- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Pros and Cons of Buying Term Life Insurance Plans

- What Is a Term Life Insurance Plan?

- How Term Life Insurance Works?

- Pros of Buying a Term Life Insurance Plan

- Cons of Buying a Term Life Insurance Plan

- Comparison: Pros and Cons of Term Life Insurance in Canada

- How to Decide if Term Life Insurance Is Right for You

- How Canadian LIC Helps Clients Choose the Right Term Life Insurance Plan

- Why You Should Consider Term Life Insurance Investments

- Final Thoughts: Is Term Life Insurance Right for You?

- More on Term Life Insurance

Pros And Cons Of Buying Term Life Insurance Plans

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 21th, 2024

SUMMARY

Deciding on the right life insurance policy can feel like trying to navigate a maze. So many people are struggling with balance: affordability, coverage, and long-term value. Perhaps the biggest dilemma of all is how to determine whether Term Life Insurance is the correct choice. Term Life Insurance is usually the cheapest and most straightforward option. But is it always the right choice? Often, clients who come to us are worried about whether Term Life Insurance Investments are enough to deliver the security they need.

Let’s further discuss some of the pros and cons that you should consider when looking into Term Life Insurance Plans. Understanding both their benefits and disadvantages will enable you to make a very informed choice and reach the decision that suits your family’s financial goals.

What Is a Term Life Insurance Plan?

A Term Life Insurance Policy is a policy that provides coverage for a specified number of years, usually between 10 and 50 years. If the insured dies during this period, the beneficiaries collect the face value amount of the death benefit. This simple design makes Term Life Insurance appealing to families who need to find savings-friendly financial security during critical years, such as raising children or paying off a mortgage.

How Term Life Insurance Works?

- Coverage for a Fixed Term: This type of life insurance pays only for a limited period, for example, 10, 20, or even 30 years. In case the policyholder dies during that term, the beneficiaries get a lump sum death benefit.

- Affordable Premiums: The premiums for Term Life Insurance are generally lower compared to Permanent Life Insurance. This affordability makes it a popular choice for families and individuals with specific financial goals.

- Customizable Policy Terms: You can choose a term that matches your financial obligations, such as covering a mortgage, raising children, or managing other temporary expenses.

- Fixed Premiums During the Term: Most Term Life Insurance Policies have fixed premiums throughout the term. This predictability helps policyholders plan their finances effectively.

- High Coverage Amounts: Term Life Insurance offers substantial coverage at an affordable cost, making it an attractive option for securing your family’s financial future.

- No Cash Value Accumulation: Unlike permanent life insurance, term life policies do not accumulate cash value. The premiums you pay go solely toward the coverage.

- Renewal and Conversion Options: Term life plans have the flexibility of continuing your insurance, which can now have a premium at the end of the term. Also, some plans can be converted into permanent forms of life insurance based on your health status, with no need for additional medical examinations.

- Death Benefit for Beneficiaries: The death benefit paid to beneficiaries is usually tax-free, providing financial security during difficult times.

- Easy Online Purchase: Many insurers, including Canadian LIC, allow you to buy Term Life Insurance online, offering a hassle-free way to secure coverage.

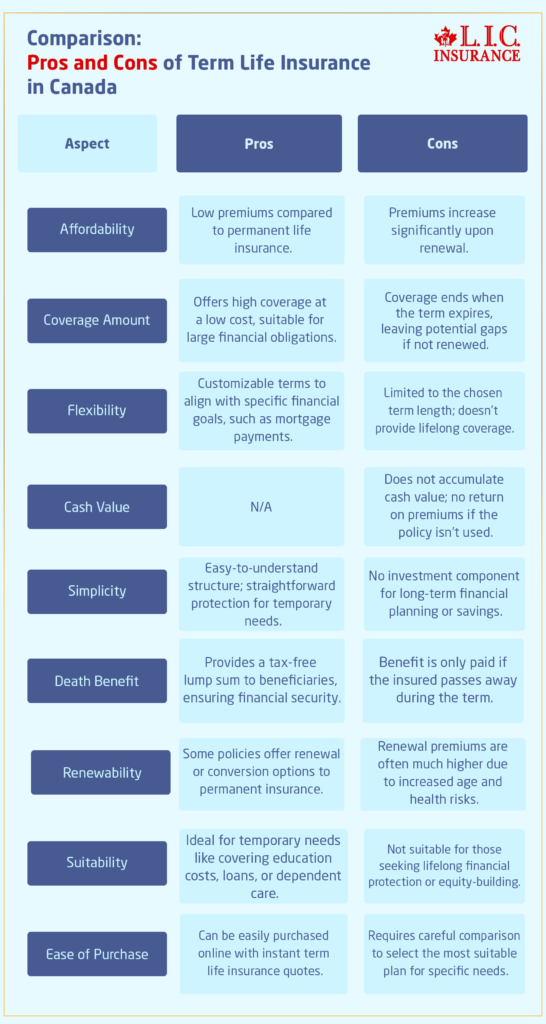

Pros of Buying a Term Life Insurance Plan

The low cost is one of the main reasons why most people opt for Term Life Insurance Plans. In comparison to Permanent Life Insurance Policies, the premium amounts for term plans are very low. Thus, huge coverage can be easily attained without straining the budgets.

For instance, a young couple we dealt with in Canadian LIC wanted to cover for their two children in a way that was not very expensive. A 20-year Term Life Insurance Policy covered them with $500,000 without the need to spend more than $50 per month.

Term Life Insurance Plans are simple to understand. There is no investment component or complex structure; you pay your premium and ensure that in the event of your death within the term, the benefit goes to your beneficiaries.

Most of the clients confessed to being relieved at the understanding that they do not have to sift through several complicated policies and policies to get the needed coverage. Such simplicity makes Term Life Insurance quite attractive, especially to first-time buyers.

The Term Life Insurance can then be aligned to match any time span, whether it is for 10, 20, or 30 years. In terms of financial obligation, most parents would get a Term Life that covers the children until they are financially independent; this term may range from 10 to 20 years.

We once worked with a client who chose a 15-year term plan so as to ensure his mortgage payments were fully covered. He appreciated having the ability to select a policy that fulfilled his unique needs.

Term insurance plans can, therefore, be a good option for individuals seeking generous coverage at a modest cost. A cover of millions of dollars can be secured to suit almost every budget, with relatively little cost when compared to permanent insurance.

One of our clients, a young entrepreneur, went for a $1 million Term Life Insurance Plan to protect his family and business interests. He was surprised at the affordability of the premiums he was offered in comparison to the coverage he would receive.

Term Life Insurance is perfect for covering temporary financial responsibilities. Be that through paying off a mortgage, saving for children to attend college, or securing your family’s financial future while you’re the breadwinner, this will serve to give you peace of mind during that specific period.

Cons of Buying a Term Life Insurance Plan

Unlike Whole Life Insurance or Universal Life Insurance, Term Life does not accumulate cash value. Therefore, when the term is due, you receive nothing in return for the premiums that have been paid.

Some customers have been frustrated by this, especially those who outlive their policy term. They keep asking if one is better off spending money on a plan that won’t build equity over time.

Term Life Policies are affordable for the young, but pricing increases with age. You could find yourself paying too much in your 50s or 60s when you renew your policy.

Not long ago, a client in her late 40s walked into our office with the realization that her 20-year term policy was close to expiring. She was shocked at the cost of renewing it for another 10 years and wished she had considered a different approach earlier.

Once the term expires, you’re no longer covered. This can be a significant drawback if your financial needs extend beyond the policy term. While some policies offer renewal options, they often come with much higher premiums.

For example, we had an aged retired teacher who had planned to rely on her term policy but never expected coverage in her 70s. She deeply regretted not taking permanent insurance when she was younger.

That’s a term life that, if purchased by an individual seeking to buy both protection and an investment opportunity, falls short. Permanent policies, such as whole or universal, build cash value that a policyholder may borrow against later or withdraw. Term Life Coverage focuses solely on coverage, which might not align with long-term financial objectives.

If your policy lapses and you have not replaced it with a new one, you will be left uninsured. This can add financial stress on families that are still plagued with high bills such as healthcare or dependent care costs.

Comparison: Pros and Cons of Term Life Insurance in Canada

How to Decide if Term Life Insurance Is Right for You

Making the right choice involves evaluating your financial situation, future obligations, and priorities. Here are some key questions to consider:

- What are your financial goals?: If your primary goal is to protect your family while paying off debt or saving for major expenses, a Term Life Insurance Plan might be the ideal solution.

- How long do you need coverage?: Consider your current stage in life and how long your dependents will rely on you financially. If you anticipate significant expenses for the next 20 years, a term plan can provide affordable protection.

- Are you prepared for higher premiums later?: If you choose a Term Life Policy, think about whether you’ll be able to handle the cost of renewing the policy or converting it to Permanent Insurance later.

- Do you have other investments?: If you’re already investing in other vehicles like RRSPs or TFSAs, a term policy can complement your financial strategy without requiring additional investment features.

How Canadian LIC Helps Clients Choose the Right Term Life Insurance Plan

At Canadian LIC, we strive to work closely with our clients to identify their own needs and guide them toward the best insurance options. Term Life Insurance Agents take some time to explain each policy so that you are made aware of all the benefits and limitations.

For example, we helped a young couple with their first-Term Life Insurance Investment. We outlined how a 25-year policy would cover their mortgage and their children’s education. This helped reassure them of a clear plan that aligned with their goals and budget.

Why You Should Consider Term Life Insurance Investments

Although Term Life Insurance Investments are not sufficient in many ways, it is the low premium and versatility that make this product excellent for most families. Through an online Term Life Insurance quote, you can compare the options and obtain a policy that best suits your needs.

For those who want to buy plain and simple term insurance without long-term commitment terms, the internet purchase is a convenient and efficient way to go.

Final Thoughts: Is Term Life Insurance Right for You?

Understanding the pros and cons of Term Life Insurance is essential in making an informed decision. Be it the affordable cost, terms that can be customized according to one’s requirements, or temporary coverage, a Term Life Insurance Plan can offer worthwhile benefits for families looking to protect themselves against financial uncertainty.

Canadian LIC is there to assist you in making that choice. Our agents will guide you through each step and give you access to various Term Life Insurance Plans, therefore ensuring you get the policy that best suits you. Act now and secure your family’s future with a Term Life Insurance Plan tailored to your specific goals.

More on Term Life Insurance

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Pros and Cons of Buying Term Life Insurance Plans in Canada

A Term Life Insurance Policy can be issued for a specific number of years, say 10, 20, 30 or 50 years. If the insured person dies during that time, the beneficiaries will get the money. It is a very easy, low-cost approach to providing security for loved ones in their financial careers. Many of Canadian LIC’s customers opt for this option for temporary requirements, such as finishing off the mortgage debt or securing children’s education.

Term Life Insurance Policies are relatively cheap because they offer coverage for a limited period of time and do not include investments. The premium charges are more concentrated on coverage. It is cost-effective for families. One of our clients recently told us that she was able to purchase a $500,000 policy for less than $40 a month—a tiny fraction of what permanent life insurance would cost.

Term insurance investments provide flexibility, high coverage at low premiums, and customized policy terms. These features are quite ideal for all individuals who would like financial protection for specified periods. For instance, a client with young children used a 20-year term policy to ensure security for her family until they were financially independent.

Yes, there are a few drawbacks. Term Life Insurance doesn’t build cash value, and once the policy term ends, coverage stops unless you renew it. Renewals are quite typically much more expensive. A client in their late 40s recently fretted about the rising cost of renewing their policy when their initial 20-year term ended.

The right term length depends on your financial obligations. If you’re covering a mortgage, consider a term that matches its duration. For parents, a term long enough to cover their children’s upbringing and education is often ideal. Our agents at Canadian LIC frequently help clients align their policy terms with their specific goals.

Yes, you can buy Term Life Insurance online from Canadian LIC’s website. It’s quick and easy – compare plans, get Term Life Insurance Quotes Online, and secure the plan of your choice. Most clients appreciate knowing that they can access extensive options for their detailed policy directly from their homes.

Absolutely. Term Life Insurance Agents will walk you through the application process, answer any questions that you may have, and offer policies specifically suited to your needs. A common situation for Canadian LIC agents is to assist clients in distinguishing among different plans and selecting the best Term Life Insurance Plan for their particular case.

If you outlive your Term Life Insurance, the coverage runs out, and no death benefit will be paid. Renewal is sometimes possible under a policy, though the premium is likely to increase. For lifetime needs, our agents often recommend finding convertible policies that allow you to convert to permanent life insurance before the term runs out.

Usually, Term Life Insurance does not provide refund options when you cancel your policy. Be sure to carefully review the details of what they are offering before you buy the policy. A recent client whom we had the opportunity to work with actually appreciated this clear, early insight into terms and conditions, which prevented unwelcome surprises.

Yes, the death benefit from a Term Life Insurance Plan is usually tax-free to your beneficiaries. This makes it a handy tool for ensuring financial security. Many clients have used Term Life Insurance to provide tax-free funds to their families during such trying times.

There are some Term Life Insurance Policies that allow the insured to convert to Permanent Insurance before the term period is completed. This is helpful if your financial condition changes over time. A client recently converted their Term Policy into a permanent one to ensure lifelong coverage for their family.

Term Life Insurance is actually suitable for short-term financial responsibilities, especially paying off debt, educating one further, and ensuring the security of one’s family during one’s working years. Several clients find it to be a great fit for certain goals, such as securing the future of their children until they are independent.

You can compare quotes for Term Life Insurance online at Canadian LIC’s website. It takes a few minutes to fill in the details and get various options ready for you. Most of our clients mention that this smooth process helps them make quick decisions.

Indeed, Term Life Insurance can help finance business loans, cover key employees, or even partnership agreements. One small business owner we have helped utilized a term policy to secure his company’s future while repaying a business loan.

Term Life Insurance is not the best choice for seniors, however, because they pay more in premiums for coverage periods that are a much shorter time than their potential long life expectancy. It does, however, work well in certain situations: final expenses or short-term debt. Our agents can help seniors find the most affordable and practical options.

Assess your family’s financial needs, including debts, living expenses, and future goals, to determine the right coverage amount. Our agents often recommend policies that provide enough to replace income and cover major expenses. A client recently shared how this approach helped them feel confident in their choice.

Term Life Insurance premiums will normally be flat throughout the term. You can renew the policy after the term. In renewal, the premiums will increase based on your age and health condition at that time.

Most Term Life Insurance Plans include a grace period wherein, in case you miss the premium payment, you can still pay it without losing coverage. It is crucial to pay on time to avoid lapsing the policy. One of our clients avoided losing coverage by reaching out to us early after facing a financial setback.

Many Term Life Insurance Plans offer optional riders, such as critical illness coverage or accidental death benefits. These add-ons enhance your policy and provide extra security. A client recently added a critical illness rider to her term plan, which gave her peace of mind during some uncertain times.

Canadian LIC delivers expert advice, a wide variety of Term Life Insurance Plans, and a seamless online platform to compare and purchase policies. Our agents help you find the best options at your particular individual level. Many customers praised our personalized service and transparent advice.

These FAQs help to alleviate your concerns while making Term Life Insurance decisions easier and more relevant. Contact Canadian LIC today for the best terms in life insurance to suit your needs.

Sources and Further Reading

- Savvy New Canadians: Offers insights into the differences between term and whole life insurance, including their pros and cons.

Savvy New Canadians - MoneySense: Provides an analysis of term versus whole life insurance, helping readers determine which policy suits their needs.

MoneySense - Life Buzz: Delivers an ultimate guide to Term Life Insurance in Canada, covering its workings, benefits, and considerations.

LifeBuzz - Dundas Life: Explains the distinctions between term and whole life insurance, assisting readers in making informed decisions.

Dundas Life - Investopedia: Offers a detailed overview of Term Life Insurance, including its types, pros, and cons.

Investopedia

Key Takeaways

- Affordable Protection:

Term Life Insurance Plans are cost-effective, offering high coverage amounts at low premiums, ideal for temporary financial needs. - Fixed Duration:

Coverage lasts for a set term, such as 10, 20, or 30 years, making it perfect for specific goals like mortgage repayment or raising children. - No Cash Value:

Unlike permanent life insurance, term policies do not build cash value. Premiums solely provide coverage. - Renewal and Conversion Options:

Many policies allow renewal or conversion to permanent insurance, though premiums may increase with age. - Tax-Free Death Benefit:

Beneficiaries receive a lump sum death benefit, typically tax-free, ensuring financial security during difficult times. - Customizable Terms:

Choose a policy length that aligns with your financial goals and obligations, such as covering education costs or other temporary needs. - Premiums Increase with Age:

While affordable when purchased young, renewing term policies later in life can lead to significantly higher costs. - Ideal for Temporary Needs:

Term Life Insurance works best for those with specific, short-term financial responsibilities, offering peace of mind during critical years. - Ease of Purchase:

Term Life Insurance can be conveniently purchased online, with tools to compare quotes and find the right coverage. - Expert Guidance:

Working with Term Life Insurance Agents, such as those at Canadian LIC, helps ensure you select a policy that fits your unique needs.

Your Feedback Is Very Important To Us

Thank you for taking the time to complete this questionnaire! Your insights will help us better understand and address the challenges Canadians face with Term Life Insurance Plans.

IN THIS ARTICLE

- Pros and Cons of Buying Term Life Insurance Plans

- What Is a Term Life Insurance Plan?

- How Term Life Insurance Works?

- Pros of Buying a Term Life Insurance Plan

- Cons of Buying a Term Life Insurance Plan

- Comparison: Pros and Cons of Term Life Insurance in Canada

- How to Decide if Term Life Insurance Is Right for You

- How Canadian LIC Helps Clients Choose the Right Term Life Insurance Plan

- Why You Should Consider Term Life Insurance Investments

- Final Thoughts: Is Term Life Insurance Right for You?

- More on Term Life Insurance