For the vast majority of Canadian parents, the government grants and the tax-free growth potential that’s attached certainly get one caught up in the mechanics of the Registered Education Savings Plan (RESP). However, just like any financial strategy, there are challenges and limitations to the RESP that are not immediately obvious. Think of the early saver for a child’s education whose child later chooses not to pursue a higher education and is left wondering what to do with funds accumulated over the years. Think of a single mom setting up an RESP for her daughter, only to later deal with the fact that the inflexibility of investment options will not allow her to align with the financial situation in which she now found herself. Many people get excited when they think about planning their child’s educational future, but these true stories show some of the problems and issues that are important to keep in mind in order to give a fair picture. Registered Education Savings Plan Canada is one of the most popular ways to save money, but this blog post takes a close look at its flaws, which every family in Canada should think about before starting. We take these characteristics to the next level by modeling them in real-life situations. This way, you can get a full picture and decide if a RESP is right for your family.

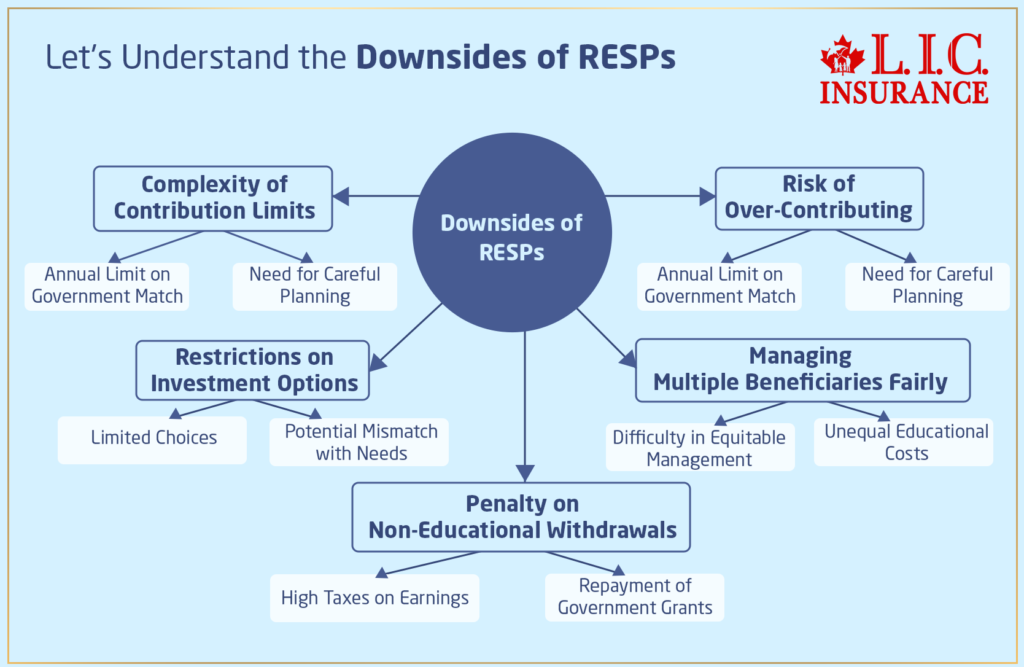

Let's Understand the Downsides of RESPs

Complexity of Contribution Limits and Impact on Planning

Let’s know the Patel family situation in order to understand how complex contribution limits in the Registered Education Savings Plan (RESP) impact financial planning. The Patels, like most other parents, were very enthusiastic savers; unfortunately, they did not realize their mistake regarding the government’s matching in the RESP. So, in year one, they made a huge contribution of $10,000 to maximize the government’s match. As per the structure of the Canada Education Savings Grant (CESG), however, the government matches 20% of the first $2,500 contributed annually to a maximum of $500 per year. Such limitation, provided by the government, is the most crucial part of the RESP structure that every subscriber needs to understand if they are looking to optimally structure their contributions. Have you at some time been so enthusiastic and motivated about something and then later on realized that you missed some information that could have changed how you would go about that very thing? That is what happened to the Patels. Their story is not unique but only goes ahead to show how important it is to take full note of the good and the bad about the RESP before making decisions that may create huge mistakes—mistakes that would prevent them from taking advantage of that free money that could have been available.

Restrictions on Investment Options

Now consider the case of Saima, which illustrates one of the major shortcomings of the RESP: restrictions on investment options. When Saima opted for tax-free growth for an RESP, she thought she would have the flexibility to change her investments in case her financial situation changed. Instead, she quickly discovered that her RESP provider had access to only a few investment options—most of them too risky or too conservative to suit her increasingly changing needs. Have you ever made a decision and later regretted it? Saima did. She wanted to lock in her contributions but now felt like she was chained down to investment choices that were not that good. This lack of full flexibility can be a strong source of stress and dissatisfaction as it comes in the way of subscribers like Sarah expressing their full ability to tailor an investment strategy to meet specific risk tolerances and financial goals.

The Penalty on Non-Educational Withdrawals

Consider Liam and his parents: Liam, after much thought, decided that college was not for him. His parents, who had been saved in an RESP, were between a rock and a hard place. They could take out their contributions without a penalty, but the earnings on their contributions would be taxed at a high rate—their marginal tax rate, plus an additional 20%. On top of that, all government grants were required to be paid back. The topic of how flexible a savings plan should be is brought up by this case, which highlights one of the main drawbacks of the RESP in the unlikely event that the funds are not used for education. For many families, the penalties attached to the non-educational withdrawal can feel like a harsh punishment too, especially for a child’s decision to take a non-academic path, and therefore the RESP becomes less attractive.

The Risk of Over-Contributing

The experience of the Chen family drives home the potential risk of over-contributing to an RESP. Since there are multiple contributors within one family, it’s easy to lose track of the total being deposited, especially when there isn’t a stringent annual limit on contributions. When the Chens exceeded the lifetime maximum of $50,000 for an RESP, they were penalized 1% per month on the overage. They could have found a way to withdraw that excess in some other manner, thus avoiding the penalty. It really shows how important record-keeping and communication between contributors is. A mistake as small as contributing too much can lead to unnecessary strain on the family finances and use valuable time fixing the problem. Can you remember a similar situation where a small mistake created unnecessary work and stress?

Managing Multiple Beneficiaries Fairly

To continue with the Thompson family, they had set up an RESP for their three children. They thought the RESP would simplify everything since it would treat all their children equally. However, when their children got closer to the age of going to university, they needed help managing the plan equitably. The costs for their oldest daughter to attend medical school were four times higher than the fees for the other two children’s programs. Can you think of a way that in the above case, where the Thompsons had set up a family RESP, this could have been foreseen and prevented? In other words, what could they have done in advance to make sure all the children had an opportunity for education without too much pressure on family finances?

| Pros of RESP | Cons of RESP |

|---|---|

| Government Contributions: The government matches 20% of annual contributions up to $2,500 per beneficiary, to a maximum of $7,200. | Contribution Limits: There’s a lifetime contribution limit of $50,000 per beneficiary, which can restrict funding beyond this point. |

| Tax-Deferred Growth: Investments grow tax-free until withdrawn for educational purposes, enhancing potential returns. | Penalties for Non-Educational Withdrawals: Withdrawing funds for non-educational purposes incurs heavy taxes and penalties, plus the return of government grants. |

| Flexibility in Investment Options: Subscribers can choose from a range of investment options depending on the RESP provider. | Limited Investment Flexibility: Some plans have restrictive investment options, which may not align with every investor’s risk tolerance or financial goals. |

| Family Plan Benefits: Allows for funds to be shared among siblings, which can simplify managing education savings for multiple children. | Complex Fund Management: Managing funds and ensuring fair distribution can be challenging in family plans, especially if beneficiaries have different educational needs. |

| Transferability: Under certain conditions, if the beneficiary doesn’t pursue higher education, the plan can be transferred to another eligible family member. | Risk of Over-Contribution: Exceeding the lifetime limit incurs penalties, requiring careful monitoring of contributions. |

| Promotes Savings Discipline: Regular contributions to an RESP can instill financial discipline with a focus on long-term educational goals. | Maturity Limitations: RESP accounts must be closed after 35 years, which can complicate planning if the beneficiary delays education. |

Find Out: What expenses are eligible for RESP in Canada?

Find Out: What is the RESP Limit in Canada?

Find Out: Does an RESP beneficiary need to live in Canada?

Find Out: How to check an RESP in Canada?

Find Out: Why to choose an RESP?

The Bottom Line

A Registered Education Savings Plan Canada has many benefits, including tax-free growth and government payments, but it also has a number of drawbacks and difficulties that should be carefully considered. There are drawbacks that could have a major impact on your family’s financial situation and your children’s educational chances. We recommend that you carefully consider these things and consult with an Education Savings Specialist to go through this correctly. If you are an existing or potential RESP holder and are reviewing your existing education savings strategy, remember that Canada’s best insurance brokerage, Canadian LIC, is here to help you. Our consultants are well-versed in the ins and outs of RESP and are in a good position to offer appropriate advice on a case-by-case basis that fits your unique family’s interests and objectives. An RESP will actually be a strong pillar towards building a bright educational future for your child. Contact Canadian LIC today so your education savings plan will be effective and beneficial, maximizing every dollar towards a brighter tomorrow for your child.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions about Registered Education Savings Plans (RESPs) in Canada

Once again, it is crucial that you know the major PROs and CONs of a Registered Education Savings Plan (RESP). One of the major PROs: this savings plan makes you eligible for government grants, such as the Canada Education Savings Grant (CESG). The Canadian Education Savings Grant can match 20% of the first $2,500 you contribute annually. On the flip side, if the funds are not used for education, the money gained would be heavily taxed on withdrawal, and you will also have to return the grants received. Consider a family that has been contributing graciously for years to have their child penalized because they chose not to attend post-secondary education. This, then, is a huge CON, as you can imagine.

The RESP has a lifetime contribution limit of $50,000 for each child. At the same time, there is no annual contribution limit set; therefore, you can contribute at your own pace. However, it is essential to remember that government matching is capped, so plan your contributions accordingly. For example, if you contribute $10,000 in one year, the CESG only matches the first $2,500. A family learned this lesson the hard way when they lost out on a couple of thousand dollars in grants, as they did not know about this cap. Always plan your contributions with the grant limits in mind to maximize benefits.

For sure, there are complaints from some subscribers that the investment options for RESPs are quite restricted. For example, Sarini is a single mom who selected a Registered Education Savings Plan for its tax benefits but felt quite frustrated by the limited conservative investment choices available within it. This lack of flexibility caused a lot of stress as she felt that she could only adjust the investments according to her risk tolerance. Research an RESP provider’s investment options in advance of selecting. An important decision is available for investigation to find an RESP provider’s investment options suitable for your financial plan.

Over-contributing to an RESP is a very simple mistake, but it could prove to be very costly. The Chen family made a mistake by over-contributing to a plan and contributed more than the $50,000 lifetime limit. This caused a 1% per month penalty on the excess contributions until they were removed. This is a strong caution for keeping good records of contributions, especially if there are multiple family members who are contributing to the plan. It is wise to monitor your total contributions regularly in order to avoid these stiff penalties.

An equal division of an RESP among several beneficiaries needs to be well planned and communicated. The Thompson family was not able to divide the funds among their children as they each had different educational expenses. Clear expectations on how the funds will be distributed among the beneficiaries should be set up at the beginning, perhaps based on the needs and educational path of each beneficiary, to avoid such c

Non-educational withdrawal of contributions to an RESP is highly penalized. If the beneficiary of an RESP does not further his education, you may withdraw your contributions without any penalty, but the earnings made on those contributions are taxed at your marginal tax rate plus an additional 20%. You will also be required to give back all of the government grants. That’s what happened to Liam’s parents. They had saved with the expectation that their son would go to college. Instead, they were penalized because he wanted to do something else.

According to the CRA, the beneficiary must be a resident of Canada and have a valid SIN number to qualify to receive contributions. Also, for funds to be withdrawn tax-free for educational purposes, the beneficiary must have been enrolled in a qualifying educational program. This rule ensures that the RESP performs the intended purpose of supporting a child’s post-secondary education.

You can transfer an RESP to another family member, subject to conditions. To illustrate, the eldest son of the Nguyens decides to start a business instead of going to university. His parents transferred his RESP to his younger sister without any tax penalties because she is under 21, and the plan is a family plan. Had the plan been for an individual, they would have to meet other conditions outlined by the Canada Revenue Agency, including the requirement that the beneficiaries are siblings. This flexibility is a major pro of the RESP but needs to be weighed against the very specific rules and conditions of transferring an RESP.

There are significant tax implications if you have to collapse an RESP and the funds are not used for education. The contributions are received by you tax-free, however the earnings are treated as income for the year and are taxed at your marginal rate plus a 20% tax penalty. You will also have to return any government grants you have received. This is the situation that the Robinson family found themselves in after their only child decided that he would rather pursue the arts as a career and didn’t need to attend college to pursue his dream. If your child seems to have no clear goals for their future education, be sure to consider this as a possible drawback.

The different RESP providers can make a big impact on how you manage an RESP. They have different investment options, fees, and quality of customer service. For instance, Maria and Jake selected the provider that had very low fees but quickly found that the lack of customer service was a problem after they struggled to talk with someone about how to reallocate investments. It’s important to shop around between different providers. Don’t just look at the fees. Look at the kinds of services and service providers. It can make a big difference when weighing the pros and cons of the RESP experience.

What happens if the person for whom your RESP was intended gets a scholarship? You may be asking yourself this question. If your RESP beneficiary gets a scholarship, you can still use the money in the RESP for other education, such as housing, books, and living costs. For example, after the Lee family’s child received a full tuition scholarship, the RESP money was used for boarding and all the other things related to college for the child, and they were able to access the saved money without any penalty.

One of the most prevalent reasons is to keep up with the changes in RESP rules. As the government policies for RESPs might change, it is more likely that rules for contributions, withdrawals, or even eligibility be changed. In short, the eligibility of types of programs that can be enrolled under an RESP, such as the recent updates, when you need it. A great idea is to check often back with a reliable source and, therefore, with your RESP provider or a financial advisor. This will ensure you are not met with any surprises and you are able to o

Yes, you can change your investments inside the RESP, depending on the flexibility of the plan and terms set by your RESP provider. Take, for example, the Carter family. They chose an investment option with high risk at the time of enrollment. As their child was getting close to college age, they wanted to change to more conservative investments in order to protect their accumulated money. Since their RESP provider had options for flexible investments, they did this easily. This flexibility of investment is one of the RESP structure’s key advantages, with the savings plan capable of being adapted to potential changes in financial circumstances and goals.

Starting later in your child’s life will lower the potential amount of government grants you will receive because the grants are capped for every year of the child’s life. For example, the Ahmed family opened an RESP when their daughter was 10. They, therefore, could not claim a maximum amount of the $7,200 possible grant money since the government grants stop when the child reaches 17. This situation provides one of the cons of RESPs: one has to start early to take full advantage of the compound interest and government contributions, a key consideration for the pros and cons of the RESP.

RESPs would not directly have any impact on eligibility for most government benefits because the money contributed and grown in a RESP is money earmarked for educational purposes and does not count as taxable income. Suppose money is taken out as Educational Assistance Payments to a beneficiary, on the other hand. Unfortunately, it might affect that beneficiary’s ability to get student aid or other benefits that depend on their income. For example, the Wong family learned that the Education Assistance Payments (EAPs )for their son did lower his access to a couple of student loans and grants that are based on personal income levels. Being able to help families plan for how they are going to finance their children’s education is important.

When an RESP passes its 35-year maturity date (or the year a child was born), it must be closed, and any remaining contributions are returned to the contributors tax-free. However, the earnings on those contributions are subject to taxation. The account must also be closed, and any government grants received must be returned. This is the situation the Gill family found themselves in when their RESP matured, but their child took a gap year. They had to make rushed decisions to avoid monetary loss, which, again, could happen if a child’s education timing is not in perfect tandem with the maturity of the RESP.

The choice between a family and an individual RESP depends on your family and your financial goals. If you have several children and want the flexibility to use the funds across them, choose a family RESP. On the other hand, if you have only one child, you may consider an individual RESP easier to manage. The Martins, who have three children in different education levels, chose a family RESP because they could distribute the funds to other siblings as their education needs changed. Each type of RESP has its pros and cons, so the decision really rests upon what would be the most beneficial for you and your family specifically.

These frequently asked questions (FAQs) and examples will help you better understand the many complicated parts of the Canadian Registered Education Savings Plan (RESP). This will allow you to use the RESP as a useful tool for planning your family’s schooling and finances.

Sources and Further Reading

For further reading and to delve deeper into the nuances of Registered Education Savings Plans (RESPs) in Canada, including their advantages and disadvantages, consider exploring the following sources:

- Canada Revenue Agency (CRA) – The official site provides detailed guidelines on RESP rules, contribution limits, and withdrawal conditions.

Website: Canada Revenue Agency

- Employment and Social Development Canada (ESDC) – Offers comprehensive information about the Canada Education Savings Grant (CESG) and other aspects of RESP.

Website: ESDC

- Canadian Scholarship Trust Foundation – Provides insights and resources for understanding RESPs, including planning tools and tips for maximizing your savings. Website: CST

- GetSmarterAboutMoney.ca – Run by the Ontario Securities Commission, this site offers educational resources on RESPs including investment options and planning strategies. Website: Get Smarter About Money

- Investopedia – Offers detailed articles on the mechanics of RESPs, including pros and cons, investment strategies, and how to manage an RESP effectively.

Website: Investopedia RESP Section

These sources provide reliable and in-depth information that can help parents and guardians make informed decisions about financing their children’s education through RESPs.

Key Takeaways

- Understand RESP contribution limits and annual government matching caps to maximize funding opportunities.

- Be aware of potential limitations in RESP investment options that may affect financial and risk management.

- Non-educational withdrawals from RESPs incur heavy taxes and require the repayment of government grants.

- Avoid costly penalties by maintaining accurate records and coordinating contributions to not exceed the RESP's lifetime limit.

- Managing funds fairly in family RESPs can be complex when beneficiaries have different educational costs.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]