Say you and your best friend are talking about an uncle who lives far away in a cozy café. Listening to the story, your friend leans in and starts to talk about how hard it is to get her parents a super visa so they can come to Canada. Just as you think her troubles are over with the visa approval, she unveils another layer of complexity—the confusing world of Super Visa Insurance. She’s unsure about the waiting period for the insurance to kick in, and it’s clear she’s not alone in this confusion. Isn’t it perplexing, trying to navigate through insurance terms, figuring out the best plans and dealing with unexpected waiting periods? That’s a pretty common situation. Today, we’re going to learn about Super Visa Insurance, mainly by learning about the waiting time and how to best handle it.

Let's Understand the Waiting Period for Super Visa Insurance

What is a Super Visa?

Indeed, Super Visa is most appealing to parents and grandparents of Canadian citizens and permanent residents to visit at five-year intervals without the need to reapply. It is really a good opportunity for families to reunite and spend quality time together.

Getting to Know Super Visa Insurance

Super Visa applicants have to buy Super Visa Insurance, which will serve to cover them medically in Canada. Let me share an experience that might be similar to what many have gone through: John was living in Vancouver and wanted to get his mother over from the Philippines. He bought a Super Visa Insurance Plan and later was shocked when a waiting period had postponed the start of the coverage. This caused a stressful situation when medical attention was needed shortly after the mother’s arrival, but coverage had not started yet.

Is There a Waiting Period?

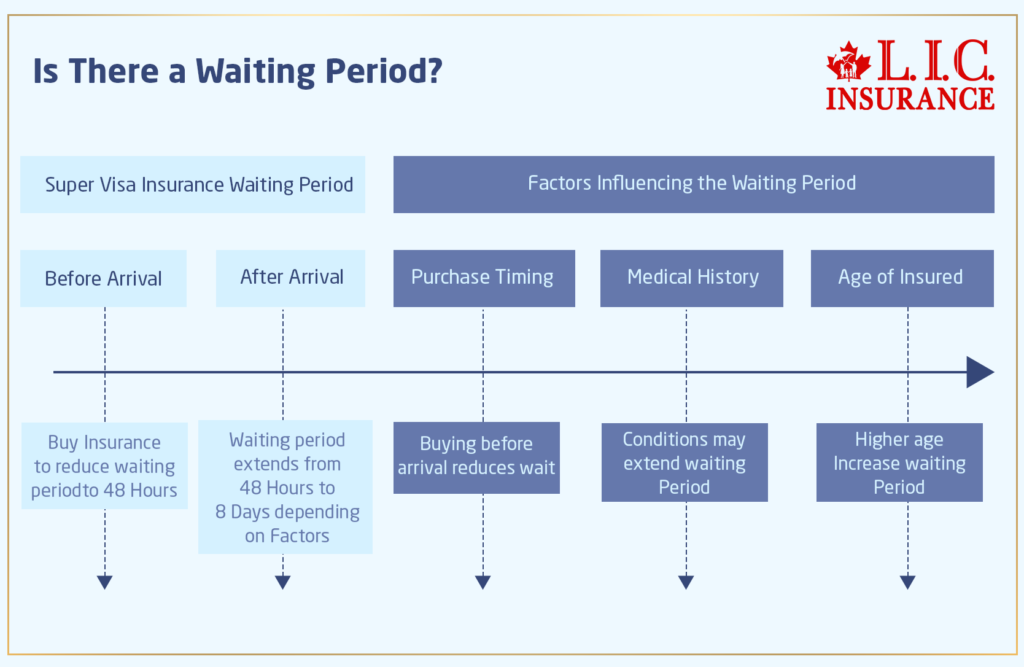

Indeed, while travelling to Canada with relatives on a Super Visa, the waiting period associated with Super Visa Insurance Plans can never be forgotten. For example, a waiting period of 48 hours to 8 days depends on whether the insurance was in place prior to the covered member’s arrival in Canada or after. When you set up the Super Visa Insurance Plan before arrival, you quite literally reduce the waiting period and generally get coverage in 48 hours.

Factors Influencing the Waiting Period

Purchase timing: Buying the coverage before your dear ones first put their foot on the land of Canada can drastically minimize the waiting period. It is a very basic step, but it is of significant importance to keep them covered as soon as they get here. As soon as they come here, would it be better to have this security than to have to deal with the stress of not being able to pay their medical bills?

Medical History: The waiting period for Super Visa Insurance may vary for persons with pre existing medical conditions. In many cases, medical history will significantly influence the estimation of insurance risks and the speed with which the coverage goes into force. Can you find out how the medical history of a near family member may impact their waiting period?

Age of the Insured: Age is more than just a number; it exists in the world of insurance. With an increase in age, applicants also face an increase in the lengths of waiting periods because the higher the age, the higher the risk from the Canadian insurance company point of view. This factor is all the more important for insurance purchase planning: the earlier, the better.

Seema's Story

How this worked out for the experience of Seema in Toronto, most of you would be able to identify with it. Within two weeks of the arrival of her father in Canada, Seema purchased a Super Visa Insurance Plan that she felt would make her life much easier. But this gave rise to an unexpected problem. Just three days after his arrival, her father had to go to the emergency room for a minor accident, and she was stunned because an 8-day waiting period had started from the moment she made her purchase, during which he was not covered for any unexpected medical expenses. That bill for the emergency room visit now added up significantly to his potential medical bill. Sara’s experience is a poignant reminder of the value of understanding Super Visa Insurance Plans and the critical nature of correctly timing your purchase.

How to Mitigate the Impact of Waiting Periods

Early Purchase is Key

For a Super Visa Insurance Plan to function properly and negotiate waiting periods, one must time their plan purchase just about right. If you were preparing a home to receive a special guest, wouldn’t you prepare everything so it was all set when he arrived? In fact, in the case of purchasing Super Visa Insurance before your family members even set foot in Canada, it’s like preparing that home so everything is set when you need it.

This is not by coincidence but a strategic move for the reduction of the overall costs. It always pays to buy Super Visa Insurance Plans at a very early date so that the insurance coverage comes to the forefront right at the outset. In effect, it will help get your loved ones safeguarded at the earliest possible time and manage the Super Visa Medical Insurance Cost in a more cost-effective way. Delayed purchases, as in Seema’s case, bring about huge out-of-pocket costs during uncovered periods, which are most unnecessary.

Medical Insurance Costs for the Super Visa

Choosing the right super visa Canada insurance plan is as important as choosing the best safety net for your family, which can be fulfilled only through an informed comparison. These include the costs for the premiums but much more in the deductibles and the coverage limits involved, which determine the value in totality of a plan.

So, important questions that need to be answered when looking at different Super Visa Insurance Plans are: Does the plan cover the pre-existing medical conditions to its fullest? Also, what are the amounts that can be deducted? Are there limits to the coverage that may leave you or loved ones exposed to high medical bills? This is no small matter; answering these questions will help you understand the depth and breadth of each plan and ensure you pick the one that gives you the best protection within your budget.

Let’s consider a real-life example that many can relate to: Michael from Calgary was in the process of selecting a Super Visa Insurance Plan for his parents. He compared a few plans, focusing on the cost and coverage details of Super Visa Medical Insurance. He understood that with many cheaper plans, some specific pre-existing medical conditions of his mother were not covered, increasing potential costs in future. Consequently, he chose a little-expensive plan that covered such conditions completely to ensure comprehensive coverage for the parents, eventually saving a lot of money and relief.

Proactive Communication and Consultation

Open discussions with insurance brokers or consultants, too, can help iron out any potential issues. People working in the sector professionally can give very useful suggestions and advice based on the consideration. Think of them as your guides in all this confusion—allowing you to navigate the maze of options and find the perfect fit for your family’s needs.

Besides, sharing such experiences with the community brings clarity and, in turn, can help other people make their own decisions. Have you ever discussed insurance choices with friends or family? If not, starting the conversation might open doors to new information and shared experiences that could possibly make the decision process easier and more informed.

There are many details regarding Super Visa Insurance, including understanding how different factors come into play with the waiting period and cost of insurance, such as the purchase timing, medical history, and age. This proactive analysis will assure you that the other family members will also be well-guarded against day one, from the entry to Canada, and will not fall into the pitfalls linked to periods of uncovered emergency medical expenses happening out of the blue. Remember, the idea is reuniting with your loved ones with the cost stress-free to have them safe and happy throughout the stay. Let’s turn this into reality with the right Super Visa Insurance with minimum waiting periods for maximum coverage.

Choosing the Right Super Visa Insurance Plan

Compare Super Visa Insurance Plans

You will need to understand the terms of the different Super Visa Insurance Plans, especially the cost of the Super Visa Medical Insurance. This might greatly vary. The plans differ by limits of coverage, exclusions, and waiting periods. Comparison is thus necessary for taking the right plan for your loved ones.

Importance of Expert Advice

This is much easier when done through a licensed insurance broker, such as Canadian LIC. The experts can be helpful in piecing together a plan that fits your family’s needs and also enlighten you on the waiting periods included in the benefits.

Lina's Story

Meet Lina from Edmonton. She wanted the best available protection for her aged parents, who were coming to visit from India. Upon meeting Canadian LIC, she got to know about the various Super Visa Insurance Plans and selected one in which the waiting period was very low, and the coverage would be effective from the time her parents would set foot in Canada.

The Final Words

Super Visa Insurance is something really confusing to deal with, along with all the waiting periods attached to it, but it is essential for those family members who have to stay protected in Canada. The shared stories remind us how important it is to be informed and prepared. Do not let confusion and uncertainty stand in the way of reuniting with your loved ones.Talk to Canadian LIC today, the top insurance brokerage in Canada, about Super Visa Insurance. Now have peace of mind for your loved ones and for yourself with the extended stay in Canada because the perfect plan is in your hands—least waiting period and the best coverage.

Find Out: How to apply for Super Visa Insurance?

Find Out: How to get the most affordable Super Visa Insurance?

Find Out: Where can I buy Super Visa Insurance?

Find Out: Can we cancel Super Visa Insurance?

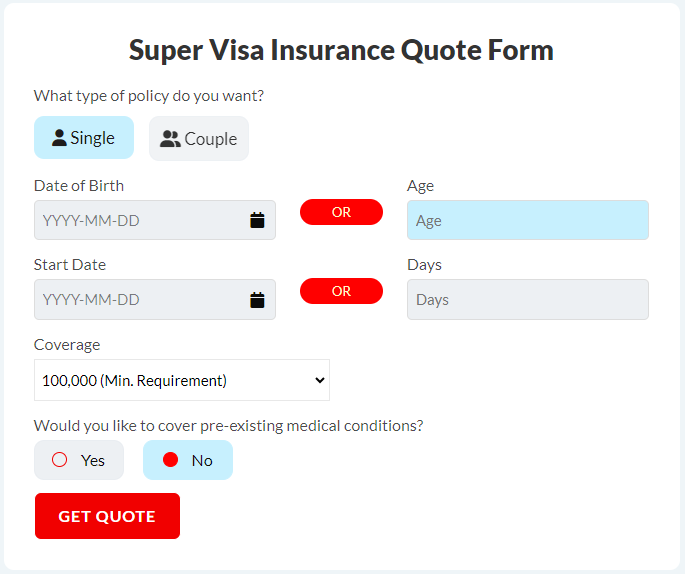

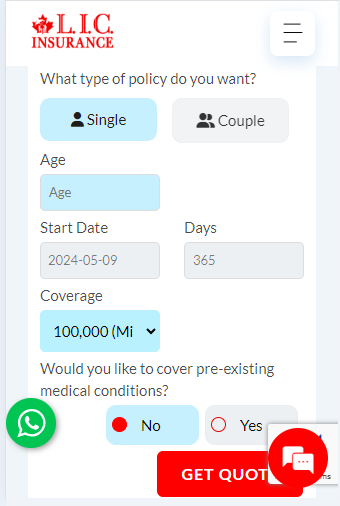

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's

Super Visa Insurance Plans have a wide range of costs and depend on the age of the applicant, the period for which coverage is required, the coverage amount, and also if the plan would cover the pre-existing condition or not. Let’s take the example of Anita from Montreal, who was shopping for insurance for a 74-year-old mother. Now, the premium quoted for her mother was very high because of her age, and above all, Anita needed very comprehensive coverage. By comparing plans, Anita had sufficient information on how a particular factor would influence the price and thus made a well-informed decision in terms of balancing cost with coverage.

Many insurers currently offer customizable Super Visa Insurance, and those can meet the specifications. For example, your relatives may have some particular health issues or you may wish to insure some particular medical conditions that are not generally covered. Discuss these needs with the insurer and how they could be incorporated into your policy. Most of these changes may come with an extra premium, but this will be meeting specific needs of the insured, giving one peace of mind and also to the loved ones.

It may vary from one insurer to another, but most insurers try to process claims quickly and efficiently. Tom, from Toronto, posted a claim when his father required emergency medical treatment in the middle of the visit. After getting all the necessary documentation, the claim was processed and cleared within weeks. Quick processing can occur if claims are submitted in a timely manner and the documents submitted are complete.

If your Super Visa Insurance claim has not been approved, please make sure you look through the reasons given to you by your insurer for the denial. Reasons may vary from missing documentation to claims for services that are not covered. If you feel that the denial was mistaken, feel free to launch an appeal. Understanding conditions and terms in most cases help to ward off misunderstandings and make sure that you are ready in case issues with the claims process arise.

A licensed insurance broker’s services are likely to be very useful in making your way among Super Visa Insurance Plans. Brokers are detailed experts in different insurance products; they help compare different plans and eventually find the best plan suitable for your particular needs. They will offer assistance in application and claims processes and support one whenever help is required during the coverage period. For instance, Nadia from Calgary used a broker to find insurance for her parents and found it to be a more streamlined and less confusing process than trying to go at it alone.

The coverage limit is the most that the insurance will pay for medical bills during the policy time. The higher the coverage limits, the higher the difference in cost, thereby increasing the premium for Super Visa Insurance Plans. For example, when you are going to buy a mobile data plan, you generally pay more for the plan when you start needing more data, right? Similarly, the insurance cost increases with the comprehensiveness of medical coverage. One always has to strike a balance between the coverage one thinks the loved ones may require and what one can afford.

Of course, age does play a big role in deciding eligibility and the cost of Super Visa Insurance Plans. Generally, older applicants are charged higher premiums since they pose a larger risk to the insurer. For example, if Rahul were to buy insurance for his 80-year-old grandmother, he would realize that the premiums charged are obviously much higher compared to what his friend’s younger parents paid. All this information would be most useful had it been known earlier when planning personal finances.

Super Visa Health Insurance typically offers emergency medical services, such as hospital stay, emergency room visit, and the cost of prescriptions. However, each plan has different specifics, so it is important to read. For example, if your mother needs physiotherapy regularly, you need to check if it covers that. It is somewhat similar to finding out the amenities of a hotel before you actually book for the stay. This way, you can make your stay much more comfortable in all respects.

While weather conditions themselves don’t directly affect insurance coverage, the activities your loved ones might engage in during certain weather conditions can impact coverage. For instance, if your father visits during the Canadian winter and decides to try skiing, you would need to ensure the Super Visa Insurance covers injuries related to winter sports, which are not always included.

You can also refund the remaining part of Super Visa Insurance in case your visitor returns home ahead of the projected time. This is except if no claim has been raised on the policy. This is something that happened to Helen from Ottawa. Her mother had to leave for Italy in a very awkward way. They were so relieved to know that they would get a refund as far as insurance is concerned. This way, their burden was slightly lightened.

Make sure you get a reputable Super Visa Insurance provider by reviewing their ratings and reviews and how many years they have been providing the service. Check whether they are registered with the Better Business Bureau or another regulatory body. The other place to get reliable Super Visa Insurance providers is from an insurance broker who has been in the industry for some time.

We hope these FAQs clarify the complexity and nuance of Super Visa Insurance for you. Each situation is unique, and great decisions come from being informed. If you have further questions or need more clarity on points, do not hesitate to turn to an expert or visit forums where others share their experiences. Your proactive steps today will ensure your loved ones pay for a worry-free and enjoyable visit. Let’s ensure you are armed with all the information you need to make the best choices for the needs of your family!

Sources and Further Reading

Government of Canada – Immigration and Citizenship

Official government pages provide authoritative information on Super Visa requirements, including insurance needs.

Website: Canada.ca

Canadian Life and Health Insurance Association (CLHIA)

Offers detailed guides and information on various types of insurance available in Canada, including Super Visa Insurance.

Website: CLHIA

Insurance Brokers Association of Canada

Provides resources to connect with licensed brokers who specialize in Super Visa Insurance and other insurance needs.

Website: IBAC

Settlement.org

Offers information and advice for newcomers to Canada, including details on insurance requirements for Super Visas.

Website: Settlement.org

These sources can provide more detailed information on Super Visa Insurance Plans, coverage options, and the latest updates regarding immigration policies in Canada.

Key Takeaways

- Super Visa Insurance typically has a waiting period of 48 hours to 8 days, reduced by purchasing before arrival.

- Buying insurance ahead ensures coverage starts upon arrival, avoiding initial high medical costs.

- Super Visa Medical Insurance Cost varies with age, medical history, and purchase timing.

- Carefully compare plans for coverage details like pre-existing conditions, coverage amounts, and exclusions.

- Licensed insurance brokers can guide you through the complexities of Super Visa Insurance.

- Super Visa Insurance must meet government requirements, including $100,000 minimum coverage and one-year validity.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]