Did you ever get scared when you were at the insurance office and realized you left an important paper at home? Or you may get frustrated because you don’t know which papers you need, which can lead to delays or even more money being spent. You’re not alone. Many travellers have trouble with the many requirements when they try to get Visitor Insurance for their trip to Canada.

This blog will help make it clear what documents you need to buy Visitor Insurance. By knowing what you need ahead of time, you can make sure your purchase process is smooth and stress-free. Let’s look at Visitor Insurance Plans and how to get a Visitor Insurance Quote easily.

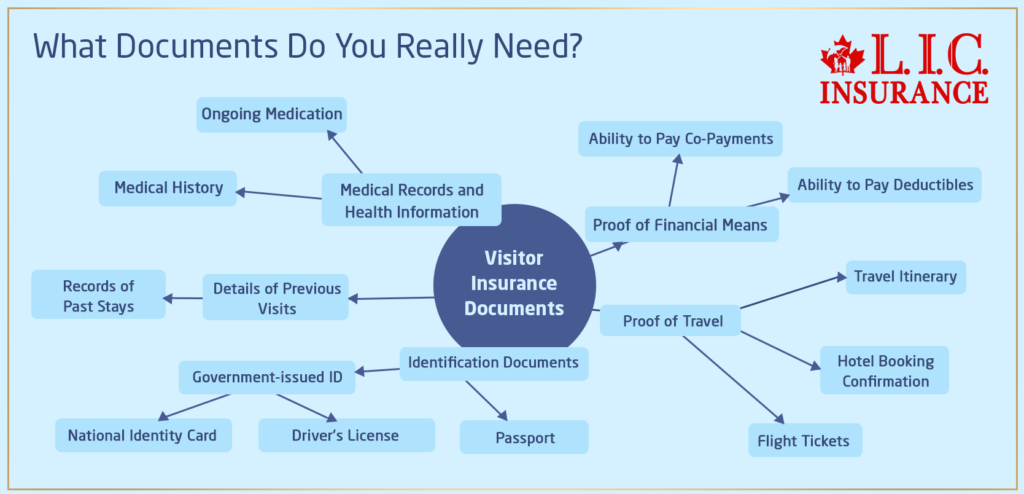

What Documents Do You Really Need?

When you plan to travel, especially to Canada, having Visitor Insurance Plans is very important. But you need to handle the paperwork before you can feel safe with your coverage. So, what do you really need?

Proof of Travel

Imagine you’re packing for your trip. While you’re excited, you decide to get your Visitor Health Insurance. The first thing the insurance provider asks for is proof of travel. Why? They need to see that your travel plans are real and happening soon. This could be your flight tickets, a travel itinerary, or a hotel booking confirmation.

Identification Documents

John, a happy retiree from Australia, reaches the insurance counter but finds out he needs more than just his passport. Insurance providers often need a government-issued I.D. in addition to your passport. This could be a driver’s license or a national identity card. These documents help verify who you are and prevent any fraud.

Details of Previous Visits (if applicable)

Have you been to Canada before? If yes, bringing records of your past stays can help. Insurance companies might look for patterns or reasons that could affect your insurance coverage and costs.

Medical Records and Health Information

Why do insurance companies ask about your medical history? They want to know the risks of insuring you. If you’re like Meesha from Spain, who once forgot to mention her ongoing medication, you’ll understand the importance. Maria faced delays because the insurance company needed to check her health carefully.

Proof of Financial Means

Li, a young backpacker from China, didn’t know that some insurance plans require proof of financial means. This is only sometimes needed but can be important depending on the coverage you want. It shows the provider that you can pay any deductibles or co-payments required under the plan.

Getting the Best Visitor Insurance Quote

Now that you know the documents you need, how can you use them to get the best Visitor Insurance Quote?

Step-by-Step Guidance:

Gather all documents beforehand. Keep them ready before you start looking for quotes. This helps you avoid last-minute stress and ensures you give correct information.

Compare different Visitor Insurance Plans. Use the documents to get exact quotes from different providers. Each document helps determine the risk and affects the quote.

Use online tools. Most Canadian insurance companies have online platforms where you can upload your documents and get a quote quickly. Use these tools for an easy experience.

Story of Anika

Let’s talk about Anika, a lively 32-year-old marketing professional from India who planned her dream vacation to explore the natural beauty and vibrant cities of Canada. Her story teaches us the importance of understanding and getting Visitors to Canada Insurance.

Planning the Trip

Anika was very excited about her three-week tour in Canada, visiting Toronto, Montreal, and Vancouver. She had everything planned perfectly: flights, hotels, and a daily schedule of places to visit.

Realizing the Need for Insurance

While talking to a friend who travelled often, Anika learned about the high medical costs she might face if she got sick or had an accident in Canada. Her friend told her about someone who had a big medical bill after a skiing accident. This made Anika realize she needed Visitor Insurance to cover medical emergencies, hospital stays, and emergency medical evacuation. But she wasn’t sure what documents she needed or how to get a good insurance quote.

Gathering the Necessary Documents

Anika contacted several insurance companies for quotes and found out she needed specific documents:

Proof of Travel: Her flight details and hotel bookings show how long she would stay.

Identification Documents: A copy of her passport and another ID will be needed to verify who she is.

Medical History: A detailed medical history to check for any existing conditions that could affect her coverage and cost.

Choosing the Right Insurance Plan

After looking at several quotes, Anika chose a plan that covered her needs and activities like hiking and skiing. The plan also covered small medical needs like prescriptions.

The Trip and the Unforeseen Illness

In her second week in Montreal, Anika got bronchitis. Because of her Visitor Insurance, she received medical care without worrying about the cost. She went to a clinic and showed her insurance details, and all her expenses, including antibiotics, were covered.

The Lesson Learned

Anika learned how important it is to be prepared with good Visitor Insurance. Getting the insurance seemed hard at first because of the documents and choices, but having the right coverage made a big difference. It allowed her to enjoy her trip even when she got sick.

Her story shows how crucial it is to understand the needed documents and get the right Visitor Insurance before travelling. It’s not just about meeting a requirement; it’s about peace of mind so you can enjoy your trip, knowing you’re protected. Anika’s adventure in Canada was memorable, and her illness didn’t ruin her plans because she had Visitor Canada Insurance Coverage.

Final Thoughts: Why Act Now?

Getting a Visitor Insurance Canada Policy is not just about meeting a requirement; it’s about having peace of mind while you enjoy Canada. With your documents ready, getting Visitor Medical Coverage is easy. Canadian LIC is here to help you. They are known for their friendly service and efficiency, making them a top choice for many international travellers.

Don’t wait until the last minute. Prepare your documents, get your Visitor Insurance Quote, and secure your plan with Canadian LIC today. Travel with confidence, knowing you’re fully covered.

Have a Happy journey, and welcome to Canada!

By now, you should feel ready to prepare your documents for Visitor Insurance with confidence. Each step you take brings you closer to a worry-free Canadian adventure.

Find Out: Is Visitor Insurance Mandatory?

Find Out: How do you file a claim for Visitor Insurance?

Find Out: Which Visitor Insurance is best?

Find Out: Is Visitor Insurance the same as Travel Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) About Visitor Insurance Plans in Canada

Getting a Visitor Insurance plan is very important when you plan to travel to Canada. Here are some common questions and answers to help you understand how to get Visitor Insurance Quotes and know the details about the coverage.

The first step is to gather all the important documents. Think of Carla from Brazil. She tried to get a quote online but didn’t have all the information she needed. She had to stop her application to find her passport and travel details. To avoid such delays, have all your documents ready, like your passport, travel plans, and any important medical records. This will make the process easier when you ask for a quote.

Insurance companies need detailed personal information to understand the risks they are taking. Alex from Japan didn’t know why his medical history was needed. When he learned that this information affects the coverage and costs, it made sense. By looking at your health, age, and stay length, insurers can give you a plan that fits your needs, making sure you are well covered.

Yes, you can, but it’s better to buy it before you travel. Sania from the U.K. thought she could get a plan at the airport, but this delayed her coverage start date and limited her options. It’s best to buy insurance before you travel so you are covered from the moment you arrive. Plus, having a plan before you travel often gives better terms and peace of mind.

You can usually extend your insurance, but you must do it before your current plan expires. Tom from Germany decided to extend his vacation but forgot about his insurance until the last day. He managed to get an extension but had to pay higher fees because of the last-minute request. Contact your insurance provider early to discuss extension terms and avoid any gap in coverage.

Comparing different quotes is important. Think of Linda from South Africa. She compared quotes from three different providers using the same documents. She looked at not just the costs but also the coverage details like emergency medical expenses, repatriation, and exclusions. Use online comparison tools and talk to customer service to understand each quote. Make sure to compare the benefits and costs to find the plan that offers the best value for you.

When you apply, tell the insurance company about any pre-existing medical condition you have. Rahul from India didn’t do this and had problems when he needed care. His ongoing medication mattered, and his claim had issues. Most insurance plans have rules about how they cover pre-existing conditions, and some cover them with limits. Be honest to get the right coverage and avoid claim problems.

Losing documents can be very stressful, just like what happened to Emily from Italy. She lost her bag with her insurance papers while in Montreal. First, contact your insurance company right away. Most companies have digital copies and can give you access online. Keep a digital copy or a photocopy separate from the originals as a backup.

It’s not required by law, but it’s highly recommended for all ages. Nguyen from Vietnam didn’t buy insurance for his young children to save money, but one child got sick, and the medical bills were high. Visitor Medical Insurance Coverage protects you from unexpected medical costs, no matter how old the traveller is. It’s a smart choice for peace of mind.

Yes, you can. Rajesh from India bought insurance for his parents, who were visiting Ontario. You need their travel details and permission to use their personal information. Make sure you have all the documents and understand their medical needs to choose the right coverage.

Many insurance plans don’t cover high-risk activities. Mia from Spain found this out when she went ice climbing in Banff. Her insurance didn’t cover extreme sports. Common exclusions are professional sports, high-risk activities, and some adventure sports. Check your policy’s exclusions before doing risky activities.

Knowing what to do is important. Tom from the U.K. had a severe allergic reaction in Toronto. He went to the nearest hospital first, then called his insurance provider’s emergency line. Always carry your insurance company’s contact information and policy number. Contact them quickly in an emergency to make sure your medical care is covered.

If your Visitor Insurance runs out while you are still in Canada, you need to be careful. Anna from Germany didn’t notice her insurance expired until she needed help for a minor injury. If you stay longer than your insurance covers, ask for an extension early. If it has already expired, you might be without coverage and need to buy a new plan, possibly at higher costs and with fewer choices.

Dental coverage can be different for each plan. For example, Clara from Mexico chipped a tooth while enjoying Canadian food. She was happy her insurance covered emergency dental care. Before you buy, check if the plan covers dental emergencies and what is considered an ’emergency.’ Some plans might only cover pain relief, not major repairs.

Keeping the right documents is very important. When James from Australia needed emergency help, he quickly gave his insurance I.D., policy number, and medical history to his provider. Always carry a copy of your insurance policy, a list of emergency contacts, and any medical records. This helps you access your benefits quickly when needed.

Coverage for medications can vary. Lisa from the U.K. needed medicine in Vancouver. She was worried about the cost but found her insurance covered it after an emergency visit. When you get your insurance quote, ask specifically about prescription coverage and under what conditions they are included.

It’s important to know this. Alex from Russia got sick in Montreal and found out his insurance required him to visit certain hospitals to be fully covered. Check if your insurance needs you to visit specific healthcare providers or if you can choose any doctor or hospital. This can save you from unexpected costs.

Insurance during layovers can be tricky. Samaira from Italy had a layover in the U.S. and needed medical help. Luckily, her insurance covered short stays in countries on the way to Canada. Check with your insurance provider about coverage during transit and layovers when you get your insurance quote.

Good communication is key. Noah from Israel kept records of his medical emergency, including hospital visits and receipts. To ensure smooth claim processing, tell your insurance provider about any incidents that might lead to a claim, keep detailed records of all medical visits, treatments, and costs, and follow the claims process in your policy.

Understanding these parts of Visitor Insurance can help you be well-prepared during your travels. Always try to get insurance quotes early and review the details to match your travel needs. This way, you can enjoy your visit to Canada with one less worry!

Sources and Further Reading

Here are some recommended sources and further reading options for individuals interested in learning more about Visitor Insurance Plans and obtaining Visitor Insurance Quotes in Canada:

Insurance Bureau of Canada (IBC) – Offers comprehensive information on various types of insurance available in Canada, including Visitor Insurance. Their website includes guides and tips for choosing the right insurance plan.

Website: Insurance Bureau of Canada

Canadian Life and Health Insurance Association (CLHIA) – Provides detailed guides and advice on health insurance for visitors to Canada. It’s a valuable resource for understanding insurance terms and conditions.

Website: Canadian Life and Health Insurance Association

Government of Canada – Travel Insurance Page – Offers official information regarding the importance of insurance while traveling in Canada, including what to look for in travel insurance policies.

Website: Government of Canada – Travel and Tourism

Immigration, Refugees and Citizenship Canada (IRCC) – While primarily focused on immigration processes, IRCC provides resources that can help understand the requirements for insurance coverage as part of planning your visit to Canada.

Website: Immigration, Refugees and Citizenship Canada

HealthCare.gov – Coverage for Travelers – Though it is a U.S.-based resource, HealthCare.gov offers insightful general information on health insurance for travelers that can be useful for understanding the types of coverage available.

Website: HealthCare.gov

These sources can provide authoritative and detailed information to help you choose the right Visitor Insurance plan in Canada, ensuring you are well-prepared for any medical emergencies or unexpected situations during your travels.

Key Takeaways

- Gather essential documents like proof of travel, identification, and a detailed medical history for an accurate Visitor Insurance Quote.

- Know the specific requirements for Visitor Insurance Plans to choose the best fit for your needs.

- Purchase Visitor Insurance before traveling to Canada to ensure coverage starts upon arrival.

- Obtain and compare multiple Visitor Insurance Quotes to find the best rates and coverage options

- Review the coverage details of your plan, especially for emergency medical services and activities you plan to engage in.

- If an extended stay might occur, ensure your Visitor Insurance can be adjusted to cover the additional time.

- Keep copies of all insurance documents accessible during your trip, including digital versions for emergencies.

Your Feedback Is Very Important To Us

This questionnaire will help insurance providers to better understand the hurdles Canadians face and improve the process of acquiring Visitor Insurance, making it more streamlined and user-friendly.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]