- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- The Evolution Of Term Life Insurance: Past, Present, And Future

- The Origins of Term Life Insurance

- Key Milestones in Term Life Insurance Evolution

- Current State of Term Life Insurance in Canada

- The Emerging Trends and Future Predictions

- How Canadian LIC Inc. Adapts to Industry Changes

- Final Thoughts

- More on Term Life Insurance

The Evolution Of Term Life Insurance: Past, Present, And Future

By Harpreet Puri

CEO & Founder

- 11 min read

- January 17th, 2025

SUMMARY

The blog looks into the evolution of Term Life Insurance in Canada, its beginning through modern times, and future trends. Important milestones include, the affordability and flexibility that current policies enjoy and emergent innovations in AI and blockchain. Agents play a crucial role in Term Life Insurance, but online quotes help make everything as convenient as possible. How the Canadian LIC keeps wup ith the times regarding industry changes, with tailored solutions designed to address client needs.

Introduction

Selecting the appropriate insurance often proves to be a difficult task for individuals as it often appears that the industry changes constantly. In this regard, most Canadians have used knowledge about the past, present, and future of Term Life Insurance as a tool for establishing financial confidence. From its initial basic safety net to being a strategic financial instrument, Term Life Insurance gives customized solutions to take care of evolving needs.

Over the years, clients at Canadian LIC have spoken about their difficulties with the conceptualization of Term Life Insurance to the changed policies and prices. These accounts show how vital it is to understand the history of Term Life Insurance and how it has evolved along with modern life. Let’s begin with its conception, important developments, its significance in Canada at present, and where it’s headed in the context of how Canadian LIC is ahead in offering solutions.

The Origins of Term Life Insurance

Term Life Insurance traces its roots back centuries and is primarily designed to stabilize the family’s finances. Term Life Insurance investments were relatively crude in the early days compared to today. The contracts were all handwritten and mainly focused on simplicity: a fixed sum of money paid upon the policyholder’s death within a specified term.

For many years, only a very few could afford Term Life Insurance, which was quite expensive and hard to get. It was bought mainly by merchants and aristocrats to protect estates or businesses. During those years, the cost of Term Life Insurance was so high that only a limited number of people could afford it.

It was a watershed moment. Now that life expectancy was increasing and the middle class was mushrooming, more people wanted available financial products. Insurance companies soon began to create simplified policies so that the masses of Canadians could look at Term Life Insurance as an affordable financial resource.

Key Milestones in Term Life Insurance Evolution

- Standardization of Policies: Term Life Insurance Policies were standardized in the late 19th and early 20th centuries. This led to the easier comparison of options and assessment of Term Life Insurance Quotes online. It also eliminated misunderstandings that arose from unclear or inconsistent terms.

- Technological Advances: By the mid-20th century, insurance companies could expand their frontiers through automation. Term life agents were no longer tethered to calculating premiums and payouts anymore. Instead, they could interact with their customers in a more dynamic way.

- Regulatory Oversight: As Term Life Insurance has become more popular, governments have brought regulations to safeguard consumers. This included measures to ensure transparency in Term Life Insurance pricing and proper practices by Term Life Insurance representatives.

- Introduction of Riders and Customization: During the late 20th century, riders included options such as Critical Illness or Disability Coverage. Now, Term Life Insurance can be customized as per the specific needs of clients.

- Digital Revolution: The Digital Revolution came along, revolutionizing the entire industry. All term life quotes became available through the internet and enabled easy online comparison shopping for clients. Estimates of coverage needs and cost for premiums were made available digitally at this time.

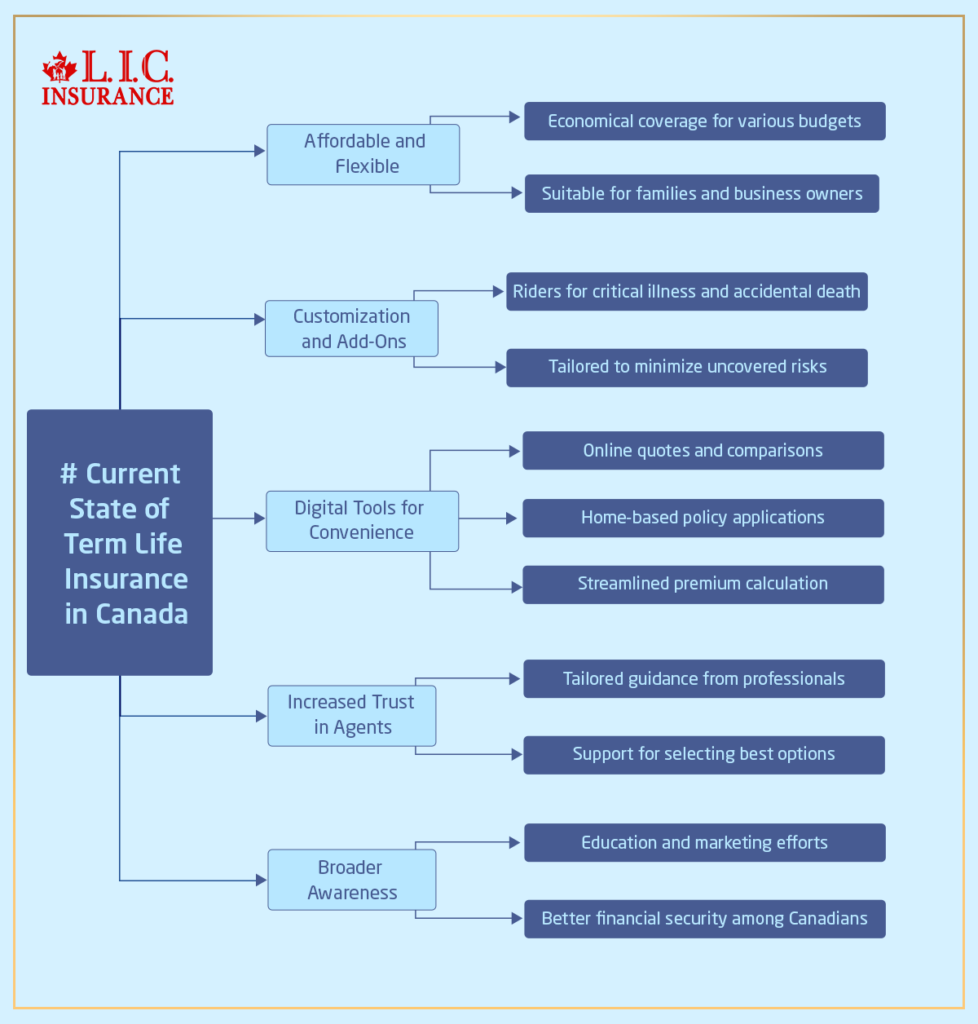

Current State of Term Life Insurance in Canada

Today, Term Life Insurance is as affordable as ever: Technology advancement and regulatory improvements have placed the product within everyone’s easy reach. Here are some key points to note about its current landscape:

Customization and Add-Ons

The new policies are highly flexible for customization. There are available riders for critical illness and accidental death. This ensures that no risk has been left uncovered with such investments.

Digital Tools for Convenience

Term Life Insurance Quotes can now be obtained on platforms. This avoids frequent visits to offices. With online facilities, Canadians can now compare policies, calculate premiums, and apply for coverage, all from a home-based location.

Increased Trust in Agents

Although a digital shift has occurred, agents still play an important role in life insurance. Agents offer tailored guidance and assist clients in selecting the best option based on their specific requirements.

Broader Awareness

Due to increased education and marketing, most Canadians are aware of the essence of life insurance. This has consequently made them more adaptive and led to a much better financially secure population.

The Emerging Trends and Future Predictions

AI-Driven Underwriting

Underwriting is the new revolution for AI (Artificial Intelligence) Algorithms are better at risk assessment, and approval is faster, along with customized Term Life Insurance investments.

Microinsurance for Short Terms

With the rise of gig economy workers, microinsurance is increasing. The short-term policies are very flexible for people with variable incomes.

Eco-Friendly Policies

Insurance providers are committed to achieving environmental sustainability objectives. Policies nowadays incorporate environmental factors into them; they offer discounts for eco-conscious behaviours.

Blockchain for Transparency

Blockchain technology aims to improve transparency, providing clients with secure and tamper-proof records of their Term Life Insurance Policies.

Greater Focus on Mental Health

Future riders may incorporate the mental health benefits as society’s priorities change. It would make Term Life Insurance holistic and well-being-related.

How Canadian LIC Inc. Adapts to Industry Changes

Canadian LIC stands out by being ahead of the curve and making sure clients take advantage of the latest Term Life Insurance developments. Here’s how:

Client-Centric Approach

Every client has a story to tell. Be it comparing Term Life Insurance Quotes online or talking directly to Term Life Insurance agents, Canadian LIC makes sure every client’s needs are unique.

Cutting-Edge Technology

Utilizing AI-based tools, the company provides prompt and precise assessments that guide customers in making decisions regarding the costs associated with Term Life Insurance.

Education and Transparency

Canadian LIC helps its clients through education. From simplifying complicated terms to explaining investment options, the team makes sure that all the client feels confident with their choice.

Commitment to Innovation

Integrating future trends such as blockchain and eco-friendly policies places Canadian LIC at the forefront of progressive solutions.

Exceptional Support

From policy selection to claims processing, Canadian LIC offers smooth support. Their commitment to addressing client needs reinforces their standing as Canada’s top insurance brokerage.

Final Thoughts

It can be said that Term Life Insurance has been with people from humble beginnings to dynamic futures. Canadian LIC is one of the guiding forces through which Canadians receive the best coverage according to their needs. Think of Term Life Insurance now. Don’t wait for a better opportunity. Contact Canadian LIC and protect your family’s future with confidence today.

More on Term Life Insurance

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs: The Evolution of Term Life Insurance in Canada

Term life covers the individual for a specified number of years, which could be 10, 20, 30 or even 50. The death benefit will be paid out within the given time if the insured dies. Most customers select these policies because of their ease and simplicity of management, especially for families that require protection for their financial safety.

The amount depends on the age, health, and coverage term. For example, the more young and healthy the person, the more eligible they are to have cheaper premiums. Canadian LIC helps clients by providing them with multiple options to get them the best value for their budget.

Term Life Insurance investments safeguard your family’s financial future. They take care of any mortgage, education, or day-to-day costs in case anything happens to you. Canadian LIC has many customers who feel comfortable knowing their families are covered.

Yes, you can buy Term Life Insurance Online to compare policies and costs from other providers easily. A significant number of Canadian LIC clients like this as it saves their time and allows for transparency.

Agents guide you through the process and help you choose the right policy based on your needs. At Canadian LIC, agents share stories of how clients who felt overwhelmed initially gain clarity with expert advice.

Most Term Life Policies have renewal and have conversion options. Renewal simply extends coverage for a period but may increase your premium. Conversion allows you to convert to Permanent Coverage without any medical exam. Canadian LIC agents very often help clients explore these options to fit changed life circumstances.

Term Life Insurance coverage is for a certain period of time, while Permanent Life Insurance is acquired for a lifetime. Term policies are less expensive and, therefore, more useful for the short-term. Canadian LIC will often suggest term policies to clients mainly for immediate financial obligations, such as raising children or paying off a mortgage.

In most scenarios, death benefits are tax-free from Term Life Insurance in Canada. Such a feature does not add much burden to a family’s economic stability. Clients, in most cases, find such features important and a good consideration in long-term financial planning.

And suppose your life policy becomes better by Critical Illness or Disability Cover. At Canadian LIC, agents work closely with clients to ensure their coverage matches their unique needs.

Term Life Insurance has undergone tremendous changes, and digital tools are now providing instant quotes online and simplified applications. Canadian LIC is ahead of the curve by embracing these changes to ensure that clients get modern solutions that suit their lifestyles.

Have in mind financial goals, budget, and the length of coverage you want. Canadian LIC agents help their clients determine their needs and match them with the best available options.

Comparing quotes online helps you get cheap options while understanding what difference one policy holds for another. Many Canadian LIC clients often appreciate the ability to make informed decisions after reviewing multiple choices.

These FAQs are crafted to answer many common questions in simple language to enable clients to make informed decisions regarding their Term Life Insurance. For more queries, feel free to contact our LIC agents from Canada anytime.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

A trusted source for understanding life insurance trends, regulations, and industry updates in Canada.

Government of Canada \u2013 Financial Consumer Agency of Canada (FCAC)

https://www.canada.ca

Provides detailed guides and resources for understanding Term Life Insurance Policies and costs.

Insurance Bureau of Canada (IBC)

https://www.ibc.ca

Offers insights into the Canadian insurance industry, including Term Life Insurance investments and innovations.

Insurance Business Canada

https://www.insurancebusinessmag.com/ca/

Features articles and reports on emerging trends in life insurance and the role of agents in the digital era.

Globe and Mail Personal Finance Section

https://www.theglobeandmail.com

Includes articles on the cost of Term Life Insurance, policy comparisons, and financial planning insights.

Canadian Underwriter

https://www.canadianunderwriter.ca

Covers updates on Term Life Insurance Policies, industry innovations, and expert opinions.

Key Takeaways

- Rich History of Term Life Insurance:

Term Life Insurance has evolved from a basic safety net to a flexible financial tool accessible to more Canadians. - Affordable Coverage:

Modern Term Life Insurance Policies offer affordable options for families, individuals, and businesses, with customizable features to suit diverse needs. - Role of Technology:

Online platforms simplify policy comparison, providing instant Term Life Insurance Quotes and easy access to tailored solutions. - Personalized Guidance:

Term Life Insurance agents play a crucial role in helping clients understand policies, costs, and investment opportunities for informed decisions. - Future Innovations:

Emerging trends like AI-driven underwriting, microinsurance, and blockchain technology promise greater transparency and accessibility. - Canadian LICs Leadership:

Canadian LIC remains at the forefront, leveraging advancements and offering tailored solutions that align with clients’ evolving needs. - Focus on Financial Security:

Term Life Insurance ensures financial protection for families, covering essential expenses and future goals during uncertain times.

Your Feedback Is Very Important To Us

Thank you for participating in this questionnaire! Your input will help us understand your experiences and challenges related to Term Life Insurance.

Thank you for your time and valuable feedback! We will use your responses to improve our services and provide better solutions tailored to your needs.

IN THIS ARTICLE

- The Evolution Of Term Life Insurance: Past, Present, And Future

- The Origins of Term Life Insurance

- Key Milestones in Term Life Insurance Evolution

- Current State of Term Life Insurance in Canada

- The Emerging Trends and Future Predictions

- How Canadian LIC Inc. Adapts to Industry Changes

- Final Thoughts

- More on Term Life Insurance