- What are the differences between a Family Plan RESP and an Individual Plan RESP?

- What is an RESP?

- Understanding the Individual Plan RESP

- Delving into the Family Plan RESP

- Flexibility and Contributions: A Comparative Look

- Government Grants and How They Differ Between the Plans

- RESP Withdrawals: How Taxes Work

- RESP Flexibility: Changing Beneficiaries

- Monitoring and Managing Your RESP

- RESP Quotes Online: Why You Shouldn’t Rely Solely on the Internet

- Conclusion: Why Canadian LIC is Your Best Choice for RESP Planning

Deciding on the right Registered Education Savings Plan (RESP) can be a bit complicated, especially when it’s a family plan vs an individual plan. We see this all the time at Canadian LIC. Clients come in the door, eyes wide with confusion, and ask, “What’s the difference between a family plan and an Individual Plan RESP?” It’s a question we get asked all the time, and for a good reason – this decision can impact your child’s education funding big time.

We see many clients come to us because they’ve read about RESPs online or used an RESP Withdrawal Tax Calculator and still feel lost. They’ve seen the numbers, but the difference between the two plans is still unclear. They’re worried about making the wrong choice, one that will cost them government grants or tax efficiency. And who can blame them? Your child’s education is at stake, after all, so it’s got to be an informed decision.

Here we go. We’ll break down the difference between a family plan and an Individual Plan RESP in Canada. We’ll share some client stories to help make you understand them more easily. By the end, you’ll know which one is right for you.

What is an RESP?

Before getting into the differences, let’s talk about the basics. An RESP, otherwise known as a Registered Education Savings Plan, is a tax-advantaged savings plan aimed at helping families save for a child’s postsecondary education. When you contribute to an RESP, it gets matched with government grants, like the Canada Education Savings Grant, which will really help your savings grow. Your contributed money grows tax-free, and when it’s time to withdraw, the funds are typically taxed in the hands of the student, who likely has a lower tax rate.

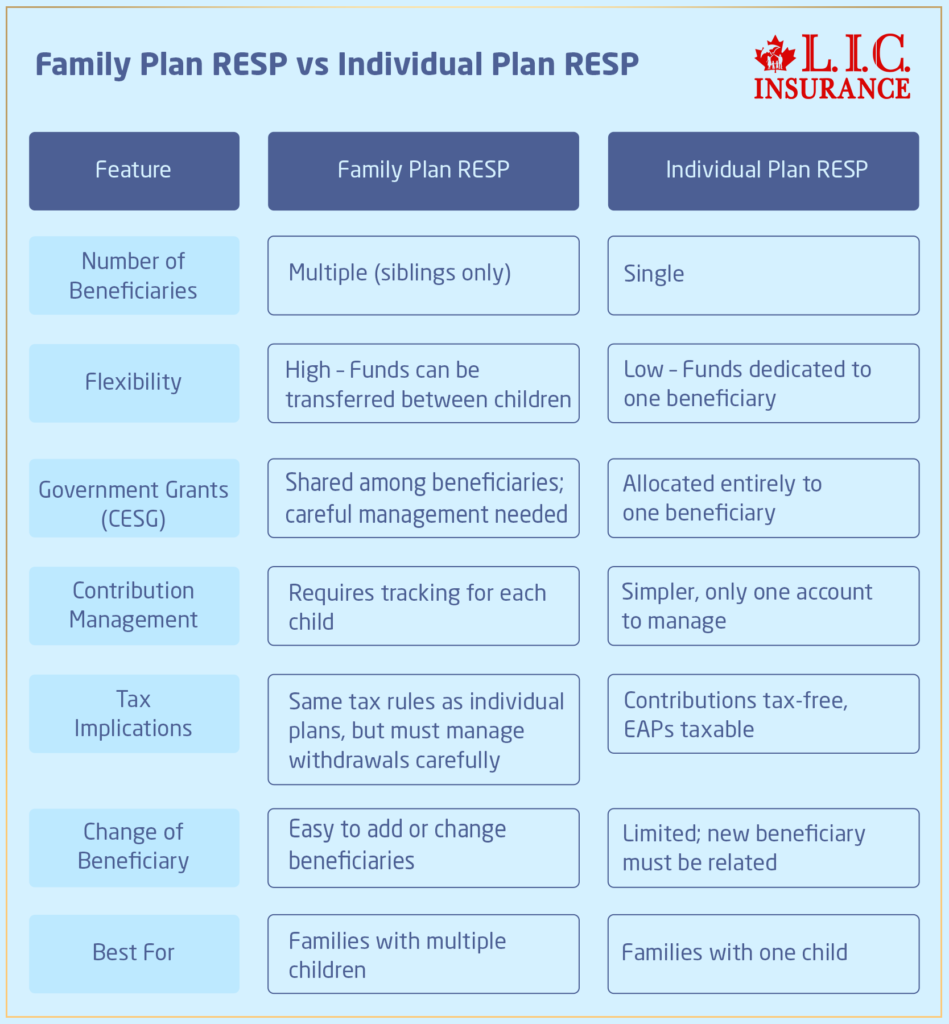

That is the big picture. At the heart of the RESP framework, however, are two main types of plans: the family plan and the individual plan. Each has its own set of rules, benefits, and possible drawbacks.

Understanding the Individual Plan RESP

Let’s start with the Individual RESPs. This is normally the choice used by parents who have one child or by those who prefer simplicity. For an Individual RESP, there can only be one beneficiary—the child for whom the account was opened.

Struggles with Individual Plans

One of our clients, Sonia, came to us after having her second child. When her first child was born, she opened an Individual Plan RESP. She contributed regularly and was confident in her choice. But when her second child came along, Sonia found herself in a dilemma. She needed to open another individual plan for her new baby, which meant starting from scratch—new contributions, new grants, and a whole new account to manage. This added complexity and a potential headache during tax time.

Sonia’s situation is a common one. An individual plan can be limiting if you have—or plan to have—more than one child. Each child will need their own plan, and that means juggling multiple accounts, which can become a logistical and financial burden. This is something to consider seriously, especially if you’re early in your family planning journey.

Delving into the Family Plan RESP

Let us now look into the RESP family plan. Unlike the individual plan, in a family plan, one can have more than one beneficiary, provided that they are all from one particular subscriber, by blood or adoption. This feature gives more flexibility, more so if one is dealing with families with more than one child.

The Benefits of a Family Plan

Take, for example, another of our clients, the Robinson family. They have three children and initially considered opening individual plans for each. However, after discussing their options with us, they decided on a Family Plan RESP. This decision allowed them to pool their contributions into one account and share the Canada Education Savings Grant (CESG) among all three children.

This flexibility is one of the biggest advantages of a family plan. If one child decides not to pursue postsecondary education, the remaining funds—and the associated government grants—can be reallocated to another child. This way, nothing goes to waste.

Flexibility and Contributions: A Comparative Look

One of the major differences between a family plan and an Individual Plan RESP in Canada is the flexibility with which contributions are made.

Every dollar you contribute is earmarked for one beneficiary in an individual plan. Suppose that child decides not to go to college or university. In that case, you’re faced with the choice of either withdrawing the funds (and paying taxes on the earnings plus returning any grants) or transferring the plan to another family member. But remember, transferring isn’t always straightforward. The new beneficiary must meet specific requirements, and there may be tax implications to consider.

In contrast, Family RESPs provide much greater flexibility. You can contribute to one account, and the funds may be used by one or more of the beneficiaries as long as they are siblings. This attribute could be very helpful, particularly when you are not sure about the future education to be chosen by your children. For example, if one of the children decides to learn a trade rather than go to the university, the rest of the children will use the remaining money without difficulty.

A Cautionary Tale on Over-Contribution

We once had a client, Mr. Adams, who was very proactive in saving for his three children’s education. He opened a Family Plan RESP and diligently contributed to it over the years. However, he didn’t keep track of the lifetime contribution limits for each child, and he accidentally exceeded the limit. This mistake triggered penalties and unnecessary stress.

This brings us to an essential point: while Family RESPs offer flexibility, they also require careful monitoring. You need to be aware of the $50,000 lifetime contribution limit per child to avoid over-contribution penalties. Using tools like an RESP Withdrawal Tax Calculator can help you manage your regular contributions effectively.

Government Grants and How They Differ Between the Plans

Although the Canada Education Savings Grant is, indeed, a big incentive to open an RESP, how this grant is applied can differ depending on whether you go for an individual plan or a Family Plan RESP in Canada.

Individual Plan Grant Allocation

In an individual plan, the CESG is straightforward. The government will match 20% of your contributions up to $500 per year, with a lifetime maximum of $7,200 per beneficiary. Since there’s only one beneficiary, all the grant money goes directly to that child.

Family Plan Grant Allocation

In a family plan, the CESG is a bit more complex. The grant is still 20% of your contributions up to $500 per year per child, but it’s important to note that the maximum grant per child remains $7,200. If you have three children, each one can receive up to $7,200 in grants, but you must contribute accordingly to maximize this benefit for each child.

A Real Example of Missed Opportunities

One of our clients, the Lee family, opened a Family Plan RESP for their two children. They contributed regularly but didn’t realize that their contributions were not being evenly allocated between the two children. As a result, one child received the full $7,200 in grants, while the other received less than they could have. This situation highlights the importance of understanding how grants work in a family plan and ensuring your contributions are balanced.

RESP Withdrawals: How Taxes Work

When it comes time to withdraw funds from your RESP, the tax implications can vary depending on the type of plan you have.

Individual Plan Withdrawals

In an individual plan, withdrawals are generally straightforward. The contributions you made are returned to you tax-free since they were made with after-tax dollars. However, the investment income and government grants—known as Educational Assistance Payments (EAPs)—are taxable in the hands of the beneficiary, who is usually in a lower tax bracket.

Family Plan Withdrawals

In a family plan, the process is similar, but there’s an added layer of complexity. Because the plan may have multiple beneficiaries, you need to carefully allocate withdrawals to ensure that each child is receiving their fair share of the funds and grants. This is where planning becomes crucial.

The Robinson Family’s Experience

Returning to the Robinson family, when their oldest child, Emily, started university, they began making withdrawals from their Family Plan RESP. They were careful to allocate a portion of the EAPs to Emily, ensuring she received the appropriate amount of the CESG funds. The remaining funds were earmarked for their younger children.

However, as we explained to them, it’s essential to keep track of how much each child is withdrawing to avoid complications later. For instance, if one child uses more than their share of the EAPs, the remaining children might not have enough grant money left when it’s their turn to go to school.

RESP Flexibility: Changing Beneficiaries

One of the most frequent questions we get at Canadian LIC is, “What happens if my child doesn’t go to college or university?” The answer depends on whether you have an individual plan or a Family Plan RESP.

Individual Plan: Limited Options

In an individual plan, your options are limited if your child decides not to pursue postsecondary education. You can either:

- Transfer the RESP to another beneficiary: The new beneficiary must be under 21 and related by blood or adoption. If the new beneficiary has already reached their $50,000 contribution limit, this option won’t work.

- Withdraw the funds: You’ll need to pay taxes on the investment income, and you’ll have to return any CESG funds to the government.

Family Plan: Greater Flexibility

The Family Plan RESP provides much greater flexibility in this regard. In a scenario in which one child does not attend school, given that the other beneficiary has not maxed out grants, you can roll over funds from an RESP without penalty or loss of grant money.

A Real Scenario

We once had a client, the Thompson family, who had set up a Family Plan RESP for their two sons, Jake and Max. When Jake decided to take a gap year, the Thompsons were worried about what to do with the RESP. We assured them that with a family plan, they could simply wait to see if Jake would pursue education later or transfer the funds to Max if needed. This flexibility was a huge relief for them, highlighting one of the family plan’s key advantages.

Monitoring and Managing Your RESP

Be it an individual or a family plan, an RESP will require continuous management. However, how complex that management becomes will depend on the type of plan you choose.

Individual Plan Management

With an individual plan, management is relatively straightforward. You monitor contributions, ensure you don’t exceed limits, and watch the investments grow. When it’s time for withdrawals, you focus on the tax implications for that one beneficiary.

Family Plan Management

A family plan requires a bit more effort. It would be best if you tracked how much each child has received in contributions, grants, and withdrawals. This can be tricky, especially if you’re managing the RESP over many years. However, this added complexity is often worth it for the flexibility it provides.

The Adams Family’s Journey

Remember Mr. Adams, who accidentally over-contributed to his Family Plan RESP? After working with us to sort out the mess, he became much more diligent in monitoring his RESP. We set him up with an RESP Withdrawal Tax Calculator and other tools to help him keep track of contributions and ensure he didn’t exceed the limits again.

The Importance of Professional Guidance

The decision between a family plan and an Individual Plan RESP in Canada cannot be taken lightly. This will depend on your family situation, financial goals, and the possible educational avenues open to your children in the future.

Canadian LIC has experienced how overwhelming this decision can be. We have helped numerous families navigate through the intricacies of RESPs to make sure they maximize their savings and government grants while reducing tax implications.

RESP Quotes Online: Why You Shouldn't Rely Solely on the Internet

As tempting as it may be to resort to online resources—be it RESP Quotes Online or DIY financial planning tools—these most often lack personalized advice that really makes a difference. Every family is unique, just like their RESP needs.

General quotes and online calculators may be fair, but they won’t take into consideration your particular situation. That’s where professional advice comes in. We take time to understand your family situation at Canadian LIC and then provide you with tailored recommendations that will align with your goals.

Conclusion: Why Canadian LIC is Your Best Choice for RESP Planning

Deciding between a family plan and an Individual Plan RESP can be tough, but it doesn’t have to be. With the right help, you can make a decision that has your children’s education funded without the stress of managing multiple accounts or worrying about over-contributing.

At Canadian LIC, we will help you navigate the RESP in Canada. We have the knowledge and expertise to walk you through every step of the process, from setting up your plan to withdrawing when the time comes.

Don’t leave your child’s future to luck. Contact Canadian LIC today and let us help you make the right decision for your family’s RESP. Your child’s education is too big to gamble—choose smart with Canadian LIC, the best insurance broker in Canada.

More on RESPs

- The RESP Rules and Contribution Limits in 2024

- How Much Time Can an RESP Remain Open?

- What Will Happen If You Miss Contributing to an RESP for a Year?

- Can I Open an RESP for a Child Who Is Not Related To Me By Blood?

- Is it Possible To Use RESP for Rent?

- Find Out the Disadvantages of RESP

- Find Out The Expenses That Are Eligible for RESP in Canada

- Find Out The RESP Limit In Canada

- Find Out How Do I Withdraw Money from RESP Canada?

- Is it Necessary for an RESP Beneficiary to Live in Canada?

- Is It Possible To Use My RESP Outside Canada?

- Find Out The Way To Check My RESP in Canada?

- What Can Happen to A RESP If You Leave Canada?

- Is It Possible to Transfer an RESP to an RRSP?

- Things To Know About RESP in Canada

- What All You Should Know About RESP in Canada

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Understanding the Differences Between a Family Plan and an Individual Plan RESP in Canada

This, in fact, is a question that we get from most parents who are keen on making the best decisions for the education of their children at Canadian LIC. Actually, this is where the key differences are. An Individual Plan RESP has only one beneficiary, usually one child. On the other hand, a Family Plan RESP can have as many beneficiaries as one wants, so long as they are related to a person by blood or adoption.

We had one client, Sheeba, who opted for an individual plan for her first child. She then had a second child and realized she needed a second RESP, which doubled her management RESPonsibilities. This situation is not unique, and this is why we always recommend taking into consideration how many children you’re going to have before choosing an RESP.

Yes, one of the most significant advantages of a Family Plan RESP is that you can transfer funds between the children. That flexibility is important if one child doesn’t go on to post-secondary education or another child requires more funding.

We’ve learned this from personal experience with clients like the Robinson family. When their oldest child took a gap year, they redirected the funds to their younger child without penalty. None of this could have occurred had they gone down the path of an individual plan, so the flexibility inherent in a family plan is what we learned.

Taxes might sound a little confusing, so let’s make it simple. When you withdraw from an RESP, your contributions are tax-free since you made them with after-tax dollars. The investment income and government grants, however—referred to as Educational Assistance Payments, or EAPs—are taxable in the hands of the beneficiary, usually your child, who very likely has a lower tax bracket.

If you are not exactly sure how much tax your child might have to pay, using an RESP Withdrawal Tax Calculator could be an excellent way to try and get an estimate of the potential tax impact. We do this all the time with clients—to help walk through what the tax impact might be before making a withdrawal.

That’s a common question and something that we help many parents navigate. This is if your child does not go to post-secondary school and you have an individual plan. You can either transfer the RESP to another beneficiary who is related by blood or adoption, or you can withdraw the funds, but you’ll have to pay taxes on the earnings and return any government grants.

For instance, a Family Plan RESP carries a lot more flexibility; transferring the funds to another child without any penalties, as long as they are eligible for the funds, is easy. That line of safety ensures you have peace of mind and reassurance that your savings will not have been squandered.

While you can get an RESP Quote online, this is one of those areas where we always recommend a call with a professional. No two families are alike, and an online quote will not be able to capture that uniqueness.

We at Canadian LIC have often found people reach a decision based on online quotations, only to be rudely surprised later by the benefit they could have availed or the wrong assumptions they had made. By associating with a professional, you will be able to ensure that you make a choice that is right for your family.

Yes, you can over-contribute, and it’s something we always point out to our clients. Each child has a lifetime contribution limit of $50,000. If you go above this limit, you will incur a penalty of 1% per month on the excess amount until it’s withdrawn.

This actually happened to one of our clients, Mr. Adams. He had been so keen on saving for his children’s education that he found himself contributing too much. We helped him solve the problem, but he went through a hectic time that could have otherwise been avoided by careful monitoring.

With either plan, the Canada Education Savings Grant (CESG) will match 20% of your contribution, up to $500 annually per child, with a lifetime maximum of $7,200. In family plans, you do have to be careful in your allocation to make sure each child maximizes their CESG entitlement.

We had one family, the Lees, who did not realize they were not properly balancing the contributions between the two kids. One child received more grant money; however, we helped to adjust the contributions going forward for proper balance. It was a learning experience. For example, the Family Plans RESPs—can be such that parents get confused about how it really works with the CESG.

This depends on your family situation. Individual plans are easy to handle with one child but become a headache if one has more than one child since you will have many accounts to handle.

An RESP family plan can be a bit more complicated because you have to keep track of contributions and grants for each child within one account. Nevertheless, many of our clients, like the Thompson family, find that the flexibility of the family plan is well worth that added work. We often provide tools and tips, like using an RESP Withdrawal Tax Calculator, to help parents manage their RESP effectively.

Technically, you can, but most people don’t. Most families use one type of plan. If you have some special situation—like if there are two sets of grandparents, and each wants to contribute to a different account—it might make sense to do both.

We’ve seen many cases where grandparents set up an individual plan with a grandchild, for example, but the parents may have a family plan that covers all their children. We can certainly help you coordinate those two plans without busting the contribution limits or losing any grants.

Of course, the best way to choose is by considering what suits your current family situation and future plans. If you have one child or do not plan on having more, an individual plan might be simpler. If you have multiple children or plan to, a family plan offers more flexibility.

At Canadian ‘LIC’, we consider it part of our job to help families assess their potential and present options, and by using tools like the RESP Withdrawal Tax Calculator, we make an informed decision. We have helped so many families make decisions that would fit into their general financial plan and, by extension, into the general plan for children’s education.

Yes, you can change the beneficiaries with the Family Plan RESP, and actually, that is one of the reasons why many of our clients choose it. For example, we have a client—the Taylor family—who, when the Family Plan RESP was first set up, named two older children as beneficiaries. They just added their newborn baby girl to the plan, and now all three children can benefit from those savings. They wouldn’t have found that quite as easy with individual plans when they had to open a new account for each child.

Especially in a family plan, if your child does not use all the funds, then you can transfer the remaining funds to another beneficiary. This is where a family plan truly excels. For instance, the Thompson family had three children, and the oldest child did not require all the funds that were allocated to him. With a family plan, they easily redirected the remaining money to their younger children, ensuring nothing went to waste.

With an individual plan, you are able to withdraw unused funds; however, you will have to return the grants to the government, and the earnings will be taxed. This is why so many parents find the flexibility of a Family Plan RESP offered in Canada to be very valuable.

Since a variety of investment options exist within RESPs, you want to invest in something that mirrors or reflects your risk tolerance and time horizon. We remind our clients—like in the case of the Morgans—just how much time they have until the kids actually get to post-secondary education. For example, Mrs. Morgan was quite aggressive at first, but by discussing goals and the timeline, we reset to a more balanced strategy in order for the RESP to grow steadily without much risk.

If you are not convinced about the right type of investments that should be placed in your RESP, it is advisable to obtain RESP Quotes Online or seek professional advice.

Taking money out of the plan early can be a hassle, certainly, if you haven’t yet reached the point of using the money to help finance a child’s post-secondary education. At Canadian LIC, we’ve seen clients like Mr. and Mrs. Chen, who needed to withdraw funds due to unexpected financial difficulties. We explained that while they could access their contributions tax-free, withdrawing the grant money or investment income would mean paying taxes on those earnings and repaying the government grants.

We always advise using an RESP Withdrawal Tax Calculator to understand the potential tax impact before making any decisions. This tool helps our clients see the bigger picture and avoid unnecessary penalties.

In order to gain the maximum benefits of an RESP, it is recommended that large amounts be contributed from an early life stage in Canada and maximize the CESG through grants. We recommend that all our clients establish an automatic RESP contribution, like our Singh family. This can be done directly from your bank account, or your funds can be transferred to the RESP investment account. This way, they didn’t miss out on any government grants, and their RESP balance always grew consistently over time.

Finally, regular financial advisor reviews ensure that your investments in the RESP are strictly in line with your goals and that you are on track to achieve the savings objective. While getting quotes online can be a good start, personalized strategies for your family may be best developed with advice from a professional.

Yes, anyone can open an RESP for a child, provided you have the child’s SIN number. This is a very common scenario that we see at Canadian LIC—whereby grandparents or other relatives would like to contribute to the education of a child. For instance, Mr. Thakare opened an RESP for his niece. He wasn’t quite sure how the plan should be structured, so we helped him set up an individual plan tailored specifically to her needs.

If you’re thinking of opening an RESP for someone else’s child, there are going to be some associated RESPonsibilities, and we are here to guide you through that.

Finally, you can withdraw from your RESP when your child reaches college-going age. At this point, you will need to provide proof that your child is enrolled in a qualified post-secondary institution. The funds can be withdrawn in two ways: contributions, which are tax-free, and Educational Assistance Payments (EAPs), which are taxable in your child’s hands.

We always advise our clients to be very careful in planning their withdrawals to minimize taxes. For example, the Davis family worked with us to structure their withdrawals over several years so that their daughter would remain within a low tax bracket while in school. An RESP Withdrawal Tax Calculator will give you an estimate of just how much tax your child may have to pay and help you plan.

Yes, you can move your RESP to any other financial institution. However, beware of transfer charges or penalties, if any. We have cases where, for example, the Miller family was seeking to move to another institution with better investment options and more affordable management. We helped them through the transfer process while ensuring that they retain their benefits or grants throughout the process.

Get quotes online for RESP before you transfer to a comparison of the different institutions’ offerings so you can make the best decision that suits your needs.

Such incorporation of your Whole Life Insurance into your estate planning is an important aspect if maximum benefits are to be derived. We have assisted Edward of Toronto in tailoring his policy towards his estate plans so that the benefits accrue maximally and in a tax-effective manner to his heirs.

In most cases, the best time to buy is when you are young and healthy. The premiums at that time will be quite affordable. However, it is never too late to start. We have advised a 50-year-old lady from Edmonton called Linda, who felt it was a bit late to be getting the insurance. Our agents still gave her options with huge benefits at her age.

Canadian LIC works hard to empower you with all knowledge in regard to your Whole Life Insurance so that you are confident and secure about your decisions. Whether it is getting a quote for the adjusting of your policy to better suit you or simply understanding the options at hand, be it for any sort of help that you may require at any step, our team is always ready. Do not hesitate to just get in touch and begin a conversation about securing your financial future today.

Sources and Further Reading

- Government of Canada – Registered Education Savings Plans (RESPs)

- Explore the official guidelines, benefits, and regulations surrounding RESPs in Canada, including detailed information on government grants.

- Visit the Government of Canada website

- Canada Education Savings Grant (CESG) Overview

- Understand how the CESG works, eligibility requirements, and how it can boost your RESP savings.

- Learn more about CESG

- Canada Learning Bond (CLB)

- Discover additional government support for low-income families saving for their child’s education.

- Find out more about the CLB

- Financial Consumer Agency of Canada – Choosing the Right RESP

- Get insights into choosing between family and individual plans and how to make the best decision for your family.

- Read more from the FCAC

- RESP Withdrawal Tax Calculator Tools

- Use these online calculators to estimate the tax implications of withdrawing from your RESP.

- Search for RESP tax calculators online

- RESP Quotes Online

- Compare RESP options from different financial institutions and get quotes online to find the best plan for your needs.

- Search for RESP Quotes Online

These resources will help you deepen your understanding of RESPs in Canada and make informed decisions about your child’s education savings.

- Government of Canada – Registered Education Savings Plans (RESPs)

Key Takeaways

- A Family Plan RESP allows multiple beneficiaries; an individual plan is simpler but less flexible.

- A Family Plan RESP lets you transfer funds between children, offering more flexibility.

- Both plans qualify for CESG, but managing contributions is key in a family plan

- RESP withdrawals have tax implications, with contributions tax-free and EAPs taxable.

- Online tools help, but personalized advice from professionals like Canadian LIC is best.

- Family plans require careful management, while individual plans are easier but less adaptable.

Your Feedback Is Very Important To Us

Thank you for your feedback! Your insights will help us better understand the challenges Canadians face with RESP plans and how we can assist you further.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]