Siksha, a 35-year-old mother of two, finally decides to buy Term Life Insurance online. She had been procrastinating on her to-do list for months because, honestly, she had no idea whatsoever what such a policy usually covers or if the investment was worth it. Her friend has faced a financial crisis recently due to the sudden loss of her partner, realizing the need for financial security at that juncture. Now, like most Canadians, it is important for Siksha to make an informed decision about the protection of her family’s future, but the jargon and fine print of Term Life Insurance Policies make it hard for her.

Welcome to our full breakdown of what’s covered and what’s not under Term Life Insurance in Canada. This blog is going to do much more than demystify the realm of Term Life Insurance. No matter if you are looking into how to protect your loved ones or even interested in knowing what a Term Life Insurance Policy is, this blog will make everything easy for you.

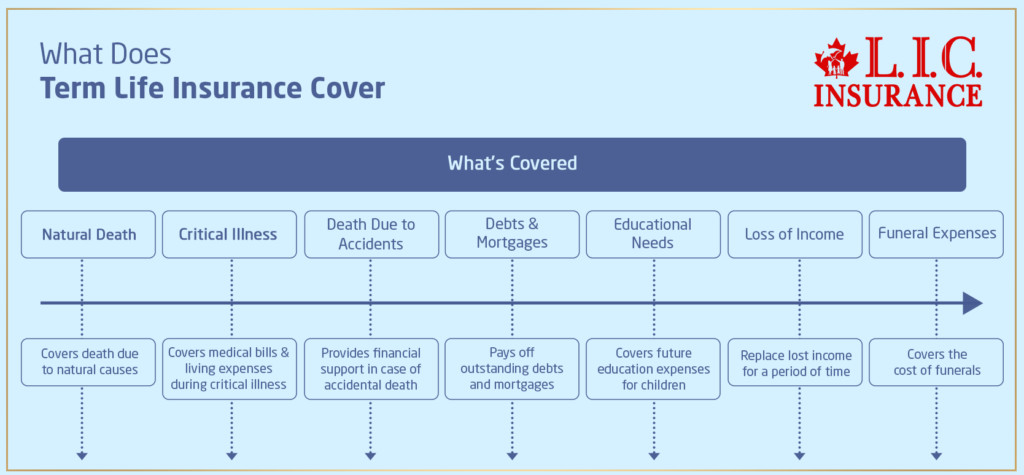

What Does Term Life Insurance Cover?

It’s not just any life insurance policy; it’s a guarantee of financial protection when your family is going to need more. Explained below is comprehensive coverage in Term Life Insurance:

Natural Death:

Example: Maria, one of our newest clients, purchased a Term Life Insurance Policy from us online a week after her father passed away due to a natural death. He was highly health conscious, but one day,he passed away from an unexpected natural illness. Fortunately, his Term Life Insurance Policy covered Natural Death, reducing the financial burden on Maria’s household. This kind of coverage is essential in reassuring that even in times as sudden as natural death, your family will have a back.

Critical Illness

One more powerful example is Robert, who was diagnosed with a critical illness. Fighting the disease was hard, but knowing that there was a critical illness covered in his term-life policy provided peace to him and his family. The policy contributed to medical bills and other living expenses, reflecting how much the policy was more than the pure policy’s death benefit.

Death Due to Accidents

Take the case of Linda, whose brother suddenly died in a car accident. The accident happened out of the blue, which shocked the family and could have caused trouble for them financially on top of their loss. However, the Term Life Insurance Policy brought immediate relief for the family, allowing them to deal with upfront financial needs without extreme stress. This is one of the very simple reasons why many procure Term Life Insurance quotes from reputed brokers.

Debts and Mortgages

A lot of people end up like John did, where their Term Life Insurance Policy pays off their home and their kids’ school costs. Most clients have said that they feel calmer knowing that their bills, especially mortgage payments, won’t be passed on to their children or grandchildren. Canadian LIC helps such clients get an understanding of how these policies work to make sure they select the right amount of coverage.

Educational Needs

A young mother, Samie, was concerned most about the expenses of the future education of her children. She discussed requirements with brokers of Term Life Insurance at Canadian LIC and agreed on a policy that clearly covered their children’s educational expenses. This foresight will ensure that, even in her absence, the education of her children will not be compromised.

Loss of Income

The sudden loss of a family’s primary earner can be devastating. Canadian LIC often shares stories like that of Emily, whose spouse’s death could have left the family destitute. However, their term life insurance policy provided a lump sum that replaced his income for several years, allowing the family to adjust financially without immediate hardship.

Funeral Expenses

A lot of people feel stressed out about how much funerals cost, but they don’t talk about it much. Canadian LIC clients appreciate their Term Life Insurance Policies for paying the costs of funerals so that one less financial worry hits them during a time of sorrow. Families focus on healing rather than on how they will afford their funerals.

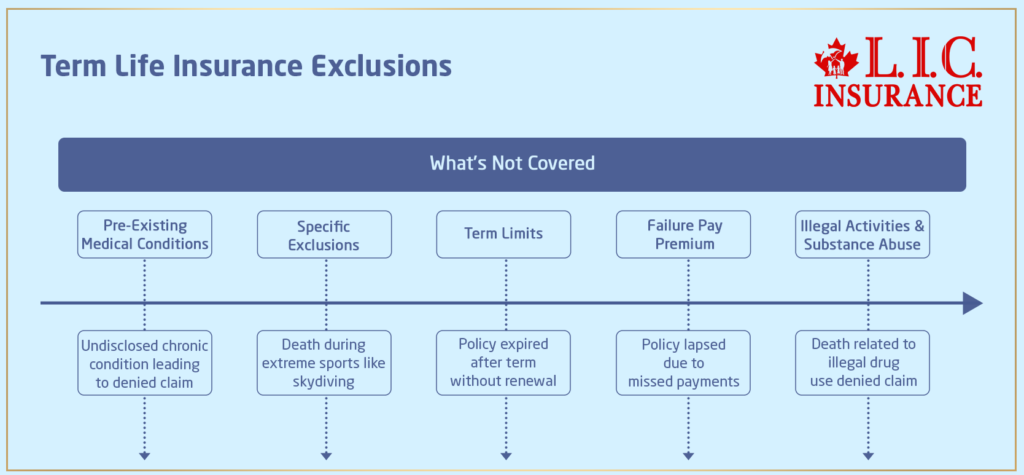

What Does Term Life Insurance Not Cover?

Understanding the ‘exclusions of Term Life Insurance’ is important in drawing the boundaries regarding its coverage. Typical exclusions that a policyholder is likely to come across are discussed in this section. Let’s break down these exclusions further.

Pre-Existing Medical Conditions

Very often, Term Life Insurance does not cover deaths relating to undeclared pre-existing medical conditions. This means that if you have a medical condition prior to buying life insurance online and you do not declare it, the insurer can deny your claim if it contributes to your death.

Rachel had been a client who purchased a policy without disclosing her chronic condition of hypertension. Years later, it would finally be that which killed her through a stroke. That would be used against her by the company, and her death claim would be denied on grounds of non-disclosure. Her family was left in a bad financial situation, all because of this. Canadian LIC uses Rachel’s story to remind agents that a client has to disclose a proposal fully.

Specific Exclusions

Engaging in high-risk activities can often lead to exclusions in Term Life Insurance Coverage. These activities would include skydiving, rock climbing, or other extreme sports that significantly increase the risk of death.

Mark was a base jumper who held a life insurance policy that did not adequately cover his kind of sport. One day, he nearly died. He subsequently contacted Canadian LIC Term Life Insurance Brokers to find a policy that offered additional coverage for his sport, ensuring he wasn’t leaving his family unprotected. This story shows the reason you should discuss your lifestyle thoroughly with your broker to make sure all activities are covered.

Term Limits

This means that Term Life Insurance Policies will cover you for a specified period called the term. If you outlive this term, then the policy will expire, and no benefits will be paid.

Laura had a 20-year term life policy. Her policy was due to expire, but she thought that it would easily be renewable. Actually, she did not rethink her insurance needs until it was very late. Now, at an advanced age and in poor health, term life premiums for a new policy were out of her reach. This is a story that Canadian LIC uses quite often to alert clients that it is important to think about the future and look at Term Life Insurance quotes early enough to prepare accordingly.

Failure to Pay Premium

If you do not pay for your premium, then the policy lapses, and there is no coverage.

Tom was a graphic designer who had been freelancing. His income took a nosedive one year, and he missed three insurance premium payments. He thought missing a short period would not make a big difference. However, as soon as he recovered and wanted to resume the policy, he was slapped with the increased Term Life Insurance premiums and severe policy conditions. Canadian LIC always advises the client to communicate with the company about their financial problem early enough so that they can work on grace periods or payment plans.

Illegal Activities and Substance Abuse

The death which occurs due to indulgence in illegal activities or substance abuse is usually not covered under the Term Life Insurance.

Anita’s brother tragically passed away in an incident related to illegal drug use. His claim was denied because his death was linked to an excluded activity. This situation serves as a critical reminder from Canadian LIC to policyholders about the severe implications of such exclusions on their insurance coverage.

Buying Term Life Insurance Online

Convenience and Comparison: The Digital Revolution

At this point in the hectic, digital age, shopping for Term Life Insurance online is simply invaluable. Imagine you’re sitting at your favourite coffee shop, the laptop is open, and you are browsing through some Term Life Insurance quotes. This is not only convenient but also empowering. You’re empowered to have access to loads of information from multiple insurers right at your fingertips.

Mark stated that by comparing quotes online, he learned what was out there in the market. At first, he had been very, very stressed out, and online comparison seemed just so convenient for him because he could compare terms, coverage limits, and required premiums side by side, finally allowing him to make an educated choice that catered to the needs of his family.

Interactive Tools and Calculators: What Are You Getting?

On most of these websites, one can get interactive tools and calculators that assess how much coverage one would desire. These tools consider factors like your age, income, debts, and future financial obligations.

Sarah, another Canadian LIC client, used an online calculator to determine her coverage needs. She input her details and adjusted the parameters to see how changes in her lifestyle, like purchasing a new home, would affect her insurance needs. This hands-on approach gave her confidence in her policy choice.

Transparency and Education: Learn on Your Own Time

Buying Term Life Insurance online is definitely more transparent than using traditional methods. Successful websites have very detailed FAQs, blogs, instructive content, and sometimes articles that go a long way toward demystifying the purpose of Term Life Insurance. Such educational content is very important in making an informed choice that is not, in any case, swayed by pressure through sales talk.

James, who was skeptical about life insurance, benefited from the educational resources available online. By reading through detailed guides and expert opinions hosted on Canadian LIC’s website, he gained a thorough understanding of what Term Life Insurance covers and how it could benefit his specific situation.

Dealing with Term Life Insurance Brokers: A Touch of Personal Interaction

The digital tools are priceless, while the input of experienced Term Life Insurance Brokers is still of great importance. They can give advice in a manner calculators and algorithms would never do. They look at your individual circumstances holistically and recommend the best policy for you.

After their initial online research, Linda and Tom approached a Canadian LIC broker. The broker helped them understand subtle nuances in policies that they hadn’t considered, such as riders for critical illness, which were suited to their family history of health issues.

Using brokers such as those found at Canadian LIC means that you will have ongoing support during the time your policy remains in force. They will help you in getting policy renewals and adjustments due to life changes that you most likely have faced. They will also help you in making claims.

When Kevin lost his job, he was quite worried about how he would keep his Term Life Insurance. He spoke to his Canadian LIC agent in Canada, who reviewed the conditions of his policy and revised his assured amount to align it better with his changed financial circumstances, hereby providing his family insurance as soon as possible.

Policy in Force: Full Application

It is very easy to finalize online as soon as you have made up your mind regarding which policy to purchase. Electronic signatures and digital processing greatly speed up what once was quite a lengthy process. Still, always be sure to finalize the details with your broker before signing.

After extensive discussions with her Canadian LIC broker, Rachel was ready to finalize her policy online. Together, they reviewed every clause to ensure that there were no surprises down the line. This final review saved Rachel from potential misunderstandings about her coverage.

Find Out: Does Term Life Insurance rates go up?

Find Out: How can one choose Term Life Insurance?

Find Out: The longest Term Life Insurance one can get

Find Out: Is it possible to get money back from Term Life Insurance?

Find Out: Why should one get Term Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) About Buying Term Life Insurance Online

Starting the process is straightforward. Visit a reputable insurance brokerage website like Canadian LIC. There, you can find detailed information and tools that help you understand your options. Just enter some basic information about yourself, and you can start comparing Term Life Insurance quotes right away.

Maria, a client of Canadian LIC, simply explained how she got started in getting Term Life Insurance Coverage online. Not knowing how to begin, she used the very user-friendly interface to get some quotes, which really helps in the comparison of policies at one’s own pace, hence less overwhelming.

While comparing Term Life Insurance quotes, you will basically want to compare the coverage amount, the term length or duration of the term, the premium rates, and some additional benefits or riders. You will then want to choose a quote that will not only comfortably fit within your budget but also have sufficient coverage.

Canadian LIC helped a young couple, John and Lisa, realize the need to align their insurance with their long-term financial aspirations. They learned how to buy quotes not based on the current lowest p

Brokers in Term Life Insurance are very knowledgeable and experienced. Therefore, they will be ready to offer customized advice according to your situation and guide you through the many policies.

It certainly worked for Tom, a Canadian LIC client, who realized that his health condition could impact his policy options. The broker was able to help him get a policy that accepted his condition without higher premiums, which is a nuance he might have missed had he decided to go directly.

Yes, provided you use safe and secure mediums for the same, you can purchase Term Life Insurance online. Canadian LIC makes sure that personal information is protected using the highest level of security and safety measures.

Canadian LIC was opted for by Emily since it held the most reputable place concerning online safety measures for its clients. Her experience with the company had been smooth and secure, so she had no apprehensions when managing her policy online.

Common mistakes include not accurately disclosing your health history, choosing insufficient coverage, and not reading the fine print of the policy. Each may lead to a number of unexpected issues that may arise later.

A client of Canadian LIC once underestimated his coverage needs by buying a minimal policy just to save some money. It took some really good discussion with his broker to realize that he actually needs a more comprehensive plan to protect his family’s future, leading to an adjustment in the policy.

Yes, most policies do allow for such adjustments. Be it increasing coverage or including another beneficiary, most of the time, you can set this by contacting your insurance broker.

After the arrival of their first child, the couple contacted their Canadian LIC broker to discuss updating the policy to reflect some additional cover for a growing family. Their proactive approach ensured that their new baby was protected under the policy.

To ensure competitiveness, compare quotes from multiple insurers. Brokers like those at Canadian LIC can help you assess the market to ensure you get the best deal based on comprehensive coverage and competitive pricing.

Helen, a diligent shopper, used Canadian LIC’s resources to compare several quotes. With her broker’s guidance, she identified the best value option, which balanced cost with extensive coverage, ensuring she wasn’t paying more for less.

Your broker is your go-to resource for any questions or concerns. Canadian LIC prides itself on continued client support, helping you understand every aspect of your policy whenever questions arise.

When Robert had questions about his policy during the financial review, his Canadian LIC broker explained everything thoroughly and gave him peace of mind about his coverage—valuing ongoing support.

The proper amount of coverage will be based on your financial obligations, your future goals, and the needs of your dependents. Online calculators can provide a good starting point, but discussing your situation with a Term Life Insurance broker can offer personalized insights.

Raj, a client at Canadian LIC, initially used an online calculator to estimate his coverage needs. However, after discussing his long-term financial goals with a broker, he realized he needed additional coverage to ensure his family’s financial stability in case of his untimely death. This conversation helped him make a well-informed decision.

In case there are discrepancies in quotes, one is expected to cross-check details with the life insurance company or consult one’s broker. Misconceptions may arise, or even errors may occur, and some brokers help to clarify any issues besides ensuring access to accurate information.

Alice found varying premiums for what seemed like similar coverage. By consulting with her Canadian LIC broker, she learned that some quotes had additional riders that affected pricing. This helped her make a more informed comparison.

The cover speed is determined by how slow or fast the underwriting process is and whether a medical exam is required. Some policies put a covered individual into immediate effect upon approval of an application, while others might take a few days or even weeks. Your broker can expedite matters for you and answer any questions about timing.

When Neil needed quick coverage due to a pending mortgage application, his Canadian LIC broker helped him find a policy that started immediately after online approval, providing the necessary documentation for his mortgage in time.

Yes, they do. Brokers add value by knowing your personal underwriting needs, getting the best policy match, helping you negotiate terms, and guiding you through complex situations that might not be evident from online quotes alone.

She appreciated the personal touch that her Canadian LIC broker could give, which the online platforms couldn’t match. The broker retained her special health issues and family history and suggested a policy with a critical illness rider that was tailored to her situation.

It’s always best to run by your broker first before cancelling any policy to interpret all potential penalties or premiums due for refunding. Brokers can also advise alternative options which may suit changing needs better.

After deciding to work abroad, Mike needed to cancel his policy. He was concerned about penalties, but his Canadian LIC broker guided him through the cancellation process and discussed potential future insurance options abroad.

Research directly the companies that interest you. Check their rankings and reviews. Independent-Term Life Insurance Brokers know the market very well and will lead clients to those that they trust the most.

Canadian LIC helped Laura vet insurance companies after she received several attractive quotes. Her broker provided insights into each company’s financial stability and customer service reputation, ensuring she chose a reliable insurance company.

Most policies will permit updates or changes in coverage. It is very critical to review your policy regularly and to discuss any serious life changes that have occurred with your broker, ensuring adequate continuing coverage.

After receiving a significant promotion, Jamal contacted his Canadian LIC broker to discuss increasing his coverage. Together, they adjusted his policy to reflect his new financial status, ensuring his family’s needs would be met.

These FAQs aim to enhance your understanding on how to buyTerm Life Insurance online and the invaluable role of brokers in this process. At Canadian LIC, we are dedicated to providing you with tailored advice and support, ensuring that you secure a policy that fits your unique life circumstances and offers peace of mind for the future.

Sources and Further Reading

Here are some suggested sources and resources for further reading on the topic of Term Life Insurance in Canada:

Insurance Bureau of Canada – Provides comprehensive information on different types of life insurance, including Term Life Insurance Policies and what they generally cover. Website: Insurance Bureau of Canada

Canadian Life and Health Insurance Association – Offers detailed guides and FAQs on life insurance products available in Canada, helping consumers understand policy specifics.

Website: Canadian Life and Health Insurance Association

Financial Consumer Agency of Canada – Offers resources for understanding life insurance, choosing a policy, and the role of insurance brokers.

Website: Financial Consumer Agency of Canada

Investopedia – Provides a wealth of articles on Term Life Insurance, including how to compare quotes and the intricacies of policy coverage.

Website: Investopedia – Term Life Insurance

NerdWallet – Features tools for comparing Term Life Insurance quotes and reviews of major providers, helping consumers make informed decisions.

Website: NerdWallet – Compare Life Insurance

These resources can provide further insight and detailed information to help you understand Term Life Insurance in Canada more deeply and make well-informed decisions regarding your insurance needs.

Key Takeaways

- Term Life Insurance covers death due to natural causes, accidents, and illnesses.

- Policies exclude coverage for deaths from high-risk activities, undisclosed health issues, or early-term suicides.

- Accuracy in providing personal and health information is crucial to avoid claim denial.

- Online tools facilitate easy comparison of Term Life Insurance quotes.

- Working with insurance brokers provides tailored advice for navigating policy details.

- Digital tools and expert advice aid in informed decision-making for purchasing Term Life Insurance.

Your Feedback Is Very Important To Us

This questionnaire aims to gauge the level of understanding and challenges faced by Canadians regarding Term Life Insurance, helping providers enhance their communication and support services.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]