- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

What Happens After 15 Year Term Life Insurance

The Nature of a 15-Year Term Life Insurance Policy

Options After the Term Ends

Factors to Consider When Deciding

The Role of Cash Value in Permanent Policies

Why Seek Professional Guidance?

Term Life Insurance in Ontario, Canada

Real Client Experiences

Making the Right Choice for You

Taking Action with Canadian LIC

What Happens After 15 Year Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 27th, 2025

SUMMARY

The blog discusses what happens after the completion of a 15-year Term Life Insurance Policy. It talks about renewal of the policy, conversion into a permanent plan, or buying a new one. It further discusses factors affecting premiums, cash value for permanent policies, and other tools that include the calculation of cost, like Term Life Insurance calculators. The blog also shares the expertise of Canadian LIC, providing insights into Term Life Insurance rates to help clients make informed decisions.

Introduction

Life is unpredictable. It’s enough to cause headaches in planning anything for the future. You would have been judicious by opting for a 15-year Term Life Insurance; you ensured your family’s financial future was economically settled. The policy is now to be closed down, and questions start coming about the next step: renew or convert or allow it to lapse. That’s the dilemma so many face. Canadian LIC has dealt with over a thousand similar clients who found themselves in similar predicaments. Let’s explore it.

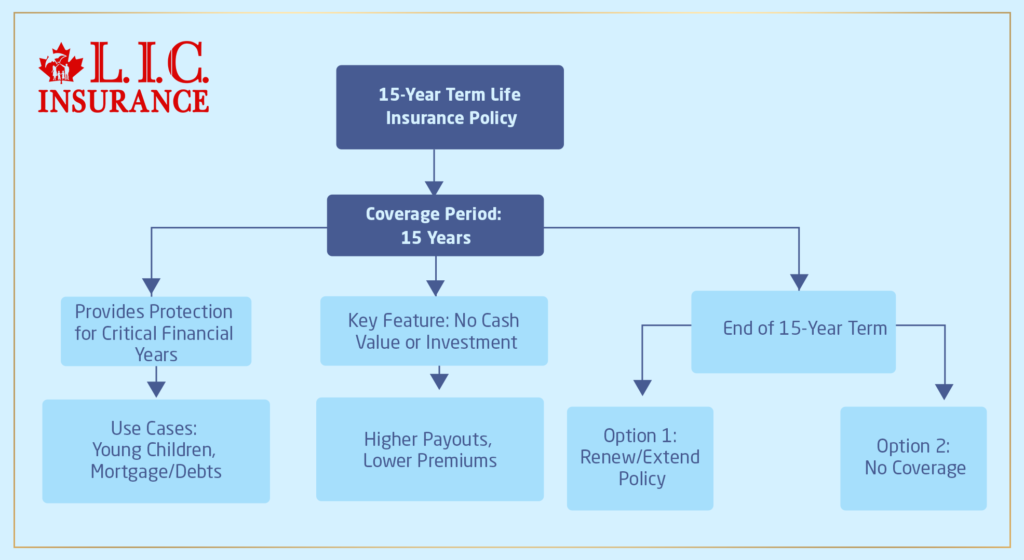

The Nature of a 15-Year Term Life Insurance Policy

A 15-year Term Life Insurance provides cover for a specific period. It is the simplest product that attracts the attention of those who wish to provide cover to their loved ones for the critical financial years. For example, many customers at Canadian LIC prefer this cover when they have young children or are paying considerable debts such as a mortgage.

Unlike permanent life insurance, term life does not invest or generate a cash value component. This can be a good feature for people who want coverage with higher payouts at a lower premium. Tools like a Term Life Insurance Calculator Canada are often helpful in determining the costs of such policies. But what happens when the term ends?

Options After the Term Ends

There are a number of choices once your 15-year Term Life Insurance Policy matures. Each option has its pros and cons. Let’s go through each of them one by one:

1. Renew the Policy

The most widely used is a renewal of the existing Term Life Insurance Policy. Most of the policies allow automatic renewal without a medical test; however, the renewal is also associated with the disadvantage that the premium increases very highly with age.

For example, Canadian LIC just helped a customer who used to pay $30 monthly for his $500,000 policy. When he renewed it, he was surprised when the premium doubled to $150 monthly. It’s because your age and health determine the renewal premium at the time of renewal.

If renewals are on your mind, then tools such as a Term Life Insurance calculator in Canada will help you calculate the new Term Life Insurance Premiums.

2. Convert to a Permanent Policy

It is possible to convert your Term Life Insurance into a policy with Permanent Coverage. For instance, Permanent Life Policies carry lifelong coverage and gather cash values with time. In contrast to the premiums, this kind of policy attracts people who would like certain coverage and to save.

Many of the clients of Canadian LIC do this, particularly if their good health has deteriorated, and it may be challenging for them to purchase a new policy. The bright side? The majority of Term Life Insurance Policies are convertible without a medical examination.

3. Purchase a New Term Policy

You could actually buy a new policy if you are still healthy and you have to renew for another term of the insurance. You may then buy another 15-year Term Life Insurance, but you can be given options on 20 or 30-year terms as per your preference.

Working with Term Life Insurance Agents can make things easy. They can help compare term life quotes online and get a policy tailored for you.

4. Let the Policy Lapse

Some people simply allow their Term Insurance to lapse when there are not nearly as many significant financial responsibilities around. Perhaps their children are raised, or a mortgage is fully paid off. It can mean you can save money on premiums but weigh that against how much your family may still require financial safety.

Factors to Consider When Deciding

Choosing what to do after your 15-year Term Life Insurance Policy ends requires careful thought. Here are some key factors to weigh:

Your Financial Obligations

Consider your current situation. Do you have anyone who relies on the money coming in for their welfare? Is any outstanding debt, like a house or school loan? Then, you must retain some type of life insurance coverage.

Your Health Status

Health is the other area where your choices play a role. If your health has worsened, a renewal or conversion of the existing policy might be easier to apply than a fresh new one.

Your Age

Age affects the cost and availability of life insurance. With age, premiums increase, and some policy types become unavailable. Calculators such as a Term Life Insurance calculator in Canada may help determine the true costs better.

The Role of Cash Value in Permanent Policies

Among the most common questions asked of Canadian LIC, we find inquiring minds that want to know about Term Life Insurance Cash Value. While Term Life Insurance doesn’t help build cash value, conversion to a permanent form of policy may prevent this facility from being able to do so. It can be used in various ways to supplement retirement incomes or fund key expenses.

For those who converted their policies, the introduction of cash value was a complete change. It doesn’t just ensure financial security but provides flexibility in the financial planning arena.

Why Seek Professional Guidance?

There are not many one-size-fits-all decisions regarding life insurance. In fact, experience with seasoned Term Life Insurance Agents can be invaluable. Such people know their stuff and will find you a way to pursue that which fits your objective.

At Canadian LIC, we have personally guided hundreds of customers through the maze of Term Life Insurance terminations. From comparing online quotes for Term Life Insurance to explaining the benefits of converting to a Permanent Plan, our team is dedicated to helping you make informed decisions.

Term Life Insurance in Ontario, Canada

There are a lot of variations in life insurance requirements among the populations living in Ontario. The province is quite diverse in terms of demographics, and families, professionals, and retirees all have their own specific concerns. Therefore, understanding the specifics of Term Life Insurance Ontario, Canada, is important.

For instance, a family based in Toronto needs to be saving for the sky-high cost of living, while a retiree in a small town needs to protect his savings. Through our services across different parts of the province, Canadian LIC was able to meet these diverse insurance needs.

Real Client Experiences

We have lately supported a client who was about to end his 15-year term policy. His main concerns were the higher Life Insurance Premiums, but still, he wanted the spouse to be covered. Based on his goals, we transferred the term policy into a Whole Life Insurance Contract. The new policy enabled lifetime coverage, plus it accumulated cash value.

There’s another case: a young professional in Ontario chooses to buy another new 20-year Term Life Insurance Policy because the term ends. He also used a Term Life Insurance calculator in Canada, thereby finding an inexpensive premium to cover his budget.

Making the Right Choice for You

It’s not the end of your financial planning journey with the end of a 15-year Term Life Insurance Policy. It is the opportunity to review your needs and choose a path that will continue to secure your loved ones. Whether it is renewal, conversion, or exploring new options, the key is to act in time.

Taking Action with Canadian LIC

At Canadian LIC, we are here to help guide you through these vital decisions. From comparing Term Life Insurance Quotes Online to calculating the premiums with our Term Life Insurance Calculator Canada to finding policies suited to your particular needs, we have experienced Term Life Insurance Agents to guide you through it.

Consider your situation now. Have you got some person who depends on such money coming to sustain his life? Is there any such outstanding debt, such as a house, school loan, etc.? Then, it is necessary for you to continue some form of Life Insurance Coverage.

More on Term Life Insurance

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs About What Happens After a 15-Year Term Life Insurance Policy

The Term Life Insurance will end when the 15-year term ends. You have options to renew, convert it into a permanent policy, or purchase another Term Life Insurance. Renewals often cost more than the initial cost, so it’s useful to know how much the Term Life Insurance rates are to plan ahead.

Yes, almost all Term Life Insurance Policies permit renewal. Nevertheless, the renewed premiums are pegged on your current age and health. The rates will, therefore, be higher compared to what you paid during the original term. Comparing quotes for Term Life Insurance online can give you the best choices.

Conversion into a Permanent Policy might be a very good option if lifelong coverage is what you need or you build up cash value. Many of the clients coming to Canadian LIC find this useful as they would not have to renew term cover after some years, which they want not to think about any longer. Let’s discuss with the agents selling Term Life Insurance as they can advise better.

Use the Term Life Insurance calculator in Canada to estimate what the new premium would be according to your age, health, and coverage amount. It is extremely useful in preparing for higher premiums at the end of the term.

Age, health condition, and coverage amount are deciding factors of Term Life Insurance rates. Pre-existing health conditions or smoking increases premiums significantly. Term Life Insurance Agents working for Canadian LIC are always there to guide clients in making the proper choices.

Yes. You may obtain a new Term Life Insurance Policy if you still require coverage. It might be cheaper to renew the policy if you are quite healthy. Many clients use Term Life Insurance Quotes Online to compare different options and then select a new policy that suits their requirements.

Most Term Life Insurance covers start immediately following approval. Nonetheless, the process of applying often involves a medical exam and underwriting, taking some time to complete. An individual can quicken the process by consulting Term Life Insurance Agents.

Since your personal finances may have changed, for example, you may no longer have dependent children or have paid up your mortgage-you probably no longer need life insurance. Most of the clients with Canadian LIC reassess their current situation to determine whether continuing Term Coverage is still necessary.

Permanent Life Insurance Plans accumulate a cash value that can be drawn upon in retirement or to pay for other needs. The benefits are generally much more valuable than the additional expense for most clients.

Online Term Life Insurance quotes are good estimates of costs but may not include all factors, like a patient’s medical history. Canadian LIC agents recommend the use of quotes as a starting point for consultation with a professional for detailed analysis.

Assess your financial goals, dependents, and liabilities. A Term Life Insurance calculator in Canada helps the person to know an estimate of the coverage he requires. Canadian LIC agents would guide clients through this process to make an informed choice for them.

This means you may have an opportunity to reduce premiums if you opt for a smaller coverage amount or select the coverage term. You may also find cheaper Term Life Insurance rates by comparing them and working with agents who understand your needs.

In Ontario, Canada, Term Life Insurance offers competitive rates but is primarily dependent upon the individual basis. Most customers use Term Life Insurance Quotes Online to evaluate the unique options created in their location and according to their needs.

Canadian LIC’s experienced agents meet with clients daily to discuss Term Life Insurance plans, compare online quotes, and make the right choices. The personalized approach guarantees you find the right coverage for your family’s needs.

Your coverage will lapse if you miss the renewal period. You may need to apply for a new Term Life Insurance plan, involving a medical exam and paying higher premiums. Always act soon so you will not end up losing your coverage.

Sources and Further Reading

Government of Canada – Life Insurance Information

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html

This resource provides a comprehensive overview of life insurance options in Canada, including term policies and their features.

Insurance Bureau of Canada – Understanding Life Insurance

https://www.ibc.ca/on/insurance-101/types-of-insurance/life-insurance

The Insurance Bureau of Canada offers insights into various types of life insurance policies, helping consumers make informed decisions.

Canadian Life and Health Insurance Association (CLHIA) – Resources for Consumers

https://www.clhia.ca/web/clhia_lp4w_lnd_webstation.nsf/page/FAQ-InsuranceProducts

CLHIA provides answers to frequently asked questions about life insurance products, including term and permanent policies.

Financial Consumer Agency of Canada – Managing Life Insurance

https://www.canada.ca/en/financial-consumer-agency/services/insurance/managing-life-insurance.html

This guide helps Canadians understand how to manage their life insurance policies effectively, including what to do at the end of a term policy.

Key Takeaways

- Options After a 15-Year Term Ends: When your 15-year Term Life Insurance Policy ends, you can renew it, convert it to a permanent plan, or purchase a new policy. Each option has its own benefits and considerations.

- Renewal Increases Premiums: Renewing your policy often leads to higher premiums due to age and potential health changes. Use a Term Life Insurance Calculator Canada to estimate costs.

- Permanent Policies Build Cash Value: Converting to a permanent life insurance plan offers lifelong coverage and the benefit of cash value growth, which can be used for future financial needs.

- Affordability of New Policies: If you’re in good health, purchasing a new Term Life Insurance Policy can be more cost-effective than renewing the old one. Comparing Term Life Insurance Quotes Online helps find the best deals.

- Customized Coverage for Ontario Residents: Term Life Insurance rates in Ontario, Canada, vary widely. Tailor your policy to meet your financial obligations, whether you’re supporting dependents or managing debts.

- Guidance is Essential: Working with experienced Term Life Insurance Agents simplifies decision-making. They can help you evaluate Term Life Insurance rates and recommend plans suited to your needs.

- Plan Early for Coverage Gaps: Avoid coverage lapses by acting promptly when your term ends. This ensures your family’s financial security remains intact.

Your Feedback Is Very Important To Us

We value your feedback and want to understand the challenges you face when deciding what to do after a 15-year Term Life Insurance Policy ends. Please take a few minutes to complete this questionnaire. Your input will help us serve you better.

Thank you for taking the time to share your thoughts. Your responses will help us provide better resources and guidance tailored to your needs.

IN THIS ARTICLE

- What Happens After 15 Year Term Life Insurance

- The Nature of a 15-Year Term Life Insurance Policy

- Options After the Term Ends

- Factors to Consider When Deciding

- The Role of Cash Value in Permanent Policies

- Why Seek Professional Guidance?

- Term Life Insurance in Ontario, Canada

- Real Client Experiences

- Making the Right Choice for You

- Taking Action with Canadian LIC