- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Limited Pay vs Regular Pay Term Insurance

- Understanding Term Life Insurance Policies

- What Is Regular Pay Term Insurance?

- What Is Limited Pay Term Insurance?

- Comparing Limited Pay and Regular Pay Term Insurance

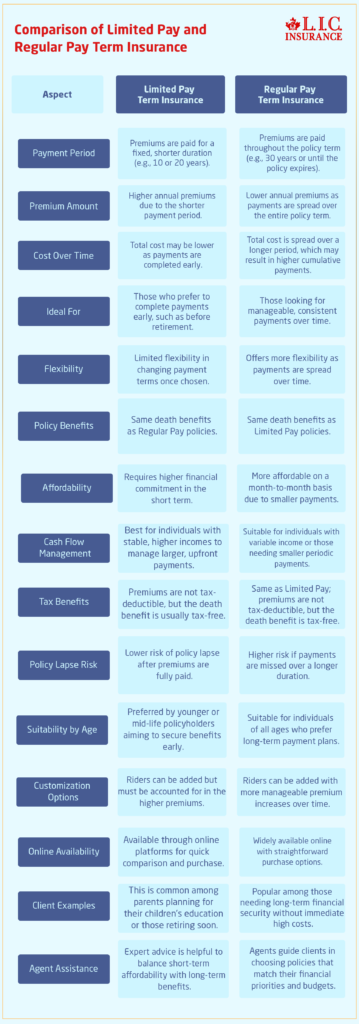

- Comparison of Limited Pay and Regular Pay Term Insurance

- How to Decide Which Option Is Right for You

- The Role of Term Life Insurance Agents

- Why Canadian LIC Is the Best Choice for Your Term Life Insurance

- Final Thoughts

Limited Pay vs Regular Pay Term Insurance

By Harpreet Puri

CEO & Founder

- 11 min read

- January 7th, 2025

SUMMARY

This blog compares Limited Pay and Regular Pay Term Life Insurance Policies in terms of their payment structures, benefits, and suitability for various financial goals. The affordability factor, flexibility, and tax implications make for interesting choices while opting for the right policy. It explains, through the experiences of Canadian LIC, how Term Life Insurance Agents and online tools ensure customized Term Life Insurance Quotes.

Introduction

In many cases, Term Life Insurance is the leading cost-effective solution to secure a family’s financial future. However, selecting a particular policy isn’t easy and often can’t be accomplished simply by deciding which one fits. A lot of people are really unsure whether the Limited Pay or Regular Pay term insurance plan better meets their specific needs. Do not worry-they are definitely not alone.

We meet such clients every day at Canadian LIC. Consider the case of a couple who came to us a few days back and wanted to buy Term Life Insurance online. The husband preferred a Regular Pay option so that premiums are low, while the wife leaned toward a Limited Pay plan so that she could pay the premium early and complete payments earlier. They were unsure about how to balance the pros and cons. If you’ve found yourself in a similar situation, let’s break down the options in a way that’s simple, relatable, and actionable.

Understanding Term Life Insurance Policies

Before comparing Limited Pay and Regular Pay options, first understand the basics of Term Life Insurance Policies. In this kind of plan, coverage is offered to a particular term, for instance, 10, 20, 30 or 50 years. If the policyholder dies during the course of the term, the insurance company pays the beneficiaries the death benefit.

Being the most popular option for Canadians, Term Life Insurance is highly affordable and easy to purchase. However, the method through which you pay for the policy, whether Limited Pay or Regular Pay, has a huge bearing on its cost, flexibility, and value.

What Is Regular Pay Term Insurance?

This Term Insurance Policy is usually paid for the entire policy period of coverage. For example, if I opt for the 20-year term, premium payments will occur annually or month-to-month, and that should be done continuously for 20 years.

Pros of Regular Pay Term Insurance:

- Lower Premiums: Payments are spread throughout the entire term of the policy to keep individual premiums lower.

- Flexible Cancellation: In case your financial condition changes, you can cancel the policy without losing a major upfront investment.

- Budget-Friendly: For those who have a small amount that they can afford to spend over a long period, Regular Pay is manageable for them.

Cons of Regular Pay Term Insurance:

- Longer Commitment: Payments last for the entire term, which may feel like a long financial obligation.

- Higher Overall Cost: While premiums are smaller, the total cost over time can add up to more than a Limited Pay plan.

Take the case of one of our customers, a sole parent who concentrated on keeping costs low for herself and her kids. She immediately chose Regular Pay because it would enable her to keep coverage on without straining her budget for monthly expenses.

What Is Limited Pay Term Insurance?

In Limited Pay term insurance, you are able to pay the premiums within a short period of time, for example, 5, 10, or 15 years, but the Term Insurance Cover remains active throughout the term.

Pros of Limited Pay Term Insurance:

- Paid-up coverage: After you have made the entire premium amount payments, you don’t have to spend anything further.

- Cost Savings Over Time: While premiums are higher, the overall cost is usually less than Regular Pay.

Convenience for High Earners: High earners can pay off early and thus free up their financial resources for other goals.

Cons of Limited Pay Term Insurance:

- Higher Premiums: Shorter payment periods mean larger installments, which can strain your cash flow.

- Reduced Flexibility: If your financial circumstances change, the higher payments may become difficult to sustain.

One client we worked with was a high-earner. She chose the lower pay level, and she justified it easily: “I don’t want to worry about premiums when I’m retired.” This strategy served her lifestyle and financial goals quite well.

Comparing Limited Pay and Regular Pay Term Insurance

The key differences between Limited Pay and Regular Pay Term Insurance are as follows:

Financial Flexibility

Regular Pay has short-term financial flexibility. Its low premiums can fit into most budgets for the month. In comparison, Limited Pay has to have higher premiums but grants a person the ability to be freely financially independent when payments are fulfilled.

Total Cost of Coverage

While Regular Pay would spread costs across time, level pay usually represents a lower cumulative cost. Of course, there is an attraction to this if long-term savings can be made for money.

Long-Term Commitment

If you hate owing money for long periods, you might prefer the Limited Pay. However, if you are comfortable with paying incrementally, you will avoid big upfront costs when you opt for Regular Pay.

Suitability for Different Life Stages

Younger policyholders or even those just starting out their careers will probably prefer Limited Pay for being relatively affordable. Limited Pay will be the better option for those earning a higher income or close to retirement.

Comparison of Limited Pay and Regular Pay Term Insurance

How to Decide Which Option Is Right for You

Choose between Limited Pay and Regular Pay term insurance according to your financial goals, the stability of your income, and long-term plans. Here are some questions that can guide you:

- Do you have extra funds to pay more in premiums? If yes, Limited Pay could save you more.

- Do you like payments that are made smaller over time? Regular Pay may be better for you.

- Are you planning for retirement? Limited Pay ensures you won’t have ongoing payments during retirement.

- Do you have a fluctuating income? Regular Pay offers more flexibility for changing financial situations.

The Role of Term Life Insurance Agents

Good Term Life Insurance Agents should make this pretty easy. Here at Canadian LIC, we work closely with our clients to understand their individual needs and specific financial situation. We break down Term Life Insurance Quotes and weigh in on comparative policy benefits to guide you through the process.

Take the story of one of the couples we have recently helped, for example. This couple was intimidated by the plethora of Term Life Insurance Plans advertised online. A good agent had to sit with them, clearly explaining Limited Pay and Regular Pay, thereby aiding them in finding a suitable policy that was consistent with their budget and long-term goals. The kind of detailed service that a customer will get with such an undertaking can really tip the balance.

Why Canadian LIC Is the Best Choice for Your Term Life Insurance

Canadian LIC has years of experience and in-depth knowledge of the Canadian insurance landscape. This makes us your number one choice for Term Life Insurance Policies. We provide an easy-to-use platform to buy Term Life Insurance online, and our agents are always there to help answer any questions you may have. We take care of the whole process, comparing quotes to tailoring policies to suit your needs, making it all stress-free and smooth.

Final Thoughts

The decision between Regular Pay Term Life Insurance and Limited Pay term insurance is a highly personal one, depending on your budgetary priorities in life. Your choice between Regular Pay or Limited Pay will give you peace of mind and security about your loved ones in the event something happens to you.

Connect today with Canadian LIC if you wish to explore a Term Life Insurance option. Get the coverage your family needs within a budget through Canadian LIC agents assisting you. Don’t wait to protect your future; let us help you make the best decision for your family.

More on Term Life Insurance

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions: Limited Pay vs Regular Pay Term Insurance in Canada

Limited Pay Term Life Insurance contracts require you to pay premiums over a shorter term, which has been predetermined beforehand, such as 10 years or 20 years. With Regular Pay options, you need to pay your premiums for the entire policy duration. At Canadian LIC, it is not infrequent that clients prefer Limited Pay options to reduce long-term financial liability.

The annual premium term of Regular Pay Term Life Cover is generally lower. However, you also save more money in the long run since you pay for a shorter period with Limited Pay options. Many clients seeking quotes for Term Life Insurance in Canadian LIC appreciate the predictability of cost from the Limited Pay plans.

Switching may not be possible once you decide on a policy. Hence, the agents for Term Life Insurance need to be consulted and guided properly. We help clients compare their options at Canadian LIC so that there is no future regret.

Limited Pay policies are very appropriate for those desiring to pay out the premiums before retirement or within some predetermined time. For instance, parents often opt for this cover so that it suits the education cycle of their children. We, in Canadian LIC, have always noticed this particular choice among many families who plan for their financial futures.-

Consider your goals, income, and whether you can afford the extra premium you would have to pay for fewer years. Let our Term Life Insurance Agents assess your needs so you get customized advice.

Yes, Term Life Insurance is available for online purchase, even Limited Pay policies. Canadian LIC makes it easy to compare and purchase a plan that meets your needs online.

Yes, they have the same death benefits. The only difference is the specific period for which the payment is made. At Canadian LIC, we explain the difference to help the client decide.

Regular Pay policies are very popular, especially due to their lower annual premiums and flexibility. Many clients in Canadian LIC find this option better as it allows for the cost to be spread over a more extended period due to fluctuating incomes.

Generally, Limited Pay plans are paid more but less frequently. The Regular Pay plans distribute the cost over the term of the policy and thus pay a smaller amount in each payment. Our team at Canadian LIC can provide detailed Term Life Insurance Quotes for both options.

Absolutely. Canadian LIC employs expert agents who work with you to assess your financial situation and recommend the best plan. That is our approach to making this process easier, more convenient, and hassle-free.

They often lack flexibility in the payment schedule. They help you finish paying much quicker. We explain this limitation at Canadian LIC so our clients are always on the right track when making a choice that is apt for their financial planning.

Many term life policies have customization by means of riders, such as Critical Illness and accidental death coverage. Canadian LIC often assists in choosing riders suited to the requirements of the clients and balancing this with costs.

You can also compare quotes by going online to some trusted sites or talking to Term Life Insurance Agents for personalized advice. Canadian LIC presents a simple and hassle-free procedure to compare side-by-side quotes of Term Life Insurance.

Policies requiring higher upfront payments are not advisable for individuals who have variable incomes. Many of the clients coming to Canadian LIC prefer Regular Pay plans, mainly because they can afford them with time.

In Canada, the premiums paid on Term Life Insurance Plans are not tax-deductible. However, the tax benefit of death benefits received by beneficiaries is usually tax-free. Our licensed insurance consultants at Canadian LIC explain this to clients during their consultation.

Missing a premium may result in policy lapses or additional charges. Limited Pay policies usually have harsher terms regarding missed payments. At Canadian LIC, we encourage automatic payments to avoid any form of disruption.

Yes, most insurance providers allow you to buy Term Life Insurance with Limited Pay options online. However, the online process of acquiring the Canadian LIC is hassle-free, supported by experts, and easy to operate.

At Canadian LIC, experienced, trustworthy agents knowledgeable about several Term Life Insurance Plans are chosen and will always represent the client’s needs.

Our agents will help clients determine whether a Limited Pay policy would be suitable for them by examining their budgets, goals, and financial priorities. We work closely with you to make complex decisions simpler.

Once a policy issue is addressed, up-gradation is generally not possible. We at Canadian LIC always advise you to choose the proper Term Life Insurance Policies to avoid any complications.

Yes, most insurers impose age limits on purchasing Limited Pay policies. More aged applicants can have higher premium costs or have limited options. Agents from Canadian LIC can guide you through the best options based on your age and needs.

We’ll be comparing multiple providers, checking your needs, and negotiating competitive rates on your behalf to ensure you get the most suitable Term Life Insurance Quotes with minimum time consumption.

Feel free to reach out to Canadian LIC’s experienced agents in order to obtain the most detailed assistance in making your decision about a Term Life Insurance policy.

Sources and Further Reading

- Canada Life

Website: www.canadalife.com

Details on Term Life Insurance products, policy types, and benefits available in Canada. - Sun Life Financial

Website: www.sunlife.ca

Comprehensive information about Limited Pay and Regular Pay life insurance options. - Manulife

Website: www.manulife.ca

Insights into Term Life Insurance Plans and customization options for Canadian residents. - BMO Insurance

Website: www.bmo.com

Overview of Term Life Insurance offerings and guidance on selecting the right policy. - Insurance Bureau of Canada (IBC)

Website: www.ibc.ca

Educational resources on understanding life insurance policies and financial planning. - TD Insurance

Website: www.tdinsurance.com

Detailed breakdowns of life insurance coverage, including Term Life Insurance. - Desjardins Insurance

Website: www.desjardinslifeinsurance.com

Guides and articles on Term Life Insurance Policies and payment structures. - Canadian Life and Health Insurance Association (CLHIA)

Website: www.clhia.ca

In-depth knowledge about life insurance products and industry trends in Canada.

CIBC Insurance

Website: www.cibc.com

Tools for calculating Term Life Insurance Quotes and understanding payment options.

Key Takeaways

- Payment Periods Differ

Limited Pay policies have a shorter payment term with higher premiums, while Regular Pay policies spread payments across the entire term. - Cost Comparison

Limited Pay may save money over time due to fewer total payments, but Regular Pay offers more manageable, lower monthly premiums. - Suitability

Limited Pay is ideal for those with stable incomes and specific financial goals, such as retiring debt-free. Regular Pay suits individuals seeking affordability and flexibility. - Policy Benefits Are Equal

Both options provide the same death benefit, making the choice dependent on payment preference and budget. - Financial Planning Is Key

Choosing the right policy requires understanding your financial situation and long-term goals. - Customization Options Available

Riders can be added to both Limited Pay and Regular Pay policies, allowing tailored coverage. - Agent Support Matters

Expert guidance from Term Life Insurance Agents ensures you select the best option for your needs. - Online Accessibility

Both policies are available online, allowing easy comparison and purchase with Term Life Insurance Quotes.

Your Feedback Is Very Important To Us

We would love to hear your thoughts about your experience when exploring Limited Pay and Regular Pay Term Insurance options. Your feedback will help us understand your struggles and improve our support.

Thank you for your feedback! We value your input and will use it to improve our services to help others find the right Term Life Insurance Policies. If you have any questions or need assistance, feel free to reach out!

IN THIS ARTICLE

- Limited Pay vs Regular Pay Term Insurance

- Understanding Term Life Insurance Policies

- What Is Regular Pay Term Insurance?

- What Is Limited Pay Term Insurance?

- Comparing Limited Pay and Regular Pay Term Insurance

- Comparison of Limited Pay and Regular Pay Term Insurance

- How to Decide Which Option Is Right for You

- The Role of Term Life Insurance Agents

- Why Canadian LIC Is the Best Choice for Your Term Life Insurance

- Final Thoughts