- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I Name Multiple Beneficiaries for My Whole Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- Can I Adjust My Whole Life Insurance Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Main Disadvantage of Term Life Insurance?

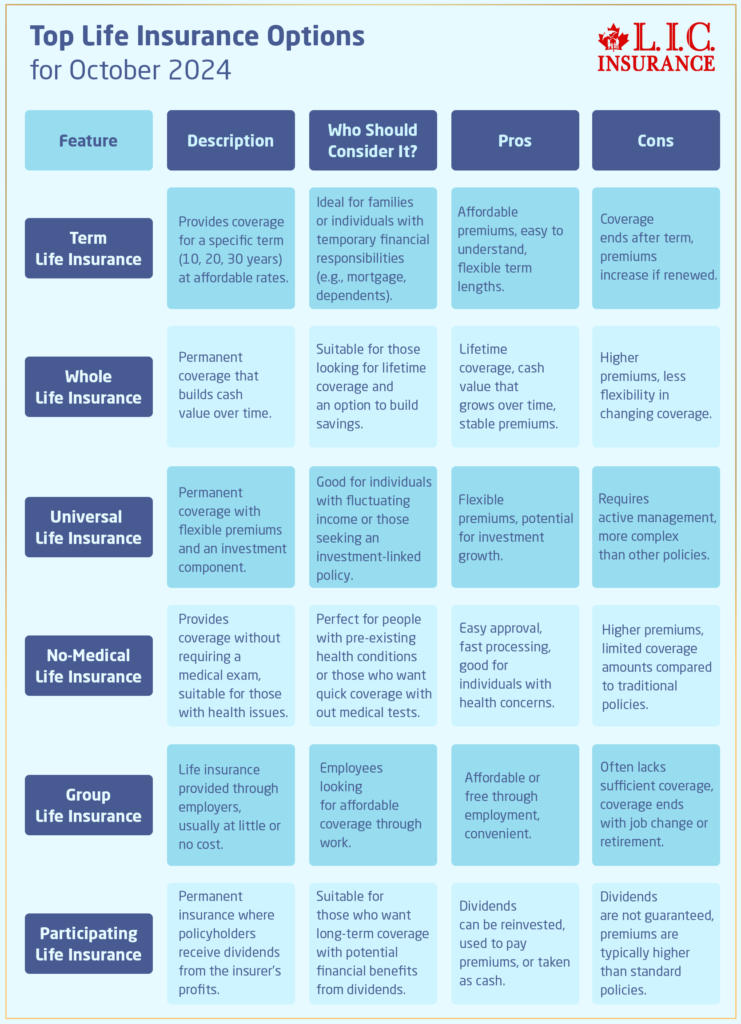

Top Life Insurance Options for October 2024

SUMMARY

The blog explores top life insurance options in Canada for October 2024, including term, whole, universal, no-medical, group, and participating policies. It breaks down the benefits, costs, and coverage of each plan, offering insights for families, individuals, and retirees. Real-life stories from Canadian LIC showcase how tailored advice helps balance life insurance costs and coverage for various needs.

- 11 min read

- September 13th, 2024

By Harpreet Puri

CEO & Founder

- 11 min read

- September 26th, 2024

Introduction

Life Insurance tends to overwhelm many Canadians, from trying to determine the correct coverage to balancing that out by weighing the cost. You have so many options and policies, and you fear making the wrong choice, which makes it impossible to make a decision. To compound that by attempting to understand how Life Insurance Cost & Coverage vary between providers is enough to confuse anybody.

Take this story from Canadian LIC’s experience: A newly married couple, expecting their first baby, wanted to secure Life Insurance for their future. They approached us disappointed, confused, and frustrated by the fact they had spent hours going through web pages comparing Life Insurance Quotes on these websites and receiving conflicting advice. After speaking to one of our agents, he realized that it is not them alone but many more going through the same stress. This is what we see every day.

But it doesn’t have to be so tough. The good news is that October 2024 brings with it a variety of Life Insurance options in Canada that are not only designed to fit different lifestyles but also offer flexible Life Insurance Cost & Coverage choices. Be it a new parent, a busy professional, or a soon-to-be retiree, there’s a plan for you.

We’ll look at some of the key Life Insurance products currently available in Canada, share stories from the field, and break down the key factors that you will need to consider in deciding which policy best suits your individual circumstances. Let’s dive in.

Term Life Insurance – Affordable, Flexible, and Ideal for Families

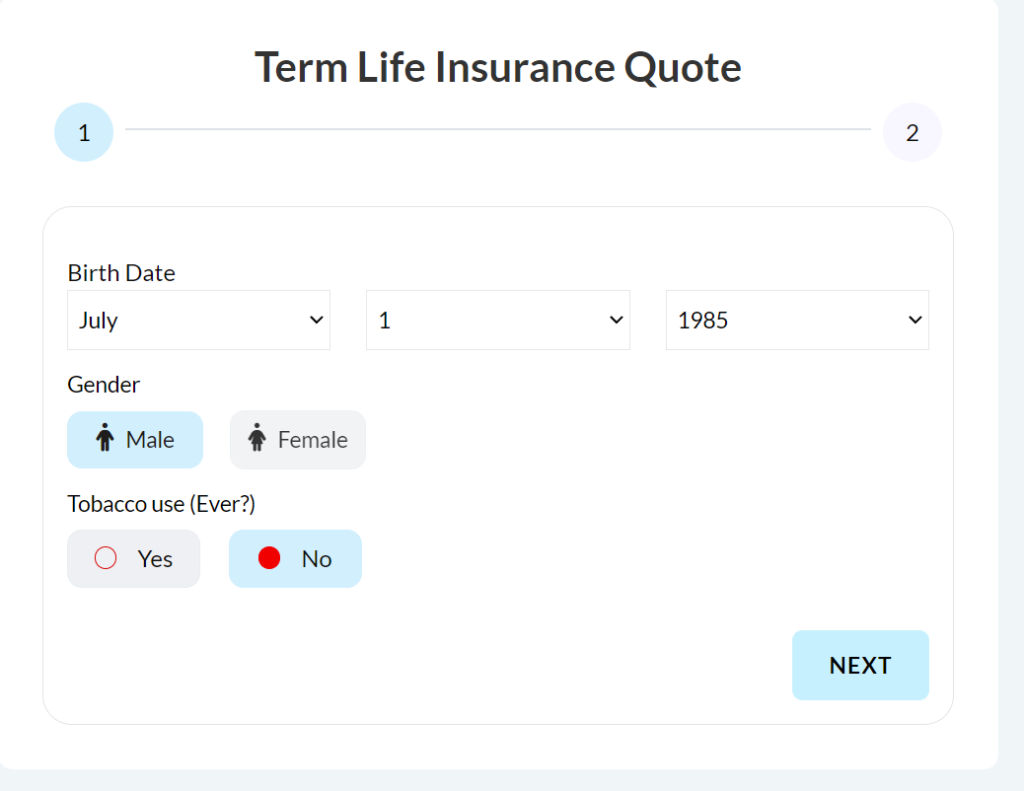

Term Life Insurance is the most outstanding and popular choice for Canadians in 2024. It is coverage over a particular period, usually 10, 20, 30, or 50 years, which can also be considered very cheap compared to others for a family or individual requiring coverage at specific stages of their lives.

- Affordability: To start with, one of the most significant reasons people purchase Term Life Insurance is because of its relatively affordable price. There is only a payment for the years when you will need coverage, which is probably why it is best suited for young families or first-time homeowners. For example, a Toronto family went to the Canadian LIC, describing how they were literally trying to choose between the mortgage of their home and raising the living costs. By choosing a 20-year term life policy, they could secure sufficient coverage for their young children and mortgage, all while keeping Life Insurance costs manageable.

- Flexibility: With Term Life Insurance, you can choose the length of coverage that aligns with your life goals, such as until your children are grown or until your mortgage is paid off.

However, when the term period is over, the policy lapses unless renewed, which is usually accompanied by increased premiums as a result of age and health issues.

Whole Life Insurance – Lifetime Protection with Cash Value

Whole life is another very popular option: it gives insurance for life, for however long you live, assuming you pay enough premiums. There is a cash value component to such a policy, where money is put away and saved, earning interest over time.

Why choose Whole Life Insurance?

- Guaranteed Coverage: Unlike Term Insurance, Whole Life Insurance Policies offer lifetime coverage. We once had a client – a retired couple – at Canadian LIC for whom the retirement plan required that their children be secure for a long time after they passed. Whole Life Insurance suited the couple quite perfectly because it ensured financial security without any worry about having to renew policies later in old age.

- Cash Value: This cash value accrues with time and can be accessed even when you are still alive. We once had a client in Vancouver who, after contributing to their policy for 20 years, made use of some of this cash value to pay for her child’s education. This is very versatile because it does more than give a death benefit.

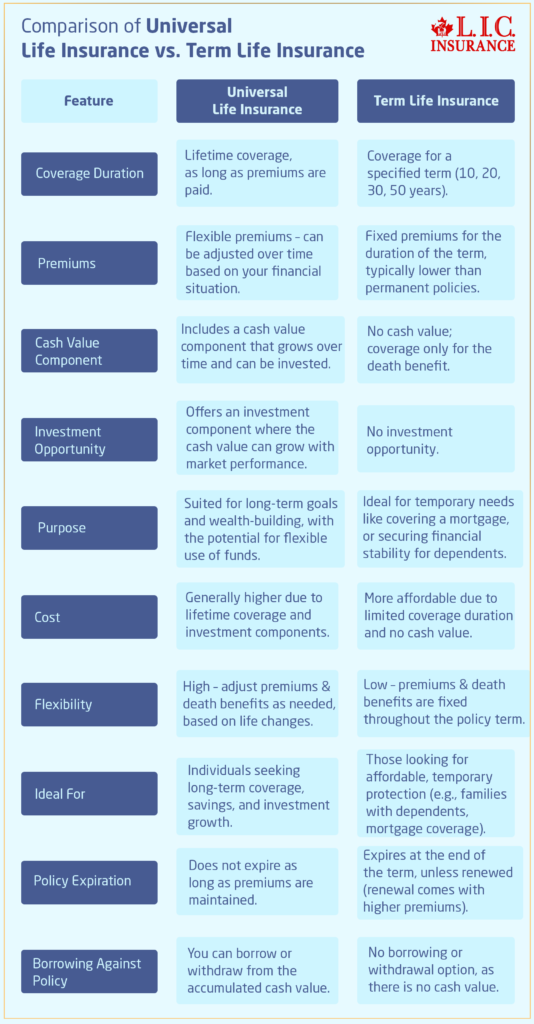

Universal Life Insurance – A Flexible Option for Long-Term Savers

Universal Life Insurance takes Whole Life Insurance one step forward. It allows policyholders to change their premiums and coverage amount as time progresses. Moreover, there is also an accumulation of a cash value component that can be invested.

Key benefits of Universal Life Insurance:

- Premium Flexibility: What this policy gives is the flexibility to pay premiums subject to fluctuation of finances. A Canadian LIC client who was self-employed found Universal Life Insurance policies to be the perfect match for his fluctuating income. He could pay higher premiums when his business was booming and lower premiums during slower periods.

- Investment Opportunities: With Universal Life, you have the ability to invest the cash value portion, allowing for potential growth. This approach makes it popular with people seeking a source of insurance that complements a more financially long-term savings package.

While Universal Life Insurance offers flexibility and growth potential, it also requires careful planning and financial knowledge to make the most of the investment options available.

Comparison of Universal Life Insurance vs. Term Life Insurance

No Medical Life Insurance – Quick and Hassle-Free

No Medical Life Insurance is a good option for any person who may be suffering from health problems or who doesn’t want to undergo a medical check to qualify for this coverage. It’s an alternative for people who otherwise will find difficulty in acquiring traditional Life Insurance.

- Accessibility: This type of policy is ideal for people who may have been denied traditional Life Insurance due to pre-existing health conditions. Canadian LIC has worked with many clients who, after being turned down by other insurers, found the peace of mind they needed through No Medical Life Insurance.

- Speed: The application process is fast and straightforward, which means you can often get coverage in as little as a few days. For someone looking for immediate protection, this is an excellent choice.

Group Life Insurance – Employer-Sponsored Security

Many Canadians receive Life Insurance through their employer, known as Group Life Insurance. While this is a great benefit, it’s important to understand its limitations.

- Cost-Efficiency: Group Life Insurance is generally provided either at no direct charge or at reduced cost to employees, which makes this type of insurance very easy to obtain for a workforce. However, group coverage is not suitable for those who have dependents or who have large liabilities against which they need security cover.

- Portability Issues: We generally hear that one of the biggest challenges clients have with Group Life Insurance at Canadian LIC is the lack of portability. Coverage usually ends with changes in jobs or leaving the workforce altogether. For example, a client who left her job during the pandemic was shocked to discover that she no longer had any Life Insurance. Thankfully, we were able to help her secure an affordable personal policy.

Participating Life Insurance – Sharing in the Profits

Participating Life Insurance allows policyholders to receive dividends from the insurer’s profits. These dividends can be reinvested into the policy, used to pay premiums, or taken as cash.

Why consider this option?

- Dividends: Over time, participating Life Insurance can provide extra value through dividend payments. For example, one of our clients at Canadian LIC used their dividends to pay down a portion of their premiums, helping to lower their overall Life Insurance cost.

- Long-Term Growth: The potential for dividends makes participating Life Insurance an attractive option for those looking for a policy that offers both security and growth.

While Participating Life Insurance can be rewarding, it’s important to remember that dividends are not guaranteed and will depend on the insurer’s financial performance.

Making the Right Choice for You

Choosing the right Life Insurance option is a deeply personal decision and depends on your unique financial situation, health status, and long-term goals. At Canadian LIC, we’ve seen clients of all backgrounds struggle with balancing Life Insurance costs & coverage, and we’ve helped them find the perfect solution that offers both protection and peace of mind.

Whether you are looking for a low-cost quote on Term Life Insurance or perhaps a way to invest for long-term wealth in whole or Universal Life Insurance, October 2024 is the perfect time to review your options and plan to ensure that you and your family have the best possible future.

Top Life Insurance Options for October 2024

Conclusion: Choosing the Best Life Insurance Option with Canadian LIC

It can get rather overwhelming to choose the right Life Insurance, but it doesn’t have to be when you get the right guidance. Canadian LIC has been guiding Canadians through choices regarding their Life Insurance for many years and knows just how to match the needs of clients with the perfect policy and the right balance of cost and coverage. Now is the time to find out which of the available Life Insurance policies suits you best and get the right Life Insurance Quote that works for you. Your financial future and that of your family deserve protection from nothing but the best.

Talk to one of our experienced financial advisors at Canadian LIC today.

More on Life Insurance

- Can I Name Multiple Beneficiaries for My Whole Life Insurance Policy?

- What is Guaranteed Life Insurance for Seniors?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- What Happens If My Life Insurance Provider Goes Bankrupt?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- How Can You Use Whole Life Insurance to Create Wealth?

- Should Both Husband and Wife Get Term Life Insurance?

- What Happens If I Take a Loan from My Whole Life Insurance Policy?

- How Do I Become a Life Insurance Agent in Canada?

- What Are Paid-Up Additions in Whole Life Insurance?

- 5 Steps to Ensure Your Life Insurance Application is Approved

- What Is Underwriting in Term Life Insurance?

- Are There Any Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- Can I Adjust My Whole Life Insurance Policy?

- Is Mortgage Protection Insurance Better Than Life Insurance?

- What Does Term Life Insurance Cover and Not Cover?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- At What Age Should You Stop Buying Term Life Insurance?

- What Age Does Whole Life Insurance End?

- What are the advantages of Short-Term Life Insurance?

- What Are the 2 Disadvantages of Whole Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- At What Age Is Whole Life Insurance Good?

- What Is the Main Disadvantage of Term Life Insurance?

- Can I Buy Whole Life Insurance for My Child?

- Who Should Opt for Whole Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Which Life Insurance Is Most Popular?

- How to Buy a Million Dollar Life Insurance Policy?

- How Do You Choose Term Insurance?

- What Is the Best Age to Buy Universal Life Insurance?

- Is Whole Life Insurance Expensive?

- Can I Leave My Life Insurance to My Child?

- Can I Get a Million Dollar Life Insurance Policy Without a Medical Exam?

- Are There Any Tax Benefits for Life Insurance?

- Understanding How Does a Whole Life Insurance Policy Work: A Comprehensive Guide

- Why Buy Life Insurance for Kids?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- Is Term Insurance Better Than a Money Back Policy?

- How Long Do You Pay Premiums for Universal Life Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Is Life Insurance Worth It After 70?

- What Is the Best Age to Buy Life Insurance?

- What Is the Biggest Risk for Whole Life Insurance?

- What Is True About Permanent Life Insurance?

- What Are the Two Main Charges Deducted Monthly from a Universal Life Insurance Policy?

- Do I Get Money Back from Term Life Insurance?

- What Are the Benefits of Universal Life Insurance in Canada?

- How is a Million Dollar Life Insurance Policy Paid Out?

- Can You Cash Out a Term Life Insurance Policy?

- Is Life Insurance a Good Investment in Canada?

- 10 Best Life Insurance Plans for 2024

- Is it Possible to have a Million Dollar Life Insurance Policy?

- What are the Biggest Life Insurance Companies in Canada?

Frequently Asked Questions (FAQs) about The Best Life Insurance Policy Options for October 2024

Choosing the right Life Insurance depends on your financial goals, family needs, and the stage of life you’re in. Many clients we work with at Canadian LIC are unsure whether they need term or Whole Life Insurance. Our experienced agents help by asking questions about your financial responsibilities, such as a mortgage or dependents, and we guide you to the right option based on your budget and future plans. You can also request a Life Insurance Quote to compare Life Insurance Cost & Coverage and see what fits best for your situation.

Yes, Term Life Insurance is generally more affordable because it covers you for a specific period, such as 10, 20, or 30 years. At Canadian LIC, we’ve seen many young families who choose term life because it provides the coverage they need while keeping costs low. A Life Insurance Quote for term life will typically show lower premiums compared to Whole Life Insurance, which covers you for your entire lifetime and includes a cash value component.

When the term ends, your coverage expires unless you renew or convert it to a permanent policy. Many clients at Canadian LIC worry about what happens after the term ends. For instance, a client in her 40s with a 20-year term policy was concerned about higher premiums if she renewed. We helped her explore conversion options to whole life, allowing her to maintain coverage at a reasonable Life Insurance Cost & Coverage

Whole Life Insurance provides coverage for your entire life and builds cash value over time. Many clients use the cash value for different financial goals, like funding their children’s education or supplementing retirement income. One of our clients at Canadian LIC used their policy’s cash value to help with a business investment. When you get a Life Insurance Quote for Whole Life Insurance, it will typically show higher premiums due to its lifetime coverage and savings feature.

Yes, Universal Life Insurance allows you to adjust your premiums and coverage over time. One of our clients at Canadian LIC, who was self-employed, found Universal Life Insurance perfect for managing his fluctuating income. He paid higher premiums during busy months and lower during slower periods. This flexibility makes universal life attractive for people with changing financial circumstances.

Yes, No Medical Life Insurance is available for those with health issues or who prefer not to undergo a medical exam. We’ve helped many clients who were turned down for traditional Life Insurance because of pre-existing conditions. With No Medical Life Insurance, you can still get coverage, but it’s important to note that the Life Insurance Cost & Coverage may be different, and premiums are often higher. Canadian LIC helps clients find the best No Medical Life Insurance option that fits their needs.

Group Life Insurance is a great benefit, but it may not provide enough coverage for your needs. We’ve had clients at Canadian LIC who lost their group coverage when they changed jobs. It’s often a good idea to supplement Group Life Insurance with an individual policy to ensure your family has adequate protection. A personal Life Insurance Quote will help you compare Life Insurance Cost & Coverage with your existing group plan.

Participating Life Insurance policies allows you to share in the Life Insurance company’s profits through dividends. These dividends can be used to reduce your premiums or increase your coverage. One of our clients used dividends to help pay down their premium, making it easier to manage their policy over time. While dividends aren’t guaranteed, many clients find participating policies valuable for the long-term potential of added benefits.

Yes, a No Medical Life Insurance plan is an option if you want to skip the medical exam. Many clients come to Canadian LIC after being turned away by other insurers due to health issues. We help them secure No Medical Life Insurance, which can provide the protection they need without the hassle of medical tests. However, keep in mind that a Life Insurance Quote for no-medical policies will often show higher premiums.

Comparing Life Insurance Cost & Coverage is key to finding the right plan. We always recommend our clients at Canadian LIC get a few Life Insurance Quotes to compare premiums, coverage amounts, and additional benefits like cash value or flexibility. Our agents help by explaining the differences between policies and showing how each option fits your unique situation.

Yes, with whole life and Universal Life Insurance, you can access the cash value built up in your policy. One client at Canadian LIC used their cash value to help with their child’s education. While it’s great to have this option, it’s important to understand that accessing the cash value can reduce your death benefit. Make sure to review your Life Insurance Cost & Coverage carefully with an advisor to see how this will affect your policy.

Several factors affect your Life Insurance cost, including your age, health, and the type of policy. At Canadian LIC, we help clients by offering tips like opting for Term Life Insurance, adjusting coverage amounts, or considering higher deductibles. A personalized Life Insurance Quote can help you see where you might be able to reduce costs without sacrificing important coverage.

Yes, in many cases, you can change your Life Insurance coverage after buying Life Insurance Policy. We’ve helped clients at Canadian LIC who needed to adjust their coverage as their life circumstances changed, such as getting married or having children. Whether you want to increase or decrease the coverage, it’s important to speak with your Life Insurance provider to understand how this will impact your Life Insurance Cost & Coverage.

You can easily get a Life Insurance Quote online or by speaking with a licensed insurance broker like those at Canadian LIC. A Life Insurance Quote will show you different options, including premiums and coverage amounts, allowing you to compare policies and choose one that fits your budget. Our clients often find it helpful to compare several quotes before making a decision.

Several factors can impact your Life Insurance cost, including your age, health, lifestyle, and the type of policy you choose. For example, at Canadian LIC, we had a young client in good health who received a lower premium on a Term Life Insurance Policy, while an older client with health issues paid a higher premium. The Life Insurance Quote you receive will reflect these factors, so it’s important to provide accurate information when applying.

Yes, you can have more than one Life Insurance Policy. In fact, some clients at Canadian LIC choose to combine different Life Insurance types of policies to ensure comprehensive coverage. For instance, one client took out both a Term Life Insurance Policy and a Whole Life Insurance Policy to cover immediate needs and long-term financial goals. Just remember, each policy will have its own Life Insurance Cost & Coverage.

Yes, health conditions can affect your Life Insurance cost. We’ve worked with clients at Canadian LIC who had pre-existing health conditions, and they were concerned about higher premiums. While it’s true that certain conditions can lead to increased Life Insurance costs, there are still options available. No Medical Life Insurance, for instance, can provide coverage without requiring a medical exam, although it usually comes with higher premiums.

The time it takes for a Life Insurance Policy to go into effect depends on the type of policy and the application process. At Canadian LIC, we’ve seen clients receive approval for No Medical Life Insurance within a few days, while traditional policies requiring a medical exam may take a few weeks. It’s important to ask about this timeline when getting your Life Insurance Quote, especially if you need coverage quickly.

If you miss a premium payment, most Life Insurance companies offer a grace period, usually around 30 days, to make the payment. If you don’t pay within that time, your policy may lapse. We’ve seen clients at Canadian LIC miss payments due to financial difficulties, and we always encourage them to contact their insurance provider as soon as possible to discuss options. Some policies even allow for premium flexibility if you’re struggling.

Yes, most Life Insurance policies cover you if you pass away while travelling abroad, but it’s always a good idea to check with your provider. One client at Canadian LIC had concerns about coverage while travelling for work. After reviewing her Life Insurance Cost & Coverage, we reassured her that her policy would still provide benefits to her family, regardless of her location.

Age is a major factor in determining your Life Insurance premium. Younger clients typically pay lower premiums because they’re considered less of a risk. For example, a 25-year-old client at Canadian LIC secured a low-cost term life policy, while a 55-year-old client faced higher premiums for similar coverage. It’s best to get a Life Insurance Quote early to lock in lower rates.

Yes, you can cancel your Life Insurance Policy at any time. However, depending on the type of policy, you may lose the coverage and any cash value built up over time. One of our clients at Canadian LIC decided to cancel their Whole Life Insurance Policy after their mortgage was paid off, but we made sure they understood the financial implications before moving forward.

For Term Life Insurance, premiums are usually fixed for the length of the term, so they won’t increase as you age during that period. However, if you renew your term life policy after it expires, the new premium will likely be higher because of your age. For whole or Universal Life Insurance, premiums may be fixed or flexible, depending on the policy. At Canadian LIC, we help clients understand how aging impacts Life Insurance Cost & Coverage and guide them through renewing or converting policies.

Smoking can significantly increase your Life Insurance cost. At Canadian LIC, we’ve had clients who smoke receive higher premiums due to the health risks associated with smoking. However, if you quit smoking for a period of time, usually 12 months or more, some Life Insurance companies may lower your premiums. It’s worth asking about this when getting a Life Insurance Quote.

This FAQ section should clarify and better understand Life Insurance options. Canadian LIC’s experience with clients who have this kind of question establishes that you are not alone in considering the little complexities of Life Insurance. Whether you are just starting to explore Life Insurance or looking to update your policy, knowing your options can be the difference in getting the right protection for your family and future.

Sources and Further Reading

- Government of Canada – Life Insurance Overview

The Government of Canada’s website provides comprehensive details about Life Insurance options, including the differences between term and permanent Life Insurance, and how to choose the right coverage.

Government of Canada – Life Insurance - Insurance Bureau of Canada (IBC)

The IBC offers valuable resources on Life Insurance, helping you understand the key elements of Life Insurance Cost & Coverage in Canada.

Insurance Bureau of Canada - Canadian Life and Health Insurance Association (CLHIA)

CLHIA provides in-depth information on various Life Insurance products, including participating Life Insurance and Universal Life Insurance. Their guides help you compare options and find the best Life Insurance Quote.

Canadian Life and Health Insurance Association - Financial Consumer Agency of Canada (FCAC)

FCAC’s website includes tips on choosing the right Life Insurance Policy, understanding premiums, and calculating how much coverage you need.

Financial Consumer Agency of Canada

These sources offer detailed guidance on Life Insurance options in Canada, allowing you to make more informed decisions.

Key Takeaways

- Variety of Life Insurance Options: In October 2024, Canadians can choose from a range of Life Insurance options, including term, whole, universal, no-medical, group, and participating Life Insurance, each offering unique benefits based on individual needs.

- Term Life Insurance: Ideal for those seeking affordable, short-term coverage, Term Life Insurance is best for families or individuals with temporary financial obligations like a mortgage.

- Whole Life Insurance: Offers lifetime coverage with a cash value component, making it a good option for long-term financial security and wealth-building.

- Universal Life Insurance: Provides flexibility in premiums and the ability to invest the cash value, making it suitable for those with changing financial situations.

- No Medical Life Insurance: This option is accessible for people with health issues or those who want to avoid medical exams, although it usually comes with higher premiums.

- Group Life Insurance: Offered through employers, Group Life Insurance can be a good starting point but may need to be supplemented with an individual policy for sufficient coverage.

- Participating Life Insurance: Allows policyholders to receive dividends from the insurer’s profits, providing potential long-term financial benefits.

- Life Insurance Cost & Coverage: Factors such as age, health, lifestyle, and policy type influence Life Insurance cost and coverage. Getting a Life Insurance Quote can help compare options.

- Importance of Flexibility: Universal life and Whole Life Policies offer more flexibility in adjusting premiums and accessing cash value, making them more versatile options.

- Seek Professional Advice: Speaking with an experienced insurance broker, like those at Canadian LIC, can help navigate Life Insurance options and find a policy that fits both your budget and long-term goals.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We value your feedback and want to understand your experience in choosing the best Life Insurance option. Please take a few moments to answer the following questions to help us better serve Canadians like you.

Thank you for taking the time to share your feedback! Your responses will help us understand the struggles Canadians face when choosing Life Insurance and how we can make the process easier.

IN THIS ARTICLE

- Top Life Insurance Options for October 2024

- Term Life Insurance – Affordable, Flexible, and Ideal for Families

- Whole Life Insurance – Lifetime Protection with Cash Value

- Universal Life Insurance – A Flexible Option for Long-Term Savers

- Comparison of Universal Life Insurance vs. Term Life Insurance

- No Medical Life Insurance – Quick and Hassle-Free

- Group Life Insurance – Employer-Sponsored Security

- Participating Life Insurance – Sharing in the Profits

- Making the Right Choice for You

- Conclusion: Choosing the Best Life Insurance Option with Canadian LIC