- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Are The Disadvantages Of Joint Term Insurance?

- Limited Payout: One Policy, One Death Benefit

- Lack of Flexibility in Changing Circumstances

- Higher Risk of Losing Coverage

- Limited Coverage Options for Complex Needs

- Difficulty in Adding Riders or Additional Benefits

- Potential for Disputes in Beneficiary Designations

- Financial Strain in Case of Early Termination

- Challenges in Policy Renewal

What Are The Disadvantages Of Joint Term Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- January 13th, 2025

SUMMARY

A Joint Term Life Insurance Policy covers two people under one plan but comes with disadvantages such as a single payout, lack of flexibility, complications in case of separation, and higher renewal costs if one partner’s health declines. It may not meet individual financial needs or offer sufficient customization. Comparing Term Life Insurance Quotes and exploring individual policies ensures better coverage and long-term benefits. Canadian LIC helps clients make informed decisions for their unique needs.

Introduction:

Joint Term Life Insurance Policies are commonly sold as an easy and affordable option for couples. On paper, the idea of combining two lives into one Term Life Insurance Policy seems practical. However, in practice, this type of insurance can sometimes create unanticipated problems. For many, these disadvantages only come to light after encountering challenges with claims or changing life circumstances. This has been observed and witnessed by many clients here at Canadian LIC; this is an article aimed to inform you, giving you valuable knowledge in making better decisions concerning term life insurance options.

If you ever had a question in your mind as to whether the Joint Term Life Insurance Policy was suitable for you or if the disadvantages outweigh the advantages, then you are not alone. Many couples face this problem and wonder whether they should purchase term life insurance online as an Individual Life Insurance Policy or take a joint policy. Let’s delve into the disadvantages of Joint Term Insurance so you can feel more confident about your decision.

Limited Payout: One Policy, One Death Benefit

A major disadvantage of Joint Term Life Insurance is usually that it would give out one death benefit, which is at the time a spouse meaning that at that time of death, that money paid for has already been spent. This can leave the surviving partner without coverage when they might need it the most.

For instance, imagine a young couple who sought our services based on the fact that their friend went through a similar situation. The surviving spouse had to buy a new Term Life Insurance Policy at a later age with a higher premium. If they bought one for each spouse, then in case one of them died, the other would have received individual death benefits and, therefore, continued financial support.

Key Tip: When evaluating Term Life Insurance Brokers or comparing Term Life Insurance Quotes, ask about Individual versus Joint Policies and their long-term implications.

Lack of Flexibility in Changing Circumstances

Life is unpredictable. Relationships change, and so do the needs of an individual regarding finance. A Joint Term Life Insurance does not factor in such changes. For example, when a couple splits up or divorces, managing how to continue or divide a joint policy can be a challenge.

We once dealt with a customer who narrated their experience as they tried to change their joint term policy since they had already separated from their partner. There were legal complications and financial wrangles. Each policyholder may change his/her policy without causing any inconvenience and still be guaranteed flexibility in such life transitions.

Pro Advice: Always assess how adaptable a Term Life Insurance Plan is to future changes when deciding between joint and single life insurance policy.

Higher Risk of Losing Coverage

Joint Term Life Insurance expires upon the payout of the death benefit. In this case, the survivor may remain exposed to loss unless they acquire another policy. Often, this will begin later in life and is usually associated with greater premiums from age or pre-existing health conditions.

One of our clients, who owned a Joint Term Life Insurance Policy, expressed sadness after losing coverage upon the passing of their partner. They were unable to find an affordable online term life insurance quote due to the other factors mentioned above, including age and medical history.

Important Note: If you’re leaning toward a Joint Term Life Insurance Policy, factor in the potential need for additional coverage in the future and the cost implications.

Limited Coverage Options for Complex Needs

Joint Policies may not provide sufficient cover for couples who have different financial obligations. For instance, one spouse may require higher coverage as the breadwinner or has larger debts. The joint policy considers both spouses as equal, hence leaving one underinsured while the other overinsured.

If a person has mortgage obligations and children who are from another relationship, the joint policy will not cater fully to their liability. Separate Policies will be needed, which may meet the needs of each member individually.

Pro Insight: Discuss your financial goals with a term life insurance broker to determine whether joint or individual policies better align with your circumstances.

Difficulty in Adding Riders or Additional Benefits

Many Term Life Insurance Policies have the option to add riders for complete coverage, which can be Critical Illness or Disability Insurance, but the options might be limited under Joint Term Life Insurance, or both ends are covered uniformly, based on joint requirements.

One couple that we helped had a chronic illness diagnosis for one of the partners and requested to add the rider for CriticalIillness Insurance. They were surprised to find that the rider would also apply to both partners, meaning they would have to pay for something they wouldn’t need.

Solution: When reviewing Term Life Insurance Plans, inquire about rider flexibility and customization options for joint versus individual policies.

Potential for Disputes in Beneficiary Designations

It normally names the survivor as a beneficiary on a Joint Term Life Insurance. This is apparently simple but often creates complications, especially when the couple has multiple dependents or in a blended family.

We have also seen clients wanting to modify beneficiary designations of children or other dependents for joint policy terms that did not allow them to do so. Individual policies allow more flexibility when assigning beneficiaries based on changing family dynamics.

Practical Advice: If you have dependents or complex beneficiary needs, discuss these scenarios with your term life insurance broker before committing to a joint policy.

Financial Strain in Case of Early Termination

Joint Term Life Insurance Policies may seem cheap initially but can end up being very expensive if cancelled prematurely. When a couple wishes to cancel the policy because of divorce or any other reason, they may not recover the amount of premiums paid and may be required to pay much more to acquire new coverage.

One of our customers expressed regret regarding the cancellation of a joint term policy in mid-term. He was left buying individual policies at higher rates, which made his already stress-ridden situation worse.

Pro Tip: Never forget to balance the long-term financial cost of a Joint Term Life Insurance Policy against any possible short-term savings.

Challenges in Policy Renewal

Renewing a Joint Term Life Insurance Policy also proves to be quite tricky, especially if the person suffers from health issues. Then, the premium is renovated at a high-risk profile, which makes it quite unaffordable.

We worked with a couple who faced this problem when their joint policy was up for renewal. The premiums were much higher due to one of the partners’ health issues, and they were forced to reassess their options.

What You Can Do: Explore Term Life Insurance Quotes online to compare renewal options and costs for joint versus individual policies before making a decision.

Lack of Individual Control

One needs to be able to get terms of Joint Term Life Insurance from both spouses on coverage amount, beneficiaries, and riders. Therefore, in most cases, individual control can prove frustrating as there is usually an imbalance between spouses in what they want.

For example, a client once complained that their joint policy was not good enough because his partner refused to increase the coverage amount when he was increasing his financial responsibilities. Separate policies allow each individual to make decisions that suit their unique needs.

Comparing Joint Term Life Insurance to Individual Policies

It is crucial to weigh your situation and make a decision on whether to go with Joint Term Life Insurance or purchase individual policies. Individual policies can be a little costlier to start with, but they offer greater benefits over a period of time.

For instance, individual policies provide separate death benefits. Therefore, if the partners die at the same time, their respective beneficiaries will get a payout from each policy. The dual payout would be highly critical for children-rearing families in securing the children’s financial futures. You are also at liberty to personalize the coverage amount, term of coverage, and the riders to be included under an individual policy in order to tailor the policy towards your desired goals.

Practical Advice: If you do not know what type of policy is best suited for you, compare Term Life Insurance Quotes from good brokers to understand the cost and benefits. It will help you make a good decision.

The Importance of Financial Independence in Coverage

One of the least obvious disadvantages of Joint Term Life Insurance Policies is how they might affect financial independence. Couples who take a single policy may not have the ability to manage their coverage separately. For example, in the event of one partner’s desire to increase the coverage or add riders to the policy, it usually has to be mutual consent.

There are times when one partner wanted more coverage because they had a new mortgage or a growing family with responsibilities, and the other wasn’t interested. Such a limitation could leave both parties inadequately protected. Under individual policies, each person can adjust their level of coverage independently without affecting the other.

Pro Tip: Financial independence in insurance planning is just as crucial as in other aspects of life. Ensure your policy allows for adjustments without requiring unnecessary negotiations.

The Hidden Costs of Joint Policies

Where one partner gets severely ill, for example, this can dramatically alter the renewal premiums or even the ability to renew the policy altogether. Although Joint Term Life Insurance Policies are always sold at a low cost, this hidden cost could catch up with the unsuspecting policyholder.

One client was very frustrated with a joint policy when the renewal premiums shot up due to the fact that her partner had been diagnosed with a chronic condition. Had they taken individual policies, the premiums of the healthy partner would have remained stable and would have saved them a lot in the long run.

Key Insight: When requesting Term Life Insurance Quotes online, ask brokers to outline not just the initial premiums but also potential costs at renewal. This will give you a clearer picture of the financial commitment involved.

Joint Policies and Estate Planning Complications

Estate planning is another area of a Joint Term Life Insurance Policy that can cause headaches. In many cases, a death benefit goes automatically to a surviving partner. This might appear simple enough; however, additional beneficiaries such as children or dependents may pose a problem with this kind of policy.

For example, a joint family client concluded that their joint policy did not meet the needs of their estate planning goals. They wanted to use some portion of the death benefit to allocate to children from another marriage. Their joint policy did not allow this flexibility, but individual policies allow for customized beneficiary designations to meet your estate planning goals.

Pro Advice: If estate planning is a priority for you, discuss your goals with a knowledgeable term life insurance broker who can guide you toward the right policy type.

Real Stories Highlighting the Drawbacks

To make these points more easy to understand, let’s look at some scenarios we’ve encountered at Canadian LIC:

- The Unexpected Divorce: A husband and wife wanted to save on the premiums of life insurance, so they decided to take a Joint Term Life Cover. After some years, they decided to separate. The joint policy became a point of contention, as neither wanted to continue paying premiums for a policy that serviced the other person. They then cancelled the joint policy and took individual Term Life covers at an increased cost.

- The Single Payout Shock: Another couple mistakenly believed their Term Policy was one that would generate two payments upon their simultaneous accident death. On discovering it made only one pay-out, the couple rapidly calculated that the remaining amount would certainly not suffice their children in any way in the case of the latter.

- The Renewal Dilemma: The husband and wife had a joint policy for 15 years. After going up in renewal, the husband’s health issues brought the premiums to an unaffordable level. His wife, who was in good health, wished she had built her own policy with a lower renewal rate.

How to Make the Right Decision

The selection of a joint or separate Term Life Insurance Policy depends on your financial position, relationship, and long-term goals. So, here’s how you can approach this decision and arrive at the best choice:

- Determine how much coverage each needs: In a situation where the financial responsibility lies more on one partner’s head, a separate life insurance policy might be advisable.

- Compare Quotes: Request Term Life Insurance Quotes from different brokers. Compare the price of joint versus individual policies throughout the policy period and at renewal.

- Consider Future Scenarios: Consider all possible changes in life, whether it is children, property, or separation. Select a policy that will cover such eventualities.

- Seek Professional Advice: Consider advice from professional and experienced Term Life Insurance Brokers and agents who shall explain the disadvantages and advantages on that basis.

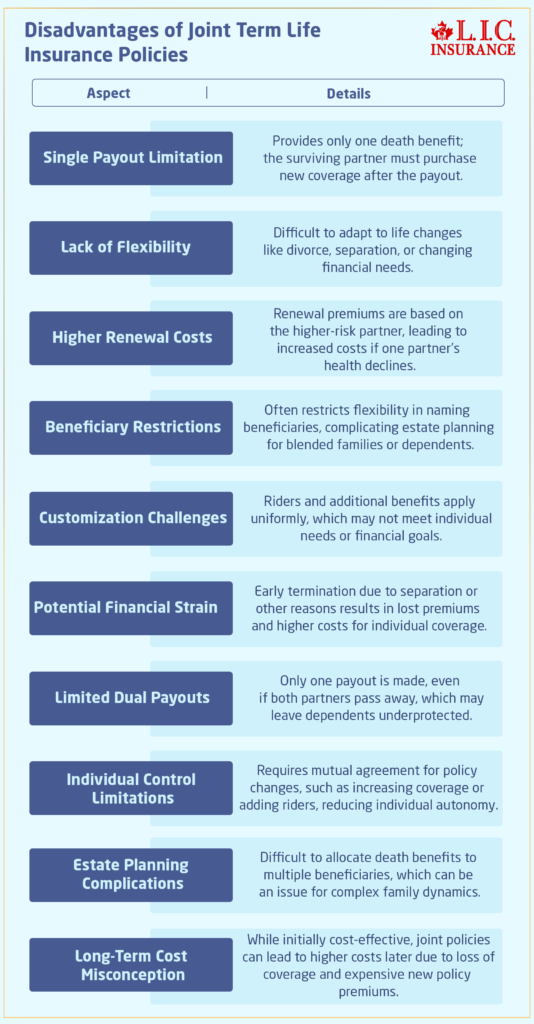

Disadvantages of Joint Term Life Insurance Policies

Why Consider Term Life Insurance with Canadian LIC?

One should know the disadvantages of Joint Term Life Insurance so that the right choice can be made. Although Joint Policies may look convenient, several drawbacks exist, which outweigh the benefits for many couples. At Canadian LIC, we work very closely with clients for their Term Life Insurance Plans to make sure they address their particular needs.

Through the individual policy, you have a better deal for flexibility, custom coverage, and the reassurance that your financial future is protected. Maybe you are buying life insurance online, or maybe you need professional assistance from a term life insurance broker-you’ll find a path that works best for you.

Take charge of your financial future today with the Term Life Insurance Plan of your choice. Request free online Term Life Insurance Quotes or consult with one of our trusted brokers for more information on your options. Let us guide you in choosing the best coverage for the things that matter most to you.

More on Term Life Insurance

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Understanding the Disadvantages of Joint Term Life Insurance Policies

Joint Term Life Insurance is one policy that will pay for two lives. This plan will provide just one death benefit, and it’s given as a payout if either one dies, which is paid out to the living spouse. Then, after a death benefit payment has been made, the policy closes. Some people who buy it think it will save them some money initially. They may change their minds in time and think, “If that’s going to end, that’s fine for now.”.

Not at all. For instance, on a Joint Term Life Insurance Plan, both individuals are treated on par, while their financial commitments may be completely different. Let’s say that if one of them earns much more or has heavy debts, that coverage amount won’t be too much for their needs. Actually, most customers of Canadian LIC do their individual policies.

If a couple splits up, it can get tricky to handle the Joint Life Insurance Coverage. Some of our clients at Canadian LIC have had to cancel their joint policy and purchase individual policies after that. All this can result in higher costs, especially if the individual policies are purchased when the buyer is older than when the joint policy was purchased.

Two Joint Policies are less expensive at first than two separate policies. However, the savings are an illusion because when the policy ends after the first payout, the surviving partner will have to buy Term Life Insurance online, which can be much more expensive. We encourage our clients at Canadian LIC to compare Term Life Insurance Quotes to understand long-term costs.

No, the Joint Term Life Insurance Policy typically pays out only once. The death benefit does not double, even if the couple dies on the same day. This makes it a potential problem for many families with dependents who require extra financial help. Many clients of Canadian LIC are interested in getting separate Term Life Insurance Plans in order to double the payouts of their beneficiaries.

Adding riders, which may include riders for critical illness or disability, to a joint policy is tough. Riders for these usually apply both ways, where it might be a bit biased if only one partner requires that extra coverage. At Canadian LIC, we advise that rider options be discussed with Term Life Insurance Brokers in searching for the appropriate plan.

Renewal premiums for Joint Policies are often based on the higher-risk partner. If either partner develops an illness, renewals can prove to be an expensive proposition. Some of our clients have experienced these issues and soon found themselves without the means to pay for renewals. In this case, separate Term Life Insurance Plans might have saved the day.

Changes in a joint policy do not have to be complicated, especially where the surviving spouse is automatically designated as the principal beneficiary. This can be difficult when a blended family client wants to incorporate children. Individual policies are more forgiving of such changes.

Joint Term Insurance Policy requires mutual agreement in case of increased coverage. Even if one of the partners differs with the increased amount, they cannot change that amount. The same has also frustrated our clients at Canadian LIC. Separate policies provide control for each partner.

The best choice for you would be based on your financial goals and family needs. Joint Policies appear attractive because they have lower front-end costs, but they are rigid and do not offer long-term benefits. For Term Life Insurance Quotes online at Canadian LIC, we recommend speaking with experienced brokers to understand the advantages of individual plans. This helps you make the right decision according to your future financial protection.

Sources and Further Reading

Canada Life

www.canadalife.com

Provides insights into different life insurance products, including term and Joint Policies, with resources to compare coverage options.

Manulife

www.manulife.ca

Offers detailed information on Term Life Insurance Plans, renewal terms, and customization options for riders and beneficiaries.

Sun Life

www.sunlife.ca

A reliable source for understanding Term Life Insurance Policies, including the pros and cons of joint coverage.

Insurance Bureau of Canada (IBC)

www.ibc.ca

A comprehensive resource for understanding insurance regulations and policy structures in Canada.

Canadian Life and Health Insurance Association (CLHIA)

www.clhia.ca

Offers guides and resources on life insurance products, helping Canadians make informed decisions.

Globe and Mail – Personal Finance Section

www.theglobeandmail.com

Features articles and expert opinions on life insurance trends, helping readers weigh policy options effectively.

Financial Consumer Agency of Canada (FCAC)

www.canada.ca/fcac

Provides resources and tools for comparing insurance products and understanding life insurance obligations.

TD Insurance

www.tdinsurance.com

Offers information on Term Life Insurance Quotes, customizable plans, and policy benefits.

Key Takeaways

Single Payout Limitation

A Joint Term Life Insurance Policy offers only one death benefit, which may leave the surviving partner without coverage after the first payout.

Lack of Flexibility

Joint Policies do not adapt well to life changes like divorce, changing financial responsibilities, or the need for customized coverage.

Higher Renewal Costs

Premiums at renewal are based on the higher-risk partner, which can make Joint Policies more expensive in the long term.

Beneficiary Restrictions

Joint Policies often limit beneficiary options, creating challenges for blended families or those with specific estate planning needs.

Customization Challenges

Riders and additional benefits may not be easily tailored to individual needs, limiting the effectiveness of joint coverage.

Potential Financial Strain

Early termination of a joint policy due to separation or other reasons can result in higher costs for new individual coverage.

Individual Policies Offer More Control

Separate Term Life Insurance Plans allow for personalized coverage, independent decision-making, and dual payouts for beneficiaries.

Comparing Policies is Essential

Reviewing Term Life Insurance Quotes and consulting brokers helps you choose a plan that aligns with your financial goals and long-term security.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts. This questionnaire will help us understand your struggles and concerns about Joint Term Life Insurance Policies. Your responses will guide us in providing better support and solutions tailored to your needs.

Thank you for your valuable feedback! A representative from Canadian LIC may reach out to provide personalized assistance based on your responses. If you have any further questions or concerns, feel free to contact us.

IN THIS ARTICLE

- What Are The Disadvantages Of Joint Term Insurance?

- Limited Payout: One Policy, One Death Benefit

- Lack of Flexibility in Changing Circumstances

- Higher Risk of Losing Coverage

- Limited Coverage Options for Complex Needs

- Difficulty in Adding Riders or Additional Benefits

- Potential for Disputes in Beneficiary Designations

- Financial Strain in Case of Early Termination

- Challenges in Policy Renewal