- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Are the Benefits of Term Insurance for Death?

- Why Term Life Insurance Matters: Safeguarding Your Loved Ones

- Key Benefits of Term Life Insurance for Death Protection

- Choosing the Right Term Life Insurance Policy

- Tax-Free Death Benefits: A Practical Advantage for Canadian Families

- Quick Payouts for Immediate Financial Needs

- Supporting Long-Term Financial Goals

- Accessible Protection for Families and Individuals

- A Decision for Long-Term Security with Canadian LIC

- More on Term Life Insurance

What Are the Benefits of Term Insurance for Death?

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 30th, 2024

SUMMARY

Many Canadians, especially those who are balancing family commitments, mortgages, and work obligations, often wonder how they would protect their family financially in case they were to die unexpectedly. Questions such as, “Will my family be able to maintain their lifestyle?” or “How will my loved ones handle the mortgage, debt, or education costs without my income?” often arise with the consideration of financial security. These thoughts are very real for many Canadians and, although uncomfortable, necessary.

Term Life Insurance can be just the stability your family needs when tragedy strikes. Many clients come into Canadian LIC with the same uncertainty about Term Life Insurance Plans but take comfort in knowing their families’ financial well-being would be protected. The benefits of Term Life Insurance are simple: it is affordable, has a simple structure, and can provide robust financial protection to your family in the event that you pass away. This blog will discuss why Term Life Insurance is important and focus on death benefits with Canadian LIC’s help to Canadians when choosing the best Term Life Insurance Quotes and plans.

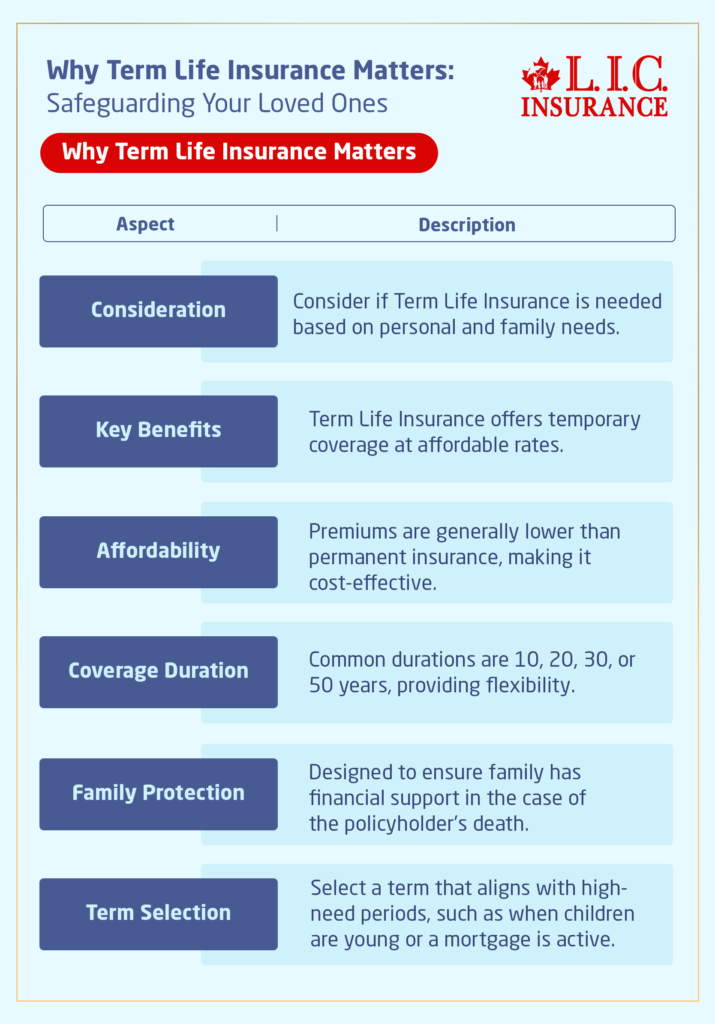

Why Term Life Insurance Matters: Safeguarding Your Loved Ones

Term Life Insurance can give you peace of mind that your family will have funds available in case of your death. Unlike Permanent Life Insurance Policy, Term Life Insurance is temporary, typically lasting 10, 20, 30 or 50 years.. That appeals to those who desire affordable premiums with coverage over the years when their family would need the most support–when children are young or a mortgage is still unpaid. From helping thousands of families find their desired Term Life Insurance Plans with a budget and priorities match, Canadian LIC has had its share of success.

For instance, a client who recently had a newborn and purchased their first home came to Canadian LIC, realizing how much more responsibility they had. They wanted to ensure their family would be protected if anything happened to them. After reviewing several Term Life Insurance Quotes, they selected a 20-year term that provided sufficient coverage to support their growing family and protect their home. This experience reflects the everyday reality that many families face, seeking a solution that ensures their family’s future security.

Key Benefits of Term Life Insurance for Death Protection

Financial Security for Dependents

The most significant benefit of Term Life Insurance is that it directly provides your family with the financial means after your death. The support received from this policy will be used to replace lost income so that dependents do not have to suffer for their lifestyle. Canadian LIC has experienced breadwinner families. The need for Term Life Insurance was evident to such families.

For example, after a health scare, a father went to Canadian LIC to find out how his family would be after he was gone, having no income. He wanted a Term Life Insurance that would pay all mortgage, the education of his children, and living expenses for many years. By selecting a policy with an affordable premium, he was able to provide this security without stretching his budget. This is proof of how practical Term Life Insurance really is to a lot of people trying to look into securing financial futures for loved ones during one’s remaining lifetime.

Affordable Premiums and Flexible Coverage

Affordability is one of the most significant attractions to Term Life Insurance. Term Life Insurance often costs less than permanent life insurance policies, so it is much more accessible for young families and individuals who require considerable coverage but are on a tight budget. Canadian LIC offers a range of Term Life Insurance Quotes tailored to meet the needs of different budgets, which means families can afford the coverage they need.

For example, recently, a young couple who approached Canadian LIC were so afraid of the cost of life insurance. They wanted to carry life protection for their recently born baby but did not like spending much money for the monthly premium payments. Hence, finally, they settled for a 30-year Term Life Insurance plan as it could balance the gigantic amount that they needed as coverage with an affordable amount of premium. This made Term Life Insurance the perfect choice for them as they expanded their family, which was also very affordable to allow them the comfort of being secure with their family without any economic pressure.

Coverage for Critical Life Stages

Term Life Insurance is very helpful during critical life stages when you are raising little children, paying off the mortgage, or supporting elderly parents. Many clients at Canadian LIC find that Term Life Insurance provides a perfect solution to protect their loved ones through these financially demanding years.

Consider a single mother who worked with Canadian LIC to find a policy that would cover her children’s future expenses. She wanted a term policy that would cover her children’s education if she were no longer there to provide for them. With a policy covering the next 20 years, she secured her children’s future educational needs while balancing her current financial obligations. This case shows the Term Life Insurance Importance in addressing critical life stages and ensuring that families have a backup plan when they need it most.

Choosing the Right Term Life Insurance Policy

One of the considerations when choosing a Term Life Insurance policy is the term. The ideal term is going to be the years when your family would most rely on your financial support. Canadian LIC has seen how customized terms can make a difference between families, as each of them has different financial timetables.

For example, if you have a 15-year-old child, the number of years until they achieve their financial independence is so close that a 10-year term would work in the family’s interest. On the other hand, a young couple would prefer a 30-year term to secure provision all through their children’s education and even for their potential college education. Therefore, by adjusting the number of years to match your aims for your family’s safety, Term Life Insurance makes great planning for them to enjoy security.

Comparing Term Life Insurance Quotes and Premiums

Quotes for Term Life Insurance vary based on the term length, amount of coverage, and age and health, among other things. According to Canadian LIC, the most important thing is to compare quotes so that one can find the best value. Most clients get confused about the options; however, with the guidance of Canadian LIC, they can realize which plans will suit them best.

A specific example is the case of a mid-30s teacher who was skeptical about the cost of life insurance. Canadian LIC advised her to compare various Term Life Insurance Quotes. She finally settled for a 20-year policy that met her budget and ensured adequate coverage over the mortgage and the children’s future requirements. Support from Canadian LIC for comparison ensured that she made her choice with confidence.

Tax-Free Death Benefits: A Practical Advantage for Canadian Families

One of the prime advantages is that the payout of death benefits in Term Life Insurance is tax-free. This means your family will not have to pay any tax on the payout when they receive it. So they can use all the funds for crucial expenses without having to worry about taxes. Canadian LIC has seen the relief this tax-free benefit brings to families, as they don’t need to worry about deductions or complications in receiving funds.

For example, a Canadian LIC client who is the breadwinner for a young family preferred a Term Life Insurance policy so that his family would not have to worry about taxes taking away the amount. The benefit of Term Life Insurance is that it provides full financial support to beneficiaries at times of need, which adds to the practicality of the policy.

Quick Payouts for Immediate Financial Needs

Term Life Insurance policies can be used to pay the claims quickly after the demise of the policyholder so that immediate expenses can be covered. Canadian LIC experienced cases where families were required to access funds immediately to cover funeral expenses, outstanding debts, or other urgent needs.

One client’s family thanked him for the speed with which he helped process their Term Life Insurance claim after the person’s death. The quicker payout helped them pay most of the medical bills, funeral costs, and then other expenses without a cramp in their finances at all. This practical benefit ensures that families can focus on healing, knowing that their financial responsibilities are being met.

Supporting Long-Term Financial Goals

In addition to covering short-term costs, term life is also an important part of long-term objectives. Often, the clients of Canadian LIC make use of Term Life Insurance Plans to help fulfill a few major goals, including their children’s education or the retirement of their spouse.

A retiree within the last year mentioned that Term Life Insurance coverage gave him peace of mind because, at his death, his wife would have money to live off during retirement. Here, Canadian LIC helped him find a policy that was in line with his financial goals, thus showing the role Term Life Insurance plays in meeting both short- and long-term needs.

Accessible Protection for Families and Individuals

Term Life Insurance is low-cost, straightforward protection available in a variety of flavours to meet different lifestyles and economic conditions. Canadian LIC services a very broad customer base, from a young professional just beginning to build his family to a retiree who wants to ensure their spouse’s future. Since Term Life Insurance Plans come in such a wide array of options, affordability and flexibility make them accessible to almost everyone.

In one case, a single parent balancing work and family approached Canadian LIC, seeking an affordable plan that wouldn’t add stress to her budget. She selected a Term Life Insurance plan that allowed her to provide for her children’s needs without financial strain. Her story demonstrates how Term Life Insurance adapts to different family structures, ensuring protection for every Canadian family.

A Decision for Long-Term Security with Canadian LIC

For the protection of your family, choosing Term Life Insurance is the responsible decision. For years, Canadian LIC has helped clients breathe a sigh of relief because they know their families will be taken care of in the event of anything happening to them. Term Life Insurance Plans offer accessible and affordable cover for dependable protection at all stages of life.

Be it the best-Term Life Insurance Quotes or varied term lengths, the Canadian LIC provides personalized guidance and expertise in finding the right fit. Such a decision may well turn out to be the starting point to securing Term Life Insurance so that your family can continue to thrive, even without you.

More on Term Life Insurance

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions about Term Life Insurance for Death Benefits

The importance of Term Life Insurance lies in its ability to provide financial security for your loved ones if something happens to you. Many families approach Canadian LIC, concerned about how they’ll manage expenses like mortgages, education costs, or daily living without their primary income. Term Life Insurance offers a straightforward solution: it ensures that your family has the funds to cover these needs if you pass away.

Term Life Insurance Plans are simple: you select a coverage amount and a term length, such as 10, 20, or 30 years. If you pass away during that time, your family receives a payout. Canadian LIC often helps clients decide on the right term based on their financial goals and responsibilities so they know their family is secure through key life stages.

Term Life Insurance is affordable, flexible, and provides significant coverage for a set period, making it ideal if you need financial protection for specific years, like when paying off a mortgage or raising children. Canadian LIC sees many clients select Term Life Insurance Plans for these exact reasons—it’s effective, budget-friendly, and gives families the security they need.

Term Life Insurance Quotes are often more affordable than people expect, especially compared to permanent life insurance. Canadian LIC provides personalized quotes, ensuring that clients find the right balance between coverage and cost. Many clients are pleasantly surprised to see how much Life Insurance Coverage they can secure within their budget.

Yes, many Term Life Insurance Plans offer a renewal option when your term ends. Canadian LIC often assists clients nearing the end of their term in renewing or exploring new options. Renewal premiums may be higher, but this flexibility means you can extend your coverage if your financial needs continue.

If you outlive your term, your policy simply ends, and no benefits are paid out. Some clients at Canadian LIC find this aspect concerning, but they often choose Term Life Insurance because of its affordability and because it covers them through their most financially demanding years. For those seeking lifelong coverage, Canadian LIC can discuss Permanent Coverage options.

Choosing the right amount of coverage depends on factors like your income, family expenses, debts, and future goals. Canadian LIC helps clients assess these areas and provides Term Life Insurance Quotes based on their specific Life Insurance needs. This way, families can rest assured that the payout will cover critical expenses if needed.

Term Life Insurance generally covers most causes of death, including accidents and illness, but exclusions may apply, such as suicide, within the first two policy years. Canadian LIC ensures that clients understand these details so they’re fully informed about what their plan covers.

Yes, you can often add riders, like critical illness or accidental death coverage, to enhance your policy. Many clients at Canadian LIC appreciate the flexibility of adding riders to create a more comprehensive protection plan. Riders can give you and your family additional peace of mind for specific situations.

Comparing Term Life Insurance Quotes is about looking at both premium costs and coverage benefits. Canadian LIC assists clients in comparing quotes from various providers, ensuring they get the best value based on their needs and budget. By doing this, clients can confidently choose a plan that provides the right coverage without overpaying.

You can name one or more beneficiaries, typically close family members, to receive the death benefit. Canadian LIC often sees clients name their spouse or children, but you have the flexibility to name anyone you wish. Choosing the right beneficiary helps ensure the payout goes exactly where it’s needed most.

A medical exam is usually required for Term Life Insurance, especially for higher coverage amounts. This exam helps determine your eligibility and premium rates. Canadian LIC guides clients through this process, so it’s straightforward and stress-free.

Your Term Life Insurance premium and coverage amount typically remain fixed once you’ve secured the plan, even if your health changes later. Canadian LIC clients often appreciate knowing that their coverage won’t be affected by health issues that may develop over time.

Yes, you can cancel your Term Life Insurance plan, but you won’t receive any refund on paid premiums. Canadian LIC advises clients to carefully consider their long-term needs before cancelling, as Term Life Insurance provides valuable security for family protection.

No, Term Life Insurance does not build cash value; it’s purely a protection plan. Canadian LIC clients often choose Term Life Insurance for its affordable premiums rather than for investment purposes. For those seeking cash value, Canadian LIC can recommend alternative insurance options.

Term Life Insurance is an essential tool in protecting your financial plan, especially if you have dependents, a mortgage, or significant financial obligations. Canadian LIC sees clients use Term Life Insurance as a safety net to ensure their family’s needs are met even without their income.

Your premium generally remains level for the length of your term. However, if you choose to renew after your initial term ends, the premium may increase. Canadian LIC informs clients about these renewal options, helping them understand the best steps for continued coverage.

Applying for Term Life Insurance with Canadian LIC is simple. They guide you through each step, from choosing the right Term Life Insurance plan to comparing Term Life Insurance Quotes. Their team ensures you understand your options and feel confident about your decision.

Term Life Insurance is essential for young families because it offers affordable protection during crucial years when financial obligations are high. Many clients at Canadian LIC, especially young parents, feel comforted knowing their family will have support if anything happens. This security helps families cover costs like mortgages, childcare, and education if a primary earner passes away.

Yes, Term Life Insurance Plans are flexible and can be customized. You can choose the coverage amount and term length based on your financial goals. Canadian LIC often helps clients tailor their Term Life Insurance Plans to cover their family’s needs precisely. By adjusting these elements, clients find a plan that aligns perfectly with their current and future financial responsibilities.

Term Life Insurance provides coverage for a set period, while permanent life insurance lasts a lifetime and may build cash value. Many clients at Canadian LIC select Term Life Insurance because it’s affordable and covers their family’s needs when expenses are highest. Permanent Life Policy is usually better suited for those looking for lifelong coverage and an investment component.

Yes, some Term Life Insurance Plans cater to individuals with health conditions, although premiums may be higher. Canadian LIC works with clients to find Term Life Insurance Quotes that fit their situation. They guide clients through options available to them based on their health, ensuring coverage is accessible and aligned with their needs.

Choosing a term length depends on your family’s financial timeline. For example, Canadian LIC often sees parents choose longer terms to cover years until children are financially independent. A 10-year term may work well for someone nearing retirement, while a 20- or 30-year term is suitable for those with young children or a long mortgage to pay off.

Once the claim process is completed, payouts are typically issued promptly to help families manage urgent expenses. Canadian LIC has assisted families in accessing these funds quickly, ensuring they can cover funeral costs, bills, and other immediate needs without financial delay. The speed of payout is one of the reasons many clients value Term Life Insurance.

Yes, many Term Life Insurance Plans allow conversion to a permanent policy without a medical exam, typically before a certain age or time limit. Canadian LIC helps clients navigate these options when they want to secure lifetime coverage. This flexibility is beneficial for clients whose needs evolve over time, offering a path to lifelong protection if needed.

Term Life Insurance Quotes increase as you age since the risk to the insurer grows over time. Canadian LIC often advises clients to secure a Term Life Insurance plan sooner rather than later to lock in lower premiums. Younger clients generally find they can obtain higher coverage at a lower cost by acting early.

Yes, you can add multiple beneficiaries and decide how the payout will be divided among them. Canadian LIC works with clients to ensure their Term Life Insurance Plans reflect their wishes, whether it’s supporting children, a spouse, or other loved ones. The clear beneficiary designation helps families receive the financial support intended for them.

No, Term Life Insurance payouts are typically unrestricted, allowing your family to use the funds for any expenses. Canadian LIC has seen families use these benefits for mortgages, daily living expenses, education costs, or even building savings. This flexibility makes Term Life Insurance an effective safety net for families.

Yes, your Term Life Insurance plan stays with you regardless of employment changes since it’s an independent policy. Canadian LIC often assists clients who need stability in their coverage, and an individual Term Life Insurance plan offers this continuity. You’ll maintain protection without needing to worry about work-related changes affecting your policy.

It’s wise to review your Term Life Insurance plan whenever you experience major life changes, such as marriage, the birth of a child, or buying a home. Canadian LIC encourages clients to check their coverage to ensure it matches their current needs. This regular review can confirm that the plan’s protection is sufficient for your family’s financial situation.

Yes, Term Life Insurance offers added protection beyond savings, which may not be enough to support long-term needs if you pass away. Canadian LIC often helps clients who want to ensure their family’s financial security without depleting their personal savings. Term Life Insurance is a reliable addition to any financial plan, complementing existing savings.

Once you have a Term Life Insurance plan, premiums usually remain fixed, even if your health improves. Canadian LIC sees this as a benefit since clients can secure affordable coverage without worrying about future rate increases due to health changes. Fixed premiums provide predictable costs, which can be helpful for long-term budgeting.

Canadian LIC works with multiple insurers to provide Term Life Insurance Quotes tailored to your unique needs. They consider factors like term length, coverage amount, and budget, helping clients find the most competitive options. This process ensures that clients receive value and coverage that aligns with their financial priorities.

Yes, Term Life Insurance is available to smokers, though premiums may be higher due to health risks associated with smoking. Canadian LIC assists smokers in finding Term Life Insurance Plans with favourable rates, helping them access coverage that fits their budget. Whether or not you smoke, Canadian LIC strives to provide coverage options that work for everyone.

Term Life Insurance can play a key role in estate planning, offering funds that may cover debts, taxes, and other final expenses. Canadian LIC clients often use Term Life Insurance Plans to ensure unforeseen costs don’t diminish their family’s inheritance. By including life insurance in estate planning, clients feel confident that their family’s future is secure.

These FAQs enlighten some practical aspects of Term Life Insurance, hence making things more clear for you on how Term Life Insurance Plans and quotes will fit your family’s needs. Feel free to approach Canadian LIC for other questions and concerns you might have when finding the right kind of protection for your family.

Sources and Further Reading

- Government of Canada – Life Insurance Basics

An overview of life insurance types, including Term Life Insurance, to help Canadians make informed decisions.

Life Insurance Basics – Government of Canada - Canadian Life and Health Insurance Association (CLHIA)

Offers insights on the importance of life insurance and industry standards in Canada.

CLHIA – Life Insurance Information - Insurance Bureau of Canada (IBC) – Term Life Insurance Overview

Provides detailed information about Term Life Insurance, its benefits, and how it works for Canadian families.

IBC – Term Life Insurance - Canadian LIC – Term Life Insurance Insights

Canadian LIC’s guide on Term Life Insurance, covering real-life client scenarios and key coverage tips.

Canadian LIC – Term Life Insurance - Financial Consumer Agency of Canada – Choosing the Right Insurance

A resource to compare different types of life insurance and assess which best suits your needs.

FCAC – Choosing Life Insurance

These sources offer further details on Term Life Insurance Plans, Term Life Insurance Importance, and obtaining the best Term Life Insurance Quotes in Canada.

Key Takeaways

- Term Life Insurance Importance: Term Life Insurance provides essential financial protection, especially during key life stages, ensuring that your family’s needs are met if you’re no longer there to support them.

- Affordability and Flexibility: Compared to other types of life insurance, Term Life Insurance offers affordable premiums, making it accessible to families seeking high coverage at a lower cost.

- Customizable Coverage: With Term Life Insurance Plans, you can choose your term length and coverage amount to align with specific financial responsibilities, like a mortgage or children’s education.

- Tax-Free Death Benefit: The death benefit from Term Life Insurance is tax-free, allowing your loved ones to use the entire payout for critical expenses.

- Quick and Direct Payout: Term Life Insurance provides prompt payouts, helping families cover immediate needs, including funeral expenses, debts, and daily living costs.

- No Cash Value: Unlike permanent life insurance, Term Life Insurance does not build cash value, making it ideal for those seeking straightforward protection rather than an investment.

- Renewal and Conversion Options: Many Term Life Insurance policies offer renewal or conversion to permanent coverage, providing flexibility as your financial needs change over time.

Your Feedback Is Very Important To Us

Financial Priorities and Concerns

This questionnaire will help Canadian LIC identify the most common struggles Canadians face regarding Term Life Insurance, allowing them to provide clearer, more supportive guidance and resources. Thank you for your feedback!

IN THIS ARTICLE

- What Are the Benefits of Term Insurance for Death?

- Why Term Life Insurance Matters: Safeguarding Your Loved Ones

- Key Benefits of Term Life Insurance for Death Protection

- Choosing the Right Term Life Insurance Policy

- Tax-Free Death Benefits: A Practical Advantage for Canadian Families

- Quick Payouts for Immediate Financial Needs

- Supporting Long-Term Financial Goals

- Accessible Protection for Families and Individuals

- A Decision for Long-Term Security with Canadian LIC

- More on Term Life Insurance