- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- Impact of Changing Mortgage Rates in Canada: How to Protect Your Investment with the Right Mortgage Insurance

- Smart Financial Moves for Women in Their 50s

- How will the new measures announced in 2024's budget impact you?

- Is Life Insurance A Good Investment In Canada?

- What is the Average Life Expectancy in Canada?

- How Much Does a Funeral Cost in Canada 2023?

Reviews

Reasons Why A Will Is An Important Part of Financial Planning

SUMMARY

When we talk about financial planning, most people think of budgeting, saving, and investing. There is, however, one very important area that few people ever talk about- is writing a will. Without a proper will in place, your family and loved ones could face serious financial consequences, including government involvement in deciding how your assets are distributed. That is why Canadian LIC always emphasizes the inclusion of a will while making your financial plan.

- 11 min read

- September 11th, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- September 12th, 2024

Most of our clients come to us with limited knowledge about how a lack of a will affects their financial affairs. Sometimes, they may think they can look after it later or don’t realize the complexities that arise when no will exists. This common oversight can lead to probate, lengthy legal processes, and government control over what happens to their estate. Let’s find out why it’s necessary to have a will and why Canadian LIC recommends this as such an important step in your financial planning.

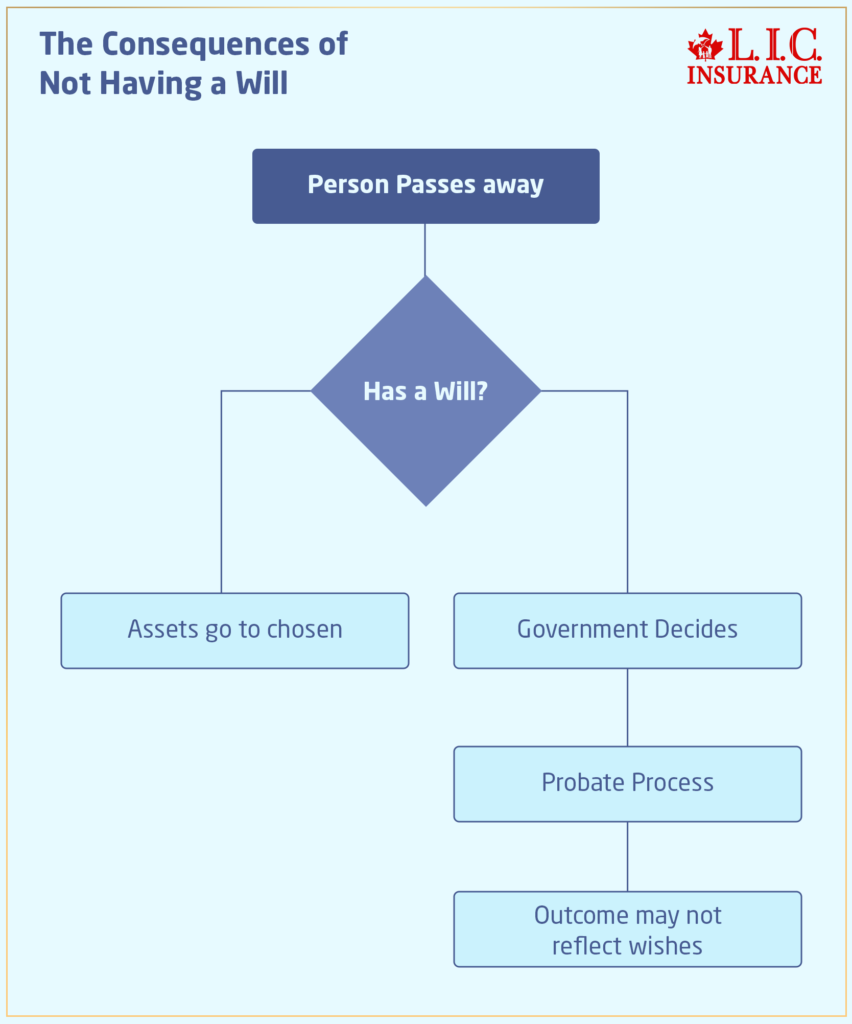

The Consequences of Not Having a Will

When we meet with clients, we often hear tales about their apprehensions of what is to come, especially regarding what would happen to their possessions once they have passed on. For example, one of our clients, an older couple with no children and living alone, believed that by default, their home and savings would flow to the closest relations. What they didn’t know was that, without having a will, the government would step in and decide on their behalf how their estate would be distributed. This is what we come across all too often.

If you die intestate- that is, without having made a will in Canada- then the duty falls upon the government as to how your estate should be dealt with. In other words, your assets would be held up in probate- a legal process that decides how the estate should be divided. The problem? It can take time and money and may not even end with an outcome you would have wished for your loved ones.

That’s why Canadian LIC strongly suggests that making a will, regardless of age or financial status, be an integral part of every client’s financial planning.

Why Is a Will So Important?

First of all, a will is not just a legal document; it’s a tool that allows you to have some say in how your assets are distributed when you’re no longer around to have your voice heard. Here’s why Canadian LIC insists that having a will is an integral part of any financial plan:

You Decide Who Inherits Your Assets

If you die without a will, the government has a pre-defined legal process for the distribution of your assets, and it might not be the way you had in mind. Your spouse might not automatically get all of your estate, while other family members may inherit parts of your estate that you never intended for them.

We’ve had so many clients at Canadian LIC coming to us in a panic because they found that their assets would be carved up in ways they’d never expected. One such case that comes to my mind is that of a client who was financially supporting a friend of his for years. Without a will, there would have been no way to ensure any portion of the estate went to this friend, even though this friend, in large measure, was part of the client’s life. This is why Canadian LIC stresses the need for a will to make sure your assets go where you want them to.

Avoiding Family Disputes

Conflicts can easily arise in families when there isn’t a will. Sometimes, even the best of family relationships have conflicts arising over the distribution of assets when it is left to interpretation. Disputes of this sort are easily emotionally charged and could be financially straining, especially when taken to court.

One of our clients related to us how her family had to go through stressful times for many years following the death of her dad, who did not write any will. The family made it to court, fighting over who should inherit the family house, which lasted for months. Had there been a will in place, all these conflicts could have been avoided, and the family could concentrate on grieving rather than legal battles.

Minimizing Legal Delays and Probate

When you don’t have a will, your estate automatically goes through probate—a legal process where the court determines how to distribute your assets. This can take several months to settle and sometimes even longer, especially in cases where there is a complication or dispute.

We have seen it ourselves when delays due to probate affected even the very families of our clients. Once, a widowed client was telling us that when her husband died, intestate, without a will with probate, she had to wait almost a year before she was allowed to access his bank accounts. This delay caused a significant financial burden, which could be easily avoided with a will in place.

Appointing a Guardian for Minor Children

A will enables one with young children to appoint a guardian who has the legal right to take care of them in case something happens to you. In other words, without doing this, it would be up to the court to decide who would be caring for the children, and the decision might not turn out exactly as desired.

Several of our clients with young families have come to us concerned about what would happen to their children in the instance of an unexpected tragedy. Canadian LIC always advises parents to make a will out in order to guarantee that, in such a case, their children’s futures can be secured both financially and in guardianship.

Tax Benefits and Planning

The other reason a will is important regarding financial planning is related to the idea of tax benefits. Estate planning through a will could reduce taxes levied on the estate, making sure more assets go to your beneficiaries and not to taxes.

Among our clientele, who had a significant amount of wealth tied up in various investments, was unaware of the tax implications her beneficiaries would face in case she did not plan accordingly. After consulting Canadian LIC, she herself found out that if she had the right will and estate planning, she could avoid these taxes, thereby leaving more to her family.

The Government's Role Without a Will: What Happens?

If you die without having written a will in Canada, your estate becomes what is commonly known as intestate; that is, it has no specific instructions regarding how to handle it. In this case, the government takes over and handles the distribution of your estate in accordance with the set provincial laws. This process involves probate, where the court appoints an executor and determines how your estate will be divided among your next of kin.

Here’s what could happen without a will:

- The government appoints an executor: Instead of someone you trust managing your estate, the court assigns an executor to handle the process. This could be a stranger or someone you wouldn’t have chosen.

- Family members you may not have intended could inherit: If you wanted certain assets to go to specific individuals, such as close friends or distant relatives, this won’t happen without a will. The government follows a strict hierarchy of inheritance, starting with your spouse and children, then moving to parents, siblings, and so on.

- Probate fees and legal costs can pile up: The probate process isn’t just slow; it’s also expensive. Your estate could end up paying significant legal fees, which reduce the amount left for your loved ones.

At Canadian LIC, we have often seen that a number of families are caught off guard by how much control the government has over their loved one’s estate in the absence of a will. A lot of them are also not anticipated to pay probate fees and take up so much time to settle an estate. We let our client know that this could have been totally avoided with a basic will.

Canadian LIC's Perspective: Why We Recommend a Will as Part of Financial Planning

At Canadian LIC, we believe in comprehensive financial planning. To us, a will is not just an optional add-on but an integral component in the protection of the family and seeing to it that your wishes are respected. So many of our clients express a tremendous sigh of relief when they can finally get through completing their wills, knowing they have taken the much-needed steps to protect their legacy and relieve their families from a lot of unnecessary stress.

Day in and day out, our practice in working with clients demonstrates just how important having a will can be, be it to young, growing families naming guardians of their children or to retirees looking to disburse their wealth. We always say the difference between peace of mind and chaos depends on whether one has a will in place.

Protecting Your Financial Legacy with Canadian LIC

While consulting clients at Canadian LIC, one encounters the same queries many times. Some feel they have enough time to make a will, and others may realize it only at such a stage when they can do nothing about it. But life is not that predictable, and withholding the writing of a will may leave your family with legal hassles, financial losses, and emotional stress.

For this reason, Canadian LIC works closely with clients to ensure creating a will is at the top of their financial planning. Our expert advisors will guide you through this, ensuring all of the important things are covered in your estate, from asset distribution to guardianship.

Final Thoughts: The Time to Act Is Now

In the world of financial planning, few things are more important than protecting your family’s future. A will ensure that your assets go to whom you want them to go, that your loved ones are taken care of, and that your estate does not face unnecessary litigation challenges. If you do not have a will, the government steps in and puts your estate into probate- a process that is potentially stressful, filled with delay, and added costs for those you care most about.

At Canadian LIC, we have seen firsthand just how very critical a will may be in securing your financial legacy. Do not wait until it is too late to do so. Start the process today and make sure your family is looked after the way you would have wanted.

Gather More Knowledge

- Smart Financial Moves for Women in Their 50s

- How Will the New Measures Announced in 2024’s Budget Impact You?

- Impact of Changing Mortgage Rates in Canada: How to Protect Your Investment with the Right Mortgage Insurance

- What Happens If My Life Insurance Provider Goes Bankrupt?

- How Can You Use Whole Life Insurance to Create Wealth?

- 5 Steps to Ensure Your Life Insurance Application is Approved

- Do I Need Insurance on My Loan?

- Is Life Insurance a Good Investment in Canada?

- What is the Average Life Expectancy in Canada?

- How Much Do I Need to Retire in Canada?

FAQs: Why a Will Is an Important Part of Financial Planning

Here are some of the most frequently asked questions on why one needs a will in financial planning. Actually, each answer is a common experience we see with our clients at Canadian LIC.

If you don’t have a will, the government will decide how your assets are distributed through a process called probate. This can be a long and expensive legal process, and your assets may not go to the people you intended.

A will allows you to control how your assets are distributed after your death. It ensures that your loved ones are taken care of and avoids unnecessary legal complications, delays, and costs. We’ve seen many families face difficult situations because their loved ones didn’t have a will in place.

Everyone needs a will, no matter how small their estate is. Whether you own property, have savings, or simply want to leave specific items to loved ones, having a will is the best way to make sure your wishes are followed. Many clients at Canadian LIC realized too late how important this is, but we guide them through the process to avoid future problems

Yes, a will can help prevent family disputes by clearly stating your wishes. We’ve seen cases where the lack of a will led to conflicts between family members over who should receive certain assets. A will eliminates this uncertainty.

A will allows you to name a guardian for your minor children. Without a will, the court will decide who takes care of them. Many parents we work with at Canadian LIC are relieved when they set up a will because it gives them control over their children’s future.

Probate is the legal process where the court decides how to distribute your assets if you die without a will. It can take months or years to complete, and the fees can reduce the amount your loved ones receive. Canadian LIC always advises clients to create a will to avoid these unnecessary delays and costs.

With proper planning, a will can help reduce the taxes your estate might owe. This means more of your assets will go to your beneficiaries rather than being lost to taxes. We’ve helped many clients at Canadian LIC understand how to maximize the value they leave behind through tax-efficient planning.

Creating a will is simpler than most people think. At Canadian LIC, we guide clients through the process, ensuring that all important aspects are covered. It’s a straightforward step that can save your family a lot of trouble in the future.

Yes, you can update your will anytime your circumstances change, such as after a marriage, divorce, or the birth of a child. We always remind clients at Canadian LIC to review their will regularly to ensure it reflects their current wishes.

We see how much stress and confusion can be avoided when clients have a will in place. It’s not just about distributing assets—it’s about protecting your family and ensuring that your wishes are respected. At Canadian LIC, we believe a will is one of the most important steps in financial planning.

The above FAQs address the common concerns our clients raise with us daily at Canadian LIC . By knowing the importance of having a will, you get to control your financial future while saving your loved ones from legal issues that are absolutely unnecessary.

Sources and Further Reading

- Government of Canada – Making a Will

A guide on the importance of having a will in Canada, explaining the legal aspects and how it can protect your family.

https://www.canada.ca/en/employment-social-development/corporate/seniors-forum-federal-provincial-territorial/will-funeral-plan.html - Canadian Bar Association – Wills and Estates

Information on how wills work in Canada and the impact of not having one.

https://www.cba.org/ - Canadian Life and Health Insurance Association (CLHIA)

A resource on estate planning, wills, and how life insurance plays a role in securing your financial future.

https://www.clhia.ca/ - Estate Planning in Canada

Detailed advice on creating wills and avoiding probate in Canada.

https://www.getsmarteraboutmoney.ca/ - Legal Information Society of Nova Scotia – Wills and Probate

An in-depth guide to the probate process in Canada and how a will can help avoid it.

https://www.legalinfo.org/

These resources offer additional information to help Canadians understand the significance of having a will as part of financial planning.

Key Takeaways

- A will is crucial for financial planning as it ensures your assets are distributed according to your wishes, avoiding government intervention and probate.

- Without a will, the government decides how your estate is handled, which can cause delays, family disputes, and higher costs.

- Probate is a lengthy and expensive process that can be avoided with a properly drafted will, saving your family time and money.

- A will allows you to appoint a guardian for minor children and provides tax benefits, ensuring more of your assets go to your beneficiaries.

- Canadian LIC emphasizes that having a will protects your family from financial and emotional burdens and should be a priority in any financial plan.

- 11 min read

- September 11th, 2024

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

Thank you for sharing your thoughts. Your feedback will help us better understand the challenges Canadians face with creating or not having a will. Please answer the following questions:

Thank you for your valuable feedback!

IN THIS ARTICLE

- Reasons Why A Will Is An Important Part of Financial Planning

- The Consequences of Not Having a Will

- Why Is a Will So Important?

- The Government's Role Without a Will: What Happens?

- Canadian LIC's Perspective: Why We Recommend a Will as Part of Financial Planning

- Protecting Your Financial Legacy with Canadian LIC

- Final Thoughts: The Time to Act Is Now

Sign-in to CanadianLIC

Verify OTP