If You Can't Pay Your Term Life Insurance?

If you miss a payment, your policy usually enters grace, which is usually 30 days. During this grace period, you can make the overdue premium payment that will keep your coverage alive. If you fail to pay within this grace period, your Term Life Insurance will lapse, and your coverage will cease.

Yes, most Ontario Term Life Insurance providers offer reinstatement within a specific period. You would likely pay the overdue premiums, complete the health check, and pay the reinstatement fee. Canadian LIC often helps clients go through this process to ensure rapid regaining of coverage.

You can avoid missed payments through automatic payments, budgeting for premiums, or opting for a Term Life Insurance Plan that comes at affordable rates. Canadian LIC will assist their clients by offering an accurate Term Life Insurance quote on the web so you can pick the plan most suitable for your budget.

If you cannot afford your premiums, talk to your provider or broker. You could reduce your coverage to pay a lower premium or find a more affordable policy. Canadian LIC’s experienced Term Life Insurance Brokers can help you decide on the best course of action.

It might. You could face higher premiums or more health requirements if you allow your policy to lapse and then try to get a new plan later. Therefore, it is prudent to explore reinstatement options with your current provider or broker.

Indeed, you may change providers if your existing plan is no longer appropriate for your budget. Canadian LIC assists its clients in Ontario, Canada, by comparing Term Life Insurance Quotes Online and finding a more suitable one.

There are typically no penalties during the grace period. However, it’s important to pay within this time to avoid a policy lapse.

If your Term Life Insurance Plan lapses, something bad will happen to you, and your beneficiaries won’t receive the death benefit, so it’s always great to keep your policy active for the financial security of your loved ones.

Yes, you can discuss reducing your coverage amount with your provider. This will lower your premiums while retaining some level of protection. In fact, most Canadian LIC brokers can help clients find flexible options.

A broker like a Canadian LIC works to ensure one gets personalized advice and solutions. Brokers can, therefore, help you get affordable online Term Life Insurance Quotes Online, adjust your policy and even switch providers without the loss of coverage.

Canadian LIC offers tailored advice, flexibility in options, and supportive service for Ontario and beyond. Be it changing plans, better rates, or reinstatement, the team protects you at every step of the way.

Online quotes help you understand all the insurance costs and coverage options clearly. This will then help you choose the right term life insurance for your budget and needs. Canadian LIC provides you with accurate quotes to make this process easier and quicker.

Yes, many providers let you adjust your payment frequency to monthly, quarterly, or annual payments. This flexibility can help you manage your budget more effectively.

The best way to find the right Term Life Insurance policy is to work with experienced Term Life Insurance Brokers. A broker such as Canadian LIC can compare Term Life Insurance Quotes Online and identify affordable and reliable options.

No, providers do not cancel your plan after one missed payment. They offer a grace period to catch up. Be sure to communicate with the provider or broker if you are struggling to pay.

Such commonplace inquiries like the above for Canadian LIC enable Canadians to move through and challenge their Term Life Insurance policy. Let’s find out how we may best help you!

Sources and Further Reading

- Government of Canada – Life Insurance Overview

https://www.canada.ca

A reliable source for understanding life insurance regulations and consumer rights in Canada. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

Provides insights into life insurance policies, coverage options, and industry standards. - Ontario Insurance Commission

https://www.fsrao.ca

Offers guidance on insurance policies, including Term Life Insurance in Ontario, Canada. - Insurance Bureau of Canada (IBC)

https://www.ibc.ca

Covers insurance basics, tips for choosing the right policy, and managing premium payments. - Canadian Financial Consumer Agency (FCAC)

https://www.canada.ca/en/financial-consumer-agency.html

Resources to help consumers make informed decisions about life insurance.

Key Takeaways

- Missed Payments Have a Grace Period: Most Term Life Insurance Plans offer a grace period (usually 30 days) to pay overdue premiums and keep coverage active.

- Policy Lapses Can Be Reinstated: If your policy lapses, many insurers allow reinstatement by paying overdue premiums and fulfilling requirements like health checks.

- Work With a Broker: Term Life Insurance Brokers like Canadian LIC can guide you in finding flexible solutions and affordable plans tailored to your needs.

- Preventive Steps Matter: Setting up automatic payments, budgeting for premiums, and choosing the right plan are effective ways to avoid missed payments.

- Alternatives Are Available: If premiums are unaffordable, consider reducing coverage, switching to a different provider, or exploring premium relief programs.

- Family Protection is Crucial: Maintaining your Term Life Insurance Plan ensures financial security for your loved ones and prevents future coverage challenges.

- Online Quotes Are Essential: Comparing Term Life Insurance Quotes Online helps you select an affordable plan that aligns with your financial situation.

- Act Quickly: Communicating with your provider or broker as soon as you face financial difficulties can help you retain your coverage and avoid complications.

Your Feedback Is Very Important To Us

We appreciate your taking the time to share your experience. Your feedback will help us better understand the challenges people face when managing Term Life Insurance payments.

Thank you for providing your feedback! If you need assistance, our team at Canadian LIC is here to help.

IN THIS ARTICLE

- What Happens If You Can't Pay Your Term Life Insurance?

- Why Missing Term Life Insurance Payments Happens

- What Happens If You Miss a Payment on Your Term Life Insurance?

- How to Avoid Missing Payments on Your Term Life Insurance

- Alternatives If You Can't Afford Your Term Life Insurance

- Why It's Important to Keep Your Term Life Insurance Plan

- How Canadian LIC Can Help

- The End

- More on Term Life Insurance