- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Are The Common Term Life Insurance Clauses?

- Why Are Clauses Important in Term Life Insurance Policies?

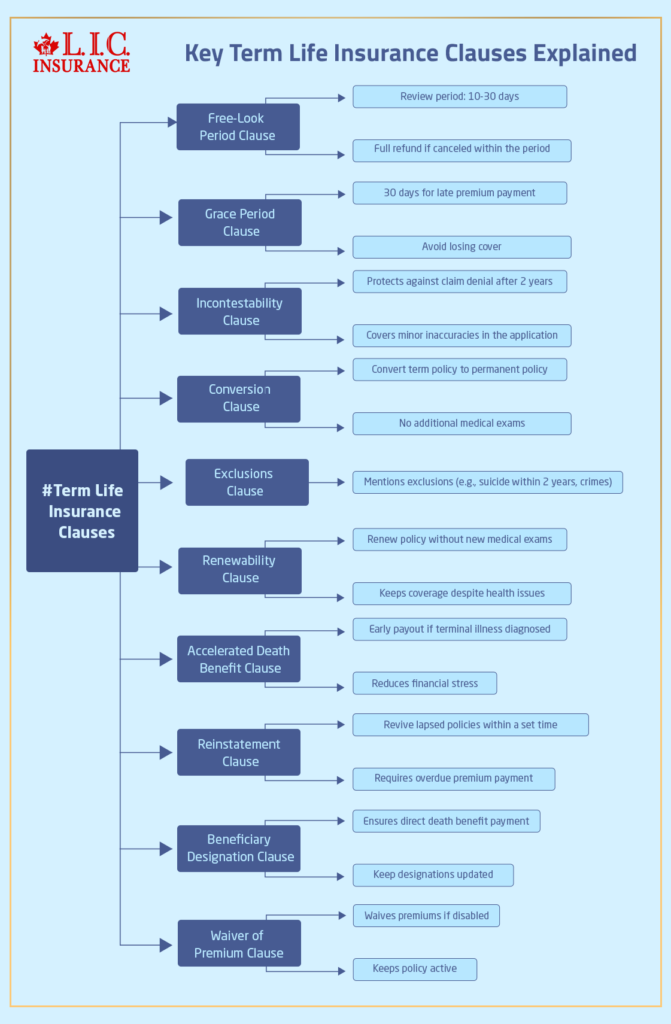

- Key Term Life Insurance Clauses Explained

- Common Struggles Around Clauses

- Why Work with Term Life Insurance Brokers?

- How Canadian LIC Helps You Understand Clauses

- Common Concerns About Term Life Insurance Clauses

- Financial Strain in Case of Early Termination

- Real-Life Impact of Understanding Clauses

What Are The Common Term Life Insurance Clauses?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 14th, 2025

SUMMARY

The blog elaborates on the common clauses in the Term Life Insurance Policy, including free-look, grace period, renewability, conversion, and exclusions. It identifies their importance, how they work, and real-life implications. Online comparison of Term Life Insurance quotes, working with expert Term Life Insurance Brokers, and how these clauses guarantee clarity and flexibility are discussed in the blog. The blog emphasizes understanding terms before deciding to buy Term Life Insurance online.

Introduction: Addressing Common Concerns

Have you ever tried to make sense of your Term Life Insurance Policy and found yourself defeated by the legal language and unfamiliar clauses? You’re certainly not alone. Many people have similar struggles when trying to review their policies, and many of them are unsure about what each clause means or how it will affect them. Often, “What does this clause really mean for me and my family?” is a question widely asked by clients of Canadian LIC’s experienced Term Life Insurance Brokers. This ambiguity might delay you from coming to a decision. Let’s discuss these clauses in detail so that you understand the nitty-gritty and don’t get hesitant in coming to a final decision while getting quotes for Term Life Insurance online or when buying Term Life Insurance online.

Why Are Clauses Important in Term Life Insurance Policies?

Each Term Life Insurance Policy includes clauses that clearly outline your rights, benefits, and responsibilities. Such clauses allow for a clearer understanding of what is expected and required between the insurer and policyholder, eliminating surprises down the line. Therefore, one would be in a better position to pick the right coverage for his needs.

Key Term Life Insurance Clauses Explained

Free-Look Period Clause

This clause provides a review period, which is generally 10 to 30 days after buying the policy. If a buyer isn’t satisfied with the policy, he or she is allowed to cancel with a full refund of the premium. Often, clients coming to Canadian LIC experience relief knowing that they have review periods to ensure their policies will meet expectations.

When exploring Term Life Insurance Brokers, ask if the free-look period applies to the policies you’re considering.

Grace Period Clause

Life is uncertain, and sometimes, one will miss a premium due to something that he/she could not avoid. The grace period clause helps avoid losing the cover immediately. In most policies, you are given 30 days for late payments.

The Canadian LIC’s brokers often guide clients through premium reminders, ensuring they remain protected without interruptions.

Incontestability Clause

It gives the policyholders protection against claim denial because of minor inaccuracies in the application after a particular time, normally two years. For instance, if you forgot to report the correct weight or misreported, the insurer will not void your policy after such a period has elapsed.

However, by working with Term Life Insurance agents, you can avoid common errors in applications that could cause issues during the incontestability period.

Conversion Clause

Many clients at Canadian LIC start their term life policy but later decide to switch permanently. The conversion clause allows a term policy owner to convert that Term Policy to a Permanent One without having additional medical exams performed. This would be invaluable since life circumstances might change.

Compare Term Life Insurance Quotes Online; check if the policy has the option for future adaptation.

Exclusions Clause

Not all deaths are included in the Term Life Insurance. The exclusions clause mentions events for which the claims would not be paid. These include suicide within two years of buying the policy or participation in a crime.

The brokers at Canadian LIC take time to explain these exclusions so that clients understand the limitations of their policy before they buy Term Life Insurance online.

Renewability Clause

The renewability clause is essential because you get to renew your Term Life Insurance at the end of the term without taking additional medical exams. This is especially beneficial as health problems typically develop with age.

For instance, one Canadian LIC client recalled having bought a 10-year Term Policy when she was in her early 30s. In her 40s, when she thought of renewing, she was relieved to find that she had a renewability clause under her policy. Though she now had minor health issues, she renewed her coverage without added complications.

You need to know the renewability of Term Life Insurance quotes, if available on the website, as well as how it will impact your premium.

Accelerated Death Benefit Clause

This pays money if you’re diagnosed with a terminal illness and have less than six months of remaining lifetime. You’ll get some of your death benefit money in advance to use for medical or other important bills.

At Canadian LIC, many clients are relieved to know that they have this option in case of challenging times to reduce financial stress. Brokers often recommend this feature for those seeking complete coverage.

Reinstatement Clause

Life is quite unpredictable and may sometimes cause the policies to lapse in case of non-payment. In this scenario, the reinstatement clause lets you revive the lapsed policy within a stipulated time, typically with evidence of insurability and payment of Term Life Insurance Premiums that are overdue.

One client at Canadian LIC was grateful for this clause when they temporarily lost income but could reinstate their policy later without starting from scratch.

Beneficiary Designation Clause

This clause ensures the direct payment of the death benefit to the individuals or entities you want. It’s essential to ensure that your information is up to date to prevent any dispute arising or delays during claim settlement.

Canadian LIC usually encourages its clients to review their beneficiary designations in the wake of significant life events such as marriage, divorce, or the birth of a child. Brokers make sure that clients know how these changes will affect their Term Life Insurance.

Waiver of Premium Clause

If you become disabled and cannot work, this provision waives your premium payments but keeps your policy active. It gives you the peace of mind that your family’s protection won’t lapse in difficult times.

Canadian LIC brokers often refer to this clause when planning long-term finances for clients.

Common Struggles Around Clauses

Misunderstanding Terms

Many customers at Canadian LIC first come to us after trying to decipher their policies independently and becoming confused. This often happens with exclusions or conversion rights, which are misunderstood and have no interpretation by the professional.

Fearing Hidden Costs

Another frequent concern is whether certain clauses will lead to unexpected financial burdens. This is why Canadian LIC ensures transparency when explaining the details of Term Life Insurance Policies.

Why Work with Term Life Insurance Brokers?

The daunting process of Term Life Insurance becomes easy once you seek assistance from expert Canadian LIC brokers who cater to individual needs. Online quotes comparison in the Term Life Insurance or interpreting a myriad of clauses could not get simpler.

How Canadian LIC Helps You Understand Clauses

Most clients complain when they seek Term Life Insurance Brokers because they are confused about policy terms. Canadian LIC works in a hands-on manner where every client gets to understand the clauses within their policy. Here’s how:

Personalized Guidance

Each client is unique. Be it a first-time Term Life Insurance buyer or upgrading an existing policy, Canadian LIC brokers explain the clauses that are most important to you.

Transparent Comparisons

Customers usually go to Canadian LIC in order to compare Term Life Insurance Quotes Online. Our brokers will explain how each policy’s clauses go along with your goals, ensuring there are no surprises down the road.

Real-Life Stories

We frequently share with you other clients’ relatable experiences that can help explain the real-world implications of certain clauses.

Common Concerns About Term Life Insurance Clauses

It normally names the survivor as a beneficiary on a Joint Term Life Insurance. This is apparently simple but often creates complications, especially when the couple has multiple dependents or in a blended family.

Financial Strain in Case of Early Termination

Are There Hidden Clauses?

Most people are anxious about some unlisted clause hidden in their Term Life Insurance. With Canadian LIC, this is something of a taboo. Every clause will be clarified before being handed to the clients, thus guaranteeing their satisfaction with their choice.

How Do Clauses Affect Premiums?

Some clauses, such as waiver of premium or accelerated death benefits, increase premiums slightly. However, they often offer much value, especially when the unexpected occurs.

You can determine whether these clauses fit into your long-term financial plans by consulting the Canadian LIC’s brokers.

Can Clauses Be Customized?

Though certain clauses are universal, others depend on your individual needs. Perhaps you would require a waiver of premium or accelerated death benefit rider. Canadian LIC brokers help customers make these selections to customize their coverage.

Real-Life Impact of Understanding Clauses

One Canadian LIC client shared how this conversion clause understanding helped them make a transition from a term policy to a Permanent Life Insurance Policies one after a significant health change. Without such understanding, they may have been at risk of higher premiums or a coverage gap.

Another customer was relieved to have paid just in time using the grace period clause during a financial crunch. Such living examples make it obvious how essential it is to understand your policy’s terms truly.

Steps to Take Before Buying Term Life Insurance

Assess Your Requirements

Identify your financial objectives, family obligations, and the length of coverage you require.

Compare Policies

Use online resources to compare Term Life Insurance Quotes Online, but also consult a trusted broker for expert insights.

Ask About Clauses

Make sure you understand key clauses such as renewability, conversion, and exclusions before finalizing your decision.

Work with Canadian LIC

Our brokers help you understand everything about your policy. You could be getting online Term Life Insurance quotes or want to buy one, but either way, at Canadian LIC, the process will be hassle-free for you.

Taking the Next Step

Understand all the clauses present in your Term Life Insurance to make informed decisions. Whether you’re ensured that you’re aware of all your rights at the grace period, whether you are utilizing your conversion option or identifying your exclusions, Canadian LIC works to demystify the whole process.

If you’re ready to protect your loved ones with confidence, explore Term Life Insurance Policies and work with trusted Term Life Insurance Brokers. Comparing Term Life Insurance Quotes Online and deciding to buy Term Life Insurance online has never been easier.

Let the best insurance brokerage, Canadian LIC, guide you in securing your future.

Wrapping Up

Common-Term Life Insurance clauses are what will make all the difference in whether your policy really serves your needs. The conversion clause will ensure that you can be flexible with your coverage, and the incontestability clause will ensure that your family is protected.

When you’re ready to begin searching for Term Life Insurance Policies, then contact the best insurance brokerage – Canadian LIC. Our Term Life Insurance Brokers have a keen understanding of the business, ensuring that you are both comfortable and covered.

Compare Term Life Insurance Quotes Online today or buy Term Life Insurance online with the help of Canadian LIC. Let your future be secured and protected through a policy designed to fit your life perfectly.

More on Term Life Insurance

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs: Common Term Life Insurance Clauses

The free-look period is the time, generally 10–30 days, that you can see your policy purchased. If not satisfied, then you can return it and obtain a full refund. Many of the clients using Canadian LIC go through this free-look period to ensure the policy meets all their expectations.

The grace period allows you to pay your premium after the due date. It is usually 30 days. Many Canadian LIC clients appreciate this buffer, especially when unexpected financial challenges arise.

Any policy that is in force for two years becomes incontestable, meaning once the policy is in force, your insurer can’t make any claim invalid even because of errors in the application, minor they may be. Protection and peace of mind are provided.

Yes, most Term Life Insurance Policies include a conversion clause. This means you can switch to a Permanent Policy without having to take new medical exams. That is the flexibility that most clients at Canadian LIC enjoy when their needs change.

There are exemptions, which happen to be periods when your coverage will not settle any claim: suicide within two years of buying the cover or death related to illegal issues. Canadian LIC brokers ensure all these exemptions are understood prior to buying a term life online.

If your policy lapses, you can sometimes reinstate it through the reinstatement clause. You will have to pay any premiums that were missed and may need to prove insurability. Canadian LIC brokers will walk clients through this process if necessary.

This clause will waive your premium payments in case you get disabled and can’t work. It ensures your policy stays active during tough times. Clients find this feature useful while planning for long-term security.

Yes, through an accelerated death benefit clause, you can benefit from a fraction of your death benefit if diagnosed with a terminal illness. According to Canadian LIC, most clients avail themselves of it in order to offset medical and other pressing bills.

However, not all policies do this; most offer it. A renewability clause allows you to renew your policy without the need for another medical exam. According to brokers who represent Canadian LIC, you should check this clause when comparing Term Life Insurance Quotes Online.

Beneficiary designation clause- This allows you to name or change the people or organizations to which you can give the payout. Canadian LIC advises their clients to review this after major life events such as marriage or having children.

Term Life Insurance Brokers at Canadian LIC guide you through understanding clauses, Term Life Insurance quote comparisons online, and finding policy coverages for your needs. They help you sort out the jumble and allow you to get the best.

Before purchasing Term Life Insurance online, analyze your financial objectives, read the clauses of the policy, and compare quotes. Canadian LIC brokers assist clients in making the best decisions by clarifying each policy’s terms and conditions.

Work with experienced brokers who understand your concerns. Canadian LIC brokers share real-world experiences to help you understand your policy and make the best decision.

Once your term ends, coverage stops unless you have a renewability clause with your policy. A renewability clause allows you to extend coverage without a new medical exam. Canadian LIC educates clients about how this works when their term is coming to an end.

One of the cheapest types of life insurance for the family is Term Life Insurance. The coverages are relatively cheap, especially if you compare their quotes online and discuss them with those brokers who can find the best deals.

Yes, online, you can procure Term Life Insurance, but while dealing with a broker, all the clauses are understood, and you know how your coverage is. Quite a number of Canadian LIC customers feel more satisfied after discussing the options with a professional.

These would include exclusions for suicide in the first two years, crimes, or other hazardous activities. Often, Canadian LIC brokers discuss such exclusions with their clients so as not to misunderstand them during claims.

If your policy includes a conversion clause, you can convert it into a Permanent Policy. This is indeed beneficial for life course changes. Most Canadian LIC clients opt for this feature to ensure adaptability over the long term.

The length of the term depends on your financial goals. For instance, a 20-year term can cover your mortgage, while a 30-year term can cover your children until they are financially independent. Canadian LIC brokers help their clients align their policies with their goals.

There are no hidden costs if you understand the policy clauses. Canadian LIC brokers clearly explain premiums, fees, and any optional riders to ensure transparency.

No, clauses can differ between insurers and types of policies. You can compare Term Life Insurance Quotes Online and consult with brokers to find a policy that contains the clauses you require.

Yes, a policy can be cancelled; however, a client will not have any premium back unless the time is within a free-look period. Generally, Canadian LIC helps its customers in planning cancellations so as not to forgo crucial coverages.

They give expert advice, compare policies from different insurers, and explain complex clauses in a simple way. Canadian LIC brokers make it easy for their clients and ensure they receive the best coverage at the best price.

Term Life covers a term, whereas Permanent Insurance will cover the rest of your lifetime. Term policies are less expensive. Many of the Canadian LICs come in on a term product but then convert it to a permanent product through a conversion clause.

This clause permits you to obtain part of your death benefit advance if you contract a terminal illness. Many Canadian LIC clients use it to pay off medical bills or cover other pressing requirements.

Yes. You can have multiple beneficiaries and define what each will be taken care of by. Those Canadian LIC brokers help people set that up to ensure their loved ones are properly cared for.

These FAQs should give you a clearer picture of how Term Life Insurance clauses impact your policy. For personalized guidance, explore Term Life Insurance Policies with Canadian LIC. Let us help you protect what matters most.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Visit the CLHIA website to access detailed guides on Term Life Insurance, policy clauses, and consumer rights in Canada.

https://www.clhia.ca

Government of Canada – Life Insurance Information

The Government of Canada provides essential information about life insurance policies, including clauses and regulations.

https://www.canada.ca

Insurance Bureau of Canada (IBC)

IBC offers insights into different types of life insurance and what to look for in policy terms.

https://www.ibc.ca

Sun Life Canada

Sun Life offers educational resources on Term Life Insurance Policies, common clauses, and how to choose the right coverage.

https://www.sunlife.ca

Manulife Canada

Manulife provides clear explanations of life insurance options and tips for understanding policy details.

https://www.manulife.ca

Financial Consumer Agency of Canada (FCAC)

The FCAC’s website helps consumers understand life insurance terms and provides tools for comparing options.

https://www.canada.ca/en/financial-consumer-agency.html

Equitable Life of Canada

Equitable Life offers resources for learning about Term Life Insurance and how different clauses protect policyholders.

https://www.equitable.ca

Desjardins Insurance

Desjardins provides practical advice on Term Life Insurance Policies and the significance of understanding clauses.

https://www.desjardins.com

Key Takeaways

Understand Common Clauses

Familiarize yourself with important clauses like the free-look period, grace period, renewability, conversion, exclusions, and waiver of premium to ensure clarity in your Term Life Insurance Policies.

Policy Flexibility Matters

Clauses like the conversion option and accelerated death benefit provide flexibility and financial security as your needs change over time.

Compare Before Buying

Use Term Life Insurance Quotes Online to evaluate different options, but consult trusted brokers to understand the details of each policy.

Expert Guidance Helps

Working with experienced Term Life Insurance Brokers ensures you select the right coverage and avoid surprises related to policy terms.

Tailor Your Policy

Clauses can often be customized with the help of a broker to better match your financial goals and family needs.

Be Informed Before the Purchase

Before you buy Term Life Insurance online, ensure you thoroughly understand all clauses to make a confident and informed decision.

Your Feedback Is Very Important To Us

We aim to understand your struggles in learning about common Term Life Insurance clauses. Your input helps us serve you better. Please fill out the details below.

IN THIS ARTICLE

- What Are The Common Term Life Insurance Clauses?

- Why Are Clauses Important in Term Life Insurance Policies?

- Key Term Life Insurance Clauses Explained

- Common Struggles Around Clauses

- Why Work with Term Life Insurance Brokers?

- How Canadian LIC Helps You Understand Clauses

- Common Concerns About Term Life Insurance Clauses

- Financial Strain in Case of Early Termination

- Real-Life Impact of Understanding Clauses