When a woman is in her 50s, her life often changes completely. Imagine that Maria had just turned 50. All of a sudden, she had to balance her work and take care of her parents, who were getting old. Susan, who has been married for a lifetime, is forced to confront the intimidating financial world when her spouse leaves her. These stories are not just made up; they are the truths that many women face as they get close to what should be the peak of their financial power. This decade, pivotal for shaping retirement, brings unique financial challenges and opportunities. For Maria and Susan, and maybe for you, being able to appreciate what is happening now and where these changes come into play is important. In this blog, we will examine common financial dilemmas for women in their 50s, including investing and insurance, as well as provide you with our proven approach to turning these challenges into opportunities to create financial freedom. Are you ready to get your finances in order? Let’s start to understand this better.

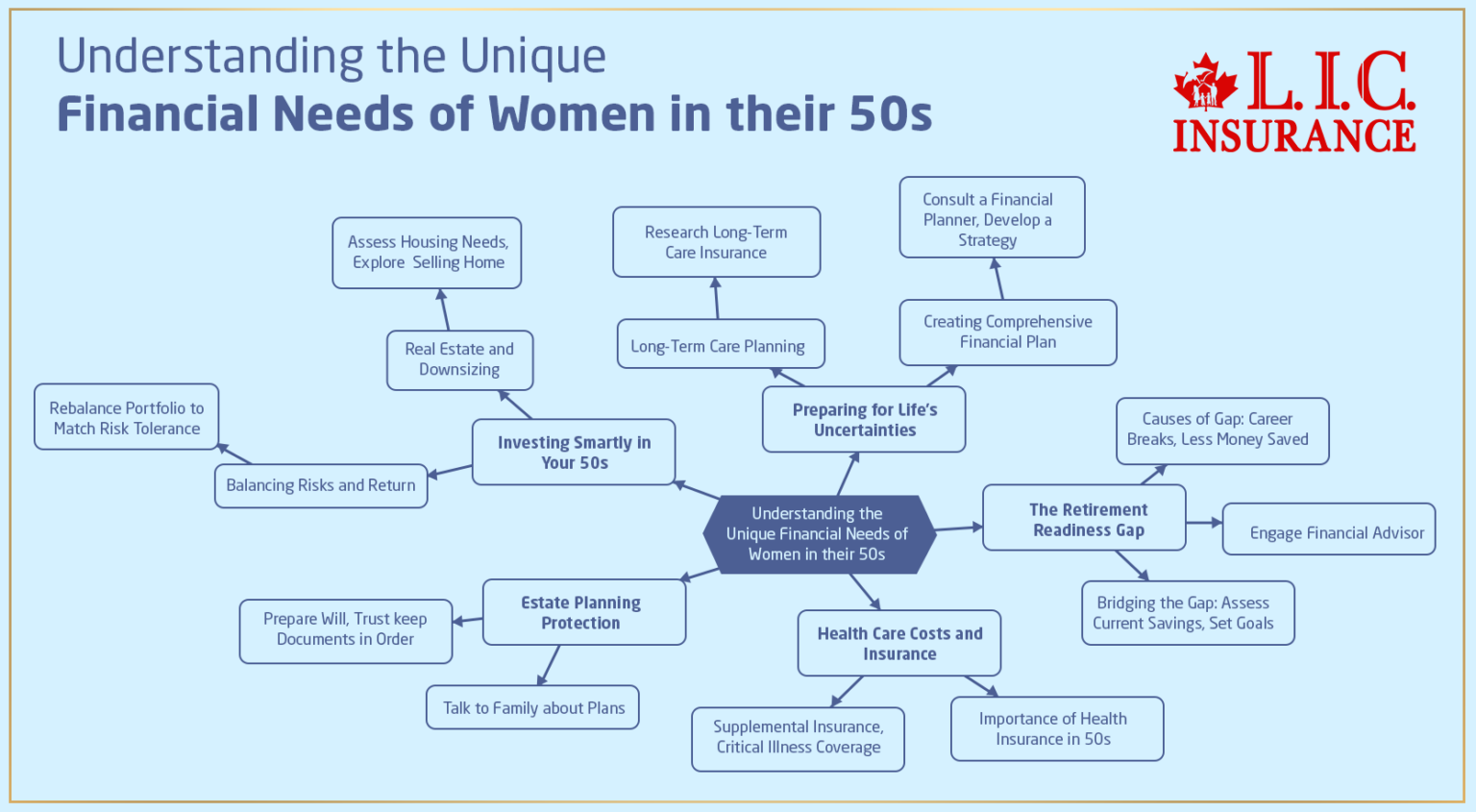

Understanding the Unique Financial Needs of Women in Their 50s

The Retirement Readiness Gap

Let’s take Laura’s story as an example. When she hit 55, she figured she was on her way to retirement. However, a recent financial assessment showed she was lagging behind in her savings goals. Unfortunately, like Laura, there are many women who only find out that they have a retirement readiness gap when it is too late. What causes this gap? For example, the need to take career breaks to care for children – or other loved ones – can ultimately mean less money saved and less of a pension accrued.

How can you bridge this gap? Take a look at what you have now and set some simple, attainable goals for the short-, mid-, and long-term (like 10, 15, and 20 years from now). You might want to engage with a financial advisor to custom-create a plan that will meet your specific needs as well as to consider potential career breaks or periods where you are receiving a lower income.

Health Care Costs and Insurance

Anita had just had a pretty serious health scare and found herself with large medical bills. As we get older, health expenses can add up quickly. Health Insurance in Your 50s is essential, especially for women in their 50s.

What steps can you take? There are even health insurance plans to cover up for the scenarios that your age brings with it and a host of other related benefits. It might be time to look into supplemental health insurance or Critical Illness Coverage to ensure you’re aware of medical expenses.

Estate Planning and Protection

Rachel lost her life suddenly, and then her family was left burdened in dealing with a myriad of legal matters afterward. One of the overlooked areas is estate planning. Understanding how to preserve your assets is gainfully important for women in their 50s as it determines who gets your inheritance.

How do you start? Prepare a will, trust where changes are required and keep all documents in order. It is also a good idea to talk to your family regarding your plans to guarantee there is no confusion or conflict when the time comes.

Investing Smartly in Your 50s

Balancing Risk and Return

Sophie, then 52, discovered that all of her investments were in high-risk stocks when the market sank, so she was forced to select low-risk investments. Rebalancing your investment portfolio to match your risk tolerance and retirement timeline is key.

What’s the best approach? Spread your investments to stocks, bonds, and more. Reassess your risk tolerance as you age, and shift towards more conservative investments if necessary. Get personalized advice from financial advisors based on your financial situation and goals.

Real Estate and Downsizing

Linda opted to downsize her home to release some of the equity in her home to help fund her retirement. Real estate can be a valuable asset for women in their 50s. From downsizing to re-renting property or purchasing a second home, every move must be planned with great detail when it comes to real estate.

Using Real Estate to Make Money

Assess your current and future housing needs and explore how selling your home could provide an avenue to better your financial welfare. For personalized, detailed information that reflects the real estate market in your area, you can also speak with a real estate professional.

Preparing for Life's Uncertainties

Long-Term Care Planning

Judy never thought she would need long-term care until her husband needed specialized care after a stroke. Long-term care planning is a vital but often overlooked part of financial planning for women in their 50s.

What should you consider? Research long-term care insurance and other ways to ensure that you and your loved ones get the care they need without spending all of the money you saved. This is a very broad area, so it is advisable to talk to the experts on insurance.

Creating a Comprehensive Financial Plan

Think of Ellen, who found peace of mind after creating a comprehensive financial plan. This plan addressed her income, investments, insurance, estate planning, and more. Having a comprehensive financial plan is like having a roadmap through the financial landscape of your 50s and beyond.

Where to begin? Organize your financial data, and think about consulting a financial planner. They can help you develop a strategy that aligns with your financial situation and future goals.

Conclusion: Why Waiting Is Not an Option

The stories of Maria, Susan, Laura, Anita, and others are not just cautionary tales. They are the typical experiences that re-emphasize the importance of proactive financial planning because the moves you make in your 50s can greatly impact your financial well-being.

Canadian LIC, with its experienced service and personal interest, will help you deal with these challenges. Do not let the unknown determine your destiny. Contact Canadian LIC today to start planning for your future! And in finance, you guessed it right, the best time to do something is always now.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

More FAQs: Empowering Women in Their 50s with Financial Knowledge

Do you ever feel like you’re not sure how to handle your retirement savings? You’re not alone. Put yourself in the shoes of Clara, who questioned at 55 whether there is enough money in her retirement fund. Calculate how much you expect to spend in retirement, should you decide to live life exactly as you do now. Next, look at your savings plus what you might reasonably expect in income during your retired years. A financial advisor can explain this to you and help you establish the savings objectives. Remember, you can always begin to save more later!

Take Beth, who was exhausted by her many options when trying to figure out what health insurance plan to choose. Enter the coverage of universal health care, which includes preventive services, chronic disease management, and significant illness coverage, and that is where you should be at this age. Assess your current health requirements and assess whether there is a family health history that may catch up in the future. Using an insurance broker can assist you in finding the appropriate cover to fit your needs.

Imagine you’re like Sandra, who thought estate planning was only for the wealthy. Notwithstanding, there is always some type of estate plan that applies to every individual to ensure that their hard-earned property is passed to others according to their will. Write a will, establish healthcare directives, and consider trusts at a baseline. This is also a prudent move to convey your plans to your family members in order to avoid confusion in the future and avoid any disputes.

Lucy suddenly discovered that high-risk stock because it started to crash, which, at this point, too much money was in. Balancing your investments means to have your portfolio diversified across different asset classes, for example, stocks, bonds, and real estate. Adjust your investment strategy to lean more toward lower-risk assets as you get closer to retirement. A financial advisor can provide personalized advice based on your risk tolerance, financial goals, and other factors.

Diane decided to downsize early and found it financially liberating. How much can downsizing free up equity and save on living expenses? Understand what you are looking to get out of where you live today and what you are working towards in your retirement. The earlier you can downsize to improve your financial health, the better.

Tanisha was in a situation after his surprise stroke where the long-term care expenses were out of reach. Long-term care insurance can help pay for care services that your regular health insurance likely won’t cover, such as in-home care or nursing home stays for you and your spouse. Shop around, and buy one when you’re in your fifties; as premiums go up the older and unhealthier you are when you start.

Collect all your financial data—assets, liabilities, income, and expenditure. Work with a financial planner that can tie all of your retirement planning, investing, insurance needs, and estate planning needs together into a single plan. This approach ensures all parts of your financial life are working together towards your goals.

Canadian LIC offers personalized service tailored to the unique needs of women in their 50s. They specialize in financial planning as well as insurance products and are happy to guide you through the challenges of retirement planning, selecting a suitable health policy, etc. Just like Maria, who found peace, belief, and clarity in her financial decisions with their help, so can you. Canadian LIC (Licensed Insurance Brokers) will be available to bring along a partner who can guide you along your financial journey.

Angela, 58, came to realize that the investment strategy she had followed for years was too risky as she neared retirement. As with Angela, you may have to move out of high-flying growth stocks and into safer, dividend-paying investments. Have your portfolio reviewed with a financial advisor to make sure it is positioned appropriately for your decreasing risk tolerance, along with the soon-to-arrive need for that capital for retirement. Rebalancing your investments can protect your assets from market volatility and prepare you for a stable income in retirement.

Think about the story of Sareena, who, after her husband passed away unexpectedly, felt they could have had better life insurance. If you are in your 50s, purchase a Life Insurance Policy to have financial protection for your dependents and to cover any liabilities present or that may come in the future. Search for plans that provide you with the necessary coverage while still fitting within your budget. You can meet with an insurance professional who can guide you to the right type and size policy that is best suited to you and your family.

Jamie was in debt for the first time after paying his way to get his children through college. For those of you who are like Jamie, look to pay off any high-interest debts (like credit card debts) first and consider consolidating loans for a lower interest rate. Creating a realistic budget that monitors how much you spend can also help you avoid going into further debt. Other times, a trip to a debt counsellor can offer extra ways to manage better and reduce your debt.

Lisa learned about tax implications the hard way when she withdrew from her retirement savings without understanding the consequences. As you plan for retirement, be aware that withdrawals from certain retirement accounts, like RRSPs in Canada, can be taxable income. Plan your withdrawals strategically to minimize tax liabilities, and consider consulting a tax advisor to optimize your retirement income and tax benefits.

Consider the example of Georgia, who had no experience with the large medical bills that could cripple his entire retirement fund. To prevent this type of scenario from affecting you or your Health Insurance Policy, be sure to supplement your health insurance plan with the provision of extended medical treatment coverage and long-term health care. On the other hand, keeping your savings under the mattress and placing a buffer aside as an emergency fund for health can give you peace of mind without unbalancing the budget.

Emily realized the importance of updating her will when she remarried and welcomed a new member into her family. The reality is that your will needs to be updated to represent where your life circumstances are now and where your life circumstances may be at some point, from your children to other legal matters. Having another set of eyes look at your will every couple of years or after a life event ensures that you are getting what you want where you would like your stuff to go, and it can also make sure your stuff does not just go down the line where there will be heated debates amongst families or litigations.

At 55 Boby finally started thinking about retirement savings when he knew it was too late. If you are in a similar spot, consider upping the amount you put into retirement accounts like RRSPs or TFSAs. Look for additional income sources, like part-time work or freelancing, to boost your savings. You definitely want to consider pushing back retirement—if possible—by a few years to give your investments a few extra years to grow.

Diversity in income streams. As mentioned earlier, Julia experienced financial freedom by creating different income streams, e.g., rental income, returns on investment, and dividends. Diversify your investments and look for passive income streams that will pay you regularly, even after you retire, to make sure of your financial independence. Finally, continue to build up that strong safety net of an emergency fund to protect against those unscheduled expenses without having to rely on others.

Imagine you are like Janet, who was unsure about her transition from a bustling career to retirement. Begin by envisioning your desired retirement lifestyle and calculating the associated costs. Gradually reduce your working hours, if possible, to ease into retirement. Financially, adjust your budget to fit a fixed income and consult a financial planner to ensure your savings and investments support your retirement goals.

Take Laura, Laura, who neglected her retirement savings during her peak earning years. People frequently make the mistake of under-contributing retirement accounts and/or withdrawing from them too soon. Not updating estate plans or insurance policies is also an error. Avoid these by regularly reviewing your financial plans and seeking advice from financial experts to keep everything current and optimized for your situation.

Take Anne, for instance, who found herself financially strained after her divorce. Everything that belongs to you and anything that should be paid back is identified. Seek advice from a divorce attorney and a financial advisor to divide them fairly. Get good insurance coverage and update beneficiaries for retirement accounts and insurance policies.

Consider Robert, who cut his monthly costs by refinancing his home loan at a lower rate of interest. Refinancing is worthwhile if it lowers interest rates, payments, or adjusts your mortgage term to something more affordable. Still, factor in closing costs and how long you plan to remain in your home to make sure it’s a cost-efficient move.

Emily took this advice to heart and sought to make her investments align with her values, preferring to invest in companies with sound environmental and social governance. Get to know funds and companies with a focus on sustainability and integrity so you can responsibly invest your money. Alternatively, socially responsible investment financial advisors help you choose investments that align with your goals without losing financial returns.

In the same way, Susan attended workshops to become more knowledgeable in financial terms and continue learning about these areas. Keep yourself updated with the financial news, subscribe to newsletters, attend seminars, and interact with financial communities online. If you stay up to date, you will make smarter financial decisions and notice any trends that might affect your financial planning.

Helen tried to create a legacy but didn’t know how to go about it? First, speak with a financial adviser to discuss how much money can be gifted to whom while minimizing tax. This is a great way to make sure your assets go where you want them to. It would help if you did the same for your insurance policies and your retirement account.

Helping her adult children financially impacted her retirement savings, and hence, Mary faced a dilemma. It’s important to set boundaries on financial support for adult children to ensure it doesn’t compromise your retirement plans. Be transparent with your children about your financial situation, and encourage their independence. Prioritizing your financial security is not selfish—it’s necessary.

you secure your future and reach the prosperity you want.

The goal of these questions and answers is to help you feel more in control and, therefore, more confident in the important financial choices of your 50s. Whether you are revising your retirement plan, updating insurance, or finalizing your estate plan, knowing these areas can help you secure your future and reach the prosperity you want.

Sources and Further Reading

To delve deeper into the topics discussed in this blog and to further your understanding of financial planning for women in their 50s, consider exploring the following resources:

Books:

“Smart Women Finish Rich” by David Bach: This book offers actionable advice for women who want to take control of their finances and secure their future.

“The Charles Schwab Guide to Finances After Fifty” by Carrie Schwab-Pomerantz: Tailored specifically for those approaching or in retirement, this guide covers everything from investment strategies to estate planning.

Websites:

Investopedia: A comprehensive resource for personal finance, investing, and market trends.

National Institute on Aging: Offers insights and tips on health, aging, and retirement planning.

The Balance: Provides a wide range of articles on personal finance, including retirement planning and insurance.

Podcasts:

“HerMoney with Jean Chatzky”: This podcast focuses on financial advice for women, covering topics like savings, investment, and financial security.

“Retirement Answer Man” by Roger Whitney: Discusses various aspects of retirement planning, providing practical tips and strategies.

Government and Non-profit Organizations:

Financial Consumer Agency of Canada (FCAC): Provides tools and information to help Canadians improve their financial health.

Women’s Institute for Financial Education (WIFE.org): Dedicated to providing financial education to women and supporting their financial independence.

Articles and Research:

Articles by credible financial news sources like Bloomberg and The Wall Street Journal often discuss market trends and financial advice relevant to the pre-retirement demographic.

Professional Financial Advisors:

Consulting with a certified financial planner or a retirement planning specialist can provide personalized advice and strategies tailored to your specific financial situation.

Each of these resources can provide further insight and detailed strategies to help you manage your finances effectively in your 50s and beyond. Whether through reading, listening, or direct consultation, continuing your financial education is crucial to navigating the complexities of financial planning at this stage in life.

Key Takeaways

- Start retirement planning early to maximize growth potential.

- Secure comprehensive health insurance to cover unexpected medical costs.

- Set up a will and estate planning documents to ensure your assets are distributed as desired.

- Shift towards conservative investments as retirement approaches to protect savings.

- Reevaluate real estate investments and consider downsizing to free up equity.

- Understand long-term care needs and explore insurance options to cover these costs.

- Integrate all financial aspects, including income and investments, with a comprehensive plan.

- Stay informed about financial matters to make educated decisions.

- Engage with financial advisors for personalized and professional advice.

- Share financial knowledge and experiences to build a supportive community.

Your Feedback Is Very Important To Us

We value your insights and experiences. This questionnaire aims to better understand the unique financial challenges you face as a woman in your 50s. Your responses will help us tailor our content and services to better meet your needs.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com