- What Happens If My Life Insurance Provider Goes Bankrupt?

- Understanding: Is Your Life Insurance Safe?

- The Role of Assuris: Your Financial Safety Net

- How Canadian LIC Helps

- What Happens to Your Premiums?

- What About Your Beneficiaries?

- Term Life vs. Whole Life: Does It Make a Difference?

- How Canadian LIC Ensures You are With the Right Provider

- What You Can Do Today

- Closing Thoughts

Life Insurance has become an essential safety net on which many people in Canada rely to protect their families and ensure that their finances are secure. On the other hand, it is disquieting even to contemplate how life would be if your provider of Life Insurance went bankrupt. It is a situation that no one ever wishes to find themselves in, but it is fundamental to understand what would transpire if this happened. What if you pay premiums for years, trusting that your Life Insurance Policy in Canada will provide the necessary financial support when the time comes? What if that trust is suddenly shaken by the news of your insurer going bankrupt?

This is not a merely hypothetical concern, since quite to the contrary, it is very real, as it is frequent that at Canadian LIC—we deal with clients who come to us with such fears about the stability of their Life Insurance Providers. This blog will take you through what happens when your Life Insurance Provider goes bankrupt and ways to keep you and your family secure.

Understanding: Is Your Life Insurance Safe?

You might have heard those horror stories about companies going into financial trouble, and, of course, the feeling that it could just happen to your Life Insurance Provider touches a raw nerve. The good news is that Life Insurance in Canada is highly regulated, and the system includes protections for policyholders. But let’s face it: when clients come to Canadian LIC, they don’t always realize these protections exist, and they worry. It is part of our job to ensure that they understand how Life Insurance in Canada is secured, even in the improbable case of the insurer declaring bankruptcy.

Yet, when you are buying Life Insurance online or from the Best Life Insurance Brokers, long-term solvency is not one of those considerations. You want to assume that your insurer is going to be there when you need them most. Life is replete with surprises, and sometimes, companies run into financial quicksand.

The Role of Assuris: Your Financial Safety Net

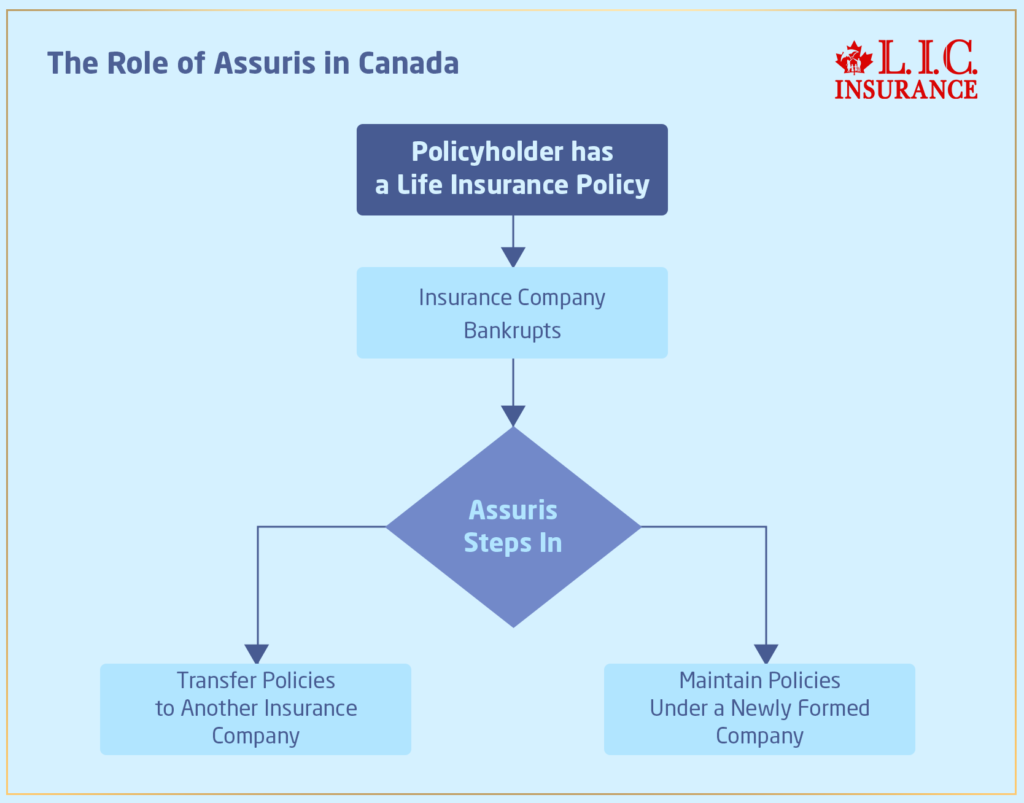

Assuris is a non-profit organization responsible for protecting policyholders against Life Insurance company bankruptcies in Canada. In order to add further to your safety net, in case the worst happens, your Canadian Life Insurance Policy remains mostly intact. One common question we get from clients who come to the Canadian LIC pertains to what exactly it is that Assuris does—quite an understandable question, for sure, given how important such Life Insurance is.

Assuris steps in to protect policyholders either by transferring the policies to another insurance company or maintaining the policies under a newly formed company. Assume that you have a death benefit of $200,000; under such circumstances, Assuris ensures that at least 85% of your policy death benefit is covered. In most cases, policyholders get 100% of the promised benefits.

How Canadian LIC Helps

We once had a client who came in quite concerned, having heard a rumour that their Life Insurance Provider was in some financial trouble. They came into Canadian LIC in a panic, worried that their Life Insurance Policy in Canada was in jeopardy. We comforted them with an explanation of how Assuris works, including how their policy was protected. The relief was palpable, and it certainly put into perspective why educating our clients on these important aspects of their Life Insurance is so crucial.

What Happens to Your Premiums?

Another popular question is regarding all the premium funds that one pays in over the years. What happens to it when your Life Insurance company goes bankrupt? The explanation at Canadian LIC is that the premiums you have paid still work for you. The new insurance company which takes over your policy will normally honour the original terms, so your coverage can continue without a break.

This was particularly the case with one of our clients who had been paying into his policy for over a full ten years. To think of losing that investment was terrifying. We were able to inform them of how Assuris ensures that the policy remains in force and the premiums continue to be used as they were originally intended. They left our office with peace of mind, knowing that their hard-earned money was still securing a bright future for their family.

What About Your Beneficiaries?

The whole point of a Life Insurance Policy is to provide for your loved ones when you’re no longer around. Therefore, it naturally brings the question of what happens with your beneficiaries in case something terrible happens to your provider of Life Insurance. This is one concern we get quite often here at the Canadian LIC, where clients intend to make sure their families are taken care of.

If your Life Insurance company goes out of business, Assuris works to ensure your beneficiaries get the death benefit you intended. For example, if you have a policy with a $500,000 death benefit, Assuris ensures your beneficiaries will get at least $425,000 and likely more, depending on the situation.

Term Life vs. Whole Life: Does It Make a Difference?

Clients often ask us if the type of Life Insurance they have affects what happens during a bankruptcy. The answer is that protection in both term and whole life policies is in place, but there are some limited differences in how they’re protected. When it comes to Term Life Insurance, if your Life Insurance Provider becomes insolvent, Assuris will ensure your coverage continues for the same period as originally promised until the end of the term. Under Whole Life Insurance, which has a cash value element, Assuris protects not just the death benefit but actually ensures the cash value is transferred to the new provider.

At Canadian LIC, we help our clients understand the differences between the two products of Term and Whole Life Insurance, especially when questions about the financial capability of the insurer are raised. We once had a client with both types of policies and a potential bankruptcy. We explained that their term policy would stay as is and that the cash value and the death benefits in their whole life policies would be safe and transferred if they were to need long-term care. Understanding these protections gave them confidence in their decision to continue with their Life Insurance Plans.

How Canadian LIC Ensures You are With the Right Provider

When you buy Life Insurance online or through a broker, it’s easy to focus solely on the cost and benefits of the policy. But what about the stability of the provider? At Canadian LIC, we don’t just sell policies; we partner with clients to ensure they are with the Best Life Insurance Brokers who work with companies that are financially stable and reputable. We carefully vet the companies we recommend, taking into account everything from their financial ratings to their customer service records to their long-term viability.

For example, one day, a customer came to us, having been informed that the competitor was charging lower premiums. They were ready to switch providers to save a few dollars each month. We did some investigation into that competitor and determined that, for all intents and purposes, its financial stability was an open question. We made this client aware of the risks of switching to a provider that could become unstable and helped him find one more secure, if a tad more expensive, fit within his means. This experience reinforced for them the value of working with the Best Life Insurance Brokers who prioritize their clients’ long-term security over short-term savings.

Steps You Can Take to Protect Yourself

While Assuris has an excellent safety net in place, it’s always wise to be proactive in protecting yourself and your family. Here are some steps you can take based on the advice we give our clients at Canadian LIC:

- Research Your Provider: Before you buy Life Insurance online or through a broker, research the financial health of the insurance company. Look for strong financial ratings from agencies like A.M. Best or Moody’s.

- Work With Trusted Brokers: Choose the Best Life Insurance Brokers who have a reputation for working with stable, reliable insurance companies. At Canadian LIC, we only recommend companies that we trust to be around for the long haul.

- Review Your Policy Regularly: Life changes, and so do your insurance needs. Regularly reviewing your policy with your broker ensures that your coverage remains adequate and that you’re still with a provider that meets your needs.

- Stay Informed: Keep an eye on the financial news related to your insurance provider. If there are signs of trouble, talk to your broker about your options.

- Diversify Your Coverage: Some clients choose to diversify their Life Insurance coverage by holding multiple Life Insurance policies with more than one provider. This strategy can reduce the impact if one insurer faces financial difficulties.

What You Can Do Today

If you are concerned about the financial stability of your Life Insurance Provider, the best thing you can do is contact Canadian LIC. We’ll be happy to help review your current policy for the purpose of determining the financial health of your provider and exploring other options if necessary. It is our mission to ensure that your Life Insurance Policy in Canada remains something on which you and your loved ones can continue to rely, no matter what happens.

We have dealt with clients apprehensive about the financial situation of their insurer, and through our deliberation, they got the much-needed reassurance. Whether you want to buy Life Insurance online or review an existing policy, we’re here to guide you through it smoothly. Plan now and don’t be left regretting later, as this safeguards your family’s future with the best brokers of Life Insurance in Canada.

Closing Thoughts

With Life Insurance, you should not have to worry about the solvency of your insurance company, but if you do, know there are protections in place, and you can take steps to protect your policy. At Canadian LIC, we’re committed to helping you understand these concerns and keeping your Life Insurance Policy in Canada a trusted source of protection for your family. Whether you are just now considering Life Insurance or have some apprehensions about your present provider, we will help you with all the guidance and support you need. Contact us today, and let’s plan your security for the future together.

By following these steps and working with Canadian LIC, one can be assured that in times of need, Life Insurance will be available for one’s family. Take control of your financial future today and partner with the Best Life Insurance Brokers in Canada to protect what really matters.

More on Life Insurance

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- How Can You Use Whole Life Insurance to Create Wealth?

- Should Both Husband and Wife Get Term Life Insurance?

- What Happens If I Take a Loan from My Whole Life Insurance Policy?

- How Do I Become a Life Insurance Agent in Canada?

- What Are Paid-Up Additions in Whole Life Insurance?

- 5 Steps to Ensure Your Life Insurance Application is Approved

- What Is Underwriting in Term Life Insurance?

- Are There Any Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- Can I Adjust My Whole Life Insurance Policy?

- Is Mortgage Protection Insurance Better Than Life Insurance?

- What Does Term Life Insurance Cover and Not Cover?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- At What Age Should You Stop Buying Term Life Insurance?

- What Age Does Whole Life Insurance End?

- What are the advantages of Short-Term Life Insurance?

- What Are the 2 Disadvantages of Whole Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- At What Age Is Whole Life Insurance Good?

- What Is the Main Disadvantage of Term Life Insurance?

- Can I Buy Whole Life Insurance for My Child?

- Who Should Opt for Whole Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Which Life Insurance Is Most Popular?

- How to Buy a Million Dollar Life Insurance Policy?

- What Is the Best Age to Buy Universal Life Insurance?

- Is Whole Life Insurance Expensive?

- Can I Leave My Life Insurance to My Child?

- Can I Get a Million Dollar Life Insurance Policy Without a Medical Exam?

- Are There Any Tax Benefits for Life Insurance?

- Understanding How Does a Whole Life Insurance Policy Work: A Comprehensive Guide

- Why Buy Life Insurance for Kids?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- How Long Do You Pay Premiums for Universal Life Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Is Life Insurance Worth It After 70?

- What Is the Best Age to Buy Life Insurance?

- What Is the Biggest Risk for Whole Life Insurance?

- What Is True About Permanent Life Insurance?

- What Are the Two Main Charges Deducted Monthly from a Universal Life Insurance Policy?

- Do I Get Money Back from Term Life Insurance?

- What Are the Benefits of Universal Life Insurance in Canada?

- How is a Million Dollar Life Insurance Policy Paid Out?

- Can You Cash Out a Term Life Insurance Policy?

- Is Life Insurance a Good Investment in Canada?

- 10 Best Life Insurance Plans for 2024

- Is it Possible to have a Million Dollar Life Insurance Policy?

- What are the Biggest Life Insurance Companies in Canada?

- What is the Difference between Life Insurance and Critical Illness Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions: What Happens if My Life Insurance Provider Goes Bankrupt?

If a life insurer in Canada were to become insolvent, then an independent not-for-profit corporation, Assuris, would step in to protect your policy. Assuris works to ensure your continuation of coverage, either by taking over your policy or selling it to another Life Insurance company. We at Canadian LIC witness people getting anxious over possible losses in their cover. We let them know that Assuris cares about their policy.

Yes, your beneficiaries will continue to receive the death benefit. Assuris ensures at least 85% of the death benefit is delivered, many times 100%. It is common for clients of Canadian LIC to mention their loved ones as a concern. We reassure them that their families would be taken care of, even in the unlikely event of an insurance provider declaring financial duress.

The premiums you pay will continue to work for you. When another insurance company assumes your policy, they generally respect the original terms. Canadian LIC takes the time to help clients understand that investment in one’s Life Insurance Policy in Canada is secure, even when their provider changes.

It covers both term and whole life policies, but there is a slight differentiation. Term policies will be continued up to the end of the term, while the whole life policies, including their cash value component accumulation, will be transferred to the new provider along with both the death benefit and cash value accumulation. More often than not, we address such fine details at Canadian LIC for those who are not quite sure how their particular policy will be handled.

You can also do your part to safeguard yourself by researching the financial health of your provider before making a purchase. Check for high ratings from organizations such as A.M. Best or Moody’s. Here at Canadian LIC, we partner with the top Life Insurance brokers who would only recommend companies that are financially stable and reputable. So many times, we have guided our clients through this process to make sure they choose a provider that will be there for the long haul.

Yes, you can if you’re concerned, but it’s highly recommended to consider the current policy and possible penalties or changes in coverage. Quite often, Canadian LIC supports its clients in reviewing options and switching to more secure providers.

In most cases, your premiums remain unchanged, even when your policy is transferred to a different company. Assuris ensures the continuity of the terms of your policy, including your premiums, as you originally set them up. We get numerous customers inquiring about increased premiums at Canadian LIC, and we are always quick to offer them assurance regarding their payments.

If you hear that your provider is in financial trouble, contact your insurance broker for advice. We at Canadian LIC often lead our clients through such a situation, considering options and making informed decisions. It’s essential to stay informed and proactive.

You can also verify the financial ratings of your provider with agencies such as A.M. Best or Moody’s. Working with top-calibre Life Insurance brokers, such as those of us at Canadian LIC, provides you with additional peace of mind. We recommend only those companies we trust to be financially secure and sound.

Yes, you can still buy Life Insurance online, but you must be cautious. Only choose the provider who has the best financial scores and consider also working directly with trusted brokers. Canadian LIC helps customers in finding trustworthy online Life Insurance policies.

Assuris is a not-for-profit organization that protects Canadian Life Insurance Policyholders in case their provider declares bankruptcy. It sees to it that your policy continues, either by transferring it to a new provider or maintaining it under a new company. At Canadian LIC, we quite often explain to concerned clients the role of Assuris.

Some would prefer to hold policies with multiple insurance companies as a form of coverage diversification in case one of the providers finds itself in financial turmoil. Canadian LIC enables customers to look into this avenue so that they get the best possible protection.

Canadian LIC guides you through the process, ensuring that your policy is transferred smoothly and that your coverage continues without interruption. We’ve helped many clients who were worried about their provider’s financial stability, offering them the support and advice they needed.

Yes, working with the Best Life Insurance Brokers, like those at Canadian LIC, ensures that you’re partnered with a financially stable provider. We thoroughly vet the companies we recommend to our clients, giving you confidence in your choice.

Review your current policy, research your provider’s financial health, and consider working with trusted brokers. At Canadian LIC, we’re here to help you take these steps, ensuring that your Life Insurance Policy in Canada continues to protect you and your loved ones.

Yes, you can switch providers if you have concerns about their stability. At Canadian LIC, we help clients review their current Life Insurance Policy in Canada and explore other options that might offer more security.

Buying Life Insurance online from lesser-known providers can be safe if they have strong financial ratings. However, working with trusted brokers like Canadian LIC can help you verify the stability of these providers. We often assist clients in evaluating new companies, ensuring their policies are secure.

If your provider goes bankrupt, Assuris protects your policy so you don’t lose the money you’ve invested. Your policy will either be transferred to another company or maintained under a new one. At Canadian LIC, we explain to our clients how Assuris safeguards their investments in their Life Insurance Policy in Canada.

Assuris ensures that your policy’s cash value is protected and transferred to a new provider. We at Canadian LIC often reassure clients that their cash value will be safe and will continue to grow according to the terms of their original policy.

A drop in financial rating can be a sign of trouble, but it doesn’t necessarily mean your provider will go bankrupt. At Canadian LIC, we advise our clients to review their policies and discuss their options if they notice a significant drop in ratings. It’s better to be cautious and consider alternatives.

The Best Life Insurance Brokers, like those at Canadian LIC, closely monitor the financial health of insurance companies. If a provider shows signs of instability, we alert our clients and help them explore safer options. Our goal is to keep your Life Insurance Policy in Canada secure at all times.

Yes, you can still file a claim. Assuris will ensure that your claim is processed and that you receive the benefits owed to you. We at Canadian LIC often help clients with this process, ensuring that they get the support they need during a challenging time.

If you’re worried about your provider’s stability, you can explore increasing your coverage or even diversifying with another provider. At Canadian LIC, we help clients assess their needs and find solutions that give them greater security.

When choosing a new provider, consider their financial ratings, customer service reputation, and the terms of their policies. We at Canadian LIC help clients evaluate these factors, guiding them to the Best Life Insurance Brokers who can find the right match.

During economic downturns, it’s important to regularly review your policy and stay informed about your provider’s financial health. At Canadian LIC, we support our clients by offering regular check-ins and updates on their provider’s status, helping them stay secure.

If your current provider goes bankrupt, Assuris will work to find a new provider for you or maintain your policy under a new company. We at Canadian LIC often guide clients through this process, ensuring their coverage continues without interruption.

While you can’t prevent a provider from going bankrupt, you can choose a provider with a strong financial history and monitor their health over time. At Canadian LIC, we help clients make informed choices and stay ahead of potential risks.

The Best Life Insurance Brokers, like those at Canadian LIC, prioritize your financial security and work only with reputable, financially stable providers. They offer personalized advice and stay up-to-date with Canada Life Insurance industry changes to protect your interests.

To ensure your policy remains valuable, regularly review your coverage, stay informed about your provider’s stability, and work with trusted brokers. At Canadian LIC, we help clients adjust their policies as needed, ensuring they get the most out of their Life Insurance investment.

These FAQs address common concerns that arise when thinking about Life Insurance Provider stability in Canada. By working with Canadian LIC, you can ensure that your Life Insurance is secure and that your family’s future is protected.

Sources and Further Reading

- Assuris – Protecting Canadian Policyholders

- Visit Assuris’s official website to understand how they protect Life Insurance Policyholders in Canada if their provider goes bankrupt. Assuris Website

- Canadian Life and Health Insurance Association (CLHIA)

- The CLHIA provides comprehensive information about the Life Insurance industry in Canada, including how Life Insurance is regulated and protected. CLHIA Website

- A.M. Best – Insurance Company Ratings

- Check the financial ratings of Life Insurance companies in Canada to assess their stability and reliability. A.M. Best Ratings

- Moody’s Investors Service

- Moody’s offers insights into the financial health and stability of insurance companies, helping you choose a reliable provider. Moody’s Website

These resources provide valuable information for understanding how your Life Insurance Policy in Canada is protected and how to make informed decisions when choosing a provider.

Key Takeaways

- Life Insurance in Canada is protected: Assuris ensures your Life Insurance Policy remains intact even if your provider goes bankrupt.

- Beneficiaries are safeguarded: Your beneficiaries will still receive at least 85% of the death benefit, often more, if your provider faces financial difficulties.

- Premiums and coverage continue: Your premiums will be honored, and your coverage will continue, usually without interruption, under a new provider.

- Choose stable providers: Working with the Best Life Insurance Brokers helps you select financially stable and reputable insurance companies.

- Stay informed: Regularly check your provider’s financial ratings and review your policy to ensure ongoing protection for your family.

Your Feedback Is Very Important To Us

We value your feedback and want to better understand the challenges you face if your Life Insurance Provider goes bankrupt. Please take a few moments to answer the following questions:

Your feedback is crucial in helping us understand and address your concerns. Thank you for taking the time to share your thoughts with us.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]