- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Does It Mean to Buy Term & Invest the Difference?

- Understanding Term Life Insurance

- What Does “Invest the Difference” Mean?

- Benefits of Buying Term & Investing the Difference

- Real-Life Example of Buying Term and Investing the Difference

- Risks of the Buy Term & Invest the Difference Strategy

- Making the Decision: Is It Right for You?

- Why Canadian LIC is the Best Choice for Your Insurance and Investment Needs

- More on Term Life Insurance

What Does It Mean To Buy Term & Invest The Difference?

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 13th, 2024

SUMMARY

Most Canadians can fit into one of two commonly reoccurring dilemmas when they consider their own plans for the future: Investing in a comprehensive insurance policy or sticking to something simpler, like Term Life Insurance, and using the savings to invest separately. This strategy, known as “buy term and invest the difference,” often leaves individuals wondering which choice truly serves their needs. What does it really mean to buy Term Life Insurance and invest the difference, and how can that impact your financial security and growth in Canada?

Imagine that you wanted your money to secure the financial future of your family. If something happens to you, your loved ones won’t have the anguish of financial stress. However, you are still building your wealth. There is, among customers of the top insurance brokerage, Canadian LIC, always the dilemma of whether to use Term Life Insurance to ensure cheap coverage, invest the rest of the budget, or prefer a more effective permanent life insurance policy that builds cash value. This has to be another balancing act between having peace of mind and potential financial growth, and it’s a question our brokers handle every day. Our goal is to help you have a full understanding of what “buy term and invest the difference” really means so that you can make the best possible decision for your needs.

In this article, we will break down the concept of buying Term Life Insurance with a difference invested, explore its benefits and risks, and share insights from our experiences with Canadian LIC clients facing this decision. Let’s dive in.

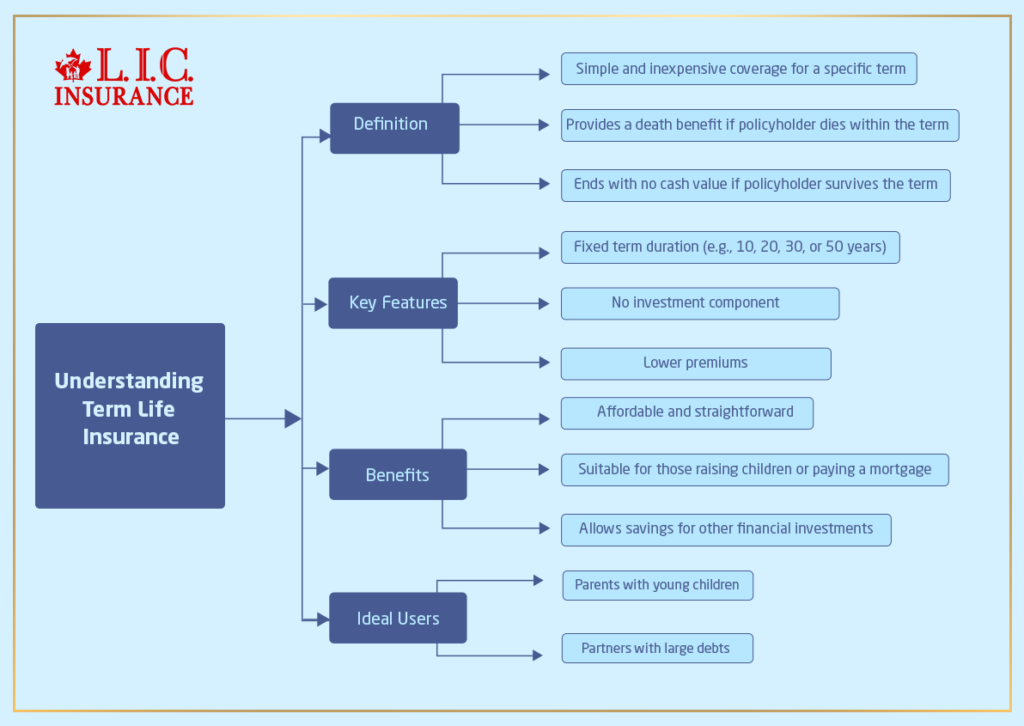

Understanding Term Life Insurance

That is why term life appeals to so many; it is just less complicated and more affordable. A Term Life Insurance Policy does not come with the investment aspect of Whole Life Insurance Policies. Rather, you are insured for the years you want the insurance, like when raising children or paying a mortgage. In doing that, premiums often end up much lower, which can fit better within a budget.

That is why term life appeals to so many; it is just less complicated and more affordable. A Term Life Insurance Policy does not come with the investment aspect of Whole Life Insurance Policies. Rather, you are insured for the years you want the insurance, like when raising children or paying a mortgage. In doing that, premiums often end up much lower, which can fit better within a budget.

A number of Canadian LIC clients require coverage for a definite period, such as parents with small children or partners with large debts to liquidate. Term Life Insurance satisfies the needs of such customers for protection without overstretching their budget, and the savings from the decision to go for term insurance open opportunities for other financial investments.

What Does “Invest the Difference” Mean?

That is why people usually save on premiums when they opt for Term Life Insurance compared to a more expensive permanent policy. The cost savings is usually referred to as the “difference.” The whole “buy term and invest the difference” concept simply goes this way: through this, you buy a Term Life Insurance Policy and put the money that you save from paying lower premiums into investment, where your wealth will grow apart from your insurance coverage.

For instance, if Permanent Insurance costs you $200 per month but a similar Term Life Insurance costs you only $50, then you are $150 better off. Investing that $150 monthly into a diversified portfolio income-generating portfolio, such as mutual funds, ETFs, or stocks—would help you grow your assets over time. When executed effectively, this strategy can allow you to accumulate savings or investments even after the term policy ends.

Benefits of Buying Term & Investing the Difference

Many clients find the “buy term and invest the difference” strategy attractive enough because of the potential financial benefit it can offer. Here are several reasons it works for most Canadian LIC clients:

- Lower Monthly Premiums with Term Life Insurance

Compared to Permanent Life Insurance Premiums, Term Life Insurance Premiums are more affordable. The lower monthly premiums make it easier for individuals, especially young families or those on a budget, to obtain the coverage they need without stretching their finances. At Canadian LIC, we work with many clients who see Term Life Insurance as a cost-effective way to secure their family’s financial protection.

- Flexibility in Investment Choices

By saving on premiums, you have more money to invest as you see fit. For some, this means a diversified stock portfolio, while others might choose to invest in real estate, bonds, or tax-advantaged accounts like a Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA). This flexibility allows you to adjust your investments based on risk tolerance and financial goals, which is appealing to many clients who want control over their financial future.

- Potential for Higher Returns

The investment component of Permanent Coverage generally grows at a conservative rate. By choosing to invest separately, you have the chance to seek higher returns, although this comes with risks. For example, if your investments perform well, the difference you invest could grow significantly over the years, potentially creating a sizable nest egg for retirement or other financial goals. Our brokers at Canadian LIC often help clients who are comfortable with some investment risk to explore this route.

- Simplicity in Coverage

For clients who only need life insurance coverage for a defined period—such as when their children are young or until their mortgage is paid off—Term Life Insurance offers simplicity. It gives you peace of mind without the long-term commitment of a permanent policy. You pay for the coverage you need when you need it, which aligns with specific financial goals and timelines.

Real-Life Example of Buying Term and Investing the Difference

Let’s take a normal case we come across in Canadian LIC: newly married young couples planning family life. They wish to secure each other economically while continuing to plan for the future. The brokers most often recommend Term Life Insurance, which will cover them in the years when they spend time with their children and pay the mortgage. The couple saves on the lower premiums and decides to invest the savings in a diversified portfolio.

It allows them to enjoy peace of mind from the insurance coverage over time, and as the investments grow, they’d be saving for a multiple number of purposes, from retirement savings to a child’s education fund, adding a balance of protection to potential growth, fitting very well with their lifestyle for financial flexibility.

Risks of the Buy Term & Invest the Difference Strategy

While buying terms and investing the difference can be a powerful financial strategy, it’s not without its risks. Here are a few considerations to keep in mind:

- Investment Risks

The success of this strategy heavily depends on the performance of your investments. Unlike permanent life insurance, where the cash value grows at a conservative, predictable rate, separate investments in stocks, bonds, or other assets carry a degree of risk. If the market performs poorly, the “difference” you’ve invested might not grow as anticipated. We often advise clients to consider their risk tolerance before deciding to invest independently.

- Loss of Coverage After the Term Ends

Term Life Insurance Policies expire. Once the policy term ends, you no longer have life insurance coverage unless you purchase a new policy, which may be more expensive due to age and potential health changes. Some clients find it challenging to secure affordable coverage later in life. At Canadian LIC, we discuss these implications with clients to ensure they fully understand the long-term impact of a term-only approach.

- Discipline in Investing the Difference

For the buy term and invest the difference strategy to succeed, you need discipline. Consistently investing the difference requires dedication. Some clients find it tempting to use the savings for other expenses rather than investing it. Our brokers often work closely with clients to create a structured investment plan that encourages disciplined investing and keeps them on track.

- No Guaranteed Cash Value

Permanent life insurance policies offer guaranteed cash value, which can serve as a source of emergency funds or even supplemental retirement income. With Term Life Insurance, there’s no such guarantee; once the policy term ends, there’s no cash value or investment component. This lack of guaranteed savings is an important consideration for clients who may prefer a more predictable financial growth option.

Making the Decision: Is It Right for You?

This is obviously going to depend on whether you are going to buy term and invest the difference, but it will largely depend on your financial goals, risk tolerance, and commitment to investing. Here at Canadian LIC, we have a structured approach that will guide clients in determining whether or not such a strategy is in line with their set objectives. We usually start by asking our brokers to look into the following aspects:

- Long-Term Financial Goals – Do you have a clear plan for your investments, such as retirement savings or a down payment on a home?

- Investment Knowledge and Comfort – Are you comfortable with the ups and downs of the market, or do you prefer stable, predictable growth?

- Coverage Needs – Do you only need coverage for a set period, or do you want lifelong protection with a cash-value component?

Protection and growth should be balanced; at Canadian LIC, we help clients understand what best applies to their situation by asking the right questions.

Why Canadian LIC is the Best Choice for Your Insurance and Investment Needs

We can help you choose the most appropriate life insurance policy or investment strategy in Canada with the knowledge and individualized guidance from Canadian LIC. Our brokers understand the various challenges imposed on Canadians, but we are dedicated to finding a solution that suits your family and financial goals. Buying Term Life Insurance and investing the difference is very much an individual decision based on particular financial landscapes. With Canadian LIC by your side, you can explore benefits and risks fully, knowing that your choice will align with future plans.

Are you ready to discover all the possibilities for Term Life Insurance Investments and determine if this policy is suitable for you? Canadian LIC will guide you. For more information on Term Life Insurance Quotes Online contact your Term Life Insurance Brokers directly for personal expert advice. At Canadian LIC, we help Canadians make the right choices today and tomorrow.

More on Term Life Insurance

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions about Buying Term and Investing the Difference

When you choose a Term Life Insurance Policy, you pay lower premiums compared to a permanent policy. The idea is to invest the money you save, or the “difference,” in other financial options like stocks or mutual funds. Many clients at Canadian LIC find that this approach helps them balance affordable coverage with potential investment growth.

A Term Life Insurance Policy is typically more affordable, especially if you only need coverage for a specific period, such as while making mortgage payments or raising children. Our Term Life Insurance Brokers at Canadian LIC often recommend term policies to clients who want straightforward protection without the added cost of a cash value component.

If you save money by choosing a Term Life Insurance Policy, you can invest that savings elsewhere. For example, if a permanent policy would cost $200 per month but a term policy only costs $50, you could invest the extra $150 in a diversified portfolio. Our clients often find that this approach allows them to grow their wealth while maintaining life insurance protection.

Yes, investing carries risks. The success of this strategy depends on the performance of your investments. Our team at Canadian LIC sees that clients with experience in investing or a higher risk tolerance are often more comfortable with this strategy, as investments like stocks or mutual funds can fluctuate over time.

This approach depends on your financial goals, comfort with investing, and need for insurance. If you’re open to investing and want affordable life insurance, buying Term Life Insurance and investing the difference might work well. Our Term Life Insurance Brokers can help you assess if this strategy aligns with your goals and circumstances.

Once your Term Life Insurance Policy expires, your coverage ends. You may need to buy a new policy if you still want coverage. However, Term Life Insurance Policies may be more expensive as you get older. At Canadian LIC, we guide clients in evaluating their future insurance needs to ensure they’re prepared for this.

You can invest the difference on your own, but working with an investment advisor can provide guidance and reduce potential risks. Many clients at Canadian LIC work with advisors to create diversified portfolios that match their risk tolerance and financial goals, giving them peace of mind in their investment choices.

No, investing the difference does not guarantee a return, as investments depend on market performance. This approach suits clients who are comfortable with the possibility of fluctuations in their investments. Our team often discusses these aspects with clients to ensure they’re aware of the potential ups and downs in investing.

Yes, Term Life Insurance Quotes Online give you a general idea of costs, but the exact premium may depend on factors like age, health, and coverage amount. At Canadian LIC, our brokers help clients get accurate quotes that fit their specific needs, making it easier to understand what they’ll pay.

Common investments include mutual funds, stocks, bonds, and tax-advantaged accounts like RRSPs or TFSAs. At Canadian LIC, clients who choose this strategy often diversify their investments based on their goals and comfort level, seeking growth over time.

Yes, some Term Life Insurance Policies offer conversion options to switch to a permanent policy. Our Term Life Insurance Brokers at Canadian LIC guide clients through this choice if they wish to have lifetime coverage or a policy with a cash value component in the future.

Cash value policies grow at a conservative rate and offer guaranteed savings, while Term Life Insurance Investments depend on market performance and can yield higher returns with higher risks. This approach can appeal to clients who want flexibility in their investments and are comfortable with market-based growth.

Yes, you can invest in tax-advantaged accounts like an RRSP or TFSA with the money you save. Many clients at Canadian LIC use these accounts to maximize their investment growth and tax savings, making the most of their Term Life Insurance Policy savings.

Look for brokers who understand both Term Life Insurance and investment options. Canadian LIC brokers are experienced in helping clients balance their insurance needs with their financial goals, offering guidance on Term Life Insurance Quotes Online and the best ways to invest their savings.

At Canadian LIC, we understand that combining Term Life Insurance Investments with a financial strategy requires thoughtful planning. Our brokers and advisors work together to provide a full picture, ensuring you have both the protection and growth potential you need.

Sources and Further Reading

“What Does ‘Buy Term and Invest the Rest’ Mean?” by JRC Insurance Group

This article explains the concept of buying Term Life Insurance and investing the savings, highlighting its advantages and potential drawbacks.

JRC Insurance Group

“The Myth of ‘Buy Term and Invest the Difference'” by Truth Concepts

This piece critically examines the strategy, discussing common misconceptions and providing insights into whole life insurance as an alternative.

Truth Concepts

“Buy Term and Invest The Difference | Life Insurance Canada” by LSM Insurance

This article explores the pros and cons of the strategy within the Canadian context, offering practical examples and considerations.

LSM Insurance

“Is ‘Buy Term and Invest The Difference’ Really Better?” by Innovative Retirement Strategies

This resource provides a detailed analysis of the strategy, comparing it with permanent life insurance options and discussing potential outcomes.

Innovative Retirement Strategies

“Debunking ‘Buy Term and Invest the Difference'” by Infinite Banking

This article challenges the effectiveness of the strategy, offering alternative perspectives on life insurance planning.

Infinite Banking

“Should I invest my money or buy a life insurance policy instead?” by MoneySense

This piece addresses the dilemma between investing directly and purchasing life insurance, providing insights to help make informed decisions.

MoneySense

“Guaranteed investment certificate” on Wikipedia

This entry offers an overview of Guaranteed Investment Certificates (GICs), a common investment vehicle in Canada, which can be relevant when considering where to invest the difference.

Wikipedia

“Tax-free savings account” on Wikipedia

This page provides information on Tax-Free Savings Accounts (TFSAs), another investment option in Canada that may be utilized when investing the difference.

Wikipedia

Key Takeaways

- Affordable Coverage with Flexibility: A Term Life Insurance Policy offers affordable premiums, allowing you to allocate savings toward investments.

- Investing the Difference: By buying Term Life Insurance and investing the savings, you have the potential to grow wealth independently, aiming for higher returns over time.

- Risk vs. Reward: Investments can yield higher returns than the cash value growth in permanent policies but come with market risks. Understanding your risk tolerance is essential.

- No Lifetime Coverage: Term Life Insurance only provides coverage for a set period, so you may need to re-evaluate your needs once the term ends.

- Discipline is Key: Consistently investing the savings from lower premiums is critical to making this strategy work effectively.

- Suitable for Specific Financial Goals: This strategy can be ideal for those needing temporary coverage while focusing on investment growth to achieve long-term financial objectives.

- Professional Guidance Helps: Working with knowledgeable brokers, like those at Canadian LIC, can help you find the right balance between insurance protection and investment goals.

Your Feedback Is Very Important To Us

We’re interested in learning about your experiences and challenges with the “buy term and invest the difference” approach. Your feedback will help us provide better guidance on Term Life Insurance and investments.

Thank you for your feedback! Your responses will help us support Canadians in making informed, confident decisions about their financial future.

IN THIS ARTICLE

- What Does It Mean to Buy Term & Invest the Difference?

- Understanding Term Life Insurance

- What Does “Invest the Difference” Mean?

- Benefits of Buying Term & Investing the Difference

- Real-Life Example of Buying Term and Investing the Difference

- Risks of the Buy Term & Invest the Difference Strategy

- Making the Decision: Is It Right for You?

- Why Canadian LIC is the Best Choice for Your Insurance and Investment Needs

- More on Term Life Insurance